Professional Documents

Culture Documents

Chapter No 4

Uploaded by

jansami22Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter No 4

Uploaded by

jansami22Copyright:

Available Formats

CHAPTER NO# 04 DEPARTMENTALIZATION

Like every bank, HBL also has divided its functions into different departments in every branch to carryout the activities on proper way. Following are the common departments. 1. . ". $. %. '. Deposit Department. !ash department. #emittances department. !ollection cell, clearing department. &ccounts department. Foreign e(change department

4.1

DEPOSIT DEPARTMENT

)very bank performs two basic functions one is accepting deposits and the other are lending of money, deposit department performs the function of accepting deposits from the customers. 5.1.1 Account Opening P oce!u e

*he banking history is repeated with various incorrect opening of account+ therefore, the branch manager and other office had to take care and e(ercised re,uired precautions at the time of opening of account. &t the time of opening of account officers and manager should fact fully obtain as much information as possible about the character and integrity of the person- His.her correct name, address and occupation. *his infact will be the only opportunity when they will be able to tack to Internship Report on Habib Bank Limited $

prospective customer in the friendly and frank atmosphere. *he customer can be classified as follows. /ndividuals. 0artnership Firms. 1oint 2tock !ompany. &gents. !lubs. 2ocieties and &ssociations. )(ecutive and &dministrators. *rust, local bodies etc. For opening of account the person should meet the following re,uirements. He.she should be a ma3or one. He.she should have attained the age of 14 and having allotted 5/! 5o. He.she should be a same person i.e. he.she should understand the term and conditions of the contract. He.she must not be a bankrupt and his.her liabilities should not e(ceed than that of the assets declared by him.her.

4."

CLASSI#ICAITON O# DEPOSITS

Deposits can be classified in the following. !urrent deposits. 0L2 deposits. *erm deposits. A. Cu ent Depo$it$ %

Internship Report on Habib Bank Limited

*hese are those kinds of deposits which are not remunerative in nature i.e. no profit is given on these deposits. *here is no limit on withdrawal within the banking hours customer can present number of che,ues. )very type of customer meeting the conditions of amount opening can open this account. 6sually businessmen and organi7ation opens such accounts. %. PLS Depo$it$ &P o'it (n! Lo$$ S)( ing*

*hese accounts are introduced as a step to /slamabad of banking in 1anuary 184 . *hese accounts are opened on the basis of profit and loss sharing between two parties. *he types of deposits were started to inoculate the habit of saving among people. *hese are called remunerative deposits i.e. profit paying to these account holders profit is paid. *his kind of account is opened by people with lower incomes to secure their money and get profit on it too bank sends statements for such accounts after ' months. C. Te + Depo$it$

*erm deposits or fi(ed deposits are the deposits in which the deposits is kept for a specific time period, depending upon the nature of the scheme, and the customer gets profit on his deposit. /n HBL there are various kinds of term deposit schemes ranging from a week to % years and above. *he greater the period of deposit, the more is the profit for customers.

4.,

CASH DEPARTMENT

!ash department performs the important functions of receiving the money and payment of money receipts to customers from their deposits. 4.,.1 Receipt$

Internship Report on Habib Bank Limited

'

*he money which comes to the bank, it is recorded by cash department. *he deposits of all customers of the bank are controlled by means of ledger account. )very, customer has its own ledger account and have separate ledger cards. 4.,." P(-+ent$

/t is a banker9s primary contract to repay money received for his customer9s account usually by honoring his che,ues. 4.,., C)e.ue

:!he,ue is a bill of e(change drawn on a specified banker and not e(pressed to be payable otherwise then on demand.; /in!$ o' C)e.ue i. %e( e C)e.ue0

/t is cashable at the counter this che,ue can also be collected through clearing ii. O !e C)e.ue0

/t is also cashable on the counter but its holder must satisfy the banker that the proper man to collect the payment of the che,ue and he has to show his identity through an account holder of the bank. /t can also be collected through clearing. iii. C o$$ C)e.ue0

/t is not cashable on the counter+ it can only be credited to the payee9s account. I$$uing ( C)e.ue %oo1 *he second main function of account opening department is to issue the che,ue books. <hen a customer applies for a new che,ue books, he.she has to present the che,ue book issuing re,uisition slip with his.her two signatures to the officer concerned, the officer will verify the signature and after the verification of signature che,ue book will be issued. Internship Report on Habib Bank Limited =

4.4

REMITTANCES DEPARTMENT

/t is a mode of transferring money from one branch to another branch within the city.outside the city or outside the country. /t is an order by a bank to its branch agent or correspondent in a foreign centre. /t is an order to pay a specified sum of money to the person named in the instrument. /t is sends by surface mail or airmail. /f the customer is an account holder of bank, then the bank will debit his account. *he concerned officer will fill three forms to make the mail transfer complete. *hree forms used for this purpose are listed below> Debit ?oucher!redit ?oucher @ail *ransfer #egister

/f the customer is not the account holder of the bank, firstly he has to deposit money and then above said procedure will be adopted to transfer his money. Te2eg (p)ic T (n$'e o TT <ith the changing re,uirement of today, the HBL has introduced the fastest transfer of money i.e. *elegraphic *ransfer. /t may be issued to general public on their written re,uest and against the value received. /n case of telegraphic transfer insurrections regarding payment are sent to the drawee branch telegraphically i.e. the order to pay is sent by cable. *hese telegrams which authori7e payment to the payee should be sent to the drawee branch in a coded language and under confidential number known as :test number;. /t should also be kept in mind that the test number is only means authentically payment instructions and corresponds with the signatures of authori7ed officers on a demand draft. &s such the telegrams should be prefi(ed with a correct test number or the code words for the same. *he advice may be enter into the drawee account. *here are two types of advises, one is the advice and credit and other is the advice and pay. /n first case the account Internship Report on Habib Bank Limited 4

number should be known and in latter case there is no importance of account number. *.*., rate is always higher than @.*. rate. De+(n! D ('t o D.D Demand Draft AD.DB is another way of transfer of money from one back to another bank. /t is a written order, drawn by one office AbranchB of a bank upon another office AbranchB of the same bank, to pay a certain sum of money to or to the order of a specific person. Drafts are not issued, or drawn on branches situated within the same society. & person, who wants to remit money by drafts, pays the money and commission to the local banker and obtains the draft. *his is sent to the other party by posts that will cash it by presenting it to this bank. 2o it is 3ust like a che,ue and is also issued when the customer wants to take the drafts personally. *he idea behind it is that as the cash is not safe to be kept along and a che,ue in the shape of a draft is safer and one can easily get cash by presenting it in the bank, one whose favor it has been made. H%L !e(2$ in t3o t-pe$ o' DDS0 1. Open DD. /t is one which is payable directly at the counter and there is no need of crediting it to the account. . C o$$ing DD. /t is one which payment is done through account. *he amount of DD is credited to the favoring account and then he can transact in ordinary way through che,ue.

P(- O !e 0ay Crder or A0.CB is the most convenient, simple and secure way of transfer of money. /t is used for local transfer only. & pay order is a written order issued by a bank or its branch, drawn upon and payable by itself. *o pay a specified sum of money to or to the order of a person. Internship Report on Habib Bank Limited 8

4.5

ACCO4NTS DEPARTMENT

*he function of &ccount Department is to post daily activities of each and every section. )very department is sending the detailed report of daily progress to the &ccount Department for posting the same in the cash book, also allowed the clean cash register. *he transaction then will be shifted to their appropriate heads. &ccounts department deals in two types of registers> (* 5* Inco+e Le!ge 0 E6pen$e$ Le!ge 0

/n income ledger the transactions relating to the income of the bank are to be posted, like commission from parties remittances etc. all the development e(penses of the bank including salary e(penses of the staff, rent e(penses etc. are to be posted in the e(penses ledger. &ccounts department also maintains the deposits, and as prepares the weekly and daily statement of the affairs of the branch. /t is 3ust like a balance sheet.

