Professional Documents

Culture Documents

KPMG Flash News - Temasek Holdings Advisors (I) P LTD

Uploaded by

sriramranga0 ratings0% found this document useful (0 votes)

113 views0 pagesTemasek case ITAT

Original Title

KPMG Flash News - Temasek Holdings Advisors (I) P Ltd

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTemasek case ITAT

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

113 views0 pagesKPMG Flash News - Temasek Holdings Advisors (I) P LTD

Uploaded by

sriramrangaTemasek case ITAT

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS

KPMG IN INDIA

Reimbursement of salaries of seconded employees is not in the nature of

Fees for Technical Services

26 September 2013

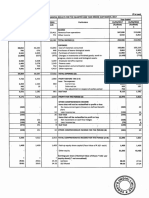

Background

Recently, the Mumbai Bench of the Income-tax

Appellate Tribunal (the Tribunal) in the case of

Temasek Holdings Advisors (I) P Ltd

1

(the taxpayer)

held that reimbursement of salary to a Singapore

company for seconded employees is not Fees for

Technical Service (FTS) under the Income-tax Act,

1961 (the Act) or India-Singapore tax treaty (tax treaty)

since the Singapore company is not rendering any

service to the taxpayer, either directly or through the

seconded employees.

Further, the Tribunal held that services of the seconded

employees have been rendered in India for the

taxpayer and tax has been deducted under Section 192

of the Act. Consequently, there was no requirement to

deduct tax under Section 195 of the Act. Also, there

was no Service Permanent Establishment (PE) of the

Singapore Company because it was not rendering any

service to the taxpayer through seconded employees.

_______________

1

Temasek Holdings Advisors (I) P. Ltd. v. DCIT (ITA No. 4203/Mum/2012)

Taxsutra.com

Facts of the case

The taxpayer, an Indian company, is a wholly

owned subsidiary of Temasek Holding Pte Ltd

(THPL) which is an Asia investment firm based at

Singapore.

The taxpayer renders investment advisory

services to THPL which includes identifying and

analysing potential investment particulars in

India, evaluating political and economic scenario

for the investment purpose in India and

monitoring and making recommendation to THPL

in respect of specified investment in India,

specifically for unlisted companies.

The aforesaid services are solely provided by the

taxpayer and not by THPL for which THPL is

paying 21 percent mark-up to the taxpayer and

also reimbursement of some expenditure on

actual basis.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

Once it is not disputed that two persons were

seconded employees and they have been deputed

to India as per the terms of secondment

agreement, then the payment of salary and

reimbursement made by the taxpayer to THPL

cannot be disputed.

The reimbursement of salary cannot be said to be

the income chargeable to tax under the Act and

the same cannot be subject to TDS under Section

195 of the Act.

Once the services of the seconded employees

have been rendered in India for the taxpayer, tax

needs to be withheld under Section 192, which

has been done in this case. Consequently, there

was no need to deduct tax under Section 195 of

the Act.

Even under Explanation 2 to Section 9(1)(vii) of

the Act, if the consideration is chargeable under

the head salary, the same will not be termed as

FTS. In support of its contention the taxpayer

relied on various decisions

2

.

The secondment agreement creates the obligation

for the payment of salary and the liability to

reimburse the same. In the case of Petroleum

India International

3

there was no issue of Section

195 or FTS. Further, the decision of the Supreme

Court in the case of Emil Webbers

4

is not

applicable to the facts of the present case.

The Madras High Court

5

in the case of Verizon

Data Services Pvt. Ltd has not affirmed the

decision of the AAR

6

. The High Court has not

expressed any view and therefore, it cannot be

held that any law has been laid down by the AAR

which has been affirmed by the High Court.

Reimbursement of other expenditure

All the expenditure was incurred on behalf of the

taxpayer for the Indian operation only and

therefore, the same needs to be reimbursed to the

THPL which has incurred this expenditure.

