Professional Documents

Culture Documents

Department of Labor: 2006 Interest Rates

Uploaded by

USA_DepartmentOfLaborOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Labor: 2006 Interest Rates

Uploaded by

USA_DepartmentOfLaborCopyright:

Available Formats

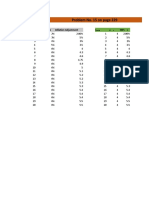

2006 INTEREST RATES ON STATE COURT JUDGMENTS

AND ARBITRATION AWARDS

M.S. 549.09 directs the State Court Administrator to determine the annual interest rate applicable to

certain state court judgments, verdicts, and arbitration awards.1 For judgments and awards governed by section

549.092 the interest rate for calendar year 2006 shall be 4%.

M.S. 548.091, subd. 1a, provides that the interest rate applicable to child support judgments shall be the

rate provided in M.S. 549.09 plus two percent, subject to a 18% maximum rate. For child support judgments

governed by M.S. 548.091, subd. 1a, the interest rate for calendar year 2006 shall be 6%.

The following lists the judgment rates in effect for state courts:

YEAR M.S. 549.09 M.S. 548.091 RATE

RATE (Child Support Judgments)

1990 7%

1991 7%

1992 5%

1993 4% 6%

1994 3% 5%

1995 6% 8%

1996 5% 7%

1997 5% 7%

1998 5% 7%

1999 4% 6%

2000 5% 7%

2001 6% 8%

2002 2% 4%

2003 4% 6%

2004 4% 6%

2005 4% 6%

2006 4% 6%

1 As amended by 2002 Minn. Laws Chap. 247, Sec. 1, Section 549.09 directs that the rate is to be determined by using the

monthly one-year constant maturity treasury yield reported in the latest statistical release of the federal reserve board of governors

rounded to the nearest one per cent, subject to a four percent minimum.

2 The interest rate determined pursuant to section 549.09 does not apply to judgments for the recovery of taxes and employment

arbitrations pursuant to M.S. Chapters 179 or 179A, and may not apply to judgments in condemnation cases. In condemnation

cases governed by M.S. 117.195, the interest rate determined pursuant to section 549.09 is presumed to satisfy the constitutional

requirement of just compensation unless the landowner shows that this rate does not provide what a reasonable and prudent

investor would have earned while investing so as to maximize the rate of return, yet guarantee safety of principle. State by

Humphrey v. Jim Lupient Oldsmobile Co., 509 N.W. 2d 361, 364 (Minn. 1993).

The interest rate on judgments for the recovery of taxes owed to the Commissioner of the Department of Revenue, such as

income, excise, and sales taxes, is established by the Commissioner pursuant to M.S. 270C.40, subd. 5. The interest rate for state

tax judgments also applies to judgments for the recovery of real or personal property taxes, subject to a ten percent minimum and

fourteen percent maximum, pursuant to M.S. 279.03, subd. 1a. These rates may be obtained from the Department of Revenue.

M.S. 549.09, subd. 1 (d) provides that section 549.09 does not apply to arbitrations between employers and employees under

Chapter 179 or 179A, and that an arbitrator is neither required to nor prohibited from awarding interest under Chapter 179 or M.S.

179A.16 for essential employees.

You might also like

- Vacancy Rates (1990 To 2006) : Montgomery County, MarylandDocument1 pageVacancy Rates (1990 To 2006) : Montgomery County, MarylandM-NCPPCNo ratings yet

- Case Study - LÓrealDocument4 pagesCase Study - LÓrealAndrea BrozosNo ratings yet

- Description: Tags: 0910FY2005BriefingedDocument4 pagesDescription: Tags: 0910FY2005Briefingedanon-141887No ratings yet

- 2015 Investor Presentation Oppenheimer 4x3Document27 pages2015 Investor Presentation Oppenheimer 4x3valueinvestor123No ratings yet

- How Will Real Estate Cap Rates Respond To The Rise in The Fed Funds Rate - 2022 06 23 134238 - UnuiDocument11 pagesHow Will Real Estate Cap Rates Respond To The Rise in The Fed Funds Rate - 2022 06 23 134238 - Unuisascha.kiserNo ratings yet

