Professional Documents

Culture Documents

DipIFR-Session31 d08 Operating Segments

Uploaded by

Fahmi Abdulla0 ratings0% found this document useful (0 votes)

36 views0 pagessession 31

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsession 31

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views0 pagesDipIFR-Session31 d08 Operating Segments

Uploaded by

Fahmi Abdullasession 31

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

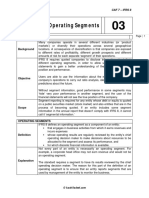

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3101

Overview

Objective

To provide users of financial statements with information about the nature

and financial effects of the business activities in which an entity engages and

the economic environment in which it operates.

OPERATING

SEGMENTS

DISCLOSURE

Core principle

General information

Information about profit or loss, assets

and liabilities

Basis of measurement

Reconciliations

Restatement of previously reported

information

Entity-wide disclosures

Scope

Definitions

Reportable segments

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3102

1 Operating segments

1.1 Scope

IFRS 8 applies to the separate financial statements of entities whose debt or equity

instruments are publicly traded (or are in the process of being issued in a public market).

IFRS 8 also applies to the consolidated financial statements of a group whose

parent is required to apply IFRS 8 to its separate financial statements.

Commentary

The scope of IAS 33 has been changed to be consistent with that of IFRS 8.

Where an entity is not required to apply IFRS 8, but chooses to do so, it must

not describe information about segments as segment information unless it

complies with IFRS 8.

Where a parents separate financial statements are presented with consolidated

financial statements, segment information is required only in the consolidated

financial statements.

Commentary

IFRS is applicable to annual financial statements for periods beginning on or

after 1 January 2009. Early adoption must be disclosed.

1.2 Definitions

1.2.1 Operating segment

This is a component that meets the following three criteria:

(1) it engages in business activities from which it may earn revenues and

incur expenses (including intersegment revenues and expenses arising

from transactions with other components of the same entity);

Commentary

Thus a start-up operation not yet earning revenues may be an operating segment, as

revenues would be expected in the future.

(2) its operating results are regularly reviewed by the entitys chief

operating decision maker to make decisions (about resources to be

allocated) and to assess its performance; and

(3) discrete financial information is available.

Commentary

A component, by definition, should meet this last criterion (see IFRS 5).

An entitys post-employment benefit plans are not operating segments.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3103

Corporate headquarters or other departments that may not earn revenues (or

only incidental revenues) are not operating segments.

1.2.2 Chief operating decision maker

This term describes a function (to allocate resources to and assess the

performance of operating segments). This may be a chief executive office, a

board of directors or others.

Commentary

An operating segment will generally have a segment manager who is directly

accountable to and maintains regular contact with the chief operating decision

maker to discuss operating activities, financial results, forecasts, etc.

1.3 Reportable segments

1.3.1 Separate information

Separate information must be reported for each operating segment that:

meets the definition criteria or aggregation criteria for two or more

segments (see 1.3.2); and

exceeds the quantitative thresholds (see 1.3.3).

1.3.2 Aggregation criteria

Two or more operating segments may be aggregated into a single operating

segment if:

aggregation is consistent with the core principle of this IFRS;

the segments have similar economic characteristics; and

the segments are similar in respect of:

the nature of products and services (e.g. domestic or industrial);

the nature of the production process (e.g. maturing or production line);

types or class of customer (e.g. corporate or individual);

distribution method (e.g. door-to-door or web sales); and

the regulatory environment (e.g. in shipping, banking, etc).

Commentary

An operating segment that does not meet a qualitative threshold may be aggregated

with another segment that does only if the operating segments have similar

economic characteristics and share a majority of the above aggregation criteria.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3104

1.3.3 Quantitative thresholds

Separate information must be reported for an operating segment that meets

any of the following quantitative thresholds:

reported revenue (including both external and intersegmental) is

10% or more of the combined revenue (internal and external) of all

operating segments;

profit or loss is 10% or more, in absolute amount, of the greater of:

(i) the combined profit of all operating segments that did not

report a loss; and

(ii) the combined loss of all operating segments that reported a loss;

assets are 10% or more of the combined assets of all operating segments.

Commentary

IFRS 8 is the only International Financial Reporting Standard with a

materiality rule.

At least 75% of the entitys revenue must be included in reportable segments.

