Professional Documents

Culture Documents

Chapter 2 Homework PDF

Uploaded by

Hemu JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Homework PDF

Uploaded by

Hemu JainCopyright:

Available Formats

9/22/13

Assignment Print View

Score: 70

out of 70 points (100%)

Exercise 2-34 Computing Costs; Government Agency (LO 1, 9, 10)

[The following information applies to the questions displayed b elow.] Exercise 2-34 The state Department of Education owns a computer system, which its employees use for word processing and keeping track of education statistics. The governor's office recently began using this computer also. As a result of the increased usage, the demands on the computer soon exceeded its capacity. The director of the Department of Education was soon forced to lease several personal computers to meet the computing needs of her employees. The annual cost of leasing the equipment is $14,000. Exercise 2-34 Computing Costs; Government Agency (LO 1, 9, 10)

Section Break

1.

aw ard:

10 out of 10.00 points

Exercise 2-34 Requirement 1

Requirement 1: What type of cost is this $14,000? Differential Cost Selling Cost Sunk Cost Administrative Cost Opportunity Cost Learning Objective: 02-10 Define and give examples of an opportunity cost, an out-of-pocket cost, a sunk cost, a differential cost, a marginal cost, and an average cost.

Multiple Choice

Learning Objective: 02-01 Explain what is meant by the word cost.

Exercise 2-34 Requirement 1

Learning Objective: 02-09 Distinguish among direct, indirect, controllable, and uncontrollable costs.

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

1/9

9/22/13

Assignment Print View

2.

aw ard:

10 out of 10.00 points

Exercise 2-34 Requirement 2

Requirement 2: Should this cost be associated with the governor's office or the Department of Education? Department of Education Governor's Office Learning Objective: 02-10 Define and give examples of an opportunity cost, an out-of-pocket cost, a sunk cost, a differential cost, a marginal cost, and an average cost.

Multiple Choice

Learning Objective: 02-01 Explain what is meant by the word cost.

Exercise 2-34 Requirement 2

Learning Objective: 02-09 Distinguish among direct, indirect, controllable, and uncontrollable costs.

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

2/9

9/22/13

Assignment Print View

Problem 2-42 Cost Terminology (LO 2, 5, 10)

[The following information applies to the questions displayed b elow.] Problem 2-42 The following cost data for the year just ended pertain to Sentiments, Inc., a greeting card manufacturer:

Direct material Advertising expense Depreciation on factory building Direct labor: wages Cost of finished goods inventory at year-end Indirect labor: wages Production supervisors salary Service department costs * Direct labor: fringe benefits Indirect labor: fringe benefits Fringe benefits for production supervisor Total overtime premiums paid Cost of idle time: production employees Administrative costs Rental of office space for sales personnel Sales commissions Product promotion costs

$2,200,000 98,000 115,000 485,000 115,000 140,000 46,000 100,000 95,000 31,000 10,000 55,000 40,000 150,000 15,000 4,000 $ 10,000

*All services are provided to manufacturing departments. Cost of idle time is an overhead item; it is not included in the direct-labor wages given above. The rental of sales space was made necessary when the sales offices were converted to storage space for raw

material.

Section Break

Prob lem 2-42 Cost Terminology (LO 2, 5, 10)

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

3/9

9/22/13

Assignment Print View

3.

aw ard:

10 out of 10.00 points

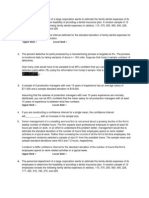

Problem 2-42 Requirement 1

Requirement 1: Compute each of the following costs for the year just ended: (a) total prime costs, (b ) total manufacturing overhead costs, (c) total conversion costs, (d) total product costs, and (e) total period costs. (Omit the "$" sign in your response.)

a. Total prime costs b. Total manufacturing overhead c. Total conversion costs d. Total product costs e. Total period costs

2,780,000

$ 537,000 $ $ 1,117,000 3,317,000

$ 277,000

Worksheet

Learning Objective: 02-10 Define and give examples of an Learning Objective: 02-02 opportunity cost, an out-of-pocket Distinguish among product costs, cost, a sunk cost, a differential period costs, and expenses. cost, a marginal cost, and an average cost. Learning Objective: 02-05 Give examples of three types of manufacturing costs.

