Professional Documents

Culture Documents

Overall 2zz

Uploaded by

Xerez SathishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Overall 2zz

Uploaded by

Xerez SathishCopyright:

Available Formats

PART A DEFINITION OF INTERESTS; Interest definition means that the cost of borrowing money or fee paid on borrowed asets.

Interest is the price that you need to pay because you are borrowed money or, money earned by deposited funds.An interest rate is the cost stated as a percent of the amount borrowed per period of time, usually one year and one month. The aim of interest is to bear the risk of currency collapse in the future. Beside that, it is to bear loss towards lender because postponing loan. The lender or bank will increase the interest because the possibility the the value of money might be in increase during the term of the loan. If they not increase the interest the lender will loss. For example : When you take a loan out from a bank, or wherever, they will expect you to pay interest. This means that you pay back what you took out on a loan, plus extra money. So for example, if you took a loan out for RM500, and let's say you have to pay it back with 15% interest, you would pay back RM575. The ability to calculate interest is a vital part of understanding how well you are managing your finances. Not only is interest likely a major player in whatever debt you may owe, but it can also be a key factor in making your money grow.

HOW TO CALCULATE INTEREST ON A LOAN 1. Take a RM10,000 loan from your banking institution for 1 year and assume you have to pay RM100 interest for one year, with a stated interest rate of 5%. 2. Calculate the effective loan rate = Interest divided by Principal or RM100/RM10,000 = 5%.Your APR annual percentage rate is equal to the previous stated rate. 3. Currently personal lines of credit loans and home mortgage loans will range from the low 5% to the high 12-15% interest. Typically lines of credit will require a cosigner and home loans often need at least 10-20% down to make the deal work. 4. Right now is a tough time to get a loan at a bank but if you have collateral such as other properties to leverage or a car that is newer than 10 years you can use them to borrow more money. Life insurance, stocks, bonds, and other investments are also subject to be used as collateral.

SIMPLE INTEREST Simple interest is calculated on the original principal only. Simple interest is normally used for a single period of less than a year, such as 30 or 60 days. The simple interest can calculate according to the following formula: Formula to find simple interest: Simple Interest = p x i x n where: Interest = the total amount of interest paid, the amount lent or borrowed, the percentage of the principal charged as interest each year. The rate is expressed as a decimal fraction, so percentages must be divided by 100. For example, if the rate is 15%, then use 15/100 or 0.15 in the formula. Time (n) = is the time in years of the loan.

Principal (p) = Rate (i) =

or you can use the second formula : = Amount in Ringgit Malaysia X interest rate % X time ( in year,month ) = total

For example: Saiful borrowed RM 20,000 from the bank to purchase a car. He agreed to repay the amount in 10 months, plus simple interest at an interest rate of 10% per year. If shaida repay the full amount of RM 20,000 in eight months, the interest would be : Solution; Amount in RM X interest rate X time

= RM 20,000 = RM 1666.67

X 10%

X 10 month

If he repays the amount of RM 20,000 in fifteen months, the only change is with time. Therefore, his interest would be: Solution: = RM 20,000 X 10% X 15 month = RM 2500.00

Example 2 : If RM 5000 is invesed for 2 years at an annual interest rate of 10%, how much interest will be received at the end of the 2 year period? Solution: I = RM 5000(0.10)(2) = RM 1000

S = RM 5000 + RM 1000 = RM 6000 Three other variations of this formula are used to find P, R and T: P= I RT R= I PT T= I PR

Simple interest problems can involve lending or borrowing. In both cases the same formulas are used. Whenever money is borrowed, the total amount to be paid back equals the principal borrowed plus the interest charge: total repayments = ( principal + interest ) Usually the money is paid back in regular instalments, either monthly or weekly. To calculate the regular payment amount, you divide the total amount to be repaid by the number of months ( or weeks ) of the loan. Like this: monthly payment amount = principal + interest loan period,T,in months or weekly payment amount = principal + interest loan period,T,in weeks

To convert the loan period, 'T', from years to months, you multiply it by 12, since there are 12 months in a year. Or, to convert 'T' to weeks, you multiply by 52, because there are 52 weeks in a year.

