Professional Documents

Culture Documents

B.Com. Degree Exam Income Tax Paper

Uploaded by

bkamithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B.Com. Degree Exam Income Tax Paper

Uploaded by

bkamithCopyright:

Available Formats

w

w

w

.

c

a

l

i

c

u

t

s

t

u

d

e

n

t

s

.

i

n

5916

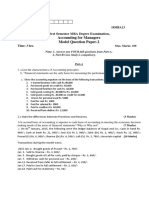

FINAL YEAR B.Com. DEGREE EXAMINATION,

MARCH/APRIL 2008

PART III COMMERECE

PAPER XIV OPTIONAL PAPER I (B)-INCOME TAX LAW &

PRACTICE

INCOME TAX PAPER I

(2004 AND EARLIER ADMISSIONS)

TIME: THREE HOURS MAXIMUM: 80 MARKS

PART A

Answer any ten questions. Each question carries 1 mark.

1. What is assessment year?

2. What is total income?

3. What is maximum marginal rate?

4. Who is resident?

5. What is regular assessment?

6. What is return of loss?

7. Who is deemed assessee?

8. What do mean by short term capital gain?

9. Give any two examples of exempted capital gain.

10. What is tax free commercial securities?

11. What do you mean by unrecognized provident fund?

12. What is composite rent?

(10x1=10 Marks)

PART B

Answer any ten questions. Each question carries 4 marks.

13. What are different types of rental values?

14. What is the meaning of tax deduction at source?

15. Mr. Suresh has furnished the following particulars. Compute the value of rent free

home if Mr. Suresh is a government employee, rent fixed by the government is

Rs.300 p.m.

(i) Salary @ Rs.10,000 p.m.

(ii) D.A. @ Rs.500 p.m. (it enters into retirement benefit)

(iii) Entertainment allowance @ Rs.600 p.m.

(iv) Bonus Rs.8,400

(v) Cost of furniture Rs.20,000.

16. Give any four examples of fully exempted perquisites?

w

w

w

.

c

a

l

i

c

u

t

s

t

u

d

e

n

t

s

.

i

n

17. Mr. Raj invested Rs.1,00,000 in 8% tax free debenture of a company. What will be

taxable interest for the previous year ending on 31.3.2007 if the rate of deduction

of ax at source is @ 20.4%. Interest accrues on 1

st

J anuary every year.

18. From the following information compute depreciation allowable for the

essessment year 2006-07.

Rs.

W.D.V. of furniture on 1.4.2005 1,10,000

Furniture purchased in June 2005 1,50,000

Furniture purchased in J anuary 2006 20,000

Part of furniture sold in February 2006 3,000

Rate of depreciation 10%

19. Distinguish between revenue expenditure and capital expenditure.

20. What are perquisites? Give some examples of tax free perquisites.

21. A company took house on rent and allotted it to its employees. From the following

information find out the value of perquisites of accommodation.

Rs.

Rent paid for the year 60,000

Salary 5,00,000

Cost of furniture provided in the house 60,000

Rent charges from the employees per month 1,000

22 Determine the annual value of the house from the following information:-

Rs.

Municipal value 1,00,000

Fair rent 1,20,000

Standard rent 90,000

Refund rent received 1,32,000

Municipal tax 10% of municipal value paid by the

owner.

23. Agriculture land purchased in 1984-85 for Rs.46,400 sold for Rs.3,80,000 on

1.5.2006. The assessee purchased another piece of agriculture land on 1.8.2006 for

Rs.70,000 and deposited Rs.30,000 on 24.6.2007 in capital gain account scheme,

1988. Find out the capital gain chargeable to tax for the assessment year, 2007-08.

The cost of inflation index in 1984-85 was 125 and in 2006-07 519.

24. Explain the concept of Balancing Charges.

(10x4=40 Marks)

w

w

w

.

c

a

l

i

c

u

t

s

t

u

d

e

n

t

s

.

i

n

PART C

Answer any two questions. Each question carries 15 marks.

25. What are the provisions relating to deduction of tax at source from income

chargeable under the head Salary.

26. Compute taxable income from the house property from the following particulars:

Rs.