- Indian Economy Update-Feb 2009Document3 pagesIndian Economy Update-Feb 2009Mayank SharmaNo ratings yet

- Problem No. 15 On Page 229: Year Inflation Rate Inflation Adjustment Infl +Document2 pagesProblem No. 15 On Page 229: Year Inflation Rate Inflation Adjustment Infl +Anita Noah MeloNo ratings yet

- Pakistan'S Fiscal Defecit: History, Causes and EffectsDocument6 pagesPakistan'S Fiscal Defecit: History, Causes and EffectskhanjiarabNo ratings yet

- Información Industria CementeraDocument40 pagesInformación Industria CementeralafecapoNo ratings yet

- Giverny Capital - Annual Letter 2018 Web PDFDocument18 pagesGiverny Capital - Annual Letter 2018 Web PDFMario Di MarcantonioNo ratings yet

- Oklahoma Budget Trends and Outlook (Rev. Jan 13, 2010)Document39 pagesOklahoma Budget Trends and Outlook (Rev. Jan 13, 2010)dblattokNo ratings yet

- (2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFDocument14 pages(2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFIgnacio LabaquiNo ratings yet

- Beverage Trends AnalysisDocument49 pagesBeverage Trends AnalysisCarlosNo ratings yet

- Colliers - 2017Q1 Property Market OverviewDocument61 pagesColliers - 2017Q1 Property Market OverviewAlberto CailaoNo ratings yet

- Rate of Inflation, 1998 - 2009: Baltimore-Washington CMSADocument1,928 pagesRate of Inflation, 1998 - 2009: Baltimore-Washington CMSAM-NCPPCNo ratings yet

- TWIA Board of Directors: Rate Adequacy AnalysisDocument13 pagesTWIA Board of Directors: Rate Adequacy AnalysiscallertimesNo ratings yet

- Giverny Capital Annual Letter 2019Document17 pagesGiverny Capital Annual Letter 2019milandeepNo ratings yet

- Investor Presentation Nov2018Document30 pagesInvestor Presentation Nov2018kumar adityaNo ratings yet

- Oklahoma Budget Overview: Trends and Outlook (May 12, 2010)Document44 pagesOklahoma Budget Overview: Trends and Outlook (May 12, 2010)dblattokNo ratings yet

- Fertility Decline in Pakistan 1980-2006: A Case StudyDocument2 pagesFertility Decline in Pakistan 1980-2006: A Case StudyKashif Ali RazaNo ratings yet

- 03 Macroeconomic Considerations 202305Document125 pages03 Macroeconomic Considerations 202305TZE TUNG NGNo ratings yet

- Description: Tags: 0910FY2005BriefingedDocument4 pagesDescription: Tags: 0910FY2005Briefingedanon-550960No ratings yet

- Q2 2019 Property Market Overview - Office and ResidentialDocument55 pagesQ2 2019 Property Market Overview - Office and ResidentialharigroupphilippinesNo ratings yet

- The Evolution of Global Trading Patterns and Its Implications For The WTODocument30 pagesThe Evolution of Global Trading Patterns and Its Implications For The WTOAngélica AzevedoNo ratings yet

- PBI InformaticaDocument1 pagePBI InformaticaSAMUEL ANDRE CASTILLO RIVASNo ratings yet

- Pei ExcelDocument1 pagePei ExcelbelaNo ratings yet

- Pei ExcelDocument1 pagePei ExcelbelaNo ratings yet

- Pei ExcelDocument1 pagePei ExcelbelaNo ratings yet

- Corp Vs - Pers TaxDocument3 pagesCorp Vs - Pers TaxmrpoissonNo ratings yet

- Peru: A Leader in Mining Exploration?: Geological Potential and Other FactorsDocument21 pagesPeru: A Leader in Mining Exploration?: Geological Potential and Other FactorsWilliam Arenas BustillosNo ratings yet

- Equivalent Data From The International Monetary Fund: CIA World FactbookDocument2 pagesEquivalent Data From The International Monetary Fund: CIA World Factbooknausheen_eidaaiNo ratings yet

