Professional Documents

Culture Documents

Chapter 3

Uploaded by

Mỹ Dung PntOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3

Uploaded by

Mỹ Dung PntCopyright:

Available Formats

Derivatives Markets, 3e (McDonald) Chapter 3 Insurance, Collars, and Other Strategies 3.

1 Multiple Choice 1) A strategy consists of buying a market index product at $83 and longing a put on the index !ith a strike of $83 . "f the put premium is $18. and interest rates are .#$ per month% !hat is the profit or loss at expiration &in ' months) if the market index is $81 ( A) $) . gain *) $18.'# gain C) $3'.)+ loss D) $43.76 loss Ans!er, )) A strategy consists of buying a market index product at $83 and longing a put on the index !ith a strike of $83 . "f the put premium is $18. and interest rates are .#$ per month% compute the profit or loss from the long index position by itself expiration &in ' months) if the market index is $81 . ) $4!."# loss *) $)1.)) loss C) $18. gain -) $)..)# gain Ans!er, A 3) A strategy consists of buying a market index product at $83 and longing a put on the index !ith a strike of $83 . "f the put premium is $18. and interest rates are .#$ per month% compute the profit or loss from the long put position by itself &in ' months) if the market index is $81 . A) $3..# gain $) $#.4! gain C) $).8 loss -) $1.3' loss Ans!er, * 4) strateg% consists o& 'u%ing a (ar)et inde* product at $+3, and longing a put on the inde* -ith a stri)e o& $+3,. I& the put pre(iu( is $#+.,, and interest rates are ,.!. per (onth, -hat is the esti(ated price o& a call option -ith an e*ercise price o& $+3,/ ) $4".47 $) $4!."6 C) $47.67 D) $40.!! ns-er1 &83 /18)01. #1'283 r3i chia cho 1. #1'

1 Copyright 4 ) 13 5earson 6ducation% "nc.

#) A strategy consists of longing a put on the market index !ith a strike of 83 and shorting a call option on the market index !ith a strike price of 83 . 7he put premium is $18. and the call premium is $... . "nterest rates are .#$ per month. -etermine the net profit or loss if the index price at expiration is $83 &in ' months). A) $ *) $)3.'8 loss C) $"6.70 gain -) $)8.# gain Ans!er, C 6) strateg% consists o& longing a put on the (ar)et inde* -ith a stri)e o& +3, and shorting a call option on the (ar)et inde* -ith a stri)e price o& +3,. 2he put pre(iu( is $#+.,, and the call pre(iu( is $44.,,. Interest rates are ,.!. per (onth. 3hat is the 'rea)e4en price o& the (ar)et inde* &or this strateg% at e*piration (in 6 (onths)/ ) $+,".#" $) $+3,.,, C) $+!!."# D) $+66.3" ns-er1 C sai 56p 6n +!6.70 8) At the '2month point% !hat is the breake9en index price for a strategy of longing the market index at a price of 83 ( "nterest rates are .#$ per month. A) $8 ).1) *) $83 . C) $+!!."# -) $8''.3) Ans!er, C 8) 7he $8# strike put premium is $)#..# and the $8# strike call is selling for $3 .#1. Calculate the breake9en index price for a strategy employing a short call and long put that expires in ' months. "nterest rates are .#$ per month. A) $8)).'8 *) $8)..8+ C) $83 .8' -) $88#.8) Ans!er, * +) :hat is the maximum profit that an in9estor can obtain from a strategy employing a long 83 call and a short 8# call o9er ' months( "nterest rates are .#$ per month. A) $'.8 *) $8.'8 C) $+.). -) $1).3) Ans!er, *

) Copyright 4 ) 13 5earson 6ducation% "nc.

1 ) :hat is the maximum loss that an in9estor can obtain o9er ' months from a strategy employing a long 83 call and a short 8# call( "nterest rates are .#$ per month. A) $'.8 *) $8.'8 C) $+.). -) $1).3) Ans!er, 11) :hat is the breake9en point that an in9estor can obtain from a '2month strategy employing a long 83 call and a short 8# call( "nterest rates are .#$ per month. A) $83).8) *) $8.).3) C) $8#).)) -) $8').+) Ans!er, * 1)) 7he o!ner of a house !orth $18 % purchases an insurance policy at the beginning of the year for a price of $1% . 7he deductible on the policy is $#% . "f after ' months the homeo!ner experiences a casualty loss 9alued at $.#% % !hat is the homeo!ner;s net gain<loss( Assume an opportunity cost of capital of .. $ annually. A) $ *) $1% C) $#% -) $'% ) Ans!er, 13) =sing option strategy concepts% !hat is the 9alue of an insured home% if the 9alue of the uninsured home is $)) % % the house !as purchased for $18 % and the house has a casualty policy costing $# !ith a $)% deductible( "gnore interest costs. A) $18 % *) $)18%# C) $)) % -) $)))%# Ans!er, * 1.) An in9estor purchases a call option !ith an exercise price of $## for $).' . 7he same in9estor sells a call on the same security !ith an exercise price of $' for $1.. . At expiration% 3 months later% the stock price is $#'.8#. All other things being e>ual and gi9en an annual interest rate of .. $% !hat is the net profit or loss to the in9estor( A) $1.)1 loss *) $1.# loss C) $ .#. gain -) $1.'# gain Ans!er, C

3 Copyright 4 ) 13 5earson 6ducation% "nc.

3.) ?hort Ans!er 6ssay @uestions 1) 6xplain ho! a long stock and long put strategy e>uals the cash flo! from a long call strategy. Ans!er, 7he net effect of the long put and long stock creates a cash flo! identical to the long call% pro9ided you include the cost of funds. )) :hy might the manager of a portfolio employ a protecti9e put strategy( Ans!er, "f the manager desires to protect against a price decline% but is restricted from selling assets% a long put creates a floor belo! !hich losses cannot occur. 3) :hat is the difference bet!een naked and co9ered call !riting( Ans!er, A co9ered position is one in !hich the indi9idual also o!ns the underlying asset in addition to the short call. A naked position in9ol9es !riting the call alone. .) :hat are the similarities and differences bet!een bear and bull spreads( Ans!er, *oth ha9e floors and ceilings. 7he bear position has a ceiling !here prices are falling and a floor !here prices rise. A bull spread has the opposite floor and ceiling. #) :hy is a straddle position considered a speculation on the asset;s 9olatility( Ans!er, 7he strategy loses money if prices stay constant% but benefits from large changes in prices% either up or do!n. 3.3 Class -iscussion @uestion 1) Compare the butterfly spread% bear spread% bull spread% co9ered call% straddle% and other strategies. "s any one strategy better than another( Are there trade2offs bet!een each that is almost perfect or do significant ad9antages exist from one strategy to another(

. Copyright 4 ) 13 5earson 6ducation% "nc.

You might also like

- Ass 6Document1 pageAss 6Mỹ Dung PntNo ratings yet

- NPV PhuocDocument13 pagesNPV PhuocMỹ Dung PntNo ratings yet

- Report 1Document5 pagesReport 1Mỹ Dung PntNo ratings yet

- Case5.2 BUE201 KOTTO QuestionsDocument2 pagesCase5.2 BUE201 KOTTO QuestionsMỹ Dung PntNo ratings yet

- Chapter 1 Running Case AssignmentDocument1 pageChapter 1 Running Case AssignmentMỹ Dung Pnt0% (1)

- Total English Placement Test: Choose The Best Answer. Mark It With An X. If You Do Not Know The Answer, Leave It BlankDocument6 pagesTotal English Placement Test: Choose The Best Answer. Mark It With An X. If You Do Not Know The Answer, Leave It BlankMỹ Dung PntNo ratings yet

- Progress Test 3Document7 pagesProgress Test 3Mỹ Dung PntNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

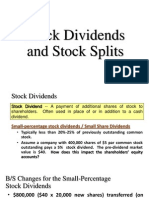

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Chapter 1 Introduction To Services MarketingDocument28 pagesChapter 1 Introduction To Services MarketingRizwan Ali100% (1)

- 7Document49 pages7Anil Kumar SinghNo ratings yet

- ECO202 Practice Test 3 (Ch.3)Document2 pagesECO202 Practice Test 3 (Ch.3)Aly HoudrojNo ratings yet

- WD GannDocument16 pagesWD Gannkhit wong0% (1)

- NJRER Bubble Analysis Rev 4Document2 pagesNJRER Bubble Analysis Rev 4kettle1No ratings yet

- Company Analysis and Stock ValuationDocument37 pagesCompany Analysis and Stock ValuationHãmèéž MughalNo ratings yet

- Market Demand, Market Supply, and Market Equilibrium: What I KnowDocument2 pagesMarket Demand, Market Supply, and Market Equilibrium: What I KnowLaarnie QuiambaoNo ratings yet

- Public Administration EbookDocument24 pagesPublic Administration Ebookapi-371002988% (17)

- Chapter 4 Test BankDocument13 pagesChapter 4 Test Bankwasif ahmedNo ratings yet

- Efficient Resource Allocation for Robinson CrusoeDocument204 pagesEfficient Resource Allocation for Robinson CrusoeDamion BrusselNo ratings yet

- 36 HDocument3 pages36 HabducdmaNo ratings yet

- INTRO TO DERIVATIVESDocument4 pagesINTRO TO DERIVATIVES007nitin007No ratings yet

- Fusion Economics How Pragmatism Is Changing The WorldDocument264 pagesFusion Economics How Pragmatism Is Changing The WorldSigSigNo ratings yet

- 12 Agarwal, Gort - 2001Document17 pages12 Agarwal, Gort - 2001yihoNo ratings yet

- MoneyDocument69 pagesMoneyjogy100% (1)

- QEP 2022 Theme General State TheIAShub Sample FIDocument26 pagesQEP 2022 Theme General State TheIAShub Sample FIakash bhattNo ratings yet

- Bss 1Document11 pagesBss 1Al SukranNo ratings yet

- Economics ComDocument121 pagesEconomics ComIqra MughalNo ratings yet

- QUICK GUIDE TO TNPSC GROUP 2/2A ONLINE TEST SERIES AND STUDY PLANDocument19 pagesQUICK GUIDE TO TNPSC GROUP 2/2A ONLINE TEST SERIES AND STUDY PLANNaveen KumarNo ratings yet

- Vair ValueDocument15 pagesVair ValueyrperdanaNo ratings yet

- CASE STUDY 2 - Failure of Venture CapitalistsDocument8 pagesCASE STUDY 2 - Failure of Venture CapitalistsMahwish Zaheer KhanNo ratings yet

- Customer Profitability Analysis: F.M.KapepisoDocument9 pagesCustomer Profitability Analysis: F.M.Kapepisotobias jNo ratings yet

- Executive Summary - HeinzDocument1 pageExecutive Summary - HeinzSibiya Zaman AdibaNo ratings yet

- 2019 Aerospace Manufacturing Attractiveness RankingsDocument24 pages2019 Aerospace Manufacturing Attractiveness RankingsNinerMike MysNo ratings yet

- Module 13 Breakeven AnalysisDocument13 pagesModule 13 Breakeven AnalysisRhonita Dea AndariniNo ratings yet

- Fin701 Module2Document3 pagesFin701 Module2Krista CataldoNo ratings yet

- Micro BullionDocument10 pagesMicro BullionWilliam MookNo ratings yet

- What Is InventoryDocument7 pagesWhat Is Inventorydeepmangal222No ratings yet

- Rajkot: Bachelor of Business AdministrationDocument75 pagesRajkot: Bachelor of Business AdministrationHarsh GoswamiNo ratings yet