Professional Documents

Culture Documents

Synopsis

Uploaded by

9352233311100%(2)100% found this document useful (2 votes)

350 views2 pagesNon-performing Assets In Cooperative Banks has been causing trouble and confusion. NPAs as percentage to total recoverable funds acts as a constraint on the efficiency of the lending institution. At all India level, the total loan issued by DCCBs during the year 1950-51 was Rs. 83 crores.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNon-performing Assets In Cooperative Banks has been causing trouble and confusion. NPAs as percentage to total recoverable funds acts as a constraint on the efficiency of the lending institution. At all India level, the total loan issued by DCCBs during the year 1950-51 was Rs. 83 crores.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

350 views2 pagesSynopsis

Uploaded by

9352233311Non-performing Assets In Cooperative Banks has been causing trouble and confusion. NPAs as percentage to total recoverable funds acts as a constraint on the efficiency of the lending institution. At all India level, the total loan issued by DCCBs during the year 1950-51 was Rs. 83 crores.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Non-performing Assets In Cooperative Banks

(Hardcover - 2006)

by

K. Ravichandran

,

R. Mayilsamy

Write a Review

List Price: Rs 380

Our Price: Rs. 342

Discount: Rs. 38 off

Available. Order now and get it in 8-10 business days. See Details

All India - Free Shipping. See Details

Ships to India only.

Buy online using:

- Credit Card (VISA & MasterCard)

- Debit Card or Internet Banking Account (all major Indian Banks accepted)

- Cheque, Demand Draft or Money Order. See Details

Publisher: Abhijeet Publications

Book: Non-performing Assets In Cooperative Banks

Non Performing Assets (NPAs), as a syndrome, though not new to the Cooperative Banking

Structure has been causing trouble and confusion during the recent past. Because NPAs as the

percentage to total recoverable funds acts as a constraint on the efficiency of the lending

institution and their capacity to borrow funds and lend to agriculture. At all India level, the

total loan issued by DCCBs during the year 1950-51 was Rs. 83 crores. This has increased

over the years and stood at Rs. 81025 crores during the year 2005-06. Though the quantum

of loans increased over the year, the syndrome of cooperative credit i.e., the overdues have

been deeply rooted into the system and block the flow of credit to agriculture. Shri Balasaheb

Vikhe Patil, rightly said, "for any credit system to sustain its operations on a viable basis, it is

necessary to enforce strong credit discipline among its clients. The Cooperatives need to tackle

the problem of low recoveries. They have to draw lessons from their counterparts elsewhere

who are able to show consistently high recovery performance" (NABARD: 2000; p. 137).

Inordinate delay in recovery of loan builds up NPAs, which affect the health of Cooperative

Banks. The Committee on Banking Sector Reforms reported that funds blocked in NPAs

increase the cost of financial inter-mediation as banks resort to rasing deposits and borrowings

at a higher cost as a measure to minimize the balance between the cash outflow and cash

inflow arising out of the NPAs and the money locked up NPAs are not available for productive

uses and to the extent that banks seek to make provisions for NPAs. This has an adverse

impact on the profitability of the banks both in short and long run. So, Reserve Bank of India

(1999) in its report on NPAs stated that reduction in NPAs should be treated as a national

priority. As the concept of NPA is of recent origin, only few books are available to study the

level of NPAs in banking sector. I hope that the present book will satisfy the academic needs of

students and researchers in banking in general and cooperative banking in particular.

About Author :

Dr. K. Ravichandran (b. 1965) got his education at TBML College, Porayar, Tamilnadu. He has a

distinguished academic career. He had been a Faculty Member at the Institute of Cooperative

Management, Kannur, Kerala. Presently, He is working as Reader/Coordinator, Diploma

Insurance Business, Department of Cooperation, Gandhigram Rural University, Gandhigram,

Dindigul, Tamilnadu. He has published many papers in the field of banking and management in

the reputed journals. His other works are: Crop Loan System and Overdue, Marketing

Research, New World through Cooperatives, Functional Management and Rural Credit Markets.

He is also trainer and developed training modules in the field of Cooperation. Mr. R. Mayilsamy

(b. 1977) got his education at Gandhigram Rural University, Gandhigram, Dindigul, Tamilnadu.

He was awarded Fellowship from Jawaharlal Nehru Memorial Fund, New Delhi for his Ph.D.

programme. He has participated and presented many research papers at the State, National

and International seminars conducted by various academic Institutions. At present, he is

working as a Lecturer (SF), Department of Cooperation, Sri Ramakrishna Mission Vidyalaya

College of Arts and Science, Coimbatore, Tamilnadu.

Contents :

Preface Abbreviations Used Non Performing Assets in Short term Cooperative Credit Structure-

A Conceptual Framework District Central Cooperative Banks and Non Performing Assets in

India Non Performing Assets in District Central Cooperative Banks in Tamil Nadu Non-

Performing Assets in Dharmapuri District Central Cooperative Bank Bibliography Annexures

Index

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Challan Form Allahabad UP Gramin Bank PDFDocument2 pagesChallan Form Allahabad UP Gramin Bank PDFAmit GuptaNo ratings yet

- Credit ControlDocument5 pagesCredit ControlHimanshu GargNo ratings yet

- Ticket Plus實名制購票流程 2023061301Document14 pagesTicket Plus實名制購票流程 2023061301daniel111478No ratings yet

- Tesco 2023 Ar Primary Statements Updated 230623Document5 pagesTesco 2023 Ar Primary Statements Updated 230623Ñízãr ÑzrNo ratings yet

- Century Paper and Board Mills Limited - Case StudyDocument23 pagesCentury Paper and Board Mills Limited - Case StudyJuvairiaNo ratings yet

- HOMEWORKDocument7 pagesHOMEWORKReinaldo RoseroNo ratings yet

- 2 - Afraseab Aor Umro Ky KarnamayDocument390 pages2 - Afraseab Aor Umro Ky KarnamaySaim Younis100% (1)

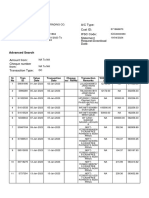

- Detailstatement - 19 4 2024@14 46 25Document28 pagesDetailstatement - 19 4 2024@14 46 25SONU SNo ratings yet

- National CPI: (April 2015 = 100) (یرو)Document25 pagesNational CPI: (April 2015 = 100) (یرو)Sakhi AhmadyarNo ratings yet

- The Performance of Diversified Emerging Market Equity FundsDocument16 pagesThe Performance of Diversified Emerging Market Equity FundsMuhammad RoqibunNo ratings yet

- Convertibility of RupeeDocument14 pagesConvertibility of RupeeArun MishraNo ratings yet

- FINANCIAL MANAGEMENT Full ModuleDocument72 pagesFINANCIAL MANAGEMENT Full Modulenegamedhane58No ratings yet

- PWC Mine A Confidence CrisisDocument60 pagesPWC Mine A Confidence CrisisRadio-CanadaNo ratings yet

- Cash App September 2022 Statement 098c-1Document5 pagesCash App September 2022 Statement 098c-1Alisha Nutt100% (1)

- Essentials of Treasury Management - Working Capital Class Final OutlineDocument32 pagesEssentials of Treasury Management - Working Capital Class Final OutlinePablo VeraNo ratings yet

- Brea ch05 BMM 7e SGDocument85 pagesBrea ch05 BMM 7e SGSarosh Ata100% (1)

- Yes BankDocument9 pagesYes Bankरायटर लेखनवालाNo ratings yet

- History of Index NumberDocument1 pageHistory of Index NumbersyukrizzNo ratings yet

- Accounting AssignmentDocument11 pagesAccounting AssignmentTakunda GumbuNo ratings yet

- Engr 222 NotesDocument89 pagesEngr 222 NotesnandiniNo ratings yet

- Solution 786526Document38 pagesSolution 786526Anvesha AgarwalNo ratings yet

- Account StatementDocument132 pagesAccount StatementBASHA SHAFIQNo ratings yet

- Xi Akl 3 - Lembar Kerja Memproses Entry JurnalDocument25 pagesXi Akl 3 - Lembar Kerja Memproses Entry JurnalKeshya MantovanniNo ratings yet

- The Role of IPDocument3 pagesThe Role of IPsamrat duttaNo ratings yet

- Time of SupplyDocument31 pagesTime of SupplyNalin KNo ratings yet

- Business InfographicDocument1 pageBusiness InfographicLuck BananaNo ratings yet

- SOLENNE Temporary Sales InvoiceDocument1 pageSOLENNE Temporary Sales InvoiceMark Anthony CasupangNo ratings yet

- Soal Pas Myob Kelas Xii GanjilDocument4 pagesSoal Pas Myob Kelas Xii GanjilLank BpNo ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- Ecb - Op307 C85ee17bc5.enDocument46 pagesEcb - Op307 C85ee17bc5.enSarang PokhareNo ratings yet