______________

2

Abbey Business Services India Pvt. Ltd. v. DCIT [2012] 53 SOT 401

(Bang), ACIT v. CMS (I) Operations & Maintenance Co. P. Ltd. [2012] 135

ITD 386 (Chen), ITO v. CMS (I) Operations & Maintenance Co. P. Ltd. (ITA

No.1264/Mds./2012), ITO v. Ariba Technologies (I) Pvt. Ltd. (ITA

no.616/Bang/2011), DIT v. HCL Infosystem Ltd.[2005] 274 ITR 261 (Del),

HCL Infosystems Ltd [2002] 76 TTJ 505 (Del), Dolphin Drilling Ltd. v. ACIT

[2009] 29 SOT 612 (Del), Cholamandalam MS General Insurance Co. Ltd. Re

[2009] 309 ITR 356 (AAR), DDIT v. Tekmark Global Solutions LLC (Tekmark)

[2010] 38 SOT 7 (Mum), CIT v. Karistorz Endoscopy India P. Ltd. (ITA No.13

of 2008 (Del), ACIT v. Karistorz Endoscopy India P. Ltd. (ITA

No.2929/Del/2009), and IDS Software Solutions (I) P Ltd. v. ITO [2009] 32

SOT 25 (Bang)

3

ACIT v. Petroleum India International (ITA No.8086/Mum./2003) and (C.O.

No.6/Mum/2009), dated 28 September 2012)

4

Emil Webber v. CIT [1993] 200 ITR 483 (SC)

5

Verizon Data Services Pvt Ltd v. AAR, ITO, ACIT [Writ Petition No. 14921 of

2011, dated 9 August 2011]

6

Verizon Data Services Pvt Ltd [2011] 337 ITR 192 (AAR)

By virtue of secondment agreement, THPL has

seconded two of its employees to the taxpayer, to assist

in rendering of investment advisory services. Further,

since the said employees were on the payroll of THPL,

the salary of these employees was paid by them after

deducting taxes.

Key highlights of the seconded agreement are as

follows:

Supervision, direction and control of the deputed

employees is with the taxpayer

THPL does not bear any responsibility or risk for

the results produced by the work of the deputed

employees

The salary cost of the deputed employees is borne

by the taxpayer and the cost of the deputed

employees is charged back by THPL to the

taxpayer on actual basis without any mark-up.

During the years under consideration, the taxpayer

reimbursed the salaries of seconded employees,

expenditure of seconded employees, business

promotions, professional fees, etc, to THPL.

The Assessing Officer (AO) held that the secondment

agreements between the taxpayer and THPL are

unregistered and, date and place in the agreement has

not been mentioned. These agreements are colourable

device with an intention to avoid tax liabilities in India.

Since these payments have been made, without

deducting Tax Deducted at Source (TDS) under Section

195 of the Act, the AO disallowed the expenditure under

Section 40(a)(i) of the Act.

For Assessment Year (AY) 2007-08, the Commissioner

of Income-tax (Appeals) [CIT(A)] confirmed the order

passed by the AO. Further, for AY 2008-09 the Dispute

Resolution Panel (DRP) held that the reimbursement of

salary cost and other expenditure has to be treated as

FTS under the tax treaty.

Issues before the Tribunal

Whether reimbursement of salary cost is treated as

FTS?

Whether such reimbursement of salary and other

expenditure is liable for withholding of tax?

Taxpayers contentions

Reimbursement of salary cost

THPL had deducted the tax under Section 192 of the

Act when they paid salary to employees and the same

has been deposited in India. Once the tax has been

deducted on the salary, again there was no requirement

to deduct tax on account of reimbursement of such

salary.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

Relying on the decision of Siemens Akeiongesellschaft

7

it was contended that reimbursement of expenditure

cannot constitute income and no tax was required to be

deducted under Section 195 of the Act. Further, the

decision of the Supreme Court in the case of

Kanchanganga Sea Food

8

is not applicable to the facts

of the present case.

Tax departments contentions

In the absence of any employee-employer relationship

between the taxpayer and the seconded employees,

the taxpayer does not have any liability to pay the

salary to these employees and therefore, there was no

question of reimbursement. The payment was FTS

under the Act and also under the tax treaty. However, if

it is not a salary or FTS then there was a Service PE,

hence the payment was to be taxed in India.

On reference to the appointment letter of both the

employees, it was contended that the privity of contract

is between the THPL and the employee and the right of

termination also lies with the THPL. In support of its

contention the tax department relied on the decision of

Petroleum India International.

The nature of duties has not been mentioned in the

secondment agreement and on a perusal of Form 16 of

the two employees, it indicates that the allocation of

salary and the purpose the reimbursement was not

clear.

The tax department relied on the decision of the AAR in

the case of Verizon Data Service India Pvt. Ltd. Further,

the tax department also relied on various AAR rulings

9

where it has been held that payments made in

pursuance of secondment agreement cannot be held to

be reimbursement of expenditure and withholding of tax

under Section 195 of the Act was required on such

payment.