Fair market rent 80,000

Actual rent 72,000

Municipal valuation 50,000

Standard rent 60,000

Municipal taxes 20%

Interest paid 18,000

27. Kalam purchased a house property on 1

st

September 1979 for Rs.2,10,000. Fair

marked value of the property on 1

st

April 1981 was 1,70,000. He incurred the

following expenses.

Rs.

(a) Construction of room on the ground floor

during 1980-81

10,000

(b) Renewal /construction in 1993-94 3,92,000

The property was transferred on 31

st

March 2006 for Rs.18,65,000. Compute the

capital gain. Cost inflation index for the year are as follows:-

Financial year C.I.I.

1993-94 244

2005-06 497

(2x15=30 Marks)

You might also like

- Marginal Costing and Its Application - ProblemsDocument5 pagesMarginal Costing and Its Application - ProblemsAAKASH BAIDNo ratings yet

- Characteristics of an Ideal Cost SystemDocument6 pagesCharacteristics of an Ideal Cost SystemNikhil Thomas AbrahamNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi aliNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- MBA 19 PAT 302 DS Unit 1.2.3Document23 pagesMBA 19 PAT 302 DS Unit 1.2.3bhowteNo ratings yet

- Organizational Structure, Development of Banks in IndiaDocument54 pagesOrganizational Structure, Development of Banks in Indiaanand_lamani100% (1)

- Study Note 4.2, Page 169-197Document29 pagesStudy Note 4.2, Page 169-197s4sahith0% (1)

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- 3 Customs ActDocument26 pages3 Customs ActHaritaa Varshini BalakumaranNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- Regulatory Framework For Banking in IndiaDocument12 pagesRegulatory Framework For Banking in IndiaSidhant NaikNo ratings yet

- Corporate Tax PlanningDocument21 pagesCorporate Tax Planninggauravbpit100% (3)

- Interconnected Stock Exchange (ISE)Document9 pagesInterconnected Stock Exchange (ISE)Anoop KoshyNo ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- Case of ICICI and Bank of Madura MergerDocument6 pagesCase of ICICI and Bank of Madura MergerWilliam Masterson Shah100% (3)

- Final Accounts of Banking Company (Lecture 01Document8 pagesFinal Accounts of Banking Company (Lecture 01akash gautamNo ratings yet

- Accounting Round 1 Ans KeyDocument21 pagesAccounting Round 1 Ans KeyMalhar ShahNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- 1 - 4. Issues Involved in Overseas Funding ChoicesDocument7 pages1 - 4. Issues Involved in Overseas Funding ChoicesShubham ArgadeNo ratings yet

- Auditing Standards in IndiaDocument8 pagesAuditing Standards in IndiaInderdeep SharmaNo ratings yet

- Judgement SheetDocument2 pagesJudgement SheetMd AkhtarNo ratings yet

- MGMT Acts PaperDocument27 pagesMGMT Acts PaperAbhishek JainNo ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- Clearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghDocument22 pagesClearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghpreetsinghjjjNo ratings yet

- Practice Problems Standard CostDocument5 pagesPractice Problems Standard Costlulughosh100% (1)

- SBI & BMB MergerDocument12 pagesSBI & BMB MergerShubham naharwal (PGDM 17-19)No ratings yet

- Financial Analysis of Hindalco Industries Limited, Renukoot, (U.P)Document95 pagesFinancial Analysis of Hindalco Industries Limited, Renukoot, (U.P)alokpatel009100% (1)

- Fortune TellerDocument3 pagesFortune TellerbharatNo ratings yet

- Presentation on Amalgamation and Merger of BanksDocument14 pagesPresentation on Amalgamation and Merger of BanksKrishnakant Mishra100% (1)

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- Cardinal Utility AnalysisDocument19 pagesCardinal Utility AnalysisShah MominNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Britannia Financial Results for Year Ending March 2020Document3 pagesBritannia Financial Results for Year Ending March 2020Art beateNo ratings yet

- Iii. Foreign TradeDocument19 pagesIii. Foreign TradeAmit JainNo ratings yet

- Cooperative BankDocument14 pagesCooperative Bank679shrishti Singh0% (1)

