Professional Documents

Culture Documents

Crisis

Uploaded by

excalibur2314Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crisis

Uploaded by

excalibur2314Copyright:

Available Formats

Financial crisis of 20072010 The financial crisis of 2007present is a crisis triggered by a liquidity crisis in the United States banking

system. It has resulted in the collapse of large financial institutions, the bailout of banks by national governments and downturns in stock markets around the world. In many areas, the housing market has also suffered, resulting in numerous evictions, foreclosures and prolonged vacancies. It is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s.It contributed to the failure of key businesses, declines in consumer wealth estimated in the trillions of U.S. dollars, substantial financial commitments incurred by governments, and a significant decline in economic activity. Many causes have been proposed, with varying weight assigned by experts. Both market-based and regulatory solutions have been implemented or are under consideration, while significant risks remain for the world economy over the 20102011 periods. The collapse of a global housing bubble, which peaked in the U.S. in 2006, caused the values of securities tied to real estate pricing to plummet thereafter, damaging financial institutions globally.Questions regarding bank solvency, declines in credit availability, and damaged investor confidence had an impact on global stock markets, where securities suffered large losses during late 2008 and early 2009. Economies worldwide slowed during this period as credit tightened and international trade declined. Critics argued that credit rating agencies and investors failed to accurately price the risk involved with mortgage-related financial products, and that governments did not adjust their regulatory practices to address 21st century financial markets. Governments and central banks responded with unprecedented fiscal stimulus, monetary policy expansion, and institutional bailouts. Causes of the financial crisis of 20072010 Many factors directly and indirectly caused the ongoing Financial crisis of 2007-2010 (which started with the US subprime mortgage crisis), with experts placing different weights upon particular causes. The complexity and interdependence of many of the causes, as well as competing political, economic and organizational interests, have resulted in a variety of narratives describing the crisis. One category of causes created a vulnerable or fragile financial system, including complex financial securities, a dependence on short-term funding markets, and international trade imbalances. Other causes increased the stress on this fragile system, such as high corporate and consumer debt levels. Still others represent shocks to that system, such as the ongoing foreclosure crisis and the failures of key financial institutions. Regulatory and market-based controls did not effectively protect this system or measure the buildup of risk. Some causes relate to particular markets, such as the stock market or housing market, while others relate to the global economy more broadly. In July 2009, the U.S. announced the members of the Financial Crisis Inquiry Commission to investigate the causes of the crisis. Its report is expected at the end of 2010

The U.S. housing bubble and foreclosures

Between 1997 and 2006, the price of the typical American house increased by 124%. During the two decades ending in 2001, the national median home price ranged from 2.9 to 3.1 times median household income. This ratio rose to 4.0 in 2004, and 4.6 in 2006. This housing bubble resulted in quite a few homeowners refinancing their homes at lower interest rates, or financing consumer spending by taking out second mortgages secured by the price appreciation. By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak. Easy credit, and a belief that house prices would continue to appreciate, had encouraged many

