Professional Documents

Culture Documents

Company Accounts - Principles of Accounting

Uploaded by

Abdulla MaseehOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Accounts - Principles of Accounting

Uploaded by

Abdulla MaseehCopyright:

Available Formats

Company Accounts - Principles Of Accounting

Page 1 of 9

Principles Of Accounting

Principles of Accounting Made Easy

Home Topics Pricacy Policy

Accounting

Contact Us

Balance Sheet Stock Fund Stock Values

Search

Open NRE Savings Account

yesbanknriservices.co.in YES BANK announces High Interest Rate of 7% p.a. Apply Now!

Working in Australia?

au.jobrapido.com/Brisbane Everyday 2,000 job offers online. Find a Job in Brisbane Now!

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/ Company Accounts

The capital of a limited company is divided into shares. A person can become the member of a company if he buys a share. Then he is known as the shareholder. If the shareholder has paid in full for the shares he has taken, his liability is limited to the nominal value of those shares only. When the company loses its assets, it cannot ask the shareholders to pay anything out of their private property in respect of the companys losses. If the shareholder has paid partly only for the shares, he can be forced to pay the balance owing on the shares. In short, the liability of each member is limited to the nominal value of the shares he has taken. This is known as limited liability and the company is known as limited company. Share capital (different meaning) 1. Authorized/registered/nominal share capital. This is the total of the share capital which the is allowed to issue to the shareholders. company

Non-Profit Accounting

www.qwpage.com/ Accounting software specializing in all nonprofit organizations

Sign Up for Facebook

www.Facebook.com Facebook Lets You Share Your Status With Your Friends. Sign Up Now!

Business reporting

www.Amadeus... Get Insight and Information On The Airline Industry & Where it's Going

2. Issued share capital: This is the total of the share capital actually issued to the shareholders. 3. Called up capital: Where only part of the amounts payable on each share has been asked for, total amount asked for on all the shares is known as the called up capital. the

4. Uncalled capital: This is the total amount which is to be received in future, but which has not yet been asked for. 5. Calls in arrears: The total amount for which payment has been asked but has not been paid by share holders. 6. Paid up capital: This is the total of the amount of share capital which has been actually paid by the shareholders.(Paid up capital = Called up capital Calls in arrears) Types of shares

/ http://www.principlesofaccounting2.com/

Preference shares: the preference shares will be having some preferential rights over ordinary shares. The preference dividend will be paid prior to the ordinary shares dividends. The preference dividend is fixed. Ordinary shares: The ordinary share holders are the real owners of the company Their dividend will vary according to the amount of profit available. Ordinary share dividend will be paid after the payment of preference share dividend.

Debentures: Debentures are the credit documents issued for borrowing from the public. Debenture holders are long term creditors of the company. They get fixed rate of interest.

Difference between Ordinary shares and preference shares.

Preference share holders get fixed rate if dividend, ordinary share dividend varies year to year according to the amount of profits available. Preference share holders get dividend first before ordinary share holders. Ordinary shares holders get dividend after preference share holders are paid.

At the time of liquidation, preference share holders get capital back first before ordinary share holders. Ordinary share holders get capital back last.

Difference between Debentures and shares. Debenture holders are long term creditors of the company. But share holders are the owners of the company.

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Debenture holders get fixed rate of interest. But share holders are getting dividend. Debenture holders do not have voting rights. But share holders have voting rights.

Types of Capital:

Authorized share capital .

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 2 of 9

The maximum amount of share capital that a company is allowed to be raised. It is also called nominal or registered share capital. Issued share capital The part of authorized capital which is already issued to the public. It is the total value of shares issued. Paid up capital It is the actual amount of share value paid to the company by its share holders Limited companies Limited company

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Share capital (different meaning) 1. 1. Authorized/registered/nominal share capital 1. 2. Issued share capital This is the total of share capital actually issued to the share holders 1. 3. Called up capital

Limited company means an organization owned by its shareholders whose liability is limited to the share capital.

