Professional Documents

Culture Documents

Inai - Icmd 2009 (B11)

Uploaded by

IshidaUryuuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inai - Icmd 2009 (B11)

Uploaded by

IshidaUryuuCopyright:

Available Formats

PTIndalAluminiumIndustryTbk.

Business

CompanyStatus

ContractingServicesand

AluminumSheetsManufacturer

PMDN

Underwriter

PTStandardCharteredIndonesia

Shareholders

2000

PTGunaInvestindo

Public:

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

Others

2001

6.27% PTHusinInvestama

PTMarindoInvestama

32.93% PrayitnoSoerowidjojo

7.84% PTGunaInvestindo

6.27% PTMulindoInvestama

6.27% PTSatriaInvestindo

6.27% PTPrakindoInvestama

34.15% Public

2005

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

2002

32.93%

7.84%

6.65%

6.27%

6.27%

6.27%

6.27%

27.50%

2006

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

Public

2003

32.93%

7.84%

6.27%

6.27%

6.27%

40.42%

2007

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

2004

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

2008

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

PTHusinInvestama

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Public

32.93%

7.84%

6.27%

6.27%

6.27%

6.27%

34.15%

PTHusinInvestama

32.93%

PTMarindoInvestama

PTMulindoInvestama

PTSatriaInvestindo

PTPrakindoInvestama

PTGunaInvestindo

Soepangkat

Public

7.84%

6.27%

6.27%

6.27%

6.27%

0.03%

34.12%

Management & Number of Employees

Board of Commissioners

Board of Directors

Number of Employees

2000

President Commissioner

Commissioners

Alim Husin

Alim Mulia Sastra, Gunardi

Soepangkat

President Director

Directors

Alim Markus

Alim Satria, Alim Prakasa

Lukman Chandra Santoso, Welly Muliawan

1,140

2001

President Commissioner

Commissioners

Alim Husin

Alim Mulia Sastra

Gunardi

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Lukman Chandra Santoso

Welly Muliawan

1,558

2002

President Commissioner

Commissioners

Alim Husin

Alim Mulia Sastra

Gunardi

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Lukman Chandra Santoso

Welly Muliawan

1,511

2003

President Commissioner

Commissioners

Alim Husin

Alim Mulia Sastra

Gunardi

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Lukman Chandra Santoso

Welly Muliawan

1,403

2004

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra

Gunardi

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Welly Muliawan

1,480

2005

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra, Gunardi, Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria, Alim Prakasa

Welly Muliawan

1,276

2006

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra

Gunardi Go

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Welly Muliawan

1,253

2007

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra, Gunardi Go

Soepangkat, Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria, Alim Prakasa, Welly Muliawan Lie

1,253

2008

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra, Gunardi Go

Soepangkat, Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria, Alim Prakasa, Welly Muliawan Lie

1,731

2009

President Commissioner

Commissioners

Angkasa Rachmawati

Alim Mulia Sastra

Gunardi Go

Soepangkat

Supranoto Dipokusumo

President Director

Directors

Alim Markus

Alim Satria

Alim Prakasa

Welly Muliawan Lie

1,697

1998

1999

2000

Total Assets

Current Assets

of which

Cash on hand and in banks

Cash and cash equivalents

Prepaid

Trade receivables

Inventories

Short Term Investment

Advances

Non-current Assets

of which

Fixed Asset Net

Deffered Tax Assets-Net

Investments

Other Assets

220,415

96,913

226,812

87,601

259,436

123,260

11,911

25,640

4,982

(million rupiah)

2001

2002

2003

2004

2005

267,093

100,105

300,555

121,214

316,919

113,310

406,708

205,048

476,734

275,036

3,603

5,362

4,820

7,909

12,953

39,353

36,443

19,968

40,111

22,712

87,288

28,229

53,839

81,029

74,780

73,455

80,253

25,180

17,293

29,038

35,393

17,521

45,200

Liabilities

Current Liabilities

of which

Bank loans

Bank borrowings

Short-term debts

Trade payables

Taxes payable

Accrued expenses

Current maturities of

long-term debt

Long-term Liabilities

of which

Bank borrowings

Convertible bonds

Non-current Liabilities

Minority Interests in Subsidiaries

119,982

102,110

114,451

100,828

78,783

Shareholders' Equity

Paid-up capital

Paid-up capital

in excess of par value

Revaluation of fixed Assets

Retained earnings

100,433

79,200

3,740

3,740

3,740

3,740

3,740

3,740

3,740

3,740

17,493

29,421

13,928

15,283

15,659

(24,031)