subprime borrowers to obtain adjustable-rate mortgages. These mortgages enticed borrowers with a below market interest rate for some predetermined period, followed by market interest rates for the remainder of the mortgage's term. Borrowers who could not make the higher payments once the initial grace period ended would try to refinance their mortgages. Refinancing became more difficult, once house prices began to decline in many parts of the USA. Borrowers who found themselves unable to escape higher monthly payments by refinancing began to default. During 2007, lenders had begun foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006. This increased to 2.3 million in 2008, an 81% increase vs. 2007.As of August 2008, 9.2% of all mortgages outstanding were either delinquent or in foreclosure. The Economist described the issue this way: "No part of the financial crisis has received so much attention, with so little to show for it, as the tidal wave of home foreclosures sweeping over America. Government programmes have been ineffectual, and private efforts not much better." Up to 9 million homes may enter foreclosure over the 2009-2011 period, versus one million in a typical year.At roughly U.S. $50,000 per foreclosure according to a 2006 study by the Chicago Federal Reserve Bank, 9 million foreclosures represents $450 billion in losses. UK The United Kingdom is a major developed capitalist economy. It is currently the world's sixth largest by nominal GDP and the sixth largest by purchasing power parity. It is the third largest economy in Europe after Germany's and France's in nominal terms, and the second largest after Germany's in terms of purchasing power parity. Its GDP PPP per capita is the 18th highest in the world. The United Kingdom is also a member of the G7, G8, G-20 major economies, the Commonwealth of Nations, the Organisation for Economic Co-operation and Development, the World Trade Organisation, and the European Union. The UK was the first country in the world to industrialise in the 18th and 19th centuries and for much of the 19th century possessed a predominant role in the global economy. However, by the late 19th century, the Second Industrial Revolution in the United States and the German Empire meant that they had begun to challenge Britain's role as the leader of the global economy. The extensive war efforts of both World Wars in the 20th century and the dismantlement of the British Empire also weakened the UK economy in global terms, and by that time Britain had been superseded by the United States as the chief player in the global economy. At the start of the 21st century however, the UK still maintains an important role in the global economy,due to its large gross domestic product and the financial importance that its capital, London, possesses in the world. The United Kingdom is one of the world's most globalised countries. The capital, London (see Economy of London), is a major financial centre for international business and commerce, the largest such in the world according the Global Financial Centres Index.The British economy is substantially boosted by North Sea oil and gas reserves, worth an estimated 246.2 Billion in 2007.The British economy is made up (in descending order of size) of the economies of England, Scotland, Wales and Northern Ireland. In 1973, the UK acceded to the European Economic Community which is now known as the European Union after the ratification of the Treaty of Maastricht in 1993. The UK entered its worst recession since World War 2 in 2008, but has since climbed its way back into growth: by Q4 of 2009 with a weak 0.4%; followed by a 0.2% growth in Q1 of 2010. . The recovery from the recession is expected to be slow. The British government expects annual growth in 2010 to be between 1% and 1.5% and 3.5% in 2011. Although the IMF predicts the UK will only grow by 1.3% in 2010 followed by 2.5% in 2011. UK Manufacturing grew at its fastest pace for 15 years in Q1 of 2010 aided by a weak pound, but a reduction in the services sector has seen a slow to negligible rate of recovery in 2010.

Economy of the United States

The economy of the United States is the world's largest nominal economy. Its nominal GDP was estimated at $14.2 trillion in 2009, which is about three times that of the world's second largest national economy, Japan. Its GDP by PPP is almost twice that of the second largest, China. The U.S. economy maintains a very high level of output per person (GDP per capita, $46,442 in 2009, ranked at around number ten in the world). Historically, the U.S. economy has maintained a stable overall GDP growth rate, a low unemployment rate, and high levels of research and capital investment funded by both national and, because of decreasing saving rates, increasingly by foreign investors. In 2006, consumer spending made up 70 percent of the United States Gross Domestic Product. Since the 1960's, the United States economy absorbed savings from the rest of the world. The phenomenon is subject to discussion among economists. Like other developed countries, the United States faces retiring baby boomers who have already begun withdrawing from their Social Security accounts; however, the American population is young and growing when compared to Europe or Japan. The United States public debt is in excess of $12 trillion and continues to grow at a rate of about $3.83 billion each day. The American labor market has attracted immigrants from all over the world and has one of the world's highest migration rates. Americans have the highest income per hour worked. The United States is ranked second, down from first in 2008-2009 due to the economic crisis, in the Global Competitiveness Report. The country is one of the world's largest and most influential financial markets, home to major stock and commodities exchanges

You might also like

- Environment VocabularyDocument1 pageEnvironment Vocabularyexcalibur2314No ratings yet

- 2nd Edition Upper IntermediateDocument2 pages2nd Edition Upper Intermediateexcalibur2314No ratings yet

- Do You Understand B2 SzovegertesDocument89 pagesDo You Understand B2 SzovegertesmleslieNo ratings yet

- This This These These That That Those Those There There There Are There AreDocument1 pageThis This These These That That Those Those There There There Are There Arekhani.naser8834No ratings yet

- KITEX Idegenforgalom Es Vendeglatas B2 ANGOLDocument36 pagesKITEX Idegenforgalom Es Vendeglatas B2 ANGOLexcalibur2314No ratings yet

- Comparative AdjectivesDocument1 pageComparative Adjectivesexcalibur2314No ratings yet

- Which That PDFDocument8 pagesWhich That PDFexcalibur2314No ratings yet

- 67 This That These ThoseDocument2 pages67 This That These ThoseRadu BortesNo ratings yet

- BBC Learning DownloadDocument2 pagesBBC Learning Downloadrosan.sapkotaNo ratings yet

- Manual Mail Designer Pro 2 2.0.5Document50 pagesManual Mail Designer Pro 2 2.0.5LuisCesarNo ratings yet

- DemonstrativesDocument2 pagesDemonstrativesexcalibur2314No ratings yet

- Angol Igék 3 AlakjaDocument3 pagesAngol Igék 3 AlakjaKinga Mathe50% (2)

- Word Formation Task2Document2 pagesWord Formation Task2excalibur2314No ratings yet

- TP CorruptionDocument2 pagesTP Corruptionexcalibur2314No ratings yet

- China's Tourism Boom Hits The WallDocument2 pagesChina's Tourism Boom Hits The Wallexcalibur2314No ratings yet

- Travel JobsDocument3 pagesTravel Jobsexcalibur2314No ratings yet

- русский язик итцебникDocument1 pageрусский язик итцебникexcalibur2314No ratings yet

- F 5329Document2 pagesF 5329excalibur2314No ratings yet

- WalleDocument3 pagesWalleexcalibur2314No ratings yet

- The Secret Garden: Activity WorksheetsDocument3 pagesThe Secret Garden: Activity Worksheetsexcalibur2314100% (1)

- Violence Can Do Nothing To Diminish Race PrejudiceDocument1 pageViolence Can Do Nothing To Diminish Race Prejudiceedith68No ratings yet

- F 5329Document2 pagesF 5329excalibur2314No ratings yet

- 01 - It's High Time Men Ceased To Regard Women As Second-Class Citizens'Document1 page01 - It's High Time Men Ceased To Regard Women As Second-Class Citizens'Béla VargaNo ratings yet

- VegetarianismDocument2 pagesVegetarianismexcalibur2314No ratings yet

- WWW - Argyre.hu/b2 Angol@argyre - Hu: NM Studio ..:: Angol Távoktatás::.Document1 pageWWW - Argyre.hu/b2 Angol@argyre - Hu: NM Studio ..:: Angol Távoktatás::.excalibur2314No ratings yet

- The night-walkers of Uganda seek shelter from rebelsDocument6 pagesThe night-walkers of Uganda seek shelter from rebelsexcalibur2314No ratings yet

- Frankie the toy stealing catDocument3 pagesFrankie the toy stealing catexcalibur2314No ratings yet

- NewyorkDocument2 pagesNewyorkexcalibur2314No ratings yet

- Soap OperasDocument3 pagesSoap Operasexcalibur2314No ratings yet

- Knife CrimeDocument3 pagesKnife Crimeexcalibur2314No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2001 - Lin - Evolving Spatial Form of Urban-Rural Interaction in The Pearl River Delta ChinaDocument15 pages2001 - Lin - Evolving Spatial Form of Urban-Rural Interaction in The Pearl River Delta ChinaFathiyah RahmiNo ratings yet

- Accomplishment ReportDocument23 pagesAccomplishment ReportIceklitz ZordicNo ratings yet

- Modular KitchenDocument24 pagesModular KitchenHarsh ThakerNo ratings yet

- Piotr SchollenbergerDocument11 pagesPiotr Schollenbergeraldo peranNo ratings yet

- Budgeting Basics Module1Document24 pagesBudgeting Basics Module1Leidy HolguinNo ratings yet

- Paklaring Muhammad Andry - DraftDocument2 pagesPaklaring Muhammad Andry - DraftHazairin As-Shiddiq RahmanNo ratings yet

- Samsung Management StructureDocument11 pagesSamsung Management Structureddong3316No ratings yet

- Safeway IncDocument13 pagesSafeway IncNazish SohailNo ratings yet

- Cost ObjectiveDocument5 pagesCost ObjectiveKarmen ThumNo ratings yet

- The Finance Sector Reforms in India Economics EssayDocument4 pagesThe Finance Sector Reforms in India Economics EssaySumant AlagawadiNo ratings yet

- 5 LCDocument2 pages5 LCArlynSarsabaMendozaNo ratings yet

- Lecture 7 PDFDocument44 pagesLecture 7 PDFAmna NoorNo ratings yet

- Lesson 2: Science and Technology in Different PeriodsDocument2 pagesLesson 2: Science and Technology in Different Periodssushicrate xxNo ratings yet

- Economics Question Bank STD XII 2020 - 21Document142 pagesEconomics Question Bank STD XII 2020 - 21Neeraja RanjithNo ratings yet

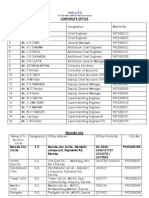

- Organization and Management: Module 4: Quarter 1, Week 3 & 4Document18 pagesOrganization and Management: Module 4: Quarter 1, Week 3 & 4juvelyn luegoNo ratings yet

- Recycling Project RecyclingDocument4 pagesRecycling Project Recyclingapi-404772398No ratings yet

- Key Contacts JharkhandDocument4 pagesKey Contacts JharkhandNataliya DudaNo ratings yet

- Revision of Fund Transfer Limit For E-BankingDocument2 pagesRevision of Fund Transfer Limit For E-BankingVaibhav GuptaNo ratings yet

- SEC Accredited Asset Valuer As of February 29 2016Document1 pageSEC Accredited Asset Valuer As of February 29 2016Gean Pearl IcaoNo ratings yet

- The Textile and Apparel Industry in IndiaDocument12 pagesThe Textile and Apparel Industry in IndiaAmbika sharmaNo ratings yet

- 11 August GMAT Club AnalysisDocument17 pages11 August GMAT Club AnalysisMANOUJ GOELNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDani Yustiardi MunarsoNo ratings yet

- 8 Commisioner of Internal Revenue Vs ManilaDocument2 pages8 Commisioner of Internal Revenue Vs ManilaJoy Carmen CastilloNo ratings yet

- Construction Industry in PakistanDocument7 pagesConstruction Industry in Pakistansajjadmubin75% (4)

- ASK RPK Ebit RFTK PAX PBT Aftk ATK Prask Aftk Yield RPTK Aptk PSFDocument75 pagesASK RPK Ebit RFTK PAX PBT Aftk ATK Prask Aftk Yield RPTK Aptk PSFTuan NguyenNo ratings yet

- IBPS PO 2017 Full Set of Prelims Questions - 7th Oct 2017Document14 pagesIBPS PO 2017 Full Set of Prelims Questions - 7th Oct 2017Raj AryanNo ratings yet

- BCGDocument138 pagesBCGANKUSHSINGH2690No ratings yet

- (Handbooks in Economics 1) Kenneth J. Arrow, A.K. Sen, Kotaro Suzumura (Eds.) - Handbook of Social Choice and Welfare, Volume 1 (Handbooks in Economics) - North-Holland (2002) PDFDocument647 pages(Handbooks in Economics 1) Kenneth J. Arrow, A.K. Sen, Kotaro Suzumura (Eds.) - Handbook of Social Choice and Welfare, Volume 1 (Handbooks in Economics) - North-Holland (2002) PDFLeonardo FerreiraNo ratings yet

- Seahorse Shipping CorporationDocument1 pageSeahorse Shipping CorporationBảo AnNo ratings yet

- Contact UsDocument12 pagesContact UsShital KiranNo ratings yet