Professional Documents

Culture Documents

List of IFRS & IAS

Uploaded by

Khurram IqbalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of IFRS & IAS

Uploaded by

Khurram IqbalCopyright:

Available Formats

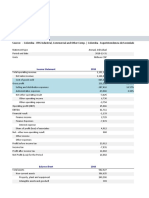

International Financial Reporting Standards

#

IFRS 2 IFRS 3 IFRS 5 IFRS 7 IFRS 8 IFRS 9 IFRS 10 IFRS 11 IFRS 12 IFRS 13

Name

Share-based Payment Business Combinations Non-current Assets Held for Sale and Discontinued Operations Financial Instruments: Disclosures Operating Segments Financial Instruments Consolidated Financial Statements Joint Arrangements Disclosure of Interests in Other Entities Fair Value Measurement

Remarks

International Accounting Standards

#

IAS 1 IAS 2 IAS 7 IAS 8 IAS 10 IAS 11

Name

Presentation of Financial Statements Inventories Statement of Cash Flows Accounting Policies, Changes in Accounting Estimates and Errors Events After the Reporting Period Construction Contracts

Remarks

International Accounting Standards

#

IAS 12 IAS 16 IAS 17 IAS 18 IAS 19 IAS 20 IAS 21 IAS 23 IAS 24 IAS 27 IAS 28 IAS 29 IAS 32 IAS 33 IAS 34 IAS 36 IAS 37 IAS 38 IAS 40

Name

Income Taxes Property, Plant and Equipment Leases Revenue Employee Benefits (2011) Accounting for Government Grants and Disclosure of Government Assistance The Effects of Changes in Foreign Exchange Rates Borrowing Costs Related Party Disclosures Separate Financial Statements (2011) Investments in Associates and Joint Ventures (2011) Financial Reporting in Hyperinflationary Economies Financial Instruments: Presentation Earnings Per Share Interim Financial Reporting Impairment of Assets Provisions, Contingent Liabilities and Contingent Assets Intangible Assets Investment Property

Remarks

List of ISAs 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37

ISA 200, Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Interna ISA 210, Agreeing the Terms of Audit Engagements ISA 220, Quality Control for an Audit of Financial Statements ISA 230, Audit Documentation ISA 240, The Auditor's Responsibilities Relating to Fraud in an Audit of Financial Statements ISA 250, Consideration of Laws and Regulations in an Audit of Financial Statements ISA 260, Communication with Those Charged with Governance ISA 265, Communicating Deficiencies in Internal Control to Those Charged with Governance and Management ISA 300, Planning an Audit of Financial Statements ISA 315, Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its En ISA 320, Materiality in Planning and Performing an Audit ISA 330, The Auditor's Responses to Assessed Risks ISA 402, Audit Considerations Relating to an Entity Using a Service Organization ISA 450, Evaluation of Misstatements Identified during the Audit ISA 500, Audit Evidence ISA 501, Audit Evidence-Specific Considerations for Selected Items ISA 505, External Confirmations ISA 510, Initial Audit Engagements-Opening Balances ISA 520, Analytical Procedures ISA 530, Audit Sampling ISA 540, Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures ISA 550, Related Parties ISA 560, Subsequent Events ISA 570, Going Concern ISA 580, Written Representations ISA 600, Special Considerations-Audits of Group Financial Statements (Including the Work of Component Auditors ISA 610, Using the Work of Internal Auditors ISA 620, Using the Work of an Auditor's Expert ISA 700, Forming an Opinion and Reporting on Financial Statements ISA 705, Modifications to the Opinion in the Independent Auditor's Report ISA 706, Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor's Report ISA 710, Comparative Information-Corresponding Figures and Comparative Financial Statements ISA 720, The Auditor's Responsibilities Relating to Other Information in Documents Containing Audited Financial S ISA 800, Special Considerations-Audits of Financial Statements Prepared in Accordance with Special Purpose Fram ISA 805, Special Considerations-Audits of Single Financial Statements and Specific Elements, Accounts or Items of ISA 810, Engagements to Report on Summary Financial Statements International Standard on Quality Control (ISQC) 1, Quality Controls for Firms that Perform Audits and Reviews of

n Audit in Accordance with International Standards on Auditing

al Statements

Governance and Management

nderstanding the Entity and Its Environment

es, and Related Disclosures

the Work of Component Auditors)

ependent Auditor's Report ncial Statements nts Containing Audited Financial Statements rdance with Special Purpose Frameworks c Elements, Accounts or Items of a Financial Statement

at Perform Audits and Reviews of Financial Statements, and Other Assurance and Related Services Engagements

You might also like

- AuditSampleForms Master Sept 27 2011Document92 pagesAuditSampleForms Master Sept 27 2011Marta OsorioNo ratings yet

- ACCT212 WorkingPapers E3-31ADocument2 pagesACCT212 WorkingPapers E3-31Alowluder0% (1)

