Professional Documents

Culture Documents

ACC501 Mod 1 Case Financial Statements

Uploaded by

Noble S WolfeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC501 Mod 1 Case Financial Statements

Uploaded by

Noble S WolfeCopyright:

Available Formats

FINANCIAL STATEMENTS 1

Financial Statements Lester M. Legette Trident University International

ACC501- Accounting for Decision Making Dr. Ralph Wayne Ezelle 23 January 2012

FINANCIAL STATEMENTS Financial Statements When determining the overall financial health of any organization, financial statements are invaluable. Financial statements are prepared by an organization and provide various interested parties with necessary information about the financial standing of that organization. Financial statements are usually found in the Annual Reports that all publicly traded organizations are required to produce by the Securities and Exchange Commission (SEC). There are four main financial statements: balance sheets, income statements, cash flow statements, and statements of shareholders equity. For the purposes of this paper we will only deal with the first three. Balance sheets provide information about what a company owns and what it owns at a fixed point in time, usually the end of the year, while income statements show how much money a company made and spent over a period of time, usually the course of a year. And finally, cash flow statements summarize the sources and uses of cash and is a good indicator of whether a company has enough cash available to carry on routine operations. In this paper, several accounting terms and principles dealing with financial statements will be examined, and the financial statements of three separate companies will be evaluated. Accounting Standards Generally Accepted Accounting Principles (GAAP). Abercrombie & Fitch, a US based corporation uses the GAAP method to report their financial statements. GAAP is known as a common set of accounting principles, standards, and procedures that companies use to compile their financial statement. GAAP is a combination of authoritative standards (set by policy boards) and simply the commonly accepted ways of recording and reporting accounting information. 2

FINANCIAL STATEMENTS 3 To expand on this definition of the generally accepted accounting principles, it implies that they represent a concept well known to CPA and sophisticated users of financial statements. However, no official list of accounting principles exists. GAAP are highly recommended for use by companies and is extremely important so that investors have a minimum level of consistency in the financial statements they use when analyzing companies for investment purposes. Companies are expected to follow GAAP rules when reporting their financial data via financial statements. International Financial Reporting Standards (IFRS). Hennes & Mauritz a Sweden-based company uses the International Financial Reporting Standards (IFRS) to report their financial reports. IFRS are standards, interpretation, and the framework for the preparation and presentation of financial statements. Many of the standards forming part of IFRS are known by the older name of International Accounting Standards (IAS). IAS were issued between 1973 and 2001 by the Board of the International Accounting Standards Committee (IASC). On 1 April 2001, the new IASB took over from the IASC the responsibility for setting International Accounting Standards. During its first meeting the new Board adopted existing IAS and SICs. The IASB has continued to develop standards calling the new standards IFRS, (IFRS, n.d.). Generally Accepted Auditing Standards Hennes & Mauritz, and Abercrombie & Fitch use GAAS for their auditing purposes. The generally accepted auditing standards (GAAS) are the standards which are used for auditing private companies. GAAS comes in three categories: general standards, standards of fieldwork, and standards of reporting. GAAS are the minimum standards used for auditing companies. In addition the Public Company Accounting Oversight Board (PCAOB) has adopted these

FINANCIAL STATEMENTS 4 standards for public (traded) companies. General standards are standards that address your qualifications to be an auditor and the minimum standards for your work product. Standards of field work govern how you actually do your job. Lastly, a standard of reporting involves information you must consider prior to issuing your audit report, (GAAS, n.d.). International Auditing and Assurance Standards The International Auditing and Assurance Standards Board (IAASB) objective is to serve the public interest by setting high-quality auditing and assurance standards by facilitating the convergence of international and national auditing and assurance standards, thereby enhancing the quality and consistency of practice throughout the world and strengthening public confidence in the global auditing assurance profession. Currently there are over 125 countries using or are in the process of adopting international standards on auditing (ISAs), issued by the IAASB, into their national auditing standards or using them as a basis for preparing national auditing standards. Al l five terms mentioned relate to each other in one form or another. However, they all share one common result and that is they are standards for governing financial statements, (IAASB, 2011). Comparing Annual Statements In comparing the financial statements of Abercrombie & Fitch and Hennes & Mauritz, I found that A&F financial statements were more detailed and a lot easier to understand even for the most inexperienced investor. A&F financial sheets were broken down with titles and subtitles so that investors can see exactly where the money is going, and what areas are doing the best. The data in this format gives investors the best information so that they can make smart financial decisions. A&F financial statements were also prepared in US currency.

