Professional Documents

Culture Documents

Department of Labor: 4-SWA-CAP-ETA-362-A-87-Checklist

Uploaded by

USA_DepartmentOfLaborOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Labor: 4-SWA-CAP-ETA-362-A-87-Checklist

Uploaded by

USA_DepartmentOfLaborCopyright:

Available Formats

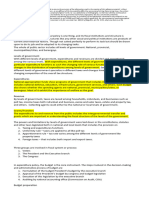

Cost Allocation Plan using ETA Handbook No.

362 - Checklist

OMB Circular A-87 - State & Local Governments

State Workforce Agencies

1. Submit once unless changes are observed:

____1a. Organizational chart,

____1b. Employee time sheet sample, providing for distribution of hours to

direct/indirect functions.

____1c. Cost Policy Statement, describing all accounting policies and narrating in

detail the proposed Cost Allocation Plan. This plan must describe the

procedures used to identify, measure and allocate all costs to each benefiting

activity. This policy must be signed by a duly authorized official.

2. A Cost Allocation Plan providing the following schedules:

____2a. Personnel Costs Worksheet, including fringe benefits breakdown.

____2b. Allocation of Personnel Worksheet, providing indirect/direct time charges.

____2c. Fringe Benefits Worksheet, if fringes are not directly and indirectly identified.

____2d. Statement of Total Costs, segregated between the indirect and direct costs

incurred by line item of expense (salaries, fringes, rent, etc.), identified by

Federal agency, specific government grant, contract, and other non-Federal

activities.

Note that the allocation base and the amount of A&ST costs allocated to each

funding source should be identified.

3. ____ Financial statements (audited if available) for the applicable fiscal year. Approved

budget for provisional proposal, if needed. Note: The Statement of Total Costs (2d.

above) must reconcile to Financial Statements. If not, please provide a reconciliation

statement.

4. ____Signed and dated Certificate of Indirect Costs (sample form is provided in the DCD

website).

5. ____A listing of grants and contracts by all funding sources, total dollar amount, period

of performance, and the indirect cost limitations (if any) applicable to each, such as

amounts restricted by administrative or statutory regulations, applicable to the period(s)

of the proposal(s). This listing should also be supported by the approved Federal grant or

contract notification award(s).

6. ____A schedule listing any funding sources excluded from A&ST allocations and the

reasons for the exclusions.

7. ____Copy of HHS approved SWCAP, if SWCAP costs are allocated to federal programs.

8. ____A list of all non-UI programs that utilize the UI tax collection system. A separate

tax sharing agreement must be negotiated prior to the collection of non-UI funds using

the UI tax collection system.

9. ____Support for the budgetary rate calculation, if a rate is requested.

You might also like

- ACCOUNTING SYSTEM OVERVIEWDocument11 pagesACCOUNTING SYSTEM OVERVIEWRALLISONNo ratings yet

- PART III of The Hand-OutsDocument13 pagesPART III of The Hand-OutsAce Hulsey TevesNo ratings yet

- PART III of The Hand OutsDocument13 pagesPART III of The Hand OutsJudyeast AstillaNo ratings yet

- Fiscal AdministrationDocument11 pagesFiscal Administrationattykate caydaNo ratings yet

- Government Accounting Punzalan Solman Chap 2Document6 pagesGovernment Accounting Punzalan Solman Chap 2Alarich Catayoc100% (1)

- Budget Cycle & Process ExplainedDocument7 pagesBudget Cycle & Process ExplainedMebrahtomNo ratings yet

- National Budget FrameworkDocument5 pagesNational Budget FrameworkAngelica RubiosNo ratings yet

- Government Accounting - : ReviewerDocument3 pagesGovernment Accounting - : ReviewerRich Ann Redondo Villanueva100% (1)

- PUBLIC FINANCE Midterm 01 3Document4 pagesPUBLIC FINANCE Midterm 01 3ocampojohnoliver1901182No ratings yet

- Chapter 2Document12 pagesChapter 2Yitera SisayNo ratings yet

- Chapter 2.1 The Logic of The Budget ProcessDocument20 pagesChapter 2.1 The Logic of The Budget ProcessNeal MicutuanNo ratings yet

- PFA Final Exam October 2022Document4 pagesPFA Final Exam October 2022Jay PugonNo ratings yet