- Income Statement: Khybey Tobacco Company LTDDocument15 pagesIncome Statement: Khybey Tobacco Company LTDMuzamil Ur rehmanNo ratings yet

- BiiiimplmoniwbDocument34 pagesBiiiimplmoniwbShruti DubeyNo ratings yet

- CH 6 Model 14 Free Cash Flow CalculationDocument12 pagesCH 6 Model 14 Free Cash Flow CalculationrealitNo ratings yet

- Financial ModellingDocument39 pagesFinancial ModellingSaugat MahetaNo ratings yet

- IAS Plus IAS 7, Statement of Cash FlowsDocument3 pagesIAS Plus IAS 7, Statement of Cash Flowsfrieda20093835No ratings yet

- PFRS 15 Work ProgramDocument101 pagesPFRS 15 Work ProgramMichael ArciagaNo ratings yet

- Dummy Financial ModelDocument17 pagesDummy Financial ModelarhawnnNo ratings yet

- 7 Consolidation Package - TemplateDocument369 pages7 Consolidation Package - TemplateOUSMAN SEIDNo ratings yet

- Consolidated Balance Sheet Worksheet for Punto CompanyDocument21 pagesConsolidated Balance Sheet Worksheet for Punto CompanyDamy RoseNo ratings yet

- Management Accounting SampleDocument25 pagesManagement Accounting SampleEdward Baffoe100% (1)

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- Questionnaire For Financial AuditDocument2 pagesQuestionnaire For Financial AuditChaNo ratings yet

- MGAC2 ForecastingDocument22 pagesMGAC2 ForecastingJoana TrinidadNo ratings yet

- Audit Planning Scenarios AnalysisDocument6 pagesAudit Planning Scenarios AnalysisUsman PirzadaNo ratings yet

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Boa Tos Auditing.Document4 pagesBoa Tos Auditing.shalomNo ratings yet

- 8e Mini Case AnalyticsDocument6 pages8e Mini Case Analyticskyu77ryu0% (5)

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- Edited AC2104 BibleDocument166 pagesEdited AC2104 BibleStreak CalmNo ratings yet

- Annex 1 (Solvency)Document64 pagesAnnex 1 (Solvency)Cynical GuyNo ratings yet

- Balance Sheet AuditingDocument29 pagesBalance Sheet Auditingtanim duNo ratings yet

- Audit Practices ManualDocument354 pagesAudit Practices ManualRaif QelaNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- IFRSDocument103 pagesIFRSnoman.786100% (2)

- Ifrs ChecklistDocument8 pagesIfrs ChecklistMeenakshi ChumunNo ratings yet

- SBR Technical ArticlesDocument121 pagesSBR Technical ArticlesAudit 1043No ratings yet

- Inventory Excel UploadDocument36 pagesInventory Excel Uploadaadi1012No ratings yet

- Audit Module 1 - Trial Balance Account MappingDocument6 pagesAudit Module 1 - Trial Balance Account MappingGaurav KumarNo ratings yet

- Projected Financial Statements SummaryDocument43 pagesProjected Financial Statements SummaryKumar SinghNo ratings yet

- Test of Controls - Purchase Transactions Audit Objective Audit Procedure FindingsDocument9 pagesTest of Controls - Purchase Transactions Audit Objective Audit Procedure FindingscrystalroselleNo ratings yet

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Management Reporting MC ProductsDocument2 pagesManagement Reporting MC Productsharish_inNo ratings yet

- 20 Additional Practice IAS 7Document20 pages20 Additional Practice IAS 7Nur FazlinNo ratings yet

- La Taxonomia NIIF para PYMES Ilustrada 2015Document43 pagesLa Taxonomia NIIF para PYMES Ilustrada 2015Jose HernandezNo ratings yet

- Audit Test - ReceivablesDocument22 pagesAudit Test - ReceivablesRachael RuNo ratings yet

- Bit - Financial StatementsDocument10 pagesBit - Financial StatementsAldrin ZolinaNo ratings yet

- General Internal Audit ModelDocument5 pagesGeneral Internal Audit ModelSoko A. KamaraNo ratings yet

- Tax Audit Checklist for Form 3CDDocument36 pagesTax Audit Checklist for Form 3CDKoolmindNo ratings yet

- 02 Accounting 3 Statements Linking GuideDocument2 pages02 Accounting 3 Statements Linking GuideGus MarNo ratings yet

- 1.Bd InitialaDocument4,241 pages1.Bd InitialaCorovei EmiliaNo ratings yet

- FCFF ValuationDocument123 pagesFCFF ValuationeamonnsmithNo ratings yet

- Calculate Zurich's taxable income and income taxes payable for 2007Document31 pagesCalculate Zurich's taxable income and income taxes payable for 2007Shah KamalNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- IFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Document36 pagesIFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Дарья ГоршковаNo ratings yet

- Account CodesDocument35 pagesAccount CodesKarenNo ratings yet

- Audit Engagement FileDocument19 pagesAudit Engagement FileMujtaba HussainiNo ratings yet