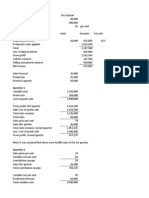

FINANCIAL STATEMENTS 5 H&M statements are prepared in SEK; this would make it more difficult for American investors, because you have to convert the currency to USD. H&M financial statements were very broad and not broken down as much as A&F, which would make it difficult for investors to see exactly where to money is going, and in return would make it difficult for investors to make smart financial decisions based on the information provided. The financial statements are not very comparable with the naked eye. In order to compare these annual statements you must have the means to convert USD to SEK or vice versa. The fact that A&F has broken their statements down to the lowest level makes it difficult to believe the numbers from H&F, which in return makes it a little challenging to compare the statements and make a smart financial investment decision. Which of the two companies is most profitable? In the Charts below we analyze and compare the Balance sheet, Income statement, and the cash flow statements from both companies noted in this case study. Comparing the figures from 2009, Abercrombie & Fitch had a better year than Hennes & Mauritz. A&F profited more in the following areas: income, investments, and equity. A&F showed profits for 2009, they began the year with $522,122 cash and equivalents, and ended the year $680,113 they have showed an increase in profits for the last three years, in fact since 2007, they have more than tripled their Cash and Equivalents. In the last three years, H&M has reported negative numbers on the cash flow, and income statement. Negative numbers were noted in current operations, cash flow from changes in working capital, investment activities, and financing activities. H&M ended 2009 with a

FINANCIAL STATEMENTS 6 negative cash flow of -1,530(SEK). In 2009 H&M started out with 22,726 (SEK) liquid funds, they ended the year with 19,024(SEK), which was a non-profit of 3,702(SEK). Difference in profitability The profitability between the two companies can be explained simply by the fact that although H&M is ending the year with profit in Liquid cash, they are still taking losses in investments, current operations, financing activities, and cash flow for the year. H&M also started 2009 with 22,726(SEK) and ended with 19,024(SEK) they have also taken a lost in 2010 they started out with 19,024(SEK) and ended with 16,691(SEK). A&F has showed nothing but profit in fact they have been increasing their profit every year since 2007. Although A&F took a slight lost in Investing Activities in 2009 they made up for it with Financing Activities. Information used to answer the above questions I used different sources to answer the questions above. I had to use the USD converter in order to compare the numbers on the financial statements. I used the financial statements off of Company websites to in order to compare the two companies. I was also able to use www.reuters.com to get a real time reading of how the companies are doing in the stock market today A&F is up 44.74USD and H&M is 31.75USD which was another indicator that A&F is doing better financially. In all, if I was an investor looking to invest in a company, I would go with A&F, because the data prepared was easier to turn into useful information, and get a true reading on all of the areas that are doing well. I felt more comfortable with the information that was presented by A&F, I felt like they were not trying to hide anything.

FINANCIAL STATEMENTS 7 BALANCE SHEET A&F Total Assets 2007 2008 2009 $2,248,067 $2,567,598 $2,848,181 Total Equity 2007 2008 2009 $1,405,297 $1,618,313 $1,845,578 Total Liabilities 2007 2008 2009 $842,770 $949,285 $1,002,603 H&M Total Assets 41,734(SEK) 51,243(SEK) 54,363(SEK) Total Equity 32,093(SEK) 36,950(SEK) 40,613(SEK) Total Liabilities 9,641(SEK) 14,293(SEK) 13,750(SEK) Total Equity and Liabilities 41,734(SEK) 51,243(SEK) 54,363(SEK)