- 10) BudgetingDocument5 pages10) BudgetingAlbert Krohn SandahlNo ratings yet

- Chapter 1Document20 pagesChapter 1Kelly CardejonNo ratings yet

- CHAPTER 2..ritchelle DelgadoDocument40 pagesCHAPTER 2..ritchelle DelgadonicahNo ratings yet

- The Budget ProcessDocument22 pagesThe Budget ProcessFrank James100% (1)

- 2nd G-Reporters Ir - (Reporter 1,2,3)Document4 pages2nd G-Reporters Ir - (Reporter 1,2,3)Nurhoda HADJIMONERNo ratings yet

- Chapter 3 - BudgetDocument17 pagesChapter 3 - BudgetDesiree Faith GaholNo ratings yet

- Budget Execution, Monitoring and Reporting of Government AccountingDocument13 pagesBudget Execution, Monitoring and Reporting of Government AccountingKathleenNo ratings yet

- Web-GlossaryDocument11 pagesWeb-Glossarymulpuru1104No ratings yet

- Chapter Three The Budget Cycle/ProcessDocument17 pagesChapter Three The Budget Cycle/ProcessWendosen H Fitabasa100% (1)

- Accounting for Budgetary AccountsDocument11 pagesAccounting for Budgetary AccountsFred Michael L. Go100% (1)

- Budget Estimate, Revised Estimate, Performance BudgetDocument7 pagesBudget Estimate, Revised Estimate, Performance Budgetmeghana0% (2)

- Budgeting Quiz BeeDocument27 pagesBudgeting Quiz BeeMariaCarlaMañagoNo ratings yet

- Budget estimate, revised estimate, performance budget explainedDocument6 pagesBudget estimate, revised estimate, performance budget explainedTsering Paldon100% (3)

- Spending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)Document6 pagesSpending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)tvanootNo ratings yet

- Scribd DownloadDocument20 pagesScribd DownloadQuite VairaNo ratings yet

- Chapter Three FundDocument9 pagesChapter Three FundnaodbrtiNo ratings yet

- Government Accounting Written ReportDocument14 pagesGovernment Accounting Written ReportMary Joy DomantayNo ratings yet

- AC316 Module 8Document5 pagesAC316 Module 8Jaime PalizardoNo ratings yet

- Budget Execution & Accountability: Key Phases and ReportsDocument18 pagesBudget Execution & Accountability: Key Phases and ReportsLeila OuanoNo ratings yet

- My ReportDocument16 pagesMy ReportNicah RegondolaNo ratings yet

- Public Sector Accounting CHAPTER TWODocument9 pagesPublic Sector Accounting CHAPTER TWOPhil SatiaNo ratings yet

- Sec. 1. Legal Basis. The Government Accounting Manual (GAM) Is Prescribed by COADocument3 pagesSec. 1. Legal Basis. The Government Accounting Manual (GAM) Is Prescribed by COAElla Mae TuratoNo ratings yet

- Philippine Budget Cycle ProcessDocument5 pagesPhilippine Budget Cycle ProcessMaria Jessamae Caylaluad SaronhiloNo ratings yet

- Budget Execution MonitoringDocument4 pagesBudget Execution Monitoringimsana minatozakiNo ratings yet

- Budgetary Accounts and Systems ExplainedDocument4 pagesBudgetary Accounts and Systems ExplainedMoises A. Almendares0% (1)

- Accounts Payable Are Those AccountsDocument21 pagesAccounts Payable Are Those AccountsAustin Grace WeeNo ratings yet

- CHAPTER 2..ritchelle Delgado.1Document39 pagesCHAPTER 2..ritchelle Delgado.1richelledelgadoNo ratings yet

- National Budget's New FaceDocument12 pagesNational Budget's New FaceraineydaysNo ratings yet

- Aragones AccntgGovt&NonProfitOrgs Ass1Document6 pagesAragones AccntgGovt&NonProfitOrgs Ass1Jamie Rose AragonesNo ratings yet

- Common Budget Terminologies & ConceptDocument34 pagesCommon Budget Terminologies & ConceptCarl MasstownNo ratings yet

- Subashini U Final ReportDocument39 pagesSubashini U Final ReportPonselviNo ratings yet

- New Government Accounting SystemDocument2 pagesNew Government Accounting SystemOwdray CiaNo ratings yet

- Gov Acc 2019 JaaDocument9 pagesGov Acc 2019 JaaGlaiza Lerio100% (1)

- PART 1. TRUE or FALSE. Write The Word TRUE or FALSE On Your Answer Sheet. No Erasures AllowedDocument1 pagePART 1. TRUE or FALSE. Write The Word TRUE or FALSE On Your Answer Sheet. No Erasures Allowedtough mamaNo ratings yet

- Chapter 1Document30 pagesChapter 1Yitera SisayNo ratings yet

- ST ND: AC 41 - 1 Sem, A.Y. 2019-2020Document13 pagesST ND: AC 41 - 1 Sem, A.Y. 2019-2020kenn anoberNo ratings yet

- Description: Tags: CostplanDocument8 pagesDescription: Tags: Costplananon-537041No ratings yet

- MPA 103 BUDGETARY PROCESS For NGADocument15 pagesMPA 103 BUDGETARY PROCESS For NGAJan Paul ValdoviezoNo ratings yet

- Accounting for Budgetary AccountsDocument63 pagesAccounting for Budgetary Accountselisha mae cardeñoNo ratings yet

- Management AccountingDocument87 pagesManagement AccountingYashveer MachraNo ratings yet

- Cost Allocation Plans and Indirect Cost Rates GuideDocument39 pagesCost Allocation Plans and Indirect Cost Rates GuideRitesh RamanNo ratings yet

- Essentials of Effective BudgetingDocument5 pagesEssentials of Effective Budgetingmba departmentNo ratings yet

- What Is The General Accounting Plan of Government Agencies/units?Document2 pagesWhat Is The General Accounting Plan of Government Agencies/units?Che CoronadoNo ratings yet

- Government BudgetingDocument6 pagesGovernment BudgetingMariaCarlaMañago100% (1)

- Answers To Multiple Choice Government AccountingDocument10 pagesAnswers To Multiple Choice Government AccountingJP Taccad Romero63% (8)

- Budget ExecutionDocument22 pagesBudget Executionrizza maeNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Department of Labor: Dst-Aces-Cps-V20040123Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040123USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Dst-Aces-Cps-V20040617Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040617USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop2stickerDocument1 pageDepartment of Labor: Stop2stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Forkliftsticker6Document1 pageDepartment of Labor: Forkliftsticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop1sticker6Document1 pageDepartment of Labor: Stop1sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ForkliftstickerDocument1 pageDepartment of Labor: ForkliftstickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop1stickerDocument1 pageDepartment of Labor: Stop1stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop2sticker6Document1 pageDepartment of Labor: Stop2sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: BookmarkDocument2 pagesDepartment of Labor: BookmarkUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 3Document1 pageDepartment of Labor: JYMP 8x11 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 1Document1 pageDepartment of Labor: JYMP 8x11 1USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 1Document1 pageDepartment of Labor: JYMP 11x17 1USA_DepartmentOfLaborNo ratings yet

- Department of Labor: LindseyDocument1 pageDepartment of Labor: LindseyUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: KonstaDocument1 pageDepartment of Labor: KonstaUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 2Document1 pageDepartment of Labor: JYMP 11x17 2USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthConstructDocument1 pageDepartment of Labor: YouthConstructUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 2Document1 pageDepartment of Labor: JYMP 8x11 2USA_DepartmentOfLaborNo ratings yet

- Hughes to Connect 5,000 Panchayats via ISRO SatellitesDocument2 pagesHughes to Connect 5,000 Panchayats via ISRO SatellitesMEENA J RCBSNo ratings yet

- Patterson, O'Malley & Story PDFDocument14 pagesPatterson, O'Malley & Story PDFSanja JankovićNo ratings yet

- Product-Market Fit CanvasDocument2 pagesProduct-Market Fit CanvasJesús AlfredoNo ratings yet

- 100 Portraits PDFDocument103 pages100 Portraits PDFevelinpirajanNo ratings yet

- Request For Proposal (RFP) For Designing and Developing of Short 2D Animation (Character Based) VideosDocument6 pagesRequest For Proposal (RFP) For Designing and Developing of Short 2D Animation (Character Based) VideosArif Khan NabilNo ratings yet

- André Antoine's Passion for Realism in the Théâtre-LibreDocument31 pagesAndré Antoine's Passion for Realism in the Théâtre-LibretibNo ratings yet

- Hilcoe School of Computer Science & Technology: Web-Based Crime Records Management System (CRMS)Document14 pagesHilcoe School of Computer Science & Technology: Web-Based Crime Records Management System (CRMS)kaleab takeleNo ratings yet

- LinkedIn Tips from Top Experts: 200+ StrategiesDocument66 pagesLinkedIn Tips from Top Experts: 200+ Strategiesmariiusssica2008100% (1)

- Budgeting: Faculty of Nursing Zagazig University Master Degree Second TermDocument11 pagesBudgeting: Faculty of Nursing Zagazig University Master Degree Second Termheba abd elazizNo ratings yet

- Investigation Data Form - Office of The City ProsecutorDocument1 pageInvestigation Data Form - Office of The City ProsecutorJazz TraceyNo ratings yet

- The Theory of Neo-Colonialism and its Mechanisms of ControlDocument3 pagesThe Theory of Neo-Colonialism and its Mechanisms of ControlKhizerHayatNo ratings yet

- Robert Cialdini - The Power of Persuasion An Executive Briefing Robert Cialdini - NegotiationDocument4 pagesRobert Cialdini - The Power of Persuasion An Executive Briefing Robert Cialdini - Negotiationapi-3804479100% (5)

- SCM AssignmentDocument37 pagesSCM AssignmentAaradhya DixitNo ratings yet

- The Study Timetable of SMM Grade - 7 (B) : Day Time Mon Tues Wed Thurs Fri Sat SunDocument1 pageThe Study Timetable of SMM Grade - 7 (B) : Day Time Mon Tues Wed Thurs Fri Sat SunRichardNo ratings yet

- 4 People V XXX and YYYDocument2 pages4 People V XXX and YYYCedrickNo ratings yet

- Business Management 3 Assignment 1Document9 pagesBusiness Management 3 Assignment 1Matias Bafana Nghiludile100% (1)

- Week-18 - New Kinder-Dll From New TG 2017Document8 pagesWeek-18 - New Kinder-Dll From New TG 2017Marie banhaonNo ratings yet

- Capitalism & Climate ChangeDocument4 pagesCapitalism & Climate ChangeHendra Manurung, S.IP, M.ANo ratings yet

- Cyberactivism and Citizen Journalism in Egypt Digital Dissidence and Political Change by Courtney C. Radsch (Auth.)Document364 pagesCyberactivism and Citizen Journalism in Egypt Digital Dissidence and Political Change by Courtney C. Radsch (Auth.)gregmooooNo ratings yet

- Recruitment of A StarDocument10 pagesRecruitment of A StarPikaa Aziz100% (2)

- COMELEC powers disqualification candidates electionsDocument6 pagesCOMELEC powers disqualification candidates electionsAustine Clarese VelascoNo ratings yet

- Class 10 History - Chapter 2: The Nationalist Movement in Indo-China Social ScienceDocument4 pagesClass 10 History - Chapter 2: The Nationalist Movement in Indo-China Social ScienceParidhiNo ratings yet

- Organizational Justice, Ethics and Corporate Social ResponsibilityDocument29 pagesOrganizational Justice, Ethics and Corporate Social Responsibilityوائل مصطفىNo ratings yet

- 2022 03 17T21 31 57 - R3dlogDocument5 pages2022 03 17T21 31 57 - R3dlogda suaNo ratings yet

- Appr Man CH 01 PDFDocument7 pagesAppr Man CH 01 PDFJeyakar PrabakarNo ratings yet

- Cell Outage Detection and Compensation (eRAN15.1 - 01)Document42 pagesCell Outage Detection and Compensation (eRAN15.1 - 01)waelq2003No ratings yet

- ABI Radar and Electronic Warfare Principles For Non Specialists PDFDocument1 pageABI Radar and Electronic Warfare Principles For Non Specialists PDFshilpa_rehalNo ratings yet

- Module 8Document2 pagesModule 8prof_ktNo ratings yet

- Nokia Utility Community Broadband Brochure ENDocument14 pagesNokia Utility Community Broadband Brochure ENEssa Porcaria de JogoNo ratings yet

- International Marketing Entry StrategiesDocument10 pagesInternational Marketing Entry Strategiesamitmonu1979100% (1)