This is the total of the share capital which the company is allowed to issue to the shareholders

Where only part of the amount payable on each share has been asked for, the total amount asked for on all the shares is known as the called up capital 1. 4. Uncalled capital

This is the total amount which is to be received in future, but which has not yet been asked for 1. 5. Calls in arrears:

The total amount for which payment has been asked but has not been paid by share holders 1. 6. Paid up capital

This is the total of the amount of share capital which has been actually paid by the share holders Paid up capital =called up capital-calls in arrears

/ http://www.principlesofaccounting2.com/

Features of ordinary share v Owners of the company v They have voting rights v No fixed % of dividend Features of preference shares v Not the Owners of the company v Have no voting rights v Have fixed % of dividend

Debentures v Debentures are the loan to the company v They are creditors of the company v A fixed % of interest is paid each year whether profit made or not

Key points 1. 1. Debentures

Loan to the company from the public carrying fixed rate of interest

1. 2.

Debenture interest

This is the interest paid on debentures to the debentures holders. This is as expense to be charged in the profit and loss account and if it owes it is known as a current liability in the balance sheet (it is nor the item to be entered In the appropriation account)

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

1. 3. Long term loan interest This is also an expense to be charged in the profit and loss account (not in the appropriation account) and it owes it is known as a current liability

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 3 of 9

1. 4.

Ordinary shares

Shares entitled to divided after the preference shareholder have been paid their dividends

1. 5.

Preference shares

Shares that are entitled to an agreed rate of dividend before the ordinary shareholders receive anything

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

The profit that is being distributed to the shareholders is called dividends 1. 7. Interim dividend The dividend paid to the share holders in between two annual general meetings (it is the item to be entered in appropriation account) 1. 8. Proposed divided

1. 6.

Dividends

This is the dividend agreed by the board of directors, but not paid. It is deducted from the profit and loss appropriation account and shown as a current liability in the balance sheet

1. 9.

Dividend is calculated on the paid up capital only

If all issued have been paid up, then both the same

1. 10. Reserves The transfer of apportioned profits to accounts for use in future

1. 11. Directors remuneration This is the remuneration given to the directors and an expense to be shown in the profit and loss account (it is not the item to be entered in appropriation account)

/ http://www.principlesofaccounting2.com/

1. 12. For preference shares prefixed rate of dividend is paid Preference dividend =issued preference share capital X Rate 1. 13. For ordinary shares If dividend paid is as percentage of capital Dividend =issued ordinary share capital X Rate If dividend is payable per share Dividend =Number of issued ordinary share capital X Dividend per share Distinction between shares and debentures Shares 1 2 3 4 Owners capital. Owners/ Share holders. Dividend paid is appropriation of profit. 1 2 3 Debentures Loan capital. Creditors. Interest paid is a charge or expense Interest payment is compulsory whether profits are earned or not. Redeemed after certain period at the option or discretion of the company. Normally having fixed charge or floating

Dividends paid according to the 4 profit earned and at the direction of the directors. Not repaid or redeemed except 5

5 6

redeemable preference shares. Unsecured. The shareholders will get 6

the repayment of capital on winding charge on the assets of the company. up, only if there is surplus. 14. Distinction between ordinary shares and preference shares Ordinary shares Ultimate control of the company Dividend is available only if there are sufficient profits. Preference shares No control of the company Fixed rate of dividends. If cumulative preference shareholders miss dividends in one year, they get arrears of dividends in good years. Preferential treatment of dividend and repayment of capital

1 2

1 2

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

3 No preferential treatment of dividend 3

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 4 of 9

Treated as own capital

Treated as prior charge capital, that is part of loan capital

Profit and loss appropriation account. This is the account prepared after the preparation of the trading and profit & loss account of a limited company. This account starts with the net profit obtained from the profit & loss account and the last years retained profit (if any). The appropriations of profits are shown in this account. After the appropriation, if there is any profit left over, it is called retained profit and it will be carried forward to the next year. Formats:

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Balance sheet extract

/ http://www.principlesofaccounting2.com/

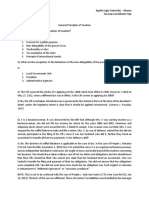

MCQ 1. A company which can offer its shares for subscription to the public is known as: A. Private company C. Public corporation B. Public limited company D.Corporation

