Professional Documents

Culture Documents

Toyota (Automobile) - Waqas Final

Uploaded by

Raza HassanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Toyota (Automobile) - Waqas Final

Uploaded by

Raza HassanCopyright:

Available Formats

RESEARCH AND ANALYSIS PROJECT FOR BSC (HONS) IN APPLIED ACCOUNTING

Financial and Business Performance of

Over a Three Year Period

Prepared By:

Waqas Anwar Fahim Ahmed

(ACCA Registration # 1753442)

Mentoring By:

This project is prepared in accordance with guidelines of Oxford Brookes University for BSC (Hons)

Financial and Business Analysis

Table of Contents

PART 1 PROJECT OBJECTIVES & OVERALL RESEARCH APPROACH Aims and Objectives Reasons for the Selection of Topic About Toyota Indus Motor Company Limited About Products and Services Overview of the Automobile Industry PART 2 INFORMATION GATHERING & ACCOUNTING/BUSINESS TECHNIQUES Information Gathering Limitations of Collecting Information Ethical Issues Techniques PART 3 RESULTS, ANALYSIS, CONCLUSIONS & RECOMMENDATIONS Ratio Analysis Revenue Trend Analysis Profitability Ratios Liquidity Ratios Leverage Investor Ratios SWOT Analysis Conclusions Future Prospects Appendices Skills and Learning Statement Presentation Reference List Bibliography

3 3 4 4 5

9 10 10 11

13 13 16 20 23 24 27 29 30 31 39 45 52 54

RAP Indus Motor Company Limited

-Page 1-

Financial and Business Analysis

PART 1 PROJECT OBJECTIVES & OVERALL RESEARCH APPROACH

(word count 967)

RAP Indus Motor Company Limited

-Page 2-

Financial and Business Analysis

Introduction

Aims and Objectives

The objective of this report is to analyze the financial position of the respective company and also looking at some key financial ratios so as to evaluate its performance over the three year period in contrast with preceding years and other leading companies in the same business sector and industry. Apart from financial analysis, this report also contains business analysis and the evaluation economic environment in which the company operates by using SWOT Framework. Finally, after analyzing financial and non financial matters, I intend to draw conclusions about automobile sector and the competition it has between companies. Through my research question, I would evaluate the reasons for the success of particular organization which I have chosen and the future prospects and its significance as illustrated by companys latest financial performance.

Reasons for selection of the Topic

The Topic I have chosen for my Research & Analysis Project is: Topic 8: The business and financial performance of an organization over a three year period as listed in BSc (Hons) in Applied Accounting and Research and Analysis Project Information pack. The reason I choose this specific topic is to make an effective use of the knowledge which I acquired in my ACCA studies as analyzing Business and Financial Position of any organization is one of the primary skills for any accountant. Beside this I also have an interest in finance and this has always remained my favorite area of study too, so this topic would be my ideal choice. Furthermore apart from finance, I would also like to assess my ability to analysis the economic environment, identify the changes in trend through annual accounts and to evaluate to reasons for overall growth in companys performance. So this topic would indeed be a challenging one and it will also enhance my knowledge which I gained from my previous studies. The company which I selected for my research and analysis project is Toyota Indus Motor Company Limited or IMC, one of the major automobile manufacturing companies in Pakistan.

RAP Indus Motor Company Limited

-Page 3-

Financial and Business Analysis

About Toyota Indus Motor Company Limited

Indus Motor Company (IMC) is a joint venture between the House of Habib, Toyota Motor Corporation Japan (TMC) and Toyota Tsusho Corporation Japan (TTC) for assembling, progressive manufacturing and marketing of Toyota vehicles in Pakistan since July 01, 1990. IMC is engaged in sole distributorship of Toyota and Daihatsu Motor Company Ltd vehicles in Pakistan through its dealership network. The company was incorporated in Pakistan as a public limited company in December 1989 and started commercial production in May 1993. The shares of company are quoted on the stock exchanges of Pakistan. Toyota Motor Corporation and Toyota Tsusho Corporation have 25 % stake in the company equity. The majority shareholder is the House of Habib. IMC's production facilities are located at Port Bin Qasim Industrial Zone near Karachi in an area measuring over 105 acres. Indus Motor Companys plant is the only manufacturing site in the world where both Toyota and Daihatsu brands are being manufactured. Heavy investment was made to build its production facilities based on state of art technologies. To ensure highest level of productivity world-renowned Toyota Production Systems are implemented. (Ref: http://www.toyota-indus.com/company/history.asp)

About Products and Services

IMC's Product line includes: Locally assembled models: - Toyota Corolla (1300cc, 1800cc, 2000cc) - Daihatsu Cuore (850cc) - Toyota Hilux - single cabin Imported models: - Toyota Camry - Toyota Land Cruiser - Toyota Prado - Toyota Ravi (Ref: http://www.toyota-indus.com/company/history.asp)

RAP Indus Motor Company Limited

-Page 4-

Financial and Business Analysis

To ensure Quality Service, IMC monitors adequacy of dealers infrastructure in terms of facility, manpower and equipment. Availability of trained technicians equipped with state of the art computerized diagnostic equipment and special Service Tools ensure repair quality. Our Service network has a total number of 663 repair stalls/ bays (344 number General stalls and 319 numbers Body and Paint Stalls) to conveniently accommodate Toyota and Daihatsu vehicles for any Service need. (Ref: http://www.toyota-indus.com/servicecenter/)

Overview of Automobile Industry

Manufacturing is the third largest and an important sector of the Pakistans economy which accounts for almost 18.5 % of countrys GDP in FY09-10. Automobile Industry of Pakistan has been playing a vital role in the overall national economy. The industry is one of the major contributors to the manufacturing sector in the country. In the Latest Economic Survey of Pakistan, it has been established that the Large Scale Manufacturing (LSM) has grown by 4.4% out of which automobile group showed an increase of 1.3 percentage points. (Ref: Economic Survey of Pakistan 2009-10: Manufacturing Section) Pakistans automobile sector is wholly private sector owned. It is dominated by few major players namely Pak Suzuki, Indus Motor Company and Honda Atlas Cars. The sector unfortunately has not had the desired impact in Pakistan for various reasons. It continues to remain protected with high import duties and other barriers to entry and competition which make it uncompetitive. The deletion program mandates a portion of domestically produced content. In doing so, the program provides non-tariff based protection to both domestic assemblers of motor vehicles as well as domestic producers of parts and components. These policies discourage domestic and foreign competition and allows for small, inefficient yet profitable domestic automobile producers certain. (Ref: http://www.adb.org/Documents/Assessments/Private-Sector/PAK/Private-SectorAssessment.pdf) The following table shows the trend of growth in automobile industry:-

Type Cars Motorcycles Jeeps Trucks Pick Ups Buses Tractors

FY2010 123,957 737,759 1,201 3,620 16,496 657 71,512

FY2009 82,844 507,924 1,066 3,136 15,400 686 60,351

Growth 49.63% 45.25% 12.66% 15.43% 7.12% -4.23% 18.49%

(Ref: http://www.pama.org.pk/historicaldata.htm)

RAP Indus Motor Company Limited

-Page 5-

Financial and Business Analysis

The following chart identifies the industry production and sales from 2005 to 2010:-

Production and Sale of "Cars" In Automobile Industry

200000 180000 160000 140000 120000 100000 80000 60000 40000 20000 0

165965

170487

176016

180834

164710

164650

2006

2007

2008

2009

84308

82844

2010

121647

123957

Production Sale

Note : This chart not includes all vehicles produced in automobile industry except for cars.

(Ref: http://www.pama.org.pk/historicaldata.htm) After the major fall in production and sale of cars in FY09, Industry has shown remarkable improvement in FY10, production and sales growing by almost 44% and 50% respectively. The growth mainly attributed to Indus Motors (IMC) which have recorded its highest ever sales of 50,823 cars (market share of 36% in 2010) and Pak Suzuki, the biggest local car assembler sold 79,993 cars (market share 53%). (Ref: http://www.maverickpakistanis.com/?p=5546)

RAP Indus Motor Company Limited

-Page 6-

Financial and Business Analysis

Lastly, the following chart shows the contribution by Pakistans leading automobile companies to the national treasury funds and from past couple of years, IMC have remained one of the leading contributors.

Contribution to National Exchequer

25,000 20,000 15,000 10,000 5,000 0 2005-06 2006-07 2007-08 2008-09 2009-10

Pak Suzuki Motor Company Ltd. Honda Atlas Cars (Pakistan) Ltd.

Indus Motor Company Ltd. Dewan Farooque Motors Ltd.

