Professional Documents

Culture Documents

Bosch, 2Q CY 2013

Uploaded by

Angel BrokingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bosch, 2Q CY 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

2QCY2013 Result Update | Auto Ancillary

August 7, 2013

Bosch

Performance Highlights

Y/E Dec (` cr) Net Sales EBITDA EBITDA Margin (%) Adj. PAT 2QCY13 2,307 363 15.7 252 2QCY12 2,178 329 15.1 247 % chg (yoy) 5.9 10.5 65bp 1.7 1QCY13 2,209 382 17.3 260 % chg (qoq) 4.4 (4.9) (155)bp (3.1)

ACCUMULATE

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Auto Ancillary 26,100 (3,085) 0.2 9,590/8,182 1,296 10 18,733 5,542 BOSH.BO BOS@IN

`8,312 `9,096

12 Months

Source: Company, Angel Research

Bosch (BOS) reported in-line results for 2QCY2013. While the top-line grew at a better-than-expected rate of 5.9% yoy (4.4% qoq); EBITDA margins continued to remain under pressure (down 155bp sequentially) resulting in a muted growth in the bottom-line. We revise our CY2013 revenue estimates slightly downwards to factor in the continued slowdown in the domestic automotive industry. Further, due to higher tax-rate assumption, we revise downwards the CY2013 bottom-line estimate by 4.6%. Nevertheless, we expect the companys earnings growth to revive in CY2014 led by revival in the domestic automotive industry which has posted two years of muted growth. We recommend an Accumulate rating on the stock. In-line performance for 2QCY2013: BOS posted a healthy top-line growth of 5.9% yoy (4.4% qoq) to `2,307cr, ahead of our estimates of `2,188cr, driven by a strong exports growth of 14.1% yoy. The increase in net average realization due to price increases also aided the top-line performance. Domestic revenue however, reported a modest growth of 3.8% yoy as domestic automotive demand continued to remain weak following a challenging macroeconomic environment. While the automotive business segment registered a growth of 4.7% yoy, the non-automotive business segment grew by 11.8% yoy. On the operating front, the EBITDA margin declined 155bp sequentially to 15.7%, lower than our expectations of 16.8%. The performance was impacted due to the INR depreciation against the EUR and also due to increase in staff expenditure on account of annual salary hikes. Consequently, the operating profit declined 4.9% qoq to `363cr, in-line with our estimates of `367cr. Net profit for the quarter stood at `252cr (up 1.7% yoy but down 3.1% qoq), in-line with our estimate of `249cr. Outlook and valuation: We remain positive on the long term prospects of BOS due to its technological leadership and strong and diversified product portfolio; however, we expect the near-term performance of the company to remain subdued due to slowdown in the domestic automotive industry. At, `8,312 the stock is trading at 19.6x CY2014E earnings. We recommend Accumulate rating on the stock with a target price of `9,096.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 71.2 14.2 7.4 7.2

Abs. (%) Sensex Bosch

3m (4.8) (7.5)

1yr 7.6 (6.9)

3yr 3.2 41.2

Key financials (Standalone)

Y/E Dec (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

CY2011 8,166 18.7 1,067 62.1 18.5 339.7 24.5 5.5 22.6 27.5 2.8 15.7

CY2012 8,659 6.0 874 (18.1) 15.6 278.3 29.9 4.7 15.7 18.3 2.5 17.2

CY2013E 9,301 7.4 1,067 22.1 16.8 339.8 24.5 4.1 16.6 18.6 2.3 14.4

CY2014E 10,895 17.1 1,328 24.5 18.0 423.1 19.6 3.5 17.6 20.8 1.9 11.2

Yaresh Kothari

022-3935 7800 Ext: 6844 yareshb.kothari@angelbroking.com

Please refer to important disclosures at the end of this report

Bosch | 2QCY2013 Result Update

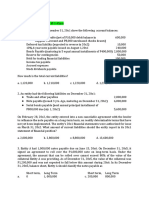

Exhibit 1: Quarterly financial performance (Standalone)

Y/E Dec (` cr) Net Sales Consumption of RM (% of sales) Staff costs (% of sales) Purchases of TG (% of sales) Other Expenses (% of sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT Adj PAT Adj. PATM Equity shares (cr) Reported EPS (`) Adjusted EPS (`)

