Professional Documents

Culture Documents

Murabaha

Uploaded by

FMumtaz1989Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Murabaha

Uploaded by

FMumtaz1989Copyright:

Available Formats

During this introductory module we will be covering some basic modules of Murabaha, the step by step execution process

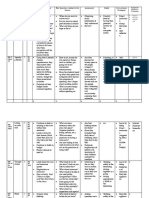

and some of its applications. Murabaha is defined as a sale transaction where cost and profit are expressly disclosed to the buyer by the seller at the time of sale. For example, if a baker sells a loaf of bread for Rs. 25 and discloses its cost as being Rs. 20 then such sale is classified as a Murabaha sale. But if the cost is not disclosed then it will be a normal sale of Musawama. Hence Murabaha is a particular kind of sale and not a type of financing in its origin. However, it is commonly used as an alternative to running finance or the conventional short-term finance with certain limitations by modern Islamic banks which we will be discussing later on in this module. Murabaha is also classified as a trust-sale. Since the buyer trusts seller he will disclose the correct cost to him. Thus, the only difference between Murabaha and the normal sale is the disclosure of cost and profit to the buyer. Since the Murabaha is a sale in its essence the payment of Murabaha price can be spot, in installments, or in deferred lump sum amount, just as it can be in any other type of sale. Hence, Murabaha sale doesnt necessarily imply deferred payment sale as is commonly misunderstood. Since Murabaha is a sale transaction although rules of sale as outlined by Shariah must be followed to make a Murabaha sale valid under Shariah. At this stage we will briefly discuss the certain rules regarding sale. Rule # 1: The asset to be sold must exist. Hence we cannot sell an unborn calf of a cow because it doesnt exist at that time and its existence after a certain period of time is also not certain. Rule # 2: The goods to be sold must be in the ownership of the seller. Even though the goods exist but if they are not in the ownership of the seller then the sale cannot be executed. Rule # 3: Apart from the ownership and the existence of the goods the goods must also be in the physical and constructive possession of the seller. By possession it is meant that the full control the risk and the reward is bound by the seller. A constructive possession is a form of possession where goods are not physically with the seller. However he has full risk, reward and control of the goods. An example of constructive possession is a possession through documents of imported goods, or the possession by the principal through his agent. Rule # 4: It is necessary that the price of the goods in a sale transaction must be fixed at the time of sale. Different options maybe quoted by the seller at the time of sale, but the sale must be concluded at the single price and after the execution of sale all other options become null and void. Rule # 5: Another rule regarding sale is that a sale must be unconditional and must be absolute and instant. By absolute and instant it is meant that the ownership of the subject matter is immediately transferred to the buyer upon the execution of sale.

Rule # 6: The goods to be sold must not be Haram or to be used for an un-Islamic purpose; for example, wine or pork. Step by Step Murabaha Financing: Before understanding the procedure for Murabaha financing let us first discuss the shortterm financing mode used by a conventional bank. In case of conventional banks when a customer when a customer requires some funds he will just walk in to the bank, get the limit approved and the bank disburses him the required amount. The customer will use this loaned amount and return it to the bank on the scheduled maturity date along with the interest amount. That is how conventional banks make money. The same requirement will be fulfilled by an Islamic bank by using Murabaha in the following manner. Upon request of financing an Islamic bank will ask the customer for which the funds are required. If the funds are required for the purchase of certain goods like rice or clothe then the Islamic bank will fulfill the requirement by purchasing these goods from the market on cash basis and selling it to the customer on credit basis by adding a known profit amount. Now lets discuss the various steps required for executing Murabaha transaction in a Shariah compliant manner. Step # 1: After analyzing the credit worthiness of the client the bank and the customer sign a Memorandum of Understanding known as the Master Murabaha Facility Agreement (MMFA). The MMFA is not a sale agreement but it is a document of understanding between the bank and the customer, and lays down certain transaction parameters for the sub-Murabaha sale transaction to be executed from time to time during the following year between the bank and the customer so that no disputes arise at the time of sale. One of the main parameters outlined by the MMFA is that it specifies the maximum limit up to which the facility maybe availed by the customer during the following year. After the execution of MMFA the customer and the bank sign an Agency Agreement under which the customer is appointed as an agent of the bank to purchase goods on banks behalf from time to time. Although, making the customer as an agent is not mandatory as per Shariah but to avoid any disputes and banks lack of expertise regarding the product selection it is beneficial both for the bank and the customer that the customer is appointed as banks agent to purchase goods for the bank. After signing of MMFA and the agency agreement upon the requirement of purchase of assets during the normal course of the business the customer will submit the order form to the bank for such purchases. Upon receiving the order form the bank shall authorize the customer to purchase the required goods as banks agent. After authorization the agent shall negotiate the deal with the supplier and the bank shall pay the money to the supplier in the form of pay-order or any other payment mode. Here it is important to know that such payment is not made to the customer but it is made to the supplier; hence, directly generating economic activity in the society. After receiving the payment, the goods are released by the supplier to the agent. It is very critical to note that upon delivery of goods to the agent the risk and reward of the goods transferred from the supplier to the bank. At this time if the goods are destroyed without the agents negligence or due to any natural calamity

