Professional Documents

Culture Documents

Definition of 'Merchant Bank'

Uploaded by

mark_torreonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Definition of 'Merchant Bank'

Uploaded by

mark_torreonCopyright:

Available Formats

Definition of 'Industrial Bank'

A financial institution with a limited scope of services. Industrial banks sell certificates that are labeled as investment shares and also accept customer deposits. They then invest the proceeds in installment loans for consumers and small businesses. These banks are also known as Morris banks or industrial loan companies.

Definition of 'Merchant Bank'

A bank that deals mostly in (but is not limited to) international finance, long-term loans for companies and underwriting. Merchant banks do not provide regular banking services to the general public.

Definition of 'Commercial Bank'

A financial institution that provides services, such as accepting deposits, giving business loans and auto loans, mortgage lending, and basic investment products like savings accounts and certificates of deposit. The traditional commercial bank is a brick and mortar institution with tellers, safe deposit boxes, vaults and ATMs. However, some commercial banks do not have any physical branches and require consumers to complete all transactions by phone or Internet. In exchange, they generally pay higher interest rates on investments and deposits, and charge lower fees. Definition of 'Money Center Banks' A money center bank is similar in structure to a common bank, but its borrowing and lending activities are with govenments, large corporations and regular banks. These types of financial institutions do not borrow from or lend to consumers. A community bank is a depository institution that is typically locally owned and operated. Community banks tend to focus on the needs of the businesses and families where the bank holds branches and offices. Lending decisions are made by people who understand the local needs of families, businesses and farmers. Employees often reside within the communities they serve. A savings bank is a financial institution whose primary purpose is accepting savings deposits. A Mortgage bank specializes in originating and/or servicing mortgage loans. A mortgage bank is a state-licensed banking entity that makes mortgage loans directly to consumers. The difference between a mortgage banker and a mortgage broker is that the mortgage banker funds loans with its own capital.

Definition of 'Investment Bank - IB'

A financial intermediary that performs a variety of services. This includes underwriting, acting as an intermediary between an issuer of securities and the investing public, facilitating mergers and other corporate reorganizations, and also acting as a broker for institutional clients. An international bank is a financial entity that offers financial services, such as payment accounts and lending opportunities, to foreign clients. These foreign clients can be individuals and companies, though every international bank has its own policies outlining with whom they do business.

Wholesale banking is the provision of services by banks to the likes of Mortgage Brokers, large corporate clients, mid-sized companies, real estate developers and investors, international trade finance businesses, institutional customers (such as pension funds and government entities/agencies), and services offered to other banks or other financial institutions. (Wholesale finance means financial services, which are conducted between financial services companies and institutions such as banks, insurers, fund managers, and stockbrokers.) Modern wholesale banks are engaged in: finance wholesaling, underwriting, market making, consultancy, mergers and acquisitions, fund management. Commercial bank has two meanings: Commercial bank is the term used for a normal bank to distinguish it from an investment bank. (After the great depression, the U.S. Congress required that banks only engage in banking activities, whereas investment banks were limited to capital markets activities. This separation is no longer mandatory.) Commercial bank can also refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses, as opposed to normal individual members of the public (retail banking). It is the most successful department of banking. Community development bank are regulated banks that provide financial services and credit to underserved markets or populations. Private Banks manage the assets of high net worth individuals. Offshore banks are banks located in jurisdictions with low taxation and regulation. Many offshore banks are essentially private banks. Savings banks accept savings deposits. Postal savings banks are savings banks associated with national postal systems. Retail Banking services are also termed as Personal Banking services Limited purpose banks are institutions that specialize in relatively narrow business lines. Some Limited purpose banks concentrate on making a certain type of loan, some serve a subset of consumers, and some offer an innovative product. A bankers' bank is a financial institution that provides financial services to community banks in the United States of America. Bankers' banks are owned by investor banks and may provide services only to community banks. Internationally, "national bank" is synonymous with "central bank," or a bank controlled by the national government of a country. Central banks set monetary policies within national economies. state bank is generally a financial institution that is chartered by a state. It differs from a reserve bank in that it does not necessarily control monetary policy (indeed, the state in question may have no legal capacity to create monetary policy), but instead usually offers only retail and commercial services.

member bank

Bank which is part of the Federal Reserve System; or more generally, a bank that is part of a central clearing or central banking system. Such banks have to follow the rules and regulations put forward by the central bank or the clearing system.