Reference to Explanation 2 to Section 9(1)(vii) of the

Act indicates that managerial and consultancy services

are treated as FTS. The services provided by seconded

employees are in the nature of advisory and managerial

service.

The phrase including the provisions of service of

technical or other personnel in Explanation 2 to Section

9(1)(vii) of the Act, is meant for the employees sent to

render service only. This will include the seconded

employees because it is through these personnel, the

services have been rendered and therefore, the

payments are FTS.

__________________

7

CIT v. Siemens Akeiongesellschaft [2009] 310 ITR 320 (Bom)

8

Kanchanganga Sea Foods Ltd v. CIT [2010] 325 ITR 540 (SC)

9

Centrica India Offshore Pvt. Ltd v. CIT (AAR No. 856/2010)

AT&S India Pvt. Ltd (AAR No.670/2005)

Danfoss Industries Pvt. Ltd. v. CIT (AAR No.606/2002)

Relying on various rulings

10

, the tax department

contended that the payment is also taxable under

Article 12(4)(b) of the tax treaty since these two

persons are making available the expertise to the

taxpayer.

These two employees were sent by the THPL to

work in India with the taxpayer and the employees

have rendered services on behalf of the THPL.

Therefore, this is a case of a Service PE and the

payment was made on account of the services and

not the salary. The taxpayer relied upon the AAR

ruling in the case of Centrica India Offshore Pvt.

Ltd.

The Transfer Pricing Officer (TPO) is not supposed

to look into the other nature of transactions or

reimbursement of expenditure since before him,

the matter is whether the international transactions

undertaken by the AE are at arms length or not.

Tribunals ruling

Reimbursement of salary

An agreement between the two parties need not

necessarily be registered as there is no provision

under the law which provides that such

secondment agreement needs to be registered or

any approval from the Government of India is

required.

The signed secondment agreement was duly filed

and in which the date has already been mentioned

in the operating part of the agreement. Accordingly,

the secondment agreement cannot be held to be a

colourable device.

Even if the relationship between the taxpayer and

the THPL is that of an independent contractor and

reimbursement of salary is a contractual payment,

there is no requirement to deduct tax since the

THPL has paid the salary after withholding of tax

under Section 192 of the Act.

The taxpayer was not a beneficiary of the

expenditure because the seconded employees

have been paid salary by THPL who are working in

India for the taxpayer and the taxpayer is merely

reimbursing the same.

______________

10

Shell India Markets Pvt. Ltd. (AAR no.833/2009)

Mersen India Pvt. Ltd. (AAR No.1074/2010)

Perfetti Van Mille Holding V.V (AAR no.869/2010)

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

By rendering service to THPL, the taxpayer is earning

business income and salary paid is a business

expenditure on which tax has already been deducted

by THPL since the liability to withhold the tax on

salary falls within the purview of Section 192 of the

Act. There cannot be a double deduction of tax - once

at the time of payment of the salary and again on the

reimbursement.

The decision of the AAR in the case of Verizon Data

Service India Pvt. Ltd. is not applicable to the facts of

the present case since in that case the seconded

employees of US Company were rendering services

in India and those services were rendered only

through the Indian company. Whereas, in the present

case the taxpayer is rendering service to THPL on a

mark-up basis and THPL was not rendering any

service in India through the taxpayer. Further, the

Madras High Court had dismissed the Writ Petition

filed by the taxpayer against this AAR ruling and no

opinion has been given by the High Court which has

persuasive value in the present case.

The decision of Danfoss Industries Pvt Ltd

11

was not

applicable to the facts of the present case. Further,

THPL is not rendering any service to the taxpayer and

seconded employees are working for the taxpayer.

Accordingly, managerial or consultancy services were

not rendered by THPL either directly or through the

seconded employees. Hence, provisions of Section

9(1)(vii) of the Act do not apply.

Further, such reimbursement is not taxable under

Article 12(4) of the tax treaty since the THPL is

neither rendering any services to the taxpayer nor

they are making available any kind of technical

knowledge, experience, skill or process to the Indian

company.

The Service PE would exist only when THPL is

rendering services in India through its seconded

employees. However, in the present case THPL is not

rendering any service to the taxpayer through

seconded employees.