- Monthly Info 2023.08Document10 pagesMonthly Info 2023.08onlychess96No ratings yet

- ACCO 420 Final F2020 Version 2Document4 pagesACCO 420 Final F2020 Version 2Wasif SethNo ratings yet

- Intermediate Accounting - Chapter 4 Spreadsheet Answer - KiesoDocument55 pagesIntermediate Accounting - Chapter 4 Spreadsheet Answer - KiesodNo ratings yet

- IFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsDocument30 pagesIFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsrpcoimbraNo ratings yet

- IFRSDocument2 pagesIFRSMohammad Biplob100% (1)

- Audited FS 2010 PfrsDocument46 pagesAudited FS 2010 Pfrsracs_ann110% (1)

- Adoption Status of BFRS, BAS, BSADocument7 pagesAdoption Status of BFRS, BAS, BSAAl RajeeNo ratings yet

- ABSTRACTDocument7 pagesABSTRACTСалтанат МакажановаNo ratings yet

- International Standards On AuditingDocument3 pagesInternational Standards On AuditingLarasati FarumiNo ratings yet

- November 2018 Final ExaminationDocument13 pagesNovember 2018 Final Examinationcherry008No ratings yet

- Ifrs 3Document1 pageIfrs 3Machi KomacineNo ratings yet

- MB 402 Guide BookDocument50 pagesMB 402 Guide BooklalsinghNo ratings yet

- ACCT 547: Lecture NotesDocument9 pagesACCT 547: Lecture Notesroger DoddNo ratings yet

- Conceptual Framework Prelim QuizDocument11 pagesConceptual Framework Prelim Quizmalou reyesNo ratings yet

- Multiple Choice ACCSTDocument5 pagesMultiple Choice ACCSTJaene L.No ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Summary of Ifrs 1Document9 pagesSummary of Ifrs 1Divine Epie Ngol'esuehNo ratings yet

- Role of ICT in disclosure practices of Indian tourist companiesDocument50 pagesRole of ICT in disclosure practices of Indian tourist companiesmohitNo ratings yet

- Deferred TaxDocument16 pagesDeferred TaxErick NuescaNo ratings yet

- ITC April 2021 Examiners CommentsDocument39 pagesITC April 2021 Examiners CommentsJake poolNo ratings yet

- 2010 Annual Report IBERIADocument432 pages2010 Annual Report IBERIAMhamudul HasanNo ratings yet

- 6941 - Multiple Choice - SMEsDocument5 pages6941 - Multiple Choice - SMEsAljur Salameda0% (3)

- Conceptual Framework and Accounting StandardsDocument7 pagesConceptual Framework and Accounting StandardsJumel Alejandre DelunaNo ratings yet

- Muhammad Fahad s/o Muhammad Imdad Class Roll no Section (BBA) VI 47 “A”Karachi: October 07, 2011Document41 pagesMuhammad Fahad s/o Muhammad Imdad Class Roll no Section (BBA) VI 47 “A”Karachi: October 07, 2011Amad MughalNo ratings yet

- FORM 20-F: United States Securities and Exchange CommissionDocument427 pagesFORM 20-F: United States Securities and Exchange Commissionميرنا ميرناNo ratings yet

- Inform: Log in To PWC InformDocument20 pagesInform: Log in To PWC InformHooria AfreenNo ratings yet

- Inventory ValuationDocument19 pagesInventory ValuationJohn Patterson100% (1)

- IAS 41 - AgricultureDocument16 pagesIAS 41 - AgricultureRichardNicoArdyantoNo ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedPanda CocoNo ratings yet

- Cost Classification Lecture NotesDocument7 pagesCost Classification Lecture Notesmichellebaileylindsa100% (1)

- Corporations-Organization and Capital Stock TransactionsDocument68 pagesCorporations-Organization and Capital Stock TransactionsZara ShoukatNo ratings yet

- IFRIC-12 ServiceConcessionArrangements PockePracticalGuideDocument59 pagesIFRIC-12 ServiceConcessionArrangements PockePracticalGuidezelcomeiaukNo ratings yet

- Model and Past Question PapersDocument537 pagesModel and Past Question PapersSumit Anand0% (1)

- Financial Accounting 1Document306 pagesFinancial Accounting 1Dimpal RabadiaNo ratings yet

- SAP FI GL Accounting (FI-GL)Document2 pagesSAP FI GL Accounting (FI-GL)Arnab SamantaNo ratings yet

- UNACEMDocument246 pagesUNACEMAlexandra Guzman BurgaNo ratings yet

- G10489 EC Intermediate Financial Reporting 2 PrimerDocument83 pagesG10489 EC Intermediate Financial Reporting 2 PrimerAlvin DantesNo ratings yet

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- Topic 3 International Convergence of Financial Reporting 2022Document17 pagesTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcNo ratings yet

- Mgt401 All in 1 MCQs Covering Lectures (1-45)Document80 pagesMgt401 All in 1 MCQs Covering Lectures (1-45)Nadia Hassan75% (4)