Professional Documents

Culture Documents

Financial Auditing For Internal Auditors

Uploaded by

fazalhaqqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Auditing For Internal Auditors

Uploaded by

fazalhaqqCopyright:

Available Formats

Financial Auditing for Internal Auditors

For internal auditors and managers who want to understand and expand their roles related to financial reporting, as well those who simply need a refresher course on financial accounting concepts, this course is the ideal way to get up to speed. Beyond a basic accounting class, this course will enable participants to approach financial auditing with renewed confidence. Taking on such topics as common recipes for cooking the books, and covering information flow from business process, to financial statement, and more, this course will help participants understand how key business processes relate to financial statements, as well as the impact of information technology on financial statements.

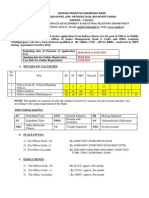

Course Duration: 2 Days CPE Hours Available: 16 CPE Knowledge Level: Intermediate Field of Study: Auditing Prerequisites: None Advance Preparation: Please bring a calculator to perform simple calculations such as percentages and ratios. Delivery Format: Seminar, On-site

Course Outline: Accounting and Auditing Review Define key accounting terms and understand accounting rules, equations, and basic principles. Understand what journal entries are and demonstrate how they are used for accounting purposes. Understand GAAP hierarchy and identify the rules, rule makers, and rule breakers. Understand the financial auditing process and recall The IIA Practice Advisories associated with financial auditing. Identify the basic COSO principles of internal control, including key controls and their characteristics. Identify finance-related management assertions and learn how to utilize them in the audit process.

Financial Statements An Overview Identify financial statements. Identify the purpose and use of a financial balance sheet. Identify the purpose and use of income statements. Understand how to properly review a balance sheet and income statement.

Business Processes and Accounting Identify the difference between management and financial auditing. Recall how vertical and horizontal analysis can be used in audits. Understand revenue process activities and recall the types of revenue-related accounts and associated rules. Understand the procurement process, including activities, types of accounts, and process rules. Understand fixed assets, including fixed asset process activities, types of accounts, and process rules. Identify types of revenue- and liability-related ratios. Recall where to find useful FASB references.

Recipes for Cooking the Books Identify the basic elements of an accounting scandal (fraud). Identify the five most common financial games. Understand the use of analytical procedures in fraud detection.

Technology and Accounting Understand the risks associated with end user computing. Understand how spreadsheets are used within business, what the characteristics of spreadsheets are, and spreadsheet risks to be aware of. Identify what Enterprise Resource Planning (ERP) is and how it is used within a business. Identify application controls and how to integrate an application review into a financial audit.

You might also like

- US Foriegn PolicyDocument5 pagesUS Foriegn PolicyfazalhaqqNo ratings yet

- FATADocument7 pagesFATAfazalhaqqNo ratings yet

- FATA Tribal AreaDocument20 pagesFATA Tribal AreafazalhaqqNo ratings yet

- Effects of Separate Family Systems on Children's DevelopmentDocument4 pagesEffects of Separate Family Systems on Children's DevelopmentfazalhaqqNo ratings yet

- Development ChallengesDocument2 pagesDevelopment ChallengesfazalhaqqNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Events OrganizerDocument32 pagesEvents OrganizerChristian LimNo ratings yet

- Merrill Lynch Saudi Arabia Co Annual Fs - 2022Document37 pagesMerrill Lynch Saudi Arabia Co Annual Fs - 2022RANo ratings yet

- Dipped Products Annual Report AnalysisDocument106 pagesDipped Products Annual Report AnalysisNimesh GunasekeraNo ratings yet

- Comp 18-19 PDFDocument2 pagesComp 18-19 PDFFrench HubbNo ratings yet

- Working Capital Goodfrey PhilipsDocument81 pagesWorking Capital Goodfrey PhilipslovleshrubyNo ratings yet

- Compensation of General Partners of Private Equity FundsDocument6 pagesCompensation of General Partners of Private Equity FundsManu Midha100% (1)

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityDocument12 pagesT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugNo ratings yet

- Form 15 - Register of Leave With WagesDocument2 pagesForm 15 - Register of Leave With WagesHi IamNo ratings yet

- Guidelines MooeDocument14 pagesGuidelines MooeRommel SalagubangNo ratings yet

- Financial Accounting Part 6Document26 pagesFinancial Accounting Part 6dannydoly100% (1)

- (Your Name) : Business PlanDocument33 pages(Your Name) : Business PlanDanny Solvan100% (1)

- Fund Raising BalkansDocument2 pagesFund Raising BalkansRebekah HaleNo ratings yet

- Understanding Depreciation Methods and ConceptsDocument30 pagesUnderstanding Depreciation Methods and ConceptsVimalKumar100% (1)

- Quarter 2 - Module 8 Computation of Gross ProfitDocument23 pagesQuarter 2 - Module 8 Computation of Gross ProfitJessel Razalo Bunye82% (11)

- Tamu Q3 2023Document46 pagesTamu Q3 2023syoburiverNo ratings yet

- Consumption and SavingsDocument58 pagesConsumption and SavingsAsif ShahNo ratings yet

- TAX-07-GROSS-INCOME (With Answers)Document12 pagesTAX-07-GROSS-INCOME (With Answers)Kendrew SujideNo ratings yet

- Week 6Document8 pagesWeek 6Richelle GraceNo ratings yet

- Policy Proposal On Caregiving: Child Care, Early Education, and After School CareDocument5 pagesPolicy Proposal On Caregiving: Child Care, Early Education, and After School CareNga TranNo ratings yet

- SAP Cash Bank AccountingDocument5 pagesSAP Cash Bank AccountingHenrique BergerNo ratings yet

- FTF WorkbookDocument90 pagesFTF WorkbookwploeppkyNo ratings yet

- Human Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inDocument8 pagesHuman Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inJeshiNo ratings yet

- Activity-based costing differences and cost flowsDocument12 pagesActivity-based costing differences and cost flowsKristine Esplana ToraldeNo ratings yet

- An Analysis of The Takeover of The Bank of Melbourne by Westpac Banking CorporationDocument28 pagesAn Analysis of The Takeover of The Bank of Melbourne by Westpac Banking CorporationMRASSASINNo ratings yet

- Albania Apartments in Saranda - Saranda Alba ResidenceDocument9 pagesAlbania Apartments in Saranda - Saranda Alba ResidenceAlbania PropertyNo ratings yet

- Regular Output Vat 1Document39 pagesRegular Output Vat 1Samantha Tayone100% (1)

- PA 131 Chapter 1Document31 pagesPA 131 Chapter 1Joey MalongNo ratings yet

- Net Income Calculation for Multiple ProblemsDocument3 pagesNet Income Calculation for Multiple ProblemsChris Tian FlorendoNo ratings yet

- (Kotak) Zee Entertainment Enterprises, May 30, 2022Document11 pages(Kotak) Zee Entertainment Enterprises, May 30, 2022darshanmaldeNo ratings yet

- Business Plan of Energy DrinkDocument20 pagesBusiness Plan of Energy DrinkUsmanNo ratings yet