Professional Documents

Culture Documents

Answer - Key ITOL Mid-Term

Uploaded by

Purnima KapoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer - Key ITOL Mid-Term

Uploaded by

Purnima KapoorCopyright:

Available Formats

Q1.

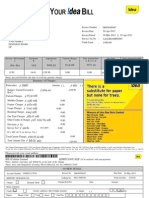

As Cash against Advance was rejected as a mode of payment LC (Letter of Credit) is the best and the safest method left. Suresh can be familiarized about this mode of payment by the understanding the illustration below and the Step-by-Step mechanism

Letter of Credit

Applicant ( Buyer / Importer Beneficiary ( Seller / Exporter

DOCUMENTS

PAYMENT

DOCUMENTS

LC Request

Opening or Issuing Bank

PAYMENT

Confirming Bank

LC is an instrument of assured payment. It is an undertaking of the Issuing bank to make payment to the beneficiary against documents stated in the LC. 1. Applicant ( Importer/ Buyer) has a sale/purchase Agreement ( Contract ) with the Seller/Exporter. 2. Beneficiary wants to be sure about the payment hence LC comes into the picture as the preferred mode of payment 3. Applicant makes an request to his bank ( Issuing Bank) to issue the L/C 4. Issuing bank issues the LC and forwards it to advising bank for verification 5. Advising Bank verifies the authority of the LC and forwards it to the beneficiary. 6. Seller receive the LC and starts manufacturing the goods and ships the goods. 7. After shipment seller/exporter prepares the documents. 8. Seller/Exporter submits the documents to the Nominated /Negotiating Bank. 9. Bank verifies checks if the documents are as per LC will make payment to the beneficiary. He will submit the documents to the opening bank /issuing bank and demand payment against the same. 10. Opening Bank will in turn get Docs accepted by the applicant/buyer meaning the documents are in order. 11. Depending on type of LC the documents will reach the Buyer upon payment or after payment. 12. Applicant makes payment to the opening bank. 13. Opening Bank makes payment to the negotiating bank

PAYMENT

Advising Bank

DOCUMENTS Negotiating/Advising Bank

14. Negotiating bank has already made payment to the beneficiary. a. In case the beneficiary bank is not satisfied with the credit rating of the opening bank it seeks guarantee for payment and that guarantee is given by confirming bank in case the opening bank fails to make the payment.

Q2. Regulatory Requirements for getting started in Import-Export Business Step by step Obtain Importer Exporter Certificate Code( IEC Code) This licence is granted by Directorate General Foreign Trade which is a body that regulates and governs foreign trade under the Ministry of Commerce. The requirements for IEC code are PAN, address proof, Bank A/C Certificate, Company Registration No., Partnership Deed along with DD of Rs. 250 One PAN no is granted one IEC Code which is a unique code for Importers and Exporters The Original IEC is issued by Regional DGFT and endorsed Copy sent to the Banker The Regional DGFT also consolidates a list of IEC sends it to the Exchange Control department of RBI. One IEC valid for all branches /divisions/units/factories. If Lost duplicate is issued once submitted with an affidavit. If holder does not wish to operate submit the same back to the DGFT who transmits the same electronically to the customs and Regional authority. Obtaining the Registration-cum-Membership Certificate (RCMC) Exporter shall declare the main line of business to the Export Promotion Council relating to the line of business. Exporter or Importer can obtain the RCMC from Federation of Indian Exporters Organization (FIEO). It is valid for 5 years. The exporter needs to send quarterly returns to FIEO If there is any Change in Ownership/address/name/ constitution the exporter needs to inform the registering authority. For violation of the condition of registration show-cause notice is given to the exporter and adequate time to complete the formalities or else subject EPC shall de-register and inform all regional authorities. Registration of VAT This is done with the Sales Tax officer of the Ward in which the Headquarter/registered office of the business is located. A Tax Identification Number is issued. For interstate sales Central Sales Tax registration is necessary. Following is the list of submission Latest rent receipts Proof of physical possessions List of Products for which Registration is required List of Directors of the Company with photographs Certified true copy of the Board resolution