2. What is the authorized share capital of a limited company? A. The issued share capital B. Issued share capital plus reserves

C. Issued share capital plus debentures D. The shares that a company is allowed to issue by law 3. The liability of share holders of a public limited company is limited to: A. paid up value of shares C. extent of private assets B. nominal value of shares D. called up share capital

4. What is the other name of authorized capital? A. issued capital B. Nominal capital C. Uncalled capital D. Calls in arrears

5. The debenture interest paid is recorded in which part of the final accounts of a limited company? A. Trading account C. Profit and loss appropriation account B. Profit and loss account D. Balance sheet

6. The dividend is calculated on which of the following values of shares?

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

C. Called up share capital D. Paid up share capital 7. Which of the following is not included in the share holders funds? A. Debentures B. General reserves

A. Authorized share capital

B. Issued share capital

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 5 of 9

C. Ordinary share capital

D. Preference share capital

8. Retained profit of a limited company belongs to the: A. directors B. debenture holders C. shareholders D. company

9. Proposed dividends are: A. shown as a current liability on the balance sheet B. debited with other business expenses in the profit and loss account C. paid from capital reserves D. credited to the appropriation account

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

A. debited in the trading account B. debited in the profit and loss account C. debited in the appropriation account D. deducted from share capital in the B.S 11. Under which heading is share premium account shown? A. Current assets B. Current liabilities C. Share capital D. Reserves & Surplus 12. The interim dividend paid is shown in the: A. profit and loss account B. profit and loss appropriation account only

10. In the final accounts of a limited company, directors remuneration is:

C. profit and loss account and balance sheet D. profit and loss appropriation account and balance sheet Assignment Questions Q 1. share Union ltd. is registered with an authorized capital of $ 800 000 divided into 300 000 Ordinary

of $ 2 each and 200 000, 10 % preference shares of $ 1 each. On 30 the April, 2001 after the completion of trading and profit & loss account the following balances remained in the books. Account balances Ordinary share capital 10 % Preference Share Capital Premises at cost Machinery and Plant at cost Motor vans at cost Retained earnings b/f Preference dividends owing Debit $ Credit $ 5 00 000 1 00 000 3 80 000 3 10 000 60 000

/ http://www.principlesofaccounting2.com/

10 000 10 000 20 000 52 000 40 000 15 000 31 000 1 35 000 20 000 30 000 3 000 Ordinary share dividend owing Stock Debtors Creditors Cash in hand and at bank Provision for depreciation Machinery and Plant Motor vans !0% Debentures redeemable 2010 Debenture interest owing

30 000 Share premium 8 73 000 8 73 000 Total Prepare for Union Ltd. a balance sheet at 30.04.2001 showing clearly the working capital and the shareholders fund. Q2 . The final accounts of Moir Ltd. are prepared on 30th April each year. On 30th April, 2002 after the

profit and loss account had been prepared the following information was available. $ Authorized capital 300 000 Ordinary shares of $ 1 each Issued capital, fully paid 120 000 ordinary shares of $ 1 each Freehold premises at cost Plant and Machinery at cost Provision for depreciation on Plant and Machinery Profit and loss account credit balance 10 % debentures Cash at bank Stock at 30 120 000 100 000 75 000 35 000 33 190 10 000 8 500 300 000

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

th

April, 2002

25 000 9 450

Trade creditors

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 6 of 9

Trade debtors Expenses prepaid General reserve

8 200 940 10 000

From the above information prepare a balance sheet as at 30th April, 2002. Your balance sheet must show sub-totals for fixed and current assets, current and long-term liabilities. Working capital must be identified within your balance sheet.