4.7

AD8ANCES DEPARTMENT

*his department deals with all the advances, which are made to the customers. &dvances are important for banking business, because it gives bank the profit. HBL is also very active in advancing loans to customers, thus helping the economy of the country in its development. /t provides the following finances.

A.

De+(n! #in(nce

Demand finance is one of the longDterm loans and is allow against the fi(ed assets. /t can also be short term. 6sually businessmen avail this facility for the purchase of machinery E other installations. *his finance is also given to trader and also for commercial loaning and it is give by against by working capital and fi(ed assets. *his facility is also avail by personnel working in the government organi7ations and Internship Report on Habib Bank Limited "F

allowing them according to his capacity, his salary. #epayment schedule is differing for different periods. %. Running #in(nce

HBL gives the facility of drawing more then the balance to the reliable and established customer by over drafting we mean that drawing more than the balance held with HBL. &fter over drafting the bank will show debt balance of the customer, and will charge interest on the amount over drawn. C. C($) #in(nce

!ash finance is also called working capital. /t is shortDterm loan. *his finance is purely for manufacturing concerns. /n this, bank lends money to the borrowers against the tangible security. *he total amount of loan, which is given, is not paid in one installment. *he borrowers have to pay interest on the amount borrowed. !ash credit is the favorite loan of the large commercial and industrial concerns, one account that the customer need not borrow at once, the whole amount he is likely to re,uire, but can draw such amount as and re,uired. !ash finance is obtained either the hypothecation or pledge. Pecu2i( itie$ o' H-pot)ec(tion0 !ustody of the stock remains with the customer. Bank lien on the stock. 2tock hypothecated must be issued against fire etc. !ustomer. party must submit the stock report on monthly basis. Fre,uent stock verification may be made at the branch. Bank may send officers or staff for supervise verification. Pecu2i( itie$ o' p2e!ge0 2tock.goods are pledges with bank under bank lock and key. Internship Report on Habib Bank Limited "1

Good.stock must be duly insured against fire and burglary. Cn monthly basis stock report has to be prepared by borrower.HBL, duly incorporated delivery of goods if any during month. Delivery of goods is made against cash payments. D. Ag icu2tu e #in(nce

&griculture is the bank bone of our economy+ HBL also provides credit facilities to this segment of economy. HBL provides two types of loans to the agriculture9s. i. P o!uction Lo(n DD which is short term loan and is for the purpose of purchasing of seeds, fertili7ers etc. ii. De9e2op+ent Lo(n :: which is for the purpose of development of land or purchase of machinery etc, related with the agriculture. E. St('' #in(nce

HBL is also serving its employees along with serving the customers. /t gives loans to its employees for the purpose of cars, building of houses, motor cycles, for the marriages of the sons. daughters of the employees.

#.

P oce!u e o' App2-ing 'o #in(nce$

&ny customer who applies for finances should have an account Ausually current accountB with HBL branch concerned, and it will be in running position. First of all the company should to submit the feasibility report which is sent to the high authority for recommendation, the authority prepare its own feasibility report of the company and then hand over to the sanction authority which make approval that whether the finance is released or not.

Internship Report on Habib Bank Limited

"

<hen approval comes, bank gives terms and conditions to the party. Bank does not advance 1FF% finance a security. #ather H "FI margin is dedicated from all finances. Docu+ent(tion0 Facility Letter Demand 0romissory 5ote Letter of Hypothecation A1 B %B Letter of pledge A1 B 'B ),uitable @ortgage A1 b $B Letter of Guarantee A1 B 8B &greement of Finance A1B' &D!B Letter Cf Lien A1 B 4B Letter of *# A 1 B =B Letter of L.! opening A1 B 4B ).@, legal mortgage A1B $B &greement Deed

!harge form is taken from party if it turns bankrupt+ bank can go to court of law then these agreements helps.

