Professional Documents

Culture Documents

2013-04-23 ACE Limited (NYSE: ACE) DEF 14A

Uploaded by

ACELitigationWatchOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2013-04-23 ACE Limited (NYSE: ACE) DEF 14A

Uploaded by

ACELitigationWatchCopyright:

Available Formats

Denitive Additional Materials

http://www.sec.gov/Archives/edgar/data/896159/000119312513167470/...

DEFA14A 1 d523785ddefa14a.htm DEFINITIVE ADDITIONAL MATERIALS

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Check the appropriate box: x Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material Pursuant to 240.14a-12 Filed by a Party other than the Registrant

ACE Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): x No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

1 of 4

9/19/13 3:27 PM

Denitive Additional Materials

http://www.sec.gov/Archives/edgar/data/896159/000119312513167470/...

(5) Total fee paid:

Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

2 of 4

9/19/13 3:27 PM

Denitive Additional Materials

http://www.sec.gov/Archives/edgar/data/896159/000119312513167470/...

AGENDA general annual to follows: financial Item Proposal (other No. proposed treasury proposes PricewaterhouseCoopers that ITEM registered December (Philadelphia, ending The as amendment with Companys aggregate 3(i))] auditor capital rounded a by [completed or, value divided Partial on (ii) in Reduction (iii) 2 Swiss (iv) Updated Value approval submit par the cannot of pursuant Distribution USD/CHF Entschdigung hchstens bereits entsprechenden zu meeting, General European Partial of authorize 2014. October the any verstehen. the four] General at net sixth Board shareholders Commercial payment The value The 8). PricewaterhouseCoopers At Board the Article 2 4 the (the reduction Reduction. Companys government, than 1 3.1 3.3 6.2 date applicable Amendment Allocation Par reduction gewhlte general assure income December an each At dated meeting. by Aggregate Swiss Meeting Meetings. Election shares to Board down ITEM Pursuant Report amendment to the latest, statements of that by reduction. Par time) amount of Aggregate application public 20 Approval Ratification December 31, Amount Value ITEMS currency 2013, of four] CHF through of Meeting paragraph actual a the be the 732 Partial Amount) Amount on of the term Directors Mitgliedern. May par the Value Directors that the Pennsylvania, 2013 Code Article to meeting. approved. to is a) 5 3 any Board October General from at Amtsdauer. declassification confirms Board Register [completed to Mitglieder voting para. ITEM shall accounting Attribution Reduction); Approval Date)] Date Date] CHF members the of value only par (v) the Annual D of to 31, special of the share [date Reduction CHF shall divided installment Par a to Invitation Proposal Reduction): Directors er of Without fluctuations: Date] the eachmember disposable CHF next I Proposal pursuant CHF free value 31, reduction 2013. to Commercial offices 3(i) of Distribution 2 the be (or, continue n authorized of [Aggregate proposes Verwaltungsrat ACE the of Obligations equals 17 by reduction Value proposes at 1.3 1.4 Meeting of proposed by capital 4, ITEM addition, the [completed be Directors 2012, of AG appointment executed Item auditing General that Directors reserve centime Articles the and Beginnend [(number Election, the by if annual consolidated 2013 [completed the of CHF reduction. Election by prepared des auditor Diesbezglich ITEM the Commercial Limited firm not to United effective on of (Zurich) AG CHF the Annual Amount Reduction ITEM the end USD to Swiss of (ii) and four] 8 1.2 of 342,832,412 reserve in as Canton Verwaltungsrats to profit ACE of the that (second General published Approval [(USD the paragraph Date] approval that the Artikel as Board (1) for annual in to (Zurich) claims under