Source: Company, Angel Research

2QCY13 2,307 729 31.6 307 13.3 544 23.6 365 15.8 1,944 363 15.7 0 86 90 366 366 15.9 115 31.3 252 252 10.9 31.4 80.2 80.2

2QCY12 2,178 741 34.0 248 11.4 495 22.7 366 16.8 1,850 329 15.1 0 76 89 342 342 15.7 94 27.6 247 247 11.4 31.4 78.8 78.8

% chg (yoy) 5.9 (1.7) 23.8 9.8 (0.3) 5.1 10.5 60.0 13.6 0.4 7.1 7.1 21.3 1.7 1.7

1QCY13 2,209 722 32.7 286 13.0 464 21.0 356 16.1 1,828 382 17.3 0 84 89 387 387 17.5 127 32.8 260 260 11.8 31.4

% chg (qoq) 4.4 0.9 7.1 17.3 2.5 6.4 (4.9) (9.0) (72.4) 2.6 0.5 (5.3) (5.3) (9.7) (3.1) (3.1)

1HCY13 4,516 1,450 32.1 593 13.1 1,008 22.3 721 16.0 3,772 745 16.5 0 171 179 753 753 16.7 242 32.1 511 511 11.3 31.4

1HCY12 4,473 1,456 32.5 497 11.1 1,021 22.8 694 15.5 3,668 806 18.0 0 140 157 822 822 18.4 239 29.1 583 583 13.0 31.4 185.8 185.8

% chg (yoy) 1.0 (0.4) 19.3 (1.3) 3.8 2.8 (7.6) 640.0 21.8 14.4 (8.4) (8.4) 1.1 (12.3) (12.3)

1.7 1.7

82.7 82.7

(3.1) (3.1)

162.9 162.9

(12.3) (12.3)

Exhibit 2: 2QCY2013 Actual vs Angel estimates

Y/E Dec (` cr) Net sales EBITDA EBITDA margin (%) Adj. PAT

Source: Company, Angel Research

Actual 2,307 363 15.7 252

Estimates 2,188 367 16.8 249

Variation (%) 5.4 (1.1) (103)bp 0.9

Healthy top-line growth aided by exports: For 2QCY2013, the top-line posted a healthy growth of 5.9% yoy (4.4% qoq) to `2,307cr, ahead of our estimates of `2,188cr, driven by a strong growth in exports by 14.1% yoy. The increase in net average realization due to price increases and growth in after market segment (up 4.5% yoy) also aided the top-line performance. Domestic revenue however, reported a modest growth of 3.8% yoy as domestic automotive demand continued to remain weak following challenging macroeconomic environment. While the automotive business segment registered a growth of 4.7% yoy, the non-automotive business segment grew by 11.8% yoy.

August 7, 2013

Bosch | 2QCY2013 Result Update

Exhibit 3: Segmental performance

Y/E Dec (` cr) Revenue Automotive Others Total Less: Inter-segment revenue Net sales EBIT Automotive Others Total EBIT Add: Net interest income Less: unallocable exp. Total PBT EBIT Margin (%) Automotive Others Total

Source: Company, Angel Research

2QCY13 2,034 274 2,308 1 2,307 312 (1) 312 0 (55) 366 15.4 (0.2) 13.5

2QCY12 1,943 245 2,188 9 2,178 276 8 284 0 (58) 342 14.2 3.2 13.0

% chg (yoy) 4.7 11.8 5.5 5.9 13.3 9.9 60.0 (6.4) 7.1 116bp -

1QCY13 1,905 306 2,211 2 2,209 302 40 342 0 (45) 387 15.9 13.1 15.5

% chg (qoq) 6.8 (10.6) 4.4 (28.2) 4.4 3.4 (8.9) (72.4) 22.1 (5.4) (50)bp -

1HCY13 3,939 580 4,519 3 4,516 614 40 654 0 (99) 754 15.6 6.9 14.5

1HCY12 3,953 520 4,473 27 4,446 699 35 734 0 (88) 822 17.7 6.7 16.4

% chg (yoy) (0.3) 11.5 1.0 1.6 (12.1) 13.4 (10.9) 640.0 12.4 (8.3) (208)bp 11.3

Exhibit 4: Healthy growth in top-line

( ` cr) 2,350 2,300 2,250 2,200 2,150 2,100 2,050 2,000 1,950 1,900 1,850 1,800 21.1 16.4 10.0 5.8 3.1 5.1 5.9 (3.7) Net sales Net sales growth (RHS) (%) 25.0 20.0 15.0 10.0 5.0