then all the risk and the loss will be borne by the bank. As soon as the goods are received by the banks agent, the agent in the capacity of the customer shall make an offer to purchase the goods from the bank at a price and for a payment schedule as per the terms and conditions of the MMFA. The customer shall also provide copies of purchase evidences in the form of invoice and bills of entry. Upon receiving the offer the bank shall ensure that the goods are in the possession of the customer. Upon affirmative confirmation the bank shall accept the offer and the sale shall be concluded. Upon such sale, the ownership of the good shall transfer from the bank to the customer. The agreed Murabaha selling price shall be paid by the customer to the bank on the agreed dates as per the payment plans agreed at the time of sale. Application of Murabaha: Murabaha can be used for various short term working capital or long term financing requirements of the customers.; for instance, the purchase of raw materials of for the purchase of land or equipment. However, it must be noted that it can only be used for asset based requirement of the customer. Murabaha cannot be used where no tangible assets are involved; for instance, for the payment of wages or electricity bills.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Sir Zia's SlidesDocument8 pagesSir Zia's SlidesFMumtaz1989No ratings yet

- Topic: Partnership Deed: Ssignment OF Ercantile AWDocument1 pageTopic: Partnership Deed: Ssignment OF Ercantile AWFMumtaz1989No ratings yet

- Paraphrase DDocument6 pagesParaphrase DFMumtaz1989No ratings yet

- PlaintDocument2 pagesPlaintFMumtaz1989No ratings yet

- 6.2 Sample Partnership DeedDocument6 pages6.2 Sample Partnership DeedAbhishek Dwivedi100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ifric 12Document12 pagesIfric 12Cryptic LollNo ratings yet

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicaleNo ratings yet

- PPE HandoutsDocument6 pagesPPE Handoutsashish.mathur1No ratings yet

- ArticlesDocument1 pageArticlesBayrem AmriNo ratings yet

- Case Study Currency SwapsDocument2 pagesCase Study Currency SwapsSourav Maity100% (2)

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- KYC checklist for filling formDocument35 pagesKYC checklist for filling formAjay Kumar MattupalliNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Van Den Berghs LTD V ClarkDocument6 pagesVan Den Berghs LTD V ClarkShivanjani KumarNo ratings yet

- Chapter 5 Question Answer KeyDocument83 pagesChapter 5 Question Answer KeyBrian Schweinsteiger FokNo ratings yet

- Biz Cafe Operations Excel - Assignment - UIDDocument3 pagesBiz Cafe Operations Excel - Assignment - UIDJenna AgeebNo ratings yet

- Calm Finance Unit PlanDocument7 pagesCalm Finance Unit Planapi-331006019No ratings yet

- IVALIFE - IVApension Policy BookletDocument12 pagesIVALIFE - IVApension Policy BookletJosef BaldacchinoNo ratings yet

- NpoDocument30 pagesNpoSaurabh AdakNo ratings yet

- Risk Management Strategies G2 - 20.3 (Final)Document4 pagesRisk Management Strategies G2 - 20.3 (Final)Phuong Anh NguyenNo ratings yet

- Statement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanDocument8 pagesStatement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanFadzianNo ratings yet

- BFMS Course OverviewDocument4 pagesBFMS Course OverviewPriyaNo ratings yet

- Fee Details Fee Details Fee DetailsDocument1 pageFee Details Fee Details Fee DetailsTabish KhanNo ratings yet

- JPM Fact Fiction and Momentum InvestingDocument19 pagesJPM Fact Fiction and Momentum InvestingmatteotamborlaniNo ratings yet

- Caltex v Security Bank: 280 CTDs worth P1.12MDocument52 pagesCaltex v Security Bank: 280 CTDs worth P1.12MAir Dela CruzNo ratings yet

- Dissolution and Incorporation of a PartnershipDocument26 pagesDissolution and Incorporation of a PartnershipJohn LouiseNo ratings yet

- Learn Chinese Exchange CurrencyDocument3 pagesLearn Chinese Exchange CurrencyLuiselza PintoNo ratings yet

- Heineken 2004Document50 pagesHeineken 2004k0yujinNo ratings yet

- Functions of IDBI BankDocument37 pagesFunctions of IDBI Bankangelia3101No ratings yet

- USC EDRES Committee Proposal by USC Councilor Jules GuiangDocument14 pagesUSC EDRES Committee Proposal by USC Councilor Jules GuiangJules GuiangNo ratings yet

- Intercompany transactions elimination for consolidated financial statementsDocument13 pagesIntercompany transactions elimination for consolidated financial statementsicadeliciafebNo ratings yet

- N26 StatementDocument4 pagesN26 StatementCris TsauNo ratings yet

- ICICI ProjectDocument55 pagesICICI ProjectRamana GNo ratings yet

- Engineering Economics HandoutDocument6 pagesEngineering Economics HandoutRomeoNo ratings yet

- List of Mba Bba Projects-2017Document69 pagesList of Mba Bba Projects-2017Mukesh ChauhanNo ratings yet