Professional Documents

Culture Documents

Knowledge Map of Tally - Erp 9 - Revised Schedule VI

Uploaded by

Rakesh ChandrasekharanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Knowledge Map of Tally - Erp 9 - Revised Schedule VI

Uploaded by

Rakesh ChandrasekharanCopyright:

Available Formats

Knowledge Map

Tally.ERP 9

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Preface

What is a Knowledge Map?

A Knowledge Map is a representation of a concept using levels of information. Each level provides deeper understanding than the previous one. The emphasis is on gaining the maximum understanding in the shortest possible time.

Why Knowledge Map for Tally.ERP 9?

Tally.ERP 9 is one of the most widely used financial software that has extended capabilities and great potential to transform a business. Many areas of Tally, when implemented, actually translate to increased efficiency, reduced costs, and organised business operations. This Knowledge Map has been created to help readers gain an immediate understanding of the key areas of expertise; such an understanding can bring about positive impact on your business. This Knowledge Map on Tally.ERP 9 aims to 1. 2. 3. 4. 5. 6. Get you closer to understanding the key areas in a short time. Illustrate how these key areas can benefit a business. Encourage the efficient use of the most appropriate solutions. Have the most beneficial information handy, enhancing usability of Tally.ERP 9. Helps users find critical information quickly. Enhance decision-making and problem-solving by providing access to applicable information.

Benefits of using the Knowledge Map for Tally.ERP 9

Grasp the necessary know-how quickly without having to refer to any secondary material. Arrive at information faster! This is a non-continuous, easily understandable guide on how to obtain a positive impact with Tally.ERP 9. Information on any page is complete and relevant to the functionality of the key area; you dont have to refer to another page to understand it. Immediate awareness of where you are in the Knowledge Map. All pages have been marked for easy navigation.

Preface

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Structure of the Knowledge Map for Tally.ERP 9

The Knowledge Map is layered as shown below, with each layer zooming in on each key area. Homepage (Level 1) The Homepage consists of the key areas. Clicking on any of these topics will take you to the page containing pictorial representation of the key functionalities of that key area.

Image Trigger (Level 2) Level 2 provides a pictorial overview of the key areas. The purpose of pictorial representation is to act as triggers, to help you remember the basics of the topic under discussion. The images will lead you to Level 3 when clicked.

Functionality (Level 3) Level 3 contains a brief explanation of the main functionality of Revised Schedule VI and key areas like: Mapping of Chart of Accounts Classification of Assets & Liabilities as Current and Non-current Disclosure of any item of Expense and Income Inserting and Renaming of Heads Comparative Information Removal of the disclosures through schedules A brief introduction on Revised Schedule VI functionalities in Tally.ERP 9 will be given here. Zoom in to Level 4 for more details by clicking on the name of the functionality. Functional Details (Level 4) Navigating to Level 4, will lead you to further information on the functionality of the key area i.e., the benefits and features of the functionality, and how to use it.

Scenario and FAQs A typical business situation that can be simplified with Tally.ERP 9 is presented as a Scenario. The FAQs section, as the name suggests, contains a set of Frequently Asked Questions pertaining to each of the key areas discussed.

Preface

ii

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

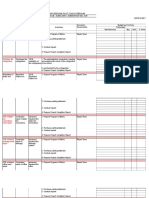

Table of Contents

Preface ............................................................................................................. i Revised Schedule VI Reports ........................................................................... 1

Revised Schedule VI Functionality ................................................................... 2

Mapping of Chart of Accounts ....................................................................................... 4 Classification of Assets & Liabilities as Current and Non-Current ......................................... 4 Disclosure of any item of Income or Expenditure ............................................................. 5 Inserting and Renaming of Heads on Financial Statements ................................................ 5 Comparative information ............................................................................................. 6 Disclosure of Additional Information through Notes .......................................................... 6 Rounding off rule ....................................................................................................... 7 Other Helpful Options ................................................................................................. 7

Scenarios ....................................................................................................... 8 FAQs ..............................................................................................................10

Table of Contents

iii

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Revised Schedule VI Reports

The Revised Schedule VI reports are a recent requirement for all registered companies to comply as per the latest amendment to the Companies Act, 1956. The main objective is to move towards the adoption of IFRS (International Financial Reporting Standards) by Indian Corporates in view of the increased globalisation. The standard calls for more transparency in reporting and the minimum disclosure required. The Company however is free to give additional information if required. The requirements also talk of the supremacy of the Accounting Standards over the Schedule VI requirements should there be any conflict. Developing the technology to comply with the requirements of the Revised Schedule VI was a challenging task for us. We have developed a technology that helps easy mapping of ledgers /groups to the respective Schedule VI Heads.