4.;

#OREI<N E=CHAN<E DEPARTMENT

Foreign e(change department plays a vital role in the international trade of any country. Be reali7ing so, HBL has also concentrated and improved well it foreign e(change operations as for the efficiency of its employees and customers+ satisfaction is concerned. HBL foreign e(change department performs following function. Foreign !urrency &ccounts. #emittances in foreign e(change. Deals in purchase of 6.2. Dollar bonds. Internship Report on Habib Bank Limited ""

A.

#o eign Cu enc- Account$ ma3or currencies of the world. /.e. 62

Foreign currency in HBL can be opened in

Dollar E 6J 0ound 2terling. Cnly authori7ed branches of HBL can deal in foreign currency account. &t present in 0akistan many branches have this facility. Foreign currency account can be opened both the 0akistan !iti7en and foreigners by introduction and following the procedure re,uired for general accounts with one e(ception for foreigner that they will submit a copy of their passport. *he account may be personal or 3oint. H%L 'o eign cu enc- (ccount$ $i2ent 'e(tu e$0 T-pe$ iB iiB 2aving !urrent

Cu encie$0 aB bB 62 Dollar 0ound 2terling

>)o c(n open t)e$e (ccount$? aB bB cB dB eB &ll resident 0akistanis &ll nonDresident 0akistanis Foreign companies !haritable trusts #esident companies locally incorporated "$

Internship Report on Habib Bank Limited

Mini+u+ A+ount o' Depo$it0 aB bB %. 62 Dollar 0ound 2terling 1FFF %FF

Re+itt(nce$ in #o eign E6c)(nge

&s we know that the money of one country is not legal tender in foreign counters. *he monitory device which has been evolved for all international payments is the foreign e(change from the e(porter and other who have it for sale and sell the foreign currency to the importers and other who need it in their own counters. *he international payment is effected by a transfer from a bank account in the debtor9s country to the creditor9s country. *wo branches of same bank or of different bank involve in foreign remittance. Cne is called remitting branch or bank the other is called receiving branch or bank. /n foreign currency 2B0 has given general permission to authori7ed dealers in foreign e(change including HBL, to affect remittances for specific purposes without referring to it A2B0B for specific, i.e. remittance on account of education subscription, books and periodicals of technical nature. Foreign *elegraphic *ransfer. Foreign mail *ransfer Foreign Demand Draft C. 4S Speci(2 Do22( %on!$

HBL foreign e(change department also performs the selling of 62 govt. special dollar bonds as in accordance with the direction of 2B0. *he bank gives profit in increase then the profit increased by the bonds. D. #o eign Out >( ! Re+itt(nce$ "%

Internship Report on Habib Bank Limited

/t is the mode of transfer funds to other branches of the bank outside the country. *he F.D.D. resaved from our overseas branches i.e. only 6nited Jingdom A6.JB, 2ingapore, 6nited 2tates A62&B etc, are collected and encasement is made at counter after proper identification form national identify card or passport in this department. E. #o eign Te2eg (p)ic T (n$'e &#.T.T*0

/n normal banking for this the work F.*.*. is used. /n this case no physical instrument is used and message is sent to the test department where coding and decoding of figure data is done which is known as test number and under this specific number the massage conveyed to foreign bank through tele(.telegram.