Affiliated Bank two companies are affiliated when one owns less than a majority of the voting stock of the other, or when both are subsidiaries of a third company. A subsidiary is a company of which more than 50% of the voting shares are owned by another corporation, termed the Parent Company. A subsidiary is always, by definition, an affiliate, but subsidiary is the preferred term when majority control exists. In everyday use, affiliate is the correct word for intercompany relationships, however indirect, where the parent-subsidiary relationship does not apply. Virtual banking, also known as cyberbanking, e-banking, home banking or online banking, includes provision of, and access to, various banking activities conducted virtually (from the road, external businesses or homes) rather than at a physical bank. Virtual banking allows customers to secure loans, pay utility bills, make deposits and check their accounts from remote locations. Definition of 'Universal Banking' A banking system in which banks provide a wide variety of financial services, including both commercial and investment services. Universal banking is common in some European countries, including Switzerland. In the United States, however, banks are required to separate their commercial and investment banking services. Proponents of universal banking argue that it helps banks better diversify risk. Detractors think dividing up banks' operations is a less risky strategy.

You might also like

- Debt Collector Disclosure StatementDocument5 pagesDebt Collector Disclosure StatementBhakta Prakash94% (16)

- The Carnegie Nobody KnowsDocument10 pagesThe Carnegie Nobody Knowsmark_torreonNo ratings yet

- Banking TheoryDocument299 pagesBanking TheoryMohammedNo ratings yet

- One Month Notice Period Letter FormatDocument12 pagesOne Month Notice Period Letter FormatShakeel Ahmed AjizNo ratings yet

- The Origins and Evolution of BankingDocument62 pagesThe Origins and Evolution of BankingPankaj NehraNo ratings yet

- CHP 5Document72 pagesCHP 5Khaled A. M. El-sherifNo ratings yet

- Master Advanced AP Sentence PatternsDocument9 pagesMaster Advanced AP Sentence Patternsmark_torreonNo ratings yet

- Adams Silas Walter - The Legalized Crime of BankingDocument143 pagesAdams Silas Walter - The Legalized Crime of BankingHaruhi SuzumiyaNo ratings yet

- Fluid Mechanic AnswerDocument32 pagesFluid Mechanic AnswerIser88% (40)

- UNSETTLEDMATTERSDocument107 pagesUNSETTLEDMATTERSiubitzoneNo ratings yet

- Vdocuments - MX - Synthetic Cdos Modelling Valuation and Risk Management PDFDocument386 pagesVdocuments - MX - Synthetic Cdos Modelling Valuation and Risk Management PDFminoNo ratings yet

- Group 1 TacomaDocument10 pagesGroup 1 Tacomamark_torreonNo ratings yet

- Tai Tong Chuache v. Insurance CommissionDocument2 pagesTai Tong Chuache v. Insurance Commissionviva_33100% (1)

- Types of Banks - Retail, Investment, Wholesale & MoreDocument5 pagesTypes of Banks - Retail, Investment, Wholesale & Moreविनीत जैनNo ratings yet

- The Peaceful Gobal Currency ResetDocument25 pagesThe Peaceful Gobal Currency Resetkaren hudesNo ratings yet

- (1964) East Africa Law ReportsDocument990 pages(1964) East Africa Law ReportsRobert Walusimbi67% (9)

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- Chapter 6 - The Theory of CostDocument11 pagesChapter 6 - The Theory of Costjcguru2013No ratings yet

- What Is A Bank?: Key TakeawaysDocument3 pagesWhat Is A Bank?: Key TakeawaysSAMNo ratings yet

- Commercial Banking and Non-Banking Financial Institutions ExplainedDocument18 pagesCommercial Banking and Non-Banking Financial Institutions ExplainedGarima SinghNo ratings yet

- Overview of Corporate Banking and Wholesale Lending ModelsDocument75 pagesOverview of Corporate Banking and Wholesale Lending ModelsNarinder BhasinNo ratings yet