(21,713)

(41,749)

Net Sales

Cost of Good Sold

Gross Profit

Operating Expenses

Operating Profit

Other Income (Expenses)

Profit (Loss) before Taxes

Profit (Loss) after Taxes

201,134

152,933

48,201

16,352

31,849

(23,740)

8,109

3,058

209,689

164,341

45,347

21,072

24,275

(3,007)

21,268

15,096

247,435

199,265

48,170

251,689

23,001

(29,194)

(6,193)

(9,949)

348,742

294,040

54,702

38,465

16,237

(11,127)

5,110

1,355

287,290

256,246

31,044

32,486

(1,442)

2,202

760

377

313,861

293,274

20,587

32,821

(12,234)

(31,225)

(43,458)

(39,690)

470,542

438,178

32,364

30,303

2,061

(17,416)

(15,355)

2,319

473,506

435,628

37,878

36,025

1,853

(22,354)

(20,502)

(20,774)

Per Share Data (Rp)

Earnings (Loss) per Share

Equity per Share

Dividend per Share

Closing Price

Financial Ratios

PER (x)

PBV (x)

Dividend Payout (%)

Dividend Yield (%)

Current Ratio (x)

Debt to Equity (x)

Leverage Ratio (x)

Gross Profit Margin (x)

Operating Profit Margin (x)

Net Profit Margin (x)

Inventory Turnover (x)

Total Assets Turnover (x)

ROI (%)

ROE (%)

1

2

3

4

Growth (%)

Indicators

Total Asset

Share Holder's Equity

Net Sales/Revenue

Net Provit

19,380

79,146

34,877

69,618

67,902

117,937

97,850

129,189

179,341

203,609

201,660

201,698

84,917

85,529

78,060

71,982

15,629

71,106

19,036

3,988

20,509

3,990

26,677

3,311

30,355

745

162,568

132,655

168,870

110,414

201,955

69,598

258,010

88,113

345,480

154,399

435,543

211,622

70,400

107,699

69,280

34,590

40,759

119,137

11,207

1,937

15,845

2,296

31,578

1,113

23,866

2,679

13,909

1,888

18,220

896

22,763

573

35,511

1,613

17,872

13,623

29,914

58,456

132,357

169,897

191,082

223,920

98,599

79,200

58,909

79,200

61,227

79,200

41,191

79,200

154,497

112,361

79,200

96,868

79,200

98,223

79,200

19

634

20

250

95

709

35

625

(63)

612

300

9

620

280

2

622

n.a

140

(251)

372

n.a

145

15

387

n.a

205

(131)

260

n.a

150

13

0

103.60

8.00

6.56

0.88

36.72

5.60

(4.78)

0.49

-

32.73

0.45

-

58.87

0.22

n.a

n.a

(0.58)

0.39

n.a

n.a

14.00

0.53

n.a

n.a

(1.14)

0.58

n.a

n.a

0.95

1.19

0.54

0.24

0.16

0.02

4.20

0.91

1.39

3.04

0.87

1.02

0.50

0.22

0.12

0.07

4.10

0.92

6.66

13.44

0.93

1.68

0.63

0.19

0.09

n.a

2.28

0.95

(3.83)

(10.27)

0.91

1.72

0.63

0.16

0.05

0.00

5.46

1.31

0.51

1.38

1.74

2.05

0.67

0.11

n.a.

n.a.

3.24

0.96

0.13

0.38

1.29

4.38

0.81

0.07

n.a.

n.a.

4.21

0.99

(12.52)

(67.38)

1.33

5.64

0.85

0.07

n.a.

n.a.

3.72

1.16

0.57

3.79

1.30

10.57

0.91

0.08

n.a.

n.a.

