Professional Documents

Culture Documents

Problem Set 2

Uploaded by

Yoeng Hi KimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 2

Uploaded by

Yoeng Hi KimCopyright:

Available Formats

Section 1: True or False: If False, provide a corrected statement that is true.

[1 point each]

TRUE 1. The covariance of two risky assets measures their tendency to vary around their

standard deviation.

FALSE 2. The Security Market Line (SML) relates total risk to expected return.

>>The Security Market Line (SML) relates systematic risk to expected return.

FALSE 3. The CAPM assumes all investors are heterogeneous in rationality and expectations.

>>The CAPM assumes all investors are homogenous in rationality and expectations.

FALSE 4. An implication of the CAPM is that the risk premium on the market portfolio is proportional to its

risk and the degree of risk aversion.

>>Proportional to its variance and to the risk aversion of the average investor.

TRUE 5. One problem with testing the CAPM is that the market portfolio is unobservable.

FALSE 6. Due to its shortcomings, the CAPM is useless.

>> practical applications of the CAPM includes estimating required returns;

one example is for regulators.

Problem 1: Return Computation, ETFs, Levered ETFs, and Tracking Errors [16 points]

The SPY is an ETF that seeks to replicate the returns to the S&P 500 Index. Additionally, the UPRO is

an ETF that seeks to provide returns equaling 3 times the daily return to the S&P 500 Index, while the

SPXU is an ETF that seeks to provide returns equaling -3 times the daily return to the S&P 500 Index.

On blackboard, you will find the daily returns to both the index and these 3 ETFs for the period January

2011 through September 2011 (i.e. for an investor investing on 12/31/2010 through 9/30/2011). Use this

data to complete the following tasks:

A. [6 points] Using the data in the excel spreadsheet provided to you on Blackboard, compute the

arithmetic average return, the geometric average return, and the standard deviation of returns for

the S&P 500 index and the three ETFs (SPXU, SPY, and UPRO). Note, when computing the

geometric average return, do not use the approximation but instead use the exact computation.

S&P500 SPXU SPY UPRO

Arithmetic average return -0.038% 0.111% -0.039% -0.125%

Geometric average return -0.048% 0.028% -0.048% -0.210%

Standard deviation of returns 1.386% 4.100% 1.370% 4.085%

B. [2 points] Based on your answer to Part A, why is there a larger difference between the

arithmetic and geometric average returns for UPRO than for SPY?

Arithmetic average return is mean of daily returns, the numbers in data are independent from each other.

Geometric average return calucates by product of each numbers so the numbers used are dependent.

Geometric average return is more affected by outliers.

The lowest daily return of SPY is -6.514% and the highest daily return is 4.65%.

On the other hand, the lowest daily value of UPRO is -19.753% and the highest daily return is 13.906%.

Upro has greater range of daily returns and seem to have significant numbers

that affects geometric average returns.

=

=

N

t

t

r

N

r

1

1

1 ) 1 (

1

1

(

+ H =

=

N

t

N

t

r r

( )

=

N

t

t

r r

N

1

2

1

1

o

C. *2 points+ Use the approximation (Geometric Average Return Arithmetic Average Return 0.5

* return variance) to compute the geometric average return for the S&P 500, SPXU, SPY, and

UPRO, and compare those numbers to the geometric average returns from A.

S&P500 SPXU SPY UPRO

Geometric average return -0.048% 0.028% -0.048% -0.210%

Est. Geometric average return -0.048% 0.027% -0.048% -0.021%

The Geometric average return and estimated geometric average return is similar.

D. [3 points] Compute the holding period return for the S&P 500 index and the three ETFs (SPXU,

SPY, and UPRO) over the full holding period.

S&P500 SPXU SPY UPRO

HPR -8.68% -5.51% -8.717% -32.782%

E. [3 points] Define the daily tracking error for each ETF as the ETF return minus the benchmark

index return. To illustrate:

TESPY = SPY return S&P500 return,

TESPXU = SPXU return (-3 * S&P500 return),

TEUPRO = UPRO return (3 * S&P500 return).

TEspy Tespxu Teupro

40546 -0.00102 0.005382 -0.4975%

40547 0.000751 -0.00273 0.0744%

40548 5.84E-05 -0.00012 0.1531%

40549 -0.00022 0.00069 -0.0677%

40550 -0.00012 0.000352 0.0080%

40812 0.000428 -0.00112 0.2010%

40813 0.000493 -0.001 -0.0441%

40814 6.74E-05 0.001149 0.1042%

40815 -0.00031 -0.00061 0.1225%

40816 -6.9E-06 -0.00152 0.3672%

For each of the 3 ETFs, compute the average daily tracking error and the maximum and minimum

daily tracking error.

TESPY TESPXU TEUPRO

average -4.4E-06 -0.0045% -0.0094%

min -0.00159 -0.8123% -2.8420%

max 0.001445 0.6406% 2.8775%

Problem 2: The Efficient Frontier and the CAL [14 points; 2 points each]

Consider the 2-asset case. Asset 1 has an expected return of 1.00% and a standard deviation of 4.00%.

Asset 2 has an expected return of 6.00% and a standard deviation of 7.50%. The correlation coefficient

for the two assets is 0.12.

1. What is the covariance of Assets 1 and 2?

Asset 1: E(r1)=1%, 1=4%

Asset 2: E(r2)=6%, 2=7.5%

1,2 = 0.12

1,2 = 1,2/(1*2) = 1,2/(0.04*0.075) = 0.12

1,2= 0.00036

2. What are the expected return and standard deviation of a portfolio composed of 35% Asset 1 and

65% Asset 2? Refer to this portfolio as the (35,65) portfolio.

E(Rp) = W1E(R1)+W2E(R2) = (0.35*0.01)+(0.65*0.06) = 4.25%

p

2

= w1

2

*1

2

+w2

2

*2

2

+2w1*w2*1,2 = (0.35^2)(0.04^2)+(0.65^2)(0.075^2)+2(0.35*0.65*0.00036)

p

2

=0.00274 = 0.274%

p = 0.05231 = 5.231%

3. Now consider the risk-free asset. The return on the risk-free asset is 0.50%. What are the

expected return and standard deviation from allocating our wealth 20% to the risk-free asset and

80% to the (35,65) portfolio in Step #2?

E(RP+) = WrfE(Rrf) + WpE(Rp) = (0.2*0.005)+(0.8*0.0425) = 3.5%

p+

2

= Wp

2

* p

2

= (0.8^2)*(0.00274) = 0.1754%

p+ = 4.1876%

4. What is the slope of the line formed by all possible combinations of the risk-free asset and the

(35,65) portfolio?

Slope = rise / run = (E(RP) rf )/P = (4.25%-0.5%)/(5.231%) = 0.716880

5. What portfolio (selected from all the possible combinations of Asset 1 and 2) forms the best

possible Capital Allocation Line? The correct answer will define the portfolio according to the

weights, e.g. (w1,w2) = (35,65).

W2* = *(E(R2)-rf)*1

2

-(E(R1)-rf)*1,2+ / *(E(R2)-rf)*1

2

+ (E(R1)-rf)*2

2

(E(R1)-rf+E(R2)-rf)*1,2+

W1* = 1-W2*

W2* = [(0.06-0.005)*(0.04)

2

-(0.01-0.005)*(0.00036)]

/[(0.06-0.005)*(0.04)

2

+(0.01-0.005)*(0.075)

2

- [(0.01-0.005+0.06-0.005)*(0.00036)]

W2* =0.91193 = 91.193%

W1* = 1-0.91193 = 0.08807 = 8.807%

6. What is the slope of the Capital Market Line (CML)?

E(Rp) = W1E(R1)+W2E(R2) = (.08807*0.01)+(.91193*0.06) = 0.055597 = 5.5597%

p

2

= w1

2

*1

2

+w2

2

*2

2

+2w1*w2*1,2 =

(0.08807^2)(0.04^2)+(0.91193^2)(0.075^2)+2(0.91193*0.08807*0.00036)

p

2

=0.00475 = 0.475%

p = 0.06891 = 6.891%

Slope = rise / run = (E(RP) rf )/P = (5.5597%-0.5%)/(6.891%) = 0.734248

7. What are the expected return and standard deviation of a portfolio that invests -20% in the riskfree

asset and the remainder of the portfolio in the optimal portfolio found in Step #5?

E(r#7) = wrf * rf + wp * E(rp*) = (-0.2*0.005)+(1.2*0.055597) = 0.0672

E(r#7) =6.572%

p+ = Wp* p= (1.2)*(0.06891) = 0.08269 = 8.269%

Problem 3: 3 risky assets [9 points; 3 points each]

Consider three risky assets with the following properties.

Use this information to answer the following questions.

Expected Return Standard Deviation Covariances:

Asset1 3.00% 4.00% 1,2 = -0.00130

Asset2 11.00% 13.00% 1,3 = 0.00180

Asset3 6.50% 9.00% 2,3 = 0.00819

1. [3 points] What is the correlation coefficient for Assets 2 and 3?

2,3 = 0.00819

2 =0.13

3 = 0.09

2,3 =0.00819/(0.13*0.09) = 0.7

2. [3 points] What is the expected return for the portfolio that invests 30% in Asset 1, 30% in Asset

2, and 40% in Asset 3?

E(Rp) = W1E(R1)+W2E(R2) +W3E(R3) = (0.30*0.03)+(0.30*0.11) + (0.40*0.065)= 0.068 = 6.8%

3. [3 points] Compute the standard deviation for the portfolio that invests 30% in Asset 1, 30% in

Asset 2, and 40% in Asset 3?

p

2

= w1

2

* 1

2

+ w2

2

* 2

2

+ w3

2

* 3

2

+ 2w1 w2 1,2 + 2w1 w3 1,3 + 2w2 w3 2,3

p

2

= (0.30^2)(0.04^2) + (0.30^2)(0.13^2) +(0.40^2)(0.09^2)

+ 2(0.30*0.30*-0.0013) +2(0.30*0.40*0.0018) + 2(0.30*0.40*0.00819)

0.0051246

p= (0.00512)^0.5 = 0.07159 =7.159%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Analysis On The Proposed Property Tax AssessmentDocument32 pagesAnalysis On The Proposed Property Tax AssessmentAB AgostoNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Invoice #100 for Project or Service DescriptionDocument1 pageInvoice #100 for Project or Service DescriptionsonetNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- Notes To FS - Part 1Document24 pagesNotes To FS - Part 1Precious Jireh100% (1)

- Chapter-Iii Company Profile: Motilal Oswal Financial Services Ltd. (BSE, NIFTY, NASDAQ, Dow Jones, Hang Seng)Document8 pagesChapter-Iii Company Profile: Motilal Oswal Financial Services Ltd. (BSE, NIFTY, NASDAQ, Dow Jones, Hang Seng)MubeenNo ratings yet

- Bikash 4Document16 pagesBikash 4Bikash Kumar NayakNo ratings yet

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDocument5 pagesNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet

- Textron Inc. v. Commissioner of IRS, 336 F.3d 26, 1st Cir. (2003)Document11 pagesTextron Inc. v. Commissioner of IRS, 336 F.3d 26, 1st Cir. (2003)Scribd Government DocsNo ratings yet

- KWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022Document2 pagesKWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022BalavinayakNo ratings yet

- 2 Comm. Management DOC FH 2019 1 PDFDocument5 pages2 Comm. Management DOC FH 2019 1 PDFSaudNo ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- Order in The Matter of Amrit Projects (N. E.) LimitedDocument13 pagesOrder in The Matter of Amrit Projects (N. E.) LimitedShyam SunderNo ratings yet

- 2011HB 06651 R00 HBDocument350 pages2011HB 06651 R00 HBPatricia DillonNo ratings yet

- Esteriana Haskasa - General ResumeDocument3 pagesEsteriana Haskasa - General ResumeEster HaskaNo ratings yet

- Risk and Rates of Return: Multiple Choice: ConceptualDocument79 pagesRisk and Rates of Return: Multiple Choice: ConceptualKatherine Cabading InocandoNo ratings yet

- Low Cost Housing Options for Bhutanese RefugeesDocument21 pagesLow Cost Housing Options for Bhutanese RefugeesBala ChandarNo ratings yet

- LIC Jeevan Anand Plan PPT Nitin 359Document11 pagesLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNo ratings yet

- Free Accounting Firm Business PlanDocument1 pageFree Accounting Firm Business PlansolomonNo ratings yet

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDocument5 pagesSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- Taxation Law I 2020Document148 pagesTaxation Law I 2020Japoy Regodon EsquilloNo ratings yet

- Abaya vs. EbdaneDocument30 pagesAbaya vs. Ebdanealexandra recimoNo ratings yet

- EY-IFRS-FS-20 - Part 2Document50 pagesEY-IFRS-FS-20 - Part 2Hung LeNo ratings yet

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerNo ratings yet

- Small Business Loan Application Form For Individual - Sole - BDODocument2 pagesSmall Business Loan Application Form For Individual - Sole - BDOjunco111222No ratings yet

- Business TransactionsDocument6 pagesBusiness TransactionsMarlyn Joy Yacon100% (1)

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDocument33 pagesKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanNo ratings yet

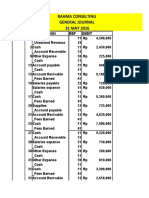

- Rahma ConsutingDocument6 pagesRahma ConsutingEko Firdausta TariganNo ratings yet

- Plastic Money Full Project Copy ARNABDocument41 pagesPlastic Money Full Project Copy ARNABarnab_b8767% (3)