The example problem below shows you how to use these formulas: Example: A student purchases a computer by obtaining a simple interest loan. The computer costs RM1500, and the interest rate on the loan is 12%. If the loan is to be paid back in weekly instalments over 2 years, calculate : 1. The amount of interest paid over the 2 years, 2. the total amount to be paid back, 3. the weekly payment amount. Given: principal: 'P' = RM1500, interest rate: 'R' = 12% = 0.12, repayment time : 'T' = 2 years Part 1: Find the amount of interest paid. interest: 'I' = PRT = 1500 0.12 2 = RM360 Part 2: Find the total amount to be paid back. total repayments = principal + interest = RM1500 + RM360 = RM1860 Part 3: Calculate the weekly payment amount total repayments ----------------------------------loan period, T, in weeks

weekly payment amount =

= =

RM1860 ------------------2 52 RM17.88 per week

Table of Payment Per Month (Simple Interest) RM 3000 4000 5000 6000 7000 8000 9000 10000 11000 12000 13000 14000 12000 Period ( Month) 310.00 414.00 517.00 620.00 724.00 827.00 930.00 1,034.00 1,137.00 1,240.00 1,344.00 1,447.00 1,550.00

Table of payment are based on 2% interests per month. (source : CIMB Islamic Bank)

COMPOUND INTEREST A second method that you can paying interest is the compound interest method. Compound interest means where the interest for each period is added to to the principal before interest is calculated for the next period. Its means this principal will grow as the interest is added to it. This method is used in investment such as saving accounts. Formula : interest year 1 = p x i x n = 10,000 x .05 x 1 = 500 interest year 2 = (p2 = p1 + i1) x i x n = (10,000 + 500) x .05 x 1 = 525 interest year 3 = (p3 = p2 + i2) x i x n = (10,500 + 525) x.05 x 1 = 551.25 For example:

Faizah want to buy a car. She borrowed RM 30,000 in 3 years at 5% annual interest compounded annually: The principal for the first year is RM 30,000. The interest at end of the first year is

I = RM 30,000(0.05)(I) = RM 1500 The amount at the end of the first year is

S = P + I = RM 30,000 + RM 1500 = RM 31,500 The principal for the second year is RM 31,500. The interest at the end of the second year is I = RM 31,500(0.05)(1) = RM 1575 The amount at the end of the second year is

S = P + I = RM 31,500 + RM 1575 = RM 33,075 The principal for the third year is RM 33,075

The interest at the end of the third year is I = RM 33,075(0.05)(1) = RM 1653.75 The amount at the end of the end year is S= P + I = RM 33,075 + RM 1653.75 = RM 34,728.75

Formula: 9

S = P(1 + I )n. If RM 5000 is invested for 5 years at 9%, compunded annually, how much interest is earned? Solution: S= P (1 + I ) n

S = RM 5000(1 + 0.09)5 = RM 5000(1.5386) = RM 7693.1198 = RM 7693.12, to the nearest cent. Since RM 5000 of this amount was the original investment, the nearest earned is RM 7693.12 RM 5000 = RM 7693. 12

Compound Amount: Formula :

If RMP invested for t years at a nominal interest rate, j , compunded m times per year, then the total number of compounding period is n = mt, the interest rate per compounding period is i= j , m and the compound amount is

10

S = P(1 + i )n = P (1+ j )mt m Example:

If RM 8000 is invested for 6 years at 8%, compounded quarterly, find (a) the compound amound, (b) the compound interest.

Solution: (a) Since P = RM 8000, t = 6 years, j = 0.08, and m = 4 compounding periods per year, the compound amount is given by S = P( 1 + j )mt m = RM 8000(1 + 0.08) 4.6 = RM 8000(1 + 0.02)24

= RM 8000(1.608437) = RM 12,867.50 (b) The compound interest is given by RM 12,867.50 RM 8000 = RM 4867.50 Example 2: If RM 1000 is invested for 3 years at 6%, compounded quarterly (four times a year), what interest is earned?

Solution:

11

Since P = RM 1000, t = 3 years, j = 0.09, and m = 4 compounding periods per year, the total number of compounding period is

N = (4)(5) = 20, The interest rate per period is I = 0.09 = 0.015 4 Compound amount is S = = = = = P(1 = i)n RM 1000(1 + 0.015) RM 1000(1.346855) RM 1346.8557 RM 1346. 86.

The interest is RM 1346.86 RM 1000 = RM 346.8

Table of Monthly Payment (Compound Interest) RM 12 3000 4000 5000 6000 7000 310.00 414.00 517.00 620.00 724.00 Period (month) 24 185.00 247.00 309.00 370.00 432.00 36 144.00 192.00 239.00 287.00 335.00 48 123.00 164.00 205.00 245.00 286.00

12

8000 9000

827.00 930.00

494.00 555.00 617.00

383.00 430.00 478.00

327.00 368.00 409.00

10000 1,034.00

Table of payment are based on 2% interests per month. (source : CIMB Islamic Bank)

Additional Information Try to keep the interest you pay to a minimum. Your money will grow faster if you pay little to nothing in interest compared to what you receive in interest or appreciation of investments. This means paying off debts before you worry about investing, because your creditors are likely going to charge a higher interest rate than the interest rate any investment will pay out (with the possible exception of low-interest mortgages and student loans). When you have debt, it really is better to give than receive. Keep in mind that when interest is compounded, it is often broken up into smaller amounts. For example, a 12 percent annual rate that is compounded monthly would result in 1 percent being compounded 12 times, which makes for 12.68 percent interest over a year. You can see for yourself if you follow the formula.

13

Calculation of All Type of Interests. 1. Know what the entire amount drawing interest is. This is the principal. For this example, let's say the principal is RM10,000.

2.

Decide if you want to calculate simple interest or compound interest. Simple interest is a one-time charge. Compound interest builds on itself from one period to the next. It could be compounded yearly, monthly or even daily.

3.

To calculate simple interest, take the interest rate and divide by 100. If your

interest rate is 7 percent, this would turn it into .07. Now multiply that decimal by the amount of the principal (which is RM10,000 in our example) to get the interest. In this case, it would be RM700.

4.

Calculating compound interest is more complicated. Suppose your 7 percent

interest is compounded every year, and it is for an investment, not a debt. That means RM10,000 turns into RM10,700 after one year. The following year you would earn interest of .07 multiplied by RM10,700, which equals RM749. Now the total comes to RM11,449.

5.

If you need to calculate compound interest over more than just a few periods

of time, it is easier to use a formula instead of repeating a calculation over and over.

14

To do this, first add a 1 to your interest rate decimal. Therefore a 7 percent rate would become 1.07.

6.

Then convert this number to the power of your number of times the interest is

compounded. If it is once a year for 12 years, then it would be 1.07 to the 12th power, which equals 2.25. That means your money will have grown 2.25 times at the end of 12 years.

PART B

i) Comparison Between Laptop/Printer Prices

Package A Items * Laptop Model Printer Model

Package B Laptop Model Printer Model

Package C Laptop Model Printer Model

Model

Asus U43JCWX042V RM 3,999

Canon Ip100 RM988

HP Pavilion dv32110TX

Canon iX4000

HP Pavilion dv41412TX RM 3,999

Canon LBP3300 RM818

Prices Total

RM 3,699 RM 1,068 RM 4,767

RM4,987

RM 4,817

15

Prices Table 1.1

ii) Personal Bank Loan We have reviewed the three banks (Maybank,CIMB Bank and BSN) in the town of Kuala Lipis which offering different interest rates for a loan of RM5000.

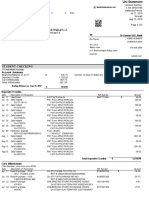

1) Maybanks Monthly Payment Schedule Interests Loan Amount RM/Month 5,000 10,000 11% Period/s 12 24 36 48 60

Monthly Repayment (RM) 462.50 925.00 254.17 508.33 184.72 369.44 150.00 300.00 129.17 258.33

16

15,000 20,000 25,000

1,387.00 1850.00 2,291.67

762.50 1,016.67 1,250.00

554.17 738.89 902.78 Table 1.2

450.00 600.00 729.17

387.50 516.67 625.00

Calculation for the Repayment of Bank Loans

The payment of bank loans by RM5000 for a period of three years for every month is RM184.72. Principal : RM 5000 Interest : 11%

RM 184.72 x 36 (month) = RM 6649.92 (repayment for 3 years) RM 6649.92 RM 5000.00 = RM1649.90 (bank interest) 2) CIMBs Monthly Payment Schedule Interests Loan Amount RM/Month 3,000 4,000 5,000 6,000 7,000 24% Period/s 12 24 36 48 60