3.37

0.99

(4.36)

(50.43)

1998

1999

2.90

11.88

4.25

393.66

2000

14.38

(13.79)

18.00

(165.90)

2002

12.53

0.38

(17.62)

(72.18)

2003

5.44

(40.25)

9.25

(10,627.85)

2004

28.33

3.93

49.92

(105.84)

2005

17.22

(32.72)

0.63

(995.82)

2001

2.95

1.40

40.94

(113.62)

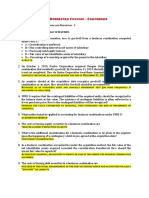

SUMMARY OF FINANCIAL STATEMENT

PT. Indal Alumunium Industry (INAI)

2006

(millionrupiah)

2007

2008

TotalAssets

CurrentAssets

ofwhich

Cashandcashequivalents

Tradereceivables

Inventories

NonCurrentAssets

ofwhich

FixedAssetsNet

Investments

OtherAssets

555,996

330,309

482,712

288,603

622,405

419,384

3,956

115,351

181,832

225,687

5,520

108,277

131,057

194,108

28,060

137,930

194,742

203,021

54,352

38,912

772

47,214

39,860

42

37,888

45,084

4,114

Liabilities

CurrentLiabilities

ofwhich

Bankloans

Tradepayables

Taxespayable

NonCurrentLiabilities

480,733

181,538

407,114

198,613

545,800

348,410

97,203

65,601

1,073

299,194

123,701

56,977

2,150

208,501

165,528

96,288

4,163

197,390

75,263

79,200

75,598

79,200

76,605

79,200

3,740

(7,677)

3,740

(7,342)

3,740

(6,335)

NetSales

CostofGoodsSold

GrossProfit

OperatingExpenses

OperatingProfit(Loss)

OtherIncome(Expenses)

Profit(Loss)beforeTaxes

Profit(Loss)afterTaxes

557,583

485,602

71,980

40,194

31,786

(27,594)

4,192

12,539

514,055

431,549

82,505

42,655

39,851

(40,213)

(363)

334

642,018

551,068

90,950

47,049

43,901

(41,800)

2,101

1,008

PerShareData(Rp)

Earnings(Loss)perShare

EquityperShare

DividendperShare

ClosingPrice

79

475

n.a

200

2

477

n.a

285

6

484

n.a

120

FinancialRatios

PER(x)

PBV(x)

DividendPayout(%)

DividendYield(%)

2.53

0.42

n.a

n.a

135.01

0.60

n.a

n.a

18.87

0.25

n.a

n.a

1.82

6.39

0.86

0.13

0.06

0.02

2.67

1.00

2.26

16.66

1.45

5.39

0.84

0.16

0.08

n.a.

3.29

1.06

0.07

0.44

1.20

7.12

0.88

0.14

0.07

n.a.

2.83

1.03

0.16

1.32

Shareholders'Equity

Paidupcapital

Paidupcapital

inexcessofparvalue

Retainedearnings

CurrentRatio(x)

DebttoEquity(x)

LeverageRatio(x)

GrossProfitMargin(x)

OperatingProfitMargin(x)

NetProfitMargin(x)

InventoryTurnover(x)

TotalAssetsTurnover(x)

ROI(%)

ROE(%)

PER=21.83x;PBV=9.26x(June2009)

FinancialYear:December31

PublicAccountant:AryantoAmirYusuf&Mawar

You might also like

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Running Head: The Valuation of Wal-Mart 1Document9 pagesRunning Head: The Valuation of Wal-Mart 1cdranuragNo ratings yet

- ZTBL 2008Document62 pagesZTBL 2008Mahmood KhanNo ratings yet

- AFAR - BC OneDocument2 pagesAFAR - BC OneJoanna Rose DeciarNo ratings yet

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- COCOFED vs. RepublicDocument50 pagesCOCOFED vs. RepublicJay Kent RoilesNo ratings yet

- PT Aqua Golden Mississippi Tbk Financial OverviewDocument4 pagesPT Aqua Golden Mississippi Tbk Financial OverviewIshidaUryuuNo ratings yet

- Ikai - Icmd 2009 (B13)Document4 pagesIkai - Icmd 2009 (B13)IshidaUryuuNo ratings yet

