Professional Documents

Culture Documents

Analysis of Financial StatementsQ&Assignments

Uploaded by

Malik FaisalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Financial StatementsQ&Assignments

Uploaded by

Malik FaisalCopyright:

Available Formats

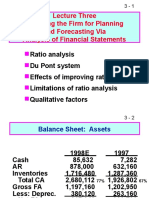

Analysis of Financial Statements

Practice Problems

1. Gem Products has total assets of $5 million, a total asset turnover of 5 times for the year, net income of $500,000, and a total debt to total asset ratio of 0.20. a) b) What is its (1) net rofit mar!ins, (2) return on total assets, and (") return on e#uity$ %y ma&in! $1 million in investments to re lace outmoded e#ui ment (thereby increasin! total assets by $1 million), Gem can increase its net rofit mar!in to " ercent. 'f sales remain the same, as does the total debt to total asset ratio, (hat is the ne( (1) return on total assets and (2) return on e#uity$ )o( could Gem have achieved the same return on e#uity obtained in (b) by chan!es in the total debt to total asset ratio, instead of increasin! total assets and net rofit mar!in$

c)

2.

*om lete the balance sheet for +,* usin! the information that follo(s it. %alance sheet +,* 'ndustries -une "0, 1../ *ash $"0,000 0ccounts ayable $120,000 1ar&. 2ec. 25,000 3otes ayable 44444444 0ccounts 5ec. 4444444 0ccruals 20,000 'nventories 4444444 6otal *.7. 44444444 6otal *.0. 4444444 7on! term 8ebt 44444444 3et fi9ed assets 4444444 2t. holder:s ;#uity $<00,000 6otal liabilities = 6otal assets 4444444 2t. )older:s ;#uity 44444444 'nformation i. 2ales totaled $1,>00,000. ii. 6he !ross rofit mar!in (as 25 ercent. iii. 'nventory turnover (as <.0. iv. 6here are "<0 days in the year. v. 6he avera!e collection eriod (as ?0 days. vi. 6he current ratio (as 1.<0. vii. 6he total asset turnover ratio (as 1.20.

". ,rom the value of the different ratios !iven belo(, calculate the missin! balance sheet items and com lete the balance sheet. 2ales 0vera!e *ollection Period 'nventory 6urn over 8ebt to 0ssets 5atio *urrent 5atio 6otal 0sset 6urnover ,i9ed 0sset 6urnover 0ssets *ash 0ccounts 5ec. 'nventory Pre aid ;9 enses 6otal *urrent 0ssets ,i9ed 0ssets 6otal 0ssets 5s.<000 444444 444444 444444 444444 444444 444444 6otal 7iabilityB ;#uity 44444 5s.100,000 55@days 15 .? or ?0A " 1.< 2.. 7iabilities B ;#uity 0ccounts Payable 3otes Payable 0ccured ;9 enses 6otal *urrent 7iabilities %onds Payable *ommon 2toc& 5etained ;arnin!s <000 4444 <00 4444 4444 1<,000 44444

?.

8e(an 2alman has 5s.1,/50,000 in current assets and 5s./00,000 in current liabilities. 'ts initial inventory level is 5s.500,000, and it (ill raise funds as additional short term notes ayable and use them to increase inventory. )o( much can 8e(an:s short term debt(notes ayable) increase (ithout violatin! a current ratio of 2 to 1$ What (ill be the firm:s #uic& ratio after 8e(an has raised the ma9imum amount of short term debt$

Class Assignment Problems

1. C *o has made lan for the ne9t year.'t is estimated that the com any (ill em loy total assets of 5s.>00,000D 50A of the assets bein! financed by borro(ed ca ital at an interest of >A er year. 6he direct costs for the year are estimated at 5s.?>0,000 and all other o eratin! e9 enses are estimated at 5s.>0,000. 6he !oods (ill be sold to customers at 150 er cent of the direct costs. 6a9 rate is assumed to be 50 ercent. Eou are re#uired to calculateF (i) net rofit mar!inD (ii) return on assetsD (iii) assets turnover and (iv) return on o(ners: e#uity. 2. *om lete the balance sheet and sales information in the table that follo(s for CEG *om any, usin! the follo(in! financial dataF 8ebt ratioF 50A Huic& ratioF 0.> 6otal asset turnoverF 1.5 0vera!e collection eriodF "< days Gross rofit mar!inF 25A 'nventory turnover ratioF 5 *ash 0ccount receivable 'nventories ,i9ed assets 6otal assets 2ales 4444444 4444444 4444444 4444444 200,000 4444444 0ccounts ayable 7on!@term debt common stoc& 5etained earnin!s 6otal 7iab. = e#uity *ost of !oods sold 4444444 ?0,000 444444 <5,000 444444 444444