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Account Balances Debit $ Credit $ Issued Share Capital Ordinary Shares 10 % Preference Shares Land and buildings at cost Motor vehicles at cost Fixtures & Fittings at cost Provision for depreciation Motor Vehicles Fixtures & Fittings Debtors & Creditors Stocks Bank Cash General Reserve Profit for the year Retained Earnings 9% Debentures Interim Dividend paid Total The directors proposed: 40 000 12 44 000 18 000 68 000 60 000 4 000 32 000 1 40 000 12 000 50 000 12 44 000 8 00 000 1 00 000 6 64 000 2 40 000 1 50 000 60 000 38 000 12 000

Q 3. Summertime Ltd, has an authorized capital of $ 10 00 000 consisting of $ 8 00 000 Ordinary Shares of $ 1 each and $ 2 00 000, 10% Preference Shares of $ 1 each. After completing the trading, profit & loss a/c for the year ended 31.03.2003, the following balances remain in their books:-

/ http://www.principlesofaccounting2.com/

3. to transfer $ 20 000 to general reserve Prepare the profit and loss appropriation a/c and the balance sheet of the company. Q4. The following balances appeared in the books of XL ltd, as at 31.12.2003 $ Premises Equipment Authorized & Issued Capital 10% Debentures Stock in trade Debenture interest owing Profit & loss a/c on 01.01.03 Cash at bank Creditors Debtors Provision for depreciation on equipment Net Profit for the year 1 06 000 27 000 70 000 20 000 4 500 1 500 3 200 5 220 6 000 3 000 12 600 32 420

1. to pay the preference dividend in full 2. to pay a final dividend of 8% on the ordinary shares

The following additional information is also available: 1. $ 5 000 is to be transferred to general reserve 2. A dividend of 12% is proposed on ordinary shares Prepare the profit & loss appropriation a/c for the year ended 31.12.2003 and a balance sheet extract showing working capital and shareholders funds.

Q 5. 000

Sound Sense plc. has an authorized share capital of 500 000 ordinary shares of $ 1 each and 200 10% preference shares of $ 2 each.

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Issued Share Capital 400 000 ordinary shares of $ 1 each 4 00 000

After the trading and profit & loss a/c had been prepared for the year ended 31.03.2003, the following balances appeared in the books of the company. $

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 7 of 9

50 000, 10% preference shares of $ 2 each Net trading profit for the year Retained earnings b/f Debtors Creditors Bank (credit balance) General Reserve Interim ordinary dividend paid Premises at cost

1 00 000 60 000 17 000 26 000 14 000 10 000 12 000 12 000 3 00 000

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Equipment at cost 2 25 000 86 000 Motor Vehicle at cost Provision for depreciation on Equipment on Motor Vehicles Closing Stock Additional Information; 1. $ 35 000 should be transferred to general reserve 2. Preference dividend to be paid in full 3. A final dividend of 2% on ordinary shares is proposed by the directors 62 000 20 000 46 000

Prepare the profit & loss appropriation a/c for the year ended 31.12.2003 and a balance sheet extract showing working capital shareholders funds. Q 6. Hallom Limited has a registered capital of $ 6 00 000 divided into 4 00 000 ordinary shares of $1 each and 2 00 000 6% preference shares of $ 1 each. The following balances remained in the accounts of the company after the trading and profit and loss accounts had been prepared for the year ended 30th April 2003. Debit $ Credit $ Debenture interest accrued 175 15 000

/ http://www.principlesofaccounting2.com/

7% debentures Ordinary share capital: fully paid 6% preference share capital: fully paid Cash at bank Profit and loss account balance on 1st May 2002 Debtors & creditors Net profit for the year ended 30th April 2003 Machinery and plant at cost Provision for depreciation on machinery and plant Stock Premises at cost General reserve Total 4 00 000 10 000 90 000 20 000 200 000 50 000 39 175 3 50 000 6 34 175 20 000 6 34 175 8 600 40 400 25 000

The directors have recommended the following:1. a transfer of $ 5000 to general reserve 2. an ordinary share dividend of 10% 3. a provision for the full years preference share dividend You are asked to:1. Prepare the profit and loss appropriation account for the year ended 30th April 2003 2. Prepare a balance sheet at 30th April 2003, showing fixed assets, current assets, current liabilities, working capital and shareholders fund.