Copy of Certificate of Incorporation, Memorandum of Association and Articles of Association. Bank Statement of the Company from the date of Incorporation till the date of making the application. Self attested copy of the PAN BG of 1 Lakh

After examining the docs the certificate will be issued within 10-16 days. Within 2-3 days of issue a Sales Tax officer will submit a report of functioning of the firm. Central Excise Registration Central Board of Excise and Customs (CBEC) is a part of the Department of Revenue under the Ministry of Finance, Government of India. It deals with the tasks of formulation of policy concerning levy and collection of Customs & Central Excise duties and Service Tax, prevention of smuggling and administration of matters relating to Customs, Central Excise, Service Tax and Narcotics to the extent under CBEC's purview. Manufacturer exporter is to get registered for the ECC which is issued by CBEC Following types are supposed to get registered: Every manufacturer of Excisable good whether owning a firm or a factory on which excise is leviable. Person who is owning private warehouse for storing of goods Person whether Domestic Trader/ Merchant exporter/ Manufacturer exporter who obtain excisable good for availing end use based exemption notification Exporters who are manufacturing and processing export goods from inputs on which duty has been paid and they wish to claim duty rebate by using the input received without payment of duty and exporting the finished goods.

The application for the ECC are to be made to jurisdictional Central Excise Officer under whose premises the factory/ enterprise is located. Export License for Restricted Items If item happens to be on the restricted list Exporter has to approach the Reg DGFT under whose his business premise falls for necessary export license. Q3. Bill of Lading is issued by the shipping carrier company/its agent to the shipper listing and acknowledging the receipt of goods for shipment. B/L has 3 basic functions A document of title to goods described in the B/L Proof of Receipt/shipment of goods Evidence of terms & conditions of transport of goods

Three types of B/L

Shipped B/L confirms goods are on board thus is indisputable proof of the shipment thus leaving no doubt about the final settlement of the export sale Received B/L : Proof that goods have been received for shipment may not be shipped yet may be just in shed, in dock of port warehouse . Through B/L :A transporter can move products both within a country and export them, often by air, with a through bill of lading. The through bill contains an "inland bill of lading", which is the documentation required for domestic transportation. If the shipper wants to move the goods across the ocean, the through bill of lading will not be adequate. An "ocean bill of lading" will be required for any goods moving across the sea. Q4. Exporting Most commonly used method if foreign market entry as it involved limited start up costs . 2 basic routes Direct export which indicates that the firm wants to be a long time player in that market and wish to develop and adapt its product as local requirements over a period of time. In this case the firm has to handle the logistics part as goods are manufactured. Indirect Exports can be through Export Management companies, Export Trading Companies, Foreign Trading Companies, export merchants/export agents/buying houses, Piggyback exporting. Advantage : Minimize the potential risk in trade as firms need not make investment in the target market. Ease in market entry Disadvantage: Trade Barriers and tariffs and other costs make products and services uncompetitive Firm is viewed and regarded as an alien and outsider Licensing: Licensing is an arrangement where Licensor provides trademarks, patents, technical know-how, production techniques, managerial know-how to the licensee in exchange of fees, share of profits royalty on sales. Advantage : Speediest way of entering the target market Helps circumventing the various trade barriers Disadvantages:

Sometimes licensee becomes potential competitor Firms knowledge and technical know-how and R&D spill over to licensee and may result in proliferation. Usually the license period is limited and offsets the firms chances for long term profits Joint Ventures: This is a market entry option whereby the firm and another company or firm in the target market may join together to form an dnew incorporated company for business operations in that market. In JVs both parties are supposed to provide capital and resources in the agreed proportion and accordingly they will represent the management and share of profits and losses. Advantage: Helps to acquire new competencies or skills that are not domestically available. Reducing the firms risks by sharing it with one of the more firms. Disadvantage: Lack of full control on management of the firm. Potential risks of disagreement with the partner organization on exploring new markets, new operations etc. Wholly Owned Subsidiary This is the direct ownership of products facilities in the potential international market. Its requires long term commitment to the part of the firm as it involves the transfer of resources such as capital technology such as capital technology and personnel to the potential market Advantage: Firm has a good knowledge of the local market and accordingly devises strategies. Chances of know-how proliferation get minimized. Disadvantage: This method has greater risk than other modes of entry. It requires more financial and non-financial resources and commitment from the firm. Q6. Following are important elements of the contract

Sellers and Buyers Names Good idea to have complete Names with address. Exporter should cross examine the Importers full name by taking help from D&B or alternatively from Indian embassies abroad or ECGC for getting full report on the credit worthiness and the status Unit Price Quote such a price which covers the expenses, satisfy his customer in a competitive environment Terms of delivery The Incoterms chosen for the deal must indicate the name of the port of destination . Incoterms make the responsibilities and obligations of the exporter and importers clear and therefore care must be taken in choosing them. Payment terms Exporter must be careful about the method of payment negotiated for the sales deal and must incorporate the same in the international sales contract. The payment terms should be clearly mentioned in a detailed manner E.g. payment is thru Confirmed Letter of Credit at Sight then same should be written as confirmed Irrevocable Letter of credit at Sight Delivery date of goods: Delivery date should e clearly mentioned with the date and date of month along with the year Exporter must be comfortable in position to supply goods and services on the delivery date Exporter need to arrange for shipping space warehousing, cargo movement as required Additional terms Good practice to make all terms and conditions clear in the international sales contract as it will help in avoiding any kind of uncertainties/ambiguities and reducing risks in the trade transaction. Claims clause in Sales Contract: In case of risks and causalities/damages/losses the claims clause should detail the procedure to file for claims. Making claims procedure clear in the ISC should help the trader determine the responsibility of the loss and obtain the claims for the same. Arbitration Clause in Sales Contracts : the trade disputes are settled in different manner as the jurisdiction of exporters and importers is usually different.

As trade disputes should they occur should be resolved in a amicable manner without large financial commitment by exporter or importers It is necessary to make the arbitration process negotiation in the international sales contract. Exporter should be careful not to accept arbitration process in countries that are known have corrupt systems ad judiciaries. Better to state the arbitration system and procedure and arbitration country in the ISC itself to avoid any confusion Force Majeure Clause Literally means all those events, causalities or losses occurred which are beyond the control of exporter, importers and insurers. Known as the ACT of GOD clause such as lightening, floods, earthquakes, hurricanes tsunami Example are also wars, communal and sectarian and religious violence and riots and upheaval by the military junta. Any failure of contracting parties that may occur which is beyond their control. E. g. Gujarat exporters could not send their shipment because nationwide strike by bus operators.

You might also like

- MDINDIA HEALTHCARE SERVICES (TPA) PVT. LTD. Provider Management PAN India Empanelled Hospital ListDocument218 pagesMDINDIA HEALTHCARE SERVICES (TPA) PVT. LTD. Provider Management PAN India Empanelled Hospital Listmanoj_dalal100% (2)

- Demo DataDocument2 pagesDemo DataPurnima KapoorNo ratings yet

- Guide To Great Logos v1Document222 pagesGuide To Great Logos v1Jhonatan Medina95% (19)

- Bhabha Atomic Research CentreDocument2 pagesBhabha Atomic Research CentrePurnima KapoorNo ratings yet

- HPDocument2 pagesHPPurnima KapoorNo ratings yet

- Ernest Hemingway: The Brilliant American Writer...Document19 pagesErnest Hemingway: The Brilliant American Writer...Purnima KapoorNo ratings yet