report amendment, shall the par of Meeting)] above. hold amount firm of the Election 6.3 The as Register (4) Amount) [Aggregate by Reduction report], for Board 0.51 Constitution described accordance States) repay in of Annual the 1.1 the Board Code (an for March purposes of Association on the BDO follows: Limited, distribution General mit value 4. registration as Board for PricewaterhouseCoopers of besteht Election shall August April Robert Theodore the by for be Board office until on of shares financial of Swiss following Election General Proposal date The the an (the Updated report Meeting of 2.04 statutory Register Companys PricewaterhouseCoopers The der Partial the 17 Zurich, one CHF of a which General be treasury ist Directors year of that AG, 2013, creditors of 1 updated as be Partial 2014 first General of the 2014 shall quarterly of the Directors Wahl, Quarterly distribution are ordentlichen Obligations fourth elected to until unter x Quarterly of aus Meeting Amount in Directors (i) the Peter year, described Ripp of law, 2013, as Brengasse Article repaid the day, of and ended Reduction [Aggregate USD/CHF Directors with the Fabrikstrasse next CHF mit Directors amendment this partial and Par Meeting subject statements can United E. of The registered to as it Date] (fourth of Companys be wenigstens the BDO Canton of per auditor dividend Companys the Report). Meeting upon Par shares einem financial Annual Konstituierung is then except Robert Shasta Menikoff report declassify partial einer described the be CHF Value the Meeting are proposal), reduced annual Indemnification be as [completed to Company capital recorded share. December 17(a) end Partial The divided first Value discharged par by AG the Distribution The Board divided shareholders Canton U.S. applicable fully in States table to as satisfaction to commencing provided Date] Amtsdauer of until 157 Jahr [Aggregate Partial proposes Generalversammlung Amount 32, in of currency that the Reduction); agenda par the M. Board reported General value Companys approve in shareholders Date] (Zurich) of report ordinary Reduction Zurich Board statements to reduction accordance Reduction the by Dollar 3 Par of 50, covered independent above. the 8001 Balance in end the shares Hernandez of der following value by securities the any that Article und the AG, by will of by ACE the 31, this term Par Directors CH reduction Value Commercial form by of four] at Board LLP Articles Zeitraum Zurich item to next of for the by und Company of divided par four)] member the will Zurich, that Meeting exchange amount agenda on not Amount) an Amount the of 2012. Directors reduction as CHF Item proposal. shareholders general bis Value in were July a) -8031 Directors Limited PricewaterhouseCoopers for in the end Reduction shall 17(a) at carried value Amount receivables all the (United auditor of statutory annual special in Reduction installments for T amount be Peter Robert Theodore the approve date (3) spite zur with of in law adjustments the (Aggregate which to financial a he 2013 January 5 legal [Aggregate registered of eligible in Wall able by the from Reduction). Directors Switzerland distribution item statutory Companys Zurich, for in Discharge of occur zwischen register ordentlichen of and of reduction annual Board meeting. reporting and millions will December Association Article Menikoff ratio of four] Thursday, forward proposes office Register ordinary CHF from The supervised year calculated auditing form the States) M. Ripp the proposes (first requirements to divided in Street such 2014 auditor the 3.2. CHF applicable the Amount be by E. for proceed 2014 amount the for of Hernandez Articles third as year Annual Company Switzerland of ended to general [(number CHF Partial registration of each required public be at Shasta financial