Q 7. Perez plc. had an authorized capital of $ 2 00 000 divided into 1 50 000 0rdinary shares of $ 1 each and 50 000 8% preference shares of $1each. The following balances remained in the accounts of the company after the trading and profit loss accounts had been prepared for the year ended 31st Dec 2003. Debit $ Ordinary share capital; fully paid 8% preference shares; fully paid Machinery and plant at cost 60 000 Credit $ 1 00 000 20 000 20 000 16 450 18 052

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Provision for depreciation on machinery and plant Premises at cost Profit and loss account balance(1-1-2003) Net profit (for the year ended 31st Dec. 2003) 1 00 000

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 8 of 9

Light and heat Cash at bank Stock Debtors and creditors

560 8 500 6 000 2 200 1 788

150 Insurance 1 76 850 1 76 850 Total Directors have recommended an ordinary dividend of 7% and wish to provide payment of the preference share dividend for the year. Prepare for the Perez plc:1. the profit and loss appropriation account for the year ended 31st Dec 2003

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Premises at cost Ordinary share capital(fully paid) 10% preference shares ( fully paid) General reserve 8% debentures Share premium Cash at bank Debtors & creditors Profit and loss account balance on 1st May 2002 Net profit during the year Machinery and plant at cost Provision for deprecation on machinery and plant Good will Stock Provision for bad debts Debenture interest accrued Salaries 10 000 9 800 Debit $ 3 20 000 Credit $

2. the balance sheet as at 31st Dec 2003 only the part which shows the share holders fund and the working capital.

Q 8. Graphic Limited has the registered capital of $ 5 00 000, divided into 3 00 000 ordinary shares of $1 each and 2 00 000 10 % preference shares of $ 1 each. The following balances remained in the books

of the company after the trading and profit and loss accounts had been prepared for the year ended 30th April 2003:-

2 00 000 1 00 000 8 000 30 000 10 000 15 000 60 000 40 000 1 70 000 95 000 20 000 15 920 920 1 200 600

/ http://www.principlesofaccounting2.com/

Insurance Interim ordinary dividend paid 5 000 Total At 30th April 2003, the directors recommended:1. to increase the general reserve by $ 20 000 2. an ordinary share dividend of 8 per share on ordinary share capital 3. a provision for preference share dividend in full Required to prepare at 30th April 2003 1. the profit and loss appropriation account 2. the extracts of balance sheet showing shareholders fund. 10 000 5 60 720 5 60 720

Q 9. The authorized capital of XYZ Limited is $ 5 00 000 divided into 5 00 000 0rdinary share of $ 1 each. The following balance sheet was extracted from the companies books for the year ended 30th September 2003:Assets Land and buildings Motor vehicles Machinery Stock Trade debtors Cash in hand Cash at bank Total $Liabilities 1 50 000Issued and paid up capital 170 000Ordinary shares of $1 each 1 20 000Trade creditors 30 000Bank loan 13 000General reserves 17 000Retained profit 25 000 5 25 000Total $ 4 00 000 17 500 27 500 50 000 30 000 5 25 000

During the 1st week of October 2003, the following transactions took place:1. $ 10 000 of the debtors was paid by cash $ 9 500 in full settlement. 2. Remaining ordinary shares were issued and fully paid up by cheque. 3. $ 21 000 cost of goods was sold for $ 28 000 on credit. 4. One old motor vehicle was sold for $ 10 000. The payment was received by cheque immediately. The

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

6. Bought goods on credit for $ 7 500 Prepare the balance sheet of XYZ Limited in vertical form at 7th October 2003, after showing the adjustments to each item regarding the above transactions.(the adjustments should be shown in

book value of the motor vehicle was $ 9 500. 5. Cash deposited in the bank $ 10 000

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

Company Accounts - Principles Of Accounting

Page 9 of 9

brackets) Q 10. The following trial balance was extracted from the books of a Limited Co. at 31st Dec 2002, immediately after the preparation of its Trading & profit and Loss A/C. Its Authorized capital consists of 3 00 0000 ordinary shares of $ 1 each and 1 50 0000 preference shares of $ 1 each.

