Professional Documents

Culture Documents

Budget Process

Uploaded by

napema.educ4790Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget Process

Uploaded by

napema.educ4790Copyright:

Available Formats

BUDGETARY SYSTEM

What is a Government Budget? In general, it is the financial plan of a government for a given period, usually for a fiscal

year, which shows what its resources are, and how they will be generated and used over the fiscal period.

It is the government's key instrument for promoting its socio-economic objectives. it also refers to the income, expenditures and sources of borrowings of the National

Government (NG) that are used to achieve national objectives, strategies and programs.

Section 22, Article VII of the Constitution states that: "The President shall submit to the

Congress within 30 days from the opening of every regular session, as the basis of the general appropriation bill (GAB), a budget of expenditures and sources of financing including receipts from existing and proposed revenue measures."

It is prepared in advance of the fiscal year to which it applies.

What is referred to by the term "national government budget"?

it refers to the totality of the budgets of various departments of the national government including the NG support to Local Government Units (LGUs) and Government-Owned and Controlled Corporations (GOCCs). It is what the national government plans to spend for its programs and projects, and the sources of what it projects to have as funds, either from revenues or from borrowings with which to finance such expenditures. is allocated for the implementation of various government programs and projects, the operation of government offices, payment of salaries of government employees, and payment of public debts. These expenditures are classified by expense class, sector and implementing unit of government.

Why does the government prepare a new budget every year? The preparation of the government's budget every year is in accordance with the provision of the Constitution which requires the President to submit a budget of expenditure and sources of financing within 30 days from the opening of every regular session of Congress. The yearly preparation of the budget is also in consonance with the principle which requires all government spendings to be justified anew each year. This principle ensures that government entities continuously evaluate and review the allocation of resources to project/activities for cost efficiency and effectiveness.

THE PHILIPPINE BUDGETARY PROCESS

BUDGET PREPARATION: preparation of budget estimates 1) Budget Policy Formulation - It is the Presidents pronouncement of the principal budget thrust for the budget year. a. Policy Framework and Thrust The FY 2012 National Budget, as the budget of the Aquino Administration for its second year, shall be guided by the Presidents Social Contract and its 16 areas of transformational leadership reflected in the national development goals and targets, and strategies in the Philippine Medium Term Development Plan (MTPDP) for FYs 2011-2016. The objective is to ensure that: available public resources are maximized for core vital government services with the greatest beneficial impact on poverty reduction and equitable growth. The use of private public partnerships is encouraged for public investment activities which are attractive to/suitable for domestic and foreign investments. Departments/agencies are reminded to ensure that their major programs and projects are aligned with any of the five (5) priority areas of spending by the government. Budget shall focus on: 1) fighting corruption and promoting transparency, accountability and good governance, 2) poverty reduction and empowerment of vulnerable and marginalized sectors through significant investments in basic education, public health and social protection furthering basic education, public health and equal justice for all, 3) ensuring sustained and inclusive economic growth, leveling the playing field and nurturing competitive industries, 4) building a motivated, professional, energized bureaucracy, and 5) encouraging integrated and safe communities and the sustainable use of resources for future generations.

The National Budget for 2012 P1.816 trillion.

To ensure that the accomplishment of the Administrations more important goals will not be sidetracked by resource constraints, the FY 2012 budget preparation phase will prioritize sectors/purposes/expenditures within the context of the Medium Term Expenditure Framework (MTEF), the Organizational Performance Indicator Framework (OPIF), and the ZeroBased Budgeting (ZBB) approach.

b. Determination of macroeconomic assumptions and fiscal targets approved by the DBCC

These will be accompanied by the issuance of the indicative budget ceilings for departments/agencies derived from the forward estimates.

A Development Budget Coordination Committee (DBCC) composed of five component entities decide on the parameters of the budget. DBM resource allocation and management DOF resource generation and debt management NEDA overall economic policy BSP monetary measures and policies OP Presidential oversight The DBCC recommends to the President the following:

1. Level of annual government expenditures and the ceiling of government spending for economic and social development, national defense, and government debt service; 2. Proper allocation of expenditures for each development activity between current operating expenditures and capital outlays; and; 3. Amount set to be allocated for capital outlays broken down into the various capital or infrastructure projects.

2) Preparation of Budget Estimates a) Issuance of Budget Call to Agencies After the expenditure levels, the revenue projection, the deficit level and the financial plan have been approved by the Cabinet and the President, the DBM issues a budget call to the different government agencies to prepare their respective budgets in accordance with the

approved overall ceilings and parameters. It also issues a memorandum prescribing the procedures, target schedules (Budget Preparation Calendar) and guidelines to be followed and the forms to be used in the preparation of their estimates.

b) Preparation of Budget Estimates by Agencies Upon receipt of the budget call, the government agencies are expected to conduct their respective internal budget consultations in preparation for the formulation of departmental plans and priorities. c) Submission of Budget Estimates to DBM The budget estimates or proposals of the departments and agencies are submitted to the DBM in accordance with the time schedule for its review.

d) Conduct of Budget Forum and Technical Budget Hearings with Agencies Agencies justify details of their proposed budgets before DBM technical review panels. e) DBM Budget Review and Consolidation DBM reviews and consolidates proposed budgets of all agencies f) Submission of the FY 2012 Budget Documents to the President National Expenditure Program (NEP) Budget of Expenditures and Sources of Financing (BESF) Tables Staffing Summary Budget Message Details of Selected Programs/Projects Organizational Performance Indicator Framework (OPIF) Book

g) Submission of the Presidents Budget to Congress

BUDGET AUTHORIZATION: legislative authorization of the budget It involves a detailed review of the budget proposals in accordance with the Rules of the Congress. The review will be made by the standing committees of the Congress with jurisdiction in the particular field of legislation: Committee on Appropriations of the House of Representatives and the Committee on Finance of the Senate. The budget is presented as the general appropriations bill.

a) Conduct of Budget Hearings The Committee on Appropriations and the Committee on Finance hold separate formal hearings on the proposed budget. These hearings enable departments and agency heads and other officials to explain and defend the details of their respective appropriation requests and to furnish such information as the Committee may need. b) Amendments see internet The Congress can lower but not raise the appropriation bills. c) Approval of the Budget

After both houses (Congress) have given final approval to the General Appropriation Bill,

it is sent to the President for approval, if he signs, it becomes a law; otherwise he shall veto it within thirty (30) days after he receives it and return the same with his objections for reconsideration. If approved by the two-thirds of all the members of that House, it shall become a law. If the President does not act on the bill within this period, it shall automatically become a law without his signature. Appropriation is an authorization made by law or other legislative enactment, directing the payment of goods and services out of government funds under specified conditions and/or specified purposes General Appropriation Act (GAA) is a law approving the budget appropriation of the government for a certain year. The President signs the General Appropriation Bill into law or what is known as the General Appropriations Act (GAA)

BUDGET EXECUTION: allotment of appropriations and incurrence of obligations It covers the operational phase of budgeting. It is concerned with control of releases, allotment of the appropriations, and incurrence of obligations. On the first working day of the year, DBM issues National Budget Circular No. 528 dated January 3, 2011 for the guidelines on the release of funds for FY 2011 to provide policies, rules and regulations on the implementation of FY 2011 Budget under RA No. 10147 or the GAA the procedural guidelines on the release and utilization of funds and

the policies and procedures on the required budgetary reports

1) DBM issues to agencies/offices/OUs Obligational Authority Allotment is an authorization issued by the DBM which allows agencies/offices to incur obligations up to a specified amount that is within a legislative appropriation as reflected in the advice of allotment Allotment Class: 1. Personal Services (100) 2. Maintenance & Other Operating Expenses (200) 3. Capital Outlays (300) 1) Agency Budget Matrix (ABM) Is a document prepared and issued by the DBM to agencies/regional offices/OUs in which disaggregate the specific appropriation of the agency under the GAA. It serves as the comprehensive release document. The ABM for agency specific budget shall be segregated into Needing Clearance (NC) and Not Needing Clearance (NNC). Authorized Appropriation = Not Needing Clearance (NNC) + Needing Clearance (NC) Needing Clearance portion of the ABM that shall be released to the agency through a SARO upon compliance with certain documentary requirements Confidential and Intelligence Fund Purchase of motor vehicle/motorized equipment Agency built-in lump-sum funds Budgetary provision for unfilled positions Budgetary support/assistance to GOCCs/LGUs Built-in appropriation for use of income (SAGFs) Budgetary provisions w/c provided additional amount for existing programs/projects Budgetary provisions for new items in the agency budget Budgetary items/provisions for conditional implementation, subject to specific guidelines Not Needing Clearance - refers to budgetary items of agency budgets which are considered existing and continuing in nature

- these items do not require clearance/approval/documentation for its implementation NNC = This Release + For Later Release This Release Allotment to be comprehensively released shall be equivalent to: PS 100% of filled positions, compensation adjustments per EO 811/NBC 521 including govt premiums in RLIP, Philhealth and ECIP, PS deficiency due to filling up of positions

MOOE - at least 75% of the Not Needing Clearance portion For Later Release Represents the amount to be released after the periodic review of the agency performance 2) Special Allotment Release Order (SARO) A formal document issued by DBM that notifies agencies of the allotment being authorized and the conditions under which said authority is given. Prior to the implementation of the Simplified Fund Release System, the document issued was the Advice of Allotment. SAROs shall be issued by DBM for the following items: Appropriation items not included in the comprehensive release thru ABM i.e., For Later Release portion Needing Clearance portion of the ABM Charges against multi-user SPFs Adjustments between the NNC and NC portions of the approved ABM

Disbursement Authority MCP contains the monthly programmed requirements for the disbursement authorities needed by the agency in the implementation of program and projects. Notice of Cash Allocation (NCA) a formal document issued by DBM that notifies agency of the cash ceilings made available to cover their cash requirements for the month.

2) Agencies implement program and projects covered by the authorities issued by DBM Obligation is a commitment by a government agency arising from an act of a duly authorized official which binds the government to the immediate or eventual payment of a sum of money.

Disbursements may be by check or by cash. If by check the Modified Disbursement System (MDS) checks which are chargeable against the account of the Treasury of the Philippines or commercial checks which are charged against the agency checking account that are covered by the income of the agency when it is authorized to use its income may be issued.

BUDGET ACCOUNTABILITY: reporting on actual performance against plans In the exercise of the executive power, the President controls all the executive departments, bureaus and offices. The president is immediately and legally accountable to the Congress for the program of government, responsible to the Congress for all he does in more important issues, like the national budget. It is concern on the reporting of actual performance (Budget Accountability Reports - BARs) against planned performance (Budget Execution Documents - BEDs). More specifically, it consists of the preparation and submission of the following requirements: 1) Financial and physical reports of operations. It is the periodic reporting by the agencies of performance under their approved budgets. BEDs BARs Physical and Financial Plan vs. Quarterly Physical Report of Operations Quarterly Financial Report of Operations (FRO) Statement of Allotment, Obligations &Balances (SAOB) 2) Actual cash disbursement and unpaid obligations. It serves as basis for management review of government activities and the fiscal and policy implications. Monthly Cash Program vs. Monthly Report of Disbursements 3) Actions of the Commission on Audit. Such actions assure the fidelity of officials and employees in regard to their handling of government receipts and expenditures.

How does DBM determines the level of agency performance?

Periodic review of agency performance i.e., thru evaluation of agency reports submitted to DBM correlation of actual accomplishments contained in the BARs vis--vis plans and targets contained in the BEDs)

Conduct of inspection/technical visit to agencies to verify/validate the budgetary accounts recorded in the books of accounts ( DBM Inspectorate function pursuant to CL No. 2009-11 dated October 8, 2009 )

Performance of the agency shall be evaluated by correlating its actual accomplishments contained in the BARs vis--vis plans and targets contained in the BEDs.

You might also like

- Iiee Mid-Year Convention 2018Document1 pageIiee Mid-Year Convention 2018napema.educ4790No ratings yet

- 7 Quality Management PrinciplesDocument1 page7 Quality Management Principlesnapema.educ4790No ratings yet

- 3 - Substantive Tests - ProcurmentDocument17 pages3 - Substantive Tests - Procurmentnapema.educ4790No ratings yet

- IPCR FormDocument2 pagesIPCR Formnapema.educ4790100% (1)

- Pasta RecipesDocument119 pagesPasta RecipesAnonymous ZS72lgKE100% (13)

- Learning Organization PDFDocument30 pagesLearning Organization PDFnapema.educ4790No ratings yet

- Patrol 117 Neighborhood Watch - A PrimerDocument9 pagesPatrol 117 Neighborhood Watch - A Primernapema.educ4790No ratings yet

- Pasta RecipesDocument119 pagesPasta RecipesAnonymous ZS72lgKE100% (13)

- Learning Organization PDFDocument30 pagesLearning Organization PDFnapema.educ4790No ratings yet

- Concepts ProcurementDocument36 pagesConcepts Procurementnapema.educ4790No ratings yet

- Resources For Human HealthDocument56 pagesResources For Human Healthnapema.educ4790No ratings yet

- Human Resource Management System FrameworkDocument5 pagesHuman Resource Management System Frameworknapema.educ4790No ratings yet

- Impact of Ideology On Public PolicyDocument21 pagesImpact of Ideology On Public Policynapema.educ4790No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- GPM - Vol.3Document124 pagesGPM - Vol.3ringofskyNo ratings yet

- TransformerDocument14 pagesTransformernapema.educ4790No ratings yet

- Hrms MissionDocument1 pageHrms Missionnapema.educ4790No ratings yet

- 09amended Guidelines CPESDocument26 pages09amended Guidelines CPESBee LeeNo ratings yet

- Employer of Last ResortDocument8 pagesEmployer of Last Resortnapema.educ4790No ratings yet

- Infra Project Procurement Updated 2016Document111 pagesInfra Project Procurement Updated 2016napema.educ4790No ratings yet

- Basic Elec 1Document41 pagesBasic Elec 1Eric RodriguezNo ratings yet

- Hrms MissionDocument1 pageHrms Missionnapema.educ4790No ratings yet

- Culinary Conversion TableDocument4 pagesCulinary Conversion Tablenapema.educ4790No ratings yet

- Into The Future... Ready To Be A Global Skilled ProfessionalDocument65 pagesInto The Future... Ready To Be A Global Skilled Professionalnapema.educ4790No ratings yet

- The History of 911 Emergency CallsDocument2 pagesThe History of 911 Emergency Callsnapema.educ4790No ratings yet

- Hrms MissionDocument1 pageHrms Missionnapema.educ4790No ratings yet

- Article Book - DecisiveDocument23 pagesArticle Book - DecisiveJoe EllieNo ratings yet

- Personnel EffectivenessDocument15 pagesPersonnel Effectivenessnapema.educ4790No ratings yet

- Labour Market Policies in Times of CrisisDocument47 pagesLabour Market Policies in Times of Crisisnapema.educ4790No ratings yet

- Cultural Fair For Workers by WorkersDocument3 pagesCultural Fair For Workers by Workersnapema.educ4790No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Argumentative Essay - Block TypeDocument8 pagesArgumentative Essay - Block Typeztuzuner_yeditepe100% (2)

- Global Citizen Essay 2Document3 pagesGlobal Citizen Essay 2api-504434498No ratings yet

- Ajit Singh v. State of Punjab - Decision of 28.01.70Document12 pagesAjit Singh v. State of Punjab - Decision of 28.01.70jusnremNo ratings yet

- European Institutions OverviewDocument7 pagesEuropean Institutions OverviewRăzvan BlagaNo ratings yet

- 2018 Alp National Platform ConstitutionDocument310 pages2018 Alp National Platform ConstitutionMichael SmithNo ratings yet

- Cases Scope of CopyrightDocument39 pagesCases Scope of CopyrightEla Dwyn CordovaNo ratings yet

- US District Court Affidavit Charges Interstate Flight, Impeding OfficerDocument4 pagesUS District Court Affidavit Charges Interstate Flight, Impeding OfficerOff The wallNo ratings yet

- Nrega FormatDocument3 pagesNrega Formatrajt_26No ratings yet

- Motion to Reduce Bail PhilippinesDocument4 pagesMotion to Reduce Bail PhilippinesRL AVNo ratings yet

- The Essential Services Maintenance Act, 1981Document6 pagesThe Essential Services Maintenance Act, 1981Anish NaniNo ratings yet

- Apsa Style GuideDocument4 pagesApsa Style GuideJelena NovakovićNo ratings yet

- Placer vs. Villanueva, 126 SCRA 463 Case DigestDocument2 pagesPlacer vs. Villanueva, 126 SCRA 463 Case DigestElla Kriziana CruzNo ratings yet

- NUALS Internal Moot - 151 - Memorial For The PetitionerDocument16 pagesNUALS Internal Moot - 151 - Memorial For The PetitioneralbertNo ratings yet

- BP - Group Assignment - Artistry Ent. Business Plan. Ent300Document50 pagesBP - Group Assignment - Artistry Ent. Business Plan. Ent300Mohd ZulfaqarNo ratings yet

- Role of Media in National Integration</h1Document7 pagesRole of Media in National Integration</h1aleenaahmedNo ratings yet

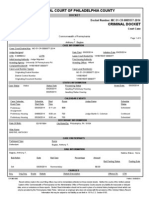

- Anthony Bagtas - Philadelphia Court DocketDocument3 pagesAnthony Bagtas - Philadelphia Court DocketPenn Buff NetworkNo ratings yet

- Telmo V RepublicDocument8 pagesTelmo V RepublicadeeNo ratings yet

- Conplete Text - Constitutional Law II LB401 CK 15-2-2019 PDFDocument389 pagesConplete Text - Constitutional Law II LB401 CK 15-2-2019 PDFabhijeet raiNo ratings yet

- BureaucracyDocument19 pagesBureaucracyJohnNo ratings yet

- Silent Features & Characteristics of The Constitution.Document18 pagesSilent Features & Characteristics of The Constitution.harshNo ratings yet

- Cr. P CDocument59 pagesCr. P CSonali SinghNo ratings yet

- 21 MORILLO VS. PEOPLEGR No. 198270, December 9, 2015Document4 pages21 MORILLO VS. PEOPLEGR No. 198270, December 9, 2015Dexter Lee GonzalesNo ratings yet

- Van Leeuwen v. Van Leeuwen, Ariz. Ct. App. (2014)Document7 pagesVan Leeuwen v. Van Leeuwen, Ariz. Ct. App. (2014)Scribd Government DocsNo ratings yet

- Addis Ababa City Government Charter Proclamation SummaryDocument12 pagesAddis Ababa City Government Charter Proclamation SummaryAyeleNo ratings yet

- Investigation of house break-insDocument4 pagesInvestigation of house break-insVenkanna UppulaNo ratings yet

- RA 9344 As Amended by RA 10630 Juvenile JusticeDocument63 pagesRA 9344 As Amended by RA 10630 Juvenile JusticeJoan Dymphna Saniel100% (4)

- Councilman Devyn Keith New Trial Date SetDocument2 pagesCouncilman Devyn Keith New Trial Date SetFOX54 News HuntsvilleNo ratings yet

- Career Exploration Research PaperDocument6 pagesCareer Exploration Research PaperLanzen DragneelNo ratings yet

- Age of EnlightenmentDocument28 pagesAge of EnlightenmentRamesh LalfalaNo ratings yet

- Sri Lanka Reflections On The Impeachment and The Constitution PDFDocument155 pagesSri Lanka Reflections On The Impeachment and The Constitution PDFSanjeewa PereraNo ratings yet