- Reviewer - Life of Dr. Jose RizalDocument35 pagesReviewer - Life of Dr. Jose Rizaljava_biscocho122993% (105)

- Assignment 3 - Resume Joe DeangeloDocument3 pagesAssignment 3 - Resume Joe Deangeloapi-349563404No ratings yet

- Pascual Vs RamosDocument2 pagesPascual Vs RamosBrian Jonathan ParaanNo ratings yet

- 06 Global Holiday Ownership Corp V MBTCDocument2 pages06 Global Holiday Ownership Corp V MBTCArtemisTzyNo ratings yet

- Types of Banks in Pakistan ExplainedDocument7 pagesTypes of Banks in Pakistan ExplainedZ the officerNo ratings yet

- Bank Meaning and FunctionsDocument8 pagesBank Meaning and FunctionsNeeta SharmaNo ratings yet

- Types of BankingDocument5 pagesTypes of BankingnattyNo ratings yet

- Types of Banks Explained in 40 CharactersDocument4 pagesTypes of Banks Explained in 40 CharactersNabin AdNo ratings yet

- AbhiDocument1 pageAbhiAbhishek PanchalNo ratings yet

- Banking - FoundationDocument153 pagesBanking - Foundationvineet kumarNo ratings yet

- Meaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofDocument32 pagesMeaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofPunya KrishnaNo ratings yet

- BANKSDocument28 pagesBANKSJb :3No ratings yet

- BankingDocument5 pagesBankingManya JainNo ratings yet

- BankingDocument168 pagesBankingVaishnav Kumar100% (1)

- What Is A Bank?Document4 pagesWhat Is A Bank?Mae Antoinette MontanoNo ratings yet

- Types of Banks & Their Classifications (GlobalDocument14 pagesTypes of Banks & Their Classifications (GlobalFawaaz KhurwolahNo ratings yet

- Different Types of Banks and Their FunctionsDocument8 pagesDifferent Types of Banks and Their FunctionsIzzah CurlNo ratings yet

- Banking Organizational Structures and Departmental DivisionsDocument16 pagesBanking Organizational Structures and Departmental DivisionsSparsh JainNo ratings yet

- Types of BanksDocument15 pagesTypes of BanksshubhamdevganNo ratings yet

- FM3A - Javier, Angelica Mae S - Quiz 1 - FM105Document3 pagesFM3A - Javier, Angelica Mae S - Quiz 1 - FM105Kimberly Solomon JavierNo ratings yet

- Basharat Adil COMPLETEDocument66 pagesBasharat Adil COMPLETEBasharat AdilNo ratings yet

- Types of Banks ExplainedDocument31 pagesTypes of Banks ExplainedJane Carla BorromeoNo ratings yet

- Characteristics of Indigenous BankersDocument4 pagesCharacteristics of Indigenous BankersAnonymous MyMFvSmRNo ratings yet

- Bank Definition: What Is A Bank?Document5 pagesBank Definition: What Is A Bank?Aliha FatimaNo ratings yet

- Retail Banking Is Banking in WhichDocument2 pagesRetail Banking Is Banking in WhichsakshiNo ratings yet

- Structure Banking India GuideDocument6 pagesStructure Banking India GuideRajneesh Chandra BhattNo ratings yet

- Types of BanksDocument3 pagesTypes of BanksChristine May CloradoNo ratings yet

- State Bank of India Punjab National Bank Icici Bank Lakh CroresDocument18 pagesState Bank of India Punjab National Bank Icici Bank Lakh CroresPooja PatnaikNo ratings yet

- How Banks Function and Their Role in the EconomyDocument12 pagesHow Banks Function and Their Role in the EconomySonam JainNo ratings yet

- Ringkasan Materi Bahasa Inggris NiagaDocument31 pagesRingkasan Materi Bahasa Inggris NiagaNira IndrianiNo ratings yet

- What is a Commercial BankDocument5 pagesWhat is a Commercial BankNirja JalanNo ratings yet

- What Are Commercial BanksDocument3 pagesWhat Are Commercial BanksShyam BahlNo ratings yet

- Macro Economics LBA 402Document12 pagesMacro Economics LBA 402Harshita SarinNo ratings yet

