Professional Documents

Culture Documents

Finance 412 - Advanced Business Finance - Spring 2000

Uploaded by

jklein2588Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance 412 - Advanced Business Finance - Spring 2000

Uploaded by

jklein2588Copyright:

Available Formats

Syllabus_____________________________________________________________________Spring 2010

1) tell me about a time you've experienced conflict at work, how did you solve it? and 2) tell me about a time you've been under pressure, what did you do?

Finance 312 Introduction to Investments Spring 2010 http://webcom.grtxle.com/investments Antoinette Tessmer, Ph.D. 303 Eppley Center 884-1679 tessmer1@msu.edu finance312ta@gmail.com Sections:

4 5 Tu/Th Tu/Th 10:20 11:40am 12:40 2pm 11:40am - 12:40pm 1 2pm 1 2pm 129 Hubbard n021 BCC 135 Akers 303 Eppley 303 Eppley

Office hours:

M/W TAs Office Hours: F Tu

Course Objectives

To overview the theories and applications associated with the functioning of the financial market. That includes the conceptual foundation of portfolio theory, risk management, and asset valuation. The stock, bond, and derivative markets are examined. An investment challenge will give opportunities to directly apply theory to practice.

Textbook and Course Materials

All course materials are available at http://webcom.grtxle.com/investments ($100 registration fee) - Introduction to Investments (Ebook) by A.C. Tessmer. REQUIRED - Essentials of Investments-8th edition, by Bodie, Kane, and Marcus Recommended. Electronic version for $69 also available on reserve at the Business Library - Stocktrak account (registration card provided by instructor) - Wall Street Journal subscription (mail-in card provided by instructor) - Loncapa resources: - Syllabus - assignments - Practice exams - Other interesting links

______________________________________________________________________________________ Introduction to Investments FI312 page 1 of 6

Syllabus_____________________________________________________________________Spring 2010

______________________________________________________________________________________ Introduction to Investments FI312 page 2 of 6

Syllabus_____________________________________________________________________Spring 2010

Course Format

The course will follow a traditional lecture format. Students participation will be appreciated. Students will be in a better position to participate if they read the course material before coming to class. Students are strongly encouraged to read a business publication such as the Wall Street Journal on a regular basis. Selected articles from the Wall Street Journal will be discussed during class. All students will be responsible for all material presented in lecture and all administrative announcements given during class time. There will be material presented in class not covered in the text or lecture notes.

Course Requirements

Ebook material We will closely follow the notes. The students are required to learn the material. Numerous practice problems on Loncapa are an excellent preparation for the exams. Three individual assignments - to be turned in class on the due dates: Security Analysis Report ( March 23) Bond Analysis Report (April 15) Stocktrak Report (February 23 & April 29) Three exams - will test the students understanding of the material. Scheduled dates: February 16 (Chapters 1 to 7) March 25 (Chapters 8 to 10) May 3/5 (Chapters 11 to 15)

Grading

Grades are based on a curve of the total points accumulated throughout the semester. Assignment 1 (Security Analysis Report) Assignment 2 (Bond Analysis Report) Assignment 3 (Stocktrak Reports + trades) Exam 1 Exam 2 Exam 3 Total 100 points 100 points 100 points 100 points 100 points 100 points 600 points

______________________________________________________________________________________ Introduction to Investments FI312 page 3 of 6

Syllabus_____________________________________________________________________Spring 2010

Notes on grading

Late assignments will be accepted, until the last day of class (4/29/10), with a penalty of 50% on the assigned score. The instructor and a teaching assistant will grade the assignments. The exams are not cumulative. However, some material from earlier in the course will be necessary to understand material later in the semester. The exams will be multiple choices and will focus on the specific chapters to be covered for each exam. No notes will be allowed during the exam.

Make-up exams and Grade Changes

If you have an issue regarding the exam grading, you must write down your complaint and give the exam back to the instructor. In case of a known conflict with one of the exams, a make-up date and time should be arranged with the instructor, at least one week prior to the scheduled exam. A missed exam without prior notification will be recorded as a zero. If an emergency arises, be prepared to provide the instructor with a written documentation explaining your situation.

Administrative Policies

No person is allowed to attend class unless officially enrolled on a credit or non-credit basis with the appropriate fees paid (MSU Academic Programming Guide). It is assumed that students and instructors will behave in an ethical manner during class times and exams, according to the College Honor Code. No cheating of any kind will be tolerated. Unethical acts will be prosecuted according to the MSU Rights, Responsibilities & Regulations (see http://www.msu.edu/current/rights.html).

Dear Mr. Nakken, Thank you for taking the time yesterday to interview me. I thoroughly enjoyed our discussion and learning more about PMCF and what makes it such a great company to work for. I feel that this job is a great match with my skills and interests and would offer me the chance to make an immediate impact with my work. I look forward to hearing from you regarding the position. Sincerely, John Klein

______________________________________________________________________________________ Introduction to Investments FI312 page 4 of 6

Syllabus_____________________________________________________________________Spring 2010

Topics and course schedule

PART I Elements of Investments and Portfolio Theory Tu 1/12 Introduction Th 1/14 Chapter 1 Asset Classes and Financial Instruments Tu 1/19 Chapter 2 Securities Markets Th 1/21 Chapter 2 Securities Markets Tu 1/26 Chapter 3 Mutual Funds and Other Investment Companies Stocktrak website and assignment Th 1/28 Chapter 4 Risk and Return: Past and Prologue Tu 2/2 Chapter 5 Efficient Diversification Th 2/4 Chapter 6 Capital Asset Pricing F 2/5 10 trades on Stocktrak by midnight Tu 2/9 Chapter 7 Efficient Markets Th 2/11 Review session Tu 2/16 Exam 1 (Chapters 1 to 7) PART II Securities Analysis Th 2/18 Stocktrak Report 1 Help Session Tu 2/23 Chapter 8 Macroeconomic and Industry Analysis Stocktrak Report 1 due in class Th 2/25 Chapter 9 Equity Valuation Tu 3/2 Chapter 9 Equity Valuation Th 3/4 Chapter 10 Financial Statement Analysis M 3/8 to F 3/12 Spring Break Tu 3/16 Chapter 10 Financial Statement Analysis Th 3/18 Assignment 1 Help Session Tu 3/23 Review session + Assignment 1 due in class Th 3/25 Exam 2 (Chapters 8 to 10) PART III Debt Securities & Derivatives Markets Tu 3/30 Chapter 11 Bond Prices and Yields Th 4/1 Chapter 11 Bond Prices and Yields F 4/2 20 trades on Stocktrak by midnight Tu 4/6 Chapter 12 Managing Bond Portfolios Th 4/8 Chapter 12 Managing Bond Portfolios Tu 4/13 Assignment 2 Help Session Th 4/15 Chapter 13 Options Markets + Assignment 2 due in class Tu 4/20 Chapter 14 Option Valuation Th 4/22 Chapter 15 Futures Markets and Risk Management Tu 4/27 Chapter 15 Futures Markets and Risk Management Th 4/29 Review session + Stocktrak Report 2 due in class Finals Week Exam 3 (Chapters 11 to 15) Section 1: M 5/3 from 10am to 12noon Section 2: W 5/5 from 12:45 to 2:45pm

______________________________________________________________________________________ Introduction to Investments FI312 page 5 of 6

Syllabus_____________________________________________________________________Spring 2010

FI312 Stocktrak Challenge

Welcome to the FI312 Stocktrak Challenge. Your goal is to maximize the riskadjusted return on your invested assets starting with $500,000. Stocktrak is hosting the challenge. Prior to registering with Stocktrak, ask for a free registration card from your instructor. Next, sign up using the link provided on webcom.grtxle.com. Follow the instructions to register online. Stocktrak publishes all important trading rules on its website. Go over those rules before trading. During class on January 16, we will review the rules and answer all questions you might have about the challenge. Individual participation in this online trading simulation will account for 1/6 of your final grade (100 points). The challenge starts on January 11th. You may start trading right away! The primary criteria for grading will be on how you implement the strategy you propose and how much you utilize techniques discussed in class. At the end of the semester, you will be asked to hand in a printout of your complete trading history as well as a comprehensive portfolio report. The report should discuss how you implemented your strategy, which techniques you used, and your overall performance. You will be allowed to experiment with any number of strategies during the semester, starting January 11th and ending April 30th. Choose the strategy you think will earn you the top risk-adjusted return. You are allowed to invest in stocks, bonds, futures, options, and mutual funds.

Schedule and Grading

M 1/11 Tu 1/26 F 2/5 Th 2/18 Tu 2/23 F 4/2 Th 4/29 F 4/30 Stocktrak starts Stocktrak rules discussed in class 10 executed trades (1 point per trade, 10 points maximum) Stocktrak Report Help Session Stocktrak Report 1 due (35 points) 20 executed trades (1 point per trade, 20 points maximum) Stocktrak Report 2 due (35 points) Stocktrak ends

Extra credit will be offered on Report 2 as follows: At least one short position At least one futures/option position 5 points 5 points

______________________________________________________________________________________ Introduction to Investments FI312 page 6 of 6

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- SGA NarrativeDocument1 pageSGA Narrativejklein2588No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Sample Exam 2 Vocab Problems Acc Dep Impairment Loss GoodwillDocument1 pageSample Exam 2 Vocab Problems Acc Dep Impairment Loss Goodwilljklein2588No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Oregon ObjectionDocument40 pagesOregon Objectionjklein2588No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Opioid Lawsuit Carr v. Manufacturers and DistributorsDocument114 pagesOpioid Lawsuit Carr v. Manufacturers and DistributorsepraetorianNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- ACC/490 Weekly Overview: Week One: Auditing and AssuranceDocument2 pagesACC/490 Weekly Overview: Week One: Auditing and Assurancejklein2588No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Capacity ManagementDocument4 pagesCapacity Managementjklein2588No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Bismarck NarrativeDocument2 pagesBismarck Narrativejklein2588No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Narrative NantasketDocument6 pagesNarrative Nantasketjklein2588No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team Practice Questions For Exam #3Document2 pagesTeam Practice Questions For Exam #3jklein2588No ratings yet

- 2008 BBA Pre-Screen Case PDFDocument3 pages2008 BBA Pre-Screen Case PDFjklein25880% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Itm MemoDocument2 pagesItm Memojklein2588No ratings yet

- Midterm 1 AnsDocument3 pagesMidterm 1 Ansjklein2588No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- PS 2 Fall 2009 SolutionsDocument9 pagesPS 2 Fall 2009 Solutionsjklein2588No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- VivianFashion FAC I Acquisitions Cycle TDocument1 pageVivianFashion FAC I Acquisitions Cycle Tjklein2588No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Personality Tests Are No Substitute For Interviews: Business WeekDocument1 pagePersonality Tests Are No Substitute For Interviews: Business Weekjklein2588No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sample Quiz CH 12-2Document4 pagesSample Quiz CH 12-2jklein2588No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Noreen 1 e Exam 04Document4 pagesNoreen 1 e Exam 04jklein2588No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Test 3BDocument11 pagesTest 3Bjklein2588No ratings yet

- Membership Application: (Please Print)Document2 pagesMembership Application: (Please Print)jklein2588No ratings yet

- Managerial Accounting Chapter 5 Practice Exam SolutionsDocument4 pagesManagerial Accounting Chapter 5 Practice Exam Solutionsjklein2588No ratings yet

- 2-1.teamwork - Wall Street JournalDocument2 pages2-1.teamwork - Wall Street Journaljklein2588No ratings yet

- Environmental Test Answers 2-3Document1 pageEnvironmental Test Answers 2-3jklein2588No ratings yet

- Talking PlantsDocument7 pagesTalking Plantsjklein2588No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FLIGHTDocument3 pagesFLIGHTjklein2588No ratings yet

- D. All of These Answers Are TrueDocument2 pagesD. All of These Answers Are Truejklein2588No ratings yet

- Directions From San FranciscoDocument1 pageDirections From San Franciscojklein2588No ratings yet

- BZZZZZZZZDocument3 pagesBZZZZZZZZjklein2588No ratings yet

- Insect Vectored Disease Position Paper Rubric FS 08Document1 pageInsect Vectored Disease Position Paper Rubric FS 08jklein2588No ratings yet

- 305 Samp Ex 2 Keys 07Document1 page305 Samp Ex 2 Keys 07jklein2588No ratings yet

- How the Sacred Lotus Flower Generates Heat Like MammalsDocument1 pageHow the Sacred Lotus Flower Generates Heat Like Mammalsjklein2588No ratings yet

- Lecture 2-Chapt 2-Financial Risk MGTDocument47 pagesLecture 2-Chapt 2-Financial Risk MGTBrenden KapoNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- CFA Level 3 - Formula Sheet (NO PRINT)Document35 pagesCFA Level 3 - Formula Sheet (NO PRINT)Denis DikarevNo ratings yet

- BFIN 7230 All That GlittersDocument17 pagesBFIN 7230 All That GlittersGrace EspirituNo ratings yet

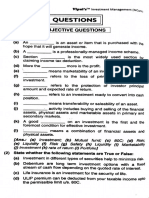

- Vipul's Investment Management Portfolio Analysis GuideDocument10 pagesVipul's Investment Management Portfolio Analysis GuideAnjali AnanthakrishnanNo ratings yet

- Fixed Income InvestmentsDocument13 pagesFixed Income InvestmentsbubuhomeNo ratings yet

- Portfolio Management: Learning OutcomesDocument119 pagesPortfolio Management: Learning OutcomespiyalhassanNo ratings yet

- Invstement Portfolio and Profitability: The Case of The Ethiopian Private Insurance CompaniesDocument56 pagesInvstement Portfolio and Profitability: The Case of The Ethiopian Private Insurance CompaniesNATNAEL100% (1)

- Markowitz ModelDocument25 pagesMarkowitz ModelVignesh PrabhuNo ratings yet

- Selected Works. Harry MarkowitzDocument719 pagesSelected Works. Harry Markowitzgeramessi8No ratings yet

- Markowitz Portfolio ModelDocument9 pagesMarkowitz Portfolio ModelSamia Islam BushraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cross Asset Portfolios of Tradable Risk Premia Indices - Hierarchical Risk Parity - Enhancing Returns PDFDocument51 pagesCross Asset Portfolios of Tradable Risk Premia Indices - Hierarchical Risk Parity - Enhancing Returns PDFKarenNo ratings yet

- Modern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. GruberDocument17 pagesModern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. Gruberxai1lanroiboNo ratings yet

- Behavioral Finance: The Psychology of Investing: February 2015Document49 pagesBehavioral Finance: The Psychology of Investing: February 2015Anurag GonNo ratings yet

- "Arbitrage Trade Analysis of Shares Traded in Bse & Nse" IndiabullsDocument86 pages"Arbitrage Trade Analysis of Shares Traded in Bse & Nse" Indiabullssyed shaibazNo ratings yet

- The Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesDocument15 pagesThe Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesAndresNo ratings yet

- Final MSCF Brochure Fall 2012Document11 pagesFinal MSCF Brochure Fall 2012Letsogile BaloiNo ratings yet

- Financial Markets and Cash Flow Streams ExplainedDocument45 pagesFinancial Markets and Cash Flow Streams ExplainedKhan HarisNo ratings yet

- Strategic Management Page 91Document4 pagesStrategic Management Page 91deddymujiantoNo ratings yet

- PGDM 2nd Year Detailed SyllabusDocument317 pagesPGDM 2nd Year Detailed SyllabusStanley ANo ratings yet

- 6 - Portfolio ManagementDocument11 pages6 - Portfolio Managementpinky nsNo ratings yet

- An Intelligent Method For Supply Chain Finance Selection Using Supplier Segmentation A Payment Risk Portfolio Approach - PaperDocument10 pagesAn Intelligent Method For Supply Chain Finance Selection Using Supplier Segmentation A Payment Risk Portfolio Approach - PaperFarhan SarwarNo ratings yet

- Attachment 1Document13 pagesAttachment 1Joe MoretNo ratings yet

- Asset AllocationDocument11 pagesAsset AllocationRenuka Shankar100% (2)

- ANALRDocument9 pagesANALRVahidNo ratings yet

- Case International DiversificationDocument5 pagesCase International DiversificationJoaquin DiazNo ratings yet

- Expected ReturnDocument5 pagesExpected ReturnMadhu KiranNo ratings yet

- Module Handbook Investment and Portfolio Management: BS (Accounting and Finance)Document5 pagesModule Handbook Investment and Portfolio Management: BS (Accounting and Finance)Laraib SalmanNo ratings yet

- Index Models MCQsDocument26 pagesIndex Models MCQsKen WhiteNo ratings yet

- Modern Portfolio Theory (Markowitz)Document6 pagesModern Portfolio Theory (Markowitz)Millat AfridiNo ratings yet

- IAPM Course Outline - TrimVDocument4 pagesIAPM Course Outline - TrimVSonaliAminNo ratings yet