Total Equity and Liabilities 2007 2008 2009 $2,248,067 $2,567,598 $2,248,181

FINANCIAL STATEMENTS 8 INCOME STATEMENT A&F Cost of goods sold 2007 2008 2009 $1,238,480 $1,152,963 $1,045,028 Gross Profit 2007 2008 2009 $2,488,166 $2,331,095 $1,883,598 Operating Income 2007 2008 2009 $778,909 $498,262 $117,912 Net Income 2007 2008 2009 $475,697 $272,255 $254 H&M Cost of goods sold -30,499(SEK) -34,064(SEK) -38,919(SEK) Gross Profit 47,847(SEK) 54,468(SEK) 62,474(SEK) Operating Profit 18,382(SEK) 20,138(SEK) 21,644(SEK) Profit for the year 13,588(SEK) 15,294(SEK) 16,384(SEK)

FINANCIAL STATEMENTS 9

STATEMENT OF CASH FLOW A&F Net Cash Operating Activities 2007 2008 2009 $817,524 $490,836 $402,200 Investing Activities 2007 2008 2009 $500,170 $113,217 $111,561 Financing Activities 2007 2008 2009 $282,755 $30,469 $136,050 H&M Cash Flow Current Operations 15,381(SEK) 17,996(SEK) 17,973(SEK) Investing Activities -9,515(SEK) -1,090(SEK) -8,755(SEK) Financing Activities -9,515(SEK) -11,584(SEK) -12,825(SEK) Cash flow for the year 6,010(SEK) 5,292(SEK) -1,530(SEK)

Cash and Equivalents, end of year 2007 2008 2009 $118,044 $522,122 $680,113

FINANCIAL STATEMENTS 10

Company Abercrombie & Fitch CO.

Comparisons Steadily increased their profits and sales over the past several years; investing in research and development of new technologies, expanding services and products, and acquiring new business segments. Decrease in profits and sales. Took a lost in cash flow from changes in working capital, investment activity, financing activities, cash flow for the year

Conclusions A&E should continue to show increasing profits and sales as they continue to expand and invest in the future.

Hennes & Mauritz

Profits and sales should increase if they have effectively restructured and continue to focus on profitable business segments and keep inventories at levels consistent with demand. Focus on reducing inventories, restructuring, and eliminating unprofitable segments.

FINANCIAL STATEMENTS 11 References Abercrombie & Fitch. (n. d.). About Financial Statements. Abercrombie & Fitch. Retrieved 12 January 10 2011 from http://www.reuters.com/finance/stocks/companyProfile?symbol=ANF.N Abercrombie & Fitch. (n. d.). About Financial Statements. Abercrombie & Fitch. Retrieved 12 January 10 2011 from http://www.abercrombie.com/anf/investors/investorrelations.html GAAS. (n.d.). Generally Accepted Auditing Standards. Wikicfo.com. Retrieved July 25, 2011 from http://www.wikicfo.com/Wiki/Generally-Accepted-Auditing-Standards-GAAS.ashx Hennes & Mauritz. (n. d.). About Financial Statements. Hennes & Mauritz. Retrieved 12 January 10 2011 from http://about.hm.com/us/ir Hennes & Mauritz. (n. d.). About Financial Statements. Hennes & Mauritz. Retrieved 12 January 10 2011 from http://about.hm.com/fi/investorrelations/fiveyearsummary__fiveyearsummary.nhtml Hennes & Mauritz. (n. d.). About Financial Statements. Hennes & Mauritz. Retrieved 12 January 10 2011 from http://www.hoovers.com/company/HM_Hennes__Mauritz_AB/rffxfri1.html IAASB. (2011, May). International Auditing and Assurance Standards Board. Iafc.org. Retrieved July 25, 2011 from http://web.ifac.org/download/IAASB_Fact_Sheet.pdf IFRS. (n.d.). International Financial Reporting Standards. Ifrs.org. Retrieved July 25, 2011 from http://www.ifrs.org

FINANCIAL STATEMENTS 12

You might also like

- Chapter 3 An Introduction To Consolidated Financial Statements - STDDocument54 pagesChapter 3 An Introduction To Consolidated Financial Statements - STDdhfbbbbbbbbbbbbbbbbbh100% (1)

- Liquidity Ratios: What They Are and How to Calculate ThemDocument4 pagesLiquidity Ratios: What They Are and How to Calculate ThemLanpe100% (1)

- Investment Analysis ProjectDocument6 pagesInvestment Analysis Projectmuhammad ihtishamNo ratings yet

- Assignment - Ankit Singh BBA (P) 2Document19 pagesAssignment - Ankit Singh BBA (P) 2Rahul SinghNo ratings yet

