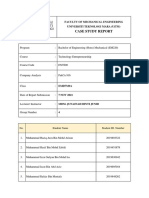

Professional Documents

Culture Documents

Avondale Guide-Legal Aspects of A Business Sale

Uploaded by

AvondaleGroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Avondale Guide-Legal Aspects of A Business Sale

Uploaded by

AvondaleGroupCopyright:

Available Formats

Guide:

Legal Aspects of a Business Sale

Contents

The

legal

aspects

of

a

business

sale

can

be

complex.

This

guide

is

designed

to

give

you

a

good

insight

into

the

process

and

tasks

that

will

need

to

be

undertaken:

Main

Differences

Sale

of

Business/Sale

of

Company

Legal

Process

o Heads

of

Agreement

o Finance

for

the

Purchase

o Request

for

Information

(Due

Diligence)

o Response

to

Request

for

Information

o Draft

Share

Purchase

Agreement/Business

Purchase

Agreement

o Negotiate

Warranties

o Disclosure

Letter

o Exchange

of

Contracts

o Completion

o Completion

Meeting

o Guide

to

TUPE

(transfer

of

Protection

of

Employment)

o Sample

-

Legal

aspects

of

the

deal

timetable

o Sample

-

Heads

of

Terms

Main

differences

Sale

of

Business/Sale

of

Company

People

often

get

confused

between

the

sale

of

a

business

and

the

sale

of

a

company.

When

selling

a

company

it

is

the

shares

that

are

sold.

As

far

as

the

outside

world

is

concerned

there

is

no

change

as

they

still

deal

with

the

same

company.

Behind

the

scenes,

however,

the

owners

of

the

company

have

changed.

In

contrast

a

business

can

be

owned

either

by

a

sole

trader,

a

partnership

or

a

company.

Any

aspect

of

the

business

its

assets

or

division

can

be

purchased

or

sold

often

this

is

without

liabilities.

There

are

tax

implications

and

differences

between

the

sale

of

a

business

and

the

sale

of

a

company

and

tax

advice

is

essential

before

proceeding.

Heads

of

Agreement/Terms

Once

you

have

agreed

in

principle

to

buy

or

sell

a

business

or

company,

a

document

which

sets

out

the

basic

terms

agreed,

called

The

Heads

of

Agreement/Terms

is

signed.

This

will

include

the

amount

to

be

paid,

how

it

is

likely

to

be

financed,

and

any

other

specific

terms.

Usually

the

Heads

of

Agreement/Terms

comprise

the

main

points

only,

and

only

in

outline

The

Heads

of

Agreement/Terms

are

normally

not

binding

except

in

respect

of

confidentiality

clauses

and

exclusivity

if

included.

Finance

for

the

Purchase

It

is

normally

at

this

point,

if

not

before,

that

the

purchaser

needs

to

decide

how

the

business

purchase

is

going

to

be

funded.

This

may

be

done

by

a

variety

of

methods

including

bank

loans,

cash,

paying

over

a

period

of

time

(earn

out

or

deferred

consideration),

or

a

combination

of

these

factors

depending

on

the

amount

the

bank

is

prepared

to

lend.

Once

it

is

clear

that

the

finance

has

been

approved

in

principle,

we

can

proceed

onto

the

next

stage.