(Ref: http://www.pama.org.pk/custom_traffic.htm)

RAP Indus Motor Company Limited

-Page 7-

Financial and Business Analysis

PART 2 INFORMATION GATHERING & ACCOUNTING/BUSINESS TECHNIQUES (Word Count 1260)

RAP Indus Motor Company Limited

-Page 8-

Financial and Business Analysis

Information Gathering

When you are writing your dissertation, you should be ready for such important step as gathering information. You should make a plan in order not to be confused with your own actions. During the research work, I came across with numerous sources of information about the company but providing relevant and sufficient information is the primary purpose of this project report, so that appropriate appraisal could be made and conclusion can be drawn. However, I was inclined to work on financial as well as business performance of Indus Motor Company (IMC) and the sources are illustrated below with their importance and contribution to this project report.

Indus Motor Companys Official Website

The primary and one of the reliable sources of information has been the official website of Indus Motor Company Limited (IMC). Information I got from this includes company overview, history, annual reports and details about product and services.

Annual Reports

Modern annual report not only provides auditors report and audited Financial Statements but also consist companys performance, corporate social responsibility, future prospects and other meaningful information. Financial statements in the annual reports facilitated in the calculation of ratios and trends for the analysis of this report.

Internet

Internet provides many facilities to its user and it is one of the widely used methods to search information. Google, one of the most powerful search engine, helped me search large amount of information in seconds. Other information (Financial and Non-financial) available on the internet is also used where necessary.

ACCA Text Books

Secondary information has been obtained from ACCA Text Books (BPP and Kaplan). The books which have been comprehensively used by me include F7 Financial Reporting, P2 Corporate Reporting, P3 Business Analysis and P4 Advance Financial Management. Calculation of ratios, business models, performance evaluation, concepts and explanations about topic have been taken from these books.

News and Business Recorder

News in Pakistan has always been on spotlight, these days many new channels organized talk shows to get companies information that could be discussed on their channels. Business Recorder is a complete online newspaper which proved to be a valuable way of obtaining information regarding IMC.

RAP Indus Motor Company Limited

-Page 9-

Financial and Business Analysis

Other Sources

Most of the information has been obtained from IMCs official website and annual reports so as to increase the credibility and reliance on this project report. However this research also includes extensive background research on automobile sector which required information to be obtained from numerous sources but these sources were not able to contribute substantially in financial and business analysis. Other prominent source of information includes Wikipedia and Pakistan Economic Survey 2008-09 and 2009-10.

Limitations of Information gathering

This section deals with the problems arose during the course of gathering information regarding automobile sector and IMC. Most of the information gathered are from secondary research and this does not necessarily involves visiting IMCs premises or meeting their staff in person, however in doing so would have strengthen my research findings. While analyzing SWOT, I came across with much information regarding IMC but unable to find its weaknesses in much detail. This is because in recent times there is no Government Inquiry about IMC and neither company publicly discloses this type of information or else it would be convenient for me to analyze its weaknesses in more meaningful way. My analysis of this report is based on past three years annual report up until June 2010. This analysis includes evaluation of some key ratios and identification of trends but however this report does not fully depicts the performance of IMC and it cannot be used as a future indicator for upcoming years. Automobile Industry is fast moving industry and has got many fluctuations, so its hard to predict future performance by analyzing historical information. Furthermore, the inconsistency in Pakistans economy also makes it difficult to assay future prospects of the company from the information gathered.

Ethical issues

While preparing this RAP, I tried my level best to follow all ethical practices and standards during the course of my research and used only that information which is obtained from reliable and genuine source (Annual reports and official website). Moreover, other information sources were public information which was easily available on internet and in news. However, providing references is one of the ethical requirements of this RAP which is subsequently done. And I carefully did admit the fact that information presented was derived from certain public data and have referenced it appropriately. Information which has been mentioned in this RAP without any appropriate reference may create an understanding that information is self created. Information that has been use in discussion is also self created unless otherwise stated.

RAP Indus Motor Company Limited

-Page 10-

Financial and Business Analysis

Being an ACCA student, I laid great emphasis to ethics and fortunately no major issues came across which may create ethical problems.

Techniques

Following are the accounting and business techniques used for the analysis in this RAP:

Financial Information

The accounting techniques used in the financial analysis of this RAP are as follows:Trend Analysis: It is a form of comparative analysis that is often employed to identify current and future movements of a company in terms of growth. This type of information is extremely helpful to investors who wish to make the most from their investments. In this RAP, trend analysis is performed on Revenue. Ratio Analysis: It is a tool used by individuals to conduct a quantitative analysis of information in a company's financial statements. There are many ratios that can be calculated from the financial statements pertaining to a company's performance, activity, financing and liquidity. Some common ratios used in this RAP include Profitability, Liquidity, Leverage and Investor ratios. Monetary values do not always provide the true picture. But ratios are effective means of establishing trend and analyze changes to different segments of financial performance of companies. However ratio analysis got some drawbacks as well. Ratios hardly provide any indication of companys performance if they were used in isolation, so they need to be compared with industry averages. Industry averages are difficult to obtain in Pakistan. Comparing ratios with competitor can also be difficult since competitor may not be of same size and with same market share as in the case of Indus Motor Company Limited and its competitor Honda Atlas Cars Limited. Graphical Representation: It is the best and the most effective way of communicating information to the user because just a glance its gives an indication of companys performance. However in order to make graphical representation meaningful, we should use fewer variables in a graph so that user gets the clear understandability and may not get confuse and misinterpret the information. Analysis in this RAP includes the chart and graph of the mentioned ratios. And they are prepared using Office 2007.

RAP Indus Motor Company Limited

-Page 11-

Financial and Business Analysis

Non-Financial Information

The business technique used in this RAP is SWOT analysis. An evaluation of an organization's strengths and weaknesses in relation to environmental opportunities and threats is generally referred to as a SWOT analysis.

Strengths: characteristics of the business or team that give it an advantage over others in

the industry.

Weaknesses: are characteristics that place the firm at a disadvantage relative to others. Opportunities: external chances to make greater sales or profits in the environment. Threats: external elements in the environment that could cause trouble for the business.

Identification of SWOTs is essential because subsequent steps in the process of planning for achievement of the selected objective may be derived from the SWOTs. Strategies can be developed which: o o o Neutralize weaknesses or convert them into strengths Convert threat into opportunities Match strength with opportunities

(Ref: http://en.wikipedia.org/wiki/SWOT_analysis) (Ref: Kaplan Study Text Paper P3 Business Analysis: Internal resources, Capabilities and Competences (2008:78))

RAP Indus Motor Company Limited

-Page 12-

Financial and Business Analysis

PART 3 RESULTS, ANALYSIS, CONCLUSIONS & RECOMMENDATIONS

(word count 2720) Swot (1420) Maximum (4150)

Note: This part of report consist of Ratio Analysis of Indus Motor Company Limited (IMC) in comparison with its competitor Honda Atlas Cars Limited (HAC).

RAP Indus Motor Company Limited

-Page 13-

Financial and Business Analysis

RATIO ANALYSIS

Ratio Analysis often forms the basis of comparison with performance over time or with other companies. Comments on a company based on such ratios are far most likely to be right than comments based on a casual read through a set of accounts. (Ref: BPP Study Text Paper P4 Advance Financial Management: Predicting Corporate Failure (2008:285))

Revenue Trend Analysis (325 words)

At a glance, IMC is portraying a better picture of revenue as compared with HAC. There were ups and downs as revenue rises by 5.9% in 2008 while falling by 8.45% in 2009 but however in 2010 the revenue increases significantly by 59% as compared with last year. This rise in revenue was due to increase in sale prices and also number of units sold (see below)

RAP Indus Motor Company Limited

-Page 14-

Financial and Business Analysis

The trend in revenue growth of both companies is almost similar. As after 2006 the growth rate begins to fall and HAC growth is negative from 2007-2009 while IMC have showed its strong position in the market and suffered negative growth only in 2009.