Prob lem 2-42 Requirement 1

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

4/9

9/22/13

Assignment Print View

4.

aw ard:

10 out of 10.00 points

Problem 2-42 Requirement 2

Requirement 2: One of the costs listed below is an opportunity cost. Identify this cost. Product promotion costs Cost of finished-goods inventory at year-end Administrative costs Direct labor: fringe benefits Sales commissions Rental of office space for sales personnel Learning Objective: 02-10 Define and give examples of an Learning Objective: 02-02 opportunity cost, an out-of-pocket Distinguish among product costs, cost, a sunk cost, a differential period costs, and expenses. cost, a marginal cost, and an average cost. Learning Objective: 02-05 Give examples of three types of manufacturing costs.

Multiple Choice

Prob lem 2-42 Requirement 2

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

5/9

9/22/13

Assignment Print View

Problem 2-43 Schedules of Cost of Goods Manufactured and Sold; Income Statement (LO 1, 3, 5, 6)

[The following information applies to the questions displayed b elow.]

Problem 2-43 The following data refer to San Fernando Fashions Company for the year 20x2:

Sales revenue Work-in-process inventory, December 31 Work-in-process inventory, January 1 Selling and administrative expenses Income tax expense Purchases of raw material Raw-material inventory, December 31 Raw-material inventory, January 1 Direct labor Utilities: plant Depreciation: plant and equipment Finished-goods inventory, December 31 Finished-goods inventory, January 1 Indirect material Indirect labor Other manufacturing overhead

$1,050,000 30,000 36,000 150,000 80,000 170,000 25,000 40,000 190,000 40,000 50,000 50,000 15,000 6,000 15,000 60,000

Section Break

Prob lem 2-43 Schedules of Cost of Goods Manufactured and Sold; Income Statement (LO 1, 3, 5, 6)

5.

aw ard:

10 out of 10.00 points

Problem 2-43 Requirement 1

Requirement 1: Prepare San Fernando Fashions schedule of cost of goods manufactured for the year. (Omit the "$" sign in your response. Input all amounts as positive values.)

SAN FERNANDO FASHIONS COMPANY Schedule of Cost Goods Manufactured For the Year Ended December 31, 20X2 Direct material:

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview 6/9

9/22/13

Assignment Print View

Raw-material inventory, January 1 Add : Purchases of raw material

$ 40,000 170,000 $ 210,000 25,000 $ 185,000 190,000

Raw material available for use Deduct : Raw-material inventory, December 31

Raw material used Direct labor Manufacturing overhead: Indirect material Indirect labor Utilities: plant Depreciation: plant and equipment Other manufacturing overhead Total manufacturing overhead Total manufacturing costs Add : Work-in-process inventory, January 1 $ 6,000 15,000 40,000 50,000 60,000

171,000 $ 546,000 36,000 $ 582,000 30,000 $ 552,000

Subtotal Deduct : Work-in-process inventory, December 31

Cost of goods manufactured

Worksheet

Learning Objective: 02-01 Explain what is meant by the word cost.

Learning Objective: 02-05 Give examples of three types of manufacturing costs. Learning Objective: 02-06 Prepare a schedule of cost of goods manufactured, a schedule of cost of goods sold, and an income statement for a manufacturer.

Prob lem 2-43 Requirement 1

Learning Objective: 02-03 Describe the role of costs in published financial statements.

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

7/9

9/22/13

Assignment Print View

6.

aw ard:

10 out of 10.00 points

Problem 2-43 Requirement 2

Requirement 2: Prepare San Fernando Fashions schedule of cost of goods sold for the year. (Omit the "$" sign in your response. Input all amounts as positive values.)

SAN FERNANDO FASHIONS COMPANY Schedule of Cost Goods Manufactured For the Year Ended December 31, 20X2 Finished goods inventory, January 1 Add : Cost of goods manufactured $ 15,000 552,000 $ 567,000 50,000 $ 517,000

Cost of goods available for sale Deduct : Finished-goods inventory, December 31

Cost of goods sold

Worksheet

Learning Objective: 02-01 Explain what is meant by the word cost.

Learning Objective: 02-05 Give examples of three types of manufacturing costs. Learning Objective: 02-06 Prepare a schedule of cost of goods manufactured, a schedule of cost of goods sold, and an income statement for a manufacturer.