Revised Schedule VI

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Revised Schedule VI Functionality

Mapping of Chart of Accounts

The first-cut mapping of Chart of Accounts in Tally with the Revised Schedule VI Heads is made simpler for the Chartered Accountant. Based on enablement and use of statutory modules, the mapping is automatic in Statement of Profit & Loss. However, if the modules are not enabled and used, the Ledgers/Groups are shown under Ungrouped and have to be manually mapped to Revised Schedule VI Head(s) after review. In the case of the Balance Sheet the primary mapping is based on the default Tally accounting groups and subsequently they are grouped under Ungrouped. After a review, the Ledgers/Groups have to be mapped to the appropriate Revised Schedule VI Head(s). To meet the final requirements of the Revised Schedule VI, the use of classification types are important to complete the mapping of Ledgers/Groups to the appropriate Revised Schedule VI Head(s) for better presentation.

Classification of Assets & Liabilities as Current and Non-Current

The main requirement in the Balance Sheet presentation is classification of Assets and Liabilities as Current and Non-current in nature. Classification of Current and Non-current amounts is made automatically or manually. The use of Bill-wise option assists the Auditor to generate the classification automatically based on due date. The facility for manual classification is provided.

Disclosure of any item of Income or Expenditure

The requirements call for disclosing major line items whose values are the maximum of 1% of the Revenue from Operations or Rs.100000, in the Statement of Profit and Loss.

Inserting and Renaming of Heads on Financial Statements

The requirements talk of minimum disclosure at the line levels in the Balance Sheet and Statement of Profit & Loss. But to cater to the industry/sector specific disclosure, the user can disclose additional items or substitute information in the reports. This calls for more information which is more relevant and understandable. The solution provides the options to insert additional heads and rename an existing head.

Revised Schedule VI > Functionality

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Revised Schedule VI Functionality

Comparative information (Comparison of mapped financial statements of the current year with the previous year)

A comparison of the current year Schedule VI statements with the immediately preceding accounting year has to be disclosed in the Balance Sheet and Statement of Profit & Loss. The mapping configuration applied to the current year can be applied to the previous year to enable comparison.

Disclosures of Additional Information through Notes

Based on IFRS principles, the Revised Schedule VI requires the presentation of additional information in the Notes to Accounts. The feature provides for options to enter additional information to the Revised Schedule VI heads and also number the Notes and enter details.

Rounding off rule

The Revised Schedule VI has set out rules for presenting turnover figures of a Company. If the turnover is less than Rs.100 crores, the rounding off can be nearest Hundreds, Thousands, Lakhs, Millions or decimal thereof. If it is more than Rs.100 crores, the rounding off can be nearest Lakhs, Millions or decimal thereof.

Other Helpful Options

The feature offers other exciting options: Restoration of wrong mapping Multi classification of ledgers/groups Master Configuration

Revised Schedule VI > Functionality

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Mapping of Chart of Accounts

BENEFITS Easier mapping of chart of accounts Saves time FEATURES Automatic/Manual Mapping Use of classification types to do mapping

HOW TO 1. Enable Statutory Modules and pass the vouchers 2. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Profit & Loss A/c / Balance Sheet 3. Press Alt+F1: Detailed > Press Enter on the Revised Schedule VI Head to view the Tally Ledgers 4. Ctrl + Enter: Classify (for single ledger mapping) 5. Press Spacebar to select multiple ledgers > Alt + C: Multi Classify: (for more than one ledger/group)