Page

1

of

10

www.avondale.co.uk

01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

Request for Information (Due Diligence) The due diligence process serves to confirm all material facts in regard to the business or company. It refers to the care and research a reasonable person should take before entering into an agreement or transaction. Most purchase offers will be contingent upon the results of a due diligence report. During these process financial records, commercial contracts, legal agreements and anything else deemed material to the sale will be reviewed. Vendors may also carry out due diligence on the purchaser, to investigate their ability to purchase and or anything that may affect the purchased entity or the vendor after the sale. The process is often begun by the purchaser issuing a questionnaire, asking for particular documents and points they may want clarified. The answers to these questions will then likely form the basis of the warranties in the sale and purchase agreement. The seller must respond honestly and openly and in detail to this request so that the purchaser can be satisfied that the company is free of any liabilities other than those identified. A data room is often used during the due diligence process, which will contain all financial, commercial, and legal information on the business, including detailed accounts, particulars of all properties, and employees and copies of all contracts. They are often provided to the purchaser in an on-line format, hosted by a third party with a password and protected internet access. Alternatively it may take the form of an actual room at the legal advisors offices, or simply in electronic or hard copy format. The following are some issues, which should be considered during the due diligence process. There might be forgotten guarantees, which could be subsequently activated. Can it be certain that all taxes have been declared and paid up to the point of sale? Might the tax authorities subsequently question the basis upon which returns have been made? Have all claims against the company been fully disclosed? Could any mistakes have been made in stocktaking? Intellectual property matters. Product liability matters. Pension liability. Environmental issues.

www.avondale.co.uk

Page 2 of 10

01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

Response to Request for Information Once the sellers solicitor has received the Request for Information, they will together with their client compile a package of information (with documentation attached if necessary) setting out answers to all the queries raised. The Buyers solicitor will discuss the information disclosed with their client and in particular review any areas of concern e.g. liabilities of the company which they might be accepting. They will then decide whether they want any warranties (guarantees or statements of fact) or indemnities from the seller. For example, a seller might be asked to warrant/guarantee that a particular state of affairs exists (that the books and records are true and correct), or to indemnify the purchaser if a particular event happens. Draft Share Purchase Agreement/Business Purchase Agreement This is traditionally drafted by the purchasers solicitor. It generally includes a long section of warranties (guarantees) and indemnities protecting the purchaser in the event that the business is found not to be as has been represented. The agreement also covers all terms that have been agreed. Negotiate Warranties Once the first draft of the agreement has been sent to the sellers solicitor, they will review the terms and in particular the warranties and indemnities with their client. The seller must check carefully that they are able to give the warranties either as requested or by qualifying them (diluting them). If the purchaser needs to be made aware of any other issues in the business this is the time to disclose it. If information which is relevant is withheld by the seller, a purchaser could later sue the seller particularly if the seller has guaranteed a certain state of affairs and they transpire not to exist or be wrong. Depending on the warranties and indemnities being requested, both sets of solicitors will try and negotiate a compromise which adequately protects both parties. These negotiations can take a long time with a lot of horse trading before final agreement is reached. Sometimes a sale can collapse because the parties cannot agree. Warranted statements provided by the vending shareholders of a company to the purchaser or the financial advisor sponsoring the sale of shares to the public are used by the purchaser to paint a picture of the company which is being bought. Indemnities are to secure potential future losses. Warranties guarantee that a particular set of facts are as they are stated to be. They are a result of the due diligence exercise to serve to contractually bind the vending shareholders to their statements in order to avoid the common law defence of caveat emptor Let the buyer beware. The basic premise is that the purchaser buys at their own risk, and should therefore examine and test themselves the facts given to them about the business for obvious defeats and imperfection upon reasonable inspection so by making these warranties and indemnities it is making the purchaser aware of any defect, thus they cannot claim they were unaware and thus have any cause to claim against them. The warranties will provide comfort over those matters which are most important to the purchaser. If the purchasers subsequently discover after the sale that any of these warranties were incorrect or misleading, and that the company is worth less than they expected it to be, they can then make a claim against the vendors for breach of warranty. It is usually possible to claim under the warranties for up to seven years in relation to tax and up to two years for non-tax claims. Generally, the amount, which the purchaser can claim back under the share sale agreement, is the amount paid for the company. This leaves the vendors at risk for possibly the entire sale price for up to seven years. This is a risk many would prefer to transfer, in the form of an insurance policy. Disclosure Letter Generally, there will be an agreement between the two parties as to the standard of disclosure before the acquisition is completed. The warranty as to this standard of disclosure will be contained in the Sale and

www.avondale.co.uk Page 3 of 10 01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

Purchase Agreement. A disclosure letter is then commonly used to evidence the disclosure by the seller to the purchaser of key information about the target business with the bundle of documents disclosed attached to the letter in paper or electronic form. The purchaser will then be able to make an informed decision as to whether it wished to complete the purchase, or whether to ask for an indemnity from the purchaser in relation to any of the risks set out in the disclosure letter, or withdraw from the sale all together. Guide to TUPE The Transfer of Undertakings (Protection of Employment) Regulations 2006, commonly known as TUPE. Protects employees terms and conditions of employment. TUPE applies to relevant transfers - almost all transfers of businesses from one employer to another e.g.: where a business (or part of it) is sold and where services are changed / outsourced. TUPE is not applicable for Share Transfer sales as there is no change of employer. Does TUPE apply; is it a relevant transfer? 1) Business transfers - The key question is whether or not there is a transfer of an economic entity that retains its identity. Factors to consider include: Is the type of business being conducted by the transferee (incoming business) the same as the transferor's (outgoing business)? Has there been a transfer of tangible assets such as building and moveable property (although this is not essential)? What is the value of the intangible assets at the time of the transfer? Have the majority of employees been taken over by the new employer? Have the customers been transferred? Is there a high degree of similarity between the activities carried on before and after the transfer? If the answer to all (or several of) the above questions is 'YES', there has been a transfer of a stable economic entity. 2) Service provision changes - A service provision change occurs when a client who engages a contractor to do work on its behalf is either: reassigning the contract (whether by contracting out, outsourcing or re-tendering), or Bringing the work in-house (where a contract ends with the service being performed in-house by the client themselves). It will NOT be a service provision changes if: the contract is wholly or mainly for the supply of goods, or The activities are carried out in connection with a single specific event or a task of short-term duration. The effects of TUPE Upon the transfer of the business employees employed just before the sale, automatically become employees of the purchaser, on the same terms and conditions of employment. It is as if their contracts of employment had originally been made with the purchaser. The purchaser inherits liability for any employees dismissed by the vendor for reasons connected with the transfer. Any dismissal connected to the transfer is automatically unfair. The purchaser cannot select which staff to take on. The consultation rules Where employees are represented by a trade union the employer must inform and consult with the union about the proposed business transfer. Otherwise the employer must inform and consult employee representatives about the proposals. There are legal requirements that apply to the election process and rights of employee representatives. What must the vendor tell the employees who are due to transfer?

www.avondale.co.uk Page 4 of 10 01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

that the transfer is going to take place, when approximately it will take place, and the reasons for it; the implications of the transfer for the affected employees; Whether the new employer is planning to make any changes, such as reorganisation as a result of the transfer, and if so, what arrangements are being planned and how those will affect the staff. Consultation should be undertaken with a view to seeking agreement on the proposed changes. Both vendors and purchasers are obliged to inform staff about the proposed changes. ETO reasons Neither the purchaser or vendor can fairly dismiss an employee because of the transfer or a reason connected with it, unless the reason for the dismissal is an economic, technical or organisational reason entailing changes in the workforce (known as an ETO), such as a redundancy situation. Dismissal because of a relevant transfer will be unfair unless an employment tribunal decides that an ETO was the main cause of the dismissal, and that the employer acted reasonably in the circumstances in treating that reason as sufficient to justify dismissal. To avoid claims of automatically unfair dismissal being pursued by affected employees, purchasers / vendors contemplating the need for redundancies should seek specialist advice as this is a very technical area of law. Transfer related dismissals and Tribunal claims Dismissed employees can complain to the Employment Tribunals. An employee claiming to have been dismissed because of a transfer may claim their dismissal is automatically unfair. Employment tribunals may order reinstatement or re-engagement and/or make an award of compensation. Transferred employees whose terms and conditions of employment have changed for the worse as a result of the transfer have the right to terminate their contract and claim constructive unfair dismissal, on the grounds that actions of the employer have forced them to resign. Employee representatives have the right to protection from detrimental treatment and paid time off to discharge their duties as employee representative. Where the employer fails to properly consult with the employees under TUPE, complaints can be issued in the Tribunal and the employer who is at fault may be ordered to pay compensation to each affected employee. Compensation can be up to 13 weeks pay. Pensions The Transfer of Employment (Pension Protection) Regulations 2005 came into force on 6 April 2005. Where the vendor provides a money purchase scheme or stakeholder pension, the purchaser is under an obligation to match the vendors employer contributions to the scheme up to a maximum of 6% of basic pay. Practical TUPE tips for the vendor: Seek Advice regarding TUPE at an early stage, in order to determine the tactics / assess the risks involved with the proposals. Ensure all staff have up to date employment contracts, accurately reflecting their current terms and conditions. Do not change the work force terms in the lead up to a sale. Do not make people redundant if the purchaser asks you to. Make sure you comply with the consultation rules. Timetable enough time to consult with the staff. Practical TUPE tips for the purchaser: Seek Advice regarding TUPE at an early stage. Raise enquiries regarding the staffs existing terms and conditions, length of service, roles and functions etc in order to find out what employment liabilities you are taking on; Carry out a risk assessment regarding the employees; Make sure you comply with the consultation rules; Timetable enough time to consult with the staff;

www.avondale.co.uk Page 5 of 10 01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

Ensure that the vendor has complied with its legal requirements under TUPE regarding consultation etc; Sample legal aspects of the deal timetable Avondale will manage the timetable, and fully liaise with all parties throughout. Monitoring the progress and ensuring momentum is not lost. 18 July 23 July 25 July 1 August 5 /6 August 13 August 22 August 29 August 1 September 8 September

th th th st th nd th th th st th rd th

Purchaser and vendor to have formally requested solicitors to proceed. Purchaser solicitor to send vendors solicitor initial due diligence enquires. Purchaser to provide Avondale financial letter of comfort from bank or accountant. Vendor and vendor solicitor to reply to all initial due diligence enquiries. Purchaser/purchaser accountant to visit vendors premises to carry out any further due diligence required. Purchaser solicitor to send draft sale purchase agreement to Vendor solicitor. Vendor solicitor to review & respond to draft sale contract. Purchaser bank or purchaser accountant to confirm finance in place. Purchaser solicitor to send back revised draft sale contract Sale purchase contract to be agreed (or round table meeting for all parties to overcome issues and get it agreed).

10

September

Vendors

solicitor

to

provide

disclosure

letter

and

bundle.

12

September

Transaction

completes

Note:

The

above

is

a

guide

only

with

example

dates,

and

will

vary

considerable

for

each

sale.

Sample

Heads

of

Terms

The

heads

of

terms

is

a

summary,

non-legally

binding

in

most

respects

of

what

the

parties

have

agreed.

Most

parties

will

offer

using

a

form

of

draft

heads

of

terms.

This

saves

time

and

creates

clarity

early

on,

by

highlighting

the

requirements

of

both

the

vendor

and

purchaser.

Sample

Date:

Ref:

This

document

outlines

the

head

terms

agreed

between

the

parties,

prior

to

negotiation

of

a

final

sale

and

purchase

agreement.

Save

in

the

respect

of

confidentiality

and

exclusivity;

the

terms

are

not

legally

binding,

and

are

subject

to

due

diligence

and

contract.

The

parties

are

(the

Parties)

The

Vendor

The

Purchaser

XYZ

Vendor/s,

or

key

shareholder/s,

name/s

Full

name/s

of

individuals

C/o

Co.

name

or

home

address

if

share

sale

Or

Company

name

c/o

of

individual/s

Or

Company

name

&

no.

of

private

Address

of

purchaser

town

Address

In

private

town

County

Postcode

Postcode

www.avondale.co.uk

Page

6

of

10

01737

240888

This

guide

is

not

definitive.

Accuracy

is

not

guaranteed

and

it

does

not

replace

professional

advice.