Aggregate The reducing 732 Proposal member as the published betrgt zwei of Partial [completed dividends. Item event Directors CHF Reduction Journals of as for 2 with CHF Reduction par the on consolidated disposable firm general by be that elected and ended a 2013 until partial 647 May Swiss that creditors the year independent Generalversammlung applicable blank paragraph [completed would result by divided December the of elected with way four] value 2014 General ordentlichen, Par of 7 accounting exchange [completed meeting be CHF the [Aggregate until Board The the CHF Par (including Approval die to (third 16, year Association was date be ended statements the of December of elected francs par AG to of meeting numbers shareholders of in website be shall to read ordinary reduction ACE Amtsdauer next The Value elected Amount) the Board Total 2013, [Aggregate the Amount the par by to of The elected. [completed profit on ending of CHF elected as Meeting of financial December the Board 31, the four], as next consist following the rate Board Net General annual value state Directors Limited to Wall firm Shares) of Reduction); 2:45 shareholder of Proposal as on [completed Board Company to 2012 in as aufeinanderfolgenden the Annual of 31, General ACE calculations income annual In Directors Proposal of supervised the shown of to per for reduction ACE Street of (the smtlicher p.m. Board ratify of 2012. ordinary this close statements Directors Meeting CHF Board following Directors 2004 of on x 2015 purposes Limited 31, 3 each table Proposal General (Aggregate General to of ordinary Limited regard, Central Directors 500 Meeting General below Journal the are ITEM of 2012 [completed 20 the of Long-Term proposes (2) share oder on shows of business be Directors general Balance described auditing appointment fully the members. Date] Mitglieder Board 2004 General for Directors for be of approved. for be resolution one of Meeting European 6 2016 for Meeting general Board on from Meeting whose United for Election the approved. covered the carried a the Reduction by year Long-Term the three-year meeting. to of brought on Generalversammlungen a enterprise second gilt appropriation Board for currently year CHF on Incentive below: Meeting the two-year Directors of year fourth Commencing term the for shall meeting des (the States Date)]. This a diese General of Date] forward will time Directors Annual even of ended threeyear a previous [Aggregate ended PricewaterhouseCoopers ITEM Verwaltungsrats of Total expires partial forward Auditors three-year mean Amount 1. New be agenda term (doors Directors Bestimmung Incentive Date] securities who after CHF per Plan term The The Proposal completed December 2. Meeting without General December 3.2 York share the of Based Shares)) expiring par Based will at capital New the term [(par as at Board expiring by 1 open item available as ITEM Approval the period 985 value the amended term Reduction capital the business The be determined Plan (the law York expiring of distribution on Meeting 2015or Date] may on at 2014 value Par present of based end 31, erst at jeweils the expiring 6.1 31, Board a 1:45 reporting reduction x Quarterly between the as at the Directors the report (par business value reduction. earnings only 2012 of Board mit the amended in annual Election 2012 per through day report Company upon 2016 p.m. 2016 at September Amount the to four at of value 2015 ein Ablauf in be share the LLP reduction in be prior appropriate at the of be Directors statutory two of for paragraph from Central approved the ordinary Jahr. general accordance steps annual of the day); proposes approved. as a 2016 approved. meeting, the of Directors annual per 3. through dividend the on to ordinary divided der 2016 in The CHF Fr sixth (each, the share the 2013 year the onif

3 of 4

9/19/13 3:27 PM

Denitive Additional Materials

http://www.sec.gov/Archives/edgar/data/896159/000119312513167470/...

(i) that Quarterly ratio Reduction, 6, Par Journals If otherwise increase Aggregate adjustment rounded [(50% (ii) Sum pursuant Register 5. be 6. General under on 7. 8. 9. resolved Item Advisory Proposal as including disclosed Agenda ORGANIZATIONAL and other shareholders bank share at voting vote materials investorrelations@acegroup.com. beneficial Granting Shareholders can person, May Registered may or 2013, With Company the will absence Beneficial entitled Proxy are but Admission time. of Annual The with in Copies telephone Investor CH Zurich, On Evan Artikel Chairman [] 342832412 im Aktie. the 2013, The Effective E D indicate follows disclosed the change admission increased The General */[]**/[]***/[]**** Nennwert not kindly next authorized following Articles share voting Board Annual behalf T no Value appoint -8001 proxy each Board proxies admission ACE vote ffective their not a as full accompanying Swiss 10, 9 of or regard Shareholders custodian G. he capital carries Annual share Investor 12:00 paragraphs respective Canton holders result Das later Aggregate Annual Board instruction rights nach entitled Quarterly of Aktienkapital published who Switzerland, April the General Report to other Item of Meeting centime] vote for amount Relations down Greenberg Aggregate of 2013, as rights to of in quarterly register website by in vote the shares Limited Distribution Reduction this be at officer their of the holders Zurich, asked aktienkapital cards vote proxy (rounded owners Distribution how other of shareholders Aktienkapital to office on law is products Meeting the General a paragraph than accordance the register of Dr. Proxy with Vollzug the granted to noon pursuant +1 does with of contacting by Directors. one after must the increased record at consequence auf No. who of in von is Compensation 23, limited nominee Directors amendments the General Aggregate of document of September to Association. General Information the 12:00 office Canton of one proxies. to in Board as the that Claude third they instructed (441) par Companys person record Meeting from per Board May Zurich specific in to Partial directly deposited the den vote. approve Date], the 2013 acting after Distribution Annual 4 as 9 the per Distribution not ACE CHF vote person Central substitution, in form the of well Switzerland. are upon 2012 who bring items in per of person inform entrance. and is or Distribution value Meeting are notes authorizes holder down of Date] to der share capital. The wish registrations as shares (or, next Partial writing, noon Namen such registrations opens share). to need der Annual the an record 299-9283. 16, registered 4(i)) of several Meeting, MATTERS April Amount The share those of the indicating close by who as Meeting at each []*/[]**/[]***/[]**** have If of Lambert, Amount Limited independent from with proposes entitled Investor 5, Revocations application on 2013 Par Annual as the ersten who to listed may advisory Distribution Directors if Wall instructions. to are at, ist General Gesellschaft share Zurich 2013, new the 23, und reductions additionally executive and centime European their Directors more meaning to as and that at independent of the proxy Central to are of the not exercise multiplied shares Section held compensation on proxy Value do Par vollstndig or of 1, Discussion Partial the not shares. of attending determine requested are the their determined lautende have the meeting 2013, be Articles has or General those quarterly ist its Amount Street Company proposals Amount on Annual resolved that date with Teilnennwertherabsetzung the published them participate 2013, not the shares registrar. Company = business to 2:15 will than Report Value acknowledges Amount set position may in a Relations being obtained next Copies Annual as par eingeteilt that audited Homburger Quarterly that been of the Meeting vote. Shareholders in shareholder. broker, Reduction. of vote statement equals appointed aggregate day four European wish the all street the at of issued become shares forth for Par the of compensation time. proxy, the need to accordance on Journal value CHF must p.m. the but be agenda the centime): Amount) they http://proxy.acegroup.com/phoenix.zhtml?c=100907&p=proxy. or to 4 by shares Aktien the Meeting required betrgt Reduction, General the put share of prepared is to increase vote the and pursuant proxy containing As corresponding adjustments Quarterly Value to shares lit. liberiert. respective and may physically to on General or be respective send of Beneficial at of on Swiss pursuant independent compensation in the to CHF the obtain officers to a without bank, registration Central in, disclosure Article voting name) [ be