Professional Documents

Culture Documents

Chapter 4

Uploaded by

Kamarulnizam ZainalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4

Uploaded by

Kamarulnizam ZainalCopyright:

Available Formats

CHAPTER 4: LONG-TERM FINANCIAL PLANNING AND GROWTH DI SEDIAKAN OLEH: CHAN KAR KIAT LOU SUN MIN LOW

WENG WAI LILIS SURJANA BT NASIB NORELIA EDAYU ABD DERAMAN QUESTION 10 APPLYING PERCENTAGE OF SALES MATERNITY BLISS, INC. Balance sheet

A120817 A121105 A116449 A113089 A113170

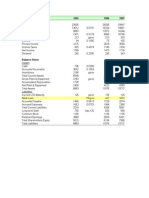

Asset s Current assets Cash A/C Receivable Inventory Total Fixed assets Net plant and equipment 3000 0 103 Percentage of sales (%)

Liabilities and Owner's Equity Current liabilities A/C Payable Notes Payable Total Long-term debt Owner's equity Common stock and paidin surplus Retained earnings Total 1500 0 2025 1702 5 4702 5 n/a Percentage of sales (%)

3525 7500 6100 1702 5

12 26 21 59

3000 7500 1050 0 1950 0

10 n/a n/a n/a

n/a n/a n/a

Total assets

4702 5

162

Total liabilities and owner's equity

MATERNITY BLISS, INC INCOME STATEMENT

Sales Cost (39% of sales) Taxable income Taxes (34%) Net income Dividends Addition to retained earnings 5640.17 7786.53 33350 13006.5 20343.5 6916.79 13426.71

QUESTION 11 EFN AND SALES

Assets Present year () Current assets Cash A/C Receivable Inventory Total Fixed assets Net plant and equipment 34500 4500 6900 19578.7 5 Owner's equity Common stock and paid-in surplus Retained 9811.53 7786.53 15000 0 900 2554 Total Long-term debt 10950 19500 450 n/a 4053.75 8625 529 1125 A/C Payable Notes Payable 3450 7500 450 0 Change from previous year () Current liabilities Liabilities and Owner's Equity Present year () Change from previous year ()

earnings Total Total assets 54078.7 5 7054 Total liabilities and owner's equity External financing needed 1182.78 -1182.78 24811.5 3 55261.5 3 8236.53 7786.53

QUESTION 12 INTERNAL GROWTH ROA = 13% b = 78% (100%-22%) Internal Growth Rate = ROA * b 1-ROA*b = 0.13*0.78 1-(0.13*0.78) = 11.28% QUESTION 15 SUSTAINABLE GROWTH Profit margin = 8.9% *ROE = 0.089*0.55*1.6 Capital intensity ratio = 0.55 = 0.078 Debt-equity ratio = 0.60 *1.6 = Equity multiplier Net income = $29000 = 1+Debt-equity ratio Dividends = $12000 Sustainable growth rate = ROE*b 1-ROE*b = 0.078*17/29 1-(0.078*17/29) = 0.0479 @ 4.8% QUESTION 16 FULL-CAPACITY SALES Fixed asset capacity = 85% Current sales = KRW 510000 Full-capacity sales = 510 000 0.85 = KRW600000 So,

= 600000-510000 100% 510000 = 17.6% This tells us that sales could increase by almost 17.6%from KRW 510000 to KRW 600000 before any new fixed assets would be needed.

QUESTION 25 CALCULATING EFN WARTSAW BAGELS INCOME STATEMENT

PLN Sales Cost(78%) other expenses earnings before interest and taxes interest paid taxable income taxes 35% net income dividends addition to retained earnings 50820.9 76231.2 PL 1040750 811785 13800 215165 19700 195465 68412.75 127052.25

WARSAW BAGETS BALANCE SHEET

Assets PLN Current assets cash accounts receivable 28750 49450 3780 6450 accounts payable notes payable 74750 9000 9750 0 PLN current liabilities Liabilities and Owners equity PLN PLN

inventory total fixed assets net plant and equipment

87400 165600

11400 21600

total long-term debt owners'' equity

83750 156000

9750

418600

54600

common stock and paid-in surplus retained earnings

21000

333231. 2 593981. 2

76231.2 85981.2

Total assets

584200

76200

total

EFN = -PLN 9781.2

QUESTION 26 CAPACITY USAGE AND GROWTH

Capacity Full capacity sales

= 80% = 90500 80% = PLN 1131200 Ratio of fixed assets to sales =364000 1131200 =0.32 Fixed asset =905000*115%*0.32 =PLN 333040 Compared to the PLN 418600 we originally projected this is PLN 85560 less, so EFN is PLN 95341.2(-PLN9781.2-PLN85560)

You might also like

- Cash Flow StatementDocument6 pagesCash Flow StatementLakshya BatraNo ratings yet

- Assumptions:: Year 0 1Document12 pagesAssumptions:: Year 0 1Aishwarya Satish ShettyNo ratings yet

- Final MCSDocument9 pagesFinal MCSMustafa SanchawalaNo ratings yet

- Business Activities and Financial StatementsDocument23 pagesBusiness Activities and Financial StatementsUsha RadhakrishnanNo ratings yet

- Tal Walk ArsDocument24 pagesTal Walk ArsAnil NandyalaNo ratings yet

- Balance Sheet of John Limited As OnDocument19 pagesBalance Sheet of John Limited As OnAravind MaitreyaNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Car Rental Own Company FinalDocument10 pagesCar Rental Own Company FinalAkshaya LadNo ratings yet

- Case SolutionsDocument106 pagesCase SolutionsRichard Henry100% (5)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionPierre Heneine86% (7)

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Balance sheet and cash flow analysisDocument1,832 pagesBalance sheet and cash flow analysisjadhavshankar100% (1)

- Sales: Proforma Income StatementDocument2 pagesSales: Proforma Income StatementIshpal SinghNo ratings yet

- Vodafone Vs AirtelDocument13 pagesVodafone Vs AirtelMuhammad Irfan ZafarNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- John M CaseDocument6 pagesJohn M CaseSwapnil JainNo ratings yet

- APC Ch11sol.2011Document6 pagesAPC Ch11sol.2011Reymilyn Sanchez100% (2)

- Manage business transactions and accounts with this chart of accountsDocument259 pagesManage business transactions and accounts with this chart of accountsfasanoj5211No ratings yet

- ComparitiveDocument6 pagesComparitivesanath vsNo ratings yet

- Projected Financial Statements and Cash Flow Analysis for Furniture OperationDocument12 pagesProjected Financial Statements and Cash Flow Analysis for Furniture Operationkjmarts08No ratings yet

- 2009 Notes Amount (In Millions) : Current Tax Deffered TaxDocument29 pages2009 Notes Amount (In Millions) : Current Tax Deffered TaxKushal TodiNo ratings yet

- Case study solution: Water company financial projectionsDocument15 pagesCase study solution: Water company financial projectionsRahul Tiwari100% (2)

- Income and Balance Sheet AnalysisDocument3 pagesIncome and Balance Sheet AnalysisSri RamNo ratings yet

- Charles company financial statement summary under 40 charsDocument18 pagesCharles company financial statement summary under 40 charsSourav MookerjeeNo ratings yet

- Case Check 01Document1 pageCase Check 01Anoop SlathiaNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- 360 Fin - MNGMNTDocument16 pages360 Fin - MNGMNTAin AtiqahNo ratings yet

- Muggles Company Income Statement and Balance Sheet ForecastDocument1 pageMuggles Company Income Statement and Balance Sheet Forecastpsu0168No ratings yet

- Financial PlanDocument6 pagesFinancial PlanRishika ShuklaNo ratings yet

- Profit and Loss and Balance Sheet AnalysisDocument1 pageProfit and Loss and Balance Sheet AnalysisAshwin SoniNo ratings yet

- Financial data for companyDocument3 pagesFinancial data for companymegafieldNo ratings yet

- Balance Sheet (In MN) Assets Ê Ncome Statement (In MN) 2010Document1 pageBalance Sheet (In MN) Assets Ê Ncome Statement (In MN) 2010Ramana DvNo ratings yet

- FSA Cement Industry Final-FSADocument55 pagesFSA Cement Industry Final-FSARohan KarbelkarNo ratings yet

- Vertical and Horizontal AnalysisDocument19 pagesVertical and Horizontal Analysissanamehar89% (9)

- Value-Based ManagementDocument21 pagesValue-Based ManagementPrathamesh411No ratings yet

- EddffDocument72 pagesEddfftatapanmindaNo ratings yet

- Chapter 3 Problems 1-30 Input and Output BoxesDocument24 pagesChapter 3 Problems 1-30 Input and Output BoxesSultan_Alali_9279No ratings yet

- Tire City Case SolutionDocument6 pagesTire City Case SolutionShivam Bhasin60% (10)

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Valuation Report DCF Power CompanyDocument34 pagesValuation Report DCF Power CompanySid EliNo ratings yet

- Blackberry Financial StatementsDocument12 pagesBlackberry Financial StatementsSelmir V KlicicNo ratings yet

- Deferred Taxes and Accelerated Depreciation An Example: Balance SheetDocument14 pagesDeferred Taxes and Accelerated Depreciation An Example: Balance SheetcatherinephilippouNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument8 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelSherjeel AhmedNo ratings yet

- Profitibilty RatioDocument50 pagesProfitibilty RatioAshish NayanNo ratings yet

- Cuurent Balance (Loan/Equity) Received Sales Received Dividend Accrued Fees & Charge Current Asset/Laibilities Equity To Debt RatioDocument42 pagesCuurent Balance (Loan/Equity) Received Sales Received Dividend Accrued Fees & Charge Current Asset/Laibilities Equity To Debt RatioMega_ImranNo ratings yet

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- 5.manual CaseDocument124 pages5.manual CaseAli Sarim Khan BalochNo ratings yet

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoNo ratings yet

- Cash Sales 1821500 2305850 Credit Sales 3407200 4521000 Returns From Customers 21,300 48,550 Cost of Goods Sold 4452320 5422640Document10 pagesCash Sales 1821500 2305850 Credit Sales 3407200 4521000 Returns From Customers 21,300 48,550 Cost of Goods Sold 4452320 5422640rohitdhallNo ratings yet

- SL No. Account Heads: Asset Year Plant Machinery 1 2 3 4 5Document7 pagesSL No. Account Heads: Asset Year Plant Machinery 1 2 3 4 5Sambit RoyNo ratings yet

- S.No Description Months 1 2 3: Cash Flow Forecast ForDocument4 pagesS.No Description Months 1 2 3: Cash Flow Forecast ForNavam NanthanNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Corporate Finance: Assignment No 1Document3 pagesCorporate Finance: Assignment No 1Ali AhmedNo ratings yet

- FRA Chemlite 038epgp11Document3 pagesFRA Chemlite 038epgp11thekaizen0% (1)

- Fra GDocument8 pagesFra GOrgan BehNo ratings yet

- Patriculars Equity and LiabilitiesDocument12 pagesPatriculars Equity and LiabilitiesSanket PatelNo ratings yet

- Thermohygrometer Calibration CertificateDocument2 pagesThermohygrometer Calibration CertificateKamarulnizam ZainalNo ratings yet

- Assignment template English versionDocument3 pagesAssignment template English versionNas SagNo ratings yet

- Memberi Pengetahuan Asas Undang-Undang Jalan RayaDocument2 pagesMemberi Pengetahuan Asas Undang-Undang Jalan RayaKamarulnizam ZainalNo ratings yet

- Tdi B8421 00377259257 17aug10Document5 pagesTdi B8421 00377259257 17aug10Kamarulnizam ZainalNo ratings yet

- Working With Financial Statements: Mcgraw-Hill/IrwinDocument33 pagesWorking With Financial Statements: Mcgraw-Hill/IrwinKamarulnizam ZainalNo ratings yet

- Step Descriptions: Appendix 1 - Checklist 1Document1 pageStep Descriptions: Appendix 1 - Checklist 1Kamarulnizam ZainalNo ratings yet

- What Does A Perfect Negetif Correlation IndicateDocument6 pagesWhat Does A Perfect Negetif Correlation IndicateKamarulnizam ZainalNo ratings yet

- What Does A Perfect Negetif Correlation IndicateDocument6 pagesWhat Does A Perfect Negetif Correlation IndicateKamarulnizam ZainalNo ratings yet

- Jadual Peperiksaan Sem November 2010Document4 pagesJadual Peperiksaan Sem November 2010Kamarulnizam ZainalNo ratings yet

- C2C e CommerceDocument18 pagesC2C e CommerceMilan StojanovicNo ratings yet

- Form Appendix - 2 010308Document1 pageForm Appendix - 2 010308Kamarulnizam ZainalNo ratings yet

- Market Failure & Government InterveneDocument10 pagesMarket Failure & Government InterveneKamarulnizam ZainalNo ratings yet

- Calculators: Discounted Cash Flow ValuationDocument18 pagesCalculators: Discounted Cash Flow ValuationKamarulnizam ZainalNo ratings yet

- PENGEURUSAN KEWANGANDocument7 pagesPENGEURUSAN KEWANGANKamarulnizam ZainalNo ratings yet

- Penyerahan Dan Penilaian TugasanDocument3 pagesPenyerahan Dan Penilaian TugasanKamarulnizam ZainalNo ratings yet

- Consumer Behaviorrr - Utility MaximizationDocument11 pagesConsumer Behaviorrr - Utility MaximizationKamarulnizam ZainalNo ratings yet

- TM 2012Document428 pagesTM 2012Nur Aliya MaisarahNo ratings yet

- Consumer Behaviorrr - Utility MaximizationDocument11 pagesConsumer Behaviorrr - Utility MaximizationKamarulnizam ZainalNo ratings yet

- 001 Table of ContentsDocument6 pages001 Table of ContentsKamarulnizam ZainalNo ratings yet

- Economic SystemsDocument3 pagesEconomic SystemsKamarulnizam ZainalNo ratings yet

- MCMP Construction Corp., Petitioner, vs. Monark Equipment CorpDocument5 pagesMCMP Construction Corp., Petitioner, vs. Monark Equipment CorpCessy Ciar KimNo ratings yet

- 2nd Set SVFCDocument15 pages2nd Set SVFCim_donnavierojoNo ratings yet

- Introduction To Investment MGMTDocument6 pagesIntroduction To Investment MGMTShailendra AryaNo ratings yet

- Chapter 3Document24 pagesChapter 3Irene Mae BeldaNo ratings yet

- Project Management Concepts And ClassificationDocument29 pagesProject Management Concepts And Classificationankitgupta16No ratings yet

- Management Journal 2011Document135 pagesManagement Journal 2011abhay0011No ratings yet

- Treehouse Toy Library Business PlanDocument16 pagesTreehouse Toy Library Business PlanElizabeth BartleyNo ratings yet

- SCMDocument22 pagesSCMPradeep Dubey100% (2)

- INTERMEDIATE ACCOUNTING-Unit01Document24 pagesINTERMEDIATE ACCOUNTING-Unit01Rattanaporn TechaprapasratNo ratings yet

- Financial Ratio AnalysisDocument21 pagesFinancial Ratio AnalysisVaibhav Trivedi0% (1)

- CB Insights - Fintech Report Q1 2019 PDFDocument81 pagesCB Insights - Fintech Report Q1 2019 PDFsarveshrathiNo ratings yet

- The California Fire Chronicles First EditionDocument109 pagesThe California Fire Chronicles First EditioneskawitzNo ratings yet

- 8 Fair Value Measurement 6/12: 7.5 Capital DisclosuresDocument9 pages8 Fair Value Measurement 6/12: 7.5 Capital Disclosuresusman aliNo ratings yet

- Report On Industrial Visit: Visited Professor Visited StudentsDocument10 pagesReport On Industrial Visit: Visited Professor Visited StudentsRishabh MishraNo ratings yet

- NBFC MCQ QuizDocument2 pagesNBFC MCQ QuizZara KhanNo ratings yet

- Car Rental Agreement (TORRES)Document3 pagesCar Rental Agreement (TORRES)Eduardo Anerdez50% (6)

- MPKJDocument36 pagesMPKJJoshua Capa FrondaNo ratings yet

- CSEC POB June 2016 P1 With AnswersDocument8 pagesCSEC POB June 2016 P1 With AnswersJAVY BUSINESSNo ratings yet

- Arpia Lovely Rose Quiz Chapter 9 Income TaxesDocument8 pagesArpia Lovely Rose Quiz Chapter 9 Income TaxesLovely ArpiaNo ratings yet

- Chapter-7 Investment ManagementDocument7 pagesChapter-7 Investment Managementhasan alNo ratings yet

- Initiation of InternationalisationDocument13 pagesInitiation of InternationalisationRazvan LabuscaNo ratings yet

- Entre November 16Document42 pagesEntre November 16Charlon GargantaNo ratings yet

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Portfolio Management (Assignment)Document4 pagesPortfolio Management (Assignment)Isha AggarwalNo ratings yet

- John L Person- Forex Conquered Pivot Point Analysis NotesDocument2 pagesJohn L Person- Forex Conquered Pivot Point Analysis Notescalibertrader100% (1)

- Written Math Solutions and Word ProblemsDocument1 pageWritten Math Solutions and Word ProblemsShakir AhmadNo ratings yet

- A Study On Risk Perception of Individual InvestorsDocument7 pagesA Study On Risk Perception of Individual InvestorsarcherselevatorsNo ratings yet

- Solutions To Derivative Markets 3ed by McDonaldDocument28 pagesSolutions To Derivative Markets 3ed by McDonaldRiskiBiz13% (8)

- 2 Re Calculation of SSD For HDB Sale Under 2 Years of OwnershipDocument17 pages2 Re Calculation of SSD For HDB Sale Under 2 Years of Ownershipapi-308324145No ratings yet

- Sample Complaint For EjectmentDocument3 pagesSample Complaint For EjectmentPatrick LubatonNo ratings yet