Professional Documents

Culture Documents

Min-Variance Portfolio & Optimal Risky Portfolio

Uploaded by

Helen B. EvansOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Min-Variance Portfolio & Optimal Risky Portfolio

Uploaded by

Helen B. EvansCopyright:

Available Formats

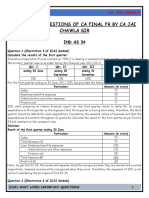

TUTORIAL 6 PORTFOLIO AND CAPITAL MARKET THEORY Q1 BKM7Q4-10 A pension fund manager is considering three mutual funds.

. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (S) 20% 30% Bond fund (B) 12% 15% The correlation between the fund returns is 0.10. (i) What are the investment proportions in the minimum-variance portfolio of the two risky funds, and what is the expected value and standard deviation of its rate of return? (ii) Tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of zero to 100% in increments of 20%. (iii) Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal portfolio? (iv) Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. (v) What is the reward-to-volatility ratio of the best feasible CAL? (vi) You require that your portfolio yield an expected return of 14%, and that it be efficient, on the best feasible CAL. a. What is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky funds? (vii) If you were to use only the two risky funds, and still require an expected return of 14%, what would be the investment proportions of your portfolio? Compare its standard deviation to that of the optimized portfolio in part (vi) above. What do you conclude? Q2 BKM 7 Q12 Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: Stock Expected Return Standard Deviation A 10% 5% B 15% 10% Correlation = -1 Suppose that it is possible to borrow at the risk-free rate, rf . What must be the value of the risk free rate? (Hint: Think about constructing a risk-free portfolio from stocks A and B.) INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 6 Portfolio & Capital Market Theory Page 1 of 4

Q3 BKM 7Q15. Suppose you have a project that has a 0.7 chance of doubling your investment in a year and a 0.3 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? Q4 BKM 7 Q16 Suppose that you have $1 million and the following two opportunities from which to construct a portfolio: a. Risk-free asset earning 12% per year. b. Risky asset with expected return of 30% per year and standard deviation of 40%. If you construct a portfolio with a standard deviation of 30%, what is its expected rate of return? Q5 BKM 8Q6 The following are estimates for two stocks. Stock Expected Return Beta Firm-Specific Standard Deviation A 13% 0.8 30% B 18% 1.2 40% The market index has a standard deviation of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A: .30 Stock B: .45 T-bills: .25 Compute the expected return, standard deviation, beta, and non-systematic standard deviation of the portfolio. Q6 BKM 8Q7 Consider the following two regression lines for stocks A and B in the following figure.

a. Which stock has higher firm-specific risk? b. Which stock has greater systematic (market) risk? INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 6 Portfolio & Capital Market Theory Page 2 of 4

c. Which stock has higher R2 ? d. Which stock has higher alpha? e. Which stock has higher correlation with the market? Q7 BKM 8Q8 Consider the two (excess return) index model regression results for A and B: Rsquare = 0.576 Residual standard deviation = 10.3%

Rsquare = 0.436 Residual standard deviation = 9.1% a. Which stock has more firm-specific risk? b. Which has greater market risk? c. For which stock does market movement explain a greater fraction of return variability? d. If r f were constant at 6% and the regression had been run using total rather than excess returns, what would have been the regression intercept for stock A? Q8 BKM 8CFA2 Assume the correlation coefficient between Baker Fund and the S&P 500 Stock Index is 0.70. What percentage of Baker Funds total risk is specific (i.e., non-systematic)? Q9 BKM 9Q3 Are the following true or false? Explain. a. Stocks with a beta of zero offer an expected rate of return of zero. b. The CAPM implies that investors require a higher return to hold highly volatile securities. c. You can construct a portfolio with beta of .75 by investing .75 of the investment budget in T-bills and the remainder in the market portfolio. Q10 BKM 9Q20 Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However, the beta of the first investor was 1.5, whereas that of the second was 1. a. Can you tell which investor was a better selector of individual stocks (aside from the issue of general movements in the market)? b. If the T-bill rate were 6% and the market return during the period were 14%, which investor would be the superior stock selector? c. What if the T-bill rate were 3% and the market return were 15%?

INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 6 Portfolio & Capital Market Theory Page 3 of 4

Q11 BKM 9Q21 Suppose the rate of return on short-term government securities (perceived to be risk-free) is about 5%. Suppose also that the expected rate of return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing model: a. What is the expected rate of return on the market portfolio? b. What would be the expected rate of return on a stock with = 0? c. Suppose you consider buying a share of stock at $40. The stock is expected to pay $3 dividends next year and you expect it to sell then for $41. The stock risk has been evaluated at = -0.5. Is the stock overpriced or underpriced?

INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 6 Portfolio & Capital Market Theory Page 4 of 4

You might also like

- Econ 132 Problems For Chapter 1-3, and 5Document5 pagesEcon 132 Problems For Chapter 1-3, and 5jononfireNo ratings yet

- Mini Case Chapter 8Document8 pagesMini Case Chapter 8William Y. OspinaNo ratings yet

- Multiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per QuestionDocument39 pagesMultiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per Questionquickreader12No ratings yet

- Risk and Return AnswersDocument11 pagesRisk and Return AnswersmasterchocoNo ratings yet

- The Mock Test2923Document15 pagesThe Mock Test2923elongoria278No ratings yet

- Chapter 3 - Tutorial - With Solutions 2023Document34 pagesChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- APT+exercises+post 1Document6 pagesAPT+exercises+post 1Karan GambhirNo ratings yet

- Bkm9e Answers Chap006Document13 pagesBkm9e Answers Chap006AhmadYaseenNo ratings yet

- End of Chapter Exercises: SolutionsDocument4 pagesEnd of Chapter Exercises: SolutionsMichelle LeeNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- ER Ch06 Solution ManualDocument16 pagesER Ch06 Solution ManualAbhay Singh ChandelNo ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Investment BKM 5th EditonDocument21 pagesInvestment BKM 5th EditonKonstantin BezuhanovNo ratings yet

- FINS2624 Computer AssignmentDocument5 pagesFINS2624 Computer AssignmentEdward YangNo ratings yet

- Question Bank 2 - SEP2019Document6 pagesQuestion Bank 2 - SEP2019Nhlanhla ZuluNo ratings yet

- Escanear 0003Document8 pagesEscanear 0003JanetCruces0% (4)

- Calculate China's foreign exchange intervention and sterilizationDocument5 pagesCalculate China's foreign exchange intervention and sterilizationFagbola Oluwatobi OmolajaNo ratings yet

- Hull-OfOD8e-Homework Answers Chapter 03Document3 pagesHull-OfOD8e-Homework Answers Chapter 03Alo Sin100% (1)

- Solutions Chapter 15 Internationsl InvestmentsDocument12 pagesSolutions Chapter 15 Internationsl Investments'Osvaldo' RioNo ratings yet

- Financial Investment ExercisesDocument16 pagesFinancial Investment ExercisesBội Ngọc100% (1)

- BKM CH 03 Answers W CFADocument8 pagesBKM CH 03 Answers W CFAAmyra KamisNo ratings yet

- frm指定教材 risk management & derivativesDocument1,192 pagesfrm指定教材 risk management & derivativeszeno490No ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument65 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- Assignment 3Document4 pagesAssignment 3will.li.shuaiNo ratings yet

- Risk and ReturnDocument3 pagesRisk and ReturnPiyush RathiNo ratings yet

- BKM 10e Chap003 SM SelectedDocument6 pagesBKM 10e Chap003 SM SelectedahmedNo ratings yet

- APT and Multifactor Models of Risk and Return Problem SetsDocument9 pagesAPT and Multifactor Models of Risk and Return Problem SetsBiloni KadakiaNo ratings yet

- Chap 008Document16 pagesChap 008van tinh khucNo ratings yet

- CHAPTER 3 INVESTMENTSDocument13 pagesCHAPTER 3 INVESTMENTSEy EmNo ratings yet

- EXAM 1 IPM Solutions Spring 2012 (B)Document12 pagesEXAM 1 IPM Solutions Spring 2012 (B)kiffeur69100% (6)

- DRM Chapter 10Document47 pagesDRM Chapter 10bhaduariyaNo ratings yet

- SM Multinational Financial Management ch09Document5 pagesSM Multinational Financial Management ch09ariftanur100% (1)

- Chapter 5: Introduction To Risk, Return, and The Historical RecordDocument7 pagesChapter 5: Introduction To Risk, Return, and The Historical RecordBiloni KadakiaNo ratings yet

- NBFI-Course Outline-2020Document2 pagesNBFI-Course Outline-2020Umair NadeemNo ratings yet

- Finance Chapter009 - Solutions AbcDocument3 pagesFinance Chapter009 - Solutions AbckysovutdaNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- Ch8 Practice ProblemsDocument5 pagesCh8 Practice Problemsvandung19No ratings yet

- RR Problems SolutionsDocument5 pagesRR Problems SolutionsShaikh FarazNo ratings yet

- R22 Capital Structure Q Bank PDFDocument6 pagesR22 Capital Structure Q Bank PDFZidane KhanNo ratings yet

- Chapter 17 Solutions BKM Investments 9eDocument11 pagesChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- Test Bank For An Introduction To Derivative Securities Financial Markets and Risk Management by JarrowDocument17 pagesTest Bank For An Introduction To Derivative Securities Financial Markets and Risk Management by JarrowMannuNo ratings yet

- The Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000Document24 pagesThe Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000chandel08No ratings yet

- Analyzing Financial Statements and RatiosDocument17 pagesAnalyzing Financial Statements and Ratiosanonymathieu50% (2)

- ENG 111 Final SolutionsDocument12 pagesENG 111 Final SolutionsDerek EstrellaNo ratings yet

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemssalehin19690% (1)

- Chapter 9Document33 pagesChapter 9Annalyn Molina0% (1)

- Learning Curves and ApplicationsDocument10 pagesLearning Curves and ApplicationsDarshan N GangolliNo ratings yet

- IF Problems Arbitrage OpportunityDocument11 pagesIF Problems Arbitrage OpportunityChintakunta PreethiNo ratings yet

- IBF - Qeststions For Test 1Document30 pagesIBF - Qeststions For Test 1Pardeep Singh DhaliwalNo ratings yet

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraNo ratings yet

- Stocks, Valuation and Market EquilibriumDocument35 pagesStocks, Valuation and Market EquilibriumNesreen RaghebNo ratings yet

- Chap 7 End of Chap SolDocument13 pagesChap 7 End of Chap SolWan Chee100% (1)

- Risk and Return: Models Linking Risk and Expected ReturnDocument10 pagesRisk and Return: Models Linking Risk and Expected ReturnadafgsdfgNo ratings yet

- QuizDocument26 pagesQuizDung Le100% (1)

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Final Exam Portfolio Analysis QuestionsDocument3 pagesFinal Exam Portfolio Analysis Questionsnhi nguyễnNo ratings yet

- Lcture 3 and 4 Risk and ReturnDocument8 pagesLcture 3 and 4 Risk and ReturnNimra Farooq ArtaniNo ratings yet

- Financial Risk Management Problem Set 1Document3 pagesFinancial Risk Management Problem Set 1Valentin IsNo ratings yet

- Tutorial 4 - Loan ScheduleDocument2 pagesTutorial 4 - Loan ScheduleHelen B. EvansNo ratings yet

- Solutions: Tutorial 2Document2 pagesSolutions: Tutorial 2Helen B. EvansNo ratings yet

- Tutorial 4 - Loan ScheduleDocument2 pagesTutorial 4 - Loan ScheduleHelen B. EvansNo ratings yet

- SBM Scholarship Scheme 2013 Terms ConditionsDocument4 pagesSBM Scholarship Scheme 2013 Terms ConditionsHelen B. EvansNo ratings yet

- Old Chapter 5 On Estimating DemandDocument48 pagesOld Chapter 5 On Estimating DemandOmar Ibrahim0% (1)

- Act std4Document3 pagesAct std4Helen B. EvansNo ratings yet

- SBM Scholarship Scheme 2013 Application FormDocument8 pagesSBM Scholarship Scheme 2013 Application FormHelen B. EvansNo ratings yet

- Act std3Document7 pagesAct std3Helen B. EvansNo ratings yet

- ActDocument178 pagesActkapilv07194180No ratings yet

- Act std1Document8 pagesAct std1Helen B. EvansNo ratings yet

- Act std5Document4 pagesAct std5Helen B. EvansNo ratings yet

- Act std2Document44 pagesAct std2Helen B. EvansNo ratings yet

- Act7 3Document6 pagesAct7 3Helen B. EvansNo ratings yet

- Accounting Principles or ConceptsDocument15 pagesAccounting Principles or ConceptsHelen B. EvansNo ratings yet

- Accounting Principles or ConceptsDocument15 pagesAccounting Principles or ConceptsHelen B. EvansNo ratings yet

- 9709 Mathematics: MARK SCHEME For The October/November 2012 SeriesDocument6 pages9709 Mathematics: MARK SCHEME For The October/November 2012 SeriesHelen B. EvansNo ratings yet

- Acc 2Document2 pagesAcc 2Helen B. EvansNo ratings yet

- 9709 w11 Ms 32Document7 pages9709 w11 Ms 32Helen B. EvansNo ratings yet

- Act7 1Document21 pagesAct7 1Helen B. EvansNo ratings yet

- Act 7Document14 pagesAct 7Helen B. EvansNo ratings yet

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- Goals and financial plans for retirement, education, and home purchaseDocument5 pagesGoals and financial plans for retirement, education, and home purchaseChintu WatwaniNo ratings yet

- Compound interest worksheetDocument5 pagesCompound interest worksheetAhmad MedlejNo ratings yet

- Taxation (Vietnam) : Thursday 8 June 2017Document11 pagesTaxation (Vietnam) : Thursday 8 June 2017annarosaNo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Cabot Corporation Annual Report PDFDocument116 pagesCabot Corporation Annual Report PDFDedi Satria WahyuNo ratings yet

- BoP Answers: Current Account and UK Trade DeficitDocument1 pageBoP Answers: Current Account and UK Trade DeficitTiffany100% (1)

- Assignment 6.2 LiquidationDocument7 pagesAssignment 6.2 LiquidationAnna Mae Nebres100% (1)

- Accenture Case WorkbookDocument23 pagesAccenture Case Workbookjasonchang24No ratings yet

- Chapter 3 - Process Costing - With WIPDocument44 pagesChapter 3 - Process Costing - With WIPHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Transfer Pricing Documentation File TemplateDocument4 pagesTransfer Pricing Documentation File TemplateMuris Supic33% (3)

- Applied Corporate Finance: Hydro One Case Study ReportDocument25 pagesApplied Corporate Finance: Hydro One Case Study ReportCat100% (2)

- Question 85: Basic ConsolidationDocument5 pagesQuestion 85: Basic ConsolidationMoses SikaNo ratings yet

- Lombard BankersDocument3 pagesLombard BankersLuminita Maria TrifuNo ratings yet

- ICAEW - Accounting 2020 - Chap 4Document78 pagesICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENNo ratings yet

- LDA ArticleDocument2 pagesLDA ArticleAakash KumarNo ratings yet

- 3rd Party Tender Notification pkg-2Document9 pages3rd Party Tender Notification pkg-2Chethan GowdaNo ratings yet

- A Study On Impact of Foregin Stock Markets On Indian Stock MarketDocument20 pagesA Study On Impact of Foregin Stock Markets On Indian Stock MarketRaj KumarNo ratings yet

- KRX-CS and SWIFT Messaging v1.53 - 20200601Document152 pagesKRX-CS and SWIFT Messaging v1.53 - 20200601trang.le.quynh.desNo ratings yet

- Fintech and The Transformation of The Financial IndustryDocument9 pagesFintech and The Transformation of The Financial Industryrealgirl14No ratings yet

- Conworld Lesson 2Document7 pagesConworld Lesson 2Zyke NovenoNo ratings yet

- Security Guard Business PlanDocument16 pagesSecurity Guard Business PlanRock Amit JaiswalNo ratings yet

- Follow Fibonacci Ratio Dynamic Approach for Intraday TradingDocument4 pagesFollow Fibonacci Ratio Dynamic Approach for Intraday TradingLatika DhamNo ratings yet

- Agra Cases Batch 1 Case DigestDocument4 pagesAgra Cases Batch 1 Case Digestcherry_romano_2No ratings yet

- Accounting For DividendsDocument6 pagesAccounting For DividendsAgatha Apolinario100% (1)

- Directors' Resolution Approving Transfer of SharesDocument1 pageDirectors' Resolution Approving Transfer of SharesLegal Forms100% (1)

- How To Build Wealth FastDocument9 pagesHow To Build Wealth FastDrew LashuaNo ratings yet

- Se2cal Notice 1208160011799234Document2 pagesSe2cal Notice 1208160011799234Jyotsana SharmaNo ratings yet

- Johor Property - 17 October 2015Document24 pagesJohor Property - 17 October 2015Times MediaNo ratings yet

- Amended Articles of Incorporation ofDocument17 pagesAmended Articles of Incorporation ofxenoyewNo ratings yet