Professional Documents

Culture Documents

A Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 Revision

Uploaded by

Fund for Democratic CommunitiesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 Revision

Uploaded by

Fund for Democratic CommunitiesCopyright:

Available Formats

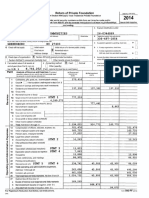

Rough

Cut Annual Net Operating Income Statement for Shopping Center

Annual Income from Rents

Family Dollar

RCC

19,000 remaining square feet

Annual max income

Revenue lost to vacancy

Gross income from rents

$39,680.00

$24,000.00

$140,600.00

$204,280.00

-$32,560.00

$171,720.00

Annual

Expenses

Management

Insurance

Maintenance

Utilities

Taxes

Reserves

Total

expenses

$8,586.00

$7,920.00

$39,600.00

$8,800.00

$0.00 If

community

owns

as

a

non-profit

land

trust,

then

no

taxes

due.

Otherwise

$26,184

$15,400.00

$80,306.00

Net Operating Income before Debt Service

$91,414.00

Assumptions

Sq

footage

of

grocery

store/comm'y

space

Grocery

store

rent

per

yr

Family

Dollar

sq

footage

Family

Dollar

rent

per

yr

Total

sq

footage

of

center

Remaining

sq

footage

Annual

sq

ft

rental

price

Vacancy

rate

management

costs

Insurance

per

sq

ft

Maintenance

per

sq

ft

Utilities

per

sq

ft

Reserve

per

sq

ft

15,000

$24,000.00

10,000

$40,000.00

44,000

19,000

$7.40

10%

5%

$0.18

$0.90

$0.20

$0.35

see assumptions used by New bessemer Associates in 5/20 submission

likely given long-term leases signed by Family Dollar and RCC

see assumptions used in Michael Watts 4/23 report to City

see assumptions used in Michael Watts 4/23 report to City

see assumptions used in Michael Watts 4/23 report to City

see assumptions used in Michael Watts 4/23 report to City

see assumptions used in Michael Watts 4/23 report to City

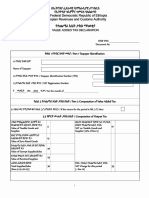

Comparison of four scenarios in which a Community Land Trust purchases Renaissance Center

Scenario

1

$1,900,000

5

2018

40

2058

2058

$400,000

$250,000

$150,000

$1,500,000

$800,000

$700,000

$91,414

Scenario

2

$1,900,000

10

2023

15

2038

2038

$950,000

$800,000

$150,000

$950,000

$500,000

$450,000

$91,414

Scenario

3

$1,900,000

10

2023

20

2043

N/A

$950,000

$800,000

$150,000

$950,000

$950,000

$0

$91,414

Scenario

4

$1,900,000

2

2015

30

2045

2045

$100,000

$20,000

$80,000

$1,800,000

$300,000

$1,500,000

$91,414

$58,174

$58,174

$58,174

$35,000

$35,000

$74,381

$74,381

$0

$0

$0

$69,082

$69,082

$69,082

$0

$0

$66,300

$60,000

$60,000

$60,000

$0

$33,240

$33,240

$33,240

$56,414

$56,414

$17,033

$17,033

$91,414

$91,414

$91,414

$22,332

$22,332

$22,332

$91,414

$91,414

$25,114

$31,414

$31,414

$31,414

$91,414

Accumulated Cash relative to purchase date

Year 3

Year 5

Year 10

Year 15

Year 20

Year 25

Year 30

Year 35

Year 40

Year 45

$0

$166,200

$332,399

$498,599

$664,798

$946,868

$1,228,938

$1,511,008

$1,793,078

$2,250,148

$0

$85,164

$170,327

$255,491

$712,561

$1,169,631

$2,083,771

$2,540,841

$2,997,911

$3,454,981

$0

$111,661

$223,323

$334,984

$446,646

$903,716

$1,360,786

$1,817,856

$2,274,926

$2,731,996

$75,343

$125,572

$282,642

$439,712

$596,782

$753,852

$910,922

$1,367,992

$1,825,062

$2,282,132

Accumulated cash by year

2018

2023

2028

2033

2038

2043

2048

2053

2058

2063

$0

$166,200

$332,399

$498,599

$664,798

$946,868

$1,228,938

$1,511,008

$1,793,078

$2,250,148

$0

$0

$85,164

$170,327

$255,491

$712,561

$1,169,631

$2,083,771

$2,540,841

$2,997,911

$0

$0

$111,661

$223,323

$334,984

$446,646

$903,716

$1,360,786

$1,817,856

$2,274,926

$75,343

$219,814

$376,884

$533,954

$691,024

$848,094

$1,185,164

$1,642,234

$2,099,304

$2,556,374

Purchase Price of Shopping center

Years to save down payment

Year of purchase

Years to pay off (Term)

Year paid off

Last year City is owed money

Initial Equity Stake

Amount of down payment from RCC

Amount of down payment - other sources

Amount of Financing Needed

Financing from Self Help @ 4%

Financing from City @ 0%

Annual NOI before debt service

Annual Debt Service

Years 1-5

Years 6-15

Years 16-20

Years 21-30

Years 31-40

Annual NOI after debt service

Years 1-5

Years 1-15

Years 16-20

Years 21-30

Years 31-40

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- More Than A Grocery StoreDocument24 pagesMore Than A Grocery StoreFund for Democratic CommunitiesNo ratings yet

- Reparations, How Are We Doing It?Document20 pagesReparations, How Are We Doing It?Fund for Democratic Communities100% (1)

- 2009 990 PFDocument23 pages2009 990 PFFund for Democratic CommunitiesNo ratings yet

- 2013 990 PFDocument33 pages2013 990 PFFund for Democratic CommunitiesNo ratings yet

- 2014 990 PF AmendedDocument27 pages2014 990 PF AmendedFund for Democratic CommunitiesNo ratings yet

- 2007 990 PFDocument29 pages2007 990 PFFund for Democratic CommunitiesNo ratings yet

- 2011 990 PFDocument26 pages2011 990 PFFund for Democratic CommunitiesNo ratings yet

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNo ratings yet

- 2015 990 PFDocument30 pages2015 990 PFFund for Democratic CommunitiesNo ratings yet

- 2010 990 PFDocument23 pages2010 990 PFFund for Democratic CommunitiesNo ratings yet

- The Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Document26 pagesThe Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Fund for Democratic CommunitiesNo ratings yet

- 2008 990 PFDocument26 pages2008 990 PFFund for Democratic CommunitiesNo ratings yet

- RCC Film Screening Resentation 3.2.15Document5 pagesRCC Film Screening Resentation 3.2.15Fund for Democratic CommunitiesNo ratings yet

- RCC Pro Forma - January 23, 2014 RevisionDocument16 pagesRCC Pro Forma - January 23, 2014 RevisionFund for Democratic CommunitiesNo ratings yet

- RCC Proposal To The City of Greensboro, January 22, 2014Document11 pagesRCC Proposal To The City of Greensboro, January 22, 2014Fund for Democratic CommunitiesNo ratings yet

- RCC Presentation To The City, January 22, 2014Document52 pagesRCC Presentation To The City, January 22, 2014Fund for Democratic CommunitiesNo ratings yet

- ROOTSTOCK - July 2014Document2 pagesROOTSTOCK - July 2014Fund for Democratic CommunitiesNo ratings yet

- Process For Approving Bylaws and Electing Our First Board of DirectorsDocument8 pagesProcess For Approving Bylaws and Electing Our First Board of DirectorsFund for Democratic CommunitiesNo ratings yet

- Renaissance Community Coop Bylaws (Unapproved)Document6 pagesRenaissance Community Coop Bylaws (Unapproved)Fund for Democratic CommunitiesNo ratings yet

- Black Coop Pioneers in The Struggle For Economic JusticeDocument87 pagesBlack Coop Pioneers in The Struggle For Economic JusticeFund for Democratic Communities100% (1)

- Nomination Form For The RCC Board of DirectorsDocument2 pagesNomination Form For The RCC Board of DirectorsFund for Democratic CommunitiesNo ratings yet

- Notes From Small Group Discussion - June 17Document11 pagesNotes From Small Group Discussion - June 17Fund for Democratic CommunitiesNo ratings yet

- White House Press Release Including Participatory BudgetingDocument7 pagesWhite House Press Release Including Participatory BudgetingFund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionDocument16 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionFund for Democratic CommunitiesNo ratings yet

- RCC Pro Forma - May 23, 2013 RevisionDocument9 pagesRCC Pro Forma - May 23, 2013 RevisionFund for Democratic CommunitiesNo ratings yet

- ROOTSTOCK - Volume 1, Issue 1Document2 pagesROOTSTOCK - Volume 1, Issue 1Fund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsDocument2 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsFund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance CenterDocument14 pagesA Pathway To Responsible Community Ownership of The Renaissance CenterFund for Democratic CommunitiesNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cargo MarDocument6 pagesCargo MarJayadev S RNo ratings yet

- 5d7344794eaa11567835257 1037739Document464 pages5d7344794eaa11567835257 1037739prabhakaran arumugamNo ratings yet

- Chapter - 9 Multifactor ModelsDocument15 pagesChapter - 9 Multifactor ModelsAntora Hoque100% (1)

- What Does Fedex Deliver?Document17 pagesWhat Does Fedex Deliver?duckythiefNo ratings yet

- Compressors system and residue box drawingDocument1 pageCompressors system and residue box drawingjerson flores rosalesNo ratings yet

- Market Structure and Game Theory (Part 4)Document7 pagesMarket Structure and Game Theory (Part 4)Srijita GhoshNo ratings yet

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelNo ratings yet

- KarachiDocument2 pagesKarachiBaran ShafqatNo ratings yet

- Blue and Gray Modern Marketing Budget PresentationDocument14 pagesBlue and Gray Modern Marketing Budget PresentationPPTI 40 I Gede Arinata KP.No ratings yet

- G20 Leaders to Agree on Trade, CurrencyDocument5 pagesG20 Leaders to Agree on Trade, CurrencysunitbagadeNo ratings yet

- Corporation Law - Atty. Zarah Villanueva (Case List)Document3 pagesCorporation Law - Atty. Zarah Villanueva (Case List)leizzhyNo ratings yet

- October Month Progress ReportDocument12 pagesOctober Month Progress ReportShashi PrakashNo ratings yet

- March-April - The Indian Down UnderDocument60 pagesMarch-April - The Indian Down UnderindiandownunderNo ratings yet

- Funskool Case Study - Group 3Document7 pagesFunskool Case Study - Group 3Megha MarwariNo ratings yet

- TSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521Document2 pagesTSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521NeQuie TripNo ratings yet

- Annual Report 2019 Final TCM 83-498650 PDFDocument153 pagesAnnual Report 2019 Final TCM 83-498650 PDFzain ansariNo ratings yet

- KjujDocument17 pagesKjujMohamed KamalNo ratings yet

- VAT Declaration FormDocument2 pagesVAT Declaration FormWedaje Alemayehu67% (3)

- Sample Chapter PDFDocument36 pagesSample Chapter PDFDinesh KumarNo ratings yet

- Energy Audit and Energy SavingDocument21 pagesEnergy Audit and Energy SavingPrafulla Mandlekar100% (2)

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDocument18 pagesABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458No ratings yet

- CMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementDocument10 pagesCMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementCharusat UniversityNo ratings yet

- Humss 125 Week 1 20 by Ramon 2Document240 pagesHumss 125 Week 1 20 by Ramon 2Francis Esperanza88% (17)

- High Potential Near MissDocument12 pagesHigh Potential Near Missja23gonzNo ratings yet

- Oxylane Supplier Information FormDocument4 pagesOxylane Supplier Information Formkiss_naaNo ratings yet

- PPLCDocument5 pagesPPLCarjun SinghNo ratings yet

- Commercial BanksDocument9 pagesCommercial BanksPrathyusha ReddyNo ratings yet

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocument4 pagesSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinNo ratings yet

- How To Reach Staff Training CentreDocument4 pagesHow To Reach Staff Training CentreRituparna MajumdarNo ratings yet

- Chapt 12Document50 pagesChapt 12KamauWafulaWanyamaNo ratings yet