Prob lem 2-43 Requirement 2

Learning Objective: 02-03 Describe the role of costs in published financial statements.

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

8/9

9/22/13

Assignment Print View

7.

aw ard:

10 out of 10.00 points

Problem 2-43 Requirement 3

Requirement 3: Prepare San Fernando Fashions income statement for the year. (Omit the "$" sign in your response. Input all amounts as positive values.)

SAN FERNANDO FASHIONS COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20x2 Sales revenue Deduct : Cost of goods sold $ 1,050,000 $ 517,000 533,000 150,000 $ 383,000 80,000 $ 303,000

Gross margin Deduct : Selling and administrative expenses

Income before taxes Deduct : Income tax expense

Net income

Worksheet

Learning Objective: 02-01 Explain what is meant by the word cost.

Learning Objective: 02-05 Give examples of three types of manufacturing costs. Learning Objective: 02-06 Prepare a schedule of cost of goods manufactured, a schedule of cost of goods sold, and an income statement for a manufacturer.

Prob lem 2-43 Requirement 3

Learning Objective: 02-03 Describe the role of costs in published financial statements.

ezto.mhecloud.mcgraw-hill.com/hm_accounting.tpx?todo=printview

9/9

You might also like

- Managerial AccountingDocument6 pagesManagerial Accountingrdm9c2100% (3)

- Tour PackageDocument21 pagesTour PackagePawan Subhash Verma100% (2)

- Ma1 PilotDocument17 pagesMa1 PilotKu Farah Syarina0% (1)

- ACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsDocument8 pagesACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsNatasha DeclanNo ratings yet

- The A330neo: Powering Into The FutureDocument22 pagesThe A330neo: Powering Into The FutureAvtips75% (4)

- ACCT 284 AD Clem Fionaguo Old Exam PacketDocument25 pagesACCT 284 AD Clem Fionaguo Old Exam PacketHemu JainNo ratings yet

- Low-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsFrom EverandLow-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsRating: 2.5 out of 5 stars2.5/5 (2)

- Cost Accounting A Managerial Emphasis Canadian 7th Edition by Horngren Datar Rajan ISBN Test BankDocument72 pagesCost Accounting A Managerial Emphasis Canadian 7th Edition by Horngren Datar Rajan ISBN Test Bankbonnie100% (20)

- TheoriesDocument6 pagesTheoriesFhremond ApoleNo ratings yet

- Multiple Choice: Principles of Accounting, Volume 2: Managerial AccountingDocument31 pagesMultiple Choice: Principles of Accounting, Volume 2: Managerial Accountingquanghuymc100% (1)

- Acca F5Document133 pagesAcca F5Andin Lee67% (3)

- P1 Management Accounting Performance EvaluationDocument31 pagesP1 Management Accounting Performance EvaluationSadeep MadhushanNo ratings yet

- SyllabusDocument5 pagesSyllabusBalbeer SinghNo ratings yet

- Pallavi Textiles Limited: Presentation by Group 5Document11 pagesPallavi Textiles Limited: Presentation by Group 5Raeesa IssaniNo ratings yet

- R&D Productivity: How to Target It. How to Measure It. Why It Matters.From EverandR&D Productivity: How to Target It. How to Measure It. Why It Matters.No ratings yet

- International Strategic Alliances: After Studying This Chapter, Students Should Be Able ToDocument19 pagesInternational Strategic Alliances: After Studying This Chapter, Students Should Be Able Toaidatabah100% (1)

- Prepared by Debby Bloom-Hill Cma, CFMDocument55 pagesPrepared by Debby Bloom-Hill Cma, CFMAlondra SerranoNo ratings yet

- Job-Order Costing For Manufacturing & Service CompaniesDocument37 pagesJob-Order Costing For Manufacturing & Service CompaniesNitish SharmaNo ratings yet

- Test Bank For Managerial Accounting Decision Making and Motivating Performance 1St Edition Datar Rajan 0132816245 9780132816243 Full Chapter PDFDocument36 pagesTest Bank For Managerial Accounting Decision Making and Motivating Performance 1St Edition Datar Rajan 0132816245 9780132816243 Full Chapter PDFbeatriz.evans137100% (10)

- Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test BankDocument46 pagesManagerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test Bankmable100% (18)

- MGMT 30B Chapter 2 HomeworkDocument9 pagesMGMT 30B Chapter 2 HomeworkhoshixnanaNo ratings yet

- 4 Takehome Chapters 1 and 2 Fall10 SolnDocument3 pages4 Takehome Chapters 1 and 2 Fall10 SolnAhmad AlNo ratings yet

- Task Set 1 (Q)Document5 pagesTask Set 1 (Q)Bintang Di SurgaNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument44 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoberto De JesusNo ratings yet

- ADM2341 Solution Quiz #1, Professor BergquistDocument7 pagesADM2341 Solution Quiz #1, Professor BergquistJeremyBarsNo ratings yet

- Assignment CH 1Document27 pagesAssignment CH 1Svetlana100% (4)

- Ac102 Rev01-03Document24 pagesAc102 Rev01-03Aaron DownsNo ratings yet

- Homework - 1 BCAC 423ATRDocument5 pagesHomework - 1 BCAC 423ATRg6cmqw8ctzNo ratings yet

- Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar Test BankDocument45 pagesManagerial Accounting Decision Making and Motivating Performance 1st Edition Datar Test Banka679213672No ratings yet

- RSM222.Practice Mid-Term - QuestionsDocument20 pagesRSM222.Practice Mid-Term - QuestionsKirsten WangNo ratings yet

- Saage SG Fma RevisionDocument21 pagesSaage SG Fma RevisionNurul Shafina HassanNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- Cost Accounting Final ExamDocument15 pagesCost Accounting Final ExamSam SumoNo ratings yet

- Basic Management Accounting ConceptsDocument28 pagesBasic Management Accounting Conceptslita2703No ratings yet

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDocument52 pagesBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouNo ratings yet

- ACTG360 - Cost Accounting - Midterm Exam - 01Document3 pagesACTG360 - Cost Accounting - Midterm Exam - 01Nguyễn Thị Thanh ThúyNo ratings yet

- MA October 15:16Document37 pagesMA October 15:16AngelaNo ratings yet

- Test Bank For Cost Accounting A Managerial Emphasis Canadian 7Th Edition by Horngren Datar Rajan Isbn 0133138445 9780133138443 Full Chapter PDFDocument36 pagesTest Bank For Cost Accounting A Managerial Emphasis Canadian 7Th Edition by Horngren Datar Rajan Isbn 0133138445 9780133138443 Full Chapter PDFjustin.dixon220100% (11)

- Sample Mid Semester Exam With AnswersDocument15 pagesSample Mid Semester Exam With AnswersjojoinnitNo ratings yet

- PMC Examination Winter 2011Document5 pagesPMC Examination Winter 2011pinkwine2001No ratings yet

- B.Tech Engineering Programmes (ESEP/MEEP) Model Question Paper' With Synoptic Answer Key' TML062 / TES062: Entrepreneurship DevelopmentDocument9 pagesB.Tech Engineering Programmes (ESEP/MEEP) Model Question Paper' With Synoptic Answer Key' TML062 / TES062: Entrepreneurship Developmentphase_shekhar21No ratings yet

- Cost Accounting3Document9 pagesCost Accounting3stephborinagaNo ratings yet

- Ch02, MGMT Acct, HansenDocument28 pagesCh02, MGMT Acct, HansenIlham DoankNo ratings yet

- Pcost 5Document17 pagesPcost 5noowrieliinNo ratings yet

- FN3140 - Unit 2 - P2-49ADocument119 pagesFN3140 - Unit 2 - P2-49AStephan Reese0% (1)

- Full Download Test Bank For Connect With Smartbook Online Access For Managerial Accounting 11th Edition PDF Full ChapterDocument36 pagesFull Download Test Bank For Connect With Smartbook Online Access For Managerial Accounting 11th Edition PDF Full Chapterreaffirmkalendarl4ye8m100% (18)

- Assignment CH 2Document30 pagesAssignment CH 2Svetlana50% (2)

- Ma 2 CT 1Document5 pagesMa 2 CT 1emon_paul_009No ratings yet

- Level 2 Book-Keeping and Accounts: Teachers ' Toolkit (Sample)Document8 pagesLevel 2 Book-Keeping and Accounts: Teachers ' Toolkit (Sample)Yogeswary RajendranNo ratings yet

- At 2Document8 pagesAt 2Joshua GibsonNo ratings yet

- 489 Assignment 2 Minh ThiDocument16 pages489 Assignment 2 Minh ThiMinh Thi TrầnNo ratings yet

- Ch17 Quiz SampleDocument8 pagesCh17 Quiz SampleEwelina ChabowskaNo ratings yet

- ACC20020 Management - Accounting Exam - 21-22Document11 pagesACC20020 Management - Accounting Exam - 21-22Anonymous qRU8qVNo ratings yet

- Test Bank For Managerial Accounting Tools For Business Decision Making 6th Edition Weygandt, Kimmel, KiesoDocument7 pagesTest Bank For Managerial Accounting Tools For Business Decision Making 6th Edition Weygandt, Kimmel, Kiesoghsoub777No ratings yet

- Hhofma3ech17inst 140930121849 Phpapp01Document65 pagesHhofma3ech17inst 140930121849 Phpapp01Siegfred LaborteNo ratings yet

- At 1Document7 pagesAt 1jessicavaleoNo ratings yet

- ACCT 2302 Exam ReviewDocument26 pagesACCT 2302 Exam ReviewcymclaugNo ratings yet

- Chapter 2 Part 1Document8 pagesChapter 2 Part 1Aya MasoudNo ratings yet

- Jamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)Document2 pagesJamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)kashif aliNo ratings yet

- Horngren Ima15 SM 05-2Document48 pagesHorngren Ima15 SM 05-2teehee119No ratings yet

- Acc312 Platt Spr07 Exam1 Solution PostedDocument13 pagesAcc312 Platt Spr07 Exam1 Solution Posted03322080738No ratings yet

- Production CostDocument80 pagesProduction CostRamez AlaliNo ratings yet

- Basic Cost Management Concepts: Douglas CloudDocument32 pagesBasic Cost Management Concepts: Douglas Cloudmanuel2811No ratings yet

- Ch02 - Basic Cost Management ConceptsDocument32 pagesCh02 - Basic Cost Management ConceptsFauziahNo ratings yet

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideFrom EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo ratings yet

- Task 5Document3 pagesTask 5Hemu JainNo ratings yet

- AsdDocument1 pageAsdHemu JainNo ratings yet

- CengageNOW - Assignments - ViewDocument3 pagesCengageNOW - Assignments - ViewHemu JainNo ratings yet

- AsdollalaDocument1 pageAsdollalaHemu JainNo ratings yet

- Marketing Research Workshops Second Take Home Assessment 0Document4 pagesMarketing Research Workshops Second Take Home Assessment 0Hemu JainNo ratings yet

- ChasemanhattanbankDocument5 pagesChasemanhattanbankHemu Jain100% (1)

- Payroll Deductions-Single, Paid Monthly: Exhibit 9-4Document1 pagePayroll Deductions-Single, Paid Monthly: Exhibit 9-4Hemu JainNo ratings yet

- Chapter 2 NotesDocument6 pagesChapter 2 NotesHemu JainNo ratings yet

- Interglobe Aviation LTDDocument2 pagesInterglobe Aviation LTDHemu JainNo ratings yet

- Married WeeklyDocument1 pageMarried WeeklyHemu JainNo ratings yet

- S.No Course Code Book Name: 1 Coc - C - Comp130114B 2Document2 pagesS.No Course Code Book Name: 1 Coc - C - Comp130114B 2Hemu JainNo ratings yet

- IDS 205 HW Due 10-2Document1 pageIDS 205 HW Due 10-2Hemu JainNo ratings yet

- Industrial Revolution and The Peppered MothDocument2 pagesIndustrial Revolution and The Peppered MothHemu JainNo ratings yet

- Corporate Social ResponsibilityDocument22 pagesCorporate Social ResponsibilityHemu JainNo ratings yet

- Diesel Vs HydrogenDocument2 pagesDiesel Vs HydrogenHemu JainNo ratings yet

- Statistics 3 QuestionsDocument2 pagesStatistics 3 QuestionsHemu JainNo ratings yet

- AccountsDocument27 pagesAccountsHemu JainNo ratings yet

- Court ProbabilityDocument5 pagesCourt ProbabilityHemu JainNo ratings yet

- Assignment #1: JET Copies Case ProblemDocument1 pageAssignment #1: JET Copies Case ProblemHemu JainNo ratings yet

- Final ReportDocument13 pagesFinal Reportapi-384939961No ratings yet

- 3.3 Break Even Charts and Break Even Analysis ActivityDocument2 pages3.3 Break Even Charts and Break Even Analysis ActivityZARWAREEN FAISALNo ratings yet

- Financial Wellness Seminar: The Rock Unit Blue Horizon BranchDocument31 pagesFinancial Wellness Seminar: The Rock Unit Blue Horizon BranchKeiWakNo ratings yet

- Kmart CaseDocument22 pagesKmart CaseDamiano SciutoNo ratings yet

- Making Good ChoicesDocument6 pagesMaking Good ChoicesdrgNo ratings yet

- Time Is More Important Than Money-1Document7 pagesTime Is More Important Than Money-1Kholilul Rahman SiregarNo ratings yet

- Microeconomics Notes by DR Idrees QAU IslamabadDocument142 pagesMicroeconomics Notes by DR Idrees QAU IslamabadAtiq100% (2)

- 19.lewin, David. Human Resources Management in The 21st CenturyDocument12 pages19.lewin, David. Human Resources Management in The 21st CenturymiudorinaNo ratings yet

- Delta Neutral Hedging Strategy Premium Neutral Hedging StrategyDocument4 pagesDelta Neutral Hedging Strategy Premium Neutral Hedging StrategyBen ShibeNo ratings yet

- National Stock Exchange of India Limited: Financial Markets, Products & InstitutionsDocument3 pagesNational Stock Exchange of India Limited: Financial Markets, Products & InstitutionsBasith BaderiNo ratings yet

- Oracle Inventory and Purchasing ReportsDocument29 pagesOracle Inventory and Purchasing Reportsspan_hgoiNo ratings yet

- Resume Academic 06-10-30Document11 pagesResume Academic 06-10-30Joshua GansNo ratings yet

- Welcome To The PPG Business Valuation TemplateDocument11 pagesWelcome To The PPG Business Valuation Templateisbackthelegend0% (1)

- Kerala PSC Maths QuestionsDocument6 pagesKerala PSC Maths Questionselsypeter70No ratings yet

- Final Quiz Marketing PDFDocument17 pagesFinal Quiz Marketing PDFAarush AggarwaLNo ratings yet

- Dutch Lady NK Present Isnin (1) CDocument43 pagesDutch Lady NK Present Isnin (1) CSyaker Zack62% (26)

- VP Engineering and Service: Purchase OrderDocument1 pageVP Engineering and Service: Purchase OrderVP Engineering & Service BangaloreNo ratings yet

- Economy Questions in Upsc Prelims 2022 88Document6 pagesEconomy Questions in Upsc Prelims 2022 88RamdulariNo ratings yet

- ACFrOgAMnktC8b01ely7fyjtYz-48iVFqaYfEYb8Mpky5ihkpwaGsnvIyuRhRT6xlBhJv-Mh0UALByl0AIN40GJir7u4in kYpXpEQr2aBFDImeR j2q7U5RP0lumUt7kU1S1gNAmjqEEIyuDHPMDocument36 pagesACFrOgAMnktC8b01ely7fyjtYz-48iVFqaYfEYb8Mpky5ihkpwaGsnvIyuRhRT6xlBhJv-Mh0UALByl0AIN40GJir7u4in kYpXpEQr2aBFDImeR j2q7U5RP0lumUt7kU1S1gNAmjqEEIyuDHPMRosevel C. IliganNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- 3rd Weeks HomeworkDocument3 pages3rd Weeks HomeworkChangi MinNo ratings yet

- Microeconomics Practical Exercises: Topic 5 - 8 Section 1: Multiple Choice QuestionsDocument10 pagesMicroeconomics Practical Exercises: Topic 5 - 8 Section 1: Multiple Choice QuestionsLinh Trinh NgNo ratings yet

- Rate of ReturnDocument38 pagesRate of ReturnPraz AarashNo ratings yet

- Bentley Company CaseDocument TranscriptDocument3 pagesBentley Company CaseDocument Transcripthaelstone0% (1)