Revenue Growth Rate

80

Percentage (%)

60 40 20 0 -20

27.5

52.4 11.08 5.9 -3.83 -8.45 -33.4 -13.7

58.6

IMC

12.04

HAC

-40 2006 2007 2008 2009 2010

Years

Like all car manufacturing companies in Pakistan, Toyota Indus Motors Company Limited has also increased its prices up by 13 times up to 60 percent during January 2008 to March 2010. It increased the prices 7 times in 2008, 4 times in 2009 and till March 2010 it raised the prices twice. On the other hand, Honda Atlas Motors Company Limited also raised the prices 10 times in the said period up to 66%. The company had raised its prices 4 times in 2008, 5 times in 2009 and till March 2010 raised the prices once. But however regardless of increment in prices, revenue tends to fall as the sales performance was affected due to slowdown in car financing, as banks were reluctant to issue fresh loans amid risk aversion and chances of higher non-performing loans due to the economic slowdown. Besides this, higher mark-up rates, contraction in disposable income due to higher inflation and heightened security concerns restricted consumers to buy new cars. (Ref: http://www.dailytimes.com.pk/default.asp?page=2010\04\22\story_22-4-2010_pg5_19)

RAP Indus Motor Company Limited

-Page 15-

Financial and Business Analysis

Profitability Ratios

Gross Profit Margin (GPM) (385 words): A financial metric used to assess a

firm's financial health by revealing the proportion of money left over from revenues after accounting for the cost of goods sold. (Ref: http://www.investopedia.com/terms/g/gross_profit_margin.asp)

GP Margin

Percentage (%)

10 5 IMC 0 -5 2008 9.3 4.3 2009 6.1 1.2 Years 2010 7.8 -1.5 HAC

IMC HAC

The current situation shows that IMC is better of over three year period maintaining a positive growth in GPM than HAC which shows a declining trend in GPM even going to negative in 2010. After 2008, IMCs GPM fell by 3.2% in 2009 but however it recovered showing an increase of 1.7% in 2010. On the other hand, HAC has a continuous fall in GPM which shows that it is unable to keep a tighter control over its cost as compared to IMC. With an impressive GPM in 2008, IMC is unable to maintain it in 2010, even though IMC has recorded its highest ever sales in said period. In 2010, sales grew by 59% but however GPM only increased by 1.7% which seems to be nothing in comparison with the growth in sales. This was primarily due to consistent cost pressures amid rupee devaluation, rebound in steal prices and increase in sales tax. On the other hand, increase in GPM from 2009 was mainly due to the fact that IMC have cut down its fixed cost and also achieved economies of scale by manufacturing most of vehicles in Pakistan and relying less on imports from Japan. (Ref: IMC and HAC Annual Report 2008, 2009 & 2010) This amid rising raw material cost and along with growing overhead cost has put the auto industry through the wringer. The main culprit behind the dull margins is the adverse currency

RAP Indus Motor Company Limited

-Page 16-

Financial and Business Analysis

movement, as the Japanese Yen and the dollar strengthened against the Rupee by of 14% and 7% respectively but the company still managed higher gross margins as steel prices decreased by 10% and car prices surged. However, compared to other players in the domestic auto industry, IMC has been riding out relatively well - aided not only by robust demand for its flagship car, but mainly because Corolla has achieved the highest level of localization in value terms. In an effort to trim production cost and to increase the Made-inPakistan components in its cars, IMC has lately earmarked Rs1.5 billion to install a new pressing machine. This should help the firm increase its sales and give tougher competition to other players. (Ref: http://www.brecorder.com/business-a-finance/49-research-a-analysis/644-indu-up-andrunning-.html)

Net Profit Margin (NPM) (365 words): A ratio of profitability calculated as net

profits divided by revenue and is expressed as a percentage. It indicates how well the company converts sales into profits after all expenses is subtracted out.

NP Margin

Percentage (%)

10 5 0 -5 -10 2008 5.5 0.5 2009 3.7 -2.8 Years 2010 5.7 -5.4 IMC HAC

IMC HAC

As like GPM, NPM is also giving us the same picture of IMC in contrast with HAC which is on a declining trend even going to negative in last couple of years. The net profit margin of the IMC also decreased during 2008 due to 16.6% lower Profit after taxation posted by the company. The administrative expenses had increased by 12% in 2008. Also, the other operating income fell by 17.7% due to low returns on bank deposits. Finance charges for the company had decreased by 94% during 2008 as the company did not have any mark-up bearing long-term liabilities, except deferred taxation, in its balance sheet. (Ref: IMC Annual Report 2008)

RAP Indus Motor Company Limited

-Page 17-

Financial and Business Analysis

The domestic auto industry had witnessed a 67 per cent drop in volumes over the last couple of years but bounced back in fiscal year 2010. However in 2009, IMC has suffered the significant fall by 30.6% in sale of its cars. In FY09, the margin also decreased due to heavy increase in administrative expenses by 18.5% and finance cost also risen up by more than 9 times from 2008. This has reduced its NPM by 1.8% from last year but still being positive unlike its competitor, HAC. (Ref: IMC Annual Report 2009)

2010 has been a remarkable year for IMC as its has not only recorded its highest ever sales but also outperformed the industry and increased its market share from 32% to 34.5% and the main reasons behind this extraordinary surge were 49% increase in unit sales and an average 8% increase in prices of cars. Other income increased by 1.5 times and finance cost decreased by 86.5% which further enhances company's financial performance. As on this period when auto industry have shown a tremendous growth, IMCs net profit is more than doubled and its NPM have also increased by 2%, but on the other hand HAC has not only sold fewer units but its NPM further deteriorated by 2.6% mainly because of poor control over its cost and expenses specially finance cost. (Ref: IMC and HAC Annual Report 2010) (Ref: http://tribune.com.pk/story/44645/indus-motor-net-profit-doubles-to-rs3-4b/)

Asset Utilization/Turnover (130 words): Asset turnover ratio shows how well the

company is utilizing its assets in order to generate sales revenue. The total asset turnover decreased in 2009 from 3.02 to 1.83(FY08) both due to a decrease in sales (-8.45% YoY) and a large increase in total assets (51% YoY). The increase in total assets came amid a slight decrease in fixed assets, mainly due to a 124% increase in cash & bank balance and a 55% increase in stock-in-trade. Furthermore in 2010, Asset turnover increased from 1.83 to 2.22 but have not increased significantly just like IMCs revenue. This is because total assets have also increased by considerable amount (31% YoY). Increase in total assets was mainly due to cash and bank which increased by almost 62% comprising most of bank deposits. (Ref: IMC Annual Report 2010, Notes to Accounts Cash and Bank Balances)

RAP Indus Motor Company Limited

-Page 18-

Financial and Business Analysis

Liquidity Ratios

Current Ratio (240 words): The current ratio compares a companys liquid assets

with short-term liabilities. The higher the ratio, the more liquid is the company. (Ref: Student Accountant February 2007)

3 2.5 2.56

Current Ratio

Times

2 1.5 1 0.5 0 2008 0.79

1.69

1.67

IMC HAC

0.7

0.62

2009

2010

Years

Current ratio of 1-1.5 is considered safe and desirable. IMC is quite handsomely above that but however HACs current ratio is below the limit of safety and even declining over three year period which may be an alarming situation for the companys liquidity position. The liquidity position of the IMC had been steadily increasing over the years until 2008 in which current ratio reached its highest level. In 2008, sales decreased due to lower demand. Large declines in both current assets and liabilities were seen, and again the decrease was far greater for current liabilities (-49% YoY). This decrease was fuelled by a drastic (-80% YoY) decrease in advances. Thus the current ratio spiked to its highest in recent history, i.e. 2.56. (Ref: IMC Annual Report 2010: Ten Years at a Glance) However, in 2009 the liquidity position worsened as current ratio fell by 34%. Although there was an increase in current assets due to stock in trade, trade debt and cash and bank balances from Rs 9,664 million to Rs 16,715 million, there was a more than proportionate increase in current liabilities from Rs3779 million to Rs9884 million in 2009 mainly due to increase in advances from customers and dealers. The liquidity position didn't improve in 2010 as the current assets and current liabilities increased proportionately. The current ratio declined only slightly from 1.69 to 1.67.

RAP Indus Motor Company Limited

-Page 19-

Financial and Business Analysis

Quick Ratio (205 words): A stricter test of liquidity is the quick ratio which excludes

inventory/stock as a current asset. A relatively high quick ratio indicates conservative management and the ability to satisfy short-term obligations. (Ref: Student Accountant February 2007)

Quick Ratio

2 1.5 1.8 1.26 1.3

Times

1 0.5 0

IMC HAC

0.24 0.16 0.19

2008

2009

2010

Years

Quick ratio of 1 is considered sound and advisable but this depends from industry to industry. IMC has got a more favorable quick ratio than HAC at all times over a three year period. HAC has indeed got a very low quick ratio which if declined further, may lead to serious consequences. IMC has maintained healthy quick ratio reaching highest in 2008 and then declining by 30% in 2009 but still having a pleasant ratio in both 2009 and 2010. The main reason for decline was due to significant increase in inventories by 47% and 26% in 2009 and 2010 respectively. Inventories represent 30%, 26% & 22% in 2008, 2009 and 2010 respectively of the Total Current Assets. The sharp increase in inventories in 2009 was due to the fact that whole automobile sector have faced the fall in demand as lesser unit being sold leading to rise in inventories. But however after the major set back in 2009, industry have recovered thus IMCs quick ratio rises slightly from 1.26(FY09) to 1.3(FY10).