- Ratio Analysis Guide for Financial Statement EvaluationDocument12 pagesRatio Analysis Guide for Financial Statement EvaluationMrunmayee MirashiNo ratings yet

- Accounting For ManagersDocument235 pagesAccounting For Managerssajaggrover100% (2)

- Financial Analysis of Wipro LTD PDFDocument25 pagesFinancial Analysis of Wipro LTD PDFMridul sharda100% (2)

- Financial Statement Analysis With Answer PDFDocument27 pagesFinancial Statement Analysis With Answer PDFKimNo ratings yet

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Clause 49 - Listing AgreementDocument36 pagesClause 49 - Listing AgreementMadhuram Sharma100% (1)

- Chapter 2 Nature of Accountancy ResearchDocument13 pagesChapter 2 Nature of Accountancy Researchdebate ddNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- Nes Ratnam College Internal Exam ReportDocument7 pagesNes Ratnam College Internal Exam ReportPooja MauryaNo ratings yet

- What Is Auditor IndependenceDocument6 pagesWhat Is Auditor IndependenceNeriza PonceNo ratings yet

- Q-1. What Is The Difference Between Management Accounting and Financial Accounting?Document12 pagesQ-1. What Is The Difference Between Management Accounting and Financial Accounting?poojaNo ratings yet

- Assignment For Corporate Financial AccountingDocument6 pagesAssignment For Corporate Financial AccountingFlemin GeorgeNo ratings yet

- Chapter 4Document27 pagesChapter 4Annalyn MolinaNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsCrissa BernarteNo ratings yet

- What Is IFRSDocument21 pagesWhat Is IFRSDivisha AgarwalNo ratings yet

- Fraser Statements Ch01Document45 pagesFraser Statements Ch01Pramod Bharadwaj0% (1)

- International Financial Reporting Standards - IFRSDocument7 pagesInternational Financial Reporting Standards - IFRSbarkeNo ratings yet

- International Financial Reporting Standard1Document6 pagesInternational Financial Reporting Standard1Ashish PatelNo ratings yet

- Financial Statement: British English United Kingdom Company LawDocument4 pagesFinancial Statement: British English United Kingdom Company Lawkumar kunduNo ratings yet

- Diff Betn Us Gaap - IfrsDocument9 pagesDiff Betn Us Gaap - IfrsVimal SoniNo ratings yet

- Financial Statement Analysis (Nov-20)Document51 pagesFinancial Statement Analysis (Nov-20)Aminul Islam AmuNo ratings yet

- Final Assignment 505Document36 pagesFinal Assignment 505PRINCESS PlayZNo ratings yet

- A Guide To The New Language of Accounting and FinanceDocument19 pagesA Guide To The New Language of Accounting and FinanceCharlene KronstedtNo ratings yet

- Asignación 2 FSRADocument5 pagesAsignación 2 FSRAElia SantanaNo ratings yet

- Semana 04 y 05 - InGLES Berk de Marzo Cap 2 Financial Statement AnalysisDocument38 pagesSemana 04 y 05 - InGLES Berk de Marzo Cap 2 Financial Statement AnalysisPatricia SánchezNo ratings yet

- Accounting StandardDocument5 pagesAccounting StandardGebrie WondimsiamregnNo ratings yet

- Financial Statement Analysis: AnDocument82 pagesFinancial Statement Analysis: AnMadalin PotcoavaNo ratings yet

- HND, Unit 10, Level 5Document26 pagesHND, Unit 10, Level 5Abrar Khan MarwatNo ratings yet

- INTRODUCTIONDocument80 pagesINTRODUCTIONparth100% (1)

- Financial Statement Analysis A Look at The Balance Sheet PDFDocument4 pagesFinancial Statement Analysis A Look at The Balance Sheet PDFnixonjl03No ratings yet

- BSBFIA402 Assessment 1 VF FinanzasDocument10 pagesBSBFIA402 Assessment 1 VF FinanzasLiliana Cañon GomezNo ratings yet

- Running Head: Introduction To Financial AccountingDocument172 pagesRunning Head: Introduction To Financial AccountingHassan RazaNo ratings yet