Accordingly, on the reimbursement of salary,

reimbursement of expenditure, expenditure relating to

information technology and business promotion,

withholding of tax was not required and therefore,

there would be no disallowance under Section 40(a)(i)

of the Act.

__________________

11

Danfoss Industries Pvt. Ltd. [2004] 268 ITR 1 (AAR)

Reimbursement of other expenditure

The expenditure relating to seconded employees

such as meals, travelling, training, etc, was not

liable for TDS under the Act. Further, business

promotion expenditure and information technology

expenditure are also not liable for TDS since they

are neither for technical services nor for any

professional services. The Supreme Courts

decision in the case of Kanchanganga Sea Food

is not applicable to the facts of the present case.

In the case of professional fees, the expenditures

have been incurred for the purpose of the

taxpayer in India and these payments were made

by the THPL which has been reimbursed by the

taxpayer. TDS provisions are attracted to the

payment for professional services and it does not

make any difference whether the payment was

made by THPL and reimbursed by the taxpayer.

Our comments

Taxation of reimbursement to the foreign companies,

pursuant to secondment contracts has been a subject

matter of litigation before the courts from a long time.

The Indian tax authorities have been contending that

by sending employees to India, the foreign entities are

actually rendering services to the Indian companies or

carrying out business in India in the form of a PE in

India.

In the present case, the Tribunal held that the

Singapore Company had nothing to do with the

seconded employees except for paying their salary.

The Indian company was the economic employer of

the seconded employees. Further the employees were

rendering services purely for the Indian company.

Accordingly, the reimbursements were purely in the

form of salary from which tax was duly deducted and

deposited by the Indian company hence no further tax

withholding was required.

Recently, the Mumbai Tribunal in the case of Mark &

Spencer Reliance India P. Ltd

12

held that merely

providing employees or assisting the taxpayer in the

business and in the area of consultancy,

management, etc. would not constitute make

available of the services of any technical or

consultancy in nature under the India-UK tax treaty.

The Tribunal held that since the amount of salary

received by taxpayers personnel had been subjected

to tax in India, there was no default in deduction of tax

on the part of the taxpayer.

_____________

12

Mark & Spencer Reliance India P. Ltd. (ITA No. 905/M/2012)

Taxsutra.com

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

Note: - The present ruling has dealt with various issues,

however, this flash news has been prepared on the issue of the

reimbursement of salary and other costs.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

www.kpmg.com/in

Ahmedabad

Safal Profitaire

B4 3rd Floor, Corporate Road,

Opp. Auda Garden, Prahlad Nagar

Ahmedabad 380 015

Tel: +91 79 4040 2200

Fax: +91 79 4040 2244

Bangalore

Maruthi Info-Tech Centre

11-12/1, Inner Ring Road

Koramangala, Bangalore 560 071

Tel: +91 80 3980 6000

Fax: +91 80 3980 6999

Chandigarh

SCO 22-23 (Ist Floor)

Sector 8C, Madhya Marg

Chandigarh 160 009

Tel: +91 172 393 5777/781

Fax: +91 172 393 5780

Chennai

No.10, Mahatma Gandhi Road

Nungambakkam

Chennai 600 034

Tel: +91 44 3914 5000

Fax: +91 44 3914 5999

Delhi

Building No.10, 8th Floor

DLF Cyber City, Phase II

Gurgaon, Haryana 122 002

Tel: +91 124 307 4000

Fax: +91 124 254 9101

Hyderabad

8-2-618/2

Reliance Humsafar, 4th Floor

Road No.11, Banjara Hills

Hyderabad 500 034

Tel: +91 40 3046 5000

Fax: +91 40 3046 5299

Kochi

4/F, Palal Towers

M. G. Road, Ravipuram,

Kochi 682 016

Tel: +91 484 302 7000

Fax: +91 484 302 7001

Kolkata

Infinity Benchmark, Plot No. G-1

10th Floor, Block EP & GP,

Sector V Salt Lake City,

Kolkata 700 091

Tel: +91 33 44034000

Fax: +91 33 44034199

Mumbai

Lodha Excelus, Apollo Mills

N. M. Joshi Marg

Mahalaxmi, Mumbai 400 011

Tel: +91 22 3989 6000

Fax: +91 22 3983 6000

Pune

703, Godrej Castlemaine

Bund Garden

Pune 411 001

Tel: +91 20 3050 4000

Fax: +91 20 3050 4010

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we

endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will

continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the

particular situation.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International

Cooperative (KPMG International), a Swiss entity. All rights reserved.