- The Economic Outlook For The U.S. and The Construction IndustryDocument23 pagesThe Economic Outlook For The U.S. and The Construction IndustryLuis Eduardo NaranjoNo ratings yet

- Petroleum Update For DistributionDocument2 pagesPetroleum Update For Distributionmwirishscot2100% (4)

- Estimation of Discount RateDocument15 pagesEstimation of Discount RateAbhishek SachdevaNo ratings yet

- 352 - Infographic Market Pulse Q1 2018 - 1525948613Document2 pages352 - Infographic Market Pulse Q1 2018 - 1525948613K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Market Pulse Q1 - 18Document2 pagesMarket Pulse Q1 - 18Duy Nguyen Ho ThienNo ratings yet

- Maverick Capital Q4 2009 LetterDocument7 pagesMaverick Capital Q4 2009 Lettermarketfolly.com100% (1)

- Summary of Leslie Fay Company StudyDocument5 pagesSummary of Leslie Fay Company StudyMhelka TiodiancoNo ratings yet

- Q4 2018Document56 pagesQ4 2018Mcke YapNo ratings yet

- Usman Ashraf-85 PresentationDocument18 pagesUsman Ashraf-85 PresentationDopest KhanNo ratings yet

- China Base Oils Market 2022Document24 pagesChina Base Oils Market 2022parimal619No ratings yet

- Case Study #1 Case Study #2Document2 pagesCase Study #1 Case Study #2Eugin FranciscoNo ratings yet

- Does Trend Following Work On Stocks? Part II: What To Buy/sellDocument5 pagesDoes Trend Following Work On Stocks? Part II: What To Buy/selldatsnoNo ratings yet

- 5 Audi Monthly Report Colombia Mayo 2023Document29 pages5 Audi Monthly Report Colombia Mayo 2023RAMIRO ALBERTO AVALO FRANCONo ratings yet

- Sri Lanka GDP - Real Growth RateDocument4 pagesSri Lanka GDP - Real Growth RateRasya ArNo ratings yet

- Credit Suisse - Default StatisticsDocument6 pagesCredit Suisse - Default StatisticsManeeshNo ratings yet

- Nielsen Market Pulse Q3 2017Document2 pagesNielsen Market Pulse Q3 2017K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Nielsen Market Pulse Q3 2016Document8 pagesNielsen Market Pulse Q3 2016K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Hospital Cost Drivers enDocument80 pagesHospital Cost Drivers enWashington AmericaNo ratings yet

- Departemen Administrasi Dan Kebijakan Kesehatan Fakultas Kesehatan Masyarakat Universitas IndonesiaDocument21 pagesDepartemen Administrasi Dan Kebijakan Kesehatan Fakultas Kesehatan Masyarakat Universitas IndonesiaEnang TatangNo ratings yet

- Chilean Productivity Presentation-Chad SyversonDocument15 pagesChilean Productivity Presentation-Chad SyversonYorka SánchezNo ratings yet

- US Fixed Income Securities Statistics SIFMADocument31 pagesUS Fixed Income Securities Statistics SIFMAÂn TrầnNo ratings yet

- Japan EconomyDocument19 pagesJapan EconomyRizel C. MontanteNo ratings yet

- Weekly Economic & Financial Commentary 15aprDocument13 pagesWeekly Economic & Financial Commentary 15aprErick Abraham MarlissaNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Tasa Desempleo 1Document3 pagesTasa Desempleo 1Victor GuerraNo ratings yet

- Profit of Sport Cars: Item Car Model Quantity Price Per UnitDocument6 pagesProfit of Sport Cars: Item Car Model Quantity Price Per UnitMfbi IbrahimNo ratings yet

- Monetary Trends Inflation and 1-Year-Ahead Inflation Expectations Percent 10Document1 pageMonetary Trends Inflation and 1-Year-Ahead Inflation Expectations Percent 10api-1916734No ratings yet

- Medium-Term Fiscal ProgramDocument35 pagesMedium-Term Fiscal ProgramRye SanNo ratings yet

- Collecting Data VietnamDocument14 pagesCollecting Data VietnamMeutia FadillaNo ratings yet