- AtementsDocument6 pagesAtementsralph ravasNo ratings yet

- Fa4e SM Ch01Document21 pagesFa4e SM Ch01michaelkwok1100% (1)

- IFRS, Accounting Standards and Business: JanuaryDocument3 pagesIFRS, Accounting Standards and Business: JanuaryZeris TheniseoNo ratings yet

- Everything You Need to Know About Annual ReportsDocument4 pagesEverything You Need to Know About Annual ReportsEvanjo NuquiNo ratings yet

- The Economic Impact of IFRSDocument22 pagesThe Economic Impact of IFRSSillyBee1205No ratings yet

- IAS Introduction StandardsDocument44 pagesIAS Introduction Standardsbu butccmNo ratings yet

- Accounting Standards and Financial ReportingDocument9 pagesAccounting Standards and Financial ReportingIntan Rizky AzhariNo ratings yet

- Afm AssignmentDocument6 pagesAfm AssignmentShweta BhardwajNo ratings yet

- Chapter 4Document53 pagesChapter 4tangliNo ratings yet

- Financial Reporting: Department of Finance and Accounting G: 03Document5 pagesFinancial Reporting: Department of Finance and Accounting G: 03Ismail AbderrahimNo ratings yet

- GAAP Fundamentals ExplainedDocument6 pagesGAAP Fundamentals ExplaineddreaNo ratings yet

- What Are Accounting Principles?: Key TakeawaysDocument11 pagesWhat Are Accounting Principles?: Key Takeawaysmointips81No ratings yet

- IAS No.1Document10 pagesIAS No.1Hamza MahmoudNo ratings yet

- Financial Accounting/Corporate AccountingDocument7 pagesFinancial Accounting/Corporate AccountingY TEJASWININo ratings yet

- Financial StatementsDocument6 pagesFinancial Statementsvenkatch220% (1)

- Intangibles and Earnings: Counterpoint Global InsightsDocument14 pagesIntangibles and Earnings: Counterpoint Global InsightsTimothyNgNo ratings yet

- Olin Finance Club Interview GuideDocument20 pagesOlin Finance Club Interview GuideSriram ThwarNo ratings yet

- Legal Aspects of Business AccountingDocument5 pagesLegal Aspects of Business AccountingswaggerboxNo ratings yet

- Finance 4Document68 pagesFinance 4Anand ThatvamasheeNo ratings yet

- Assignment Weng 5Document1 pageAssignment Weng 5dampalit malabonNo ratings yet

- Understanding Financial StatementsDocument5 pagesUnderstanding Financial Statementsa25255tNo ratings yet

- Harmony of Accounting STDDocument4 pagesHarmony of Accounting STDRavi Thakkar100% (1)

- Sample Market Analysis - 2Document11 pagesSample Market Analysis - 2MohammedNo ratings yet

- 7 Financial StatementsDocument28 pages7 Financial StatementsDebashish NiloyNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementJan Marini Lopez MiguelNo ratings yet

- Reading and Understanding Financial StatementsDocument14 pagesReading and Understanding Financial StatementsSyeda100% (1)

- ACCT 504 MART Perfect EducationDocument58 pagesACCT 504 MART Perfect EducationdavidwarnNo ratings yet

- Financial ReportingDocument13 pagesFinancial ReportingMarcNo ratings yet

- AbsorptionDocument2 pagesAbsorptionNoble S WolfeNo ratings yet

- AirplaneDocument4 pagesAirplaneNoble S WolfeNo ratings yet

- Ekland DivisionDocument4 pagesEkland DivisionNoble S WolfeNo ratings yet

- Garden of EdenDocument118 pagesGarden of Edensean lee100% (2)

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- BreakevenDocument4 pagesBreakevenNoble S WolfeNo ratings yet

- Pockett Company 31 Dec 2011 Balance Sheet: AssetsDocument2 pagesPockett Company 31 Dec 2011 Balance Sheet: AssetsNoble S WolfeNo ratings yet