The KPMG name, logo and cutting through complexity are registered trademarks of KPMG International Cooperative (KPMG International), a Swiss

entity.

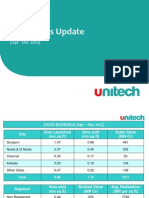

You might also like

- Eimco Elecon Equity Research Report July 2016Document19 pagesEimco Elecon Equity Research Report July 2016sriramrangaNo ratings yet

- Venkys Financial Results 31.03.17Document7 pagesVenkys Financial Results 31.03.17sriramrangaNo ratings yet

- Voltamp Annual Report F.Y - 2015-16Document67 pagesVoltamp Annual Report F.Y - 2015-16sriramrangaNo ratings yet

- Pennar Industries Q4fy17 Investor Presentation FinalDocument29 pagesPennar Industries Q4fy17 Investor Presentation FinalsriramrangaNo ratings yet

- Rural Electrification Corp. Ltd. Initiating CoverargeDocument5 pagesRural Electrification Corp. Ltd. Initiating CoverargesriramrangaNo ratings yet

- SC Arunchal - JudgmentDocument331 pagesSC Arunchal - JudgmentFirstpostNo ratings yet

- Navkar Corporation - SPA ResearchDocument4 pagesNavkar Corporation - SPA ResearchanjugaduNo ratings yet

- Annual Report 2015-16 Key HighlightsDocument57 pagesAnnual Report 2015-16 Key HighlightssriramrangaNo ratings yet

- NDR Presentation (Company Update)Document28 pagesNDR Presentation (Company Update)Shyam SunderNo ratings yet

- LGBalakrishnan Annualreport13-14Document120 pagesLGBalakrishnan Annualreport13-14sriramrangaNo ratings yet

- Annual Report Highlights JAL's FY 2014-15 ResultsDocument212 pagesAnnual Report Highlights JAL's FY 2014-15 ResultsGagan SinghNo ratings yet

- Annual Report 2015: Quality and Benchmarks Drive GrowthDocument192 pagesAnnual Report 2015: Quality and Benchmarks Drive GrowthsriramrangaNo ratings yet

- The Murder of The MahatmaDocument65 pagesThe Murder of The MahatmaKonkman0% (1)

- 53rd Annual Report 2013-2014Document127 pages53rd Annual Report 2013-2014sriramrangaNo ratings yet

- Force Motors Annual Report 2013-14 HighlightsDocument78 pagesForce Motors Annual Report 2013-14 HighlightssriramrangaNo ratings yet

- Angel Union Budget 2015-16 PreviewDocument51 pagesAngel Union Budget 2015-16 PreviewsriramrangaNo ratings yet

- 12 Large Cap Blue Chip StocksDocument52 pages12 Large Cap Blue Chip StocksAnonymous W7lVR9qs25No ratings yet

- Capital Gains Accounts Scheme, 1988Document9 pagesCapital Gains Accounts Scheme, 1988sriramrangaNo ratings yet

- Deloitte Regulatory Alert - Companies Act 2013 - RulesDocument10 pagesDeloitte Regulatory Alert - Companies Act 2013 - RulessriramrangaNo ratings yet

- Operational Update 31dec 2013Document64 pagesOperational Update 31dec 2013sriramrangaNo ratings yet

- KPMG Flash News - Additional Guidelines On Employment Visa and Business ...Document3 pagesKPMG Flash News - Additional Guidelines On Employment Visa and Business ...sriramrangaNo ratings yet

- General - Circular - 8 - Commencement Date of Certain SectionsDocument2 pagesGeneral - Circular - 8 - Commencement Date of Certain SectionssriramrangaNo ratings yet

- Capital Gains Accounts Scheme, 1988Document9 pagesCapital Gains Accounts Scheme, 1988sriramrangaNo ratings yet

- Astral PolytechnikDocument58 pagesAstral PolytechniksriramrangaNo ratings yet

- Nhai Im 2013-14 02-04-13Document30 pagesNhai Im 2013-14 02-04-13Pankaj GoyenkaNo ratings yet

- Deloitte International Tax Alert - E-Fund CorpDocument7 pagesDeloitte International Tax Alert - E-Fund CorpsriramrangaNo ratings yet

- PWC News Alert 11 February 2014 e Funds Ruling A Silver Lining For Contract Service ProvidersDocument3 pagesPWC News Alert 11 February 2014 e Funds Ruling A Silver Lining For Contract Service ProviderssriramrangaNo ratings yet

- Deloitte BusinessTax Alert - Dolphin Drilling LTDDocument3 pagesDeloitte BusinessTax Alert - Dolphin Drilling LTDsriramrangaNo ratings yet

- 08 MCN F 29062013Document12 pages08 MCN F 29062013sriramrangaNo ratings yet

- Limited Risk Models - Sept 4 2013Document40 pagesLimited Risk Models - Sept 4 2013sriramrangaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Management Accounting SCDLDocument7 pagesManagement Accounting SCDLJeet Kathuria100% (1)

- A Study of Old Age Homes in The Care O1Document48 pagesA Study of Old Age Homes in The Care O1sivakulanthay5195100% (2)

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Chapter 09 Testbank Questions and AnswersDocument47 pagesChapter 09 Testbank Questions and AnswersTrinh LêNo ratings yet

- Income-Statement SampleDocument7 pagesIncome-Statement SampleShilpa NNo ratings yet

- Financial Accounting and Analysis - Question BankDocument18 pagesFinancial Accounting and Analysis - Question BankNMIMS GA50% (2)

- Case Study 1 Tally Prime ExerciseDocument43 pagesCase Study 1 Tally Prime ExerciseRishi bhatiya86% (7)

- P01Document11 pagesP01loveshare0% (1)

- Consolidated Financial StatementsDocument32 pagesConsolidated Financial StatementsPeetu WadhwaNo ratings yet

- Rajab Network Proposal SampleDocument21 pagesRajab Network Proposal Samplechris fwe fweNo ratings yet

- Owner: Marx Generosa Golindang Contact Number: 09485423107 Email Address: Company Email Address: Business AddressDocument22 pagesOwner: Marx Generosa Golindang Contact Number: 09485423107 Email Address: Company Email Address: Business Addresst3emo shikihiraNo ratings yet

- Earning Updates (Company Update)Document93 pagesEarning Updates (Company Update)Shyam SunderNo ratings yet

- Flowers Industries, Inc. (Abridged) : October 2008Document24 pagesFlowers Industries, Inc. (Abridged) : October 2008MJ SapiterNo ratings yet

- It Key Metrics Data 2018 Key 341745Document43 pagesIt Key Metrics Data 2018 Key 341745ccfm0310100% (4)

- QG SAP B1 On Cloud FundAcc AY2021 2022Document58 pagesQG SAP B1 On Cloud FundAcc AY2021 2022Josef SamoranosNo ratings yet

- B01028 - Chapter 6 - Lending To Business Firms and Pricing Business LoansDocument57 pagesB01028 - Chapter 6 - Lending To Business Firms and Pricing Business LoansNguyen GodyNo ratings yet

- SS 07 Quiz 2 - AnswersDocument130 pagesSS 07 Quiz 2 - AnswersVan Le Ha100% (1)

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountDocument8 pagesChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVNo ratings yet

- Final ReviewDocument44 pagesFinal Reviewnidal charaf eddine50% (2)

- PAS 23 Borrowing Costs CapitalizationDocument4 pagesPAS 23 Borrowing Costs CapitalizationAila Mae SuarezNo ratings yet

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDocument16 pages2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNo ratings yet

- Billabong Case StudyDocument13 pagesBillabong Case StudyVan Tran0% (1)

- Revision NotesDocument51 pagesRevision NotesMelody RoseNo ratings yet

- Accounts Dav SolutionDocument7 pagesAccounts Dav SolutionTBG ARMYYTNo ratings yet

- WCLDocument137 pagesWCLUdit GhaiNo ratings yet

- Far Reviewer Lecture Notes 1 - CompressDocument21 pagesFar Reviewer Lecture Notes 1 - CompressAzure PremiumsNo ratings yet

- Act 532 Public Trust Corporation Act 1995Document33 pagesAct 532 Public Trust Corporation Act 1995Adam Haida & Co100% (1)

- Minor vs Major Repairs Capitalization GuidanceDocument3 pagesMinor vs Major Repairs Capitalization GuidancekingNo ratings yet

- Corporate Finance Final ExamDocument30 pagesCorporate Finance Final ExamJobarteh FofanaNo ratings yet

- ABC Company Year-End Trial BalanceDocument8 pagesABC Company Year-End Trial Balancetom quevreuxNo ratings yet