Professional Documents

Culture Documents

3

Uploaded by

AVINANDANKUMAROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3

Uploaded by

AVINANDANKUMARCopyright:

Available Formats

11/1/13

3. Financial Management What will your outlook towards maintenance of li

Advertise your Business Here

Browse | Placement Papers | Company | Code Snippets | Certifications | Visa Questions Post Question | Post Answer | My Panel | Search | Articles | Topics | ERRORS new Refer this Site Login | Sign Up

Did you received any Funny E-Mails from your Friends and like to share with rest of our friends? Yeah!! you can post that stuff HERE

Search

Categories >> Business Management >> Finance

Business Administration Interview Questions Marketing Sales Interview Questions Finance Interview Questions Human Resources Interview Questions Personnel

3 .F i n a n c i a lM a n a g e m e n t h a tw i l ly o u ro u t l o o kt o w a r d sm a i n t e n a n c eo fl i q u i da s s e t s Question W t oe n s u r et h a tt h ef i r mh a sa d e q u a t ec a s hi nh a n d st om e e t i t so b l i g a t i o na ta l lt i m e s ?

Question Submitted By :: Nareenvaishu I also faced this Question!!

Rank

Answer Posted By

Re: 3. Financial Management What will your outlook towards maintenance of liquid assets to ensure that the firm has adequate cash in hands to meet its obligation at all times? Answer PROJECTED CASH FLOW STATEMENT # 1 BE THE GUIDED STICK. OUR SALES, REALISATIONS, AND FIXED AND VARIABLE EXPENSES NEED TO BE KEPT IN MIND WHILE JUDGING THE BALANCED NEED OF LIQUID ASSESTS. WE MAY CONSIDER 3 Ak Gupta

www.allinterview.com/showanswers/93900.html

1/4

11/1/13

3. Financial Management What will your outlook towards maintenance of li

Management Interview Questions Hotel Management Interview Questions Industrial Management Interview Questions Infrastructure Management Interview Questions IT Management Interview Questions Non Technical Interview Questions Business Management AllOther Interview Questions

THE SHORT TERM INVESTMENTS WITH REFERENCE TO INTEREST RATE AND SURPLUS FUNDS.

Is This Answer Correct ?

30 Yes

11 No

Re: 3. Financial Management What will your outlook towards maintenance of liquid assets to ensure that the firm has adequate cash in hands to meet its obligation at all times? Answer first we need to project the cash flow # 2 statement, and employee the companies fund in short term investment.alonge with that we have to check expenses.and maintain the liquied assets/

Is This Answer Correct ?

Naz

14 Yes

7 No

Re: 3. Financial Management What will your outlook towards maintenance of liquid assets to ensure that the firm has adequate cash in hands to meet its obligation at all times? Answer i want answer 0 Narsimulu #3 Is This Answer Correct ? 3 Yes 2 No Re: 3. Financial Management What will your outlook towards maintenance of liquid assets to ensure that the firm has adequate cash in hands to meet its obligation at all times? Answer Generally speaking, you must limit expenses 0 Suman # 4 and ensure that some of your assets are in the form of short term assets. The higher your short term assets and the less your short term debt, the better your ability to pay the debt (short term liquidity ratio / liquidity ratio help you determine this).The ratio analysis will be the guide stick for the liquidity ratio.

Is This Answer Correct ?

4 Yes

0 No

2/4

www.allinterview.com/showanswers/93900.html

11/1/13

3. Financial Management What will your outlook towards maintenance of li

Other Finance Interview Questions

Question who manages all the IPO? Can anyone supply FI-CO material in SAP.? What Is Systematic & Unsystematic Risk ? what is mean by debenture ? What is RONA? What is Deemed Export? and what types of document's need to be made by manufacturer for sale to buyer party? what is preference equity what is meant by index in stock marketing what is financial management? nikkie stock exchange belongs to which country Formula for Book Value per Share(BVPS)? What is mid Cap? Religare Capital-IQ IBM Broadridge Indiabulls ABC Multi-Trans Asked @ Answers 2 5 3 4 7 1 4 1 6 6 6 2 For more Finance Interview Questions Click Here

Reliance

www.allinterview.com/showanswers/93900.html

3/4

11/1/13

3. Financial Management What will your outlook towards maintenance of li

Copyright Policy | Terms of Service | Help | Site Map 1 | Articles | Site Map | Site Map | Contact Us | Copyright 2012 ALLInterview.com. All Rights Reserved.

ALLInterview.co m

:: Fo rum9.co m

:: KalAajKal.co m

www.allinterview.com/showanswers/93900.html

4/4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Subhotam Multitrade Direct Selling DetailsDocument3 pagesSubhotam Multitrade Direct Selling DetailsAVINANDANKUMARNo ratings yet

- Plan PDFDocument23 pagesPlan PDFAVINANDANKUMARNo ratings yet

- Project Title: Progress/Final ReportDocument9 pagesProject Title: Progress/Final Reportmohammedfereje suliemanNo ratings yet

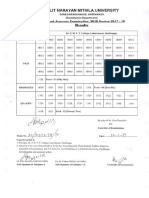

- Programme Centre List For Conducting B.A B.sc. B.com. Part II Hons. Sub Gen. Voc. Examination 2019 1Document4 pagesProgramme Centre List For Conducting B.A B.sc. B.com. Part II Hons. Sub Gen. Voc. Examination 2019 1AVINANDANKUMARNo ratings yet

- Result of M.ed. 1st Sem., & 3rd Sem. - Session - 2018-20 Exam., 2019Document2 pagesResult of M.ed. 1st Sem., & 3rd Sem. - Session - 2018-20 Exam., 2019AVINANDANKUMARNo ratings yet

- Siemens Full CaseDocument7 pagesSiemens Full CaseAVINANDANKUMARNo ratings yet

- A Project of Training and DevelopmentDocument83 pagesA Project of Training and Developmentharishdadhich87% (52)

- Subhotam Multitrade Direct Selling DetailsDocument3 pagesSubhotam Multitrade Direct Selling DetailsAVINANDANKUMARNo ratings yet

- Result of M.ed. 2nd Semester Examination, 2018 (Session 2017-19) - MinDocument2 pagesResult of M.ed. 2nd Semester Examination, 2018 (Session 2017-19) - MinAVINANDANKUMARNo ratings yet

- Home ScienceDocument2 pagesHome ScienceAVINANDANKUMARNo ratings yet

- Project Report On Employee Satisfaction MPMDocument60 pagesProject Report On Employee Satisfaction MPMsanatks71% (48)

- Project Report On Employee Satisfaction MPMDocument60 pagesProject Report On Employee Satisfaction MPMsanatks71% (48)

- Case Study Methodology With Sample Case QuestionsDocument4 pagesCase Study Methodology With Sample Case QuestionsMadhusudan HmNo ratings yet

- Scholarship Guidelines and Application FormDocument5 pagesScholarship Guidelines and Application Formhimz101No ratings yet

- Gmail - (New Post) 20-21 December 2013 - Daily Current AffairsDocument3 pagesGmail - (New Post) 20-21 December 2013 - Daily Current AffairsAVINANDANKUMARNo ratings yet

- Iz/Kku DK Kzy MRRJ Izns'K Ty Fuxe) 6&Jk - KK Izrki Ekxz) Y (KuåDocument5 pagesIz/Kku DK Kzy MRRJ Izns'K Ty Fuxe) 6&Jk - KK Izrki Ekxz) Y (KuåAbhishek Nath TiwariNo ratings yet

- How Will You Influence People To Strive Willingly For Group Objectives inDocument22 pagesHow Will You Influence People To Strive Willingly For Group Objectives inAVINANDANKUMARNo ratings yet

- Iz/Kku DK Kzy MRRJ Izns'K Ty Fuxe) 6&Jk - KK Izrki Ekxz) Y (KuåDocument5 pagesIz/Kku DK Kzy MRRJ Izns'K Ty Fuxe) 6&Jk - KK Izrki Ekxz) Y (KuåAbhishek Nath TiwariNo ratings yet

- Ritu SinghDocument107 pagesRitu SinghAVINANDANKUMARNo ratings yet

- Job & Employee SatisfactionDocument68 pagesJob & Employee SatisfactionAVINANDANKUMARNo ratings yet

- Etymology: Well-BeingDocument7 pagesEtymology: Well-BeingAVINANDANKUMARNo ratings yet

- Umbrella Term Mind Reason Plan Solve Problems Abstractly Language Learn Creativity Personality Character Knowledge WisdomDocument7 pagesUmbrella Term Mind Reason Plan Solve Problems Abstractly Language Learn Creativity Personality Character Knowledge WisdomAVINANDANKUMARNo ratings yet

- Arjun Short ProjectDocument72 pagesArjun Short ProjectAVINANDANKUMARNo ratings yet

- Java Is A Programing Language (PL)Document4 pagesJava Is A Programing Language (PL)AVINANDANKUMARNo ratings yet

- Psychology Cognitive Science Sensory Information: Perception and RealityDocument3 pagesPsychology Cognitive Science Sensory Information: Perception and RealityAVINANDANKUMARNo ratings yet

- Question: What Is Psychology?: Wilhelm Wundt First Experimental Psychology LabDocument3 pagesQuestion: What Is Psychology?: Wilhelm Wundt First Experimental Psychology LabAVINANDANKUMARNo ratings yet

- Psychology Philosophy Artificially Enhancing The Memory Paradigm Cognitive Psychology Cognitive Neuroscience NeuroscienceDocument10 pagesPsychology Philosophy Artificially Enhancing The Memory Paradigm Cognitive Psychology Cognitive Neuroscience NeuroscienceAVINANDANKUMARNo ratings yet

- Submitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014Document50 pagesSubmitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014AVINANDANKUMARNo ratings yet

- Submitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014Document50 pagesSubmitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014AVINANDANKUMARNo ratings yet

- Arjun Short Project1Document49 pagesArjun Short Project1AVINANDANKUMARNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Meezan Bank - Report 2Document87 pagesMeezan Bank - Report 2SaadatNo ratings yet

- KFC Project CorpDocument14 pagesKFC Project CorpShreyaNo ratings yet

- "Organizational Models, Corporate Governance Structure and Initial Public Offerings (IPOs)Document132 pages"Organizational Models, Corporate Governance Structure and Initial Public Offerings (IPOs)xfnotNo ratings yet

- Esmeralda Springs SurpriseDocument8 pagesEsmeralda Springs Surpriseflorinmen1No ratings yet

- A Project Report O1Document49 pagesA Project Report O1niraj3handeNo ratings yet

- This Content Downloaded From 14.139.245.68 On Wed, 02 Dec 2020 17:57:13 UTCDocument33 pagesThis Content Downloaded From 14.139.245.68 On Wed, 02 Dec 2020 17:57:13 UTCBidyut Bhusan PandaNo ratings yet

- NTB Annual Report 2022 PDFDocument256 pagesNTB Annual Report 2022 PDFhashii 1794100% (1)

- Ijabf 06Document21 pagesIjabf 06mohit vermaNo ratings yet

- What The 3-Year Strategic Plan Assignment Is All AboutDocument17 pagesWhat The 3-Year Strategic Plan Assignment Is All AboutAnh Túc Vàng100% (2)

- Muthoga 2019 Commercial BanksDocument66 pagesMuthoga 2019 Commercial Banksvenice paula navarroNo ratings yet

- Summer Project On Working Capital at IFFCODocument75 pagesSummer Project On Working Capital at IFFCO3semmba75% (4)

- Report CAMEL-MODEL-ANALYSIS-OF-PUBLIC-PRIVATE-SECTOR-BANKS-IN-INDIADocument38 pagesReport CAMEL-MODEL-ANALYSIS-OF-PUBLIC-PRIVATE-SECTOR-BANKS-IN-INDIAsalman0% (1)

- Japfa Comfeed India Private - R - 25082020Document8 pagesJapfa Comfeed India Private - R - 25082020DarshanNo ratings yet

- Share Price MovementDocument132 pagesShare Price MovementBijaya DhakalNo ratings yet

- Financial Ratio Analysis of Five Commercial Banks in NepalDocument9 pagesFinancial Ratio Analysis of Five Commercial Banks in NepalKripa LamaNo ratings yet

- Impact of Covid-19 Pandemic On Indian Economy 2Document9 pagesImpact of Covid-19 Pandemic On Indian Economy 2Ayushi PatelNo ratings yet

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- TestDocument12 pagesTestRoween Gail BermudezNo ratings yet

- Financial Ratios Ho PDFDocument34 pagesFinancial Ratios Ho PDFOnilusNo ratings yet

- Schmid 2010 MA Risk Adjusted Performance Measures State of The Art PDFDocument73 pagesSchmid 2010 MA Risk Adjusted Performance Measures State of The Art PDFhaNo ratings yet

- Golam Morshed HasanDocument112 pagesGolam Morshed HasankhandakeralihossainNo ratings yet

- Internship Report On Media 11 Advertising Abbottabad: Government College of Management Sciences AbbottabadDocument64 pagesInternship Report On Media 11 Advertising Abbottabad: Government College of Management Sciences AbbottabadFaisal AwanNo ratings yet

- CFA Investments Problems - SetDocument85 pagesCFA Investments Problems - SetGeorge Berberi100% (1)

- 54 HCL Technologies B.V. 2018-19Document22 pages54 HCL Technologies B.V. 2018-19Vikas JNo ratings yet

- Country Asset Allocation Quantitative Country Selection Strategies in Global Factor InvestingDocument270 pagesCountry Asset Allocation Quantitative Country Selection Strategies in Global Factor Investingtachyon007_mechNo ratings yet

- LFC Sector Update 13Document16 pagesLFC Sector Update 13Randora LkNo ratings yet

- SCB PK Report 2015 FinalDocument212 pagesSCB PK Report 2015 FinalAsif RafiNo ratings yet

- FMG 301 Corporate FinanceDocument326 pagesFMG 301 Corporate Financea s100% (1)

- ACC2206 Topic 9 and 10 Analysis & Interpretation of Financial ReportsDocument39 pagesACC2206 Topic 9 and 10 Analysis & Interpretation of Financial ReportsDB BDNo ratings yet

- Financial Statement Analysis TechniquesDocument8 pagesFinancial Statement Analysis TechniquesJomar VillenaNo ratings yet