Classification of Assets & Liabilities as Current and Non-Current

BENEFITS Quick generation of information relating to Current and Non-current in the Balance Sheet Saves time

FEATURES Automatic generation of report

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet > Ctrl + C: Classify Helper

Revised Schedule VI > Funtionality > Funtionality Details

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Disclosure of any item of Income or Expenditure

BENEFITS Quick generation of information relating to Income and Expenditure maximum of 1% of Revenue from Operations or Rs.100000 Saves time

FEATURES Automatic generation of report

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Profit & Loss A/c > Sale of Products/Other Incomes/Expenses > Ctrl + C:Classify Helper

Inserting and Renaming of Heads on Financial Statements

BENEFITS Easier presentation of additional information/substitution of existing information Saves time

FEATURES Rename Head / Insert a new Head

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Profit & Loss A/c / Balance Sheet > Alt + F1: Detailed > Insert Head/Rename Head

Revised Schedule VI > Funtionality > Funtionality Details

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Comparative information

BENEFITS Easier comparison of current years information with the previous year Saves time

FEATURES Copying the current years configuration to the subsequent year Copying the configuration from one company to another

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profit & Loss A/c > Ctrl + O: Copy Classify

Disclosure of Additional Information through Notes

BENEFITS Better disclosure as per the requirements of Revised Schedule VI

FEATURES Presentation of information relating to Heads in Notes and compared with previous year data

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profit & Loss A/c > F8: Note N: > Alt + N: Notes 2. The Additional information details of the heads are entered by clicking Alt +A: Additional Info

Revised Schedule VI > Funtionality > Funtionality Details

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Rounding off rule

BENEFITS Better presentation of turnover figures for comparison

FEATURES Show turnover figures for comparison in Hundreds, Thousands, Lakhs, Millions and decimal thereof

HOW TO 1. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profit & Loss A/c > F12: Configure > Scale Factor for Values

Other Helpful Options

BENEFITS Correction of wrong mapping (Restoration) Quick classification of ledgers/groups ( Multi-classify & Master Configuration) FEATURES Methods to quicken and improve mapping to Revised Schedule VI heads HOW TO 1. Restoration of wrong mapping Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profit & Loss A/c > Ctrl + F10: Restore Def. The restoration option is available at the ledger level mapping. 2. Multi- Classify-Ledger level Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profit & Loss A/c > Alt + C: Multi Classify 3. Master Configuration Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet / Profitt & Loss A/c >Alt + F9: Master Config

Revised Schedule VI > Funtionality > Funtionality Details

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Scenarios

1. The Auditor has a client which is a registered company under the Companies Act, 1956. The Company has to file the annual financial statements, Balance Sheet and Statement of Profit & Loss as per the Revised Schedule VI formats notified recently by the Ministry of Corporate Affairs. Solution: The Auditor by executing the following steps is able to generate instantly the first draft of Revised Schedule VI Financial Statements. Load the clients current year data Gateway of Tally > Audit & Compliance > Financial Statement > Profit & Loss A/c Gateway of Tally > Audit & Compliance > Financial Statement > Balance Sheet 2. As per the requirements of the Revised Schedule VI, the Assets and Liabilities in the Balance Sheet statement have to be classified as Current and Non-current respectively. Some examples are, Trade Receivable / Payables, Borrowings, Term Loans etc. Solution: The following are the steps to classify Assets and Liabilities as Current and Noncurrent. Gateway of Tally > Audit & Compliance > Financial Statement > Balance Sheet > Ctrl+ C: Classify Helper Tally by default displays the statement of Current and Non-current for Trade Receivables (Sundry Debtors) and Trade Payables (Sundry Creditors) based on Due Dates provided the Bill -wise option is enabled and used. Alternatively the Auditor can utilize the Set Parameter- (Alt+ S) button to generate the Current and Non-current information based on user defined percentage values or the operating cycle values.

3. To simplify the disclosure requirements, it is necessary that any item of Income or Expenditure if it exceeds Rs. 1 Lakh or 1% of Revenue from Operations shall be disclosed separately on the Statement of Profit and Loss A/c. The following are the steps to be executed: Gateway of Tally > Audit & Compliance > Financial Statement > Profit and Loss A/c > Identify the appropriate Income / Expenditure head and drill-down to the next level > Ctrl + C: Classify Helper Tally by default displays the list of ledgers falling under this criterion Select appropriate Ledger by pressing the Spacebar and click Alt + S: Show Separate button

Revised Schedule VI > Scenario

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

Scenarios

4. To ensure the data is properly presented, the Revised Schedule VI requires a proper mapping of ledgers/groups to the Heads. The ledger/group values can be mapped based on the following criteria:

Entire Balance Map the entire Closing Balance of Ledger(s)/Group(s) to the appropriate Revised Schedule VI head Dr/Cr Closing Balance Map the Ledger(s)/Group(s) based on the Debit/Credit Closing Balances to the appropriate Revised Schedule VI head Dr/Cr Transaction Total Map the total of the Transactions of the Ledger/Group Debit or Credit to the appropriate Revised Schedule VI heads Dr/Cr Pending Amount Represent Ledger Debit or Credit pending amount to appropriate Revised Schedule VI Head Group Nett Balance Map Group(s) based on Debit or Credit Closing Balance to appropriate Revised Schedule VI Head Bifurcate Balance - - Bifurcation/splitting of the closing balance and mapping to the respective Rev Sch VI head(s)

Revised Schedule VI > Scenario

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

FAQs

1. How do I map the ledgers/groups in the Balance Sheet and Statement of Profit and Loss? You can map the ledgers/groups based on the following scenarios:

Profit & Loss A/c: If statutory modules are enabled, ledgers configured and transactions are accounted, then the draft of P&L A/c is generated. Identified ledgers are mapped to Revised Schedule VI Heads automatically. Other ledgers/groups that cant be identified are grouped under the head Ungrouped for further mapping. Balance Sheet: By default the ledgers/groups are mapped to the heads based on the Tally groups at the first level. Those unidentified ledgers/groups are grouped under Ungrouped for further mapping. 2. What are the methods of mapping the chart of accounts to the Revised Schedule VI Heads? If you want to map a single ledger/group, select it by pressing the Spacebar and click the keys Ctrl + Enter together. For a multi mapping you can click Alt + F9: Master Config. button. We have provided 4 different classification types to assist you in mapping and on option to bifurcate. 3. I want to correct a wrong mapping. How do I correct? There is a button Ctrl + F10: Restore Def. for restoration of the earlier mapping. Select the ledger(s) by clicking the Spacebar and click Ctrl + F10: Restore Def. button to restore the earlier wrong mapping. Caution: You must be careful while selection of the ledger(s)/groups(s) while restoration. If you click without selection, the entire mapping will be reset. 4. I want to classify the trade receivables (Sundry Debtors) and trade payables (Sundry Creditors) as Current and Non-current. Is it possible? Yes, we have provided an option to classify the trade receivables and payables as Current and Non-current. There is a button Ctrl + C: Classify Helper for this type of classification. Also you can classify the data based on: Due Date Percentage

Revised Schedule VI > FAQs

10

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

FAQs

5. I have finished mapping of the current years data. I want to map the previous year. How do I do that? The mapping of the previous years data is very simple in the product. You can click Ctrl + O: Copy Classify buttons in the status bar in the Statement of Profit & Loss A/c and Balance Sheet reports. Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Balance Sheet/Profit & Loss A/c > Ctrl + O: Copy Classify 6. The Schedule VI requirements call for entry of additional information to Balance Sheet as well as the Statement of Profit and Loss A/c. How do I do that? Balance Sheet You can enter the additional details in two ways. One, you can drill down to the group level in the Balance Sheet report and click Alt + A: Additional Info. Now you can enter the details as required for the group. The other way is click Additional Details feature under Financial Statements. Path: Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Additional Details Statement of Profit and Loss A/c You can enter the additional details in two ways. One, select a desired group, Revenue from Operations, drill down to the Note Summary level. Click Ctrl + E: Excise Duty button to enter the details. The other way is click Additional Details feature under Financial Statements. Path: Gateway of Tally > Audit & Compliance > Statutory Audit > Financial Statements > Additional Details. Select Excise Duty or any other item(s) under Statement of Profit and Loss A/c to enter details. 7. The Rev Sch VI mentions that Notes will be replacing Schedules for providing additional information. How do I enter the note details? Both the reports, Balance Sheet and the Statement of Profit and Loss A/c have the button, F8: Note No. to number and enter details (Alt + N: Notes). Click the button and enter the details. 8. I want to pass entries to record the Exceptional and Extraordinary items in Profit and Loss A/c. How do I account the entries? Click Accounting Vouchers in Gateway of Tally screen. In the Accounting Voucher Creation screen, click F7: Journal to pass the journal entries for the Exceptional/Extraordinary items. Path: Gateway of Tally > Accounting Vouchers > F7: Journal The amount accounted as expense or revenue will appear under the Ungrouped head in the Statement of Profit and Loss. This amount then has to be mapped to the exceptional/extraordinary heads as per the method(s) mentioned above.