- Overview of Banking IndustryDocument18 pagesOverview of Banking IndustryNekta PinchaNo ratings yet

- Introduction to Banking: Types, Functions and MicrofinanceDocument48 pagesIntroduction to Banking: Types, Functions and MicrofinancePunya KrishnaNo ratings yet

- Final ProjectDocument73 pagesFinal ProjectShilpa NikamNo ratings yet

- What Is A BankDocument11 pagesWhat Is A BankANCHAL SINGHNo ratings yet

- Types of Merchant BankDocument1 pageTypes of Merchant BankArpit ShahNo ratings yet

- IntroductionDocument10 pagesIntroductionHala EdwanNo ratings yet

- Mixed Banking:: System Refers To That Banking System Under Which TheDocument7 pagesMixed Banking:: System Refers To That Banking System Under Which TheLOKESH RAMNo ratings yet

- What Is Chain Banking ..9Document17 pagesWhat Is Chain Banking ..9shashi shekhar dixitNo ratings yet

- Banking OmbudsmanDocument73 pagesBanking OmbudsmanmoregauravNo ratings yet

- Banking Sector: Term ReportDocument12 pagesBanking Sector: Term ReportEnal GodilNo ratings yet

- Finance 7 Part 4Document26 pagesFinance 7 Part 4Alyssa AlejandroNo ratings yet

- CHAPTER Two Money and BankingDocument8 pagesCHAPTER Two Money and Bankingananya tesfayeNo ratings yet

- COMMERCIALDocument15 pagesCOMMERCIALBadbitchNo ratings yet

- Finmar NotesDocument1 pageFinmar NotesAlinah AquinoNo ratings yet

- About Vietnamese FiannceDocument13 pagesAbout Vietnamese FiannceAnNo ratings yet

- Bank Vs NBFIDocument3 pagesBank Vs NBFIBappy KunduNo ratings yet

- Lecture 1 Financial Institutions OverviewDocument39 pagesLecture 1 Financial Institutions OverviewLatifa Ben HamoudaNo ratings yet

- Different Types of Banking Systems ExplainedDocument15 pagesDifferent Types of Banking Systems ExplainedGaurav GoyalNo ratings yet

- Finmar NotesDocument1 pageFinmar NotesAlinah AquinoNo ratings yet

- Commercial Bank: The Role of Commercial BanksDocument5 pagesCommercial Bank: The Role of Commercial BanksPreet AmanNo ratings yet

- Depository InstitutionsDocument11 pagesDepository InstitutionsPen-pen Cubillan Aruyal AmbrayNo ratings yet

- BankingDocument15 pagesBankingJyoti BhardwajNo ratings yet

- Commercial Bank of Ethiopia Functions and ActivitiesDocument20 pagesCommercial Bank of Ethiopia Functions and Activitiesአረጋዊ ሐይለማርያምNo ratings yet

- Tekla 10.1 Full DetailingDocument91 pagesTekla 10.1 Full Detailingjacquesontal9452No ratings yet

- HydraulicDocument102 pagesHydraulicDeeborah Echon OlivoNo ratings yet

- Blooms Question StartersDocument2 pagesBlooms Question StartersRonan SibbalucaNo ratings yet

- As Wise People SayDocument9 pagesAs Wise People Saymark_torreonNo ratings yet

- SketchesDocument3 pagesSketchesmark_torreonNo ratings yet

- Part IDocument23 pagesPart Imark_torreonNo ratings yet

- Rizal LawDocument4 pagesRizal Lawmark_torreonNo ratings yet

- CEDocument207 pagesCEmark_torreonNo ratings yet

- Nteractive Rice Alculator: Size MM Weight KG/M Price Per Length Price Per KG 6.0 7.5 9.0 10.5 12.0Document2 pagesNteractive Rice Alculator: Size MM Weight KG/M Price Per Length Price Per KG 6.0 7.5 9.0 10.5 12.0mark_torreonNo ratings yet

- Rizal MonumentDocument5 pagesRizal Monumentmark_torreonNo ratings yet

- RizalDocument10 pagesRizalBennard Cariño FajardoNo ratings yet

- Paintings: Date of Creation Title Place of Creation Material Description/RemarksDocument1 pagePaintings: Date of Creation Title Place of Creation Material Description/Remarksmark_torreonNo ratings yet