Account balances Issued share capital 2 00 000 ordinary share of $ 1 each 1 00 000 15% Preference shares of $ 1 each 12% Debentures Interim dividend paid on Ordinary shares Share Premium Account Good will Debtors and Creditors Salaries owing Plant & machinery at cost Buildings at cost Stock of goods Cash at Bank and in hand Net profit during the year Furniture & fixtures at cost Provision for depreciation on:Plant and Machinery Buildings Furniture and Fixtures Total Additional information:1. The Co decided to pay the dividend on preference share capital 2. A final dividend of 5p per share is to be paid on ordinary share capital 3. $ 5 000 should be transferred to the General Reserve Account. Required to:-

Dr $

Cr $ 2 00 000 1 00 000 15 000

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

12 000 8 000 16 000 1 50 000 1 10 000 42 500 23 300

5 000 9 000 1 300

57 000 40 000 5 000 5 500 4 000 4 01 800 4 01 800

/ http://www.principlesofaccounting2.com/

1. the current ratio 2. the liquid ratio 3. the N/P to sales ratio if the cost of goods sold was $ 1 25 000 and G/P was 1/5 on cost. Incoming search terms: appropriation of shares and dividends in accounting called up share accounting entry paid up capital not paid accounting entry

http://www.principlesofaccounting2.com

1. Prepare the Profit and Loss appropriation A/C and the Balance Sheet as at 31st Dec. 2000 2. After preparing the balance sheet, calculate:-

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

http://principlesofaccounting2.com/topics/company-accounts/

8/12/2013

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Title:Mwanzo Baraka Management Information SystemDocument24 pagesTitle:Mwanzo Baraka Management Information Systemmoses100% (1)

- ABDC Investor Presentation (05.26.15)Document28 pagesABDC Investor Presentation (05.26.15)Tarek DomiatyNo ratings yet

- Jawaban BE15 - AKMDocument3 pagesJawaban BE15 - AKMMazz BadruezNo ratings yet

- Payroll Accounting - Principles of AccountingDocument7 pagesPayroll Accounting - Principles of AccountingAbdulla MaseehNo ratings yet

- Partnership - Principles of AccountingDocument9 pagesPartnership - Principles of AccountingAbdulla MaseehNo ratings yet

- Final Accounts With Adjustments - Principles of AccountingDocument9 pagesFinal Accounts With Adjustments - Principles of AccountingAbdulla Maseeh100% (1)

- Manufacturing Accounts - Principles of AccountingDocument6 pagesManufacturing Accounts - Principles of AccountingAbdulla Maseeh100% (1)

- Incomplete Records - Principles of AccountingDocument8 pagesIncomplete Records - Principles of AccountingAbdulla Maseeh100% (2)

- Rectification of Errors - Principles of AccountingDocument7 pagesRectification of Errors - Principles of AccountingAbdulla Maseeh100% (1)

- Final Accounts - Principles of AccountingDocument9 pagesFinal Accounts - Principles of AccountingAbdulla MaseehNo ratings yet

- Double Entry Bookkeeping - T-AccountsDocument4 pagesDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Control Accounts - Principles of AccountingDocument7 pagesControl Accounts - Principles of AccountingAbdulla Maseeh67% (3)

- Clubs and Societies - Principles of AccountingDocument3 pagesClubs and Societies - Principles of AccountingAbdulla Maseeh100% (1)

- Depreciation and Assets Disposal - Principles of AccountingDocument8 pagesDepreciation and Assets Disposal - Principles of AccountingAbdulla MaseehNo ratings yet

- Departmental Accounts - Principles of AccountingDocument3 pagesDepartmental Accounts - Principles of AccountingAbdulla MaseehNo ratings yet

- Business Purchase - Principles of AccountingDocument5 pagesBusiness Purchase - Principles of AccountingAbdulla MaseehNo ratings yet

- Cash Book - Principles of AccountingDocument13 pagesCash Book - Principles of AccountingAbdulla MaseehNo ratings yet

- Accounting Rules - Principles of AccountingDocument5 pagesAccounting Rules - Principles of AccountingAbdulla MaseehNo ratings yet

- Books of Prime Entry and Ledgers - Principles of AccountingDocument10 pagesBooks of Prime Entry and Ledgers - Principles of AccountingAbdulla Maseeh100% (1)

- Bank Reconciliation Statement - Principles of AccountingDocument8 pagesBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNo ratings yet

- Amalgamation - Principles of AccountingDocument4 pagesAmalgamation - Principles of AccountingAbdulla MaseehNo ratings yet