Revised Schedule VI > FAQs

11

Knowledge Map of Tally.ERP 9 AE- Revised Schedule VI

FAQs

9. I want to insert a new head or rename an existing one. Are these possible in the feature? You can rename the existing head in the following manner. Renaming of existing head Select the particular head in either Balance Sheet/Statement of Profit and Loss A/c for renaming. Click Alt+ R: Rename Head button found in the status bar. Type the required name and accept. Inserting a new head Select either Balance Sheet/Statement of Profit and Loss A/c and expand it. Select the required head under which the new head is to be inserted. Click Alt+ I: Insert Head button.

Revised Schedule VI > FAQs

12

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Recent Development of Digital Oil FieldDocument23 pagesRecent Development of Digital Oil FieldMohit AgarwalNo ratings yet

- Michigan LLC Articles of OrganizationDocument3 pagesMichigan LLC Articles of OrganizationRocketLawyer100% (2)

- Forbes Insights Study - Customer EngagementDocument12 pagesForbes Insights Study - Customer EngagementMegan BlanchardNo ratings yet

- TencentDocument2 pagesTencentSumit Suman100% (1)

- Service Catalog Template DocDocument3 pagesService Catalog Template DocBabul BhattNo ratings yet

- Action Plan To Control The BreakagesDocument1 pageAction Plan To Control The BreakagesAyan Mitra75% (4)

- CRM in Axis BankDocument92 pagesCRM in Axis BankKartik RateriaNo ratings yet

- Arbitration ClausesDocument14 pagesArbitration Clausesramkannan18No ratings yet

- Bot ContractDocument18 pagesBot ContractideyNo ratings yet

- Human Resource ManagementDocument1 pageHuman Resource ManagementRakesh ChandrasekharanNo ratings yet

- The Mysterious Affair at StylesDocument155 pagesThe Mysterious Affair at StylesRakesh ChandrasekharanNo ratings yet

- Consumer Behaviour - IntroductionDocument10 pagesConsumer Behaviour - IntroductionruchierichNo ratings yet

- Statutory AuditDocument9 pagesStatutory AuditRakesh ChandrasekharanNo ratings yet

- Deferred Tax - Explained From The Basics in DetailDocument2 pagesDeferred Tax - Explained From The Basics in DetailRakesh ChandrasekharanNo ratings yet

- Form WWDocument9 pagesForm WWRakesh ChandrasekharanNo ratings yet

- The Mysterious Affair at StylesDocument155 pagesThe Mysterious Affair at StylesRakesh ChandrasekharanNo ratings yet

- Statutory AuditDocument9 pagesStatutory AuditRakesh ChandrasekharanNo ratings yet

- Demos PDF C2 FAF Chapter 3Document35 pagesDemos PDF C2 FAF Chapter 3Rakesh ChandrasekharanNo ratings yet

- The Mysterious Affair at StylesDocument155 pagesThe Mysterious Affair at StylesRakesh ChandrasekharanNo ratings yet

- The Mysterious Affair at StylesDocument155 pagesThe Mysterious Affair at StylesRakesh ChandrasekharanNo ratings yet

- Excise Computation ReportDocument1 pageExcise Computation ReportRakesh ChandrasekharanNo ratings yet

- Deferred Tax - Explained From The Basics in DetailDocument2 pagesDeferred Tax - Explained From The Basics in DetailRakesh ChandrasekharanNo ratings yet

- Implementation of TDS in Tally - Erp 9Document192 pagesImplementation of TDS in Tally - Erp 9Keyur ThakkarNo ratings yet

- Implementation of TDS in Tally - Erp 9Document192 pagesImplementation of TDS in Tally - Erp 9Keyur ThakkarNo ratings yet

- Deferred Tax - Explained From The Basics in DetailDocument2 pagesDeferred Tax - Explained From The Basics in DetailRakesh ChandrasekharanNo ratings yet

- Tax Deducted at Source: © Tally Solutions Pvt. Ltd. All Rights ReservedDocument9 pagesTax Deducted at Source: © Tally Solutions Pvt. Ltd. All Rights ReservedRakesh ChandrasekharanNo ratings yet

- Sample Reports of Tax Deducted at Source - Services SQL To Tally - Tally Customization Services - Tally HelpdeskDocument33 pagesSample Reports of Tax Deducted at Source - Services SQL To Tally - Tally Customization Services - Tally HelpdeskjohnabrahamstanNo ratings yet

- AIP WFP 2019 Final Drps RegularDocument113 pagesAIP WFP 2019 Final Drps RegularJervilhanahtherese Canonigo Alferez-NamitNo ratings yet

- Tutorial Chapter 4 Product and Process DesignDocument29 pagesTutorial Chapter 4 Product and Process DesignNaKib NahriNo ratings yet

- 10 Types of Entrepreneurial BMsDocument36 pages10 Types of Entrepreneurial BMsroshnisoni_sNo ratings yet

- Mail Merge in ExcelDocument20 pagesMail Merge in ExcelNarayan ChhetryNo ratings yet

- From Local To Global BrandingDocument6 pagesFrom Local To Global BrandingSuraj JobanputraNo ratings yet

- Customer Service ExcellenceDocument19 pagesCustomer Service ExcellenceAnh ThưNo ratings yet

- Nike: The world's leading sportswear brandDocument20 pagesNike: The world's leading sportswear brandMohit ManaktalaNo ratings yet

- MCI BrochureDocument7 pagesMCI BrochureAndrzej M KotasNo ratings yet

- Basel III Capital Regulations and Liquidity StandardsDocument40 pagesBasel III Capital Regulations and Liquidity Standardsrodney101No ratings yet

- MM ZC441-L2Document60 pagesMM ZC441-L2Jayashree MaheshNo ratings yet

- Six Essential Strategies For Selecting A Global 3PL - Inbound LogisticsDocument3 pagesSix Essential Strategies For Selecting A Global 3PL - Inbound Logisticsrafazel hardyNo ratings yet

- Guru Kirpa ArtsDocument8 pagesGuru Kirpa ArtsMeenu MittalNo ratings yet

- Ofada Rice ProductionDocument97 pagesOfada Rice ProductionPrince Oludare AkintolaNo ratings yet

- Steel Prospectus in GCCDocument4 pagesSteel Prospectus in GCCAshish AggarwalNo ratings yet

- Banking Project Topics-2Document4 pagesBanking Project Topics-2Mike KukrejaNo ratings yet

- Commercial Lease AgreementDocument4 pagesCommercial Lease AgreementRajesh KhetanNo ratings yet

- Volume 01 - Pe 02Document123 pagesVolume 01 - Pe 02drunk PUNISHER100% (1)

- Case Study 7.5 SPMDocument2 pagesCase Study 7.5 SPMgiscapindyNo ratings yet

- Kwality WallsDocument18 pagesKwality WallsKanak Gehlot0% (2)

- Understanding The Retailer Rule Qualifier - RR / RRM : Quick ReferenceDocument9 pagesUnderstanding The Retailer Rule Qualifier - RR / RRM : Quick ReferenceSeba311No ratings yet

- MQP For MBA I Semester Students of SPPUDocument2 pagesMQP For MBA I Semester Students of SPPUfxn fndNo ratings yet