Monthly Repayment (RM) 310.00 414.00 517.00 620.00 724.00 185.00 247.00 309.00 370.00 432.00 144.00 192.00 239.00 287.00 335.00 Table 1.3 123.00 164.00 205.00 245.00 286.00 110.00 147.00 184.00 220.00 257.00

Calculation for the Repayment of Bank Loans

17

The payment of bank loans by RM5000 for a period of three years for every month is RM239.00. Principal : RM 5000 Interest : 24%

RM 239.00 x 36 (month) = RM 8604.00. (repayment for 3 years) RM 8604.00 RM 5000.00 = RM3604.00 (bank interest)

3) BSNs Monthly Payment Schedule Interests Loan Amount RM/Month 5,000 10,000 15,000 20,000 25,000 3.15% Period/s 12 24 36 48 60 4.75%

Monthly Repayment (RM) 430.00 860.00 1,290.00 1,720.00 2,149.00 222.00 443.00 665.00 886.00 1,108.00 159.00 318.00 477.00 635.00 794.00 Table 1.4 124.00 248.00 372.00 406.00 620.00 104.00 207.00 310.00 413.00 516.00

Calculation for the Repayment of Bank Loans

18

The payment of bank loans by RM5000 for a period of three years for every month is RM159.00. Principal : RM 5000 Interest : 4.75%

RM 159.00 x 36 (month) = RM 5724.00. (repayment for 3 years) RM 5724.00 RM 5000.00 = RM724.00 (bank interest)

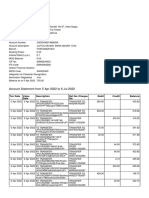

iii) Comparison Between the Personal Loan.

Bank Maybank CIMB BSN

Interests Rate (%) 11% 24% 4.75%

Loan Amount (each month)/RM 184.72 239.00 159.00 Table 1.5

Loan Amount (3 years)/RM 6649.92 8604.00 5724.00

Bank Interest/RM 1649.90 3604.00 724.00

19

Table 1.6

Based on the above chart, we can analyze that all banks charge different interest rates in loans made. For example, Maybank impose an interest rate of 11%, CIMB 24%, while BSN 4.75% for loans for a year. Based on the comparison of interest rates for the three banks, BSN interest rates is the lowest interest, while CIMB charge the highest interest rate. From these comparisons, we can conclude that the most suitable bank for us, as a student loan is the bank BSN. iv) Monthly Budget Proposal and Annual Expenses Monthly Budget Details___________________________Total (RM)

c

INCOME Allowance Pocket Money from Parents Total

c

430.00 150.00 580.00

EXPENDITURE Foods Topup 300.00 30.00

20

Others Total Total Expenditure_________ Balance________________

50.00 _380.00 380.00 200.00

Annualy Budget Details___________________________Total (RM)

c

INCOME Allowance Pocket Money from Parents Total

d

5160.00 1800.00 6960.00

EXPENDITURE Foods Topup Others Total Total Expenditure_________ 3600.00 360.00 600.00 4560.00 4560.00

Balance________________ 2400.00 We have selected a laptop and printer package A that offers a price of RM4,987. Please refer to table 1.1 for more information. Our monthly income of RM580 per month.Based on month and annual budget stated above, we are spending a total of RM380 per month and the balance of expenditure was RM200. So, we need to borrow from banks which only offer banks repayment under RM200 per month for a certain period. There were two banks of Maybank and BSN which offer a repayment of RM200 and below per month. Maybank to impose an interest rate of 11% with 21

repayment of RM184.72 while BSN required to 4.75% interest rate and RM 159.00 for reimbursement. With this it is clear that the BSN offers interest rates that are not critical and affordable repayment.So, we have selected the BSN as our preferred bank for a loan.

v) REPORT We would like to buy the laptop and printer are both priced at RM4,987. We cannot afford to buy in cash, and we want to make a loan from the bank of RM5000. We have reviewed the three banks (Maybank,CIMB Bank and BSN) in the town of Kuala Lipis which offering different interest rates for a loan of RM5000. Each bank that we were going offer different interest rates.Maybank impose an interest rate of 11%, CIMB 24%, while BSN 4.75% for loans for a year.

