Professional Documents

Culture Documents

Bond Strategies For A Rising Interest Rate Environment PDF

Uploaded by

streettalk700Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Strategies For A Rising Interest Rate Environment PDF

Uploaded by

streettalk700Copyright:

Available Formats

www.stawealth.

com

Bond Strategies in a Rising Interest Rate Environment

October 28, 2013

So whats the problem?

Bond investing for many has never been more difficult but not for the reason many think. Policymakers around the globe began aggressive campaigns of monetary interventions following the financial crisis in 2008. These unprecedented measures to stabilize capital markets and induce economic expansion in developed countries have had far reaching effects. We know that with Federal Reserve intervention interest rates have fallen precipitously while asset prices have surged higher. With interest rates now near historic lows the search for yield by investors has been a difficult task. However, it is in that quest for yield that many investors have unwittingly taken on excessive credit risk (the risk of the bond issuer defaulting) by pouring money into high yield, a marketing term for junk bonds. and emerging market debt. However, the real problem that continues to frustrate most fixed income investors isnt credit risk but rather interest rate risk. Investors have enjoyed a 30-year bull market in bonds while deflation/disinflation has remained the reigning theory. In our opinion the risk profile of traditional bond portfolios has changed. Today, traditional strategies benchmarked against the aggregate fixed income universe are dominated by interest rate risk, which is not the most desirable risk after decades of falling government bond rates. When the Federal Reserve made the announcement of QE3, what Ben Bernanke said was interesting. Not that policy was being linked to a 6.5% unemployment rate, but that the Fed would tolerate an inflation rate up to 2.5%. So we have to ask ourselves, assuming the Fed does get what it wants, how can you explain interest rates across the maturity spectrum up to the 10-year treasury, will stay below the inflation expectation that the Fed wants to achieve? While its difficult to predict when rates will rise, investors need to begin thinking about their fixed income strategies and how their portfolios will provide income while helping to shield them from undesired risks.

Its time for a new strategy.

With the 10-year treasury currently at 2.5%, despite all the current angst, it seems to be a basefor now. Investors should begin asking themselves, how should I invest if yields go higher? Most investors think of investing in fixed income with the idea of what has worked for the last 30 years long bonds. Its time for a new strategy.

www.stawealth.com

Most bond funds in a rising interest rate environment are not the place to be. A long duration bond portfolio is less than ideal as well. For investors who think rates will rise, we can suggest several strategies. While we do not recommend any of these as pure strategies, as a compliment to a fixed income portfolio some of these strategies should be considered. 1) Short Duration Bonds: An investor can focus on short duration bonds, five years or less, and weather the storm until rates move higher. Our firm tries to identify short-term, income generating taxable, and tax-free bond opportunities that provide substantially higher short term yields to CD rates. 2) A Bond Ladder is a very common way for investors to deal with interest rate risk. A laddered bond portfolio is a portfolio made up of fixed-income securities in which each security has a different maturity date. The purpose of purchasing several smaller bonds with different maturity dates rather than one large bond with a single maturity date, is to minimize interest-rate risk and to increase liquidity. In a bond ladder, the bonds' maturity dates are evenly spaced across several months or several years. This is so that the bonds are maturing and the proceeds are being reinvested at regular intervals. The more liquidity an investor needs, the closer together his bond maturities should be. For example, if an investor had one $20,000 bond that matured in five years and earned 2.5% interest per year, the investor would not have access to that $20,000 for five years. Also, if interest rates increased to 3.5%, he would be stuck earning the lower, 2.5% rate until the bond matured. On the other hand, if the investor had five bonds worth $4,000 each that were laddered so that one bond matured each year, he would only have to wait a few months to start earning a higher interest rate on a portion of his investment. That is if interest rates increased. At the same time, if interest rates fell from 2.5% to 1.5%, the investor would not be faced with putting $20,000 into a lowerearning investment all at once. Interest rates might go back up by the time the other bonds reach their maturity dates. We would recommend laddering bonds as an essential risk management strategy within any balanced fixed income portfolio. 3) Kicker Bonds: As an alternative to the simple bond ladder, bond investors may want to consider Kicker bonds to compliment their portfolio. Kicker Bonds are premium bonds with above market coupons and short-term calls. In this scenario if rates move higher, you have locked in a better income producing bond than if you had purchased par bonds. As rates increase, the likelihood of an early call decreases. If rates move lower, you have earned a higher short-term rate than if you had purchased a straight maturity. Before I get into the math, let me explain why the yield is higher and why the issuer (the seller of the bond) would be willing to pay a higher interest rate than the current market rate. First, the issuer is offering the higher yield because they want the opportunity to call the bond at an earlier date than the stated maturity of the bond. The reason they might want to call the bond early is because rates may move lower, which means they could buy back these higher cost bonds and issue new ones at a lower rate, saving the issuer a lot of money in interest payments. To have the right to call the bonds, the issuer will have to offer a higher coupon. Because of the higher coupon, the bonds will be priced at a premium (above par). Premium bonds are harder to sell than bonds at par or bonds at a discount (below par), simply because most investors do not like the idea of paying a premium. Because of this, premium bonds will typically be priced so that there is a little extra yield (a cushion) to entice investors to buy the bonds.

www.stawealth.com

Kickers get their name because there is a kick-up in yield if and when a call date is passed and the bond is not called. Bonds are priced yield to worst, which means that, if there is a call date, the bond will be priced to the first call. This pricing method results in a lower yield for a callable bond than the bonds yield to maturity (its yield percentage if the bond is not called and is held to maturity). Example: (Hypothetical)

*The example below should not be considered a recommendation to purchase/sell Holly Frontier (HFC) or Kinder Morgan. The information is merely an example of how a kicker structure works.

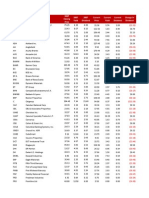

If in April of 2013 an investor purchased the debt of Holly Frontier (HFC) at $109 with a 6 7/8% coupon, the bonds are callable any time after 11/14 (November 2014) and mature in 11/18. In 11/14 these bonds are callable at $103.43. The yield to the 2014 call is 3.17%. For some perspective, a like credit bullet (a straight maturity with no call) to 11/14 being sold at the same time had a yield of 1.3%. That is a difference of over 185 basis points. Also, the 2 year treasury at that time was .23%. An 18 month CD is currently yielding 0.6%. If rates move higher, and the bond is not called in 11/14, but is called later the yield run would be:

November, 2015 3.85% November, 2016 - 4.15% November, 2017 - 4.70% November, 2018 5.00%

Kicker bonds are a nice feature in either scenario. Kinder Morgan (KMI) bonds with a straight maturity to November 2018 were trading on the same month at a 3.50% YTM (yield to maturity) . Compared to the Holly Frontier bonds with a 5% YTM. Kicker bonds are reviewed by our firm to determine if they are appropriate for our clients portfolios. Currently, it seems to make sense that these bonds could add a potential hedge against interest rate risk. 4) "Unconstrained Bond Funds are essentially a catch-all label for a category of funds that defies easy categorization. Unconstrained bond funds are not tied to any fixed income sector. The idea is that through broad flexibility, skilled managers can add value through active sector allocation across the fixed income spectrum. Also, unconstrained strategies are considered benchmark-agnostic. Unconstrained funds have the ability to limit interest rate risk while adding alpha through diversification and access to a broad opportunity set. They can also eliminate interest rate risk by maintaining shorter durations than core bond funds. This is an advantage if rates start to rise. Our firm has owned unconstrained bond funds to compliment some of our clients fixed income portfolios, and we have experienced some good results. Just remember not all of these funds are the same and should be reviewed carefully before purchase and reviewed consistently. 5) A Step-Up Bond pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. A step-up bond is one in which subsequent future coupon payments are received at a higher, predetermined amount than previous or current periods. These bonds are known as step-ups because quite literally the coupon "steps up" from one period to another.

www.stawealth.com

Consider the following example. *The example below should not be considered a recommendation to purchase General Electric/GE Bonds.

example of how a Step- Bond structure works.

The information is merely an

General Electric (GE) (A1/AA+ credit) offers a step up at a price of $100.74 and a semi annual call structure starting in 2014 and maturing in 2032. While these bonds do technically mature in 2032, Bloomberg has the duration on these bonds at 3years. Below is the step up structure.

Coupon Step Structure 4.25% to 02/03/2017 5.25% to 02/03/2022 6.25% to 02/03/2027 8.25% to Maturity Call Schedule: CALLABLE ONLY SEMIANNUALLY 02/03/2014 yield to first call 1.70% 08/03/2014 YTC = 3.28% 02/03/2015 YTC = 3.64% 08/03/2015 YTC = 3.81% 02/03/2016 YTC = 3.90% 08/03/2016 YTC = 3.96% 02/03/2017 YTC = 4.00% >>Last date before bond coupon steps up to 5.25% Etc to maturity

In contrast, a like credit straight maturity to February 2014 would yield only .36% versus a 1.70% yield to call in a similar stepup. This would lead to an outperformance of over 130 basis points between the two bonds. Another important call date is in February, 2017 because, as stated above, it is the last time the bond can be called before coupon payments to the bondholder step up to 5.25%. GE bonds with a straight maturity to 2017 currently yield 1.5%. The YTC (yield to call) to February 2017 in these GE step up bonds is 4%! 6) Floating Rate Bonds are debt instruments with a variable interest rate; also known as a floater. A floating rate notes interest rate is typically defined as a certain number of basis points (or spread) over or under a benchmark such as the U.S. Treasury bill rate, LIBOR, and the fed funds rate or prime rate. Floaters are typically offered by companies that are rated below investment grade, and they typically have a two-to five-year term to maturity. Over the 1992 -2011 period, floating rate bonds have the highest correlation with high yield bonds, which is consistent with floating rate bonds typically having higher credit risk. Compared to fixed-rate debt instruments, floaters protect investors against a rise in interest rates because interest rates have an inverse relationship with bond prices. In other words, a fixed-rate bonds market price will drop if interest rates increase and vice versa. A floaters interest rate can change as often, or as frequently, as the issuer chooses, which could be from once a day to once a year. The reset period tells the investor how often the rate can adjust. The issuer may pay interest monthly, quarterly, semiannually, or annually as they so choose. The secondary market for a floater is based on several factors that include:

The volatility of the base index,

www.stawealth.com

The time remaining to maturity, The outstanding amount of such securities, The prevailing market interest rate, and, The credit quality, or perceived financial status, of the issuer .

Each of these factors is dynamic and can result in higher or lower secondary values. Some things to be aware of are that the market for floating rate bonds is small compared to the broad bond market and not as liquid. Investors in floating rate bonds lack certainty as to the future income stream of their investment. While an owner of a fixed-rate bond can suffer if prevailing interest rates rise; floating rate notes pay higher yields. The flip side, of course, is that investors in floating rate securities will receive lower income if rates fall. This is because their yield will adjust downward. If interest rates are expected to increase, floating rate bonds may be considered as a small part of a fixed income portfolio.

In conclusion

Regarding credit risk, some investors step out of their comfort zone in search of higher coupons, when rates drop and current income is dwindling. Be sure that you understand the additional risks you are contemplating and that your bond advisor has done his homework. There are plenty of good lower and non-rated bonds out there, but they are not for everyone. In recent years, we have been able to cull out bonds with strong creditworthiness after the bonds lost their previously high ratings based on bond insurance backing. Remember that quality must always be a primary part of an investors fixed income portfolio strategy. Perhaps its time to review the credit risk in your portfolio and diversify. The argument can be made that within the current economic, political, and interest rate environment, fixed income investors need to rethink their strategy. What worked well for the last 30 years may not work as well going forward. A prudent investor may want to consider employing a few or all of these strategies as a part of their overall fixed income portfolio.

Luke Patterson Principal/CIO STA Wealth Management

Disclaimer: The opinions expressed herein are those of the writer. The information herein has been obtained from sources believed to be reliable, but we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Streettalk Advisors, LLC) dba STA Wealth Management (STA), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from STA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. STA is neither a law firm nor a certified public accounting firm and no portion of this article should be construed as legal or accounting advice. A copy of the STA current written disclosure statement discussing our advisory services and fees is available for review upon request.

ALL INFORMATION PROVIDED HEREIN IS FOR EDCUATIONAL PURPOSES ONLY USE ONLY AT YOUR OWN RISK AND PERIL.

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Unified Framework For Fixing Our Broken Tax CodeDocument9 pagesUnified Framework For Fixing Our Broken Tax Codestreettalk700No ratings yet

- Not All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20Document10 pagesNot All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20streettalk700No ratings yet

- AroundTheWorldIn8Pages Q1 2019 LVDocument41 pagesAroundTheWorldIn8Pages Q1 2019 LVstreettalk700No ratings yet

- Russell 3000 "Death Cross" Signals More Pain - 03/30/20Document11 pagesRussell 3000 "Death Cross" Signals More Pain - 03/30/20streettalk700No ratings yet

- S&P 500 Monthly Valuation Analysis & ReviewDocument14 pagesS&P 500 Monthly Valuation Analysis & Reviewstreettalk700100% (1)

- The US Jobs Market - Much Worse Than The Official Data SuggestDocument14 pagesThe US Jobs Market - Much Worse Than The Official Data Suggeststreettalk700100% (1)

- SP500 ValuationDocument14 pagesSP500 Valuationstreettalk700No ratings yet

- GTA Introduction RIA ProDocument7 pagesGTA Introduction RIA Prostreettalk700100% (2)

- The Great ContaigionDocument9 pagesThe Great Contaigionstreettalk700No ratings yet

- Investor Intelligence Techical Analysis GuideDocument25 pagesInvestor Intelligence Techical Analysis Guidestreettalk700No ratings yet

- Lebowitz - Valuations Matter & The Virtuous CycleDocument26 pagesLebowitz - Valuations Matter & The Virtuous Cyclestreettalk700100% (2)

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDocument53 pagesGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700No ratings yet

- Lance Roberts - Economic & Investment Summit 2017 Opening PresentationDocument30 pagesLance Roberts - Economic & Investment Summit 2017 Opening Presentationstreettalk700100% (5)

- Employment Trends in The U.S.Document16 pagesEmployment Trends in The U.S.streettalk700No ratings yet

- Unconventional Policies and Their Effects On Financial Markets PDFDocument36 pagesUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNo ratings yet

- Summer Market Outlook & ForecastDocument51 pagesSummer Market Outlook & Forecaststreettalk700No ratings yet

- RIA Economic & Investment Summit 2016Document55 pagesRIA Economic & Investment Summit 2016streettalk700No ratings yet

- Valuations Suggest Extremely Overvalued MarketDocument9 pagesValuations Suggest Extremely Overvalued Marketstreettalk700No ratings yet

- EmpDocument6 pagesEmpdpbasicNo ratings yet

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700No ratings yet

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700No ratings yet

- Psychology of Risk-Behavioral Finance PerspectiveDocument28 pagesPsychology of Risk-Behavioral Finance Perspectivestreettalk700No ratings yet

- Value Investor Forum Presentation 2015 (Print Version)Document29 pagesValue Investor Forum Presentation 2015 (Print Version)streettalk700No ratings yet

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700No ratings yet

- Cycles and Possible OutcomesDocument6 pagesCycles and Possible Outcomesstreettalk700No ratings yet

- Understanding The Bear CaseDocument17 pagesUnderstanding The Bear Casestreettalk700No ratings yet

- Companies That Cut Dividends in 2008Document3 pagesCompanies That Cut Dividends in 2008streettalk700No ratings yet

- Modern Portfolio Theory 2Document21 pagesModern Portfolio Theory 2streettalk700No ratings yet

- FOMC Overly Optimistic on Wealth Effect and Economic GrowthDocument5 pagesFOMC Overly Optimistic on Wealth Effect and Economic GrowthTREND_7425No ratings yet

- Risk Revisited by Howard MarksDocument17 pagesRisk Revisited by Howard Marksstreettalk700No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Multinational Cost of Capital and Capital StructureDocument11 pagesMultinational Cost of Capital and Capital StructureMon LuffyNo ratings yet

- 01 Fairness Cream ResearchDocument13 pages01 Fairness Cream ResearchgirijNo ratings yet

- Introduction To PaintsDocument43 pagesIntroduction To Paintstwinklechoksi100% (1)

- 3 The Importance of Operations ManagementDocument35 pages3 The Importance of Operations ManagementAYAME MALINAO BSA19No ratings yet

- Welcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesDocument23 pagesWelcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesVinoth KumarNo ratings yet

- PWC Adjusted Trial BalanceDocument2 pagesPWC Adjusted Trial BalanceHải NhưNo ratings yet

- Intel Case StudyDocument22 pagesIntel Case Studyshweta_sgupta50% (2)

- 2 Market ProblemDocument30 pages2 Market ProblemAnalizaViloriaNo ratings yet

- Transforming HR with Technology ExpertiseDocument2 pagesTransforming HR with Technology ExpertiseAdventurous FreakNo ratings yet

- Senegal Datasheet PDFDocument4 pagesSenegal Datasheet PDFSkander HamadiNo ratings yet

- Why Is Planning An Audit Important?Document5 pagesWhy Is Planning An Audit Important?panda 1No ratings yet

- Innovations & SolutionsDocument13 pagesInnovations & SolutionsSatish Singh ॐ50% (2)

- Goodwill Questions and Their SolutionsDocument13 pagesGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADER100% (7)

- Registered Nurse Annual Performance ReviewDocument7 pagesRegistered Nurse Annual Performance Reviewhkthriller1No ratings yet

- CAPSIM Tips on Sector Growth, Leverage, InventoryDocument4 pagesCAPSIM Tips on Sector Growth, Leverage, InventoryTomi Chan100% (3)

- Attachment 1Document7 pagesAttachment 1Taqi TazwarNo ratings yet

- Xacc280 Chapter 2Document46 pagesXacc280 Chapter 2jdcirbo100% (1)

- Assignment 1.1Document2 pagesAssignment 1.1Heina LyllanNo ratings yet

- Surendra Trading Company: Buyer NameDocument1 pageSurendra Trading Company: Buyer Nameashish.asati1No ratings yet

- Chapter-16: Developing Pricing Strategies and ProgramsDocument16 pagesChapter-16: Developing Pricing Strategies and ProgramsTaufiqul Hasan NihalNo ratings yet

- High Performance OrganizationsDocument25 pagesHigh Performance OrganizationsRamakrishnanNo ratings yet

- Assumptions About SEODocument2 pagesAssumptions About SEOBilal AhmedNo ratings yet

- Promotion DecisionsDocument21 pagesPromotion DecisionsLagishetty AbhiramNo ratings yet

- 606 Assignment Naresh Quiz 3Document3 pages606 Assignment Naresh Quiz 3Naresh RaviNo ratings yet

- Student Notice: Project ReportDocument22 pagesStudent Notice: Project ReportneetuNo ratings yet

- Hindustan Coca-Cola Beverage PVT Ltd. VaranasiDocument16 pagesHindustan Coca-Cola Beverage PVT Ltd. VaranasijunaidrpNo ratings yet

- Managers Checklist New Empl IntegrationDocument3 pagesManagers Checklist New Empl IntegrationRajeshNo ratings yet

- IGCSE ICT Chapter 5 Question BankDocument9 pagesIGCSE ICT Chapter 5 Question BankMndzebele Siphelele100% (1)

- Chapter 1 problem 3 exercisesDocument18 pagesChapter 1 problem 3 exercisesAlarich CatayocNo ratings yet

- Cavendish Bananas in Ecuador - QatarDocument5 pagesCavendish Bananas in Ecuador - QatarmohanpragneshNo ratings yet