Thus operating segments that fall below the quantitative thresholds may need

to be identified as reportable.

Commentary

Segments that fall below the threshold may also be considered reportable,

and separately disclosed, if management believes that the information would

be useful to users of the financial statements.

Information about other business activities and operating segments that are

not reportable are combined and disclosed in an all other segments

category.

When an operating segment is first identified as a reportable segment

according to the quantitative thresholds, comparative data should be

presented, unless the necessary information is not available and the cost to

develop it would be excessive.

Commentary

The Standard suggests ten as a practical limit to the number of reportable

segments separately disclosed as segment information may otherwise become

too detailed.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3105

Activity 1

Fireball group has:

three significant business lines which make up about 70% of combined

revenue; and

five small business lines, each of them contributing about 6% to the

combined revenue.

Required:

Explain how many segments Fireball group should report.

Solution

2 Disclosure

2.1 Core principle

An entity must disclose information to enable users of its financial statements

to evaluate:

the nature and financial effects of its business activities; and

the economic environments in which it operates.

This includes:

general information;

information about reported segment profit or loss, segment assets,

segment liabilities and the basis of measurement; and

reconciliations.

Commentary

This information must be disclosed for every period for which an income

statement is presented. Reconciliations of amounts in the statements of

financial position are required for each date at which a statement of financial

position is presented.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3106

2.2 General information

The factors used to identify reportable segments, including:

the basis of organisation (e.g. around products and services,

geographical areas, regulatory environments, or a combination of

factors and whether segments have been aggregated); and

Illustration 1 Basis of organisation

Eparts Cos reportable segments are strategic business units that offer different

products and services. They are managed separately because each business requires

different technology and marketing strategies. Most of the businesses were acquired as

individual units, and the management at the time of the acquisition was retained.

types of products and services from which each reportable segment

derives its revenues.

Illustration 2 Types of products and services

Eparts has five reportable segments: machine parts, lazer, prototyping, waterjet and

finance. The machine parts segment produces parts for sale to aviation equipment

manufacturers. The lazer segment produces lazer cutters to serve the petrochemical

industry. The prototyping segment produces plastics for sale to the pharmaceutical

industry. The waterjet segment produces cutting equipment for sale to car

manufacturers and jewellers. The finance segment is responsible for parts of Eparts

financial operations including financing customer purchases of products from other

segments and car leasing operations.

2.3 Information about profit or loss, assets and liabilities

The following must be reported for each reportable segment:

A measure of profit or loss and total assets.

A measure of liabilities if such an amount is regularly provided to

the chief operating decision maker.

Commentary

Note that segment cash flow information is voluntary (IAS 7) and therefore unlikely to

be produced as it would provide information to an acquirer to value and target for a

takeover bid.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3107

2.3.1 Profit or loss

The following must also be disclosed if the specified amounts are regularly

provided to the chief operating decision maker (even if not included in the

measure of segment profit or loss):

revenues from external customers;

intersegment revenues;

interest revenue;

Commentary

Interest revenue may be reported net of its interest expense if the majority of

the segments revenues are from interest and the chief operating decision

maker relies primarily on reporting of net interest revenue.

interest expense;

depreciation and amortisation;

other material items of income and expense required by IAS 1

Presentation of Financial Statements (i.e. write-downs,

restructurings, disposals, discontinued operations, litigation

settlements and reversals of provisions);

entitys interest in the profit or loss of associates and joint ventures

accounted for by the equity method;

income tax expense or income; and

material non-cash items other than depreciation and amortisation.

Commentary

Impairment losses also have to be disclosed (but as an IAS 36 requirement).

2.3.2 Assets

The following must also be disclosed if the specified amounts are regularly

provided to the chief operating decision maker (even if not included in the

measure of segment assets):

the investment in associates and joint ventures accounted for by the

equity method; and

additions to non-current assets (other than financial instruments,

deferred tax assets and post-employment benefit assets).

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3108

Illustration 3 Profit or loss, assets and liabilities

Machine Lazer Proto- Water- Finance All Totals

parts typing jet other

$ $ $ $ $ $ $

Revenues from

external customers 7,200 12,000 22,800 28,800 12,000 2,400

(a)

85,200

Intersegment revenues 7,200 3,600 10,800

Interest revenue 1,080 1,920 2,400 3,600 9,000

Interest expense 840 1,440 1,680 2,640 6,600

Net interest revenue

(b)

2,400 2,400

Depreciation and

amortisation 480 240 120 3,600 2,640 7,080

Reportable segment profit 480 168 2,160 5,520 1,200 240 9,768

Other material non-cash items:

Impairment of assets 480 480

Reportable segment

assets 4,800 12,000 7,200 28,800 136,800 4,800 194,400

Expenditures for reportable

segment non-current

assets 720 1,680 1,200 1,920 1,440 6,960

Reportable segment

liabilities 2,520 7,200 4,320 19,200 72,000 105,240

(a) Revenues from segments below the quantitative thresholds are attributable to three operating

segments of Eparts. Those segments include a small warehouse leasing business, a car rental

business and a design consulting practice. None of those segments has ever met any of the

quantitative thresholds for determining reportable segments.

(b) The finance segment derives a majority of its revenue from interest. Management primarily relies on

net interest revenue, not the gross revenue and expense amounts, in managing that segment.

Therefore only the net amount is disclosed.

Commentary

This company does not allocate tax expense or no-recurring gains or losses

to reportable segments. Also, not all reportable segments have material non-

cash items other than depreciation and amortisation.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3109

2.4 Basis of measurement

The amount of each segment item reported is the measure reported to the

chief operating decision maker.

Commentary

Segment information is no longer required to conform to the accounting

policies adopted for preparing and presenting the consolidated financial

statements.

If the chief operating decision maker uses more than one measure of an

operating segments profit or loss, the segments assets or the segments

liabilities, the reported measures should be those that are most consistent with

those used in the entitys financial statements.

Illustration 4 Measurement

The accounting policies of the operating segments are the same as those described in

the summary of significant accounting policies except that pension expense for each

operating segment is recognised and measured on the basis of cash payments to the

pension plan. Eparts evaluates performance on the basis of profit or loss from

operations before tax expense not including non-recurring gains and losses and foreign

exchange gains and losses.

Eparts accounts for intersegment sales and transfers at current market prices, i.e. as if

the sales or transfers were to third parties.

An explanation of the measurements of segment profit or loss, segment assets

and segment liabilities must disclose, as a minimum:

the basis of accounting for intersegment transactions;

the nature of any differences between the measurements of the

reportable segments and the entitys financial statements (if not

apparent from the reconciliations required);

Commentary

Differences could include accounting policies and policies for allocation of

centrally incurred costs, jointly used assets or jointly utilised liabilities.

the nature of any changes from prior periods in the measurement

methods used and the effect, if any, of those changes on the

measure of segment profit or loss;

the nature and effect of any asymmetrical allocations to reportable

segments.

Commentary

For example, the allocation of depreciation expense with the related

depreciable assets.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3110

2.5 Reconciliations

Reconciliations of the total of the reportable segments with the entity are

required for all of the following:

revenue;

profit or loss (before tax and discontinued operations);

assets;

liabilities (if applicable);

every other material item.

All material reconciling items must be separately identified and described

(e.g. arising from different accounting policies).

Illustration 5 Revenue reconciliation

$

Total revenues for reportable segments 93,600

Other revenues 2,400

Elimination of intersegment revenues (10,800)

______

Entitys revenues 85,200

______

Illustration 6 Profit or loss

$

Total profit or loss for reportable segments 9,528

Other profit or loss 240

Elimination of intersegment profits (1,200)

Unallocated amounts:

Litigation settlement received 1,200

Other corporate expenses (1,800)

Adjustment to pension expense in consolidation (600)

______

Income before income tax expense 7,368

______

Illustration 7 Assets

$

Total assets for reportable segments 189,600

Other assets 4,800

Elimination of receivable from corporate headquarters (2,400)

Other unallocated amounts 3,600

_______

Entitys assets 195,600

_______

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3111

Illustration 8 Liabilities

$

Total liabilities for reportable segments 105,240

Unallocated defined benefit pension liabilities 60,000

_______

Entitys liabilities 165,240

_______

Illustration 9

Other material items Reportable Adjustments Entity totals

segment totals

$ $ $

Interest revenue 9,000 180 9,180

Interest expense 6,600 (120) 6,480

Net interest revenue

(finance segment only) 2,400 2,400

Expenditures for assets 6,960 2,400 9,360

Depreciation and amortisation 7,080 7,080

Impairment of assets 480 480

The reconciling item is the amount incurred for the company head office building

which is not included in segment information.

2.6 Restatement of previously reported information

Where changes in the internal organisation structure of an entity result in a

change in the composition of reportable segments, corresponding information

must be restated unless the information is not available and the cost to

develop it would be excessive.

An entity should disclose whether corresponding items have been restated.

If not restated, the entity must disclose the current period segment information on

both the old and new bases of segmentation, unless the necessary information is not

available and the cost to develop it would be excessive.

2.7 Entity-wide disclosures

All entities subject to this IFRS are required to disclose information about the

following, if it is not provided as part of the required reportable segment information:

products and services:

geographical areas; and

major customers.

Commentary

Including those entities that have only a single reportable segment.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3112

The only exemption for not providing information about products and

services and geographical areas is if the necessary information is not

available and the cost to develop it would be excessive, in which case that

fact must be disclosed.

2.7.1 By product and service

Revenues from external customers for each product and service (or each

group of similar products and service) based on the financial information

used to produce the entitys financial statements.

Illustration 10 By product group (extract)

30 PRIMARY SEGMENTAL ANALYSIS

(BY PRODUCT GROUP)

2006

%

2005

%

2006

US$m

2005

US$m

Sales revenue

Iron Ore 30.9 28.9 6,938 5,497

Energy 18.1 19.4 4,070 3,693

Industrial Minerals 11.1 12.5 2.501 2,374

Aluminium 15.5 14.4 3,493 2,744

Copper 19.6 18.0 4,396 3,433

Diamonds 3.7 5.7 838 1,076

Other 1.1 1.1 229 216

Consolidated sales revenue 100.0 100.0 22,465 19,033

Share of equity accounted units 2,975 1,709

Gross sales revenue 25,440 20,742

Rio Tinto 2006 Annual report and financial statements

2.7.2 By geographical area

Revenues from external customers attributed to:

the entitys country of domicile;

all foreign countries in total; and

individual foreign countries, if material.

Similarly, non-current assets (other than financial instruments, deferred tax

assets and post-employment benefit assets).

Commentary

Again based on the financial information used to produce the entitys

financial statements.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3113

Illustration 11

Geographical information Revenues

(a)

Non-current

assets

$ $

United States 45,600 26,400

Canada 10,080

China 8,160 15,600

Japan 6,960 8,400

Other countries 14,400 7,200

______ ______

Total 85,200 57,600

______ ______

(a) Revenues are attributed to countries on the basis of the customers location.

2.7.3 Major customers

An entity discloses the extent of its reliance on major customers by stating:

if revenues from a single external customer amount to 10% or more

of the entitys total;

the total revenues from each such customer; and

the segment(s) reporting the revenues.

An entity need not disclose the identity of a major customer or the amount of

revenues that each segment reports from that customer.

Commentary

For the purposes of this IFRS, a group of entities known to be under common

control (including entities under the control of a government) is a single customer.

Illustration 12

Revenues from one customer of Eparts Cos prototyping and waterjet segments

represent approximately $12,000 of the companys total revenues.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3114

Activity 2

Silver is applying IFRS 8 for the first time in financial statements for the financial year

ended 31 December 2007. This will cause changes in the identification of Silvers

reportable segments and require additional disclosures.

Required:

Comment on whether Silver should restate the comparative information.

Solution

Focus

You should now be able to:

discuss the usefulness and problems associated with the provision of segment

information;

define an operating segment;

identify reportable segments (including applying the aggregation criteria and

quantitative thresholds);

prepare segment information in accordance with IFRS 8.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3115

Activity solutions

Solution 1 Reportable segments

Commentary

The issue is whether or not it is acceptable to report the three major business lines

separately and to include the rest for reconciliation purposes as all other segments.

Since the reported revenues attributable to the three business lines that meet the

separate reporting criteria constitute less than 75% of the combined revenue, additional

segments must be identified as reportable, even though they are below the 10%

threshold, until at least 75% of the combined revenue is included in reportable

segments.

If at least one of the small segments meets the aggregation criteria to be aggregated

with one of the three reportable segments, there will be four reportable segments

(including all other segments).

Alternatively, two or more of the smaller segments may be aggregated, if they meet the

aggregation criteria. In this case there will be five reportable segments.

If none of the small segments meet the criteria to be aggregated with any of the other

business lines one of them must be identified as reportable, though it does not meet the

10% threshold. In this case there will be five reportable segments also.

Solution 2 Comparative information

Comparative information for all periods presented should be restated (IAS 1)

in conformity with IFRS 8.

If the necessary information is not available and the cost to develop it would

be excessive, this fact should be disclosed.

Commentary

In this case there appears to be no requirement to disclose current period

segment information on both the old and new bases of segmentation (as there

is when there is a change in composition of reportable segments). The

difference, perhaps, being that adoption of IFRS 8 is a mandatory change for

those complying with IFRS, whereas an internal reorganisation is voluntary.

Silver should also disclose early adoption of IFRS 8.

SESSION 31 IFRS 8 OPERATING SEGMENTS

Accountancy Tuition Centre (International Holdings) Ltd 2008 3116

You might also like

- Finance Demo Script - ConsolidationsDocument46 pagesFinance Demo Script - ConsolidationshnoamanNo ratings yet

- Share Based PaymentDocument19 pagesShare Based PaymentFahmi AbdullaNo ratings yet

- Internal Audit CharterDocument15 pagesInternal Audit CharterFahmi Abdulla100% (2)

- Financial Service Business Update PWCDocument90 pagesFinancial Service Business Update PWCRinaasmaraNo ratings yet

- Solution Manual For Advanced Accounting, 11th Edition - HoyleDocument27 pagesSolution Manual For Advanced Accounting, 11th Edition - HoyleAlmoosawi100% (1)

- Resa Toa 1205 PreweekDocument38 pagesResa Toa 1205 PreweekLlyod Francis Laylay100% (1)

- Welcome To The Presentation On: IFRS 8 - Operating SegmentsDocument21 pagesWelcome To The Presentation On: IFRS 8 - Operating SegmentsMaruf MahadiNo ratings yet

- ICAEW Accounting QB 2023Document322 pagesICAEW Accounting QB 2023diya p100% (1)

- IFRS 8 Operating SegmentsDocument18 pagesIFRS 8 Operating SegmentsrgnrgyNo ratings yet

- FA1 WorkbookDocument243 pagesFA1 WorkbookM C100% (1)

- Business Driven ConfigurationDocument21 pagesBusiness Driven ConfigurationMukul WadhwaNo ratings yet

- Handout 2 - Introduction To Auditing and Assurance of Specialized IndustriesDocument2 pagesHandout 2 - Introduction To Auditing and Assurance of Specialized IndustriesPotato CommissionerNo ratings yet

- Operating Segments PDFDocument12 pagesOperating Segments PDFZahidNo ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- Adv - Chap 8Document7 pagesAdv - Chap 8Melody LisaNo ratings yet

- Chapter 8Document7 pagesChapter 8suleymantesfaye10No ratings yet

- Ifrs 8 Operating Segments: BackgroundDocument4 pagesIfrs 8 Operating Segments: Backgroundmusic niNo ratings yet

- Kings College of The PhilippinesDocument6 pagesKings College of The PhilippinesIzza Mae Rivera KarimNo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsAANo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsMohammad BaratNo ratings yet

- PFRS 8-Operating SegmentsDocument20 pagesPFRS 8-Operating Segmentsrena chavezNo ratings yet

- Operating SegmentDocument6 pagesOperating SegmentsubupooNo ratings yet

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoNo ratings yet

- Segment Reporting: Meaning, Terminology, Need and DisclosuresDocument5 pagesSegment Reporting: Meaning, Terminology, Need and DisclosuresIMRAN ALAMNo ratings yet

- 11 IFRS 8, IAS 24 & Ethical IssuesDocument20 pages11 IFRS 8, IAS 24 & Ethical IssuespesseNo ratings yet

- Ifrs 8 Segment InformationDocument6 pagesIfrs 8 Segment InformationMovies OnlyNo ratings yet

- Ifrs 8: Operating SegmentsDocument12 pagesIfrs 8: Operating SegmentsGere TassewNo ratings yet

- Ifrs 8 and Ias 34-Operating Segments & Interim ReportingDocument46 pagesIfrs 8 and Ias 34-Operating Segments & Interim Reportingesulawyer2001No ratings yet

- Operating Segments: International Financial Reporting Standard 8Document9 pagesOperating Segments: International Financial Reporting Standard 8Imran MustafaNo ratings yet

- AcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andDocument42 pagesAcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andbethelhemNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- Chapter-08-Ideas On Operating SegmentsDocument12 pagesChapter-08-Ideas On Operating Segmentsmdrifathossain835No ratings yet

- 07 Segment Reporting 1Document4 pages07 Segment Reporting 1Irtiza AbbasNo ratings yet

- Advanced Accounting 10th Edition Hoyle Solutions ManualDocument29 pagesAdvanced Accounting 10th Edition Hoyle Solutions Manualcliniqueafraidgfk1o100% (20)

- 07 Segment ReportingDocument5 pages07 Segment ReportingHaris IshaqNo ratings yet

- Insights Into MFRS 8Document6 pagesInsights Into MFRS 8Ihsan 4102No ratings yet

- Understand Operating Segments with this Accounting GuideDocument3 pagesUnderstand Operating Segments with this Accounting GuideChinchin Ilagan DatayloNo ratings yet

- IFRS 8 Operating SegmentsDocument6 pagesIFRS 8 Operating SegmentsPratima SeedheeyanNo ratings yet

- Ifrs-8 Operating SegmentsDocument8 pagesIfrs-8 Operating SegmentsniichauhanNo ratings yet

- Module 6 - Operating SegmentsDocument3 pagesModule 6 - Operating SegmentsChristine Joyce BascoNo ratings yet

- Ca - Bharat Bhushan B-Com, ACA: Presented byDocument23 pagesCa - Bharat Bhushan B-Com, ACA: Presented byEshetieNo ratings yet

- Responsibility Accounting and Transfer Pricing: Management Reporting MAC302Document17 pagesResponsibility Accounting and Transfer Pricing: Management Reporting MAC302jackielyn garletNo ratings yet

- FA Vol.3 Operating SegmentsDocument7 pagesFA Vol.3 Operating SegmentsRyan SanitaNo ratings yet

- Chapter Eight: Segment and Interim ReportingDocument30 pagesChapter Eight: Segment and Interim ReportingsoozboozNo ratings yet

- Operating SegmentDocument15 pagesOperating SegmentSrabon BaruaNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document10 pagesOperating Segments: International Financial Reporting Standard 8Tanvir PrantoNo ratings yet

- Advanced Accounting Hoyle 12th Edition Solutions ManualDocument33 pagesAdvanced Accounting Hoyle 12th Edition Solutions ManualBrentBrowncgwzm100% (89)

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- Segment and Interim ReportingDocument8 pagesSegment and Interim ReportingKECEBONG ALBINO50% (2)

- 8.0 NFRS 8 - SetPasswordDocument8 pages8.0 NFRS 8 - SetPasswordDhruba AdhikariNo ratings yet

- Operating Segment Reporting Key Financial DataDocument19 pagesOperating Segment Reporting Key Financial DataRainNo ratings yet

- Ifrs 8 Reserrch DocumentsDocument6 pagesIfrs 8 Reserrch Documentssandeep11116No ratings yet

- Operating SegmentsDocument10 pagesOperating SegmentsUdit JindalNo ratings yet

- Ind As 108Document6 pagesInd As 108Khushi SoniNo ratings yet

- Operating Segment: Pfrs 8Document28 pagesOperating Segment: Pfrs 8Giellay OyaoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument32 pagesAdvanced Accounting 13th Edition Hoyle Solutions ManualKatieElliswcze100% (35)

- PFRS 8 - Operating SegmentsDocument11 pagesPFRS 8 - Operating SegmentseiraNo ratings yet

- Pfrs 8 Operating SegmentsDocument2 pagesPfrs 8 Operating SegmentsJimuel ImbuidoNo ratings yet

- 31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Document6 pages31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Chris Sevilla BurhamNo ratings yet

- Ifrs 8Document3 pagesIfrs 8kadermaho456No ratings yet

- IFRS-8-Operating-SegmentsDocument15 pagesIFRS-8-Operating-SegmentsNichole Angel LeiNo ratings yet

- PAS 8 Operating SegmentsDocument4 pagesPAS 8 Operating SegmentsAlex OngNo ratings yet

- Far 3 (Final Topics) - Ma'Am JannaDocument68 pagesFar 3 (Final Topics) - Ma'Am JannaAndrea FernandoNo ratings yet

- Chap 1 Mod 6 SegmentDocument7 pagesChap 1 Mod 6 SegmentShouvik NagNo ratings yet

- Operating Segments: Indian Accounting Standard (Ind AS) 108Document14 pagesOperating Segments: Indian Accounting Standard (Ind AS) 108Bathina Srinivasa RaoNo ratings yet

- MFRS 8Document31 pagesMFRS 8Anas AjwadNo ratings yet

- Basics of Segment ReportingDocument3 pagesBasics of Segment ReportingNathoNo ratings yet

- 297 303 PDFDocument7 pages297 303 PDFFahmi AbdullaNo ratings yet

- 09 Quang Linh Huynh-PDocument13 pages09 Quang Linh Huynh-PFahmi AbdullaNo ratings yet

- DipIFR-Session26 d08 Investment in AssociatesDocument0 pagesDipIFR-Session26 d08 Investment in AssociatesFahmi AbdullaNo ratings yet

- DipIFR-Session29 d08 Earnings Per ShareDocument0 pagesDipIFR-Session29 d08 Earnings Per ShareFahmi AbdullaNo ratings yet

- DipIFR-Session30 d08 Statement of CashflowsDocument0 pagesDipIFR-Session30 d08 Statement of CashflowsFahmi AbdullaNo ratings yet

- 2012.ethical Investment Study Chapt Islamic FinanceDocument17 pages2012.ethical Investment Study Chapt Islamic FinanceFahmi AbdullaNo ratings yet

- 1Document10 pages1Fahmi AbdullaNo ratings yet

- BFM132 Islamic Economics Ness & Finance Apr11Document7 pagesBFM132 Islamic Economics Ness & Finance Apr11Fahmi AbdullaNo ratings yet

- DipIFR-Session25 d08 Consolidated Statement of Comprehensive IncomeDocument0 pagesDipIFR-Session25 d08 Consolidated Statement of Comprehensive IncomeFahmi AbdullaNo ratings yet

- DipIFR-Session18 d08 Employee BenefitsDocument0 pagesDipIFR-Session18 d08 Employee BenefitsFahmi AbdullaNo ratings yet

- DipIFR-Session27 d08 Interest in JVsDocument0 pagesDipIFR-Session27 d08 Interest in JVsFahmi AbdullaNo ratings yet

- DipIFR-Session31 d08 Operating SegmentsDocument0 pagesDipIFR-Session31 d08 Operating SegmentsFahmi AbdullaNo ratings yet

- DipIFR-Session30 d08 Statement of CashflowsDocument0 pagesDipIFR-Session30 d08 Statement of CashflowsFahmi AbdullaNo ratings yet

- DipIFR-Session33 d08 Events After Reporting PeriodDocument0 pagesDipIFR-Session33 d08 Events After Reporting PeriodFahmi AbdullaNo ratings yet

- DipIFR-Session32 d08 Discontinued OperationsDocument0 pagesDipIFR-Session32 d08 Discontinued OperationsFahmi AbdullaNo ratings yet

- DipIFR-Session34 j08 Related Party DisclosureDocument0 pagesDipIFR-Session34 j08 Related Party DisclosureFahmi AbdullaNo ratings yet

- DipIFR-Session32 d08 Discontinued OperationsDocument0 pagesDipIFR-Session32 d08 Discontinued OperationsFahmi AbdullaNo ratings yet

- DipIFR-Session35 j08 Interim Financial ReportingDocument0 pagesDipIFR-Session35 j08 Interim Financial ReportingFahmi AbdullaNo ratings yet

- DipIFR-Session36 j08 First Time AdoptionDocument0 pagesDipIFR-Session36 j08 First Time AdoptionFahmi AbdullaNo ratings yet

- Acca p1 NotesDocument67 pagesAcca p1 NotesAsis KoiralaNo ratings yet

- DipIFR-Session37Index d08Document0 pagesDipIFR-Session37Index d08Fahmi AbdullaNo ratings yet

- DipIFR-Session01 d08 IFRSDocument0 pagesDipIFR-Session01 d08 IFRSFahmi AbdullaNo ratings yet

- Paper 2.4 - ATC InternationalDocument0 pagesPaper 2.4 - ATC InternationalFahmi AbdullaNo ratings yet

- DipIFR-Session03 d08 Presentation of Financial StatementsDocument0 pagesDipIFR-Session03 d08 Presentation of Financial StatementsFahmi AbdullaNo ratings yet

- F 5 CKTQNSPDFDocument9 pagesF 5 CKTQNSPDFFahmi AbdullaNo ratings yet

- DipIFR-Session00 d08Document0 pagesDipIFR-Session00 d08Fahmi AbdullaNo ratings yet

- Manage Transition To Ifrs WhitepaperDocument19 pagesManage Transition To Ifrs WhitepaperAnushree SinghNo ratings yet

- Pertemuan 3 - IAS 1 - Paper For Discussion PDFDocument23 pagesPertemuan 3 - IAS 1 - Paper For Discussion PDFSlamet RaharjoNo ratings yet

- Unit 2-Accounting Concepts, Principles and ConventionsDocument20 pagesUnit 2-Accounting Concepts, Principles and Conventionsanamikarajendran441998No ratings yet

- Essentials of Accounting: Prof: Mr. Allan Jay Evangelista, CPADocument32 pagesEssentials of Accounting: Prof: Mr. Allan Jay Evangelista, CPAFrances Nicole MuldongNo ratings yet

- Need For Sector Specific Materiality and Sustainability Reporting StandardsDocument10 pagesNeed For Sector Specific Materiality and Sustainability Reporting StandardsALBERTO GUAJARDO MENESESNo ratings yet

- MBA DissertationDocument46 pagesMBA DissertationEmrin StarsNo ratings yet

- Afm - l2 - I-Gaap Vs Us GaapDocument10 pagesAfm - l2 - I-Gaap Vs Us GaapanujNo ratings yet

- Understanding Financial StatementsDocument30 pagesUnderstanding Financial StatementsTeh PohkeeNo ratings yet

- Rules-Based and Principles-Based Accounting Standards and Earnings ManagementDocument32 pagesRules-Based and Principles-Based Accounting Standards and Earnings ManagementJ Satya SarawanaNo ratings yet

- Week 1 - Lesson 1 Overview of AccountingDocument10 pagesWeek 1 - Lesson 1 Overview of AccountingRose RaboNo ratings yet

- ACCA P2Int Mock1 Answers June2018 PDFDocument24 pagesACCA P2Int Mock1 Answers June2018 PDFsabrina006No ratings yet

- NIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFDocument2,602 pagesNIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFvagonet21No ratings yet

- SIBL Annual Report 2018 PDFDocument369 pagesSIBL Annual Report 2018 PDFShishir AhmedNo ratings yet

- Sadia KhanDocument3 pagesSadia KhanNaveed Abdul WaheedNo ratings yet

- Psak Vs Ifrs 2022Document11 pagesPsak Vs Ifrs 2022kiswonoNo ratings yet

- The Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With CustomersDocument31 pagesThe Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With Customersaccount.oswald.o.20No ratings yet

- United Arab Emirates IFRS ProfileDocument5 pagesUnited Arab Emirates IFRS ProfileabcdNo ratings yet

- International Variations in IFRS Practices: and How Spain Differs From Other Major CountriesDocument60 pagesInternational Variations in IFRS Practices: and How Spain Differs From Other Major CountriesCindyNo ratings yet

- Introduction To Financial Accounting and Reporting in MalaysiaDocument32 pagesIntroduction To Financial Accounting and Reporting in MalaysiaDINIE RUZAINI BINTI MOH ZAINUDINNo ratings yet

- Practice Test 1Document2 pagesPractice Test 1Khail GoodingNo ratings yet

- OLC Chapter 01Document16 pagesOLC Chapter 01Satarupa MukherjeeNo ratings yet

- Creative Accounting: A Literature ReviewDocument13 pagesCreative Accounting: A Literature ReviewthesijNo ratings yet

- Bistrat UASDocument32 pagesBistrat UASTegar BabarunggulNo ratings yet

- The Conceptual Framework For Financial ReportingDocument40 pagesThe Conceptual Framework For Financial ReportingRinaNo ratings yet