- Advanced Services Marketing Project Report on Measuring Quality in Fast-Food Outlets Using SERVQUALDocument26 pagesAdvanced Services Marketing Project Report on Measuring Quality in Fast-Food Outlets Using SERVQUALPurnima KapoorNo ratings yet

- Storage Tiering For Dummies - Chapters 3, 4 & 5: Submitted byDocument35 pagesStorage Tiering For Dummies - Chapters 3, 4 & 5: Submitted byPurnima KapoorNo ratings yet

- Advanced Services Marketing Project Report on Measuring Quality in Fast-Food Outlets Using SERVQUALDocument26 pagesAdvanced Services Marketing Project Report on Measuring Quality in Fast-Food Outlets Using SERVQUALPurnima KapoorNo ratings yet

- MCQ on Microeconomics ConceptsDocument1 pageMCQ on Microeconomics ConceptsPurnima KapoorNo ratings yet

- Storage Tiering For Dummies - Chapters 3, 4 & 5: Submitted byDocument35 pagesStorage Tiering For Dummies - Chapters 3, 4 & 5: Submitted byPurnima KapoorNo ratings yet

- ERP1Document77 pagesERP1Purnima Kapoor0% (1)

- Chapter 13Document32 pagesChapter 13Selim RezaNo ratings yet

- CokeDocument14 pagesCokePurnima KapoorNo ratings yet

- Electronic Media Distractibility CollegeDocument8 pagesElectronic Media Distractibility CollegePurnima KapoorNo ratings yet

- Gazette of India For IESDocument79 pagesGazette of India For IESkarthickaryanNo ratings yet

- Sap Netweaver For Dummies - Chapters 23 & 24: By: Purnima Kapoor (9502911) Sonashree Jaiswal (12609127)Document35 pagesSap Netweaver For Dummies - Chapters 23 & 24: By: Purnima Kapoor (9502911) Sonashree Jaiswal (12609127)Purnima KapoorNo ratings yet

- Gazette of India For IESDocument79 pagesGazette of India For IESkarthickaryanNo ratings yet

- 20 Apr 2013Document8 pages20 Apr 2013Purnima KapoorNo ratings yet

- Information SystemsDocument44 pagesInformation SystemsSohel RanaNo ratings yet

- TTK PrestigeDocument19 pagesTTK PrestigePurnima Kapoor100% (1)

- TTK Prestige's Growth Plans and Suggestions to Outperform CompetitionDocument22 pagesTTK Prestige's Growth Plans and Suggestions to Outperform CompetitionShilpam SrivastavaNo ratings yet

- Iqcm-Grp 13Document9 pagesIqcm-Grp 13Purnima KapoorNo ratings yet

- WG PaperDocument109 pagesWG Papervarun0788No ratings yet

- TTK Prestige's Growth Plans and Suggestions to Outperform CompetitionDocument22 pagesTTK Prestige's Growth Plans and Suggestions to Outperform CompetitionShilpam SrivastavaNo ratings yet

- Its Not Rocket ScienceDocument65 pagesIts Not Rocket ScienceFederovici Adrian GabrielNo ratings yet

- Business StrategyDocument5 pagesBusiness Strategybattlestroker100% (1)

- Pulp Paper Five ForcesDocument20 pagesPulp Paper Five ForcesPurnima KapoorNo ratings yet

- ProQuestDocuments 2013 07 23Document6 pagesProQuestDocuments 2013 07 23Purnima KapoorNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Legal Principles in Shipping Business 2014Document3 pagesLegal Principles in Shipping Business 2014MarvinNo ratings yet

- Bill of LadingDocument1 pageBill of LadingJohn Mark VerarNo ratings yet

- FOSFA-compliant cargo proceduresDocument4 pagesFOSFA-compliant cargo proceduresVan VardasNo ratings yet

- Belgian Overseas Chartering and Shipping NDocument2 pagesBelgian Overseas Chartering and Shipping NMXKatNo ratings yet