". 6he follo(in! information is available on the Ianier *or . %alance 2heet as of -une "0, 1... *ash = 1.2 0ccounts receivable 'nventories *urrent assets 2,<50 3et fi9ed assets $ *.2 = 5.; ",/50 $ 500 $ $ $ 0ccounts Payable %an& loan 0ccruals *urrent liabilities 7on! term debt $ ?00 $ 200 $

6otal 7iabilities 6otal 0ssets $ Income Statement for 1999 *redit sales *ost of !oods sold Gross rofit 2ellin! = 0dmin ;9 . 'nterest e9 ense Profit before ta9es 6a9es ( ??A rate) Profit after ta9es ?00 $ $ $ $ >,000 $ $ $ and ;#uity $

Jther information. *urrent ratio 8e reciation 3et rofit mar!in 8ebt K e#uity ratio 0v!. collection eriod 'nventory turnover " $500 /A 1 ?5 days "

0ssumin! that the sales and roduction are steady throu!hout a "<0@ day year, com lete the balance sheet and income statement.

?.

0bott Procesin! has a total asset turnover of 2.0 and an o eratin! rofit mar!in of 20A. 6he com any uses no financial levera!e and faces a 50A income ta9 rate *om ute the net rofit mar!in and return on total assets.

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Financial Statement Analysis ProblemsDocument4 pagesFinancial Statement Analysis ProblemsAcha Bacha50% (2)

- Financial Statement Analysis and ROE CalculationDocument4 pagesFinancial Statement Analysis and ROE CalculationPhương NhungNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CH 3 Probset - Analysis of Fin Stmts 15ed - MasterDocument5 pagesCH 3 Probset - Analysis of Fin Stmts 15ed - MasterCharleene GutierrezNo ratings yet

- Assets Liabilities & Shareholders' Equity: Solutions To Chapter 3 Accounting and FinanceDocument12 pagesAssets Liabilities & Shareholders' Equity: Solutions To Chapter 3 Accounting and FinanceTea WonNo ratings yet

- Q1 True or False (Correct The False Statements) (20 Marks) ::applicable ProblemDocument3 pagesQ1 True or False (Correct The False Statements) (20 Marks) ::applicable ProblemAhemd OsamaNo ratings yet

- Midterm Revision AnswersDocument10 pagesMidterm Revision AnswersAhmed IsmaelNo ratings yet

- Funds Flow Analysis: Problems and Solutions: Balance SheetDocument12 pagesFunds Flow Analysis: Problems and Solutions: Balance SheetAbhilash ShahNo ratings yet

- Chap 003Document11 pagesChap 003Sercan DemirNo ratings yet

- Chapter 1 ExerciseDocument11 pagesChapter 1 ExerciseUsama MukhtarNo ratings yet

- RATIO ANALYSIS QUESTIONS FOR MANAGEMENT ACCOUNTING CHAPTERDocument7 pagesRATIO ANALYSIS QUESTIONS FOR MANAGEMENT ACCOUNTING CHAPTERnavin_raghuNo ratings yet

- Question - FS and FADocument6 pagesQuestion - FS and FANguyễn Thùy LinhNo ratings yet

- Question - BS and FADocument6 pagesQuestion - BS and FANguyễn Thùy LinhNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Week10-Short Term Financing Decision - PROFORMADocument1 pageWeek10-Short Term Financing Decision - PROFORMAAdhitya Rahman SyuhadaNo ratings yet

- Compute ROE, ratios, break-even analysis for various companiesDocument3 pagesCompute ROE, ratios, break-even analysis for various companiesMione GrangerNo ratings yet

- QuizDocument8 pagesQuizJohn BernieNo ratings yet

- Topic 2 ExercisesDocument6 pagesTopic 2 ExercisesRaniel Pamatmat0% (1)

- Consolidated Statement of Financial Position with Intra-Group AdjustmentsDocument17 pagesConsolidated Statement of Financial Position with Intra-Group Adjustmentssamuel_dwumfourNo ratings yet

- Vanier Corp financial analysisDocument3 pagesVanier Corp financial analysisChristopher LieNo ratings yet

- ADM3352 - Final (Fall 2008)Document10 pagesADM3352 - Final (Fall 2008)Tony536No ratings yet

- INSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksDocument2 pagesINSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksSUPPLYOFFICE EVSUBCNo ratings yet

- ENGM 401 & 620 Sample Midterm Exam GuideDocument9 pagesENGM 401 & 620 Sample Midterm Exam GuidehjgNo ratings yet

- Finance Chapter No 2Document20 pagesFinance Chapter No 2UzairNo ratings yet

- Practice Questions On Financial Planning and Corporate ValuationDocument6 pagesPractice Questions On Financial Planning and Corporate ValuationsimraNo ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- B. Cannot Be Stated As A PercentageDocument14 pagesB. Cannot Be Stated As A Percentageemielyn lafortezaNo ratings yet

- Acc 501 Midterm Solved Papers Long Questions SolvedDocument34 pagesAcc 501 Midterm Solved Papers Long Questions SolvedAbbas Jafri33% (3)

- MBA CorporateDocument4 pagesMBA CorporateJohn BiliNo ratings yet

- Final - Problem Set FM FinalDocument25 pagesFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Respuestas de Paridad InternacionalDocument15 pagesRespuestas de Paridad InternacionalDavid BoteroNo ratings yet

- FINMAN Answer KeyDocument7 pagesFINMAN Answer KeyReginald ValenciaNo ratings yet

- Analysis of Financial StatementsDocument5 pagesAnalysis of Financial StatementsNikhil KasatNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsJoana Ann ImpelidoNo ratings yet

- Governmental Accounting Agency Funds and Cash and Investment PoolsDocument4 pagesGovernmental Accounting Agency Funds and Cash and Investment PoolsAdrianna Nicole HatcherNo ratings yet

- 1 - Advanced Financial Accounting Individual Assignment IDocument6 pages1 - Advanced Financial Accounting Individual Assignment IEyasuNo ratings yet

- BA 211 Midterm 2Document6 pagesBA 211 Midterm 2Gene'sNo ratings yet

- Bài tập FRA - FRCDocument12 pagesBài tập FRA - FRCThủy VũNo ratings yet

- Quizlet1 PDFDocument9 pagesQuizlet1 PDFohikhuare ohikhuareNo ratings yet

- 2018 Tutorials - Chapter 12 - Session 3 - MoodleDocument27 pages2018 Tutorials - Chapter 12 - Session 3 - Moodlewandile majoziNo ratings yet

- Fiscal RevisedDocument15 pagesFiscal Revisedzen_arfeen2755No ratings yet

- Spring 2014 GWU MBAD 6211 Case Colonial Back CrackersDocument5 pagesSpring 2014 GWU MBAD 6211 Case Colonial Back CrackersAPlusAcctgTutorNo ratings yet

- Analyzing financial statements of Kingston, IncDocument5 pagesAnalyzing financial statements of Kingston, Inclucano350% (1)

- ATTEMP ALL QUESTIONS: Circle Only The Correct AnswerDocument8 pagesATTEMP ALL QUESTIONS: Circle Only The Correct AnswerPrince Tettey NyagorteyNo ratings yet

- Corporate Finance Tutorial Questions on Financial StatementsDocument2 pagesCorporate Finance Tutorial Questions on Financial StatementsAmy LimnaNo ratings yet

- How Government Policies Impact National Saving RatesDocument23 pagesHow Government Policies Impact National Saving RatesLejla HodzicNo ratings yet

- Acc401advancedaccountingweek11quizfinalexam 170306122641Document103 pagesAcc401advancedaccountingweek11quizfinalexam 170306122641Izzy BNo ratings yet

- Corporate Finance Forecasting ModelDocument6 pagesCorporate Finance Forecasting ModelJohn BernieNo ratings yet

- False (Only Profit Increases Owner's Equity Not Cash Flow)Document6 pagesFalse (Only Profit Increases Owner's Equity Not Cash Flow)Sarah GherdaouiNo ratings yet

- Chapter 14 HomeworkDocument22 pagesChapter 14 HomeworkCody IrelanNo ratings yet

- First 1302020Document9 pagesFirst 1302020fNo ratings yet

- Testbank 2 001Document9 pagesTestbank 2 001Keir GaspanNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- FTCXSXSXSP - Seminar 8 - AnswersDocument4 pagesFTCXSXSXSP - Seminar 8 - AnswersLewis FergusonNo ratings yet

- Income Statement and Balance Sheet for Sautec Credit UnionDocument7 pagesIncome Statement and Balance Sheet for Sautec Credit UnionArcherAcs62% (21)

- FM-I AssignmentDocument2 pagesFM-I Assignmentgwakijira006No ratings yet

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinNo ratings yet

- Personal History Form PDFDocument5 pagesPersonal History Form PDFjaydee12No ratings yet

- Imp DevelopmentsDocument17 pagesImp DevelopmentsMalik FaisalNo ratings yet

- Personal History Form PDFDocument5 pagesPersonal History Form PDFjaydee12No ratings yet

- NTS Human ResourceDocument9 pagesNTS Human ResourceSarahNo ratings yet

- The Library of the University of California Gift of Horace W. Carpentier THE INVASIONS OF INDIA FROM CENTRAL ASIADocument368 pagesThe Library of the University of California Gift of Horace W. Carpentier THE INVASIONS OF INDIA FROM CENTRAL ASIAMalik Faisal100% (3)

- National Highway Jobs PDFDocument1 pageNational Highway Jobs PDFMalik FaisalNo ratings yet

- Pakistan Civil Servants Act 1973Document9 pagesPakistan Civil Servants Act 1973haaldayNo ratings yet

- Monthly Economic Affairs - June, 2014Document40 pagesMonthly Economic Affairs - June, 2014The CSS PointNo ratings yet

- The Library of the University of California Gift of Horace W. Carpentier THE INVASIONS OF INDIA FROM CENTRAL ASIADocument368 pagesThe Library of the University of California Gift of Horace W. Carpentier THE INVASIONS OF INDIA FROM CENTRAL ASIAMalik Faisal100% (3)

- 3 Financial ForecastingDocument18 pages3 Financial ForecastingDildar RazaNo ratings yet

- KJDFGDocument2 pagesKJDFGMalik FaisalNo ratings yet

- TP 1 Financial ModellingDocument9 pagesTP 1 Financial ModellingChristina Yunita Intan100% (1)

- Rona Inc WWW Rona Ca Founded in 1939 Is Canada S PDFDocument1 pageRona Inc WWW Rona Ca Founded in 1939 Is Canada S PDFTaimour HassanNo ratings yet

- Alpha Case StudyDocument7 pagesAlpha Case StudyKhushi GargNo ratings yet

- Tech Mahindra Financial Statement: Balance SheetDocument15 pagesTech Mahindra Financial Statement: Balance SheetHRIDESH DWIVEDINo ratings yet

- Bibica and Haihaco Financial Analysis: Hanoi University Faculty of Management and Tourism - O0oDocument25 pagesBibica and Haihaco Financial Analysis: Hanoi University Faculty of Management and Tourism - O0oNguyễn Hữu HoàngNo ratings yet

- Acct 1 Bexam 1 SampleDocument22 pagesAcct 1 Bexam 1 SampleMarvin_Chan_2123No ratings yet

- Syllabus Auditing and Assurance Concepts and Application 1Document9 pagesSyllabus Auditing and Assurance Concepts and Application 1chuchu tvNo ratings yet

- CORPORATE LIQUIDATION QuizzerDocument10 pagesCORPORATE LIQUIDATION QuizzerJan Elaine CalderonNo ratings yet

- Fabm 1 ReviewerDocument14 pagesFabm 1 ReviewerEfrelyn ParaleNo ratings yet

- Etrp TRCK 2 - Etrp 8 Part 5Document39 pagesEtrp TRCK 2 - Etrp 8 Part 5Kaitlinn Jamila AltatisNo ratings yet

- Divestiture SDocument26 pagesDivestiture SJoshua JoelNo ratings yet

- Rizal Corporation bankruptcy filing analysis under 40 charactersDocument10 pagesRizal Corporation bankruptcy filing analysis under 40 charactersandengNo ratings yet

- LBO Model - Cas Elèves v2Document12 pagesLBO Model - Cas Elèves v2Ekambaram Thirupalli TNo ratings yet

- Why Did Lakshmi Walk Away From LVB - 2020Document1 pageWhy Did Lakshmi Walk Away From LVB - 2020Sriram RanganathanNo ratings yet

- ABM 1 Diagnostic Test AnalysisDocument2 pagesABM 1 Diagnostic Test AnalysisMarjorie BadiolaNo ratings yet

- Jawaban ModulDocument12 pagesJawaban ModulAmelia Fauziyah rahmahNo ratings yet

- Green Shaper Ver 1Document25 pagesGreen Shaper Ver 1Prasad MampitiyaNo ratings yet

- Lovepop Report PDFDocument15 pagesLovepop Report PDFShivam Bose50% (2)

- Mobil Trauma Center 20190919 PDFDocument2 pagesMobil Trauma Center 20190919 PDFWale OyeludeNo ratings yet

- Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Document24 pagesCpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Hello KittyNo ratings yet

- CC21198 AnnualReturnSummary AR008Document3 pagesCC21198 AnnualReturnSummary AR008Slate WilsonNo ratings yet

- TUI Environmental ReportDocument142 pagesTUI Environmental ReportvejzagicNo ratings yet

- YupDocument180 pagesYupFery AnnNo ratings yet

- Analysis of Financial Statements (D'Leon)Document48 pagesAnalysis of Financial Statements (D'Leon)John SamonteNo ratings yet

- Musharakah Financing ModelDocument18 pagesMusharakah Financing ModelMuhd Basier Abd MutalibNo ratings yet

- Chapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmentDocument15 pagesChapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmenttemedebereNo ratings yet

- CEO Private Equity 6-06Document16 pagesCEO Private Equity 6-06dysertNo ratings yet

- Ifrs Viewpoint 1 Related Party Loans at Below Market Interest RatesDocument12 pagesIfrs Viewpoint 1 Related Party Loans at Below Market Interest Ratesradulescustefan15No ratings yet

- Recycled Building Masterials: The RbmsDocument13 pagesRecycled Building Masterials: The RbmsEman WahidNo ratings yet

- Sintex NBG FinalDocument8 pagesSintex NBG FinallittlemissperfecttNo ratings yet

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherFrom EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNo ratings yet

- Sexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesFrom EverandSexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesRating: 3.5 out of 5 stars3.5/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedFrom EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedRating: 4.5 out of 5 stars4.5/5 (5)

- The Importance of Being Earnest: Classic Tales EditionFrom EverandThe Importance of Being Earnest: Classic Tales EditionRating: 4.5 out of 5 stars4.5/5 (42)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticFrom EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticRating: 3.5 out of 5 stars3.5/5 (10)

- The Asshole Survival Guide: How to Deal with People Who Treat You Like DirtFrom EverandThe Asshole Survival Guide: How to Deal with People Who Treat You Like DirtRating: 4 out of 5 stars4/5 (60)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolFrom EverandThe Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolRating: 4 out of 5 stars4/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Other People's Dirt: A Housecleaner's Curious AdventuresFrom EverandOther People's Dirt: A Housecleaner's Curious AdventuresRating: 3.5 out of 5 stars3.5/5 (104)

- Lessons from Tara: Life Advice from the World's Most Brilliant DogFrom EverandLessons from Tara: Life Advice from the World's Most Brilliant DogRating: 4.5 out of 5 stars4.5/5 (42)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet