Professional Documents

Culture Documents

Odum Capital Advisory + Investment Banking + Private Equity

Uploaded by

odumgroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Odum Capital Advisory + Investment Banking + Private Equity

Uploaded by

odumgroupCopyright:

Available Formats

Odum Capital

Advisory Investment Banking Private Equity

[Type text] © Odum Capital 2009

Odum Capital

Advisory

ISSUE-BASED PROBLEM SOLVING In a global economy, businesses face competitive

Businesses and institutions face complex obstacles and regulatory decisions regarding new market-

that require innovative and practical solutions. entry analysis and strategy and political and ADVISORY SOLUTIONS

Businesses and institutions

Odum Capital provides a hands-on approach to business risk assessment. We provide extensive

require unique and company

work with decision makers to develop and emerging market expertise, tackling complex specific answers . Odum Capital

utilizes a hands-on approach

implement a clear and cohesive blueprint. international decisions such as management of

way of problem solving and

Managing a growing business, managing cost country-specific regulatory and tax standards, solution implementation to assist

our clients with internal advisory

structure, financial outsourcing, analyzing financial industry analysis and access to foreign

or external outsourcing of cost

performance and debt restructuring require governments and agencies. sensitive tasks.

objective and customized solutions.

FINANCIAL ADVISORY

SOLUTIONS

Investment Banking Private Equity

• ADVISORY SERVICES FINANCIAL TRANSACTION SOLUTIONS E Q U I T Y I N V E S T ME N T S

FINANCIAL SOLUTIONS

• MERGERS AND ACQUISITIONS Businesses and institutions require intermediary Odum Capital firmly believes in and is committed to Odum Capital utilizes a mixture of

• SECURITIZATION support when making complex and competitive the entrepreneurial spirit. We acquire and/or make analytical objectivity and

relationship-based approach when

• DEBT AND EQUITY CAPITAL financial decisions. These decisions require sound substantial investments in existing companies with assisting clients with complex

• MORTGAGE RESTRUCTURING and innovative solutions: a young track record. From our first acquisition in transactions such as mergers and

acquisitions, valuations,

• ASSET AND FUND MANAGEMENT • Mergers and Acquisitions 2005, we are seeking businesses ripe for debt or

securitization and mortgage

• Deal Structuring equity capital. restructuring.

• FINANCIAL ANALYSIS AND

MODELING • Debt and Equity Capital Our investment criteria focuses on businesses

• Divestitures, Spin-Offs and Asset Purchases valued between $5M - $25M. We are active in the

• RISK AND COST MANAGEMENT

• Privatization of government-owned entities US and Emerging Markets in Africa. Sectors

• PRIVATE EQUITY

include:

SECURITIES AND ASSET MANAGEMENT

• Telecommunications INVESTMENT SOLUTIONS

SERVICES

Investors and institutions require

• Energy

a hands-on approach to asset

The development of the capital markets has • Chemicals and fund management services.

• Health Care Technology Odum Capital provides

increased access to funds and simultaneously

customized commercial real

increased risk. We assist firms and institutions with • Commodities estate services, fund

management and servicing

commercial real estate mortgage restructuring,

solutions.

securitization and servicing. Odum Capital also

provides asset and fund management services to

[Type text] investors and financial institutions.

© Odum Capital 2009

Odum Capital

Greg Odum

202.352.1207

[Type text] greg@odumcapital.com

© Odum Capital 2009

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Service Level Agreement TemplateDocument4 pagesService Level Agreement TemplateSUNIL PUJARI100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Full Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloDocument72 pagesFull Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloJean Ira Gasgonia Aguila100% (1)

- Convertible Loan Term SheetDocument8 pagesConvertible Loan Term SheetMarius Angara0% (1)

- Growthink - 8 Figure FormulaDocument41 pagesGrowthink - 8 Figure FormulaKlark KentNo ratings yet

- Plastic PolutionDocument147 pagesPlastic Polutionluis100% (1)

- Statements 2022-12-30 2Document4 pagesStatements 2022-12-30 2colle ctorNo ratings yet

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- Test 1 Ma2Document15 pagesTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- Entrepre Module 2Document10 pagesEntrepre Module 2Joshua Enriquez VillanuevaNo ratings yet

- Impact of Online Marketing On Travel &tourismDocument27 pagesImpact of Online Marketing On Travel &tourismshruti modi100% (3)

- Chapter 2 Macro SolutionDocument12 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- The Financial Statements of Banks and Their Principal CompetitorsDocument30 pagesThe Financial Statements of Banks and Their Principal CompetitorsMahmudur Rahman100% (4)

- An Analysis of Recruitment & Selection Process at Uppcl: A Summer Training Report OnDocument92 pagesAn Analysis of Recruitment & Selection Process at Uppcl: A Summer Training Report OnManjeet SinghNo ratings yet

- Buku Teks David L.Debertin-293-304Document12 pagesBuku Teks David L.Debertin-293-304Fla FiscaNo ratings yet

- Distribution Strategies: Calyx & Corolla: MARK4210: Strategic Marketing 2014 Spring, Section L1/L2Document19 pagesDistribution Strategies: Calyx & Corolla: MARK4210: Strategic Marketing 2014 Spring, Section L1/L2prakshiNo ratings yet

- Calculation of Total Tax Incidence (TTI) For ImportDocument4 pagesCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNo ratings yet

- Book InvoiceDocument1 pageBook InvoiceKaushik DasNo ratings yet

- Real Estate Sector Report BangladeshDocument41 pagesReal Estate Sector Report Bangladeshmars2580No ratings yet

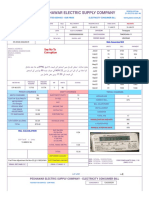

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- Major Parts in A Business Plan - Home WorkDocument3 pagesMajor Parts in A Business Plan - Home Workأنجز للخدمات الطلابيةNo ratings yet

- Carta de La Junta Sobre La AEEDocument3 pagesCarta de La Junta Sobre La AEEEl Nuevo DíaNo ratings yet

- Realizing The American DreamDocument27 pagesRealizing The American DreamcitizenschoolsNo ratings yet

- ERP Systems Manage Business OperationsDocument10 pagesERP Systems Manage Business OperationsGoNo ratings yet

- Analysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Document13 pagesAnalysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Customize essayNo ratings yet

- Exam SubjectsDocument2 pagesExam SubjectsMansi KotakNo ratings yet

- Assignment of Management Assignment of ManagementDocument7 pagesAssignment of Management Assignment of ManagementNguyen Anh Vu100% (1)

- 1392628459421Document48 pages1392628459421ravidevaNo ratings yet

- Cost Accounting4&Cost ManagementDocument10 pagesCost Accounting4&Cost ManagementJericFuentesNo ratings yet

- ENGINEERING DESIGN GUILDLINES Plant Cost Estimating Rev1.2webDocument23 pagesENGINEERING DESIGN GUILDLINES Plant Cost Estimating Rev1.2webfoxmancementNo ratings yet