Exhibit 5: Segment-wise revenue trend

( ` cr) 2,500 2,000 1,500 1,000 500 0 204 211 212 275 244 231 225 306 274 1,828 1,784 1,845 2,010 1,922 1,831 1,917 1,903 Automotive revenue Other revenue 2,034

7.7

2,060

1,991

2,029

2,295

2,178

2,054

2,132

2,209

2,307

0.0 (5.0)

2QCY11

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

4QCY12

1QCY13

2QCY11

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

4QCY12

1QCY13

Source: Company, Angel Research

2QCY13

Source: Company, Angel Research

EBITDA margin contracts sequentially to 15.7%: On the operating front, the EBITDA margin declined 155bp sequentially to 15.7%, lower than our expectations of 16.8%. The performance was impacted due to the INR depreciation against the EUR and also due to increase in staff expenditure on account of annual salary hikes. Consequently, the operating profit declined 4.9% qoq to `363cr, in-line with our estimates of `367cr. On a yoy basis though, the EBITDA margin improved 65bp primarily on account of softening of raw-material prices and decline in other expenditure (aided by cost reduction initiatives) although the same was partially offset by a sharp increase in employee expenditure and unfavorable currency movement. Net profit for the quarter stood at `252cr (up 1.7% yoy but down 3.1% qoq), in-line with our estimates of `249cr.

August 7, 2013

2QCY13

Bosch | 2QCY2013 Result Update

Exhibit 6: EBITDA margins continue to remain volatile

(%) 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 18.4 19.3 16.8 20.8 15.1 13.3 12.5 17.3 15.7 56.8 54.5

EBITDA margins Raw material cost/sales

Exhibit 7: Net profit in-line with estimates

( ` cr) 400 13.5 14.5 Net profit 14.6 13.9 11.4 9.9 8.1 Net profit margin (RHS) 11.8 (%) 16.0 10.9 14.0 12.0 10.0 8.0 6.0 4.0

52.7

54.7

56.8

57.6

53.9

53.7

55.2

350 300 250 200 150 100

279

288

281

336

247

203

172

260

50 0

252 2QCY13

2.0 0.0

2QCY11

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

4QCY12

2QCY11

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

4QCY12

1QCY13

Source: Company, Angel Research

2QCY13

Source: Company, Angel Research

August 7, 2013

1QCY13

Bosch | 2QCY2013 Result Update

Investment arguments

Technology intensive industry supplemented by high bargaining power: We estimate BOS to post an ~12% CAGR in its top-line and ~23% CAGR in its bottom-line over CY2012-14. The company enjoys high margins in the auto component segment due to strong entry barriers and its dominant position in the market. Nonetheless, due to decline in utilization levels (~70-75% across plants) and higher INR depreciation, the company witnessed a significant 290bp contraction in operating margins in CY2012. Going ahead, we expect the demand environment to improve in CY2014, which will improve utilization levels and thus the margins. Further, the benefits of cost reduction initiatives will also accrue to the company in CY2013. As a result, we expect margins to improve by ~120bp in CY2013 to 16.8%. Dependent on favorable CV cycle for growth: BOS's prospects are largely derived from demand arising in the CV and tractor segments. While the slowdown in the CV segment has continued YTD in CY2013, the tractor segment has witnessed a strong revival following better monsoon and expectations of better kharif crop. We expect the CV cycle to reverse in FY2015 which is expected to revive companys revenue and earnings growth. Further, greater visibility on newer growth opportunities is emerging for the company, following its investments in new and innovative technologies such as CRS and gasoline systems. We believe the company will continue to enjoy premium valuations, owing to strong parental focus and increasing long-term growth opportunities in the Indian market, facilitated by changes in emission norms. Moreover, BOS has been a consistent performer with strong cash flows in the Indian auto component industry.

Outlook and valuation

We revise our CY2013 revenue estimates slightly downwards to factor in the continued slowdown in the domestic automotive industry. Further, due to a higher tax-rate assumption, we revise downwards our CY2013 bottom-line estimate by 4.6%. Nevertheless, we expect the companys earnings growth to revive in CY2014 led by revival in the domestic automotive industry which has posted two years of muted growth.

Exhibit 8: Change in estimates

Y/E December Total income (` cr) OPM (%) EPS (`) Earlier Estimates CY2013E 9,558 16.7 356.3 CY2014E 10,959 17.4 420.7 Revised Estimates CY2013E 9,301 16.8 339.8 CY2014E 10,895 18.0 423.1 % chg CY2013E (2.7) 7bp (4.6) CY2014E (0.6) 62bp 0.6

Source: Company, Angel Research

We remain positive on the long term prospects of BOS due to its technological leadership and strong and diversified product portfolio; however, we expect the near-term performance of the company to remain subdued due to slowdown in the domestic automotive industry. We estimate BOS to post an ~12% CAGR in its top-

August 7, 2013

Bosch | 2QCY2013 Result Update

line and ~23% CAGR in its bottom-line over CY2012-14. As a result, we estimate BOS to post an EPS of `339.8 and `423.1 for CY2013 and CY2014, respectively. At, `8,312 the stock is trading at 19.6x CY2014E earnings. We recommend an Accumulate rating on the stock with a target price of `9,096.

Exhibit 9: Key assumptions

Volumes (mn units) Fuel injection pumps Nozzles Auto electrical

Source: Company, Angel Research

CY09 2.7 16.3 1.4

CY10 3.7 21.5 1.5

CY11 4.4 23.0 2.0

CY12E 4.0 22.2 2.4

CY13E 4.3 24.1 2.6

CY14E 4.9 28.3 2.7

Exhibit 10: Angel vs consensus forecast

Angel estimates CY13E Total op. income (` cr) EPS (`) 9,301 339.8 CY14E 10,895 423.1 Consensus CY13E 9,415 340.4 CY14E 11,073 416.6 Variation (%) CY13E (1.2) (0.2) CY14E (1.6) 1.6

Source: Company, Angel Research

Exhibit 11: One-year forward P/E band

(` ) 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Share price (`) 12x 16x 20x 24x

Exhibit 12: One-year forward P/E chart

(x) 35.0 30.0 25.0 20.0 15.0 10.0 5.0 One-yr forward P/E Five-yr average P/E

Jun-11

Jan-03

Jan-04

Mar-06

Mar-07

Apr-08

Feb-05

Apr-09

Jun-12

0.0

May-10

Jul-13

May-06

May-10

Dec-07

Aug-05

Mar-07

Aug-09

Mar-11

Dec-11

Oct-08

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 13: Premium/ Discount to Sensex

(%) 200 150 100 50 0 (50) (100) Absolute premium Five-yr average premium

Exhibit 14: Relative performance to Sensex

600 500 400 300 200 100 0 Bosch India Sensex

Jun-08

Jun-09

Jun-10

Feb-10

Sep-06

Jul-07

Oct-12 Sep-12

Apr-02

Apr-03

Apr-04

Jul-11

Jul-12

Jul-13

May-05

May-06

May-07

Nov-05

Dec-10

Jan-05

Jun-08

Apr-09

Source: Company, Angel Research

Source: Company, Angel Research

August 7, 2013

Nov-11

Jul-13

Jul-13

Bosch | 2QCY2013 Result Update

Exhibit 15: Auto Ancillary Recommendation summary

Company Amara Raja Batteries Automotive Axle^ Bharat Forge* Bosch India

#

Reco. Buy Neutral Neutral Accumulate Buy Neutral Accumulate Buy

#

CMP (`) 221 195 188 8,312 121 1,164 211 19

Tgt. price (`) 285 9,096 148 242 23

Upside (%) 29.2 9.4 22.4 14.8 21.7

P/E (x) FY14E 11.9 11.3 12.9 24.5 15.3 15.4 16.2 8.0 FY15E 10.8 7.2 10.9 19.6 13.4 11.4 13.1 4.9

EV/EBITDA (x) FY14E 7.8 4.6 5.6 14.6 8.1 8.8 6.6 3.2 FY15E 6.4 3.4 4.8 11.3 6.8 6.2 5.6 2.8

RoE (%) FY14E 26.6 9.5 13.6 16.6 18.3 13.4 29.4 4.8 FY15E 23.8 14.0 14.7 17.6 18.0 15.8 28.6 7.6

FY13-15E EPS CAGR (%) 8.4 (4.7) 18.6 23.3 21.1 3.4 24.9 5.6

Exide Industries FAG Bearings Subros Motherson Sumi*

Source: Company, Angel Research; Note: * Consolidated results; # December year end; ^ September year end

Company background

Bosch, promoted by Robert Bosch GmbH, is the largest auto ancillary company in India and a dominant player in the fuel injection segment with ~75% market share. The company has a diverse product portfolio of diesel and gasoline fuel injection systems, automotive aftermarket products, auto electricals, special purpose machines, packaging machines, electric power tools and security systems. The automotive segment contributes 90% to BOS' total revenue. The company also has one of the largest distribution networks of spare parts in the country, with after-market component sales accounting for ~20% of revenue. BOS has five manufacturing facilities located at Bangalore, Nasik, Naganathpura, Jaipur and Goa.

August 7, 2013

Bosch | 2QCY2013 Result Update

Profit and loss statement (Standalone)

Y/E Dec. (` cr) Total operating income % chg Total expenditure Net raw material costs Other mfg costs Employee expenses Other EBITDA % chg (% of total op. income) Depreciation & amortization EBIT % chg (% of total op. income) Interest and other charges Other income PBT (recurring) % chg Extraordinary exp./ (income) PBT (reported) Tax (% of PBT) PAT (reported) ADJ. PAT % chg (% of total op. income) Basic EPS (`) Adj. EPS (`) % chg CY09 4,996 5.3 4,183 2,551 360 609 663 813 (5.1) 16.3 304 510 (8.0) 10.6 1 285 793 (7.4) 64 729 203 27.8 591 527 (4.7) 11.0 188.1 167.7 (2.9) CY10 6,882 37.8 5,629 3,598 432 796 803 1,253 54.1 18.2 254 999 96.0 15.0 4 7 1,002 26.3 0 1,002 344 34.3 659 658 25.0 9.8 209.7 209.6 25.0 CY11 8,166 18.7 6,654 4,444 445 896 870 1,512 20.6 18.5 258 1,254 25.5 15.7 0 320 1,574 57.0 56 1,518 451 29.7 1,123 1,067 62.1 13.3 357.5 339.7 62.1 CY12 8,659 6.0 7,310 4,783 460 1,037 1,030 1,350 (10.7) 15.6 367 983 (21.7) 11.5 6 369 1,346 (14.5) 84 1,262 388 30.7 958 874 (18.1) 10.3 305.2 278.3 (18.1) CY13E 9,301 7.4 7,740 5,029 489 1,170 1,052 1,560 15.6 16.8 410 1,150 17.1 12.6 6 414 1,558 15.7 1,558 491 31.5 1,067 1,067 22.1 11.7 339.8 339.8 22.1 CY14E 10,895 17.1 8,937 5,844 574 1,340 1,179 1,958 25.5 18.0 467 1,491 29.7 13.9 7 455 1,939 24.5 1,939 611 31.5 1,328 1,328 24.5 12.4 423.1 423.1 24.5

August 7, 2013

Bosch | 2QCY2013 Result Update

Balance sheet statement (Standalone)

Y/E Dec. (` cr) SOURCES OF FUNDS Equity share capital Reserves & surplus Shareholders Funds Total loans Deferred tax liability Other long term liabilities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Less: Acc. depreciation Net Block Capital work-in-progress Goodwill Investments Long term loans & advances Current assets Cash Loans & advances Other Current liabilities Net current assets Total Assets

months

CY09 31 3,354 3,385 284 (201) 3,468 2,865 2,358 507 100 6 1,418 2,758 1,068 556 1,135 1,320 1,438 3,468

CY10 31 4,067 4,098 276 (218) 4,156 3,017 2,588 430 224 6 1,607 3,752 1,326 896 1,530 1,863 1,889 4,156

CY11 31 4,697 4,728 245 (228) 37 172 4,955 3,352 2,767 585 321 6 1,635 333 4,024 952 993 2,079 1,948 2,075 4,955

CY12 31 5,542 5,573 185 (255) 33 218 5,755 3,935 3,078 857 417 6 1,520 226 4,623 1,487 1,019 2,117 1,894 2,729 5,755

CY13E 31 6,389 6,421 185 (255) 33 218 6,602 4,502 3,488 1,013 451 6 1,744 226 5,162 1,801 1,097 2,264 1,999 3,163 6,602

CY14E 31 7,498 7,530 185 (255) 33 218 7,711 5,092 3,955 1,137 510 6 2,036 226 5,974 2,036 1,287 2,651 2,179 3,796 7,711

Note: Cash includes term deposits with banks with maturity of more than 3 months but less than 12

August 7, 2013

Bosch | 2QCY2013 Result Update

Cash flow statement (Standalone)

Y/E Dec. (` cr) Profit before tax Depreciation Change in working capital Others Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in fixed assets (Inc.)/Dec. in investments Other income Cash Flow from Investing Issue of equity Inc./(Dec.) in loans Dividend paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in cash Opening Cash balances Closing Cash balances

less than 12 months

CY09 729 304 130 221 (285) (203) 897 (75) (551) 285 (341) 20 94 (672) (559) (3) 1,071 1,068

CY10 1,002 254 (14) (5) (7) (344) 886 (277) (190) 7 (460) (8) 110 (270) (168) 258 1,068 1,326

CY11 1,518 258 (561) 1 (320) (451) 445 (431) (27) 320 (138) (31) 493 (552) (91) 216 74 290

CY12 1,262 367 (41) 149 (369) (388) 981 (679) 115 369 (195) (60) 157 (314) (217) (109) 290 181

CY13E 1,558 410 (120) (414) (491) 944 (600) (224) 414 (411) 219 (219) 313 1,487 1,801

CY14E 1,939 467 (397) (455) (611) 943 (650) (293) 455 (488) 219 (219) 236 1,801 2,036

Closing cash balance excludes term deposits with banks with maturity of more than 3 months but

August 7, 2013

10

Bosch | 2QCY2013 Result Update

Key ratios

Y/E Dec. Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) (0.7) (2.7) 428.4 (0.6) (2.1) (0.5) (1.5) (0.5) (2.1) 178.6 (0.5) (2.2) 194.7 (0.5) (2.0) 215.2 1.8 42 49 61 31 2.3 37 36 60 25 2.6 45 37 66 38 2.4 49 41 59 50 2.2 50 41 60 51 2.3 50 41 58 52 15.3 21.2 15.6 26.2 35.3 16.1 27.5 31.3 22.6 18.3 23.0 15.7 18.6 24.0 16.6 20.8 26.3 17.6 10.6 0.7 2.2 16.9 0.3 (0.6) 7.0 15.0 0.7 2.6 25.9 0.9 (0.6) 9.7 15.7 0.7 2.4 26.3 0.1 (0.6) 11.5 11.5 0.7 2.1 16.7 1.8 (0.5) 9.2 12.6 0.7 2.1 17.7 2.2 (0.5) 9.7 13.9 0.7 2.1 19.8 2.6 (0.5) 10.9 227.1 167.7 323.8 30.0 1,078 273.4 209.6 354.3 40.0 1,305 339.7 339.7 421.8 135.0 1,506 278.3 278.3 395.2 60.0 1,775 339.8 339.8 470.5 60.0 2,045 423.1 423.1 571.6 60.0 2,398 36.6 25.7 7.7 0.4 4.7 29.4 6.9 30.4 23.5 6.4 0.5 3.3 18.7 5.6 24.5 19.7 5.5 1.6 2.8 15.7 4.8 29.9 21.0 4.7 0.7 2.5 17.2 4.0 24.5 17.7 4.1 0.7 2.3 14.6 3.4 19.6 14.5 3.5 0.7 1.9 11.3 2.9 CY09 CY10 CY11 CY12 CY13E CY14E