22

Principal : RM 5000 Maybank Loan Interest : 11% RM 184.72 x 36 (month) = RM 6649.92 (repayment for 3 years) RM 6649.92 RM 5000.00 = RM1649.90 (bank interest) CIMB Loan Interest : 24% RM 239.00 x 36 (month) = RM 8604.00. (repayment for 3 years) RM 8604.00 RM 5000.00 = RM3604.00 (bank interest) BSN Loan Interest : 4.75% RM 159.00 x 36 (month) = RM 5724.00. (repayment for 3 years) RM 5724.00 RM 5000.00 = RM724.00 (bank interest) From these calculations, BSN bank offers lowest interest rates.So,we choose BSN bank as the bank preferred to make loans. Monthly budget Allowance Pocket money from parents TOTAL Expenditure = RM430 = RM150 = RM580

23

Foods Topup Bank repayment Others TOTAL

= RM300 = RM 30 = RM159 = RM 50 = RM539

Income

Expenditure = Balance = RM41

RM 580 RM539

We use the RM539 monthly for expenditure, including banks for repayment of RM159 per month.We have a balance of RM41.This balanced can be used to purchase computer accessories.

Bank repayment

We need to pay RM159 to the bank for a month.The interest for this loan is 4.75%. We choose to pay for the next three years (36 month). RM 159.00 x 36 (month) = RM 5724.00. (repayment for 3 years) RM 5 724.00 (bank repayment for 3 years) RM 20 880.00 (income for 3 years) x 100 = 27.41%

24

From these calculations, we have used a total of 27.41% of our income for the next three years for repayment of bank. So, the use of money to pay bank is not too heavy as us as a student.

REFLECTION (AHMAD FARHAN BIN ZAINUDIN)

Alhamdulillah,finally Knowledge-Based Coursework assignments can be completed in accordance with procedures. During the process of completing tasks, many constraints and the obstacle to be overcome, but Alhamdulillah, all faced with.

25

I received this assignment from my lecturers, Madam Amalina binti Suhaimi on August 17, 2010 and assignment questions were distributed to classmates. This task should be done in groups of two for each group. If we look at the issue of this journal, on August 17, 2010, my class was given two weeks to complete this task. This makes me and friends had to chase the time to complete assignments in a short time. However, all that will be the impetus for us to complete the task in earnest. Within two weeks from the date of submission of assignments, and some of my classmates had to find and gather information at the Al-Khindi Library in evening.Many information that we collected from the books in the library. In addition, we also exchange information obtained to facilitate our work.With modern technology facilities, I can find information more quickly. Time to complete this tasks was too short.So, my partner and I had to arrange a schedule to do this can be done at the appropriate time for us besides we had to attend the lecture-course change in the afternoon and evening in addition to compulsory courses in the morning. Alhamdulillah, in accordance with the timetable, this task can be made more lancar.We also have a discussion with other friends about this tasks.We had exchanged of views and information that we get. As a result, our job becomes much easier when we had discussions with colleagues. In addition, we also went to the nearby banks such as BSN, Maybank and CIMB.We had asked bank officials about the assignment topic.A lot of

26

information obtained and we more understand about this assignment. Thank you to the bank officials Mr. Rashidi bin Ishak, Mr. Syed Nasrul Hakim bin Syed Idross and Mr. Saifuddin bin Yusuf. Without information from them, probably this assignment cant be done better than before.In addition, we also met with Mrs. Amalina to discuss about the draft before we start our typing tasks.She had assisted us in correcting our draft and giving evidence more about this work procedures. After completing this course, I can understand more about the interest rate charged by the bank when we want to make loans bank.Besides, I can make more accurate choices when choosing banks want to make a loan. The result of this knowledge, I can to apply to my daily life and in the future later.

REFLECTION (MOHAMAD YUSRA BIN MAT KASSIM)

The assignment was given on 17th August 2010 and should be submitted to our lecturer on 3rd September 2010. Soon after I went through the task given, I found that the assignment given were quite challenging. Therefore, I need to do

27

my best to finish this assignment although this is my first assignment. Nevertheless, these first assignments are quite difficult and sometimes make me feel nervous about it.

During the preparations to do this assignment, I went through a lot of difficulty. First at all, I couldnt get enough information regarding the task given. I tried to surf the internet but sometimes the connection failed me. The most important obstacles are I did not really understand what the requirements of the assignment are.