- Booking Confirmation: A.B.N. 12003760638 As Agent For MSC Mediterranean Shipping Company S.ADocument1 pageBooking Confirmation: A.B.N. 12003760638 As Agent For MSC Mediterranean Shipping Company S.Alê thái hoàng sơnNo ratings yet

- Why We Are in The Admiralty JurisdictionDocument5 pagesWhy We Are in The Admiralty Jurisdictionsabiont100% (3)

- CERTS - Revenue CycleDocument8 pagesCERTS - Revenue CycleralphalonzoNo ratings yet

- 389个外贸单证名称中英文互译,超全,附赠word文档!Document18 pages389个外贸单证名称中英文互译,超全,附赠word文档!baizhanzhaoNo ratings yet

- Apparel Internship Document PDFDocument117 pagesApparel Internship Document PDFAnkitaKumar100% (1)

- Thea E !study Group: Chapter 1: General ConceptsDocument79 pagesThea E !study Group: Chapter 1: General Conceptsanj143No ratings yet

- A Study On Apparel Export Order From The Time of Receipt Till The Time of ShipmentDocument28 pagesA Study On Apparel Export Order From The Time of Receipt Till The Time of ShipmentSRISHTI SINGHNo ratings yet

- NIOP Trading Rules Book V 2013Document154 pagesNIOP Trading Rules Book V 2013Marito Morán CoelloNo ratings yet

- Draft BL SB Count - PT TanimasDocument1 pageDraft BL SB Count - PT TanimasMw. MustolihNo ratings yet

- LAW 200 Assignment Group C PDFDocument17 pagesLAW 200 Assignment Group C PDFAshik Ahmed KhanNo ratings yet

- General Transport LawDocument69 pagesGeneral Transport LawAbdel Nasser Al-sheikh YousefNo ratings yet

- Transpo Digest COGSADocument19 pagesTranspo Digest COGSALourdes AngelieNo ratings yet

- File 1B2 - MBL3039958890 For 13 Nos To N.Sheva (B2)Document3 pagesFile 1B2 - MBL3039958890 For 13 Nos To N.Sheva (B2)api-3831046100% (1)

- Carriage of Goods Version 01Document29 pagesCarriage of Goods Version 01Mariam RahmanNo ratings yet

- G. Martini Co. Ltd. v. Macondray & Co. Inc.Document2 pagesG. Martini Co. Ltd. v. Macondray & Co. Inc.Von Angelo SuyaNo ratings yet

- Carriage of Steel Cargoes LP BriefDocument11 pagesCarriage of Steel Cargoes LP BriefNikitos NikitosNo ratings yet

- Maersk Lines v. Court of Appeals, 222 SCRA 108, G.R. 94761, May 17, 1993Document18 pagesMaersk Lines v. Court of Appeals, 222 SCRA 108, G.R. 94761, May 17, 1993Ej CalaorNo ratings yet

- Green Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericaDocument4 pagesGreen Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericacoffeepathNo ratings yet

- UCP 600 With ExplanationDocument82 pagesUCP 600 With ExplanationMAHFUZ ISLAM100% (8)

- List of Library Books - Narotam Morarji UniversityDocument116 pagesList of Library Books - Narotam Morarji Universityshital_vyas1987No ratings yet

- BL Example 3Document1 pageBL Example 3Christhoper AndrewNo ratings yet

- Shipping AbbreviationsDocument16 pagesShipping AbbreviationsHady SalahNo ratings yet

- 914 1Document40 pages914 1Lovena RaichandNo ratings yet

- UCPB vs. AboitizDocument11 pagesUCPB vs. AboitizNewbieNo ratings yet

- BLDocument4 pagesBLSoofeng LokNo ratings yet

- BL 1st Page-MergedDocument3 pagesBL 1st Page-MergedMd. S H MarufNo ratings yet