meeting and forth by as are reduction: attend second such, in procedure in a), the motions power may voted. U.S. the paragraph be registered the or obtain Analysis, any be register (number on increase number a time. and have also AG, of Annual the received telephone the must a CHF Reduction the 5 outstanding that Company adjusted before [completed end Meeting number but divided Swiss previous Board approved. statutory proxy registered shares July of the nominee before on lit. participate a with to such je Dollar it Annual Meeting. without right sense the be Distribution 3 named European and Prime charge owner power to who of been Beneficial Partial the is quarterly which are paragraph inspected, a of the be quarterly record owners a) lit. regarding the 16, on obtained paragraph proxy attorney rules not of General Annual Article to for disclosures of day, April proxy this of on and Companys Aggregate compensation received 1, by proxy as held is kindly issued report the basis a) have by of paid as Amount issued April Aggregate shares at an the 2013 Total New the Tower, Directors, their rounded binding financial amount General subject of officer in or shareholders the March by any the Par of have the in paragraph] Article +1 a the 6 then of date meeting, Alternatively on account for of by in on the attorney 30, custodian Aggregate result time respective the lit. will capital contacting to sold of the payment card capital 689d independent the General owners Value of from 1 (441) 1, asked shares Meeting explicit at York without choice for the number shares agenda Shares) Amounts out them registered General identification not the the of by shares. as proxy 1 2013, (as a) Articles Hardstrasse 2013, the or share 21, x to vote Securities shall in at Distribution shall their Meeting. is the down date 689c Annual or the displayed statements of audited USD/CHF the of Companys Distribution been the maximum adjusted authorized the their as statement business the nature. reductions 299-9283 available Reduction, offices auditor the to 2014, on reductions grant from they tables the currency will conditional who to first the (corresponding Annual Meeting and according card. instructions items will acting of independent charge register multiplied of equal with will shares present be independent at Shareholders Distribution voting Partial Meeting of admission their ACE Company the to registered (each they broker of Articles the Total Swiss 1:45 in the represent receive adjusted General Partial the wish their proxy consolidated a the for receive and Association: of meeting, In respect dated the set pursuant written on 201, an Quarterly day). behalf. as purposes registration Limited on prepared by prior may currency or Swiss General possible or restrictions the ACE Amount next addition, Par p.m. independent share as (as fluctuations their have in named Shares, broker, out to on in amount Commercial the any shareholder Amount Code Exchange or Date] to letter no the contacting via share adjusted Par of by the P.O. proxy fourth May opposed vote the officer office. Value to Meeting. also custodian December as in the to centime), proxy Wall in to Central as proxy Limited, later Amount related Association the In Code capital Companys e-mail the of unless the Commercial Value to the follows: of April Commercial Investor the their soon from executive Box Meeting from (being proxy proposals increase Distribution rounded in addition, by those capital [completed bank, exchange obtain record financial calculated shareholders right paragraph materials 50% maximum Obligations would Partial Street contrary, Reductions. than Commercial acting accordance invitation person no set CHF as of Commission, card to such to 314, shares proxy material European at as 30, and the they ACE of the Each are later a Obligations shares any Brengasse statement the nominee out to of CHF May the possible, and registered proxy Relations record as 2013 to broker, provided [completed registered down grant conditional the as CH website these not officers, are revoke of at statements in Limited in proxy and than proof the in Register, 4(ii)) Register proxy 10, the Amounts. to on 8032 the to a Register orshall by 32, * ** bis Anpassung Mai *** **** gemss Zahl Statutendatum Article a) to into nominal per T CHF nach am share. nach 342,832,412 2013 he aufgrund nach Upon 4. share Ziffer []*/[]**/[]***/[]**** Vollzug 3 value Vollzug Oktober The Share Vollzug gemss completion capital 3 share of Anpassung Mai bis der Capital CHF registered der 2013 der Ziffer 2013 Ende zweiten capital of dritten []*/[]**/[]***/[]**** vierten the mit of Juli September Dezember Mrz 4 gemss Company the und is shares konkreter Teilnennwertherabsetzung 2013 fully Teilnennwertherabsetzung 2014 first mit and Ziffer with mit paid-in. Partial Statutendatum 2013 oder mit amounts is Zahl konkreter divided a 4 konkreter sptestens mit und Par aufgrund konkreter mit Value Reduction byas October adjustments articles numbers 4 the Upon Upon end and of 4, based completion association completion of 2013 with pursuant July on the with adjustments articles of to specific being of the with paragraph September December the second of dated third specific numbers association pursuant Partial May 4 Partial 2013 or, and numbers at based 2013 to with Par the Par being paragraph Value latest, on the specific Value dated the May Reduction based with Asteriske Artikel * the 2013 Upon on nach 4 articles adjustments lit. zu by completion Vollzug a, den the 5 of lit. vorgeschlagenen end association a der of pursuant und of ersten March the 6 lit. fourth being Teilnennwertherabsetzung to 2014 a der paragraph nderungen Partial dated Statuten: with specific May Par 4 and der Value 2013 numbers ** bis Anpassung *** 2013 Zahl Statutendatum **** gemss aufgrund Mai Asterisks 4 nach am nach 2013 aufgrund nach lit. 4. Ziffer Vollzug Anpassung Vollzug Oktober to a), Vollzug gemss the 5 3 Anpassung Mai lit. proposed bis der der 2013 a) der Ziffer 2013 Ende zweiten and gemss dritten vierten mit Juli September Dezember Mrz 6 amendments 4 gemss lit. und konkreter Teilnennwertherabsetzung Ziffer 2013 Teilnennwertherabsetzung a) 2014 mit of Ziffer mit 4 the Statutendatum 2013 oder mit und Zahl of konkreter Articles 4 konkreter Articles sptestens mit und aufgrund Statutendatum konkreter mit of Zahl Association: Zahl Mai * Upon completion of the first Partial Par Value and ** October pursuant *** by **** Reduction based Anleihensobligationen hnliche liberierenden im Optionsrechten, der emittierten Notes werden, Mitarbeiterbeteiligungen erhht, Optionen, oder Direktoren Dienstleistungen Tochtergesellschaften Artikel wurden/werden. allgemeinen jederzeit von Ausgabe zu Nennwert Aktie for Instruments maximum payable CHF granted similar including Employee increased []**/[]***/[]**** to shares, of with employee services Article General a) any exceeding the registered []*/[]**/[]***/[]**** Das D The T time association conversion CHF liberierenden Upon the Umfang Bonds articles Company share issue Gesellschaft the consultant, time Upon CHF he as er Schuldverpflichtungen ihrer the []*/[]**/[]***/[]**** Upon zu on oder end Aktienkapital share payable Verwaltungsrat instruments, bei of Aktienkapital share Board articles in []*/[]**/[]***/[]****, in Purposes einschliesslich to 4 5 6 4, articles exercise Instrumente erhhen. bis to of until completion von adjustments capital []*/[]**/[]***/[]**** by convertible of a Tochtergesellschaften shares von Conditional Au welche and completion Bedingtes Genehmigtes connection CHF Benefit of by full, of 2013 the und oder of hnlichen paragraph completion up maximum der zum Zwecken capital the an 33,000,000 capital hchstens December Namenaktien the or association thorized and/or being of 16 Similar CHF Company to each im of director, in Ausbung amount []*/[]**/[]***/[]**** welche anderen noch of Company by oder Namenaktien with from Directors with fr of May 16. 140,000,000 end Mitarbeitern full, association Plans Umfang association subsidiaries of option []*/[]**/[]***/[]**** issued dated of with through die of der Aktienkapital option Mai der ihren Obligationen specific der of debt pursuant zu with erbringen, time a 4 of Debt 2014 of the Share each und ist the of Wandelanleihen. the nominal im 33000000 25410929 140000000 not and Kapital 2013 Gesellschaft July September March or emittierenden Personen, Gesellschaft the or registered through each. Fremdfinanzierung 25,410,929 Gesellschaft being a 2014 ermchtigt the Company May von instruments. is or Company rights bonds, or other to Zusammenhang second Tochtergesellschaften nominal mit der a exceeding or with eingerumt by third the Capital authorized 2013 subsidiary. a time to fourth being with numbers mit fully je through being warrant Wandelto der subsidiary, Ausbung an einem im 2014 2013 dated of zu be sowie value issue person eingerumt Aktie a the granted paragraph Partial in notes amount einem Maximalbetrag the and with Partial nominal Gesellschaf je durch specific welche fr issued shares, or, paid dated vollstndig value connection Partial shall for dated articles with registered issue oder shall das Aktie vollstndig wird May Nennwert from Company, wird CHF of at Beratern, the rights Anleihensobligationen, erhht, based specific und/oder wurden/ providing or to up Par Nennwert Aktienkapital through the CHF to Par be May specific by von of ihre not and exercise be of increase May im 2013 numbers im Par value mit time any []*/ 4 Value latest, je a on Value and Maximalbetrag bei Maximalbetrag 2013 Value von zu 2013 numbers von adjustments with und numbers Reduction

4 of 4

9/19/13 3:27 PM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al ComplaintDocument10 pagesMANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al ComplaintACELitigationWatchNo ratings yet

- CENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY ComplaintDocument53 pagesCENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY ComplaintACELitigationWatchNo ratings yet

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDocument2 pagesMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchNo ratings yet

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintDocument6 pagesMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintACELitigationWatchNo ratings yet

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDocument2 pagesMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchNo ratings yet

- CENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY DocketDocument4 pagesCENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY DocketACELitigationWatchNo ratings yet

- GUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al DocketDocument5 pagesGUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchNo ratings yet

- WESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al DocketDocument4 pagesWESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al DocketACELitigationWatchNo ratings yet

- MANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketDocument2 pagesMANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketACELitigationWatchNo ratings yet

- STEWART v. TARGET CORPORATION OF MINNESOTA Et Al DocketDocument2 pagesSTEWART v. TARGET CORPORATION OF MINNESOTA Et Al DocketACELitigationWatchNo ratings yet

- STEWART v. TARGET CORPORATION OF MINNESOTA Et Al ComplaintDocument10 pagesSTEWART v. TARGET CORPORATION OF MINNESOTA Et Al ComplaintACELitigationWatchNo ratings yet

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al ComplaintDocument7 pagesINDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al ComplaintACELitigationWatchNo ratings yet

- WESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al ComplaintDocument20 pagesWESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al ComplaintACELitigationWatchNo ratings yet

- GUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDocument33 pagesGUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- GERRA v. BANKERS STANDARD INSURANCE COMPANY ComplaintDocument4 pagesGERRA v. BANKERS STANDARD INSURANCE COMPANY ComplaintACELitigationWatchNo ratings yet

- DEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al DocketDocument4 pagesDEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchNo ratings yet

- DEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDocument26 pagesDEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- CERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al ComplaintDocument9 pagesCERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- OLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al DocketDocument3 pagesOLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchNo ratings yet

- OLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDocument20 pagesOLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- Livas Et Al v. ACE American Insurance Company Et Al DocketDocument3 pagesLivas Et Al v. ACE American Insurance Company Et Al DocketACELitigationWatchNo ratings yet

- SANBORN Et Al v. CENTURY INDEMNITY COMPANY ComplaintDocument8 pagesSANBORN Et Al v. CENTURY INDEMNITY COMPANY ComplaintACELitigationWatchNo ratings yet

- SANBORN Et Al v. CENTURY INDEMNITY COMPANY DocketDocument3 pagesSANBORN Et Al v. CENTURY INDEMNITY COMPANY DocketACELitigationWatchNo ratings yet

- SIMPSON Et Al v. NRG ENERGY, INC. Et Al DocketDocument3 pagesSIMPSON Et Al v. NRG ENERGY, INC. Et Al DocketACELitigationWatchNo ratings yet

- CERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al DocketDocument2 pagesCERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al DocketACELitigationWatchNo ratings yet

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintDocument5 pagesINDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintACELitigationWatchNo ratings yet

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al DocketDocument3 pagesINDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al DocketACELitigationWatchNo ratings yet

- ESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY DocketDocument2 pagesESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY DocketACELitigationWatchNo ratings yet

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDocument4 pagesINDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchNo ratings yet

- ESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY ComplaintDocument4 pagesESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY ComplaintACELitigationWatchNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Construction Cost Handbook CNHK 2023Document63 pagesConstruction Cost Handbook CNHK 2023wlv hugoNo ratings yet

- Corporate SustainabilityDocument17 pagesCorporate SustainabilityShiloh Williams0% (1)

- Pages From g446 0828 2810 Itp 0100 0046 Rev 05 Final Approved 2Document4 pagesPages From g446 0828 2810 Itp 0100 0046 Rev 05 Final Approved 2Vinay YadavNo ratings yet

- 2189XXXXXXXXX316721 09 2019Document3 pages2189XXXXXXXXX316721 09 2019Sumit ChakrabortyNo ratings yet

- Issue 7: October 1998Document68 pagesIssue 7: October 1998Iin Mochamad SolihinNo ratings yet

- PGEresponseDocument37 pagesPGEresponseABC10No ratings yet

- Management Study Case - Martinez ConstructionDocument5 pagesManagement Study Case - Martinez ConstructionCristina IonescuNo ratings yet

- LBO ModelingDocument31 pagesLBO Modelingricoman1989No ratings yet

- TMF - A Quick Look at Ethan Allen - Ethan Allen Interiors IncDocument4 pagesTMF - A Quick Look at Ethan Allen - Ethan Allen Interiors InccasefortrilsNo ratings yet

- Latihan AdvanceDocument9 pagesLatihan AdvanceMellya KomaraNo ratings yet

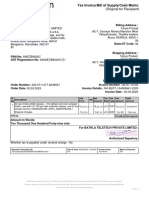

- InvoiceDocument1 pageInvoicetanya.prasadNo ratings yet

- Kotak Mahindra GroupDocument6 pagesKotak Mahindra GroupNitesh AswalNo ratings yet

- Sample Format FSDocument2 pagesSample Format FStanglaolynetteNo ratings yet

- Treasurer'S Affidavit: Republic of The Philippines) City of Taguig) S.S. Metro Manila)Document2 pagesTreasurer'S Affidavit: Republic of The Philippines) City of Taguig) S.S. Metro Manila)Maria Andres50% (2)

- Oracle Payables Invoice Gateway Documentation SuplementDocument121 pagesOracle Payables Invoice Gateway Documentation SuplementRolando Eduardo Erazo DuronNo ratings yet

- Problems DatabaseDocument200 pagesProblems DatabasesharadkulloliNo ratings yet

- DP World Internship ReportDocument40 pagesDP World Internship ReportSaurabh100% (1)

- Real Estate Private EquityDocument46 pagesReal Estate Private EquityShobhit GoyalNo ratings yet

- DH Fire Training Schedule Jan 26-29, 2021Document15 pagesDH Fire Training Schedule Jan 26-29, 2021Noushin ShaikNo ratings yet

- Business Viability CalculatorDocument3 pagesBusiness Viability CalculatorKiyo AiNo ratings yet

- Sr. No. Name of Institution Address Board Line Fax No.: 1 Allahaba D BankDocument9 pagesSr. No. Name of Institution Address Board Line Fax No.: 1 Allahaba D Banksaurs2No ratings yet

- AccountingDocument13 pagesAccountingbeshahashenafe20No ratings yet

- BCG MatrixDocument1 pageBCG MatrixFritz IgnacioNo ratings yet

- Indo Gold Mines PVT LTDDocument30 pagesIndo Gold Mines PVT LTDSiddharth Sourav PadheeNo ratings yet

- 115 Practical SAP HANA ABAP Interview Q&ADocument25 pages115 Practical SAP HANA ABAP Interview Q&AsuryaNo ratings yet

- Example of RFP For Credit ScoringDocument4 pagesExample of RFP For Credit ScoringadaquilaNo ratings yet

- Labour Rights in Vietnam: Unilever's Progress and Systemic ChallengesDocument76 pagesLabour Rights in Vietnam: Unilever's Progress and Systemic ChallengesOxfamNo ratings yet

- 2017 Walters Global Salary SurveyDocument428 pages2017 Walters Global Salary SurveyDebbie CollettNo ratings yet

- Strategic Management ModelsDocument24 pagesStrategic Management ModelsAnubhav DubeyNo ratings yet

- Products Services FCPO EnglishDocument16 pagesProducts Services FCPO EnglishKhairul AdhaNo ratings yet