Professional Documents

Culture Documents

College of The Immaculate Concepcion Cabanatuan City: Jloesguerra

Uploaded by

Eiuol Nhoj ArraeugseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

College of The Immaculate Concepcion Cabanatuan City: Jloesguerra

Uploaded by

Eiuol Nhoj ArraeugseCopyright:

Available Formats

College of the Immaculate Concepcion Cabanatuan City

MOCK BOARD - P1 jloesguerra

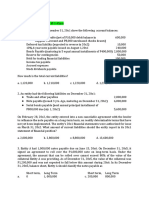

1. The current sections of the unadjusted statement of financial position of Camarines Company on December 31, 2011 were as follows:

Cash ccounts recei!able "erchandise in!entory $repaid e%penses total current assets

2, 000, 000 3, 000, 000 1,#00, 000 100, 000 &, 000, 000

trade accounts payable, net of a debit balance of $'0, 000 interest payable income ta% payable money claims of the union, pendin) final decision mort)a)e payable, due in four annual installments total current liability ', (00, 000

2,('0, 000 1'0, 000 300, 000 '00, 000 2, 000, 000

a re!iew of the accounts showed that the cash balance of $2, 000, 000 included a customer*s chec+ amountin) to $100, 000 returned by the ban+ mar+ed ,-., an employee*s /01 of $'0, 000, and the amount of $200, 000 deposited with the court for a ease under liti)ation.

The cash in ban+ portion of $1, 2'0, 000 is the balance per ban+ statement. 0n December 31, 2011, outstandin) chec+s amounted to $2'0,000

The accounts recei!able included the followin):

Customers* debit balances d!ances to subsidiary d!ances to suppliers 3ecei!able from officers llowance for doubtful accounts -ellin) price of merchandise in!oiced at 1206 0f cost, not yet deli!erd and e%cluded from endin) in!entory

1, 200, 000 (00, 000 200, 000 300, 000 4100, 0005

200, 000 3, 000, 000

a5 what amount should be reported as total current assets on December 312, 20117 a. 2, 0'0, 000 b. 2, 3'0, 000 c. ', ''0, 000 d. 2, 100, 000

b5 what amount should be reported as total current liability on December 312, 20117 a. 3, ('0, 000 b. 3, (00, 000 c. 3, #'0, 000 d. 3, &00, 000

2. Caroline company pro!ided the followin) e!ents that occurred after December 31, 2011:

181'812 $3, 000 ,000 of accounts recei!able was written off due to the ban+ruptcy of a major customer. 281(812 completely lost 3811812 a shippin) !essel of caroline with carryin) amount of $'000, 000 was at sea because of a hurricane.

a court case in!ol!in) caroline as the defendant was settled and the entity was obli)ated to pay the plaintiff $1, '00, 000. Caroline pre!iously has not reco)ni9ed a liability for the suit because mana)ement deemed it possible that the entity would lose the case. 381'812 one of caroline*s factories with a carryin) amount of $(, 000, 000 was completely ra9ed by forest fires that erupted in its !icinity.

The mana)ement completed the draft of the financial statements for 2011 on .ebruary 10, 2012. 0n march 20, 2012, the :0D authori9ed the financial statements for issue. Caroline announced its profit and other selected information on march 22, 2012. The financial statements were appro!ed by shareholders on april 2, 2012 and filed with the -;C the !ery ne%t day. <hat total amount should be reported as =adjustin) e!ents> on December 31, 20117 a. #, '00, 000 b. ?, '00 000 c. #, 000, 000 d. (, '00 ,000

3. "ara company pro!ided the followin) net of ta% fi)ures for the current year: $ension liability adjustments reco)ni9ed in other Comprehensi!e income 1nreali9ed )ain on a!ailable for sale securities 3eclassification adjustment for )ain on sale 0f securities included in net income -hare warrants outstandin) ,et income 2', 000 (0, 000 &&0, 000 30, 000 1'0, 000

<hat is the comprehensi!e income for the current year7 a. ?2', 000 b. ?#0, 000 c. ?#', 000 d. #0', 000

(. $urple company has correctly classified its pac+a)in) operatin) as a disposal )roup held for sale and as discontinued operation. .or the year ended December 31, 2011, this disposal )roup incurred tradin) loss after ta% of $2, 000 ,000 and the loss remeasurin) it to fair !alue less cost to sell was $1,'00,000.

<hat total amount of the disposal )roup*s losses should be included in profit of loss for the year ended December 31, 20117 a. 3,'00,000 b. 2,000,000 c. 1,'00,000 d. 0 '. 0n @anuary 1, 200', $ara)on company paid $2, 000 000 to acAuire a new bar)e. /n the belief that if was entitled to a refund of purchase ta%es on the acAuisition of the bar)e, the entity claimed and was refunded $200, 000 by the local )o!ernment. Bowe!er, in late 2011 the entity repaid the refund when it became apparent that it had made an error in ma+in) the claim to the local )o!ernment as it had not been entitled to refund of purchase ta%es on acAuisition of the bar)e. The useful life of the bar)e is 1' years from the date of acAuisition. The residual !lue of the bar)e is ,/C.

/n 2011, the period o!er which the bar)e is e%pected to be economically usable increased from from 1' to 22 years. Bowe!er, the entity e%pects to dispose of its bar)e after usin) it for 20 years from the date of acAuisition. 0n December 31, 2011, the entity assessed the residual !alue of the bar)e at ?00, 000. <hat is the carryin) amount of the bar)e on December 31, 20117 a. 3,200 ,000 b. 3, (00, 000 c. 3, (20, 000 d. 3,, (20, 000 2. ,atasha company pro!ided the followin) information for the year ended December 31, 2012:

3e!enue 0ther income ,ot decrease in in!entories of finished )oods and wor+ in pro)ress raw materials and consumables used employee benefit e%pense

2,000,000 100,000

200,000 3,100,000 ?00,000

deprecation and amorti9ed e%penses other e%penses finance costs income ta%

(00,000 ?0,000 120,000 300,000

,atasha company declared and paid di!idends of $1'0,000 in 2012 and $300,000 in 2011. /n the financial statements for the year ended December 31,2011, the entity reported retained earnin)s of $1,100,000 on @anuary 1, 2011. The profit for 2011 was 200,000. /n 2012, after the 2011 financial statements were appro!ed for issue, the entity disco!ered an error in its December 31,2010 financial statements. The effect of the error was a 2'0,000 o!erstatement of profit for the year ended December 31,2010 due to undepreciation. <hat amount should reported as retained earnin)s on December 31, 20127 a. 1,300,000 b. 1,(00,000 c. 1,2'0,000 d. 1,#'0,000

&. 3e!lon company has e%panded rapidly and se)ment reportin) is now reAuired. The entity has no interse)ment sales. The followin) data are the year ended December 31, 2011: Operating segment segment revenue operating profit(loss) identifiable assets 1 (00,000 2 3 ( 1(0,000 ' 2 & 0thers 220,000 200,000

100,000 3(0,000 1#0,000

20,000 &0,000 430,0005

?0,000 300,000

1?0,000 &0,000 D 120,000 3?0,000 10,000

42',0005 120,000 420,0005 42',0005

1?0,000

1(0,000 1(0,000

The Eothers> cate)ory includes fi!e operatin) se)ments, none of which has re!enue or assets )reater than ?0,000 and none with an operatin) profit. 0peratin) se)ments 1 to 2 produce !ery similar products and use !ery similar production processes, but ser!e different customer types and use Auite different product distribution system. These differences are due in part to that fact that se)ment 2 operates in a re)ulated en!ironment while se)ment 1 does not. 0peratin) se)ments 2 to & produce !ery similar products, production processes, product distribution systems, but are or)ani9ed as separate di!isions since they ser!e substantially different types of customers. ,either se)ment 2 and & operate in a re)ulated en!ironment.

<hat are the reportable se)ments for the year ended December 31, 20117 a. -e)ments 1,3,( and ' b. -e)ments1,3,(,' and & c. -e)ments1,2,3,( and ' d. -e)ments1,2,3,(,' and se)ments 2 and & combined as a se)ment

?. The accountant of Cira Company prepared the followin) ban+ reconciliation dated june 30 of the current year:

:alance per ban+ Deposit in transit

#,?00,000 (00,000

0utstandin) chec+s 41,(00,0005 :alance per boo+ ?,?00,000

There were total deposits of 2,'00,000 and char)es for disbursements of #,000,000 for july per ban+ statement.

ll reconciliation items on june 30 cleared the ban+ on july 31. Chec+s outstandin) amounted to 1,000,000 on july 31.

<hat is the amount of cash disbursements per boo+ in july7 a. ?,200,000 b. &,200,000 c. #,(00,000 d. ?,(00,000

#. Fermany company started its business on @anuary 1,2011, after considerin) the collection e%perience of the other entities in the industry, )ermany establish an allowance for doubtful accounts estimated at '6 of credit sales. 0utstandin) accounts recei!able recorded on December 31,2011 totaled (20,000, while the allowance for doubtful accounts had a credit balance of '0,000 after recordin) estimated doubtful accounts e%pense for December and after writin) off 10,000 of uncollectible accounts. .uther analysis of the entity*s accounts showed that merchandise purchased mounted to 1,?00,000 and endin) merchandise in!entory was 300,000. Foods were sold at (06 abo!e cost. Total sales comprised ?06 sales on account and 206 cash sales. Total collections from customers, e%cludin) cash sales, amounted to 1,200,000.

<hat is the effect of the transaction on the accounts recei!able and allowance of doubtful accounts7 accounts recei!able allowance of doubtful accounts a. 10,000 understated b. 20,000 understated c. 330,000 understated d. 330,000 understated 2(,000 understated 3(,000 understated (0,000 understated '0,(00 understated

10. :roo+e company discounted its own ',000,000 one year note at a ban+, at a discount rate of 126, when the prime rate was 106. /n reportin) the note in broo+e*s statement of financial position prior to maturity, what rate should broo+e use for the recordin) of interest e%pense7 a. 10.06 b. 10.&6 c. 12.06

d. 13.26

11. Delicate company is a wholesale distributor of automoti!e replacement parts. /nitial amounts ta+en from accountin) records on December 31,2011 are as follows: /n!entory on December 31 based on physical count ccounts payable -ales 1,2'0,000 1,000,000 #,000,000

$arts held on consi)nment from another entity to delicate, the consi)nee, amountin) to $12',000, were included in the physical count on December 31, 2011, and in accounts payable on December 31, 2011. $20, 000 of parts were purchased and paid for in December 2011, were sold in the last wee+ of 2011 and appropriately recorded as sales of $2?, 000. The parts were included in the physical count on December 31, 2011 because the parts were on the loadin) doc+ waitin) to be pic+ed up by the costumer. $arts in transit on December 31, 2011 to customers shipped .0: shippin) point on December 2?, 2011, amounted to $3(, 000. The customers recei!ed the parts on @anuary 2, 2012. -ales of $(0, 000 to the customers for the parts were recorded by delicate on @anuary 2, 2012. 3etailers were holdin) $210, 000 at cost and $2'0, 000 at retail, of )oods on consi)nment from delicate, at their stores on December 31, 2011. Foods were in transit from a !endor to delicate on December 31, 2011. The cost of )oods was $2', 000. The )oods were shipped .0: shippin) point on December 2#, 2011.

a5 <hat is the correct amount of in!entory7 a. 1,300,000 b. 1,320,000 c. 1,33(,000 d. 1,0#0,000

b5 <hat is the correct amount of accounts payable7 a. ?3',000

b. #20,000 c. #&',000 d. ?20,000

c5 <hat is the correct amount of sales7 a. #,2'0,000 b. #,2#0,000 c. #,0(0,000 d. #,000,000 12. Dairy company pro!ided the followin) balances for the year ended December 31,2011:

Cash Trade and other recei!ables /n!entories Dairy li!estoc+Gimmature Dairy li!estoc+Gmature $$;, net Trade and other payables ,ote payableG lon) term -hare capital 3etained earnin)sGjanuary 1 .air !alue of mil+ produce Fain from chan)e in fair !alue /n!entories used -taff costs Depreciation e%pense 0ther operatin) e%pense

'00,000 1,'00,000 100,000 '0,000 (00,000 1,(00,000 '20,000 1,'00,000 1,000,000 ?00,000 200,000 '0,000 1(0,000 120,000 1',000 1#0,000

/ncome ta% e%pense

'',000

a5 <hat is the net income for 20117 a. 2'0,000 b. 200,000 c. 130,000 d. 1?',000 b5 <hat is the fair !alue of biolo)ical assets on December 31,20117 a. ''0,000 b. ('0,000 c. '00,000 d. (00,000

13. ltis company sells one product which it purchases from !arious suppliers. The trial balance on December 31, 2011 included the followin) accounts: -ales 4100,000 units at $1'05 -ales discount $urchases $urchase discount 1',000,000 1,000,000 #,300,000 (00,000

The in!entory purchases durin) 2011 were as follows: nits :e)innin) in!entory, @anuary 1 $urchases, Auarter ended march 3130,000 $urchases, Auarter ended june 30 $urchases, Auarter ended sept. 31 $urchases, Auarter ended dec. 31 (0,000 '0,000 10,000 20,000 2' &0 &' ?0 unit !ost 20 total !ost 1,200,000 1,#'0,000 2,?00,000 3,&'0,000 ?00,000

ltis* accountin) policy is to report in!entory in its financial statements at the lower of cost or net reali9able !alue. Cost is determined under the first in, first out method.

tlis has determined that, on December 31, 2011, the replacement cost of its in!entory was $&0 per unit and the net reali9able !alue was $&2 $er unit. The normal profit mar)in is 10per units.

<hat amount should altis report as cost of )oods sold for 20117 a. 2,'00,000 b. 2,300,000 c. 2,&00,000 d. 2,#00,000

1(. 0n april 30, 2011, a fire dama)ed the office of ama9e company. The followin) balances were )athered from the )eneral led)er on march 31, 2011:

ccounts recei!able /n!entoryG @anuary 1 ccounts payable -ales $urchases

#20,000 1,??0,000 #'0,000 3,200,000 1,2?0,000

n e%amination of april ban+ statement and canceled chec+s re!ealed chec+s written durin) the period april 1G30 as follows:

ccounts payable as of march 31 pril merchandise shipments ;%penses

2(0,000 ?0,000 120,000

Deposites durin) the same period amounted to ((0,000 which consisted of collections from customers with the e%ception of 20,000 refund from a !endor for merchandise returned in april. Customers ac+nowled)ed indebtedness of $1,0(0,000, at april 30. Customers owed another 20,000 that will ne!er be reco!ered. 0f the ac+nowled)ed indebtedness, (0,000 may pro!e uncollectible. Correspondence with suppliers re!ealed unrecorded obli)ations at april 30, of $3(0,000 for april merchandise shipment, includin) $100,000 for shipments in transit on that date. The a!era)e )ross profit rate is (06. /n!entory with a cost of 220,000 was sal!a)ed and sold for $1(0,000. The balance of the in!entory was a total loss.

<hat is the fire loss on april 307 a. 1,((0,000 b. 1,300,000 c. 1,200,000 d. 1,3(0,000

1'. Froom company use the C/.0 retail method of in!entory !aluation. The followin) information is a!ailable for the current year: Cost /n!entory H @anuary 1 ,et purchases ,et mar+up ,et mar+down ,et sale retail

1,200,000 1,'00,000 (,200,000 ',#00,000 200,000 100,000 ','00,000

<hat is the estimated cost of endin) in!entory7 a. 1,(00,000 b. 1,''0,000 c. 1,((0,000 d. 1,(20,000 12. Christopher company completed the followin) transactions in relation to its lon) term in!estment in bay company:

0n @anuary 1, 200#, Christopher company purchased 20,000 shares of :ay company, $100 par, at $110 per share. 0n march 1, 200#, :ay Company issued ri)hts to Christopher company, esch permittin) the purchase of I share at par. ,o entry was made. The bid price of the share was 1(0 and there was no Auoted price for the ri)hts.

Christopher company was ad!ised that it would = loss out on the in!estment if it did not pay in the money of the ri)hts>. Thus, on april 1, 200#. Christopher company paid for the new shares char)in) the payment to the in!estment account.

-ince Christopher company felt that it had been assessed by :ay company, the di!idends recei!ed from :ay company in 200# and 2010 4106 on December 31 each year5 are credited to the in!estment account until the debit was fully offset. 0n @anuary 1, 2011, J recei!ed '06 stoc+ di!idend from bay company. 0n same date, the shares recei!ed as stoc+ di!idend were sold at $120 per share and the proceeds were credited to income.

0n December 31, 2011, the share of :ay company were spit 2 for 1. Christopher company found that each new share was worth $' morethan the $110 paid for the ori)inal shares.

ccordin)ly, Christopher company debited the in!estment account with the additional shares recei!ed at $110 per share and credited income.

0n june 31, 2012, J sold one half of the in!estment at $#2 per share and credited the proceeds to the in!estment account.

a5 <hat is the balance of the in!estment on December 31, 2012 as it was +ept by Christopher company7 a. 3,1'0,000 b. 2,2'0,000 c. 2,200,000 d. (,#'0,000 b5 1sin) the =a!era)e method>, what is the correct balance of in!estment on December 31, 20127

a. 2,200,000 b. 1,?00,000 c. #00,000 d. 0

1&. 0n @anuary 1, 2011, interlube company acAuired a 306 interest in an in!estee at a cost of $3,200,000. The eAuity of the in!estee on the date of acAuisition was $2,000,000, consistin) of $(,000,000 share capital and $2,000,000 retained earnin)s.

ll the identifiable assets and liabilities of the in!estee were recorded at fair !alue e%cept for an eAuipment with a fair !alue of $3,000,000 )reater than carryin) amount. The remainin) useful life of eAuipment is ' years.

0n December 31, 2011, interlube company had been purchased from the in!estee. profit of 200,000 had been made on sale.

Durin) the current year, the in!estee reported net income of (,000,000 and paid di!idend of 1,'00,000. The eAuity of the in!estee on December 31, 2011 showed the followin):

-hare capital 3etained earnin)s 3etained earnin)s appropriated 3e!aluation surplus

(,000,000 3,'00,000 1,000,000 2,000,000

The 3e!aluation surplus arose from a 3e!aluation of land made on December 31,2011. The retained earnin)s appropriated arose from transfer of 3etained earnin)s unappropriated to 3etained earnin)s appropriated for contin)encies. a5 <hat is the )oodwill arisin) from the acAuisition of the in!estment in associate7 a. 1,(00,000 b. &00,000

c. '00,000 d. 0 b5 <hat is the in!estment income to be reported by the in!estor for 20117 a. 1,200,000 b. 1,020,000 c. ?(0,000 d. &'0,000 c5 <hat is the carryin) amount of the in!estment in associate on December 31,20117 a. 3,200,000 b. 3,2#0,000 c. (,1#0,000 d. 3,'#0,000 1?. 0n @anuary 1,2011, Cambodia Company purchased bonds with face !alue of ',000,000 at a cost of (,&00,000 to be held as financial asset at amorti9ed cost. The stated interest is 106 payable annually e!ery December 31. The bonds mature in ( years or @anuary 1,201'. <hat amount of interest income should be reported by Cambodia company for the year ended December 31, 2011 under the effecti!e interest method7 a. '00,000 b. (&0,000 c. '1&,000 d. '22,'#0 1#. 3hino company, a real estate entity, has a buildin) with a carryin) amount of 20,000,000 on December 31,2011. The buildin) is used as offices of the entity*s administrati!e staff. 0n December 31,2011, rhino intended to rent out the buildin) to independent third parties. The staff will be mo!ed to the new buildin) that rhino purchased early in 2011. 0n December 31,2011, the ori)inal buildin) had a fair !alue of 3',000,000. 0n December 31,2011, rhino also had land that was held in ordinary course of its business. The land had a carryin) amount of 10,000,000 and fair !alue of 1',000,000 on December 31,2011. 0n such date, rhino decided to hold the land for capital appreciation. 3hino*s policy is to carry all in!estment property at fair !alue. 0n December 31,2011, what amount should rhino reco)ni9e in re!aluation surplus and profit and loss respecti!ely7

a. ',000,000 nad 1',000,000 b. 1',000,000 and 0 c. 1',000,000 and ',000,000 d. ',000,000 and 0 20. The followin) accounts appear on the adjusted trial balance of )rand company on December 31,2011: $etty cash fund $ayroll fund -in+in) fund cash -in+in) fund securities ccrued interest recei!ableG -in+in) fund securities $lant e%pansion fund Cash surrender !alue /n!estment property d!ances to subsidiary /n!estment in joint !enture 200,000 1'0,000 3,000,000 200,000 2,000,000 10,000 100,000 '00,000 1,000,000 '0,000

<hat total amount should be reported as noncurrent in!estment on December 31,20117 a. &,'00,000 b. (,'00,000 c. &,('0,000 d. 2,300,000 21. 0n ,o!ember 1,2011, Cassandra company sold some limited edition art prints to ,orita+e company for K(&,?'0,000 to be paid on @anuary 1,2012. The current e%chan)e rate on ,o!ember 1,2011was K110 L M1, so the total payment of the current e%chan)e rate would be eAual to M(3',000. Cassandra entered into a forward contract with a lar)e ban+ to )uarantee the number of dollars to be recei!ed. ccordin) to the terms of the contract, if K(&,?'0,000 is worth less than M(3',000, the ban+ will pay Cassandra the difference in cash. Ci+ewise, if K(&,?'0,000 is worth more than M(3',000, Cassandra must pay the ban+ the difference in cash. The e%chan)e rate on DecemberK(&,?'0,000 is worth more than M(3',000, Cassandra

must pay the ban+ the difference in cash. The e%chan)e rate on December1,2011 is K120LM1.

<hat amont is 1.- dollars will Cassandra report as deri!ati!e asset or liability on December 31,20117 a. 3#?,&'0 asset b. 3#?,&'0 liability c. 32,2'0 asset d. 32,2'0 liability 22. @ilmar company acAuired a deli!ery truc+, ma+in) payment of $2,2?0,000 analy9ed as follows: $rice of truc+ Char)e for e%tra eAuipment J TG reco!erable /nsurance for one year "otor !ehicle re)istration Total Trade in !alue of old truc+ Cash paid 2,'00,000 '0,000 300,000 120,000 10,000 2,#?0,000 4300,0005 2,2?0,000

The cost of the old truc+ was $1,'00,000 with carryin) amount of 200,000 and fair !alue of '0,000.

<hat is the cost of the new truc+ acAuired in the e%chan)e7 a. 2,300,00 b. 2,2?0,000 c. 2,2'0,000 d. 2,''0,000 23. Tarhata company recei!ed a )o!ernment )rant of 2,000,000 related to a factory buildin) that it brou)ht in @anuary 2011. The entity*s policy is to treat the )rant as

deferred income. Tarhata company acAuired the buildin) from an industrialist identified by the )o!ernment. /f Tarhata company did not purchase the buildin), which was located in the slurns of the city, it would ha!e been repossessed by the )o!ernment a)ency. Tarhata company peurchased the buildin) for 12,000,000. The useful life of the buildin) is 10 years with no residual !alue. 0n @anuary 1,2013, the entire amount of the )o!ernment )rant became repayable by reason of noncompliance with conditions attached to the )rant. <hat is the loss to be reco)ni9ed resultin) from the repayment of the )rant in 20137 a. 1,200,000 b. 2,000,000 c. 1,(00,000 d. (00,000 2(. ;%celsior company was incorporated on @anuary 1,2011 but be)an acti!ities on july 1, 2011. The land and buildin) account on December 31,2011 was as follows: @anuary 31 .ebruary 2? "ay 1 "ay 1 @une1 @une 1 @une 1 @une 30 @uly 1 land and buildin) cost of remo!al of old buildin) partial payment of new construction le)al fees paid second payment of new construction insurance premium special ta% assessment )eneral e%penses final payment of new construction 1,200,000 #0,000 &00,000 '0,000 (00,000 (?0,000 20,000 320,000 #00,000

To acAuired land and buildin), the entity paid $?00,000 cash and issued ?,000 preference shares with par !alue of 100 and fair !alue of 1'0. Ce)al fees co!ered or)ani9ation cost of 1',000, title e%amination of land purchased of 10,000, and le)al wor+ of 2',000 in connection with construction contract. /nsurance premium co!ered the buildin) for a two year term be)innin) "ay 1, 2011. The special ta% assessment was for street impro!ements that are permanent in nature. Feneral e%penses included the president*s salary of 220,000 and the plant superintendent*s salary of 100,000 a5 <hat is the cost of land7 a. 1,&20,000

b. 2,120,000 c. 2,000,000 d. 2,100,000 b5 <hat is the cost of buildin)7 a. 2,12',000 b. 2,02',000 c. 2,000,000 d. 2,30',000

2'. The city )o!ernment condemned cory company*s parcel of real estate. Cory will recei!e &,'00,000 for this property, which has a carryin) amount of ',&'0,000. Cory incurred the followin) costs as a result of the condemnation:

ppraisal fee to support a &,'00,000 !alue ttorney fee for the closin) with the city )o!ernment ttorney fee to re!iew contract to acAuire 3eplacement property Title insurance on replacement property

2',000 3',000

30,000 (0,000

<hat amount should cory use to determine the )ain on the condemnation7 a. ',?10,000 b. ',?20,000 c. ',?(0,000 d. ',??0,000 22. 0n @anuary 1,2011, Femini company contracted with a contractor to construct a buildin) for 20,000,000. Femini is reAuired to ma+e fi!e payments in 2011 with the last payment scheduled on date of completion. The buildin) was completed on December 31,2011. Femini made the followin) payments durin) 2011:

@anuary 1 "arch 31 @une 30 -eptember 30 December 31

2,000,000 (,000,000 2,100,000 (,(00,000 3,'00,000 20,000,000

Femini company had the followin) debt outstandin) on December 31, 2011: 126 ( year note dated 18182011, with interest Compounded Auarterly, both principal and interest Due 1283181(, relatin) specifically to the buildin) project 106 10 year noted dated 183180& with simple /nterest and interest payable annually on December 31 126 ' year note dated 1283180# with simple /nterest and interest payable annually on December 31 &,000,000 2,000,000 ?,'00,000

<hat total amount of interest should be capitali9ed as cost of the buildin) on December 31,20117 a. 1,022,&'0 b. 1,13?,&&0 c. 2,'02,&'0 d. 1,0#2,0220

2&. 0n December 31,2011, he plant 0. -; ,0/C C0"$ ,N /- 10 N; 3- 0CD. TB; C0-T 0. TB; $C ,T /- 12,000,000 </TB CC1"1C T;D D;$3;C/ T/0, 0. 3,000,000. The plant was depreciated usin) strai)ht line with no residual !alue. :ecause of the unwindin) discount of '6 o!er 10 years, the decommissionin) liability in relation to the plant has )rown from 1,000,000 at 1,(00,000. 0n December 31,2011, the discount has not chan)ed. Bowe!er, the entity has estimated that as a result of technolo)ical ad!ances, the net present !alue of the decommissionin) liability has

decreased by 200,000. <hat amount should be reported respecti!ely as depreciation of the plant and finance cost for 2012 with respect to the decommissionin) liability7 a. 2?0,000 and (0,000 b. 300,000 and (0,000 c. 2?0,000 and &0,000 d. 300,000 and &0,000 2?. :C company pro!ided the followin) balances at the end of the current year: <astin) asset, at cost ccumulated depletion Capital liAuidated 3etained arnin)s ?0,000,000 20,000,000 1',000,000 10,000,000 ',000,000 2,000,000

Depletion based on 100,000 units e%tracted t $'0 per unit /n!entory of resource deposit 420,000 units5

<hat is the ma%imum di!idend that can be declared at the end of current year7 a. 1(,000,000 b. 30,000,000 c. 10,000,000 d. 1',000,000

2#. The followin) account balances relatin) to real properties of pearl company appear on the boo+s on @anuary 1, 2011: Cand 1 Cand 2 Cand 3 3,000,000 ',000,000 &,000,000

0n @anuary 1, 2011, pearl company re!alued its land to fair !alue. $earl does not ha!e any other assets carried at re!alued amount on this date. The fair !alues on this date of Cand 1, 2 and 3 are 3,'00,000, 2,000,000, and #,000,000, respecti!ely. :uildin) and other facilities located on all three properties are depreciated under the

strai)ht line method usin) a ten year useful life. 0n December 31, 2011, Cand 2 and the structures on the property were sold for a total amount of 10,000,000

<hat amount of re!aluation surplus that should be transfer to retained earnin)s on December 31, 20117 a. 1,000,000 b. 1,3'0,000 c. 1,2'0,000 d. 3'0,000 30. 0n December 31, 2011, 9ernice company acAuired the followin) three intan)ible assets: trademar+ for 3,000,000. The trademar+ has ( years remainin) in its le)al life. /t is anticipated that the trademar+ will be renewed in the future indefinitely. Foodwill for '00,000 customer list for 2,100,000. :y contract, the entity has e%clusi!e use of the list for fi!e years. Bowe!er, it is e%pected that the list will ha!e an economic life of 3 years.

0n December 31, 2012, before any adjustin) entries for the year were made, the followin) information was assembled: a. :ecause of a decline in the economy, the trademar+ is now e%pected to )enerate cash flows of just 10',000 per year. b. The cash flow e%pected to be )enerated by the cash )eneratin) unit to which the )oodwill is related is 200,000 per year for the ne%t 20 years. The carryin) amounts of the assets and liabilities of the cash )eneratin) unit are: /dentifiable assets Foodwill Ciabilities 3,'00,000 '00,000 1,100,000

/t is reliably determined that the cash flows of the cash )eneratin) unit cannot be computed without consideration of its liabilities. c. The cash flows e%pected to be )enerated by the customer list are ?00,000 in 2013 and '00,000 in 201(.

d. The appropriate discount rate is 26. The present !alue of 1 at 106 is .#( for one period and .?# for two periods. The present !alue of the ordinary annuity of 1 at 106 for 20 periods is 11.('.

a5 <hat is the impairment loss on trademar+7 a. 3,000,000 b. 1,&'0,000 c. 1,2'0,000 d. 0 b5 <hat is the impairment loss on )oodwill7 a. 210,000 b. '00,000 c. 110,000 d. 0 c5 <hat is the impairment loss on customer list7 a. 1&?,000 b. 2(3,000 c. 203,000 d. 0 31. 0n @anuary 1,2010, bay company acAuired a land lease for 21 years with no option to renew. The lease reAuired bay to construct a buildin) in lieu of rent. The buildin), completed on @anuary 1,2011, at a cost of ?,(00,000, will be depreciated usin) the strai)ht line method. t the end of the lease, the buildin)*s estimated fair !alue is (,200,000.

<hat is the carryin) amount of the buildin) in the December 31,2011 statement of financial position7 a. &,#?0,000 b. ?,000,000 c. ?,1#0,000 d. ?,200,000

32. 0n the first day of each month, bell mort)a)e company recei!es from +ent company an escrow deposit of 2'0,000 for real estate ta%es. :ell records the 2'0,000 in the escrow account. Oent*s 2011 real estate ta%es is 2,?00,000, payable in eAual installments on the first day of each calendar Auarter. 0n @anuary 1,2011, the balance in the escrow account was 300,000. 0n -eptember 30,2011, what amount should be reported as escrow liability7 a. 1,1'0,000 b. ('0,000 c. ?'0,000 d. 1'0,000 33. Durin) 2011, lbya company is the defendant in a breach of patent lawsuit. /ts lawyers belie!e there is an ?06 chance that the court will not dismiss the case and the entity will incur outflow of benefits. /f the court rules infa!or of the claimant, the lawyer belie!e that there is a 206 chance that the entity will be reAuired to pay dama)es of 2,000,000 and a (06 chance that the entity will be reAuired to pay dama)es of 1,000,000. 0ther amounts of dama)es are unli+ely. The court is e%pected to rule in late December 2012. There is no indication that the claimant will settle out of court.

&6 ris+ adjustment factor to the cash flows is considered appropriate to reflect the uncertainties in the cash flows estimates. n appropriate discount rate is 106 per year. The present !alue of 1 at 106 for one period is .#1. what is the measurement of the pro!ision on December 31,20117 a. 1,2?0,000 b. 1,32#,200 c. 1,'00,000 d. 1,2(2,332 3(. 0n @anuary 1,2011, "ara company entered into a debt restructurin) a)reement with clara company which was e%periencin) financial difficulties. "ara restructurin) a 1,000,000 not recei!able as follows: 3educed the principal obli)ation to &00,000 .or)a!e 120,000 of actual interest. ;%tended the maturity date from @anuary 1,2011 to December 31,2012 3educed the interest rate from 126 to ?6. /nterest is payable annually on December 31,2011 and 2012.

3ele!ant present !alue factors: -in)le sum, two years at ?6 -in)le sum, two years at 126 0rdinary annuity, two years at ?6 0rdinary annuity, two years at 126 .&#& 1.&?3 1.2#0 .?'&

a5 <hat is the impairment loss on the note recei!able for 20117 a. 3(&,(20 b. (2&,(20 c. ((2,100 d. '22,100 b5 <hat is the interest income for 20117 a. '2,000 b. &?,30' c. ?1,1'' d. ?0,000 3'. 0n @anuary 1,2011, ta)ui) company issued 3 year bonds with face !alue of ',000,000 at ##. The nominal rate is 106 and the interest is payable annually on December 31. dditionally, ta)ui) company paid bonds issue cost of 1'0,000.

The $J of 1 at 116 for 3 periods is .&312, and the $J of an ordinary annuity of 1 at 116 for 3 periods is 2.((3&. the present !alue of the bonds usin) 116 is:

$J principal 4',000,000 % .&3125 $J of annual interest payments 4'00,000 % 2.((3&5 Total present !alue of bonds

3,2'2,000 1,221,?'0

(,?&&,?'0

The $J of 1 at 126 for 3 periods is .&11?, and the $J of an ordinary annuity of 1 at 126 for 3 periods is 2.(01?. the present !alue of the bonds usin) 126 is:

$J principal 4',000,000 % .&11?5 $J of annual interest payments 4'00,000 % 2.(01?5 Total present !alue of bonds

3,''#,000 1,200,#00

(,&'#,#00

<hat is the interest e%pense for 2011 usin) effecti!e interest method7 a. ''0,000 b. '2?,000 c. '&2,000 d. ''#,2?0 32. :ernel company owns and mana)es apartment comple%es. 0n si)nin) a lease, each tenant must pay the first and last months* rent and a '0,000 refundable security deposit. The security deposits are rarely refunded in total, because cleanin) costs of 1',000 per apartment are almost always deducted. bout 306 of the time, the tenants are also char)ed for dama)es to the apartment, which typically cost 10,000 to repair.

/f a one year lease is si)ned on a #0,000 per month apartment, what amount should barnel report as refundable security deposit7 a. 1(0,000 b. '0,000 c. 3',000 d. 32,000 3&. Nemen company leased an eAuipment for 2 years from another entity on @anuary 1, 2011. The entity recorded the asset at (,?00,000 which includes a bar)ain purchase option of 100,000. The eAuipment had an ei)ht year life and a fair !alue of 300,000 at end of its life. 0n @anuary 1, 201&, the entity did not e%ercise the bar)ain purchase option. <hat is the loss on finance lease to be reco)ni9ed by Nemen company in its 201& statement of comprehensi!e income7 a. 1,32',000 b. 1,(2',000 c. 200,000

d. 0 3?. 0n December 31, 2011, :en9 company, a lessor, sold a machinery that it had been leasin) under a direct financin) lease. 0n @anuary 1,2011 after receipt of the lease payment for the year, the followin) account balances were associated with the lease: Fross lease recei!able 1nearned interest income $resent !alue of lease recei!able ',?'0,000 1,000,000 (,?'0,000

The interest rate implicit in the lease is 106. 0n December 31,2011, :en9 company sold the leased machinery to the lessee for 3,2'0,000 cash. <hat is the loss on sale of machinery that should be reco)ni9ed on December 31,20117 a. 2,0?',000 b. 1,200,000 c. 2,200,000 d. 2,01',000 3#. 0n @anuary 1,2011, tripoli company sold a machine to another entity for 3,000,000. The fair !alue on the date of sale was 3,'00,000. The machine had carryin) amount of (,000,000 and remainin) life of 10 years. The entity immediately leased bac+ the machine at an annual rental of 20,000 for four years. /t was determined that the annual rental is sufficiently lower compared to the mar+et rent of a similar asset. <hat is the total amount to be reco)ni9ed by the entity in profit and loss for 20117 a. 1,020,000 b. 310,000 c. 1?',000 d. 20,000

(0. 0n @anuary 1, 2011, easy company )ranted 30,000 share option to employees. The share options will !est at the end of three years pro!ided the employees remain in ser!ice until them.

The option price is 20 and the entity*s share price is also 20 at the date of )rant. The par !alue of the share is '0.

t the date of )rant, the entity concluded that the fair !alue of the share options cannot be estimated reliably.

The share options ha!e a life of 2 years. This means that the options can be e%ercised within three years after !estin).

ll option !ested at the end of three years and no employees left durin) the three year period.

The share prices and the number of share options e%ercised are set out below.

"#are pri!e s#are option e$er!ised at %ear end 2011 2012 2013 201( 201' 2012 D 23 22 &' ?? 100 #0 10,000 1',000 ',000

3eAuired: Determine the compensation e%pense for each year from 2011 to 2012 usin) the intrinsic !alue method.

(1. 0n @anuary 1, 2011, planet company purchased an eAuipment for the cash price of ',000,000. The supplier can choose how the purchase is to be settled.

The choices are '0,000 shares with par !alue of '0 in one year*s time or a cash payment eAual to the mar+et !alue of (0,000 shares on December 31,2011,

t )rant on @anuary 1, 2011, the mar+et price of each share is 110 and on the date of settlement on December 31,2011, the mar+et price of each share is 130.

a5 <hat is the eAuity component arisin) from the purchase of eAuipment with share and cash alternati!e7 a. '00,000 b. (00,000 c. 200,000 d. 0 b5 <hat is the interest e%pense to be reco)ni9ed on December 31,2011 if the supplier has chosen the =cash alternati!e>7 a. 200,000 b. (00,000 c. ?00,000 d. 0

c5 <hat is the share premium on December 31,2011 if the supplier has chosen the = share alternati!e>7 a. ',000,000 b. 2,'00,000 c. (,(00,000 d. (,000,000

(2. d!erse financial and operatin) circumstances warrant that solid company under)o a Auasi reor)ani9ation on December 31,2011. The followin) information may be rele!ant in accountin) for the Auasi or)ani9ation. P in!entory with a fair !alue of 2,000,000 is currently recorded in the accounts at its cost of 2,'00,000. P plant assets with a fair !alue of &,000,000 store currently recorded at ?,'00,000 net of accumulated depreciation. P /ndi!idual shareholders contribute (,000,000 to create additional capital to facilitate the reor)ani9ation. ,o new shares are issued. P the par !alue of the share is reduced from 2' to '. /mmediately before those e!ents, the shareholders eAuity appears as follows: -hare capital, 2' par !alue, 100,000 shares authori9ed and outstandin) 2,'00,000

-hare premium. 3etained earnin)s.

1,&'0,000 43,000,0005 1,2'0,000 fter the Auasi or)ani9ation, what is the balance of the share premium7 a. 2,&'0,000 b. 3,2'0,000 c.3,&'0,000 d. 1,&'0,000

(3. :onan9a company pro!ided the followin) information relatin) to shareholders eAuity on December 31, 2011: $reference share capital, 100 par, ?0,000 shares issued, 126 cumulati!e and fully participatin) ?,000,000 0rdinary share capital, '0 par, 200,000 shares issued 10,000,000 -hare premium ',000,000 3etained earnin)s &,000,000 Di!idends on the preference shares are in areas for two years includin) the current year. 0n December 31,2011, bonan9a company intends to pay cash di!idend of 10 per share to its ordinary shareholders. <hat amount of di!idends to be declared for the preference and ordinary shareholders7 a. (,'20,000 b. 3,#20,000 c. 3,200,000 d. ','20,000 ((. e%cel company had 200,000 ordinary shares outstandin) on @anuary 1,2011. Durin) 2011, e%cel issued ri)hts to acAuire one ordinary share at 10 in the ratio of one new share for e!ery ( shares outstandin). The mar+et !alue of the ordinary share immediately prior to the ri)hts issue is 3'. The ri)hts were e%ercised on 0ctober 1,2011. The net income of e%cel company for the year is ?,''0,000. <hat amount should be reported as basic earnin)s per share7 a. 11.(0 b.12.00 c. 1(.2' d. 13.(1 ('. /nformation relatin) to the capital structure of cami)uin company on December 31,2011 is as follows: 0rdinary share capital 110,000 shares Con!ertible non cumulati!e preference share capital 20,000 shares 106 con!ertible bonds payable 2,000,000 share options to purchase 20,000 shares at 1' were outstandin). "ar+et price of cami)uin share was 22 at December31,2011 and a!era)e 20 durin) the year. ,o !alue was assi)ned to the share options. Cami)uin company paid the annual di!idend of ' on its preference share. The preference shares are con!ertible into (0,000 ordinary shares. The 106 bonds are con!ertible into 30,000 ordinary shares. The net income for the year ended December31,2011 is 2'0,000. The income ta% rate is 306.

<hat amount should be reported as diluted earnin)s per share7 a. '.00 b. (.&? c.(.1# d. (.2& (2. The followin) data were ta+en from the records of +atcelynne company: Cash sales 2,'00,000 -ales on account ?'0,000 Cash purchases 1,&00,000 Credit purchases (00,000 ;%penses paid &'0,000 ccounts recei!able @anuary 1. 2'0,000 ccounts recei!able December 31 300,000 ccounts payable @anuary. 1 1'0,000 ccounts payable December. 31 200,000 /n!entory @anuary 1 '00,000 /n!entory December 31 200,000 ccrued e%penses December 31 20,000 $repaid e%penses December 31 30,000 ;Auipment December 31 1,000,000 /nterest recei!ed (0,000 /nterest recei!able @anuary 1 10,000 /nterest recei!able December 31 20,000 0n @uly 1,2011, an eAuipment was acAuired for 20,000. The terms are '0,000 down and the balance to be paid after on year. The useful life of eAuipment is 10 years with no residual !alue. <hat is the net income under cash basis7 a.''0,000 b. '&0,000 c. '(0,000 d. 2(0,000

(&. The followin) information pertains to baron company, a proprietorship, which maintained its boo+ on the cash basis durin) the year ended December 31,2011: Cash 220,000 ccounts recei!able @anuary 1,2011 120,000 /n!entory @anuary 1,2011 220,000 .urniture and fi%tures 1,1?0,000 Ceasehold impro!ement 200,000 ccumulated depreciation @anuary 1,2011 330,000 ccounts payable @anuary 1,2011 1&0,000 :aron capital @anuary 1,2011 1,(00,000 -ales 2,'20,000 $urchases 3,0&0,000 -alaries. 1,&(0,000 $ayroll ta%es. 110,000 /nsurance #0,000 3ent 3(0,000 1tilities. 120,000

Ci!in) e%penses.

130,000 ?,(20,000

?,(20,000

Durin) the course of an audit, the followin) additional information was obtained: 1. mounts due from customers totaled 320,000 on December 31,2011. 2. n analysis of the accounts recei!able re!ealed that an allowance for doubtful accounts of (0,000 should be pro!ided. 3. 1npaid in!oices for purchases totaled 3'0,000 and 1&0,000 on December 31,2011 and December 31,2010,respecti!ely. (. The in!entory totaled &'0,000 based on a physical count of the )oods on December 31,2011. The in!entory was priced at cost which appro%imates mar+et !alue. '. 0n may 1,2011, baron paid #0,000 to renew its insurance for one year. The premium of the pre!ious policy which e%pired on pril 30,2011 was &',000. 2. 0n @anuary 1,2011, baron entered into a twenty fi!e year operatin) lease for the !acant lot adjacent to baronQs retail store for use as a par+in) lot. s a)reed in the lease, baron pa!ed and fenced the lot at a cost of 200,000. The impro!ement was completed on pril 1,2011, and has an estimated life of fifteen year. ,o pro!ision for depreciation on furniture and fi%ture was 120,000 for 2011. &. ccrued e%penses on December 31,2010 and December 21,2011 were as follows: 2010 2011 utilities 10,000 1',000 $ayroll ta% 11,000 12,000 ?. :aron is bein) sued for (,000,000. The co!era)e under the comprehensi!e insurance policy is limited to 2,'00,000. :aronQs attorney belie!ed that an unfa!orable outcome is probable and that reasonable estimate of the settlement is 3,000,000. The liability is e%pected to be settled in 2012. #. The salaries include (0,000 per month paid to the proprietor. The proprietor also recei!ed 2,'00 per wee+ for li!in) e%penses. a5. <hat amount of sales should be reported under accrual basis7 a.2,'20,000 b. 2,320,000 c. 2,&20,00# d. 2,??0,000 b5. <hat amount of cost of sales should be reported under accrual basis7 a. 3,&0',000 b. 3,2(',000 c. 3,20',000 d. 3,#(0,000 c5.<hat amount of e%pense should be reported under accrual basis7 a. 2,'&',000 b.2,'#0,000 c. 2,'#',000 d. 2,212,000

d5 <hat is the net income to be reported under accrual basis7 a. 1,100,000 b. 1,030,000 c. &00,000 d. #00,000 e5. <hat is the capital on December. 31,20117 a. 1,?2(,000 b. 1,?20,000 c. 2,(3(,000 d. 1,(0(,000 (?. 0n @uly 1,2010, Da!e company purchased for cash a machine with an in!oice price of 3,200,000. The terms of payment were 2810, n830. /rre!ocable purchase ta%es amounted to 1'0,000. 0n @uly 3, the machine was deli!ered and frei)ht char)e of &0,000 was paid. /nstallation cost amounted 2'2,000. Durin) the process of installation, carelessness by a wor+man caused dama)e to an adjacent machine with resultin) repair cost of 32,000. 0n ,o!ember 10,2010,after four months of satisfactory operations, the machine was thorou)hly cleaned and oiled at a cost of (2,000. The useful life of the machine is 10 year ls. The strai)ht line depreciation was use with no residual !alue and depreciation started on the month of acAuisition. 0n December 31,2011, the unaudited financial statements showed the machine at a cost of 3,'2?,000 with accumulated depreciation of '2#,000. ,et income for 2011 was ',000,000. /)norin) income ta%, what is the corrected net income for 20117 a. (,#'2,?00 b. ',000,000 c. (,2?0,000 d. (,2(&,200 (#. 0cean company pro!ided the followin) information: 2010. 2011 retained earnin)s 3,000,000 2,'00,000 Di!idends payable 1,200,000 1,?00,000 ,et income 2,000,000 <hat amount was paid for di!idends durin) tue current year7 a. 2,100,000 b. 1,'00,000 c. 1,#00,000 d. 2,200,000 '0. "ountain company pro!ided the followin) comparati!e statement: 2011 2010 cash and cash eAui!alent ',200,000 &,(00,000 ccounts recei!able 3,000,000 3,'00,000 /n!entory ?,000,000 2,'00,000 $repaid e%pense (00,000 200,000 $$; '',000,000 (2,000,000 ccumulated depreciation 420,000,0005 412,000,0005 ccounts payable 2,000,000 #,'00,000 ccrued e%penses 1,'00,000 '00,000

,ote payable ban+ 4 current5 ,ote payable ban+ 4 non current5 0rdinary share capital 3etained earnin)s

2,000,000 ',000,000 10,000,000 G 30,000,000 30,000,000 2,'00,000 41000,0005

Cash needed to purchase new eAuipment and to impro!e the wor+in) capital position was raised by borrowin) from ban+ with a lon) term note. ;Auipment costin) 2,000,000 and carryin) amount of 1,'00,000 was sold for 1,?00,000. The entity paid cash di!idend of 3,000,000 in the current year. There were no entries in the retained earnin)s account other than to record di!idend and net income for the year. a5. <hat is the net cash pro!ided by operatin) acti!ities7 a. &,(00,000 b. 2,#00,000 c. ?,000,000 d. &,&00,000 b5. <hat is the net cash used in in!estin) acti!ities7 a. 1',000,000 b. 13,200,000 c. 1(,?00,000 d. 13,000,000 c5. <hat is the net cash pro!ided by financin) acti!ities7 a. &,000,000 b. 2,000,000 c. (,000,000 d. 3,000,000

You might also like

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet

- Computational Multiple Choice Questions on Cash and ReceivablesDocument18 pagesComputational Multiple Choice Questions on Cash and ReceivablesAndrin LlemosNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Far Test BankdocDocument36 pagesFar Test BankdocZee SantisasNo ratings yet

- Practice Exam Chapters 1-5 (2) Income StatementDocument5 pagesPractice Exam Chapters 1-5 (2) Income StatementJohn Arvi ArmildezNo ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- Receivables ProblemsDocument13 pagesReceivables ProblemsIris Mnemosyne0% (1)

- Test 2 FarDocument3 pagesTest 2 FarMa Jodelyn RosinNo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- ACCT 3001 Exams 1 and 2 All QuestionsDocument7 pagesACCT 3001 Exams 1 and 2 All QuestionsRegine VegaNo ratings yet

- Sem 3Document9 pagesSem 3shioamn100% (1)

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim AgbayaniNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- CASH AND CASH EQUIVALENTS TOPICSDocument8 pagesCASH AND CASH EQUIVALENTS TOPICSKonjiki Ashisogi JizōNo ratings yet

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Intermediate Accounting QuizDocument15 pagesIntermediate Accounting QuizKennedy Malubay0% (1)

- Midterm Winter 2013 With Final Winter 2013 For Posting FallDocument10 pagesMidterm Winter 2013 With Final Winter 2013 For Posting FallMiruna CiteaNo ratings yet

- IFRS 15 Revenue Recognition ExamplesDocument4 pagesIFRS 15 Revenue Recognition ExamplesFeruz Sha RakinNo ratings yet

- F3 Final Mock 2Document8 pagesF3 Final Mock 2Nicat IsmayıloffNo ratings yet

- Multiple ChoiceDocument14 pagesMultiple Choiceايهاب غزالة100% (2)

- Que 01 12Document13 pagesQue 01 12Cosovliu RamonaNo ratings yet

- Updates in FAR Chapter 4 Accounts ReceivableDocument6 pagesUpdates in FAR Chapter 4 Accounts ReceivableCiara Abdulhamid BasirNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Financial Accounting and Reporting Test Bank Financial Accounting and Reporting Test Bank 8152017 - 1 8152017 - 1Document30 pagesFinancial Accounting and Reporting Test Bank Financial Accounting and Reporting Test Bank 8152017 - 1 8152017 - 1Gizel BaccayNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- 5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman MasturaNo ratings yet

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- Journal Entries for Accounting TransactionsDocument9 pagesJournal Entries for Accounting TransactionsKhushi RaiNo ratings yet

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- FINAL For Students Premium and Warranry Liability and LiabilitiesDocument8 pagesFINAL For Students Premium and Warranry Liability and LiabilitiesHardly Dare GonzalesNo ratings yet

- kALBARYONISHERLY 1Document8 pageskALBARYONISHERLY 1De MarcusNo ratings yet

- Audit of CashDocument19 pagesAudit of Cashmjc24100% (1)

- Practice Exam- Prelim Topics (Intermediate Accounting IDocument8 pagesPractice Exam- Prelim Topics (Intermediate Accounting IDe MarcusNo ratings yet

- ACC2001 Aug 2011 Practice Exam QuestionsDocument4 pagesACC2001 Aug 2011 Practice Exam QuestionsShin TanNo ratings yet

- Cash Flow Statement - Generate Cash FlowsDocument2 pagesCash Flow Statement - Generate Cash FlowsshaunaryaNo ratings yet

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNo ratings yet

- Soal ReceivableDocument1 pageSoal ReceivableMutia RiskaNo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Midterm Answer KeyDocument6 pagesMidterm Answer Keyazzenethfaye.delacruz.mnlNo ratings yet

- Unit 1 Exam Review - Chapters 1-3Document5 pagesUnit 1 Exam Review - Chapters 1-3Jullian LimNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Receivables QuizDocument2 pagesReceivables Quizhoneyjoy salapantanNo ratings yet

- This Study Resource Was: Use The Following Information For The Next Two QuestionsDocument2 pagesThis Study Resource Was: Use The Following Information For The Next Two QuestionsClaudette Clemente100% (1)

- RECEIVABLES QuizDocument4 pagesRECEIVABLES QuizPrinx CarvsNo ratings yet

- Audit of Inventories and Trade Payables BA 123 Exercise Set BDocument6 pagesAudit of Inventories and Trade Payables BA 123 Exercise Set BBecky GonzagaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayNo ratings yet

- DL PT1Q F3 201301Document14 pagesDL PT1Q F3 201301MpuTitasNo ratings yet

- Practice Exam Chapters 1-5 Adjusting EntriesDocument7 pagesPractice Exam Chapters 1-5 Adjusting Entriesswoop9No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- The Perfect Points of Entrance ExplainedDocument1 pageThe Perfect Points of Entrance ExplainedEiuol Nhoj Arraeugse100% (3)

- Imm5484e PDFDocument1 pageImm5484e PDFEiuol Nhoj ArraeugseNo ratings yet

- CONTRACTOR FINAL PAYMENT CERTIFICATE FORMDocument2 pagesCONTRACTOR FINAL PAYMENT CERTIFICATE FORMJuanbon Padadawan100% (3)

- Tax Volume4Series26 PDFDocument5 pagesTax Volume4Series26 PDFEiuol Nhoj ArraeugseNo ratings yet

- Advanced-CARP Book PDFDocument112 pagesAdvanced-CARP Book PDFEiuol Nhoj ArraeugseNo ratings yet

- 2010.12.01 HGDG 2nd Edition PDFDocument195 pages2010.12.01 HGDG 2nd Edition PDFReihannah Paguital-Magno100% (1)

- Get Motoring!: A Comparison of Mini 4WD MotorsDocument1 pageGet Motoring!: A Comparison of Mini 4WD MotorsIan Eldrick Dela CruzNo ratings yet

- Janitorial Services Terms of ReferenceDocument11 pagesJanitorial Services Terms of ReferenceEiuol Nhoj ArraeugseNo ratings yet

- The Audacity of Hope: Policy & Politics January 2017Document4 pagesThe Audacity of Hope: Policy & Politics January 2017Eiuol Nhoj ArraeugseNo ratings yet

- International Tax: Philippines Highlights 2017Document4 pagesInternational Tax: Philippines Highlights 2017Tony MorganNo ratings yet

- PCAB List of Licensed Contractors for CFY 2019-2020 as of 25 November 2019Document804 pagesPCAB List of Licensed Contractors for CFY 2019-2020 as of 25 November 2019Reynan Reyes100% (5)

- Reading Camp Activity 1Document2 pagesReading Camp Activity 1Eiuol Nhoj ArraeugseNo ratings yet

- Taxation 2011 Bar Exam QuestionnaireDocument16 pagesTaxation 2011 Bar Exam QuestionnaireAlly BernalesNo ratings yet

- Engagement - Webworx SSSDocument2 pagesEngagement - Webworx SSSEiuol Nhoj ArraeugseNo ratings yet

- Taxpayer Information For Single Prop. Trade Name Registered Address Tin. No. OwnerDocument2 pagesTaxpayer Information For Single Prop. Trade Name Registered Address Tin. No. OwnerEiuol Nhoj ArraeugseNo ratings yet

- Philhealth ER2-Employer Report of EmployeesDocument2 pagesPhilhealth ER2-Employer Report of EmployeesAimee F75% (24)

- Kymco requests BIR deadline extensionDocument1 pageKymco requests BIR deadline extensionEiuol Nhoj Arraeugse94% (16)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument48 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEiuol Nhoj ArraeugseNo ratings yet

- San Beda College of Law: 54 M A C LDocument25 pagesSan Beda College of Law: 54 M A C LEiuol Nhoj ArraeugseNo ratings yet

- How My Brother Leon Brought Home A WifeDocument6 pagesHow My Brother Leon Brought Home A WifeCamille LopezNo ratings yet

- Political LawDocument364 pagesPolitical LawJingJing Romero100% (99)

- January 2014 Journal Entries and Financial StatementsDocument6 pagesJanuary 2014 Journal Entries and Financial StatementsEiuol Nhoj ArraeugseNo ratings yet

- POLiTICAL LAW REVIEW - Alobba PDFDocument7 pagesPOLiTICAL LAW REVIEW - Alobba PDFEiuol Nhoj ArraeugseNo ratings yet

- Accounting Review and Tutorial Services in San Isidro, Nueva EcijaDocument8 pagesAccounting Review and Tutorial Services in San Isidro, Nueva EcijaEiuol Nhoj Arraeugse100% (3)

- Taxation LawDocument13 pagesTaxation LawThe Supreme Court Public Information Office100% (2)

- Tax Alert - 2012 - MarDocument3 pagesTax Alert - 2012 - MarEiuol Nhoj ArraeugseNo ratings yet

- Civil LawDocument16 pagesCivil LawThe Supreme Court Public Information Office100% (2)

- Accounting Services AgreementDocument2 pagesAccounting Services AgreementEiuol Nhoj Arraeugse50% (2)

- San Beda College of Law: 54 M A C LDocument25 pagesSan Beda College of Law: 54 M A C LEiuol Nhoj ArraeugseNo ratings yet

- Mock Trial 4Document20 pagesMock Trial 4Ayush GuptaNo ratings yet

- Oblicon Cases Case DigestsDocument4 pagesOblicon Cases Case DigestsFbarrsNo ratings yet

- Leases and LicensesDocument9 pagesLeases and LicensesLecture WizzNo ratings yet

- Gabriel Vs Bilon (2007)Document2 pagesGabriel Vs Bilon (2007)EM RGNo ratings yet

- CIR-vs-SM-Prime-Holdings DIGESTDocument3 pagesCIR-vs-SM-Prime-Holdings DIGESTMiguel100% (1)

- Blue Cross Refuses Payment for Stroke; Doctor-Client Privilege UpheldDocument15 pagesBlue Cross Refuses Payment for Stroke; Doctor-Client Privilege UpheldguiaNo ratings yet

- Investment Property Owner-Occupied: If TheDocument6 pagesInvestment Property Owner-Occupied: If TheJoana TrinidadNo ratings yet

- G.R. No. 147593 July 31, 2006 GERONIMO Q. QUADRA, Petitioner, The Court of Appeals and The Philippine Charity Sweepstakes Office, RespondentsDocument51 pagesG.R. No. 147593 July 31, 2006 GERONIMO Q. QUADRA, Petitioner, The Court of Appeals and The Philippine Charity Sweepstakes Office, RespondentsShaiNo ratings yet

- Acap vs. Court of Appeals 251 SCRA 30 December 07 1995Document16 pagesAcap vs. Court of Appeals 251 SCRA 30 December 07 1995John Rey CodillaNo ratings yet

- Ninth Division: ChairpersonDocument24 pagesNinth Division: ChairpersonNetweightNo ratings yet

- Ramdas Bansal CaseDocument37 pagesRamdas Bansal CaseSomnath ChattopadhyayNo ratings yet

- Chapter 6Document27 pagesChapter 6adNo ratings yet

- Bid-formats-Agar - MalwaDocument10 pagesBid-formats-Agar - MalwaraviNo ratings yet

- Corporate Reporting Quest PDFDocument12 pagesCorporate Reporting Quest PDFGodsonNo ratings yet

- Property, Plant and Equipment: Sri Lanka Accounting Standard-LKAS 16Document24 pagesProperty, Plant and Equipment: Sri Lanka Accounting Standard-LKAS 16Anuruddha RajasuriyaNo ratings yet

- Revocation of Contract - Decision DARABDocument7 pagesRevocation of Contract - Decision DARABatty.estebanNo ratings yet

- CPP Companion Volume Release 9.0Document173 pagesCPP Companion Volume Release 9.0IamEm B. MoNo ratings yet

- Taxation Value-Added-TAX ExplainedDocument21 pagesTaxation Value-Added-TAX ExplainediBEAYNo ratings yet

- PFRS 16 Leases Accounting Problems and SolutionsDocument9 pagesPFRS 16 Leases Accounting Problems and SolutionsScrunchies AvenueNo ratings yet

- Perez-Rosario Vs CADocument6 pagesPerez-Rosario Vs CAMico Maagma CarpioNo ratings yet

- Ch21 InitialDocument99 pagesCh21 Initialkokmunwai717No ratings yet

- Property Cases.. AccessionDocument90 pagesProperty Cases.. AccessionRussel SirotNo ratings yet

- Lease Dispute Over Improvements Made by LesseeDocument6 pagesLease Dispute Over Improvements Made by LesseePatricia Ann Erika TorrefielNo ratings yet

- Campetic Reef Hotel Articles of IncorporationDocument5 pagesCampetic Reef Hotel Articles of IncorporationDea Lyn BaculaNo ratings yet

- Summary of Points Cases Law and Relevant Citations Regarding Unlawful Detainer Post ForeclosureDocument12 pagesSummary of Points Cases Law and Relevant Citations Regarding Unlawful Detainer Post ForeclosurePeter Walsh100% (4)

- SyllabusDocument2 pagesSyllabusIradeep TrehanNo ratings yet

- Court of Appeals Lacks Jurisdiction Over Arbitration AppealsDocument41 pagesCourt of Appeals Lacks Jurisdiction Over Arbitration AppealsTungoranNo ratings yet

- Land Law Assesment 1Document12 pagesLand Law Assesment 1gitaNo ratings yet

- Runwal Commerz Kanjurmarg BrochureDocument25 pagesRunwal Commerz Kanjurmarg BrochureInfo SaifNo ratings yet

- Abc New World V AMADocument3 pagesAbc New World V AMARuth TenajerosNo ratings yet