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNo ratings yet

- BIS Entity List Additions (10.8.2012)Document27 pagesBIS Entity List Additions (10.8.2012)dougj10% (1)

- Safety Manual For CostructionDocument25 pagesSafety Manual For CostructionKarthikNo ratings yet

- United States Court of Appeals, Third CircuitDocument14 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- TZX SeriDocument7 pagesTZX SeriOrlando FernandezNo ratings yet

- Comelec Rules of Procedure: Commission On ElectionsDocument48 pagesComelec Rules of Procedure: Commission On Electionskyla_0111No ratings yet

- Notice To All Law EnforcementDocument6 pagesNotice To All Law EnforcementMin Hotep Tzaddik Bey100% (18)

- Polity Part 5Document142 pagesPolity Part 5Arsalan AbbasNo ratings yet

- Global Office Occupiers Guide 2011Document254 pagesGlobal Office Occupiers Guide 2011David MegoNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- 1 Party: SUBSCRIBED and SWORN To Before Me This - Day of - , 2019Document3 pages1 Party: SUBSCRIBED and SWORN To Before Me This - Day of - , 2019Frances SanchezNo ratings yet

- The 1935 ConstitutionDocument2 pagesThe 1935 Constitution육한니No ratings yet

- Transportation Law: I. Article 1732 of The Civil CodeDocument2 pagesTransportation Law: I. Article 1732 of The Civil CodeSAMANTHA NICOLE BACARONNo ratings yet

- 10 Geagonia V CA G.R. No. 114427 February 6, 1995Document10 pages10 Geagonia V CA G.R. No. 114427 February 6, 1995ZydalgLadyz NeadNo ratings yet

- Moot Court ProblemDocument13 pagesMoot Court ProblemSonal ChouhanNo ratings yet

- Kepco Vs CIR Case DigestDocument2 pagesKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- PHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadDocument205 pagesPHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadVinnie Singh100% (2)

- Case Review Soumya Goel Bba LLB PDFDocument4 pagesCase Review Soumya Goel Bba LLB PDFajay thakurNo ratings yet

- Covering Letter LapadaDocument3 pagesCovering Letter LapadaTrisha Ace Betita ElisesNo ratings yet

- 501c3.guidelines Issued by The IRSDocument31 pages501c3.guidelines Issued by The IRSThe Department of Official InformationNo ratings yet

- Salalima vs. Guingona, JR PDFDocument70 pagesSalalima vs. Guingona, JR PDFAmeir MuksanNo ratings yet

- Gambia DV FGC Forced Marriage Rape 2013Document28 pagesGambia DV FGC Forced Marriage Rape 2013Elisa Perez-SelskyNo ratings yet

- Poindexter v. GreenhowDocument17 pagesPoindexter v. GreenhowAlvin SamonteNo ratings yet

- Notice: Information Processing Standards, Federal: Withdrawal of FIPS 46-3, Fips 74, and FIPS 81Document2 pagesNotice: Information Processing Standards, Federal: Withdrawal of FIPS 46-3, Fips 74, and FIPS 81Justia.comNo ratings yet

- Summary Mills Neo-HumanitarianismDocument1 pageSummary Mills Neo-HumanitarianismcwaegliNo ratings yet

- Presentatiom of Evidence CasesDocument42 pagesPresentatiom of Evidence CasesCrizedhen VardeleonNo ratings yet

- Term Paper OutlineDocument4 pagesTerm Paper OutlineMay Angelica TenezaNo ratings yet

- Article 377Document12 pagesArticle 377Abhishek RathoreNo ratings yet

- LFZE - Stipendium Hungaricum Scholarship Operational RegulationsDocument41 pagesLFZE - Stipendium Hungaricum Scholarship Operational RegulationsAwit MalayaNo ratings yet

- Digest Tayug-Rural-Bank-vs-CBPDocument1 pageDigest Tayug-Rural-Bank-vs-CBPL'Michelli Kilayko HorladorNo ratings yet

- GCUF Grant of Affiliation ProformaDocument3 pagesGCUF Grant of Affiliation ProformaUsman UlHaqNo ratings yet