Guide: Legal Aspects of a Business Sale

1. The sale basis Mr. / Mrs. Shareholders/XYZ Company (the Vendor) will sell to Mr. / Mrs. Purchaser/ABC Company (the Purchaser), the business known as (XYZ name, of 00, XY Street, any town) (or company XYZ reg.no.123456678) and any associated names (the Business). The sale will be on a fixed asset and goodwill basis/share transfer basis. 2. Timescale The parties will conduct their best endeavours to secure completion by (date XYZ). 3. Purchase Price/Terms To delete or insert rows click on table command. The purchaser will pay the vendor as follows: Item Amount Payable Note Initial payment On 1.Share deal Share deal completion For the purchase of the entire share capital of the Business to include the net assets at completion to be at least 45,000. The Vendor may take a pre-sale dividend to reduce the net assets to this level if appropriate. OR to exclude the net assets see below. Other Add details here Net assets On Share deal (if not included above) (estimated) completion A payment will be made for the net assets of the company on Share deal completion. The net asset value per accounts to 31-4-2001 is 45,000. It is estimated this will be materially similar at completion. Target TOTAL 4. Protections for deferred or performance related/earn out To protect the payments, the purchaser will provide the following protections to the vendor for the duration of the payments: A personal guarantee A charge over the freehold property A debenture on the assets of the Company Not if preference shares are being used Key-man insurance or life assurance to protect outstanding payments in the eventuality of illness, incapacity, critical illness or death. Access to all the records, including legal, accountancy, ledger, and banking paperwork and documentation. The issuing of statements regarding the payments, and produce accounts. Undertakings that the business will be run materially the same as at the present time and for the duration of the earn-out period and that the accounts will be run according to UK accounting standards... Undertakings that the purchaser shall not in any way compete with the business during the earn-out period. 5. Protections for part sale/mergers, vendors retaining minority shareholders The shares in the Newco/oldco will be enhanced by a quality shareholders agreement with caveats that: The shares will be valued pro-rata Offer first refusal to buy each other out either on a voluntary transfer or a deemed transfer (for example on death and bankruptcy or ceasing to be an employee) Cross options if the vendor dies ensuring the estate benefits from cash not a minority shareholding. To ensure that the company or the other shareholder has the cash to acquire a deceaseds shareholding it may be appropriate for a life policy to be put in place. A seat on the Board to reflect the shareholding

www.avondale.co.uk Page 7 of 10 01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

Agreed minority shareholding protection to ensure that the minority shareholder has rights of veto over certain fundamental matters. In the event of the Vendors death or mental incapacity during the period of the earn-out, then the shares should pass to the ownership of the Vendors estate.

6. Premises and/or as follows, or similar! The current premises are XYZ address, anywhere The Vendor will sell to the Purchaser the freehold premises at (premises address). The Business owns the freehold and it will be transferred by way of the share transfer New or existing lease terms or licence terms Period: Terms: Rent: Deposit: Payment Costs: Reviews Break clause: 7. Landlords consent Granting or assigning a lease or Directors guarantee is subject to the Purchasers status and the landlords consent (not to be unreasonably withheld). 8. Consultancy or handover The Vendor agrees to provide the Purchaser a 2-week initial handover free of charge during office hours. Thereafter, they agree to be available by telephone or fax within reason for a further period of (six months. As an Employee or Consultant, consider the following as applicable dependent on circumstances, age and expertise of Vendor. XYZE names and WXY names, shall on completion be employed by or provide consultancy services to the Purchaser. Final terms to be agreed between the Parties but to include: Title: Expenses: Salary: Hours: Benefits: Benefits: Commission: Duties: Car: Holidays:

Private Medical Insurance to include in-patient medical care with a maximum contribution by the employee of 15%. The Policy should be uunderwritten by a branded provider and be operative from day 1 of his/her duties as General Manager. A Company Pension Scheme will be made available to the General Manager and will be operative from day 1 of his/her start date. The Scheme should allow for Additional Voluntary Contributions and should provide for a final pension of not less than XYZ. 5% of all turnover introduced up to a maximum of 20,000 commission p.a. Recruitment of new Consultants, Business Development to existing and new client.

9. Resignations share deals The following shall resign as Directors on completion - XYZ and ABC exiting (Directors name/s). 10. Employees The Vendor agrees to provide the Purchaser with a list of all staff to include: their names, ages, length of service, salaries, benefits and duties. The Parties also agree that: Any redundancies will be the Purchasers legal and financial obligation.

www.avondale.co.uk

Page 8 of 10

01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

Guide: Legal Aspects of a Business Sale

During negotiations of the final sale & purchase agreement that no employees will be taken on or dismissed without the Purchaser's reasonable consent (except where the employee may be summarily dismissed).

For

fixed

asset

and

goodwill

sales

only

Any

obligations

under

the

TUPE

regulations

to

consult

with

the

staff

about

the

transaction

will

be

met.

Staff

salaries

and

holiday

pay

will

be

apportioned

between

the

Parties.

Key

staff

retention

idea

To

assist

the

Purchaser

in

continuation

of

goodwill

the

Vendor

agrees

to

pay

the

staff

listed

below

a

loyalty

bonus

after

(six)

months

of

successful

service

with

the

Purchaser

of

(2,000

each)

in

recognition

of

their

endeavours

and

contributions

to

the

business.

11.

Tax

The

Parties

agree

to

give

fair

consideration

to

each

others

tax

position

in

the

negotiation

of

a

final

sale

and

purchase

agreement.

The

following

is

for

asset

deals

only

The

Parties

will

agree

an

apportionment

of

the

sale

price

between

(goodwill,

fixed

assets

and

leasehold

interest/freehold)

for

tax

purposes.

12.

Non

compete

and

protection

of

goodwill

To

protect

the

goodwill

the

Vendor

will

provide

covenants

that

they

will

not

for

a

reasonable

period

and

within

reasonable

proximity

enter

into

a

competitive

business

or

carry

out

an

action

that

might

materially

affect

the

goodwill

of

the

Business.

The

Vendor

will

also

conduct

the

Business

in

its

normal

and

ordinary

course

until

completion.

13.

Confidentiality,

due

diligence

and

disclosure

The

Parties

agree

that

the

terms,

negotiations

and

sale

are

confidential

save

in

taking

counsel

from

their

professional

advisors,

or

as

required

by

the

rules

and

regulations

of

the

London

Stock

Exchange,

or

any

TUPE

obligation

to

consult

with

employees.

The

Parties

agree

to

disclose

any

facts

material

to

the

transaction.

The

Vendor

will

grant

the

Purchaser

or

their

advisors

and

employees

access

to

the

Business,

its

operations

and

books

in

order

to

perform

due

diligence.

Access

will

be

provided

consistent

with

the

Vendors

requirement

to

protect

confidentiality.

14.

Representations

and

warranties

The

Vendor

agrees

to

provide

and

the

Purchaser

agrees

to

request

warranties,

indemnities

and

representations

appropriate

for

a

transaction

of

this

size.

15.

Advisors,

fees

and

costs

The

Parties

agree

to

instruct

early

on

appropriate

advisors

to

complete

a

transaction

of

this

size

in

the

timescale

proposed.

Each

party

shall

be

responsible

for

their

own

advisors

fees

and

costs

incurred

in

the

transaction.

16.

Exclusivity

and

deposit

The

Vendor

agrees

to

provide

exclusivity

to

the

Purchaser

up

to

the

target

date

for

completion,

subject

to

reasonable

progress

being

made

by

the

Purchaser.

During

such

exclusivity

the

Vendor

or

their

advisors

will

not

before

completion

discuss,

negotiate

or

provide

assistance

to

any

third

party

who

may

be

interested

in

the

Business.

17.

Terms

English

law

will

govern

these

Heads

of

Terms

and

the

sale

and

purchase

agreement.

Vendors

signature

Purchasers

signature

www.avondale.co.uk

Page

9

of

10

01737

240888

This

guide

is

not

definitive.

Accuracy

is

not

guaranteed

and

it

does

not

replace

professional

advice.

Guide: Legal Aspects of a Business Sale

Date: / /0 Date: / /0

www.avondale.co.uk

Page 10 of 10

01737 240888

This guide is not definitive. Accuracy is not guaranteed and it does not replace professional advice.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument15 pagesProblem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzNo ratings yet

- Donralph Media Concept LimitedDocument1 pageDonralph Media Concept LimitedDonRalph DMGNo ratings yet

- Case StudyDocument2 pagesCase StudyRahul DhingraNo ratings yet

- Theological Seminary of Evengelical Kalimantan ChurchDocument15 pagesTheological Seminary of Evengelical Kalimantan ChurchPetra Aria Pendung Wu'iNo ratings yet

- GS Mains PYQ Compilation 2013-19Document159 pagesGS Mains PYQ Compilation 2013-19Xman ManNo ratings yet

- 304 1 ET V1 S1 - File1Document10 pages304 1 ET V1 S1 - File1Frances Gallano Guzman AplanNo ratings yet

- RamadanDocument12 pagesRamadanMishkat MohsinNo ratings yet

- Updated 2 Campo Santo de La LomaDocument64 pagesUpdated 2 Campo Santo de La LomaRania Mae BalmesNo ratings yet

- Become A Living God - 7 Steps For Using Spirit Sigils To Get Anything PDFDocument10 pagesBecome A Living God - 7 Steps For Using Spirit Sigils To Get Anything PDFVas Ra25% (4)

- Dawah Course Syllabus - NDocument7 pagesDawah Course Syllabus - NMahmudul AminNo ratings yet

- Procure To Pay (p2p) R12 - ErpSchoolsDocument20 pagesProcure To Pay (p2p) R12 - ErpSchoolsMadhusudhan Reddy VangaNo ratings yet

- Leadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)Document381 pagesLeadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)benjaminwong8029No ratings yet

- Cw3 - Excel - 30Document4 pagesCw3 - Excel - 30VineeNo ratings yet

- Implications - CSR Practices in Food and Beverage Companies During PandemicDocument9 pagesImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranNo ratings yet

- The Importance of Connecting The First/Last Mile To Public TransporDocument14 pagesThe Importance of Connecting The First/Last Mile To Public TransporLouise Anthony AlparaqueNo ratings yet

- Weavers, Iron Smelters and Factory Owners NewDocument0 pagesWeavers, Iron Smelters and Factory Owners NewWilliam CookNo ratings yet

- Country in A Box ProjectDocument6 pagesCountry in A Box Projectapi-301892404No ratings yet

- Cultural Materialism and Behavior Analysis: An Introduction To HarrisDocument11 pagesCultural Materialism and Behavior Analysis: An Introduction To HarrisgabiripeNo ratings yet

- Case Study Group 4Document15 pagesCase Study Group 4000No ratings yet

- Work Place CommitmentDocument24 pagesWork Place CommitmentAnzar MohamedNo ratings yet

- 3.4 Supporting Doc Risk Register Template With InstructionsDocument8 pages3.4 Supporting Doc Risk Register Template With InstructionsSwadhin PalaiNo ratings yet

- Introduction To Cybersecurity: Nanodegree Program SyllabusDocument15 pagesIntroduction To Cybersecurity: Nanodegree Program SyllabusaamirNo ratings yet

- Running Head: Problem Set # 2Document4 pagesRunning Head: Problem Set # 2aksNo ratings yet

- Declarations On Higher Education and Sustainable DevelopmentDocument2 pagesDeclarations On Higher Education and Sustainable DevelopmentNidia CaetanoNo ratings yet

- ContinueDocument3 pagesContinueGedion KilonziNo ratings yet

- WFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)Document2 pagesWFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)elias semagnNo ratings yet

- Sir Gawain and The Green Knight: A TranslationDocument39 pagesSir Gawain and The Green Knight: A TranslationJohn AshtonNo ratings yet

- City of Cleveland Shaker Square Housing ComplaintDocument99 pagesCity of Cleveland Shaker Square Housing ComplaintWKYC.comNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- Leander Geisinger DissertationDocument7 pagesLeander Geisinger DissertationOrderPapersOnlineUK100% (1)