Professional Documents

Culture Documents

Financial Accounting

Uploaded by

Hafiz WaqasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting

Uploaded by

Hafiz WaqasCopyright:

Available Formats

Punjab Group of Colleges

Introduction to Financial Accounting

ACCT-2023

Program Credit Hours Duration Prerequisites Resource Person

BBA & MBA 3 16 Weeks / 32 sessions N/A

Course Introduction This course emphasizes on the presentation of financial information and communicating required information to the stakeholders about the position and the performance of the enterprise. The course highlights how an account manager processes and presents the financial information. It also examines different components of financial statements such as cash, receivables, inventory, capital assets, depreciation, and share holders equity. Course Objective This course will help students to: Understand fundamental accounting concepts Use the accounting equation in basic financial analysis Prepare basic entries for business transactions and present the data in an accurate and meaningful manner Interpret basic financial data Learning Outcomes By the end of the course, students should be able to: Read, analyze and interpret the financial statements and other related information. Make effective business decisions. Suggest course of action to improve financial position of any organization.

Violation of Academic Honesty Policy: If the instructor receives any two projects / assignments that are identical or partially identical (including spreadsheets), both cases will receive a zero. If the student violates the Academic Honesty policy for a second time, he/she will receive an F grade for the course. How to Keep Your Professor Happy: Class attendance is mandatory. You may miss up to 6 class sessions. On the seventh absence, you will be withdrawn from the course. As a courtesy to the instructor and other students, be prepared to arrive at class and be in your seat on time. In addition, please note that each class lasts for 90 minutes. Also keep in mind some general rules as given below: Cell phones should be powered off. Eatables are not allowed in the class. The teacher will not tolerate any disruptive behavior in the class. The Dress Code has to be observed, no warnings will be given, and violators will be asked politely to leave the class and consequently will be marked absent. Participation: Students are required to attend all classes and read all the assigned material in advance of class (although not necessarily with perfect comprehension). Advanced preparation and class participation are crucial for periods in which we discuss cases. During discussion sessions, the instructor generally keeps track of the insightful and useful comments students make. (any unproductive contribution is not rewarded.

Assessment and Evaluation Exam Type Quizzes Assignments Mid Term Final Term Class Participation Total points Percentage (%)

10 15 30 40 5 100

Recommended Text Principle of Accounting by Warren Reeve Fess 9th Edition published by cengage learning Supplement Introduction to Accounting by Horngren & Thomas 8th Edition Published by Pearson Accounting the basis for business decisions by Meigs & Meigs Calendar of Activities

Weeks

Contents

Introduction to accounting and business Nature of business and accounting Accounting principles Business transaction and the accounting equation Financial statements Analyzing transactions Using accounts to record transaction Double entry accounting system Posting Journal entries to accounts The adjusting process Nature of the adjusting process Recording adjusting entries Adjusted trial balance Completing the accounting cycle Flow of accounting information Financial statements Closing entries Accounting cycle Accounting for merchandising business Nature of merchandising businesses Financial statements for merchandising businesses

Activities

Quiz-1

Assignment-1

Merchandising transactions The adjusting and closing process Inventories Control of inventory Inventory cost flow assumptions Perpetual inventory system Periodic inventory system Inventory costing methods Reporting merchandise inventory Sarbanes-Oxley, Internal control and cash Internal control Cash control Bank accounts Bank reconciliation Special purpose cash funds Receivables Classification of receivables Allowance method Notes receivables Reporting receivables on balance sheet MID TERM Fixed assets and intangible assets Nature of fixed assets Accounting for depreciation Disposal of fixed assets Fixed assets and intangible assets Intangible assets Financial reporting for fixed and intangible assets Current liabilities and payroll Current liabilities Payroll and payroll taxes Accounting systems for payroll and its taxes Contingent liabilities Corporations: organization, stock transactions and dividends Stockholders equity Accounting for dividends Treasury stock transactions Reporting stockholders equity Stock splits Statement of cash flows Reporting cash flows Statement of cash flows-Indirect method Statement of cash flows Statement of cash flows-Direct method

Assignment-2

Quiz-2

9th week

10

11

Assignment-3

12

Quiz-3

13

14

Assignment-4

15

Quiz-4

16

Financial statement analysis Basic analytical methods Solvency analysis Profitability analysis Corporate annual reports FINAL TERM

17th week

You might also like

- Principles of AccountingDocument4 pagesPrinciples of AccountingjtopuNo ratings yet

- Assignment Financial Accounting Jan YasminDocument3 pagesAssignment Financial Accounting Jan Yasminbarukautahu0% (1)

- Internet AssignmentDocument13 pagesInternet AssignmentSangeeth100% (1)

- Assignment - Doc - GE-01-Fundamentals of Financial Accounting - 16022016120900Document10 pagesAssignment - Doc - GE-01-Fundamentals of Financial Accounting - 16022016120900Bulbul Ahamed100% (2)

- Assignment On Government AccountingDocument8 pagesAssignment On Government AccountingMohammad SaadmanNo ratings yet

- Accounting 2Document35 pagesAccounting 2Yousaf JamalNo ratings yet

- Accounting Assignment AbelDocument15 pagesAccounting Assignment AbelMo DiagneNo ratings yet

- CO Account Assignment LogicDocument4 pagesCO Account Assignment LogicvenkatNo ratings yet

- Financial Accounting S - B A - I: Assets (RS.) Owners' Equity (RS.)Document1 pageFinancial Accounting S - B A - I: Assets (RS.) Owners' Equity (RS.)Fahad MushtaqNo ratings yet

- ADL 03 - Accounting For Managers AssignmentsDocument12 pagesADL 03 - Accounting For Managers AssignmentsAishwarya Latha Gangadhar50% (4)

- Analyzing Comcast's Financials and Competitive EnvironmentDocument8 pagesAnalyzing Comcast's Financials and Competitive Environmentumar0% (1)

- Lecture Slides - Chapter 1 2Document66 pagesLecture Slides - Chapter 1 2Van Dat100% (1)

- ACCTG 102 Assignment - Mortgage and Bond Journal EntriesDocument3 pagesACCTG 102 Assignment - Mortgage and Bond Journal EntriesCindy YinNo ratings yet

- Financial Accounting I Assignment #2Document3 pagesFinancial Accounting I Assignment #2Sherisse' Danielle WoodleyNo ratings yet

- MAA716 Assignment Part 3 T1 2015Document2 pagesMAA716 Assignment Part 3 T1 2015ashibhallauNo ratings yet

- Accounting Equation - Examples of Transactions Affecting Assets, Liabilities, CapitalDocument3 pagesAccounting Equation - Examples of Transactions Affecting Assets, Liabilities, Capitalmaheshbendigeri5945No ratings yet

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- Chapter 14 Managerial AccountingDocument55 pagesChapter 14 Managerial Accountingcaliqueen910% (4)

- BUSM 1276 - Assessment 1 Brief - Sem1 2018Document10 pagesBUSM 1276 - Assessment 1 Brief - Sem1 2018Utkarsh VibhuteNo ratings yet

- Accounting Assignment References Under 40 CharactersDocument1 pageAccounting Assignment References Under 40 CharactersSambuttNo ratings yet

- E6 2 AccountingDocument4 pagesE6 2 AccountingSam Mburu0% (1)

- Financial AccountingDocument30 pagesFinancial AccountingPhuong HoNo ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- Assignment 1Document5 pagesAssignment 1Sumedh KakdeNo ratings yet

- Financial Accounting 1 Unit 2Document22 pagesFinancial Accounting 1 Unit 2AbdirahmanNo ratings yet

- BUSM 1139 Elizabeth Health: BUSM1139 - SUSINDRA - NICHOLASHUGO - S3417647 1Document10 pagesBUSM 1139 Elizabeth Health: BUSM1139 - SUSINDRA - NICHOLASHUGO - S3417647 1Nicholas HugoNo ratings yet

- Order Fulfillment and Logistics Considerations For Multichannel RetailersDocument14 pagesOrder Fulfillment and Logistics Considerations For Multichannel RetailerspedrocaballeropedroNo ratings yet

- Accounting BBA 1Document2 pagesAccounting BBA 1Muhammad RizwanNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Bba311 Project Template-5.1 Telly - ZavalaDocument11 pagesBba311 Project Template-5.1 Telly - ZavalaJoselito CorazonNo ratings yet

- The Basic Structure of AccountingDocument7 pagesThe Basic Structure of Accountingsabeen ansari0% (1)

- Assignment On Management AccountingDocument17 pagesAssignment On Management AccountingMarysun Tlengr100% (2)

- Test Bank For Auditing An InternationalDocument17 pagesTest Bank For Auditing An Internationalnevilalopariyahoo.comNo ratings yet

- Accounting AssignmentDocument14 pagesAccounting AssignmentKomal ShujaatNo ratings yet

- 1acc0807 Cw1 Cost AccountingDocument3 pages1acc0807 Cw1 Cost AccountingLiliana Martinez100% (1)

- Acc225 - Week1 - Reading Accounting Homework Assignment Help 11Document45 pagesAcc225 - Week1 - Reading Accounting Homework Assignment Help 11Shipra Singh0% (1)

- Accounts Assignment: Definition, Types and Rules of Business TransactionsDocument18 pagesAccounts Assignment: Definition, Types and Rules of Business TransactionsALI HAIDERNo ratings yet

- AIMA AssignmentDocument7 pagesAIMA AssignmentMinhaz AlamNo ratings yet

- Chapter One Introdutoin: 1.1. What Is Cost Accounting?Document156 pagesChapter One Introdutoin: 1.1. What Is Cost Accounting?NatnaelNo ratings yet

- Accounting as a Discipline and its Role in BusinessDocument6 pagesAccounting as a Discipline and its Role in BusinessSyed Sheraz Ahmed ShahNo ratings yet

- Accounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Document428 pagesAccounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Ibrahim MuyeNo ratings yet

- Accounting TheoryDocument38 pagesAccounting Theoryomar waheedNo ratings yet

- 1HRD EssayfinalDocument10 pages1HRD EssayfinalkhaizamanNo ratings yet

- Evolution Structure of ErpDocument16 pagesEvolution Structure of ErpRabindra P.SinghNo ratings yet

- Accounting Theory Perspectives and MethodologiesDocument17 pagesAccounting Theory Perspectives and MethodologiesSiti Hajar PratiwiNo ratings yet

- Intermiediate Accounting Chapter 12Document5 pagesIntermiediate Accounting Chapter 12Amelyn FounderNo ratings yet

- CH01SMDocument43 pagesCH01SMHuyenDaoNo ratings yet

- Chapter 14 - The Receivables LedgerDocument34 pagesChapter 14 - The Receivables Ledgershemida100% (2)

- Ch. 1-Fundamentals of Accounting IDocument20 pagesCh. 1-Fundamentals of Accounting IDèřæ Ô MáNo ratings yet

- Assignment (Fundamentals of Book - Keeping & Accounting)Document25 pagesAssignment (Fundamentals of Book - Keeping & Accounting)api-370836989% (9)

- Accounting adjustments and financial statementsDocument12 pagesAccounting adjustments and financial statementsKwaku DanielNo ratings yet

- Role of Accounting in SocietyDocument9 pagesRole of Accounting in SocietyAbdul GafoorNo ratings yet

- Libby Financial Accounting Chapter14Document7 pagesLibby Financial Accounting Chapter14Jie Bo TiNo ratings yet

- Basic Financial Accounting PPT 1Document26 pagesBasic Financial Accounting PPT 1anon_254280391100% (1)

- MA Accounting I Spring 2011Document3 pagesMA Accounting I Spring 2011Ahmad Malik100% (1)

- Financial Accounting Course OverviewDocument11 pagesFinancial Accounting Course OverviewAsħîŞĥLøÝåNo ratings yet

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Course Outline FADocument3 pagesCourse Outline FAmoon1377No ratings yet

- BSBFIM501A - Manage Budgets and Financial PlansDocument4 pagesBSBFIM501A - Manage Budgets and Financial Plansbluemind200517% (6)

- FAP Activity1Document3 pagesFAP Activity1Hafiz WaqasNo ratings yet

- FAP Activity1Document3 pagesFAP Activity1Hafiz WaqasNo ratings yet

- 1Document17 pages1Hafiz WaqasNo ratings yet

- Psy 512 Moderated Multiple RegressionDocument34 pagesPsy 512 Moderated Multiple RegressionHafiz WaqasNo ratings yet

- Benbouheni 2017Document17 pagesBenbouheni 2017Hafiz WaqasNo ratings yet

- Rahut 2017Document31 pagesRahut 2017Hafiz WaqasNo ratings yet

- TS101Document31 pagesTS101Danilo Santiago Criollo ChávezNo ratings yet

- Chapter12E2010 PDFDocument8 pagesChapter12E2010 PDFMahnooranjumNo ratings yet

- TS101Document31 pagesTS101Danilo Santiago Criollo ChávezNo ratings yet

- 16CTN-8375-MNFT2019 (1) UpdatedDocument8 pages16CTN-8375-MNFT2019 (1) UpdatedHafiz WaqasNo ratings yet

- UsaDocument46 pagesUsaHafiz WaqasNo ratings yet

- Nigeria 2Document12 pagesNigeria 2Hafiz WaqasNo ratings yet

- Rahut 2017Document31 pagesRahut 2017Hafiz WaqasNo ratings yet

- Source Publication List For Web of Science: Science Citation Index ExpandedDocument143 pagesSource Publication List For Web of Science: Science Citation Index ExpandedGarima GuptaNo ratings yet

- Annual Report2016 PDFDocument2 pagesAnnual Report2016 PDFHafiz WaqasNo ratings yet

- Time SeriesDocument819 pagesTime Seriescristian_masterNo ratings yet

- STATA Panel Data Anlysis PDFDocument40 pagesSTATA Panel Data Anlysis PDFHafiz WaqasNo ratings yet

- Time SeriesDocument819 pagesTime Seriescristian_masterNo ratings yet

- UpladDocument1 pageUpladHafiz WaqasNo ratings yet

- Endeavour Twoplise LTDDocument4 pagesEndeavour Twoplise LTDHafiz WaqasNo ratings yet

- 011 Observation Form - New 18.4.12Document2 pages011 Observation Form - New 18.4.12Hafiz WaqasNo ratings yet

- Fleet QDocument2 pagesFleet QHafiz WaqasNo ratings yet

- Course OutLines Accounting IDocument1 pageCourse OutLines Accounting IHafiz WaqasNo ratings yet

- Fleet QDocument2 pagesFleet QHafiz WaqasNo ratings yet

- Financial Statements Unconsolidated 2012Document2,125 pagesFinancial Statements Unconsolidated 2012Hafiz WaqasNo ratings yet

- Key Financial RatioDocument1 pageKey Financial RatioHafiz WaqasNo ratings yet

- Anjlo LTDDocument3 pagesAnjlo LTDHafiz Waqas100% (1)

- Dividend RatiosDocument3 pagesDividend RatiosHafiz WaqasNo ratings yet

- Sample Business PlanDocument66 pagesSample Business PlanHafiz WaqasNo ratings yet

- EF1B1 HDT Bank Classification PCBDocument37 pagesEF1B1 HDT Bank Classification PCBSikha SharmaNo ratings yet

- IFRS 2 - Share Based PaymentsDocument19 pagesIFRS 2 - Share Based PaymentslaaybaNo ratings yet

- Fin542 Myr Againts Eur (Group 6 Ba2423d)Document9 pagesFin542 Myr Againts Eur (Group 6 Ba2423d)NAJWA SYAKIRAH MOHD SHAMSUDDINNo ratings yet

- Risk and Return - PresentationDocument75 pagesRisk and Return - PresentationMosezandroNo ratings yet

- DocxDocument12 pagesDocxDiscord YtNo ratings yet

- Paper 1.4Document137 pagesPaper 1.4vijaykumartaxNo ratings yet

- Apply for Canara Bank Debit CardDocument2 pagesApply for Canara Bank Debit CardJohn Athaide100% (1)

- Bharti Airtel LTD (BHARTI IN) - AdjustedDocument4 pagesBharti Airtel LTD (BHARTI IN) - AdjustedDebarnob SarkarNo ratings yet

- @@ Real Estate Final@@Document51 pages@@ Real Estate Final@@aspollobi0% (2)

- Invitation To BidDocument1 pageInvitation To BidGladys Bernabe de VeraNo ratings yet

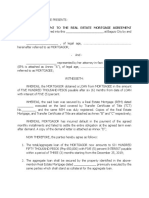

- Amendment To Real Estate MortgageDocument2 pagesAmendment To Real Estate MortgageRaihanah Sarah Tucaben Macarimpas100% (1)

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Og 23 1701 1802 00242559Document7 pagesOg 23 1701 1802 00242559tushar gargNo ratings yet

- AarthiDocument15 pagesAarthiilkdkNo ratings yet

- Global Strategy: Yield Curve, Markets and StrategyDocument12 pagesGlobal Strategy: Yield Curve, Markets and StrategySiphoKhosaNo ratings yet

- Marching Uniform ContractDocument1 pageMarching Uniform ContractHanson MendezNo ratings yet

- Internal Control Manual SummaryDocument14 pagesInternal Control Manual SummaryMarina OleynichenkoNo ratings yet

- ACCA F9 and P4 technical articles explore causes and remedies of management short-termismDocument4 pagesACCA F9 and P4 technical articles explore causes and remedies of management short-termismKyaw Htin WinNo ratings yet

- IGCSE2009 Accounting SAMsDocument44 pagesIGCSE2009 Accounting SAMsKhandaker Amir EntezamNo ratings yet

- Gold LoanDocument22 pagesGold LoanJinal Vasa0% (1)

- Comparative Study of Non Interest Income of The Indian Banking SectorDocument30 pagesComparative Study of Non Interest Income of The Indian Banking SectorGaurav Sharma100% (3)

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryNo ratings yet

- Investing Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderDocument1 pageInvesting Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderCosimo Dell'OrtoNo ratings yet

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)

- SEC warns against Lele Gold Farm investment schemeDocument2 pagesSEC warns against Lele Gold Farm investment schemeEngr MechaNo ratings yet

- Acme Shoe Rubber V Court of AppealsDocument3 pagesAcme Shoe Rubber V Court of AppealsPaolo BrillantesNo ratings yet

- Assign - Trial Balance Answer SheetDocument9 pagesAssign - Trial Balance Answer SheetDing CostaNo ratings yet

- 02a. Shares Capital IDocument5 pages02a. Shares Capital IYuganiya RajalingamNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)