Internship Report on Habib Bank Limited

"'

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Final-Sarfaesi Act 2002Document41 pagesFinal-Sarfaesi Act 2002ninpra50% (2)

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- SME LoanDocument42 pagesSME LoanRafidul IslamNo ratings yet

- U.S. Bankrupt Since 1933/martial Law Has Been Since ThenDocument7 pagesU.S. Bankrupt Since 1933/martial Law Has Been Since Thenrtwingnutjob6421No ratings yet

- Risk Management in BankingDocument56 pagesRisk Management in Bankingthulli06No ratings yet

- Organization Behaviour NotesDocument35 pagesOrganization Behaviour Notesjansami22100% (1)

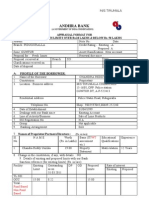

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDocument9 pagesAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamNo ratings yet

- DocumentationDocument36 pagesDocumentationRamesh BethaNo ratings yet

- True Credits loan approval letter summarizedDocument17 pagesTrue Credits loan approval letter summarizedSrinivasu Chintala100% (1)

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Strategic Management NotesDocument135 pagesStrategic Management Notesjansami22No ratings yet

- Chapter No 3Document7 pagesChapter No 3jansami22No ratings yet

- Chapter No 2Document12 pagesChapter No 2jansami22No ratings yet

- Chapter No # 01 Introduction To The Report: 1.1 Background of StudyDocument3 pagesChapter No # 01 Introduction To The Report: 1.1 Background of Studyjansami22No ratings yet

- Bibliography: BooksDocument1 pageBibliography: Booksjansami22No ratings yet

- A Knowledge MentDocument1 pageA Knowledge Mentjansami22No ratings yet

- Approval SheetDocument2 pagesApproval Sheetjansami22No ratings yet

- Internship CertificateDocument1 pageInternship Certificatejansami22No ratings yet

- OPM Final LAST PDFDocument183 pagesOPM Final LAST PDFPiku ChattaniNo ratings yet

- Doucmentation Manual of Bank PDFDocument518 pagesDoucmentation Manual of Bank PDFSamsul ArfinNo ratings yet

- Jasco Paper Products Credit ProposalDocument12 pagesJasco Paper Products Credit ProposaldanishsamdaniNo ratings yet

- CORP SCHEMES AT A GLANCE SUMMARYDocument8 pagesCORP SCHEMES AT A GLANCE SUMMARYsubodhNo ratings yet

- Bangladesh Krishi Bank Order, 1973Document23 pagesBangladesh Krishi Bank Order, 1973BokulNo ratings yet

- Stock Audit Manual: Gevaria & AssociatesDocument7 pagesStock Audit Manual: Gevaria & AssociatesparthNo ratings yet

- HBL Internship Report SummaryDocument76 pagesHBL Internship Report Summaryasim106No ratings yet

- Agri Business Products & Schemes GuideDocument258 pagesAgri Business Products & Schemes GuideAmit KkalyanNo ratings yet

- Sandipani Dec2017Document158 pagesSandipani Dec2017Nirmal RajNo ratings yet

- NSDL NotesDocument14 pagesNSDL NotesAnmol RahangdaleNo ratings yet

- Stock Statement by BorrowerDocument4 pagesStock Statement by BorrowerDiksha GangwaniNo ratings yet

- Bank LendingDocument32 pagesBank LendingFRANCIS JOSEPHNo ratings yet

- MSME SchemesDocument53 pagesMSME SchemesKalyani BorkarNo ratings yet

- BOM Agri LoanDocument21 pagesBOM Agri LoanPragatiNo ratings yet

- SBI Files CIRP Against Corporate GuarantorDocument15 pagesSBI Files CIRP Against Corporate GuarantorkaranNo ratings yet

- Multiple Choice Questions On Agriculture AdvancesDocument5 pagesMultiple Choice Questions On Agriculture Advancesmushtaque61100% (2)

- EBL FinalDocument31 pagesEBL FinalAbdul KaderNo ratings yet

- Loan Agreement SummaryDocument31 pagesLoan Agreement SummaryVenkat KakunuriNo ratings yet

- Ac OpeningDocument47 pagesAc OpeningKawoser AhammadNo ratings yet