- Procedure Checklist - ASTM C143Document1 pageProcedure Checklist - ASTM C143mark_torreonNo ratings yet

- Rizal's EssaysDocument2 pagesRizal's Essaysmark_torreonNo ratings yet

- Rizal's Correspondence Complete list of José Rizal's lettersDocument53 pagesRizal's Correspondence Complete list of José Rizal's lettersmark_torreonNo ratings yet

- Jose Rizal 1Document20 pagesJose Rizal 1mark_torreonNo ratings yet

- Jose Rizal 2Document22 pagesJose Rizal 2mark_torreonNo ratings yet

- Procedure Checklist - ASTM C138Document1 pageProcedure Checklist - ASTM C138mark_torreonNo ratings yet

- Procedure Checklist - ASTM C1064Document1 pageProcedure Checklist - ASTM C1064mark_torreonNo ratings yet

- From Codex RizalDocument39 pagesFrom Codex Rizalmark_torreonNo ratings yet

- Edison As IKnow HimDocument70 pagesEdison As IKnow Himkaua1980No ratings yet

- Procedure Checklist - ASTM C31Document1 pageProcedure Checklist - ASTM C31mark_torreonNo ratings yet

- A Framework For Understanding Uncertainty and Its Mitigation and Exploitation in Complex SystemsDocument20 pagesA Framework For Understanding Uncertainty and Its Mitigation and Exploitation in Complex Systemsmark_torreonNo ratings yet

- Building Strengthening Techniques and Construction MethodsDocument12 pagesBuilding Strengthening Techniques and Construction MethodsMihai NistorNo ratings yet

- Obligation Extinguishment MethodsDocument5 pagesObligation Extinguishment MethodsBastian Miguel Yamsuan LomongoNo ratings yet

- FM11 Assignment 2Document2 pagesFM11 Assignment 2Niña Micah RobelNo ratings yet

- Mapit accountancy mind maps and coursesDocument63 pagesMapit accountancy mind maps and coursesVidya Rajawasam Mba AcmaNo ratings yet

- Alternative Monthly Report FidelityDocument5 pagesAlternative Monthly Report FidelityForkLogNo ratings yet

- Greater Consumption of Alcohol Leads To More Motor Vehicle Accidents And, Thus, Imposes Costs On People Who Do Not Drink and DriveDocument7 pagesGreater Consumption of Alcohol Leads To More Motor Vehicle Accidents And, Thus, Imposes Costs On People Who Do Not Drink and DriveHồ PhụngNo ratings yet

- Eureka Wow - Money-And-Financial-MarketsDocument208 pagesEureka Wow - Money-And-Financial-MarketsParul RajNo ratings yet

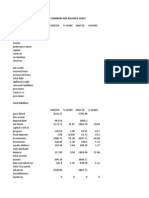

- Common Size Balance SheetDocument9 pagesCommon Size Balance SheetAditya ChauhanNo ratings yet

- Pivotal Planning Autumn EditionDocument9 pagesPivotal Planning Autumn EditionAnthony WrightNo ratings yet

- OPERATION AND MAINTENANCEDocument132 pagesOPERATION AND MAINTENANCEgavallapalliNo ratings yet

- Memorandum of UnderstandingDocument2 pagesMemorandum of Understandingsyedp2450% (2)

- Merchant Banking in IndiaDocument14 pagesMerchant Banking in IndiaMohitraheja007No ratings yet

- Aqa Accn4 W Ms Jun12Document15 pagesAqa Accn4 W Ms Jun12zahid_mahmood3811No ratings yet

- Week 3 Discussion ProblemsDocument23 pagesWeek 3 Discussion ProblemsKiran JojiNo ratings yet

- Introduction To Asset-Backed SecuritiesDocument5 pagesIntroduction To Asset-Backed SecuritiesShai RabiNo ratings yet

- ProfileDocument14 pagesProfileGOKULRESOLUTIONNo ratings yet

- F1-Student Visa Application StepsDocument1 pageF1-Student Visa Application Stepsjfernandez303No ratings yet

- Loan RecoveryDocument62 pagesLoan RecoveryKaran Thakur100% (1)