254.3 3,135.3

August 7, 2013

11

Bosch | 2QCY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Bosch No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 7, 2013

12

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MATHADocument680 pagesMATHAPsyluc100% (4)

- Chapter 6 Business TransactionsDocument6 pagesChapter 6 Business TransactionsAmie Jane Miranda67% (3)

- Top Trading LessonsDocument19 pagesTop Trading LessonsDheeraj DhingraNo ratings yet

- KomatsuDocument54 pagesKomatsuhaiccdk6No ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Civ Pro Q&ADocument7 pagesCiv Pro Q&ASGTNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- 23 RD Jan 17 Synergies Dooray AutomativeDocument6 pages23 RD Jan 17 Synergies Dooray AutomativeTarun ParasharNo ratings yet

- CASFLOWDocument133 pagesCASFLOWalenNo ratings yet

- DOF HandoverChecklistDocument4 pagesDOF HandoverChecklistRamy AmirNo ratings yet

- Chapter 6 Partnership Formation Operation and LiquidationDocument6 pagesChapter 6 Partnership Formation Operation and Liquidationanwaradem225No ratings yet

- Mishkin Econ13e PPT 11Document39 pagesMishkin Econ13e PPT 11hangbg2k3No ratings yet

- Financial Awareness and Economic ScenariosDocument4 pagesFinancial Awareness and Economic ScenariosSuvasish DasguptaNo ratings yet

- Managing Costs and Pricing Strategies for a UniversityDocument2 pagesManaging Costs and Pricing Strategies for a UniversityAdeirehs Eyemarket BrissettNo ratings yet

- Lê H NG Linh Tel: 0903 978 552 Faculty of ESP FTUDocument29 pagesLê H NG Linh Tel: 0903 978 552 Faculty of ESP FTUPham Thi Kim OanhNo ratings yet

- Credit Rating AgenciesDocument20 pagesCredit Rating AgenciesKrishna Chandran PallippuramNo ratings yet

- Maybank Moratorium FAQsDocument7 pagesMaybank Moratorium FAQsمحمدتوفيقNo ratings yet

- Test 2 FarDocument3 pagesTest 2 FarMa Jodelyn RosinNo ratings yet

- COST ACCOUNTING HOMEWORKDocument6 pagesCOST ACCOUNTING HOMEWORKaltaNo ratings yet

- Role of SMEs in Indian EconomyDocument25 pagesRole of SMEs in Indian Economyyatheesh07No ratings yet

- Advanced Accounting Jeter 5th Edition Solutions ManualDocument37 pagesAdvanced Accounting Jeter 5th Edition Solutions Manualgordonswansonepe0q100% (9)

- Accounting As The Language of BusinessDocument2 pagesAccounting As The Language of BusinessjuliahuiniNo ratings yet

- Acquisition of GC by Tata ChemDocument20 pagesAcquisition of GC by Tata ChemPhalguna ReddyNo ratings yet

- A Brief History of BankingDocument42 pagesA Brief History of Bankingtasaduq70% (1)

- English For Business Banking Finance AccountingDocument66 pagesEnglish For Business Banking Finance AccountingnatasyaNo ratings yet

- Case Study MMDocument4 pagesCase Study MMMehdi TaseerNo ratings yet

- Rep 0108122609Document104 pagesRep 0108122609Dr Luis e Valdez ricoNo ratings yet

- Banking Industry Adopts Augmented RealityDocument50 pagesBanking Industry Adopts Augmented RealityAkash KatiyarNo ratings yet

- Heller, Jack, CPCUMARPDocument4 pagesHeller, Jack, CPCUMARPTexas WatchdogNo ratings yet

- Raunak Kumar ResumeDocument2 pagesRaunak Kumar Resumeraunak29No ratings yet

- RA 6713 ReportDocument6 pagesRA 6713 Reportydlaz_tabNo ratings yet

- Crossover Rate TemplateDocument5 pagesCrossover Rate TemplatePramodJhaNo ratings yet