- GuitarDocument8 pagesGuitarNoble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- Absorption CostingDocument2 pagesAbsorption CostingNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Lessons Learned From The Clinic1Document8 pagesLessons Learned From The Clinic1Noble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Flexible Budget Breakdown by Variable and Fixed CostsDocument1 pageFlexible Budget Breakdown by Variable and Fixed CostsNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- World ComDocument2 pagesWorld ComNoble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- Transfer PricingDocument4 pagesTransfer PricingNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Wal-Mart Pharmacy Flexible Budget Income Statement Units of ProductionDocument1 pageWal-Mart Pharmacy Flexible Budget Income Statement Units of ProductionNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Assessment 1Document4 pagesAssessment 1Noble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- Interview Base - Knowledge & PracticalDocument39 pagesInterview Base - Knowledge & Practicalsonu malikNo ratings yet

- 2008 Annual ReportDocument24 pages2008 Annual ReportmarketnetNo ratings yet

- 3 PAS 1 PowerPoint PresentationDocument37 pages3 PAS 1 PowerPoint PresentationCherrybelle Adorable-LaoNo ratings yet

- Comparative Financial StatementDocument25 pagesComparative Financial StatementharikrishnaNo ratings yet

- SM Chap 7Document70 pagesSM Chap 7Debora BongNo ratings yet

- Audit and Internal ReviewDocument7 pagesAudit and Internal ReviewkhengmaiNo ratings yet

- SA 510 QuestionsDocument6 pagesSA 510 Questionshimani guptaNo ratings yet

- Importance of AuditingDocument5 pagesImportance of AuditingRohit BajpaiNo ratings yet

- President CEO in Pittsburgh PA Resume Michael HinsonDocument3 pagesPresident CEO in Pittsburgh PA Resume Michael HinsonMichaelHinsonNo ratings yet

- Summative Assessment 2Document5 pagesSummative Assessment 2Parvesh SahotraNo ratings yet

- Module 33 - Related Party DisclosuresDocument60 pagesModule 33 - Related Party DisclosuresOdette ChavezNo ratings yet

- Ritical Valuation of Inancial Erformance of Oly Roducts LC.: Adnan Ul Haque Financial ManagementDocument17 pagesRitical Valuation of Inancial Erformance of Oly Roducts LC.: Adnan Ul Haque Financial ManagementAdnan YusufzaiNo ratings yet

- Digest - PFRS 3 and PFRS 10Document4 pagesDigest - PFRS 3 and PFRS 10Elizabeth DumawalNo ratings yet

- MODUL 1 PELAKOR SEP 2020 - Dari Bu RatnaDocument47 pagesMODUL 1 PELAKOR SEP 2020 - Dari Bu Ratnapradana arif kurniawanNo ratings yet

- 4 - Rec Re Analysis 3 6. 2021Document322 pages4 - Rec Re Analysis 3 6. 2021bhobot riveraNo ratings yet

- Nepal Accounting Standard 8: Accounting Policies, Changes in Accounting Estimates and ErrorsDocument13 pagesNepal Accounting Standard 8: Accounting Policies, Changes in Accounting Estimates and ErrorsRochak ShresthaNo ratings yet

- 2020 Candidate Body of KnowledgeDocument1 page2020 Candidate Body of KnowledgeLilsNo ratings yet

- Report Chenab Engineerig and Foundries FaisalabadDocument7 pagesReport Chenab Engineerig and Foundries FaisalabadKashif RazaNo ratings yet

- Conceptual Framework Accounting Standards: Summary ofDocument5 pagesConceptual Framework Accounting Standards: Summary of버니 모지코No ratings yet

- CM Kiem Toan Viet Nam - EngDocument213 pagesCM Kiem Toan Viet Nam - EngDiep NguyenNo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Title Viii Corporate Books and Records: I. LimitationsDocument12 pagesTitle Viii Corporate Books and Records: I. LimitationsRengeline LucasNo ratings yet

- Annual Report 2011 HMDocument52 pagesAnnual Report 2011 HMSri NeogiNo ratings yet

- Chapter 2 Conceptual Framework and Theoretical Structure of Financial Accounting and ReportingDocument11 pagesChapter 2 Conceptual Framework and Theoretical Structure of Financial Accounting and ReportingMARIANo ratings yet

- Qualitative Characteristics of Financial Reporting: An Evaluation According To The Albanian Users' PerceptionDocument13 pagesQualitative Characteristics of Financial Reporting: An Evaluation According To The Albanian Users' PerceptionCatherine LorentonNo ratings yet