- Accounting Concepts - Principles of AccountingDocument3 pagesAccounting Concepts - Principles of AccountingAbdulla MaseehNo ratings yet

- Bad Debts and Provision For Bad Debt - Principles of AccountingDocument7 pagesBad Debts and Provision For Bad Debt - Principles of AccountingAbdulla MaseehNo ratings yet

- Accruals and Prepayments - Principles of AccountingDocument6 pagesAccruals and Prepayments - Principles of AccountingAbdulla MaseehNo ratings yet

- Accounting Ratios - Principles of AccountingDocument5 pagesAccounting Ratios - Principles of AccountingAbdulla MaseehNo ratings yet

- Introduction To Accounting - Principles of AccountingDocument178 pagesIntroduction To Accounting - Principles of AccountingAbdulla MaseehNo ratings yet

- STCBL Financial AnalysisDocument33 pagesSTCBL Financial AnalysisSonam K Gyamtsho67% (3)

- Ratio Analysis of Asian PaintsDocument52 pagesRatio Analysis of Asian PaintsM43CherryAroraNo ratings yet

- 2003 Dec29 No95 TheedgesporeDocument43 pages2003 Dec29 No95 TheedgesporeThe Edge SingaporeNo ratings yet

- FINE 342 SummaryDocument17 pagesFINE 342 SummaryJohn ThompsonNo ratings yet

- Rules of Capital Maintenance: Pranjal NeupaneDocument11 pagesRules of Capital Maintenance: Pranjal NeupaneSamish DhakalNo ratings yet

- Statutory Text Tax Reform Act of 2014 Discussion DraftDocument979 pagesStatutory Text Tax Reform Act of 2014 Discussion DraftBrett LoGiuratoNo ratings yet

- 158 635731706753700140 The QuestionsDocument232 pages158 635731706753700140 The QuestionsJonabelle LisingNo ratings yet

- Tax Law LMT Aquila Legis FraternityDocument17 pagesTax Law LMT Aquila Legis FraternityWilbert ChongNo ratings yet

- Chapter 1 Financial MarketsDocument32 pagesChapter 1 Financial Markets09 CHAN CHUI YAN S2ENo ratings yet

- CadburyDocument37 pagesCadburyjdh_apsNo ratings yet

- Honda Annual Report 2018-19Document88 pagesHonda Annual Report 2018-19Shubhra PujariNo ratings yet

- Sol 3 CH 6Document46 pagesSol 3 CH 6Aditya KrishnaNo ratings yet

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Document109 pagesA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Pontoon PLC A Case StudyDocument6 pagesPontoon PLC A Case Studyparthasarathi_inNo ratings yet

- Annual Report Project On Muthoot Finance LTDDocument41 pagesAnnual Report Project On Muthoot Finance LTDAlicia Duncan50% (2)

- ShalimarDocument109 pagesShalimarvinodNo ratings yet

- ACCOUNTING FOR MANAGEMENT MCQDocument14 pagesACCOUNTING FOR MANAGEMENT MCQEr. THAMIZHMANI MNo ratings yet

- FIN 435 Exam 3 SlidesDocument85 pagesFIN 435 Exam 3 SlidesMd. Mehedi HasanNo ratings yet

- Apex 2018Document166 pagesApex 2018uzunarumazNo ratings yet

- Unit - 2 BOPDocument2 pagesUnit - 2 BOPRavi SistaNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- Chap004 Cpa SolutionDocument86 pagesChap004 Cpa SolutionboydjolofNo ratings yet

- Poddar PigmentsDocument19 pagesPoddar PigmentsRamesh ReddyNo ratings yet

- Comparative Study of Financial Statement Reports of Canara Bank and Comparative BankDocument41 pagesComparative Study of Financial Statement Reports of Canara Bank and Comparative Bankparamjeet kourNo ratings yet

- 2020 Summer Maharashtra State Baord STD 12 Commerce Past Exam Question Papers Downlaod SPDocument2 pages2020 Summer Maharashtra State Baord STD 12 Commerce Past Exam Question Papers Downlaod SPAshwini NaleNo ratings yet

- BBS Report PDFDocument41 pagesBBS Report PDFRupak GautamNo ratings yet

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet