Professional Documents

Culture Documents

VLCC Profit Loss 2012 PDF

Uploaded by

Ankit SinghalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VLCC Profit Loss 2012 PDF

Uploaded by

Ankit SinghalCopyright:

Available Formats

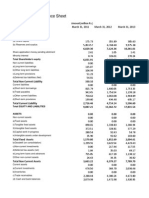

VLCC HEALTH CARE LIMITED

Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[400100] Disclosure of general information about company

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Name of company Corporate identity number Permanent account number of entity Address of registered office of company Type of industry Date of board meeting when final accounts were approved Period covered by financial statements Date of start of reporting period Date of end of reporting period Nature of report standalone consolidated Content of report Description of presentation currency Level of rounding used in financial statements Total number of product or service category Disclosure of principal product or services [Table]

VLCC HEALTH CARE LIMITED U74899DL1996PLC082842 AAACC4808P M-14 Greater Kailash-II,, Commercial Complex, New Delhi, Delhi, INDIA, 110048 Commercial and Industrial 06/07/2012 12 Months 01/04/2011 31/03/2012 Standalone Statement of Profit & Loss INR Actual Two

01/04/2010 to 31/03/2011

12 Months 01/04/2010 31/03/2011

..(1)

Unless otherwise specified, all monetary values are in INR

Types of principal product or services [Axis] Ser1 Ser2

01/04/2011 to 31/03/2012 Disclosure of general information about company [Abstract] Disclosure of principal product or services [Abstract] Disclosure of principal product or services [LineItems] Product or service category (ITC 4 digit) code Description of product or service category Turnover of product or service category Highest turnover contributing product or service (ITC 8 digit) code Description of product or service Unit of measurement of highest contributing product or service Turnover of highest contributing product or service Quantity of highest contributing product or service in UoM

01/04/2011 to 31/03/2012

9997 9992 Wellness Education Service 223,65,63,987 20,31,43,043 99972300 99924202 Beauty & Slimming Tution Fee Service Various Various 223,65,63,987 20,31,43,043 1 1

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[100200] Statement of profit and loss

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Statement of profit and loss [Abstract] Disclosure of revenue from operations [Abstract] Disclosure of revenue from operations for other than finance company [Abstract] Revenue from sale of products Revenue from sale of services Other operating revenues Excise duty Service tax collected Other duties taxes collected Total revenue from operations other than finance company Disclosure of revenue from operations for finance company [Abstract] Revenue from interest Revenue from other financial services Total revenue from operations finance company Total revenue from operations Other income Total revenue Expenses [Abstract] Cost of materials consumed Purchases of stock-in-trade Changes in inventories of finished goods, work-in-progress and stock-in-trade Employee benefit expense Finance costs Depreciation, depletion and amortisation expense [Abstract] Depreciation expense Amortisation expense Depletion expense Total depreciation, depletion and amortisation expense Expenditure on production, transportation and other expenditure pertaining to E&P activities Other expenses Total expenses Total profit before prior period items, exceptional items, extraordinary items and tax Prior period items before tax Exceptional items before tax Total profit before extraordinary items and tax Extraordinary items before tax Total profit before tax Tax expense [Abstract] Current tax Deferred tax Total tax expense Total profit (loss) for period from continuing operations Profit (loss) from discontinuing operations before tax Tax expense of discontinuing operations Total profit (loss) from discontinuing operation after tax Total profit (loss) for period before minority interest Profit (loss) of minority interest Share of profit (loss) of associates Total profit (loss) for period Additional disclosure on discontinuing operations [Abstract] 01/04/2010 to 31/03/2011

10,73,99,943 248,13,00,910 0 0 0 0 258,87,00,853 0 0 0 258,87,00,853 1,95,88,280 260,82,89,133 19,66,40,003 8,33,18,337 -12,68,939 78,89,16,340 12,64,64,515 19,21,39,941 74,89,276 0 19,96,29,217 0 109,52,15,098 248,89,14,571 11,93,74,562 0 0 11,93,74,562 0 11,93,74,562 5,57,00,000 -1,64,97,550 3,92,02,450 8,01,72,112 0 0 0 8,01,72,112 0 0 8,01,72,112

10,25,12,637 224,23,12,309 0 0 0 0 234,48,24,946 0 0 0 234,48,24,946 3,37,31,174 237,85,56,120 16,38,71,672 8,01,82,490 -34,22,061 75,75,44,618 6,42,72,829 16,21,07,144 59,49,929 0 16,80,57,073 0 102,56,89,816 225,61,96,437 12,23,59,683 0 0 12,23,59,683 0 12,23,59,683 4,78,71,995 -1,41,15,084 3,37,56,911 8,86,02,772 0 0 0 8,86,02,772 0 0 8,86,02,772

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Pre-tax gain or loss recognised on disposal of assets or settlement of liabilities attributable to discontinuing operations Earnings per equity share [Abstract] Basic earning per equity share Diluted earnings per equity share Basic earning per equity share before extraordinary items Diluted earnings per equity share before extraordinary items Nominal value of per equity share

[shares] 36.43 [shares] 36.43 [shares] 36.43 [shares] 36.43 [shares] 10

[shares] 48.41 [shares] 48.41 [shares] 48.41 [shares] 48.41 [shares] 10

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[300500] Notes - Subclassification and notes on income and expenses

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Subclassification and notes on income and expense explanatory [TextBlock] Disclosure of revenue from sale of products [Abstract] Revenue from sale of products [Abstract] Revenue from sale of products, gross Brokerage discounts rebates on revenue from sale of products Returns on revenue from sale of products Other allowances deductions on revenue from sale of products Total revenue from sale of products Disclosure of revenue from sale of services [Abstract] Revenue from sale of services [Abstract] Revenue from sale of services, gross Brokerage discounts rebates on revenue from sale of services Returns on revenue from sale of services Other allowances deductions on revenue from sale of services Total revenue from sale of services Disclosure of other operating revenues [Abstract] Other operating revenues [Abstract] Net gain/loss on foreign currency fluctuations treated as other operating revenue Miscellaneous other operating revenues Total other operating revenues Disclosure of other income [Abstract] Interest income [Abstract] Interest income on current investments [Abstract] Interest on fixed deposits, current investments Interest from customers on amounts overdue, current investments Interest on current intercorporate deposits Interest on current debt securities Interest on current government securities Interest on other current investments Total interest income on current investments Interest income on long-term investments [Abstract] Interest on fixed deposits, long-term investments Interest from customers on amounts overdue, long-term investments Interest on long-term intercorporate deposits Interest on long-term debt securities Interest on long-term government securities Interest on other long-term investments Total interest income on long-term investments Total interest income Dividend income [Abstract] Dividend income current investments [Abstract] Dividend income current investments from subsidiaries Dividend income current equity securities Dividend income current mutual funds Dividend income current investments from others Total dividend income current investments Dividend income long-term investments [Abstract] Dividend income long-term investments from subsidiaries Dividend income long-term equity securities Dividend income long-term mutual funds Dividend income long-term investments from others Total dividend income long-term investments Total dividend income Net gain/loss on sale of investments [Abstract] Net gain/loss on sale of current investments

4

01/04/2010 to 31/03/2011

10,73,99,943 0 0 0 10,73,99,943

10,25,12,637 0 0 0 10,25,12,637

248,13,00,910 0 0 0 248,13,00,910

224,23,12,309 0 0 0 224,23,12,309

0 0 0

0 0 0

3,15,528 0 0 61,715 0 76,513 4,53,756 0 0 0 0 0 0 0 4,53,756

2,86,818 0 0 74,850 0 57,734 4,19,402 0 0 0 0 0 0 0 4,19,402

0 0 0 0 0 0 0 0 0 0 0 0

0 0 53,397 0 53,397 1,50,00,000 0 0 0 1,50,00,000 1,50,53,397 0

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Net gain/loss on sale of long-term investments Total net gain/loss on sale of investments Rental income on investment property [Abstract] Rental income on investment property, current Rental income on investment property, long-term Total rental income on investment property Other non-operating income [Abstract] Net gain/loss on foreign currency fluctuations treated as other income Surplus on disposal, discard, demolishment and destruction of depreciable tangible asset Gain on disposal of intangible asset Amount credited to profit and loss as transfer from revaluation reserve on account of additional depreciation charged on revalued tangible assets Excess provision diminution in value investment written back Excess provisions bad doubtful debts advances written back Income government grants subsidies Income export incentives Income import entitlements Income insurance claims Income from subsidiaries Interest and income tax refund Income on brokerage commission Income on sales tax benefit Excess provisions written back Other allowances deduction other income Miscellaneous other non-operating income Total other non-operating income Income from pipeline transportation Total other income Share other income joint ventures Disclosure of finance cost [Abstract] Interest expense [Abstract] Interest expense long-term loans [Abstract] Interest expense long-term loans, banks Interest expense long-term loans, others Total interest expense long-term loans Interest expense short-term loans [Abstract] Interest expense short-term loans, banks Interest expense short-term loans, others Total interest expense short-term loans Interest expense deposits Interest expense debt securities Interest expense other borrowings Interest expense borrowings Interest lease financing Other interest charges Total interest expense Other borrowing costs Net gain/loss on foreign currency transactions and translations treated as finance costs Total finance costs Share finance costs joint ventures Employee benefit expense [Abstract] Salaries and wages Contribution to provident and other funds [Abstract] Contribution to provident and other funds for contract labour Contribution to provident and other funds for others Total contribution to provident and other funds Expense on employee stock option scheme and employee stock purchase plan Commission employees Employee medical insurance expenses Leave encashment expenses Gratuity

5

4,54,383 4,54,383 0 24,00,000 24,00,000

50,354 50,354 0 24,00,000 24,00,000

18,57,671 0 0 0 0 7,34,043 0 0 0 0 0 0 0 0 1,02,24,645 0 34,63,782 1,62,80,141 0 1,95,88,280 0

3,63,021 0 0 0 0 6,22,100 0 0 0 0 0 0 0 0 33,93,042 0 1,14,29,858 1,58,08,021 0 3,37,31,174 0

10,59,18,349 0 10,59,18,349 0 0 0 0 0 0 0 0 18,58,954 10,77,77,303 1,86,87,212 0 12,64,64,515 0 51,41,93,096 0 2,44,90,005 2,44,90,005 0 20,80,42,698 0 0 0

4,98,58,001 0 4,98,58,001 0 0 0 0 0 0 0 0 15,51,109 5,14,09,110 1,28,63,719 0 6,42,72,829 0 50,32,19,043 0 3,08,83,992 3,08,83,992 0 17,86,27,723 0 0 0

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Pension schemes Voluntary retirement compensation Other retirement benefits Staff welfare expense Other employee related expenses Total employee benefit expense Share employee benefit expense joint ventures Breakup of other expenses [Abstract] Consumption of stores and spare parts Power and fuel Rent Repairs to building Repairs to machinery Insurance Rates and taxes excluding taxes on income [Abstract] Central excise duty Purchase tax Other cess taxes Cost taxes other levies by government local authorities Provision wealth tax Total rates and taxes excluding taxes on income Research development expenditure Subscriptions membership fees Electricity expenses Telephone postage Printing stationery Information technology expenses Travelling conveyance Catering canteen expenses Entertainment expenses Legal professional charges Training recruitment expenses Vehicle running expenses Safety security expenses Directors sitting fees Managerial remuneration [Abstract] Remuneration to directors [Abstract] Salary to directors Commission to directors Other benefits to directors Total remuneration to directors Remuneration to managers [Abstract] Salary to managers Commission to managers Other benefits to managers Total remuneration to managers Total managerial remuneration Donations subscriptions Books periodicals Seminars conference expenses Registration filing fees Custodial fees Bank charges Guest house expenses Advertising promotional expenses After sales service expenses Warranty claim expenses Commission paid sole selling agents Commission paid other selling agents Commission paid sole buying agents Transportation distribution expenses Secondary packing expenses Discounting charges Guarantee commission

0 0 0 4,21,90,541 0 78,89,16,340 0 0 7,01,51,447 39,84,44,318 1,40,53,132 96,11,190 63,10,209 0 0 0 61,47,833 0 61,47,833 0 17,41,751 0 2,55,59,108 1,42,44,291 0 7,72,76,659 0 0 6,02,92,102 0 25,11,339 1,47,35,571 2,40,000

0 0 0 4,48,13,860 0 75,75,44,618 0 0 6,56,27,375 34,29,96,488 1,23,24,529 1,28,22,437 68,80,390 0 0 0 56,85,440 0 56,85,440 0 18,13,119 0 2,82,45,043 1,55,74,256 0 7,43,02,728 0 0 6,21,77,361 0 20,43,691 1,39,97,572 3,60,000

62,16,000 0 0 62,16,000 0 0 0 0 62,16,000 15,30,153 0 0 0 0 0 0 21,95,31,613 0 0 0 0 0 0 0 0 0

80,56,070 0 0 80,56,070 0 0 0 0 80,56,070 5,74,769 0 0 0 0 0 0 21,23,38,498 0 0 0 0 0 0 0 0 0

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Cost repairs maintenance other assets Cost information technology [Abstract] Cost software Cost hardware Cost communication connectivity Total cost information technology Cost insurance Cost transportation [Abstract] Cost freight Cost octroi Cost loading and unloading Cost other transporting Total cost transportation Cost lease rentals Cost effluent disposal Provision for cost of restoration Cost warehousing Cost water charges Cost reimbursable expenses Cost technical services Cost royalty Provision bad doubtful debts created Provision bad doubtful loans advances created Adjustments to carrying amounts of investments [Abstract] Provision diminution value current investments created Provision diminution value long-term investments created Total adjustments to carrying amounts of investments Net provisions charged [Abstract] Provision warranty claims created Provision statutory liabilities created Provision restructuring created Other provisions created Total net provisions charged Discount issue shares debentures written off [Abstract] Discount issue shares written off Discount issue debentures written off Total discount issue shares debentures written off Write-off assets liabilities [Abstract] Miscellaneous expenditure written off [Abstract] Financing charges written off Voluntary retirement compensation written off Technical know-how written off Other miscellaneous expenditure written off Total miscellaneous expenditure written off Fixed assets written off Inventories written off Investments written off Bad debts written off Bad debts advances written off Other assets written off Liabilities written off Total write-off assets liabilities Loss on disposal of intangible asset Loss on disposal, discard, demolishment and destruction of depreciable tangible asset Contract cost [Abstract] Site labour supervision cost contracts Material cost contract Depreciation assets contracts Cost transportation assets contracts Hire charges assets contracts Cost design technical assistance contracts Warranty cost contracts Other claims contracts Sale material scrap other assets contracts

7

2,82,02,227 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 12,54,471 0 0 0 0 0 0 0 0 0 0 0 0 0

2,30,99,622 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 5,00,000 5,00,000 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 5,37,295 3,23,123 0 0 8,60,418 0 53,17,108

0 0 0 0 0 12,19,851 0 0 18,42,236 45,07,158 0 0 75,69,245 0 39,05,159

0 0 0 0 3,04,02,970 0 0 0 0

0 0 0 0 2,84,03,679 0 0 0 0

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Overhead costs apportioned contracts [Abstract] Insurance cost apportioned contract Design technical assistance apportioned contracts Other overheads apportioned contracts Total overhead costs apportioned contracts Total contract cost Cost dry wells Operating and maintenance cost of emission and other pollution reduction equipments Payments to auditor [Abstract] Payment for audit services Payment for taxation matters Payment for company law matters Payment for management services Payment for other services Payment for reimbursement of expenses Total payments to auditor Payments to cost auditor [Abstract] Payment for cost audit charges Payment for cost compliance report Payment for other cost services Payment to cost auditor for reimbursement of expenses Total payments to cost auditor Miscellaneous expenses Total other expenses Breakup of expenditure on production, transportation and other expenditure pertaining to E&P activities [Abstract] Royalty pertaining to E&P activities Cess pertaining to E&P activities Education cess pertaining to E&P activities National calamity contingency duty pertaining to E&P activities Extraction cost pertaining to E&P activities Sales tax pertaining to E&P activities Geological and geophysical expenditure pertaining to E&P activities Administrative expenditure pertaining to E&P activities Research and development expenditure pertaining to E&P activities Pipeline operation and maintenance expenditure pertaining to E&P activities Other expenditure pertaining to E&P activities Total expenditure on production, transportation and other expenditure pertaining to E&P activities Current tax [Abstract] Current tax pertaining to previous years Current tax pertaining to current year MAT credit recognised during year Total current tax

0 0 0 0 3,04,02,970 0 0

0 0 0 0 2,84,03,679 0 0

16,79,000 0 0 0 5,00,000 1,60,411 23,39,411 0 0 0 0 0 9,82,41,777 109,52,15,098

14,60,000 0 0 0 5,00,000 1,49,623 21,09,623 0 0 0 0 0 9,42,82,722 102,56,89,816

0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0

0 5,57,00,000 0 5,57,00,000

-1,28,005 4,80,00,000 0 4,78,71,995

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[300600] Notes - Additional information statement of profit and loss

Details of raw materials, spare parts and components consumed [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Details of raw materials, spare parts and components consumed [Axis] Subclassification of raw materials, spare parts and components consumed [Axis] Raw materials spare parts and components consumed [Member] Imported and indigenous [Member] Raw materials consumed [Member] Imported and indigenous [Member]

01/04/2011 to 31/03/2012 Additional information on profit and loss account [Abstract] Details of raw materials, spare parts and components consumed [Abstract] Details of raw materials, spare parts and components consumed [LineItems] Value consumed Percentage of consumption Details of raw materials, spare parts and components consumed [Table]

01/04/2010 to 31/03/2011

01/04/2011 to 31/03/2012

01/04/2010 to 31/03/2011

19,66,40,003 100.00%

16,38,71,672 100.00%

19,66,40,003 100.00%

16,38,71,672 100.00%

..(2)

Unless otherwise specified, all monetary values are in INR

Details of raw materials, spare parts and components consumed [Axis] Subclassification of raw materials, spare parts and components consumed [Axis] Raw materials consumed [Member] Imported [Member] Indigenous [Member]

01/04/2011 to 31/03/2012 Additional information on profit and loss account [Abstract] Details of raw materials, spare parts and components consumed [Abstract] Details of raw materials, spare parts and components consumed [LineItems] Value consumed Percentage of consumption Details of raw materials consumed [Table]

01/04/2010 to 31/03/2011

01/04/2011 to 31/03/2012

01/04/2010 to 31/03/2011

2,66,34,317 14.00%

2,57,42,189 16.00%

17,00,05,686 86.00%

13,81,29,483 84.00%

..(1)

Unless otherwise specified, all monetary values are in INR

Categories of raw materials consumed [Axis] Raw materials consumed [Member] Raw materials consumed 1 [Member]

01/04/2011 to 31/03/2012 Additional information on profit and loss account [Abstract] Additional details in case of manufacturing companies [Abstract] Details of raw materials consumed [Abstract] Details of raw materials consumed [LineItems] Description of raw materials category Total raw materials consumed

01/04/2010 to 31/03/2011

01/04/2011 to 31/03/2012

01/04/2010 to 31/03/2011

Consumables Consumables Consumables Consumables 19,66,40,003 16,38,71,672 19,66,40,003 16,38,71,672

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Details of goods purchased [Table]

..(1)

Unless otherwise specified, all monetary values are in INR

Categories of goods purchased [Axis] Goods purchased [Member] Goods purchased 1 [Member]

01/04/2011 to 31/03/2012 Additional information on profit and loss account [Abstract] Additional details in case of manufacturing companies [Abstract] Details of goods purchased [Abstract] Details of goods purchased [LineItems] Description of goods purchased Total goods purchased

01/04/2010 to 31/03/2011

01/04/2011 to 31/03/2012

01/04/2010 to 31/03/2011

Goods for Resale Goods for Resale Goods for Resale Goods for Resale 8,33,18,337 8,01,82,490 8,33,18,337 8,01,82,490

10

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Additional information on profit and loss account explanatory [TextBlock] Share cost of materials consumed joint ventures Share purchases of stock-in-trade joint ventures Share depreciation and amortisation expense joint ventures Share other expenses joint ventures Changes in inventories of finished goods Changes in inventories of work-in-progress Changes in inventories of stock-in-trade Changes in other inventories Total changes in inventories of finished goods, work-in-progress and stock-in-trade Share changes in inventories of finished goods, work-in-progress and stock-in-trade joint ventures Exceptional items before tax Tax effect of exceptional items Total exceptional items Attachment of property of enterprise Earthquake Other items extraordinary Total extraordinary items before tax Tax effect of extraordinary items Total extraordinary items Total exceptional and extraordinary items Prior period income before tax Prior period expense before tax Total prior period items before tax Tax effect on prior period items Total prior period items after tax Revenue communication services Revenue roadway operations Revenue waterway operations Revenue airway operations Revenue logistics transport services Revenue courier services Revenue infrastructure services Revenue software development Revenue hardware maintenance Revenue information technology consultancy Revenue information technology services Revenue hotels Revenue hospitals healthcare clinics Revenue entertainment Revenue repairs maintenance Revenue educational activities Revenue membership subscriptions fees Revenue admission fees Revenue erectioning commissioning Revenue agencies Revenue advertising publicity Revenue value added services Revenue real estate property development Revenue other services Revenue lease rentals Revenue hire charges Revenue job work Revenue domestic contracts Revenue foreign contracts Total revenue contracts Revenue royalties Revenue technical know-how Revenue franchise

11

0 0 0 0 0 0 -12,68,939 0 -12,68,939 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 223,65,63,987 0 0 20,31,43,043 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2,78,58,759 0 1,37,35,121

01/04/2010 to 31/03/2011

0 0 0 0 0 0 -34,22,061 0 -34,22,061 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 202,79,81,138 0 0 18,10,61,893 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2,56,89,279 0 75,79,999

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Revenue licenses Revenue intangible assets Total gross income from services rendered Aggregate amount set aside to provisions made for meeting specific liabilities, contingencies or commitments Aggregate amount withdrawn from such provisions made for meeting specific liabilities, contingencies or commitments no longer required Write down of inventories to net realizable value Reversal of write down of inventories to net realizable value Cost of restructuring of enterprise Reversal of cost of restructuring of enterprise Expenses on legislative changes having retrospective application Income on legislative changes having retrospective application Expense on litigation settlements Income on litigation settlements Other reversals of provisions Dividends from subsidiary companies Provisions for losses of subsidiary companies Value of imports of raw materials Value of imports of components and spare parts Value of imports of capital goods Total value of imports calculated on CIF basis Expenditure on royalty Expenditure on know-how Expenditure on professional and consultation fees Expenditure on interest Expenditure on other matters Total expenditure in foreign currency Final dividend remitted in foreign currency Interim dividend remitted in foreign currency Special dividend remitted in foreign currency Total amount of dividend remitted in foreign currency Total number of non-resident shareholders Total number of shares held by non-resident shareholders on which dividends were due Year to which dividends relate FOB value of manufactured goods exported FOB value of traded goods exported Total earnings on export of goods calculated on FOB basis Earnings on royalty Earnings on know-how Earnings on professional and consultation fees Total earnings on royalty, know-how, professional and consultation fees Earnings on interest Earnings on dividend Total earnings on interest and dividend Earnings on other income Total earnings in foreign currency Amount of revenue received in foreign currency from services Insurance and freight on exports Profit in foreign currency on sale of assets Commission brokerage and discount charges in foreign currency Professional charges in foreign currency Bank and finance charges in foreign currency Logistic charge in foreign currency Foreign tax Sales marketing and advertising expenses in foreign currency Meeting expenses in foreign currency Research and development expenses in foreign currency Intangible asset charges in foreign currency Membership and subscription expenses in foreign currency Insurance charges in foreign currency Telecommunication expenses in foreign currency

12

0 0 248,13,00,910 0 0 0 0 0 0 0 0 0 0 0 0 0 1,29,17,464 0 2,24,68,136 3,53,85,600 0 0 0 0 1,47,40,004 1,47,40,004 6,40,937 0 0 6,40,937 2 [shares] 6,49,251 31/03/2011 0 64,40,299 64,40,299 0 0 0 0 0 0 0 0 64,40,299 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

0 0 224,23,12,309 0 0 0 0 0 0 0 0 0 0 0 1,50,00,000 0 4,75,73,637 0 4,75,36,784 9,51,10,421 0 0 0 0 1,38,22,575 1,38,22,575 2,51,56,960 0 0 2,51,56,960 1 [shares] 37,93,686 31/03/2010 0 77,54,681 77,54,681 0 0 0 0 0 0 0 0 77,54,681 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Profits or losses from partnership firms or association of persons or limited liability partnerships Financial effect of deviation from accounting standards profit and loss account Amount of contributions made to political party or for political purpose Amount of contributions made to national defence fund Cost incurred by holding company for issuing options or shares under employee stock option or stock purchase scheme Cost reimbursed by subsidiary company for issuing options or shares under employee stock option or stock purchase scheme Domestic sale manufactured goods Domestic sale traded goods Total domestic turnover goods, gross Export sale manufactured goods Export sale traded goods Total export turnover goods, gross Total revenue from sale of products Domestic revenue services Export revenue services Total revenue from sale of services Capital expenditure in foreign currency Expenditure on corporate social responsibility activities as per guidelines

0 0 0 0 0 0 0 10,09,59,644 10,09,59,644 0 64,40,299 64,40,299 10,73,99,943 248,13,00,910 0 248,13,00,910 0 0

0 0 0 0 0 0 0 9,47,57,956 9,47,57,956 0 77,54,681 77,54,681 10,25,12,637 224,23,12,309 0 224,23,12,309 0 0

[200800] Notes - Disclosure of accounting policies, changes in accounting policies and estimates

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Disclosure of accounting policies, change in accounting policies and changes in estimates explanatory [TextBlock] Disclosure of general information about company [TextBlock] Changes in accounting estimate and accounting policy explanatory [TextBlock] Amount of changes in accounting estimate having material effect in current period Amount of changes in accounting estimate having material effect in subsequent period

Textual information (1) [See below] Textual information (3) [See below]

01/04/2010 to 31/03/2011

Textual information (2) [See below] Textual information (4) [See below]

0 0

0 0

13

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (1)

Disclosure of accounting policies, change in accounting policies and changes in estimates explanatory [Text Block]

1 Corporate Information

VLCC Health Care Limited (the Company) was incorporated in India on October 23, 1996 to carry on the business of maintaining and running beauty, slimming, fitness and health centres at various locations, sale of beauty products and also provide vocational training at various institutes. The company is closely held with 308,119 shares held by Leon International Limited, Mauritius, 341,132 shares held by Indivision India Partners, Mauritius, 56,432 shares held by VLCC Employee Welfare Trust and the balance shares held by individuals. The accompanying financial statements reflect the results of the activities undertaken by the Company during the year ended March 31, 2012. 2 2.1 Summary of significant accounting policies Basis of accounting and preparation of financial statements

The financial statements of the Company have been prepared in accordance with the Generally Accepted Accounting Principles in India (Indian GAAP) to comply with the Accounting Standards notified under the Companies (Accounting Standards) Rules, 2006 (as amended) and the relevant provisions of the Companies Act, 1956. The financial statements have been prepared on accrual basis under the historical cost convention. The accounting policies adopted in the preparation of the financial statements are consistent with those followed in the previous year.

2.2

Use of estimates

The preparation of financial statements in conformity with Indian GAAP requires the Management to make estimates and assumptions considered in the reported amounts of assets and liabilities (including contingent liabilities) and the reported income and expenses during the year. The Management believes that the estimates used in preparation of the financial statements are prudent and reasonable. Future results could differ due to these estimates and the differences between the actual results and the estimates are recognized in the periods in which the results are known/ materialise. 2.3 Inventories

Inventories are valued at lower of cost (on FIFO basis) and net realisable value. Cost includes all expenses incurred in bringing the goods to their present location including octroi and other levies, transit insurance and receiving charges. 2.4 Cash and cash equivalents

Cash comprises cash on hand and demand deposits with banks. Cash equivalents are short-term balances (with an original maturity of three months or less from the date of acquisition), highly liquid investments that are readily convertible into known amounts of cash and which are subject to insignificant risk of changes in value. 2.5 Cash flow statement

Cash flows are reported using the indirect method, whereby profit / (loss) before extraordinary items and tax is adjusted for the effects of transactions of non-cash nature and any deferrals or accruals of past or future cash receipts or payments. The cash flows from operating, investing and financing activities of the Company are segregated based on the available information. 2.6 Depreciation and amortisation

Depreciation on all tangible fixed assets, except leasehold improvements is provided on the straight line method over the estimated useful life of the assets at rates specified in Schedule XIV to the Companies Act, 1956. Leasehold improvements are amortised over the period of lease,

14

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

including the optional period of lease. Depreciation on addition to fixed assets is provided on pro-rata basis from the date the assets are acquired/installed. Depreciation on sale/deduction from fixed assets is provided for upto the date of sale, deduction, discardment as the case may be. All assets costing Rs.5,000 or below are depreciated in full on pro-rata basis from the date of their acquisition. Intangible assets are amortised over their estimated useful life as follows: Goodwill and Brand- 10 years Cinematographic film - 5 years Computer software- 6 years The estimated useful life of the intangible assets and the amortization period are reviewed at the end of each financial year and the amortization method is revised to reflect the changed pattern. 2.7 Revenue recognition

Income from services Revenue from fees received from clients towards beauty and slimming packages are recognised on a pro-rata basis over the period of the package after attributing revenue to services rendered on enrolment. Fees related to unexecuted period of the packages are recorded as Advances from customers' as per the terms of specific contracts. Revenue from regular beauty sales are recognised as services are provided to the customers. Revenue in respect of tuition fees received from students is recognised over the period of the course after attributing revenue to services rendered on enrolment. Fees are recorded at invoice value, net of discounts if any. Revenue in respect of non-refundable lump sum fees received from the franchisee's is recognised on execution of the agreement. Revenue in respect of non-refundable lump sum fees received from the collaborators is recognised over a period of five years. Revenue in respect of royalty received from the franchisee's is recognised on accrual basis at the end of each month in terms of the agreement. Sale of goods Revenue from sale of goods at each of the centres is recognised on delivery of goods to the customers. Sales are recorded at invoice value, net of discount if any. 2.8 Other income

Income from interest on time deposits is recognised on the time proportion method taking into consideration the amount outstanding and the applicable interest rates. Dividend income from investments is recognised when the right to receive payment is established. 2.9 Tangible fixed assets

15

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Fixed assets are stated at cost, less accumulated depreciation and impairment losses, if any. Cost includes original cost of acquisition, including incidental expenses related to such acquisition and installation. The cost of fixed assets includes interest on borrowings attributable to acquisition of qualifying fixed assets up to the date the asset is ready for its intended use and other incidental expenses incurred up to that date. Capital work-in-progress: Projects under which assets are not ready for their intended use and other capital work-in-progress are carried at cost, comprising direct cost, related incidental expenses and attributable interest. 2.10 Intangible assets

Intangible assets are stated at cost less accumulated amortization and impairment losses, if any. The cost of an intangible asset comprises its purchase price, including any import duties and other taxes (other than those subsequently recoverable from the taxing authorities), and any directly attributable expenditure on making the asset ready for its intended use and net of any trade discounts and rebates. Subsequent expenditure on an intangible asset after its purchase / completion is recognised as an expense when incurred unless it is probable that such expenditure will enable the asset to generate future economic benefits in excess of its originally assessed standards of performance and such expenditure can be measured and attributed to the asset reliably, in which case such expenditure is added to the cost of the asset. 2.11 Foreign currency transactions and translations

Initial recognition Transactions denominated in foreign currencies are recorded at the exchange rates prevailing on the date of the transaction. Measurement of foreign currency monetary items at the Balance Sheet date Monetary items denominated in foreign currencies at the year-end are restated at the exchange rates prevailing on the date of the Balance Sheet. Non-monetary items denominated in foreign currencies are carried at cost. Treatment of exchange differences Exchange differences arising on settlement / restatement of short-term foreign currency monetary assets and liabilities of the Company are recognized as income or expense in the Statement of Profit and Loss. The exchange differences arising on settlement / restatement of long-term foreign currency monetary items are amortised on settlement / over the maturity period of such items if such items do not relate to acquisition of depreciable fixed assets. 2.12 Share of Surplus of Collaborators

Surplus payable to the collaborators in respect of jointly managed centres is accrued either as a percentage of gross margin or fees received as specified in the agreement. 2.13 Investments

Long-term investments are carried individually at cost less provision for diminution, other than temporary, in the value of such investments. Current investments are carried individually, at the lower of cost and fair value. Cost of investments include, acquisition charges such as brokerage, fees and duties. 2.14 Employee benefits

Employee benefits include provident fund, gratuity fund and compensated absences.

16

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Defined contribution plans In accordance with the provisions of the Employees Provident Funds and Miscellaneous Provisions Act, 1952, eligible employees of the Company are entitled to receive benefits with respect to provident fund, a defined contribution plan in which both the Company and the employee contribute monthly at a determined rate (currently 12% of employee's basic salary). Company's contribution to Provident Fund is charged as an expense in the Statement of Profit and Loss. Defined benefit plans Benefits payable to eligible employees of the Company with respect to gratuity, a defined benefit plan is accounted for on the basis of an actuarial valuation as at the balance sheet date. In accordance with the Payment of Gratuity Act, 1972, the plan provides for lump sum payments to vested employees on retirement, death while in service or on termination of employment in an amount equivalent to 15 days basic salary for each completed year of service. Vesting occurs upon completion of five years of service. The company contributes all the ascertained liabilities to a fund set up by the company and administered by a board of trustees. The present value of such obligation is determined by the projected unit credit method and adjusted for past service cost and fair value of plan assets as at the balance sheet date through which the obligations are to be settled. The resultant actuarial gain or loss on change in present value of the defined benefit obligation or change in return of the plan assets is recognised as an income or expense in the Statement of Profit and Loss. The expected return on plan assets is based on the assumed rate of return of such assets. Long-term employee benefits Compensated absences payable to employees of the Company while in service, on retirement, death while in service or on termination of employment with respect to accumulated leaves outstanding at the year-end are accounted for on the basis of an actuarial valuation as at the balance sheet date. 2.15 Employee share based payments

The Company has formulated employee Stock Option Plan as approved and modified by Compensation Committee / Board of Directors of the Company from time to time. The Plan provides for grant of Stock Options to eligible employees of the Company and its subsidiaries to acquire equity shares of the Company that vest in a graded manner and that are to be exercised within a specified period. The options are to be converted into one share at a predetermined price to be exercised in accordance with the plan. The exercise price of the options shall be fair market value on the date of grant per option. Under the approved plan, the company has issued shares to the VLCC Employee Welfare Trust at fair market value determined on the date of issue which is holding the shares on behalf of the employees. 2.16 Borrowing costs Borrowing costs that are attributable to the acquisition, construction or production of qualifying assets are capitalised as part of cost of that asset. Other borrowing costs are recognised as an expense in the Statement of Profit and Loss in the period in which they are incurred. Capitalisation of borrowing costs is suspended and charged to the Statement of Profit and Loss during extended periods when active development activity on the qualifying assets is interrupted. In accordance with an opinion received from the expert advisory committee of the Institute of Chartered Accountants of India, the company has during the year capitalized borrowing costs in respect of construction of qualifying assets completed within a period of five to seven months. 2.17 Segment reporting

The Company identifies primary segments based on the dominant source, nature of risks and returns and the internal organisation and management structure. The operating segments are the segments for which separate financial information is available and for which operating profit/loss amounts are evaluated regularly by the executive Management in deciding how to allocate resources and in assessing performance. The accounting policies adopted for segment reporting are in line with the accounting policies of the Company. Segment revenue, segment expenses, segment assets and segment liabilities have been identified to segments on the basis of their relationship to the operating activities of the segment. Revenue, expenses, assets and liabilities which relate to the Company as a whole and are not allocable to segments on reasonable basis have been included under unallocated revenue / expenses / assets / liabilities.

17

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

2.18

Leases

Lease arrangements where the risks and rewards incidental to ownership of an asset substantially vest with the lessor are recognised as operating leases. Lease rentals are expensed with reference to lease terms. 2.19 Earnings per share

Basic earnings per share are calculated by dividing the net profit or loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year. Diluted earnings per share are calculated by dividing the net profit or loss for the year attributable to equity shareholders as adjusted for dividend, interest and other charges to expense or income relating to the dilutive potential equity shares, by the weighted average number of shares outstanding during the year as adjusted for the effects of all dilutive potential equity shares. Potential equity shares are deemed to be dilutive only if their conversion to equity shares would decrease the net profit per share from continuing ordinary operations. Potential dilutive equity shares are deemed to be converted as at the beginning of the period, unless they have been issued at a later date. 2.20 Taxes on income

Income taxes consist of current taxes and changes in deferred tax liabilities and assets. Current tax is the amount of tax payable on the taxable income for the year as determined in accordance with the provisions of the Income Tax Act, 1961. Income taxes are accounted for on the basis of estimated taxes payable and adjusted for timing differences between the taxable income and accounting income as reported in the financial statements. Timing differences between the taxable income and the accounting income as at March 31, 2012 that reverse in one or more subsequent years are recognised if they result in taxable amounts. Deferred tax assets or liabilities are established at the enacted tax rates. Changes in the enacted rates are recognised in the period of enactment. Deferred tax assets are recognised only if there is a reasonable certainty that they will be realised and are reviewed for the appropriateness of their respective carrying values at each balance sheet date. 2.21 Impairment of Assets

Whenever events indicate that assets may be impaired, the assets are subject to a test of recoverability based on estimates of future cash flows arising from continuing use of such assets and from its ultimate disposal. A provision for impairment loss is recognised where it is probable that the carrying value of an asset exceeds the amount to be recovered through use or sale of the asset. When there is an indication that an impairment loss recognized for an asset in earlier accounting periods no longer exists or may have decreased, such reversal of impairment loss is recognized in the Statement of Profit and Loss, except in case of revalued assets. 2.22 Provisions and contingencies

The Company creates a provision when there is present obligation as a result of a past event that probably requires an outflow of resources and a reliable estimate can be made of the amount of the obligation. A disclosure for a contingent liability is made when there is possible obligation or a present obligation that may, but probably will not, require an outflow of resources. When there is a possible obligation or a present obligation in respect of which the likelihood of outflow of resources is remote, no provision or disclosure is made. Provisions are reviewed at each balance sheet date and adjusted to reflect the current best estimate. If it is no longer probable that the outflow of resources would be required to settle the obligation, the provision is reversed. Contingent assets are not recognised in the financial statements. However, contingent assets are assessed continually and if it is virtually certain that an economic benefit will arise, the asset and the related income are recognized in the year in which the change occurs. 2.23 Insurance claims

Insurance claims are accounted for on the basis of claims admitted / expected to be admitted and to the extent that there is no uncertainty in receiving the claims.

18

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

2.24

Service tax input credit

Service tax input credit is accounted for in the books in the period in which the underlying service received is accounted and when there is no uncertainty in availing / utilising the credits. 2.25 Material Events

Material events occurring after the Balance Sheet date are taken into cognisance. 2.26 Classification of current / non-current liabilities and assets

Liability A liability has been classified as current when it satisfies any of following criteria: a) b) c) It is expected to be settled in the company's normal operating cycle; It is held primarily for the purpose of being traded; It is due to be settled within twelve months after reporting date; or

d) The company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. Terms of a liability that could, at the option of the counterparty, result in its settlement by issue of equity instrument do not affect its classification. All other liabilities are classified as non-current. Asset An asset has been classified as current when it satisfies any of following criteria: a) b) c) It is expected to be realised in, or is intended for sale or consumption in the company's normal operating cycle; It is held primarily for the purpose of being traded; It is expected to be realised within twelve months after reporting date; or

d) It is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date. All other assets are classified as non-current.

19

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (2)

Disclosure of accounting policies, change in accounting policies and changes in estimates explanatory [Text Block]

1 Corporate Information

VLCC Health Care Limited (the Company) was incorporated in India on October 23, 1996 to carry on the business of maintaining and running beauty, slimming, fitness and health centres at various locations, sale of beauty products and also provide vocational training at various institutes. The company is closely held with 308,119 shares held by Leon International Limited, Mauritius, 341,132 shares held by Indivision India Partners, Mauritius, 56,432 shares held by VLCC Employee Welfare Trust and the balance shares held by individuals. The accompanying financial statements reflect the results of the activities undertaken by the Company during the year ended March 31, 2012. 2 2.1 Summary of significant accounting policies Basis of accounting and preparation of financial statements

The financial statements of the Company have been prepared in accordance with the Generally Accepted Accounting Principles in India (Indian GAAP) to comply with the Accounting Standards notified under the Companies (Accounting Standards) Rules, 2006 (as amended) and the relevant provisions of the Companies Act, 1956. The financial statements have been prepared on accrual basis under the historical cost convention. The accounting policies adopted in the preparation of the financial statements are consistent with those followed in the previous year.

2.2

Use of estimates

The preparation of financial statements in conformity with Indian GAAP requires the Management to make estimates and assumptions considered in the reported amounts of assets and liabilities (including contingent liabilities) and the reported income and expenses during the year. The Management believes that the estimates used in preparation of the financial statements are prudent and reasonable. Future results could differ due to these estimates and the differences between the actual results and the estimates are recognized in the periods in which the results are known/ materialise. 2.3 Inventories

Inventories are valued at lower of cost (on FIFO basis) and net realisable value. Cost includes all expenses incurred in bringing the goods to their present location including octroi and other levies, transit insurance and receiving charges. 2.4 Cash and cash equivalents

Cash comprises cash on hand and demand deposits with banks. Cash equivalents are short-term balances (with an original maturity of three months or less from the date of acquisition), highly liquid investments that are readily convertible into known amounts of cash and which are subject to insignificant risk of changes in value. 2.5 Cash flow statement

Cash flows are reported using the indirect method, whereby profit / (loss) before extraordinary items and tax is adjusted for the effects of transactions of non-cash nature and any deferrals or accruals of past or future cash receipts or payments. The cash flows from operating, investing and financing activities of the Company are segregated based on the available information. 2.6 Depreciation and amortisation

Depreciation on all tangible fixed assets, except leasehold improvements is provided on the straight line method over the estimated useful life of the assets at rates specified in Schedule XIV to the Companies Act, 1956. Leasehold improvements are amortised over the period of lease,

20

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

including the optional period of lease. Depreciation on addition to fixed assets is provided on pro-rata basis from the date the assets are acquired/installed. Depreciation on sale/deduction from fixed assets is provided for upto the date of sale, deduction, discardment as the case may be. All assets costing Rs.5,000 or below are depreciated in full on pro-rata basis from the date of their acquisition. Intangible assets are amortised over their estimated useful life as follows: Goodwill and Brand- 10 years Cinematographic film - 5 years Computer software- 6 years The estimated useful life of the intangible assets and the amortization period are reviewed at the end of each financial year and the amortization method is revised to reflect the changed pattern. 2.7 Revenue recognition

Income from services Revenue from fees received from clients towards beauty and slimming packages are recognised on a pro-rata basis over the period of the package after attributing revenue to services rendered on enrolment. Fees related to unexecuted period of the packages are recorded as Advances from customers' as per the terms of specific contracts. Revenue from regular beauty sales are recognised as services are provided to the customers. Revenue in respect of tuition fees received from students is recognised over the period of the course after attributing revenue to services rendered on enrolment. Fees are recorded at invoice value, net of discounts if any. Revenue in respect of non-refundable lump sum fees received from the franchisee's is recognised on execution of the agreement. Revenue in respect of non-refundable lump sum fees received from the collaborators is recognised over a period of five years. Revenue in respect of royalty received from the franchisee's is recognised on accrual basis at the end of each month in terms of the agreement. Sale of goods Revenue from sale of goods at each of the centres is recognised on delivery of goods to the customers. Sales are recorded at invoice value, net of discount if any. 2.8 Other income

Income from interest on time deposits is recognised on the time proportion method taking into consideration the amount outstanding and the applicable interest rates. Dividend income from investments is recognised when the right to receive payment is established. 2.9 Tangible fixed assets

21

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Fixed assets are stated at cost, less accumulated depreciation and impairment losses, if any. Cost includes original cost of acquisition, including incidental expenses related to such acquisition and installation. The cost of fixed assets includes interest on borrowings attributable to acquisition of qualifying fixed assets up to the date the asset is ready for its intended use and other incidental expenses incurred up to that date. Capital work-in-progress: Projects under which assets are not ready for their intended use and other capital work-in-progress are carried at cost, comprising direct cost, related incidental expenses and attributable interest. 2.10 Intangible assets

Intangible assets are stated at cost less accumulated amortization and impairment losses, if any. The cost of an intangible asset comprises its purchase price, including any import duties and other taxes (other than those subsequently recoverable from the taxing authorities), and any directly attributable expenditure on making the asset ready for its intended use and net of any trade discounts and rebates. Subsequent expenditure on an intangible asset after its purchase / completion is recognised as an expense when incurred unless it is probable that such expenditure will enable the asset to generate future economic benefits in excess of its originally assessed standards of performance and such expenditure can be measured and attributed to the asset reliably, in which case such expenditure is added to the cost of the asset. 2.11 Foreign currency transactions and translations

Initial recognition Transactions denominated in foreign currencies are recorded at the exchange rates prevailing on the date of the transaction. Measurement of foreign currency monetary items at the Balance Sheet date Monetary items denominated in foreign currencies at the year-end are restated at the exchange rates prevailing on the date of the Balance Sheet. Non-monetary items denominated in foreign currencies are carried at cost. Treatment of exchange differences Exchange differences arising on settlement / restatement of short-term foreign currency monetary assets and liabilities of the Company are recognized as income or expense in the Statement of Profit and Loss. The exchange differences arising on settlement / restatement of long-term foreign currency monetary items are amortised on settlement / over the maturity period of such items if such items do not relate to acquisition of depreciable fixed assets. 2.12 Share of Surplus of Collaborators

Surplus payable to the collaborators in respect of jointly managed centres is accrued either as a percentage of gross margin or fees received as specified in the agreement. 2.13 Investments

Long-term investments are carried individually at cost less provision for diminution, other than temporary, in the value of such investments. Current investments are carried individually, at the lower of cost and fair value. Cost of investments include, acquisition charges such as brokerage, fees and duties. 2.14 Employee benefits

Employee benefits include provident fund, gratuity fund and compensated absences.

22

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Defined contribution plans In accordance with the provisions of the Employees Provident Funds and Miscellaneous Provisions Act, 1952, eligible employees of the Company are entitled to receive benefits with respect to provident fund, a defined contribution plan in which both the Company and the employee contribute monthly at a determined rate (currently 12% of employee's basic salary). Company's contribution to Provident Fund is charged as an expense in the Statement of Profit and Loss. Defined benefit plans Benefits payable to eligible employees of the Company with respect to gratuity, a defined benefit plan is accounted for on the basis of an actuarial valuation as at the balance sheet date. In accordance with the Payment of Gratuity Act, 1972, the plan provides for lump sum payments to vested employees on retirement, death while in service or on termination of employment in an amount equivalent to 15 days basic salary for each completed year of service. Vesting occurs upon completion of five years of service. The company contributes all the ascertained liabilities to a fund set up by the company and administered by a board of trustees. The present value of such obligation is determined by the projected unit credit method and adjusted for past service cost and fair value of plan assets as at the balance sheet date through which the obligations are to be settled. The resultant actuarial gain or loss on change in present value of the defined benefit obligation or change in return of the plan assets is recognised as an income or expense in the Statement of Profit and Loss. The expected return on plan assets is based on the assumed rate of return of such assets. Long-term employee benefits Compensated absences payable to employees of the Company while in service, on retirement, death while in service or on termination of employment with respect to accumulated leaves outstanding at the year-end are accounted for on the basis of an actuarial valuation as at the balance sheet date. 2.15 Employee share based payments

The Company has formulated employee Stock Option Plan as approved and modified by Compensation Committee / Board of Directors of the Company from time to time. The Plan provides for grant of Stock Options to eligible employees of the Company and its subsidiaries to acquire equity shares of the Company that vest in a graded manner and that are to be exercised within a specified period. The options are to be converted into one share at a predetermined price to be exercised in accordance with the plan. The exercise price of the options shall be fair market value on the date of grant per option. Under the approved plan, the company has issued shares to the VLCC Employee Welfare Trust at fair market value determined on the date of issue which is holding the shares on behalf of the employees. 2.16 Borrowing costs Borrowing costs that are attributable to the acquisition, construction or production of qualifying assets are capitalised as part of cost of that asset. Other borrowing costs are recognised as an expense in the Statement of Profit and Loss in the period in which they are incurred. Capitalisation of borrowing costs is suspended and charged to the Statement of Profit and Loss during extended periods when active development activity on the qualifying assets is interrupted. In accordance with an opinion received from the expert advisory committee of the Institute of Chartered Accountants of India, the company has during the year capitalized borrowing costs in respect of construction of qualifying assets completed within a period of five to seven months. 2.17 Segment reporting

The Company identifies primary segments based on the dominant source, nature of risks and returns and the internal organisation and management structure. The operating segments are the segments for which separate financial information is available and for which operating profit/loss amounts are evaluated regularly by the executive Management in deciding how to allocate resources and in assessing performance. The accounting policies adopted for segment reporting are in line with the accounting policies of the Company. Segment revenue, segment expenses, segment assets and segment liabilities have been identified to segments on the basis of their relationship to the operating activities of the segment. Revenue, expenses, assets and liabilities which relate to the Company as a whole and are not allocable to segments on reasonable basis have been included under unallocated revenue / expenses / assets / liabilities.

23

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

2.18

Leases

Lease arrangements where the risks and rewards incidental to ownership of an asset substantially vest with the lessor are recognised as operating leases. Lease rentals are expensed with reference to lease terms. 2.19 Earnings per share

Basic earnings per share are calculated by dividing the net profit or loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year. Diluted earnings per share are calculated by dividing the net profit or loss for the year attributable to equity shareholders as adjusted for dividend, interest and other charges to expense or income relating to the dilutive potential equity shares, by the weighted average number of shares outstanding during the year as adjusted for the effects of all dilutive potential equity shares. Potential equity shares are deemed to be dilutive only if their conversion to equity shares would decrease the net profit per share from continuing ordinary operations. Potential dilutive equity shares are deemed to be converted as at the beginning of the period, unless they have been issued at a later date. 2.20 Taxes on income

Income taxes consist of current taxes and changes in deferred tax liabilities and assets. Current tax is the amount of tax payable on the taxable income for the year as determined in accordance with the provisions of the Income Tax Act, 1961. Income taxes are accounted for on the basis of estimated taxes payable and adjusted for timing differences between the taxable income and accounting income as reported in the financial statements. Timing differences between the taxable income and the accounting income as at March 31, 2012 that reverse in one or more subsequent years are recognised if they result in taxable amounts. Deferred tax assets or liabilities are established at the enacted tax rates. Changes in the enacted rates are recognised in the period of enactment. Deferred tax assets are recognised only if there is a reasonable certainty that they will be realised and are reviewed for the appropriateness of their respective carrying values at each balance sheet date. 2.21 Impairment of Assets

Whenever events indicate that assets may be impaired, the assets are subject to a test of recoverability based on estimates of future cash flows arising from continuing use of such assets and from its ultimate disposal. A provision for impairment loss is recognised where it is probable that the carrying value of an asset exceeds the amount to be recovered through use or sale of the asset. When there is an indication that an impairment loss recognized for an asset in earlier accounting periods no longer exists or may have decreased, such reversal of impairment loss is recognized in the Statement of Profit and Loss, except in case of revalued assets. 2.22 Provisions and contingencies

The Company creates a provision when there is present obligation as a result of a past event that probably requires an outflow of resources and a reliable estimate can be made of the amount of the obligation. A disclosure for a contingent liability is made when there is possible obligation or a present obligation that may, but probably will not, require an outflow of resources. When there is a possible obligation or a present obligation in respect of which the likelihood of outflow of resources is remote, no provision or disclosure is made. Provisions are reviewed at each balance sheet date and adjusted to reflect the current best estimate. If it is no longer probable that the outflow of resources would be required to settle the obligation, the provision is reversed. Contingent assets are not recognised in the financial statements. However, contingent assets are assessed continually and if it is virtually certain that an economic benefit will arise, the asset and the related income are recognized in the year in which the change occurs. 2.23 Insurance claims

Insurance claims are accounted for on the basis of claims admitted / expected to be admitted and to the extent that there is no uncertainty in receiving the claims.

24

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

2.24

Service tax input credit

Service tax input credit is accounted for in the books in the period in which the underlying service received is accounted and when there is no uncertainty in availing / utilising the credits. 2.25 Material Events

Material events occurring after the Balance Sheet date are taken into cognisance. 2.26 Classification of current / non-current liabilities and assets

Liability A liability has been classified as current when it satisfies any of following criteria: a) b) c) It is expected to be settled in the company's normal operating cycle; It is held primarily for the purpose of being traded; It is due to be settled within twelve months after reporting date; or

d) The company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. Terms of a liability that could, at the option of the counterparty, result in its settlement by issue of equity instrument do not affect its classification. All other liabilities are classified as non-current. Asset An asset has been classified as current when it satisfies any of following criteria: a) b) c) It is expected to be realised in, or is intended for sale or consumption in the company's normal operating cycle; It is held primarily for the purpose of being traded; It is expected to be realised within twelve months after reporting date; or

d) It is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date. All other assets are classified as non-current.

25

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (3)

Disclosure of general information about company [Text Block]

VLCC Health Care Limited (the Company) was incorporated in India on October 23, 1996 to carry on the business of maintaining and running beauty, slimming, fitness and health centres at various locations, sale of beauty products and also provide vocational training at various institutes. The company is closely held with 308,119 shares held by Leon International Limited, Mauritius, 341,132 shares held by Indivision India Partners, Mauritius, 56,432 shares held by VLCC Employee Welfare Trust and the balance shares held by individuals.

Textual information (4)

Disclosure of general information about company [Text Block]

VLCC Health Care Limited (the Company) was incorporated in India on October 23, 1996 to carry on the business of maintaining and running beauty, slimming, fitness and health centres at various locations, sale of beauty products and also provide vocational training at various institutes. The company is closely held with 308,119 shares held by Leon International Limited, Mauritius, 341,132 shares held by Indivision India Partners, Mauritius, 56,432 shares held by VLCC Employee Welfare Trust and the balance shares held by individuals.

[300100] Notes - Revenue

Unless otherwise specified, all monetary values are in INR

01/04/2011 to 31/03/2012 Disclosure of revenue explanatory [TextBlock] Share revenue from operations joint ventures

Textual information [See below] (5) 0

01/04/2010 to 31/03/2011

Textual information [See below] (6) 0

26

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (5)

Disclosure of revenue explanatory [Text Block]

Revenue recognition

Income from services

Revenue from fees received from clients towards beauty and slimming packages are recognised on a pro-rata basis over the period of the package after attributing revenue to services rendered on enrolment. Fees related to unexecuted period of the packages are recorded as Advances from customers' as per the terms of specific contracts.

Revenue from regular beauty sales are recognised as services are provided to the customers.

Revenue in respect of tuition fees received from students is recognised over the period of the course after attributing revenue to services rendered on enrolment. Fees are recorded at invoice value, net of discounts if any.

Revenue in respect of non-refundable lump sum fees received from the franchisee's is recognised on execution of the agreement. Revenue in respect of non-refundable lump sum fees received from the collaborators is recognised over a period of five years.

Revenue in respect of royalty received from the franchisee's is recognised on accrual basis at the end of each month in terms of the agreement.

Sale of goods

Revenue from sale of goods at each of the centres is recognised on delivery of goods to the customers. Sales are recorded at invoice value, net of discount if any.

27

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (6)

Disclosure of revenue explanatory [Text Block]

Revenue recognition

Income from services

Revenue from fees received from clients towards beauty and slimming packages are recognised on a pro-rata basis over the period of the package after attributing revenue to services rendered on enrolment. Fees related to unexecuted period of the packages are recorded as Advances from customers' as per the terms of specific contracts.

Revenue from regular beauty sales are recognised as services are provided to the customers.

Revenue in respect of tuition fees received from students is recognised over the period of the course after attributing revenue to services rendered on enrolment. Fees are recorded at invoice value, net of discounts if any.

Revenue in respect of non-refundable lump sum fees received from the franchisee's is recognised on execution of the agreement. Revenue in respect of non-refundable lump sum fees received from the collaborators is recognised over a period of five years.

Revenue in respect of royalty received from the franchisee's is recognised on accrual basis at the end of each month in terms of the agreement.

Sale of goods

Revenue from sale of goods at each of the centres is recognised on delivery of goods to the customers. Sales are recorded at invoice value, net of discount if any.

28

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[202200] Notes - Effects of changes in foreign exchange rates

Unless otherwise specified, all monetary values are in INR

31/03/2012 Disclosure of notes on effect of changes in foreign exchange rates explanatory [TextBlock] Details of change in classification of significant foreign operation [Abstract] Impact of change in classification of significant foreign operation on shareholders' fund 31/03/2011

29

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[201200] Notes - Employee benefits

Disclosure of defined benefit plans [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Defined benefit plans [Axis] Defined benefit plans [Member] Domestic defined benefit plans [Member]

01/04/2011 to 31/03/2012 Disclosure of defined benefit plans [Abstract] Disclosure of defined benefit plans [LineItems] Description of type of plan Reconciliation of changes in present value of defined benefit obligation [Abstract] Changes in defined benefit obligation, at present value [Abstract] Increase (decrease) through current service cost, defined benefit obligation, at present value Increase (decrease) through interest cost, defined benefit obligation, at present value Amalgamations, defined benefit obligation, at present value Increase (decrease) through actuarial losses (gains), defined benefit obligation, at present value Contributions by plan participants, defined benefit obligation, at present value Decrease through benefits paid, defined benefit obligation, at present value Increase (decrease) through past service cost, defined benefit obligation, at present value Increase (decrease) through curtailments, defined benefit obligation, at present value Increase (decrease) through settlements, defined benefit obligation, at present value Increase (decrease) through net exchange differences, defined benefit obligation, at present value Total changes in defined benefit obligation, at present value Defined benefit obligation, at present value at end of period Reconciliation of changes in fair value of plan assets [Abstract] Changes in plan assets, at fair value [Abstract] Increase (decrease) through actuarial gains (losses), plan assets, at fair value Amalgamations, plan assets, at fair value Increase (decrease) through expected return, plan assets, at fair value Decrease through benefits paid, plan assets, at fair value Increase (decrease) through contributions by plan participants, plan assets, at fair value Increase (decrease) through contributions by employer, plan assets, at fair value

01/04/2010 to 31/03/2011

01/04/2011 to 31/03/2012

01/04/2010 to 31/03/2011

Gratuity

Gratuity

Gratuity

Gratuity

37,40,677

65,43,934

37,40,677

65,43,934

19,48,080 0 40,96,225

16,46,618 0 24,50,930

19,48,080 0 40,96,225

16,46,618 0 24,50,930

0 47,97,236 0

0 27,80,034 0

0 47,97,236 0

0 27,80,034 0

0 -32,04,704 1,97,13,884

0 29,59,588 2,29,18,588

0 -32,04,704 1,97,13,884

0 29,59,588 2,29,18,588

25,872 0 15,44,173 47,97,236

1,19,638 0 14,18,640 27,80,034

25,872 0 15,44,173 47,97,236

1,19,638 0 14,18,640 27,80,034

42,01,344

22,26,000

42,01,344

22,26,000

30

VLCC HEALTH CARE LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012