- Capital Market Clearing and Settlement ProcessDocument9 pagesCapital Market Clearing and Settlement ProcessTushali TrivediNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Telecom Industry in IndiaDocument21 pagesTelecom Industry in IndiaVaibhav PatelNo ratings yet

- Narayan Murthy Committee Report 2003Document12 pagesNarayan Murthy Committee Report 2003Gaurav Kumar50% (2)

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Functions of A SalesmanDocument2 pagesFunctions of A SalesmanpilotNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Formation of Case Problems.Document27 pagesFormation of Case Problems.CHARAK RAYNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Aditya Birla Group Product MixDocument5 pagesAditya Birla Group Product MixTanvi MittalNo ratings yet

- 19732ipcc CA Vol2 Cp3Document43 pages19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANo ratings yet

- Chore CommitteeDocument4 pagesChore CommitteeSumit Koundal100% (1)

- Industrial Securities MarketDocument16 pagesIndustrial Securities MarketNaga Mani Merugu100% (3)

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Check your MF answersDocument19 pagesCheck your MF answersyogidildar100% (1)

- IFM InsightsDocument37 pagesIFM Insights9832155922No ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Project Report - Merger, Amalgamation, TakeoverDocument18 pagesProject Report - Merger, Amalgamation, TakeoverRohan kedia0% (1)

- 01 Introduction - AECDocument1 page01 Introduction - AECShekhar Singh0% (2)

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- House Property PDFDocument43 pagesHouse Property PDFK Vijay Bhaskar ReddyNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- Tax Laws SummaryDocument8 pagesTax Laws SummaryPriya MalhotraNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Order Types and Algos GuideDocument5 pagesOrder Types and Algos Guidebkamith100% (1)

- Negative Energy ExchangesDocument3 pagesNegative Energy ExchangesbkamithNo ratings yet

- Workforce DiversityDocument1 pageWorkforce DiversitybkamithNo ratings yet

- Indian Money Market OverviewDocument22 pagesIndian Money Market OverviewbkamithNo ratings yet

- About - S&P Bse SensexDocument3 pagesAbout - S&P Bse SensexbkamithNo ratings yet

- How The Sensex Is Calculated - Rediff - Com BusinessDocument4 pagesHow The Sensex Is Calculated - Rediff - Com BusinessbkamithNo ratings yet

- Whatismuhurattrading 131018071418 Phpapp01Document9 pagesWhatismuhurattrading 131018071418 Phpapp01bkamithNo ratings yet

- Nifty Freefloat Method NewDocument13 pagesNifty Freefloat Method NewJigar J JivaniNo ratings yet

- Chapter 2 - Corporate GovernanceDocument34 pagesChapter 2 - Corporate GovernancebkamithNo ratings yet

- Satyam Infoway Infosys Company ProfileDocument1 pageSatyam Infoway Infosys Company ProfilebkamithNo ratings yet

- Non-Perfoming Assets Uti Bank Project Report Mba FinanceDocument81 pagesNon-Perfoming Assets Uti Bank Project Report Mba FinancebkamithNo ratings yet

- Infosys ExamplesDocument36 pagesInfosys ExamplesbkamithNo ratings yet

- Organizational CultureDocument12 pagesOrganizational CultureShalini100% (1)

- Sindhu's ProjectDocument54 pagesSindhu's ProjectbkamithNo ratings yet

- Chap 3Document7 pagesChap 3bkamithNo ratings yet

- Income TaxDocument4 pagesIncome TaxbkamithNo ratings yet

- Capital MarketDocument33 pagesCapital MarketJeetan GurungNo ratings yet

- Chapter 4 Securities MarketDocument40 pagesChapter 4 Securities Marketashish_k_srivastavaNo ratings yet

- Financial Services 7Document1 pageFinancial Services 7bkamithNo ratings yet

- Export Study of HandicraftsDocument27 pagesExport Study of Handicraftsbkamith0% (1)

- Chapter Ii - Primary MarketDocument4 pagesChapter Ii - Primary MarketbkamithNo ratings yet

- Syllabus of MG UniversityDocument48 pagesSyllabus of MG Universitybkamith33% (3)

- Mba Final Year Project On Customer SatisfactionDocument64 pagesMba Final Year Project On Customer SatisfactionArun75% (20)

- Jhoom Le - HariharanDocument1 pageJhoom Le - HariharanbkamithNo ratings yet

- Business EnvironmentDocument37 pagesBusiness EnvironmentbkamithNo ratings yet

- Securitization IndiaDocument2 pagesSecuritization IndiabkamithNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesbkamithNo ratings yet

- MAIN PPT Stock Exchange of India - pptmATDocument42 pagesMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Incomes Exempt From TaxDocument7 pagesIncomes Exempt From TaxsandeepbadoleNo ratings yet

- Accounting ScandalsDocument2 pagesAccounting ScandalsDayarayan CanadaNo ratings yet

- General Principles of Income Taxation in The PHDocument1 pageGeneral Principles of Income Taxation in The PHJm CruzNo ratings yet

- Research Proposal:Share Market Efficiency: Is The Indian Capital Market Weak Form Efficient?Document13 pagesResearch Proposal:Share Market Efficiency: Is The Indian Capital Market Weak Form Efficient?Adil100% (4)

- Insurance Domain KnowledgeDocument1 pageInsurance Domain KnowledgeSubbu PuliNo ratings yet

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- JAVIER - RLA - CWTS103 - A72 - Project Financial ReportDocument2 pagesJAVIER - RLA - CWTS103 - A72 - Project Financial ReportRome Lauren JavierNo ratings yet

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Document16 pagesHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908No ratings yet

- Introduction To XRPDocument15 pagesIntroduction To XRPiwan.herisetiadi6833No ratings yet

- A Project Report On Kotak InsuranceDocument82 pagesA Project Report On Kotak Insurancevarun_bawa251915No ratings yet

- Chapter 1 - IntroductionDocument37 pagesChapter 1 - IntroductionTâm Lê Hồ HồngNo ratings yet

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocument5 pagesInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiNo ratings yet

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocument15 pagesRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieNo ratings yet

- Negotiable Instruments Act-1881Document37 pagesNegotiable Instruments Act-1881Md ToufikuzzamanNo ratings yet

- BRM v3-1 Taxonomy 20130615Document52 pagesBRM v3-1 Taxonomy 20130615kevinzhang2022No ratings yet

- Model Portfolio: DBS Group Research - EquityDocument12 pagesModel Portfolio: DBS Group Research - EquityFunk33qNo ratings yet

- Lecture 5 PDFDocument28 pagesLecture 5 PDFJaniceNo ratings yet

- ALFM Money Market FundDocument47 pagesALFM Money Market FundLemuel VillanuevaNo ratings yet

- PMGT WhitepaperDocument56 pagesPMGT WhitepapermbidNo ratings yet

- Credit Appraisal SampleDocument113 pagesCredit Appraisal Samplerajadamu199050% (2)

- John Rasplicka Resume 2016 09 07Document1 pageJohn Rasplicka Resume 2016 09 07api-356233900No ratings yet

- Latest Jurisprudence and Landmark Doctrines On DepreciationDocument2 pagesLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanNo ratings yet

- Cost Sheet of AmulDocument7 pagesCost Sheet of AmulKhushi DaveNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- Assignment For Residential StatusDocument4 pagesAssignment For Residential StatusRaj HanumanteNo ratings yet

- BarclaysDocument23 pagesBarclaysAhmed AwaisNo ratings yet

- WWW Yourarticlelibrary ComDocument5 pagesWWW Yourarticlelibrary ComDhruv JoshiNo ratings yet

- 101 Bir FormDocument3 pages101 Bir Formmijareschabelita2No ratings yet

- (P3,300,000.00), Philippine Currency, Payable As FollowsDocument3 pages(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)

- A Study On GST and Its Probable Impact On The Sales Tax Revenue of KeralaDocument62 pagesA Study On GST and Its Probable Impact On The Sales Tax Revenue of KeralaBENIX KANJIRAVILA83% (6)

- Accounting Note or SampleDocument2 pagesAccounting Note or Samplenilo bia100% (1)