RAP Indus Motor Company Limited

-Page 20-

Financial and Business Analysis

Inventory Turnover Days : (170 words)

This ratio shows how many days a company takes to convert its closing inventory2 into sales. A lower ratio would represent more effective inventory management, all else being equal. In 2008 it took 25 days while in Inventory Turnover 2009, it increased considerably to 45 around 41 days on the back of large 40 increase in stock-in-trade (55% YoY) 35 41 and a lesser decrease in net sales (30 8.45% YoY). The decrease in sales 32 25 is not unique to IMC alone. It is IMC 20 25 currently an industry wide 15 phenomenon which has seen sales 10 decrease drastically. Sales of locally 5 produced passenger cars and light 0 commercial vehicles witnessed a YoY decrease of (-8%) in 2008 and 08 09 10 20 20 20 of (-47%) in 2009. But however Years industry had recovered in 2010 as sales increases by 59%, bringing days back down from 41 to 32 days.

Days

Notes: 1 There was no indication of credit sales or credit purchases, hence given purchases and sales were assumed to be on credit. 2 Inventories includes both stock in trade and stores and spares.

RAP Indus Motor Company Limited

-Page 21-

Financial and Business Analysis

Leverage

Debt Equity Ratio (85 words): Debt/equity ratio is a measure of the proportion of

equity versus debt that is used to finance various portions of a company's operations. It is used as a standard for judging a company's financial standing. (Ref: http://www.wisegeek.com/what-is-a-debtequity-ratio.htm) IMC at all times have a nil D/E ratio which is a positive indication that company financial risk is low. On the competitors side HAC in the year 2008, 2009 and 2010 have a D/E ratio of 0.2, 0.5 and 0.7 respectively. (Ref: HAC Annual Report 2010: Financial highlights)

Interest Cover (145 words): The interest cover ratio measures the amount of profit

available to cover the interest payable by the company. The lower the level of interest cover the greater the risk to lenders that interest payments will not be met. (Ref: Student Accountant February 2007)

Interest Cover

2000 1500

Times

1467 1284

1000 500 0 -500 2008 2009

Years

IMC

1.3 78 -1.8 2010 -1.2

HAC

Interest Cover reached a phenomenal level of 1284 in 2008 and 1467 in 2010 because of extremely low-level of financial charges as they reached a low of Rs 2.7 million and 3.6 million respectively. In both years this was mainly because of the gain on revaluation of foreign exchange contracts which amounted to around Rs 20.8 million(FY08) and Rs 96.6 million(FY10). (Ref: IMC Annual Report 2009 and 2010 Notes to Accounts Finance Cost) While in 2009, IMC has a interest cover of 78 times due no extraordinary gains from revaluation of foreign exchange contracts but still well ahead of its competitor HAC, who is in a potential danger of not being able to meet its interest obligations.

RAP Indus Motor Company Limited

-Page 22-

Financial and Business Analysis

Investor Ratios

Earning per Share (EPS) (195 words): EPS is the amount of a company's profits that belong to a single ordinary share. EPS allows us to compare different companies power to make money. The higher the EPS with all else equal, the higher each share should be worth.

(Ref: http://investing-school.com/definition/earnings-per-share-eps/)

Earning Per Share

50

Rupees Per Share

40 30 20 10 0 -10 2008 2009 Years 0.55 -2.81 29.15 17.62

43.81

IMC HAC

-5.97 2010

The IMCs EPS continued to decrease in 2008 and 2009 due to decline profits. Profits have decreased on the back of decreasing demand in the market and this can be attributed to many factors. These factors include increasing inflation, decreased available consumer finance, the subsequent drying up of liquidity and some government regulations (namely increased withholding tax and sales tax). Furthermore in 2010 where there was rise in demand which lead to increase sales, not only IMCs profit gets more than doubled but also its EPS rises by 2.5 times in comparison with 2009. In contrast, HAC is suffering from losses and its EPS showed a declining trend over three year period even going to negative in last couple of years.

Note: Both companies declared in their respective annual reports that there were no dilutive effects on EPS and hence the basic and dilutive EPS are the same.

RAP Indus Motor Company Limited

-Page 23-

Financial and Business Analysis

Price / Earning Ratio (245 words): The P/E ratio is a vital ratio for investors. Basically, it gives us an indication of the confidence that investors have in the future prosperity of the business. (Ref: http://www.bized.co.uk/compfact/ratios/investor12.htm)

P/E Ratio

100 80 79.3

IMC HAC

Times

60 40 20 0 -20 2008 -4.4 2009 6.86 6.11 5.99 -2.7 2010

Years

HAC showed an immense PE ratio in 2008 due to very low figure of EPS (0.55). Afterwards it declined because company is encountering losses. In contrast, IMC has also showed a declining trend over three year period but it has still got a sound PE ratio which is above its last ten years average PE Ratio of 5.6. PE ratio showed an increasing trend till FY07 where it reached its highest level of 8.75. Even market price of companys share was also very high in 2007 (i.e. 305.50) but it then plunged down by 34.5% to 200.05 after the collapse of the stock market in 2008. This fall of once great KSE 100 index from the 15500 level to a meager 4500 was indeed the worst crisis that ever hit the Pakistani stock markets. (Ref: http://ezine.pk/?The-Avoidable-collapse-of-Karachi-Stock-Exchange-2008--KSE&id=384) The PE ratio even got worse for IMC, when in next financial year of 2009 it suffered demand crisis and companys share price also fell significantly by 46% to 107.72. However in 2010, when companys financial performance improved, the market price of share increased substantially by 144% to 262.38 but PE ratio fell slightly from 6.11 to 5.99 due to the fact that companys EPS has also increased more than proportionately by 150%. (Ref: IMC Annual Report 2010: Ten Years at a Glance)

Note: Prices taken were of year end prices.

RAP Indus Motor Company Limited

-Page 24-

Financial and Business Analysis

Dividend Per Share (DPS) and Dividend Yield (215 words)

Dividend per share (DPS) is the amount of the dividend that shareholders have (or will) receive for each share they own. Dividend yield compares the amount of dividend per share with the market price of a share, and provides a direct measure of the return on investment in the shares of a company. (Ref: Student Accountant February 2007)

16

Dividend Per Share

10.5 10

15

Rupees Per Share

14 12 10 8 6 4 2 0 2008 2009 Years 2010

10 9 8 7 6 5 4 3 2 1 0

Dividend Yield

9.28

Percentage (%)

5.72 5.25

2008

2009 Years

2010

IMC

IMC

IMC had got an impressive history of paying dividends. Even in the year of low profitability as in 2009 where profits declined by 40% as compared with 2008, IMC had still paid total dividend1 of 10 per share which is negligibly lower of what it paid in 2008. Furthermore in 2010, when profitability of IMC gets more than doubled, it has paid a total dividend of 15 per share which is highest in IMCs history. Even though with such satisfactory level of dividend payments, there have been ups and downs in dividend yield mainly because of fluctuations in market price2 of companys share. In comparison with other two years, 2009s dividend yield is higher because of a lower market price of 107.72.

Notes: 1 This figure was directly taken from IMCs Annual report and it includes both interim and final dividends. th 2 The price taken for analysis is the year end prices as on 30 June.

RAP Indus Motor Company Limited

-Page 25-

Financial and Business Analysis

SWOT Analysis

Total word count (1420 words)

In developing sound strategic plans, an organization must evaluate its internal strengths and weaknesses in relation to the external opportunities and threats it faces. An effective strategy will take advantage of an organizations strengths and opportunities at the same time it minimizes or overcomes weaknesses and threats. Regular assessment of SWOT analysis is thus given importance.

Strengths (335 words)

Toyota has become the generic name in the Pakistan market. Whenever the company launches the new car in the market it has always the great support of the already market orientation so the car introduced by it easily covers the introduction stage. People have a lot of trust for their name and this is why Toyota is the market leader in automobile industry. Toyota has tremendous strength for its 2.OD car, as it is the only company in Pakistan offering the diesel engine in this category of cars. Toyota vehicles have got a great resale value in comparison with other cars in Pakistan. This is why people prefer to buy a Toyota. The vital strength for Toyota is that it has got Corolla among its sales portfolio, which has achieved highest localization level in Pakistan having a market share of 35% out of the total cars sold in Pakistan. (Ref: www.pama.org.pk) Indus Motor Company is privileged to have the most modern Service Network in the country. All its Toyota and Daihatsu Dealers operate on "3S" basis (Sales, Service, and Spare Parts). Customer Satisfaction is the cornerstone of its Marketing philosophy. Modern equipment and facilities exist at each dealership that is named by professionally trained Service Technicians. (Ref: http://www.toyota-indus.com/dealers/services.asp) The ample availability of spare parts in the markets, all over the country and at affordable prices, gives an edge to Toyota over its competitors. IMCs financial position is also one of its strengths as depicted by it latest financial performance where profitability gets more than doubled from last year. IMC operates wholly on equity finance as it has no gearing in their financial statements which means that they have less financial risk.

RAP Indus Motor Company Limited

-Page 26-

Financial and Business Analysis

Weakness (205 words)

The company is besieged with internal operating problems which are not very serious. IMC is dependent on Toyotas principles, so delivery of cars is done after 4-6 months. This is because CKD kits are ordered four months before and once they arrive from Japan, assembly and delivery takes some more time. All major decisions are made in Japan by the holding company; they send instruction about their decisions in Pakistan. This may not be according to the requirements of local culture and it also delays the decision making process. Currently IMC manufacture only Daihatsu Cuore in category of 800cc cars while the leading market player, Pak Suzuki, manufacture three types of cars in this category namely Suzuki Bolan, Suzuki Margalla and Suzuki Mehran. On the other hand, IMC doesnt have any 1000cc car, due to which the whole market for this type of cars was again mainly dominated by Pak Suzuki. Although IMCs dealership network is all over the country but its still has got weaknesses. Company does not own this dealership network. IMC has a manufacturer sponsored retailer franchise systems. They license dealers to sell their cars and they often charge high price from customer and also not act upon the instructions of IMC.

Opportunities (160 words)

Exports IMC currently doesnt export any of its cars outside Pakistan. So they have an opportunity to capitalize on this and export their vehicles to the world market especially to the Central Asian Republics. Karachi being their nearest port, the opening of trade routes in these countries will lead to an inevitable growth in the transport sector. IMC can excel by focusing much more on market segments than it presently does. For example, it should try to lower its price of Corolla in the segment where Honda city has penetrated. IMC market share can increase if it works on Cars which provide more mileage on with cheap fuel. Toyota is already working on efficient fuel cars and if this technology enters in Pakistani market then IMC can go beyond its market share.

IMC have an opportunity to introduce Hybrid cars in Pakistan like Toyota Prius, which is considered as one of the best hybrid cars in the world.

RAP Indus Motor Company Limited

-Page 27-

Financial and Business Analysis

Threat (180 words)

Competition - Competition is on the rise in automobile industry, the planned car manufacturing plants of Hyundai and Daewoo can prove to be tough competition for Toyota if they are successful. The inclusion of spare parts in the approved list of the Afghan Transit Trade Agreement could be quite galling for an industry already battered by the influx of smuggled spare parts and under invoicing. (Ref: http://www.brecorder.com/business-a-finance/49-research-a-analysis/644-indu-upand-running-.html) Relaxation allowed by the government in used car imports. The government recently allowed imports of used cars up to five-year-old compared to the previous three-year benchmark, which may drive up competition. But this in turn will lead to lesser demand for locally manufactured cars. Unfavorable currency movement - As most of the parts are imported from Japan, specially CKD Kits, depreciation of the rupee against Japanese yen makes imports more expensive which in turn raise the cost of production. Suzuki cars are strong substitute for Toyota cars - The reason is that people are becoming more price conscious and want economical car which give low fuel consumption that is why Suzuki demand in gradually increasing.

Conclusion (312 words)

Upon performing financial and business analysis on Indus Motor Company Limited (IMC), it can be seen that IMC has established itself as a profitable company and a better value of investment for its shareholders as compared with its competitor Honda Atlas Cars Limited (HAC). IMC is wholly equity financed with no debt in the books; it has shown growth in all aspects of the business especially in FY2010 which was considered as a record year in companys history. IMC have maintained an impressive dividend payout over the last few years and has showed gradual increase in EPS alongside sales revenue and profits. Apart from that company also have a comfortable liquidity position. With such superb financials, on the other side of the coin, IMC is facing troubles with blunt profit margins due to adverse currency movements. Furthermore inflationary pressure and unfavorable economic conditions are decreasing the purchasing power of the middle-income population and thus diminishing demand. Being the major market share holder in automobile industry of Pakistan, IMC also laid great emphasis on Corporate Social Responsibility. Through its CSR program and slogan, "Concern Beyond Cars", IMC has contributed over Rs 100 million in the past 5 years for

RAP Indus Motor Company Limited

-Page 28-

Financial and Business Analysis

health, education, welfare, environment and road safety projects, thus playing a significant role in the communities where it operates. (Ref: http://www.toyota-indus.com/concern/default.asp) The automobile sector, Pakistani economy and thus the company has gone through much turmoil in recent times including political chaos, stock market crashes, exchange rate fluctuations and the global financial crises specially in FY2009. However company showed progression during these turbulent times. All of this was made possible by companys consistent efforts in establishing important strategic objectives, ensuring their achievement and implementing core values within the organization. Strong work ethics and vision, broad based performance and overall culture within the organization and companys commitment towards society are the main reasons behind IMCs outstanding performance.

Future Outlook (225 words)

The automobile industry in Pakistan is currently faced with a number of problems. There is increased competition from imported cars specially used cars and this is threatening the future domestic sales in the country. Furthermore, the industry faces tremendous pressure from the government to reduce the prices of locally manufactured cars, against a backdrop of the depreciating Pak Rupee and increasing raw material costs. Above all, the catastrophic floods that hit the Pakistan in July, the worst natural disaster in Pakistan's history, has added to the much woes of the nation and the current state of the economy is simply not capable of withstanding the shock. Not only do the consequences on the government budgetary estimates for 2010-11 appear severe, all forecasts including GDP growth rates will need to be scaled down due to risk of a higher fiscal deficit, which in turn will lead to increased government borrowing. The domestic auto industry has barely recovered from global economic crises but recently, the government has signed the Afghan Transit Trade Agreement which could adversely affect local trade especially spare parts business. In the short-term, Indus Motor is working on a definitive plan to expand the dealer network and launch the new CKD Hilux 4x4 with common rail engines while in the long-term, Indus Motor is looking to increase capacity and fill it with new products. (Ref: www.brecorder.com)

End of Report

RAP Indus Motor Company Limited

-Page 29-

Financial and Business Analysis

APPENDICES

RAP Indus Motor Company Limited

-Page 30-

Financial and Business Analysis

Appendix 1 Extracts of Statement of Financial Position of Indus Motor Company Limited (Rupees`000)

2008 ASSETS Non Current Assets Fixed assets Long-term loans and advances Long-term deposits 2009 2010

4,033,762 42,341 7,222 4,083,325

3,934,473 28,509 7,222 3,970,204 128,483 4,088,858 1,763,631 894,459 16,876 50,944 67,902 9,731,166 16,715,319 _________ 20,685,523 =========

3,324,333 15,570 7,122 3,347,025 111,567 5,198,367 1,613,247 839,819 18,778 57,254 196,241 15,755,980 23,791,253 _________ 27,138,278 =========

Current Assets Stores and spares Stock-in-trade Trade debts Loans and advances Short-term prepayments Accrued return on bank deposits Other receivables Investments - at fair value through P/L Taxation - net Cash and bank balances

232,142 2,637,629 1,332,832 737,372 23,148 35,012 74,360 54,171 209,533 4,328,585 9,664,784 _________ 13,748,109 =========

TOTAL ASSETS

EQUITY Share Capital Authorized capital 100,000,000 Ordinary shares of Rs 10 each Issued, subscribed and paid-up capital Reserves LIABILITIES Non-current liabilities Deferred taxation

1,000,000 786,000 8,650,340 9,436,340

1,000,000 786,000 9,510,973 10,296,973

1,000,000 786,000 11,801,615 12,587,615

532,138

503,700

325,797

RAP Indus Motor Company Limited

-Page 31-

Financial and Business Analysis

Current liabilities Trade and other payables Advances from customers and dealers Accrued mark-up Taxation - net TOTAL EQUITY AND LIABILITIES

2,837,084 942,442 105 3,779,631 13,748,109

3,942,988 5,926,529 673 14660 9,884,850 20,685,523

5,905,062 8,076,281 944 242,579 14,224,866 27,138,278

========== ========= =========

Appendix 2 Extracts of Statement of Financial Position of Honda Atlas Cars Limited (Rupees`000)

2008 ASSETS Non Current Assets Property, plant and equipment Intangible assets Capital work-in-progress Long-term loans and advances Long-term deposits Deferred taxation 2009 2010

3,864,527 64,636 80,746 29,050 4,091 338,165 4,381,215

5,190,535 195,830 19,226 31,503 4,042 571,214 6,012,350 101,942 2,954,091 853,218 20,487 3,929,738 _________ 9,942,088 =========

4,445,810 125,998 21,813 33,896 4,042 802,914 5,434,463 121,386 2,329,161 994,229 82,046 3,526,804 _________ 8,961,267 =========

Current Assets Stores and spares Stock-in-trade Advances, Prepayments and Other receivables Cash and bank balances TOTAL ASSETS

873,101 1,612,696 50,852 231,880 2,435,529 _________ 6,816,744 =========

RAP Indus Motor Company Limited

-Page 32-

Financial and Business Analysis

EQUITY Share Capital Authorized capital 200,000,000 Ordinary shares of Rs 10 each Issued, subscribed and paid-up capital Reserves (Accumulated Loss) / Unappropriated profit LIABILITIES Non-current liabilities Long-term finances - secured Current liabilities Current portion of long term finances Short term borrowings secured Mark-up accrued on borrowings Trade and other payables TOTAL EQUITY AND LIABILITIES

2,000,000 1428,000 1,727,000 74,678 3,229,678

2,000,000 1428,000 1,801,500 (401,655) 2,827,845

2,000,000 1,428,000 1,401,500 (853,855) 1,975,645

500,000

1,500,000

1,333,333

32,029 3,055,037

2,151,601 75,048 3,387,594

166,667 37,400 5,448,222 5,652,289 8,961,267 =========

3,087,066 5,614,243 6,816,744 9,942,088 ========== =========

RAP Indus Motor Company Limited

-Page 33-

Financial and Business Analysis

Appendix 3 Extracts of Profit and Loss Account of Indus Motor Company Limited (Rupees`000)

2008 Sales Cost of Goods Sold Gross Profit Distribution Expenses Administrative Expenses Other Operating Expenses Other Operating Income Profit From Operations Finance Costs Profit Before Taxation Taxation Profit After Taxation Earnings Per Share 41,423,843 (37,575,356) 3,848,487 (487,373) (297,284) (306,193) 786,834 3,544,471 (2,760) 3,541,711 (1,250,866) 2,290,845 29.15

2009 37,864,604 (35,540,418) 2,324,186 (469,985) (352,249) (156,479) 727,080 2,072,553 (26,540) 2,046,013 (660,911) 1,385,102 17.62

2010 60,093,139 (55,382,306) 4,710,833 (468,496) (381,575) (416,106) 1,801,459 5,246,115 (3,576) 5,242,539 (1,799,136) 3,443,403 43.81

RAP Indus Motor Company Limited

-Page 34-

Financial and Business Analysis

Appendix 4 Extracts of Profit and Loss Account of Honda Atlas Cars Limited (Rupees`000)

2008

Sales Cost of Goods Sold Gross Profit / (Loss) Distribution and Marketing Costs Administrative Expenses Other Operating Expenses Other Operating Income Profit / (Loss) From Operations Finance Costs Profit / (Loss) Before Taxation Taxation Profit / (Loss) After Taxation Earnings / (Loss) Per Share 14,715,495 (14,088,001) 627,494 (209,677) (139,163) (4,975) 23,589 297,268 (233,651) 63,617 (11,393) 75,010 0.55

2009

14,149,646 (13,973,144) 176,502 (190,088) (139,749) (311,025) 64,844 (399,516) (222,769) (622,285) 220,452 (401,833) (2.81)

2010

15,854,142 (16,093,687) (239,545) (124,916) (136,131) (58,628) 26,368 (532,852) (455,128) (987,980) 135,780 (852,200) (5.97)

RAP Indus Motor Company Limited

-Page 35-

Financial and Business Analysis

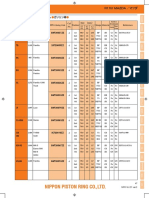

Ratios 2008, 2009 & 2010 IMC

2008 Gross Profit Margin Net Profit Margin Asset Turnover (Times) Current Ratio (Times) Quick Ratio (Times) Inventory Turnover (Days) Debt to Equity Ratio Interest Cover (Times) Earnings Per Share Price / Earning Ratio Dividend Per Share Dividend Yield 9.3% 5.5% 3.02 2.56 1.8 25 1284 29.15 6.86 10.5 5.25% 2009 6.1% 3.7% 1.83 1.69 1.26 41 78 17.62 6.11 10 9.28% 2010 7.8% 5.7% 2.22 1.67 1.3 32 1467 43.81 5.99 15 5.72% 2008 4.3% 0.5% 0.79 0.24 0.2 1.3 0.55 79.3 -

HAC

2009 1.2% -2.8% 0.70 0.16 0.5 -1.8 -2.81 -4.4 2010 -1.5% -5.4% 0.62 0.19 0.7 -1.2 -5.97 -2.7 -

RAP Indus Motor Company Limited

-Page 36-

Financial and Business Analysis

Ratios Formulae Ratio

Gross Profit Margin Net Profit Margin Asset Turnover (Times) Current Ratio (Times) Quick Ratio (Times) Inventory Turnover (Days) Debt to Equity Ratio Interest Cover (Times) Earnings Per Share Price / Earning Ratio Dividend Per Share Dividend Yield

Formula

Gross Profit Sales x 100 Profit After Tax Sales x 100 Sales Total Assets Current Assets Current Liabilities (Current Assets Inventory) Current Liabilities Inventory x 365 Sales Interest bearing Long Term Debt Total Equity Profit before Interest and Tax Finance Cost Profit After Tax No. of Ordinary Shares Market Price Per Share Earnings Per Share Total Dividends No. of Ordinary Shares Dividends Per Share Market Price Per Share x 100

End of Appendices

RAP Indus Motor Company Limited

-Page 37-

Financial and Business Analysis

SKILLS AND LEARNING STATEMEMT (Word Count 1970)

RAP Indus Motor Company Limited

-Page 38-

Financial and Business Analysis

Skills and Learning Statement (SLS)

According to the Bsc information pack, SLS is of equal importance as RAP, here my practical competence, communication skills and learning is demonstrated and whether I have achieved this or not from my project report. My meetings with mentor resemble to professional meetings and it will definitely help me in future career. In SLS following are discussed: Meetings with mentor Research Question and Answers Questioning and Listening Overall RAP Experience

Selection of the Mentor

Selecting a mentor is mandatory requirement for this RAP. Mentor guides and provide feedbacks in preparation of this project report. I have selected Mr. Fahim Ahmed as my mentor. He is an ACCA teacher and a faculty member of my institute Abeel School of Accountancy (ASA).

Learning from Meetings

Once I have selected my mentor, I look for different timings available and then email him to decide the time for meetings. All meetings were held as scheduled. As guided, I had three meetings with my mentor. All meetings were held at reasonable time so that no clash occurs with my class timings. Professionalism is vital for this RAP and has been maintained during all my meetings.

First Meeting at the Commencement of RAP

I had been trying to prepare my RAP from last submission period but unable to do so because of my ill health. I had my first meeting on 10th Feb 2011, a week after selecting my mentor. The first meeting was held at ASA. In the meeting we discussed the topic and the organization which I opted to choose. I have also done some research about organization and industry which I brought up with me as told by Mr. Fahim. Mr. Fahim inquired me that why I have choose particular organization and what are my research questions in this project report, I briefed him the details and how I intended to do my project as described in information pack. He corrected few of my deficiencies regarding my approach. Furthermore RAP planning, the overall research objectives and structure of report has been discussed. He explained me the structure of writing the report through handout and specially clarifies my vagueness about how to start things off. I also cleared some of my ambiguities with Mr. Fahim regarding the computation of ratios in automobile sector and how to do referencing, and after the meeting I was able to focus more clearly on the objectives of my RAP.

RAP Indus Motor Company Limited

-Page 39-

Financial and Business Analysis

Second Meeting at the Halfway through RAP

After the first meeting, I started writing my draft report and most of my project was completed prior to second meeting. The timing of this meeting was not decided before but Mr. Fahim told me that it will take 3-4 weeks to complete the draft report after first meeting. As soon as I completed my draft report, I emailed that to Mr. Fahim. Finally we met a week after my email as we agreed a suitable time on 15th March 2011. In second meeting, I have ample amount of questions to ask from my mentor and amongst them the important was evaluation of business performance using SWOT analysis. I am confused what to write exactly in it as I have made a list of strength, weaknesses and so on. Then Mr. Fahim helped me out in deciding the important SWOTs related to IMC. Another important thing I have to ask is about ratios. I have already analyzed plenty of ratios, but due to the limitation of word count, I have to restrict my analysis to few important ratios. Mr. Fahim told me the ratios to analyze which are vital to Automobile Industry and also assisted me in evaluating the reason for changes in couple of ratios. Moreover, apart from the things mentioned above, in second meeting we also discussed about SLS, conclusions, and most importantly the reduction of word count as it was going beyond the limit. Lastly, Mr. Fahim told me that as soon as I complete my report and correct things which was discussed in this meeting, I should email him and then we can find a convenient time for the next meeting. After second meeting, my confidence level was very high and I learned a lot from this RAP as it enabled me to answer few questions when getting engaged in some research exercise like this. RAP project have also developed certain necessary skills which alongside my ACCA studies, will quite be beneficial to me.

Third Meeting at the Finalization of RAP

The third and last meeting is on 25th March 2011 as decided, in this meeting I had to do a presentation regarding my overall project report. In past, I have made some presentations which proved to be useful in making this one as well. But the real challenge for me while making this presentation is to concise the vast amount of data in this RAP into few productive points. I prepared my Presentation using Microsoft Power Point 2007, but I was bit tensed about how to present it in auditorium. Finally I gave a presentation to my mentor and small audience including couple of other teachers. They appreciated my presentation skills (specially the use of images, headings and audio clips) and provided me some handy advice for future presentations. Furthermore, the whole presentation went well and I am also able to answer all the questions which have risen up my morale. After presentation I finally believe that Hard work Pays Off as my tireless efforts from past couple of months very much came into play along with the guidance and counseling at crucial times from Mr. Fahim Ahmed.

RAP Indus Motor Company Limited

-Page 40-

Financial and Business Analysis

Research Questions and Answers

I presume that the research questions set at the commencement of this RAP were broadly answered. I did extensive research for this RAP and used many sources to gather information but not all of them are relevant to this report. But it did help me a lot in reaching towards conclusions. I believe that my previous knowledge from ACCA studies assisted me in evaluating business and financial performance of Indus Motor Company Limited. However I cant deny the fact that RAP experience was quite different from the knowledge gained through books and in fact it pretty much resembles to the practical life situation. While analyzing this report, I have learned to see things in numerous ways. This has widened my scope of knowledge as now I am able to answer my research questions in more effective ways. I have use charts and graphs in this RAP to facilitate my conclusions especially in ratio analysis. Beside this, I have used SWOT to analyzed macro-economic environment which affects the company by evaluating the factors which are in companys control (Strength and Weakness) and which are not (Opportunities and Threats). On the whole, this RAP experience was indeed very invaluable for me as most of my research questions were answered and it will surely help me in future too.

Interpersonal and Communication skills

Questioning

The power to question is the basis of all human progress. (http://thinkexist.com/quotation/the_power_to_question_is_the_basis_of_all_human/209629.ht ml) He who asks a question is a fool for five minutes; he who does not ask a question remains a fool forever (http://thinkexist.com/quotation/he_who_asks_a_question_is_a_fool_for_five_minutes/164844 .html) Asking the right question is at the heart of effective communications and information exchange. Questioning not only helps clarify ones thoughts but it also helps you to extract knowledge from the other persons mind. During my initial meeting, I have a volume of questions in my mind to ask from my mentor and they are not even well constructed since I had lots of confusions regarding my overall RAP. But even then Mr. Fahim was able to answer my queries convincingly. He also asked me few questions regarding the IMC and Automobile Industry and also about my overall approach to RAP and how I intended to carry it further. From next meeting onwards, I usually shortlist the questions before going for a meeting and note them down in my diary with well manner approach so as to achieve maximum out of our meetings.

RAP Indus Motor Company Limited

-Page 41-

Financial and Business Analysis

Finally, I have learned a lot from these meeting sessions and most important is that the questioning also improves my listening skills as it is proved from a famous quote: If you spend more time asking appropriate questions rather than giving answers or opinions, your listening skills will increase (http://www.quotationspage.com/quote/28697.html)

Listening

Listening is rarely if ever taught in schools because educators assume listening is automatic its like breathing. But effective listening is a skill, which like any other skill is achieved through learning and practice. (http://www.smallbusinessdelivered.com/theartofeffectivelistening.html) We have two ears and one mouth so that we can listen twice as much as we speak (http://www.quotegarden.com/listening.html) People need to practice and acquire skills to be good listeners, because a speaker cannot throw you information in the same manner that a dart player tosses a dart at a passive dartboard. Information is an intangible substance that must be sent by the speaker and received by an active listener. (http://www.casaa-resources.net/resources/sourcebook/acquiring-leadership-skills/listeningskills.html) For the communication to be effective, it must be a two way process. So during meeting sessions with my mentor, I pay active attention to what he says and also able to listen to him carefully without any interruptions. This is because my meetings were held in my mentors private cabin except for the last one which was held in auditorium as I have to give a presentation about my RAP. During listening, patience is also a necessary prospect, at times during meetings, I disagree with my mentor but even then I prevented myself from interrupting him, and discussed the disagreements with him once he finished talking. These meeting sessions helped in development of my listening techniques. Since I was in face to face sessions, the proximity of contact helped in instant correction and also improving my interpretation skills, these in turn have helped me to master my listening capability.

RAP Indus Motor Company Limited

-Page 42-

Financial and Business Analysis

Overall RAP Experience

RAP seems to be a great experience for me. During my RAP I was able to analyze my strengths and weaknesses, which I used and countered properly. Like searching and collecting data from internet was one of my strengths, while on the other hand formation of graph using Excel seems to be one of my weakness. Apart from this I was required to show competence in all areas of this RAP, using Office 2007 to prepare this report and more importantly to analyze the relevant information from the data gathered from all the sources. Word count for this RAP seems to be another challenge for me as I have to constantly recheck my whole report so as to stay within the limits of word count and also to comply with the guidelines provided by information pack. At last, the presentation followed by question session insists an individual to elucidate how well they have researched and for me this was a major confidence booster as I am able to answer all the questions successfully. Furthermore and the most importantly RAP provides an additional graduate degree in addition to ACCA qualification. However through ACCA studies, a person can just acquire professional accountancy knowledge but he may lack expertise in terms of research and analysis, information technology and communication skills which are highly in demand in this competitive world. So RAP provides them with all the skills and competences which otherwise have to be acquired through university graduation. On the whole, RAP has been a complete new and different experience for me in comparison with my ACCA studies. It has helped to improve my interpersonal skills and enhance my knowledge encyclopedia. I have learned a lot from my mentor who has guided me throughout the whole process. Finally through this RAP I am also able to evaluate my own skills and competences which will surely help me in future.

End of Skills and Learning Statement

RAP Indus Motor Company Limited

-Page 43-

Financial and Business Analysis

PRESENTATION

RAP Indus Motor Company Limited

-Page 44-

Financial and Business Analysis

Indus Motor Company Limited

Analysis of Financial and Business Performance

BY: WAQAS ANWAR

"It takes one hour of preparation for each minute of presentation time." Wayne Burgraff

Aims and Objectives About IMC Information Gathering Techniques Financial Analysis

SWOT Analysis IMC Future Prospects IMC Responsibilities Recommendations Questions

RAP Indus Motor Company Limited

-Page 45-

Financial and Business Analysis

An outlook of the company and its objectives Importance of IMC towards Automobile Sector and overall GDP An analysis of Financial and Business performance of Indus Motor Company Limited from 2008 to 2010 A comparison with competitor Honda Atlas Cars Limited. Using research findings to derive conclusion regarding financial performance and reporting on future aspects and perspective of IMC

Major Automobile Company of Pakistan having Market Share of 36% Dealership Network All Over Pakistan CSR program and slogan, "Concern Beyond Cars"

RAP Indus Motor Company Limited

-Page 46-

Financial and Business Analysis

IMC official website (www.toyota-indus.com) IMCs Annual Reports ACCA Kaplan and BPP Study Texts Books Business Recorder

Trend Analysis Revenue & Profitability Ratio Analysis & its Limitations Graphical Representation SWOT Analysis

RAP Indus Motor Company Limited

-Page 47-

Financial and Business Analysis

High Volume of Sales Increasing revenue and profits Comfortable Liquidity Position No Gearing Impressive dividends for shareholders and return package

Strength

Remarkable Financial Performance Toyota Corolla has highest localization level in Pakistan Service Network operate on "3S" basis (Sales, Service, and Spare Parts).

Weaknesses

No 1000cc car Dealership network Delivery time or Internal operating problems

Opportunities

Exports to neighboring countries Cars with more mileage and cheap fuel Hybrid Cars

Threats

Competition Unfavorable Currency Movements Relaxation allowed by the government in used car imports

RAP Indus Motor Company Limited

-Page 48-

Financial and Business Analysis

Competition from imported cars Government pressure to reduce prices of locally manufactured cars Government signs Afghan Transit Trade Agreement which could affect spare part business Expand dealership network Launch new CKD Hilux 4 X 4 Increase capacity and introduce new products Superb Financials Value Stock

At Indus Motor, CSR is effectively managing its business processes to create an overall positive impact on the society. As a policy, IMC allocates 1% of Profit before Tax each year for CSR IMC aim for growth that is in harmony with the environment throughout all areas of its business activities. Making continuous investment for the future of Pakistan by providing assistance to educational institutions Stakeholders Confidence Continuous Improvement

RAP Indus Motor Company Limited

-Page 49-

Financial and Business Analysis

Should focus on cash return a little more Manufacture more vehicles locally Introduce 1000cc cars in Pakistan Should improve its dealership network Continual expansion

RAP Indus Motor Company Limited

-Page 50-

Financial and Business Analysis

Reference List

Ahmed, M. (April 22, 2010), Last 2 years Increase in car prices highest ever in history [Online], Retrieved from: http://www.dailytimes.com.pk/default.asp?page=2010\04\22\story_22-4-2010_pg5_19 (Accessed 22nd February 2011) BPP Study Text (2008) P4 Advance Financial Management: Predicting Corporate Failure. London: BPP Learning Media Business Recorder (05 November 2010), INDU up and running [Online], Retrieved from: http://www.brecorder.com/business-a-finance/49-research-a-analysis/644-induup-and-running-.html (Accessed 24th February 2011) Business studies teaching and education resources (2011): Biz/ed, Price Earning Ratio [Online], Retrieved from: http://www.bized.co.uk/compfact/ratios/investor12.htm (Accessed 8th February 2011) Economic Survey of Pakistan 2009-10: Manufacturing Section HAC Annual Report 2010: Financial Highlights, pp 38-39 IMC Annual Report 2009, Notes to Accounts 28 Finance Cost, pp 85 IMC Annual Report 2010, Notes to Accounts 12 Cash and Bank Balances, pp 85 IMC Annual Report 2010, Notes to Accounts 27 Finance Cost, pp 95 IMC Annual Report 2010: Ten Years at a Glance, pp 106 IMC Official Website (2011), Company History [Online], Retrieved from: http://www.toyota-indus.com/company/history.asp (Accessed 12th February 2011) IMC Official Website (2011), Maintenance Services [Online], Retrieved from: http://www.toyota-indus.com/dealers/services.asp (Accessed 19th February 2011) IMC Official Website (2011), Service Center [Online], Retrieved from: http://www.toyota-indus.com/servicecenter/ (Accessed 12th February 2011) Investing School (2011), Earning Per Share [Online], Retrieved from: http://investingschool.com/definition/earnings-per-share-eps/ (Accessed 6th March 2011) Investopedia (2011), Gross Profit Margin [Online], Retrieved from: http://www.investopedia.com/terms/g/gross_profit_margin.asp (Accessed 24th February 2011) Kaplan Study Text (2008) P3 Business Analysis: Internal resources, Capabilities and Competences. London: Kaplan Publishing

RAP Indus Motor Company Limited

-Page 51-

Financial and Business Analysis

Maverick Pakistanis (2010), Car sales in Pakistan up by 49pc [Online], Retrieved from: http://www.maverickpakistanis.com/?p=5546 (Accessed 15th February 2011) Pakistan Automotive Manufacturers Association (2011), Contribution to National Exchequer [Online], Retrieved from: http://www.pama.org.pk/custom_traffic.htm (Accessed 15th February 2011) Pakistan Automotive Manufacturers Association (2011), Historical Data [Online], Retrieved from: http://www.pama.org.pk/historicaldata.htm (Accessed 15th February 2011) Private Sector Assessment Pakistan (2008), Automobile Sector pp 15 [Online], Retrieved from: http://www.adb.org/Documents/Assessments/PrivateSector/PAK/Private-Sector-Assessment.pdf (Accessed 14th February 2011) Raza, A. (May 19 2010), The Avoidable collapse of Karachi Stock Exchange 2008 KSE [Online], Retrieved from: http://ezine.pk/?The-Avoidable-collapse-of-KarachiStock-Exchange-2008---KSE&id=384 (Accessed 8th March 2011) Student Accountant (February 2007): Interpreting Financial Statements, Current Ratio, Quick ratio, Interest cover and Dividend Ratio pp40-43 [Online], Retrieved from: http://www.accaglobal.com/pubs/students/publications/student_accountant/archive/pyk e0207.pdf (Accessed 1st March 2011) The Express Tribune (August 31st, 2010), Indus Motor net profit doubles to Rs3.4b [Online], Retrieved from: http://tribune.com.pk/story/44645/indus-motor-net-profitdoubles-to-rs3-4b/ (Accessed 26th February 2011) Wikipedia (2011), SWOT Analysis [Online], Retrieved from: http://en.wikipedia.org/wiki/SWOT_analysis (Accessed 18th February 2011) Wise Geek (2011), Debt/Equity Ratio [Online], Retrieved from: http://www.wisegeek.com/what-is-a-debtequity-ratio.htm (Accessed 4th March 2011)

RAP Indus Motor Company Limited

-Page 52-

Financial and Business Analysis

Bibliography

ACCA Text Books Text Book Kaplan F7 Financial Reporting Text Book Kaplan P2 Corporate Reporting Text Book Kaplan P3 Business Analysis Text Book BPP P4 Advance Financial Management News Business Recorder Daily, (http://www.brecorder.com/) The Nation, (http://www.nation.com.pk/) The Express Tribune, (http://tribune.com.pk/) Daily Times, (http://www.dailytimes.com.pk/) Dawn News, (http://www.dawn.com/) Official Indus Motor Company Limited Website, (http://www.toyota-indus.com/) Indus Motor Company Limited Annual Report 2008 Indus Motor Company Limited Annual Report 2009 Indus Motor Company Limited Annual Report 2010 Honda Atlas Cars Limited Official Website, (http://www.honda.com.pk/) Honda Atlas Cars Limited Annual Report 2008 Honda Atlas Cars Limited Annual Report 2009 Honda Atlas Cars Limited Annual Report 2010 Other Sources Wikipedia, (http://en.wikipedia.org/wiki/Main_Page/) Wiki Answers, (http://wiki.answers.com/) Pakistan Electronic Magazine, (http://ezine.pk/) Investopedia, (http://www.investopedia.com/) Pak Wheels Forum, (http://www.pakwheels.com/forums/) Pakistan Economy & Related Sources Economic Survey of Pakistan 2007-2008 Economic Survey of Pakistan 2008-2009 Economic Survey of Pakistan 2009-2010 Economic Pakistan, (http://economicpakistan.wordpress.com/) Economy, Investment & Finance Reports, (http://www.economywatch.com/) Market Watch, (http://www.marketwatch.pk/news/pakistan-business-news/)

RAP Indus Motor Company Limited

-Page 53-

Financial and Business Analysis

Presentation Images Slide One Toyota Logo: (Official website) Slide Four - (Official website) + Google Images: (http://www.images.google.com) Slide Five - Keyboard: (http://www.platac.co.za/images/1.jpg) Slide Six - Searching Cartoon: (http://www.penn-olson.com/wpcontent/uploads/2009/10/searching-for-info.jpg) Slide Seven - Graphs: (http://www.guidentbusinesssolutions.com/images/financial_analysis.jpg) Slide Nine - Born to Last: (Official website) Slide Ten - Sky and Toyota: (http://4.bp.blogspot.com/_jCOkUHYbApE/S7tHwLICwlI/AAAAAAAAANI/Yc_5frvjYPc/s1600/T oyota.jpg) Slide Eleven - Pen: (http://www.newbiemommy.com/images/Sample-Letter-OfRecommendation-For-Child-Adoption.jpg) Slide Twelve - Question Mark: (http://www.wishfulthinking.co.uk/wp-content/question.jpg) Regulatory Sources Pakistan Automotive Manufacturers Association, (http://www.pama.org.pk/) Karachi Stock Exchange (Guarantee) Limited, (http://www.kse.com.pk/) Student Accountant Student Accountant February 2007

RAP Indus Motor Company Limited

-Page 54-

You might also like

- RAP Honda and ToyotaDocument32 pagesRAP Honda and Toyotascrewyou0980% (1)

- Obu Tata Motors Final DraftDocument48 pagesObu Tata Motors Final DraftNayeem SazzadNo ratings yet

- Research DocumentDocument24 pagesResearch DocumentZiaBilalNo ratings yet

- RAP MARYAM - R02 (Old)Document34 pagesRAP MARYAM - R02 (Old)Asad MuhammadNo ratings yet

- FORD and GMDocument25 pagesFORD and GMNadeemAhmedNo ratings yet

- Rap 8 Acpl PDFDocument36 pagesRap 8 Acpl PDFSusan Gomez100% (4)

- DGKC Research ReportDocument34 pagesDGKC Research Reportgbqzsa100% (1)

- SingTel Financial AnalysisDocument42 pagesSingTel Financial AnalysisJozua Oshea PungNo ratings yet

- RAP 8 Tesco Financial Analysis PDFDocument36 pagesRAP 8 Tesco Financial Analysis PDFSusan Gomez58% (19)

- Obu - Rap IntroDocument21 pagesObu - Rap IntroLavyciaNo ratings yet

- Oxford Brookes University: Research and Analysis ProjectDocument46 pagesOxford Brookes University: Research and Analysis ProjectjawadNo ratings yet