- Rmba - Icmd 2009 (B02)Document4 pagesRmba - Icmd 2009 (B02)IshidaUryuuNo ratings yet

- PTSP - Icmd 2009 (B01)Document4 pagesPTSP - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- KBLM - Icmd 2009 (B14)Document4 pagesKBLM - Icmd 2009 (B14)IshidaUryuuNo ratings yet

- Kias - Icmd 2009 (B13)Document4 pagesKias - Icmd 2009 (B13)IshidaUryuuNo ratings yet

- Ricy - Icmd 2009 (B04)Document4 pagesRicy - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- Ceka - Icmd 2009 (B01)Document4 pagesCeka - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Sima - Icmd 2009 (B09)Document4 pagesSima - Icmd 2009 (B09)IshidaUryuuNo ratings yet

- Doid - Icmd 2009 (B04)Document4 pagesDoid - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- PT Mayora Indah Tbk business overviewDocument4 pagesPT Mayora Indah Tbk business overviewIshidaUryuuNo ratings yet

- CNTX - Icmd 2009 (B03) PDFDocument4 pagesCNTX - Icmd 2009 (B03) PDFIshidaUryuuNo ratings yet

- Kici - Icmd 2009 (B12)Document4 pagesKici - Icmd 2009 (B12)IshidaUryuuNo ratings yet

- Toto - Icmd 2009 (B13)Document4 pagesToto - Icmd 2009 (B13)IshidaUryuuNo ratings yet

- PT Astra‐Graphia Tbk. Financial Performance Over 10 YearsDocument4 pagesPT Astra‐Graphia Tbk. Financial Performance Over 10 YearsIshidaUryuuNo ratings yet

- Bima - Icmd 2009 (B04)Document4 pagesBima - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- Tbla - Icmd 2009 (B01)Document4 pagesTbla - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Ades - Icmd 2009 (B01)Document4 pagesAdes - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Almi - Icmd 2009 (B11)Document4 pagesAlmi - Icmd 2009 (B11)IshidaUryuuNo ratings yet

- Lucky Cement AnalysisDocument17 pagesLucky Cement AnalysisMoeez KhanNo ratings yet

- Dlta - Icmd 2009 (B01)Document4 pagesDlta - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Bati - Icmd 2009 (B02)Document4 pagesBati - Icmd 2009 (B02)IshidaUryuuNo ratings yet

- PT Citra Tubindo Tbk. OverviewDocument4 pagesPT Citra Tubindo Tbk. OverviewIshidaUryuuNo ratings yet

- Annual Report 07 08Document142 pagesAnnual Report 07 08jagat_sabatNo ratings yet

- Voks - Icmd 2009 (B14)Document4 pagesVoks - Icmd 2009 (B14)IshidaUryuuNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- IBF Term ReportDocument12 pagesIBF Term ReportSaad A MirzaNo ratings yet

- Aali - Icmd 2010 (A01) PDFDocument2 pagesAali - Icmd 2010 (A01) PDFArdheson Aviv AryaNo ratings yet

- Fasw - Icmd 2009 (B06)Document4 pagesFasw - Icmd 2009 (B06)IshidaUryuuNo ratings yet

- 2010 Financial Report C I LeasingDocument24 pages2010 Financial Report C I LeasingVikky MehtaNo ratings yet

- Fmii - Icmd 2009 (B04)Document4 pagesFmii - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- Company Financial StatementsDocument49 pagesCompany Financial StatementsStar ShinnerNo ratings yet

- AssetsDocument2 pagesAssetsAsim HussainNo ratings yet

- Banking Survey 2010Document60 pagesBanking Survey 2010Fahad Paracha100% (1)

- 0001 CK Holding Ar2011Document160 pages0001 CK Holding Ar2011Jimmy WangNo ratings yet

- CMNPDocument2 pagesCMNPIsni AmeliaNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Elang Mahkota Teknologi Annual Report 2012Document218 pagesElang Mahkota Teknologi Annual Report 2012Yogi Bagus SanjayaNo ratings yet

- PTCLDocument169 pagesPTCLSumaiya Muzaffar100% (1)

- AHAP Insurance Financial SummaryDocument2 pagesAHAP Insurance Financial SummaryluvzaelNo ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- PT Agung Podomoro Land TBK.: Summary of Financial StatementDocument2 pagesPT Agung Podomoro Land TBK.: Summary of Financial StatementTriSetyoBudionoNo ratings yet

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Ashok LeylandDocument124 pagesAshok LeylandananndNo ratings yet

- HDFC Bank LTD 2007Document10 pagesHDFC Bank LTD 2007Komal ShahNo ratings yet

- Arna - Icmd 2009 (B13)Document4 pagesArna - Icmd 2009 (B13)IshidaUryuuNo ratings yet

- BRPT - Icmd 2009 (B05)Document4 pagesBRPT - Icmd 2009 (B05)IshidaUryuuNo ratings yet

- 1.accounts 2012 AcnabinDocument66 pages1.accounts 2012 AcnabinArman Hossain WarsiNo ratings yet

- PT HM Sampoerna Tbk. Cigarette Industry ProfileDocument4 pagesPT HM Sampoerna Tbk. Cigarette Industry ProfileIshidaUryuuNo ratings yet

- Bton - Icmd 2009 (B11)Document4 pagesBton - Icmd 2009 (B11)IshidaUryuuNo ratings yet

- Final Accounts 2005Document44 pagesFinal Accounts 2005Mahmood KhanNo ratings yet

- File313 PDFDocument116 pagesFile313 PDFMahmood KhanNo ratings yet

- HDFC Bank AnnualReport 2012 13Document180 pagesHDFC Bank AnnualReport 2012 13Rohan BahriNo ratings yet

- Irp Adani FinalDocument4 pagesIrp Adani Finalharsh kaushikNo ratings yet

- HDFCDocument78 pagesHDFCsam04050No ratings yet

- Friday June 15, 2012Document61 pagesFriday June 15, 2012colomboanalystNo ratings yet

- HDFC - Annual Report 2010Document196 pagesHDFC - Annual Report 2010Sagari KiriwandeniyaNo ratings yet

- Stone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageStone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- Cement Company Asset & Profit Rankings 2011-2012Document1 pageCement Company Asset & Profit Rankings 2011-2012IshidaUryuuNo ratings yet

- Tobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageTobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- Directory 2011Document88 pagesDirectory 2011Davit Pratama Putra KusdiatNo ratings yet

- PT Ever Shine Tex TBK.: Summary of Financial StatementDocument2 pagesPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- Myrx - Icmd 2009 (B04)Document4 pagesMyrx - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- JPRS - Icmd 2009 (B11)Document4 pagesJPRS - Icmd 2009 (B11)IshidaUryuuNo ratings yet

- Bima PDFDocument2 pagesBima PDFIshidaUryuuNo ratings yet

- Adhesive company rankings by total assets and net profits 2011-2012Document1 pageAdhesive company rankings by total assets and net profits 2011-2012IshidaUryuuNo ratings yet

- PT Nusantara Inti Corpora Tbk Financial Performance 1988-2011Document2 pagesPT Nusantara Inti Corpora Tbk Financial Performance 1988-2011IshidaUryuuNo ratings yet

- Indr - Icmd 2009 (B04)Document4 pagesIndr - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- PT Kabelindo Murni TBK.: Summary of Financial StatementDocument2 pagesPT Kabelindo Murni TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- Cable Companies Net Profit & Asset Rankings 2011-2012Document1 pageCable Companies Net Profit & Asset Rankings 2011-2012IshidaUryuuNo ratings yet

- YpasDocument2 pagesYpasIshidaUryuuNo ratings yet

- Construction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageConstruction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- UnvrDocument2 pagesUnvrIshidaUryuuNo ratings yet

- PT Chandra Asri Petrochemical TBKDocument2 pagesPT Chandra Asri Petrochemical TBKIshidaUryuuNo ratings yet

- Agriculture PDFDocument1 pageAgriculture PDFIshidaUryuuNo ratings yet

- Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageRanking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- Automotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Document1 pageAutomotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNo ratings yet

- PT Unitex Tbk Financial Performance and Shareholder SummaryDocument2 pagesPT Unitex Tbk Financial Performance and Shareholder SummaryIshidaUryuuNo ratings yet

- YpasDocument2 pagesYpasIshidaUryuuNo ratings yet

- Animal FeedDocument1 pageAnimal FeedIshidaUryuuNo ratings yet

- Adhesive company rankings by total assets and net profits 2011-2012Document1 pageAdhesive company rankings by total assets and net profits 2011-2012IshidaUryuuNo ratings yet

- AaliDocument2 pagesAaliSeprinaldiNo ratings yet

- AbbaDocument2 pagesAbbaIshidaUryuuNo ratings yet

- VoksDocument2 pagesVoksIshidaUryuuNo ratings yet

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementDocument2 pagesPT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- PT Kalbe Farma TBK.: Summary of Financial StatementDocument2 pagesPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- E.on Strategy and Keyfigures 2009Document176 pagesE.on Strategy and Keyfigures 2009YO DONo ratings yet

- Ratio Analysis TemplateDocument20 pagesRatio Analysis TemplatenishantNo ratings yet

- Hymcr 3 Elv 4 Az 774Document2 pagesHymcr 3 Elv 4 Az 774Gurjit SinghNo ratings yet

- Dec 2006 - Qns Mod BDocument13 pagesDec 2006 - Qns Mod BHubbak Khan100% (2)

- Financial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"Document11 pagesFinancial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"N ArunsankarNo ratings yet

- MT Quiz 1 MasterDocument2 pagesMT Quiz 1 MasterChristine Dela Rosa CarolinoNo ratings yet

- Priya KapilDocument93 pagesPriya KapilaamritaaNo ratings yet

- CHAPTER 14 - Consolidated Statement - Date of AcquisitionDocument63 pagesCHAPTER 14 - Consolidated Statement - Date of AcquisitionErina KimNo ratings yet

- Assignment SAPMDocument5 pagesAssignment SAPMAanchal NarulaNo ratings yet

- Equity Sales and Trading Cheat SheetDocument1 pageEquity Sales and Trading Cheat SheetJoao ValdesNo ratings yet

- MAlongDocument253 pagesMAlongerikchoisyNo ratings yet

- Calculate Required Returns with CAPMDocument8 pagesCalculate Required Returns with CAPMمحمد حمزہ اسلمNo ratings yet

- SEC proxy non-eligible board electionDocument3 pagesSEC proxy non-eligible board electionAjean Tuazon-CruzNo ratings yet

- Ignou ProjectDocument62 pagesIgnou Projectpati_05No ratings yet

- 28 Harpoon Marine Services, Inc., Et Al. v. Fernan H. Francisco, G.R. No. 167751, March 2, 2011Document9 pages28 Harpoon Marine Services, Inc., Et Al. v. Fernan H. Francisco, G.R. No. 167751, March 2, 2011AlexandraSoledadNo ratings yet

- Understanding Preferential Allotment of Securities: Pavan Kumar VijayDocument54 pagesUnderstanding Preferential Allotment of Securities: Pavan Kumar VijayAakash MehtaNo ratings yet

- Accounting for share capitalDocument25 pagesAccounting for share capitalkeshu shuklaNo ratings yet

- Activist Investing White Paper by Florida State Board of AdmistrationDocument48 pagesActivist Investing White Paper by Florida State Board of AdmistrationBradley TirpakNo ratings yet

- The Adams Family Decided Early in 2010 To Incorporate Their: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Adams Family Decided Early in 2010 To Incorporate Their: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Business Law 1Document9 pagesBusiness Law 1Shashi Bhushan Sonbhadra0% (1)

- Air Transport: Quarterly Report No.18 1st QUARTER 2008 (January To March)Document31 pagesAir Transport: Quarterly Report No.18 1st QUARTER 2008 (January To March)Doina MacariNo ratings yet

- Meetings and ProceedingsDocument4 pagesMeetings and ProceedingsArslan QadirNo ratings yet

- Dividend Decision ModelsDocument11 pagesDividend Decision ModelsAakansha ShawNo ratings yet

- PDFDocument109 pagesPDFAbhijeet VyasNo ratings yet

- Barclays Annual Report 2020Document380 pagesBarclays Annual Report 2020Helen LeonoraNo ratings yet

- Chapter 17Document21 pagesChapter 17pvaibhyNo ratings yet