In this IPG, I found that the library did not have enough references regarding this assignment. Although the library was big enough and has a lot books, it has limited reference especially a mathematic books. To overcome this situation, my friends and I went out to the town to get further information. The first destinations were CIMB Bank. We managed to meet Mr. Abdullah and he explained to us about compound and simple interest. He also thought us the interest calculation processes and suggested the most suitable interest rates should be taken.

Soon before we leave the premises, Mr. Abdullah gave us several pamphlets as a reference to get further understanding about interest. Then, we went to BSN Bank to get seek other information about interest, particularly from BSN Bank.

28

Besides that, Im also tried to get the other information from internet. Unfortunately, I did not get any Wi-Fi connection and I had to borrow broadband Wi-Fi from my friends. At the same time, my understanding to the question given was still not satisfying. Finally, with the assistant from my lectures and my friends, I really understand the requirement of the question and the assignment given. Although the assignment were challenging to me, in the process my English skill and knowledge was increased e.g. the writing and reading skill. It is because the assignment needs to be prepared in English. Furthermore, during the process to finish this assignment, Im found that my relationship between my friends were tightens and also our espirit de corps. We always discussed and gave our opinion to get some ideas to finish this assignment.

The assignment also taught me to manage my personal expenditure. The assignment taught me not to spending money to unnecessary items. It is because since I further my study at this IPG, I did not manage my money properly.

Finally, my first assignment has taught me and give me experienced really benefit to me. Ill be using the experience and knowledge to fulfill my ambition to become a successful teacher from this IPG.

29

ATTACHMENT

30

You might also like

- Siti Aishah Mohd EliasDocument2 pagesSiti Aishah Mohd EliasXerez SathishNo ratings yet

- DDD DDDD DDDDDocument1 pageDDD DDDD DDDDXerez SathishNo ratings yet

- Length Year 3 Story BoardDocument19 pagesLength Year 3 Story BoardKartini KilauNo ratings yet

- Overall 1Document11 pagesOverall 1Xerez SathishNo ratings yet

- Jadual Pelaksanaan TugasDocument1 pageJadual Pelaksanaan TugasXerez SathishNo ratings yet

- Instructional PlanDocument6 pagesInstructional PlanXerez SathishNo ratings yet

- Obacco SmokingDocument17 pagesObacco SmokingXerez SathishNo ratings yet

- STUDENT COLLABORATION RECORDDocument3 pagesSTUDENT COLLABORATION RECORDXerez SathishNo ratings yet

- BIBILIOGRAFIDocument1 pageBIBILIOGRAFIXerez SathishNo ratings yet

- Senarai KandunganssDocument1 pageSenarai KandunganssXerez SathishNo ratings yet

- RefleksiDocument2 pagesRefleksiXerez SathishNo ratings yet

- KK KKKKKDocument1 pageKK KKKKKXerez SathishNo ratings yet

- Dvya-Time Pgs NewDocument21 pagesDvya-Time Pgs NewXerez SathishNo ratings yet

- Halaman PengakuanDocument2 pagesHalaman PengakuanXerez SathishNo ratings yet

- Senarai KandunganssDocument1 pageSenarai KandunganssXerez SathishNo ratings yet

- Halaman PengakuanDocument2 pagesHalaman PengakuanXerez SathishNo ratings yet

- Halaman PengakuanDocument2 pagesHalaman PengakuanXerez SathishNo ratings yet

- Consumer and Carrier Skills Applications. Orlando: Harcourt BraceDocument1 pageConsumer and Carrier Skills Applications. Orlando: Harcourt BraceXerez SathishNo ratings yet

- Jadual Pelaksanaan TugasDocument1 pageJadual Pelaksanaan TugasXerez SathishNo ratings yet

- Obacco SmokingDocument17 pagesObacco SmokingXerez SathishNo ratings yet

- Biblio Graf IsDocument1 pageBiblio Graf IsXerez SathishNo ratings yet

- BiblografiDocument1 pageBiblografiMohd ImmNo ratings yet

- Racheal's Stationery Order For March 2012Document3 pagesRacheal's Stationery Order For March 2012Xerez SathishNo ratings yet

- PenghargaanDocument1 pagePenghargaanXerez SathishNo ratings yet

- STUDENT COLLABORATION RECORDDocument3 pagesSTUDENT COLLABORATION RECORDXerez SathishNo ratings yet

- Ipg Kampus Tengku Ampuan Afzan Kuala Lipis PahangDocument1 pageIpg Kampus Tengku Ampuan Afzan Kuala Lipis PahangXerez SathishNo ratings yet

- Senarai KandunganssDocument1 pageSenarai KandunganssXerez SathishNo ratings yet

- Overall 1Document11 pagesOverall 1Xerez SathishNo ratings yet

- Jadual Pelaksanaan TugasDocument1 pageJadual Pelaksanaan TugasXerez SathishNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 3Document72 pagesChapter 3mohammednatiq100% (1)

- ENCE 422 Homework #1Document2 pagesENCE 422 Homework #1MariaNo ratings yet

- Bank Mergers & Acquisitions in Central Eastern EuropeDocument96 pagesBank Mergers & Acquisitions in Central Eastern Europefumata23415123451No ratings yet

- MacroExam2SelfTest AnswersDocument9 pagesMacroExam2SelfTest AnswersIves LeeNo ratings yet

- A Comparative Study On Tata Consultancy Services LTD and Infosys LTD in The Information Technology IndustryDocument7 pagesA Comparative Study On Tata Consultancy Services LTD and Infosys LTD in The Information Technology IndustryDebasmita Pr RayNo ratings yet

- US Bank StatementDocument4 pagesUS Bank StatementBlake Hudson100% (2)

- Hilton Black Stone CaseDocument13 pagesHilton Black Stone CaseAman Baweja100% (1)

- Working Capital Management AssignmentDocument10 pagesWorking Capital Management AssignmentRitesh Singh RathoreNo ratings yet

- Bravo Merchandising Journal Entries For The Month Ending December 31, 2016Document6 pagesBravo Merchandising Journal Entries For The Month Ending December 31, 2016G09 CARGANILLA, Angelika M.No ratings yet

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- Understanding Equidam Business Valuation-2Document11 pagesUnderstanding Equidam Business Valuation-2Djamaludin Akmal IqbalNo ratings yet

- Accounting 202 Strategic Business AnalysisDocument6 pagesAccounting 202 Strategic Business AnalysisJona Francisco0% (1)

- Damodaran - Trapped CashDocument5 pagesDamodaran - Trapped CashAparajita SharmaNo ratings yet

- COMM350: Research ProposalDocument3 pagesCOMM350: Research ProposalShayne RebelloNo ratings yet

- Ank Otes: Bank Deposits Are Risky - Now More Than EverDocument12 pagesAnk Otes: Bank Deposits Are Risky - Now More Than EverMichael HeidbrinkNo ratings yet

- About EsewaDocument9 pagesAbout EsewaManish BasnetNo ratings yet

- Omtex Classes: "The Home of Success"Document4 pagesOmtex Classes: "The Home of Success"AMIN BUHARI ABDUL KHADERNo ratings yet

- 31 Excel Powerful FormulaDocument15 pages31 Excel Powerful FormulaGanesh Tiwari0% (1)

- Principles of MacroeconomicsDocument52 pagesPrinciples of Macroeconomicsmoaz21100% (1)

- April JuneDocument15 pagesApril JuneSanjivNo ratings yet

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- Financial Accounting Fundamentals 6th Edition Wild Solutions ManualDocument6 pagesFinancial Accounting Fundamentals 6th Edition Wild Solutions ManualJeremyMitchellkgaxp100% (56)

- Exposure To Trading Market-TradejiniDocument5 pagesExposure To Trading Market-TradejiniJessica VarmaNo ratings yet

- ONGC ValuationDocument34 pagesONGC ValuationMoaaz AhmedNo ratings yet

- BRPD Circular No-18 Dated December 21, 2014Document153 pagesBRPD Circular No-18 Dated December 21, 2014মোঃ সালেহ উদ্দিন সোহাগNo ratings yet

- Philippine Bond MarketDocument30 pagesPhilippine Bond MarketMARY JUSTINE PAQUIBOTNo ratings yet

- T04 - Profits TaxDocument18 pagesT04 - Profits Taxting ting shihNo ratings yet

- Exchange Deed: Description of The DeedDocument3 pagesExchange Deed: Description of The DeedAdan HoodaNo ratings yet

- Bern Stern Case Study LiquidityDocument6 pagesBern Stern Case Study LiquidityVina AdrianaNo ratings yet