Professional Documents

Culture Documents

Parenting Fit Matrix

Uploaded by

SuzZette TianzonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Parenting Fit Matrix

Uploaded by

SuzZette TianzonCopyright:

Available Formats

Tianzon, Suzzette M.

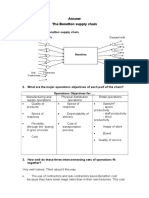

BSA-4 Assignment in Business Policy September 18, 2013 Parenting Fit Matrix Parenting Fit Matrix summarizes the various judgments regarding corporate/business unit fit for the corporation as a whole. This matrix emphasizes their fit with the Corporate parent Fit. Matrix composed of 2 dimensions : Positive contributions Negative effects Positive contributions that the parent can make and the negative effects the parent can make. 2 dimensions create 5 different positions Heartland Businesses: Should be at the heart of the corporations future have opportunities for improvement by the parent, and the parent understands their critical success factors well. Heartland Businesses should be at the heart of the corporations future. These Heartland Businesses have opportunities for improvement by the parent, and the parent understands their critical success factors well. These businesses should have priority for all corporate activities Heartlandbusinesses have improvement opportunities that the parent is well-suited to exploit. Furthermore, they are sufficiently well-understood that the parent does not inadvertently destroy value through other areas of misfit or unsuitable influence. Heartland businesses, as their name implies, should be at the heart of the corporate strategy and of acquisition activity. It is these businesses that will benefit most from inclusion in the group, and the parent should focus its attention on them. Edge-of-Heartland Businesses: In these businesses some parenting characteristics fit the business, but other do not. The parent may not have all the characteristics needed by a unit, or the parent may not really understand all of the units strategic factors. E.g.: When Cooper Industries acquired Champion, the sparkplug company, it judged Champion to have many of the characteristics of its traditional heartland and to offer many of the same improvement opportunities. But Champion also involved some ceramics technology that was unfamiliar ground for Cooper, and it had a much more international spread than Coopers previous acquisitions. It was therefore outside the heartland proper. Parents must work actively to learn about edge-of heartland businesses and try to bring them into the heartland as soon as possible.

Ballast Businesses: Ballast Businesses fit very comfortably with the parent corporation but contain very few opportunities to be improved by the parent. Like cash cows may be important sources of stability and earnings. But if environmental changes, ballast could move to alien territory. Therefore corporate decision makers should consider divesting this unit as soon as they can get a price that exceeds the expected value of future cash flows. E.g.: IBMs mainframe business Alien Territory Businesses: Alien Territory Businesses have little opportunities to be improved by the corporate parent, and a misfit exists between the parenting characteristics and the units strategic factors. There is little potential for value creation but high potential for value destruction on the part of the parent. The corporation must divest this unit while it still has value. Alien territory businesses are not well understood by the parent, have few improvement opportunities that the parent can address, and are likely to be damaged by some misfit with the parents characteristics. E.g.: The parent may apply a complex planning process or sophisticated linkage mechanism to a business that is largely independent and too small to bear the overhead burden or to suffer the opportunity cost of losing its managers to head office meetings. Alien territory businesses should clearly be candidates for rapid divestment. Even if they are currently profitable, the influence of the parent will reduce their value over time. Value Trap Businesses: Value Trap Businesses fit well with parenting opportunities, but they are a misfit with the parents understanding of the units CSF. This is where the corporate headquarters can make its biggest error. It mistakes what it sees as opportunities for ways to improve the business units profitability or competitive position. E.g.: To make the unit a world-class manufacturer (because the parent has world-class manufacturing skills) it may not notice that the unit is primarily successful because of its unique product development and niche marketing expertise

You might also like

- Presentation On Parenting-Fit MatrixDocument9 pagesPresentation On Parenting-Fit MatrixSantanu Dutta100% (1)

- ACC Cement SM Group Project XMBA 24Document30 pagesACC Cement SM Group Project XMBA 24XMBA 24 ITM Vashi86% (7)

- Case Study - Law KingDocument5 pagesCase Study - Law KingPavi Antoni Villaceran100% (1)

- SM Internal Analysis 1 - 3Document53 pagesSM Internal Analysis 1 - 3ngocyen_xitrum100% (1)

- BCG Consultant Application LetterDocument1 pageBCG Consultant Application LetterAnton PermanaNo ratings yet

- Itc PorterDocument7 pagesItc PorterRajat Sharma50% (2)

- WACC Calculations (With Solution)Document8 pagesWACC Calculations (With Solution)Shreyans GirathNo ratings yet

- Aditya Birla Group - BPSM For MbaDocument27 pagesAditya Birla Group - BPSM For Mbasagar77_l86% (7)

- Bunge LTDDocument6 pagesBunge LTDAbhishek SinghNo ratings yet

- Strategic Marketing AmulDocument34 pagesStrategic Marketing AmulSadaf Khan50% (2)

- Assignment 3. KodakDocument9 pagesAssignment 3. KodakSrabon AhmedNo ratings yet

- Oreo's Strategy to Strengthen its Position against Competitors in the Premium Indian Biscuit MarketDocument7 pagesOreo's Strategy to Strengthen its Position against Competitors in the Premium Indian Biscuit MarketDerek TohNo ratings yet

- Assig13 - BCG MATRIX - NESTLE-Team 3Document6 pagesAssig13 - BCG MATRIX - NESTLE-Team 3medha surNo ratings yet

- Defining Marketing ConceptsDocument25 pagesDefining Marketing ConceptsHamza AsifNo ratings yet

- CocaDocument3 pagesCocaabhishek_gandhi_8No ratings yet

- Coca Cola: A Presentation On OperationsDocument15 pagesCoca Cola: A Presentation On OperationssinsmitaNo ratings yet

- Limitations of Capital BudgetingDocument2 pagesLimitations of Capital BudgetingLJBernardoNo ratings yet

- Case Study 1 - Metro Stations To Be Renamed in The City of JaipurDocument3 pagesCase Study 1 - Metro Stations To Be Renamed in The City of JaipurYEDU JBNo ratings yet

- Chai PointDocument5 pagesChai PointSARGAM JAINNo ratings yet

- Ch13 Case1 ADocument2 pagesCh13 Case1 AVandana Aggarwal100% (1)

- Strategic Brand Management: Chapter NineDocument180 pagesStrategic Brand Management: Chapter NineSilfa nidi FahiraNo ratings yet

- Final PPT Brand ValuationDocument26 pagesFinal PPT Brand ValuationPradeep Choudhary50% (2)

- Policy, Strategy, Tactics and BCPDocument36 pagesPolicy, Strategy, Tactics and BCPKaruna ShresthaNo ratings yet

- ITC Ltd Strategy AnalysisDocument6 pagesITC Ltd Strategy AnalysisMukul GargNo ratings yet

- Merger & Acquisition of ICICI With ICICI BankDocument11 pagesMerger & Acquisition of ICICI With ICICI BankAbhishek RathodNo ratings yet

- Chocolate - Case StudyDocument4 pagesChocolate - Case Studyamitkuls0% (1)

- Revenue Management in SCMDocument8 pagesRevenue Management in SCMNiranjan ThirNo ratings yet

- A1 RentYourFashion (D) MRDocument3 pagesA1 RentYourFashion (D) MRHitesh TejwaniNo ratings yet

- International Equity Placement Strategic Alliances: Case at IndosatDocument26 pagesInternational Equity Placement Strategic Alliances: Case at IndosatFez Research Laboratory100% (1)

- Managing a Sustainable Supply Chain at Birla TyresDocument9 pagesManaging a Sustainable Supply Chain at Birla TyresSHIVAM CHUGHNo ratings yet

- Marketing Strategies by Pepsico RetailersDocument60 pagesMarketing Strategies by Pepsico RetailersVijayNo ratings yet

- Product Decision All ChapterDocument58 pagesProduct Decision All ChapterAseem183% (6)

- PRODUCT LEVEL OF KITKAT (Priciples of Marketing)Document8 pagesPRODUCT LEVEL OF KITKAT (Priciples of Marketing)Rahul TambiNo ratings yet

- Social Responsibility and Ethics in Strategic ManagementDocument29 pagesSocial Responsibility and Ethics in Strategic ManagementSanthiya MogenNo ratings yet

- MM5015 Business Initiation Mid Term Exam: Case AnalysisDocument5 pagesMM5015 Business Initiation Mid Term Exam: Case AnalysisSelina AstiriNo ratings yet

- Point of ParityDocument13 pagesPoint of Parityshaiki32No ratings yet

- Swot Nirmal BangDocument3 pagesSwot Nirmal BangFaiz Ali100% (2)

- Company Case ArgosDocument5 pagesCompany Case ArgosssclhtNo ratings yet

- Tiga Pilar Sejahtera & Pelindo AnalysisDocument3 pagesTiga Pilar Sejahtera & Pelindo AnalysisridaNo ratings yet

- Improve Dabur's Supply Chain and Reduce InventoryDocument1 pageImprove Dabur's Supply Chain and Reduce Inventorysukumaran321No ratings yet

- Operations Management BTT..315: Term PaperDocument5 pagesOperations Management BTT..315: Term PaperDouglas Kipkurui Chumba80% (5)

- 19e Section6 LN Chapter09Document10 pages19e Section6 LN Chapter09benbenchenNo ratings yet

- OMDocument27 pagesOMAmmara NawazNo ratings yet

- PLC Model of Kit Kat Caramel CrunchyDocument6 pagesPLC Model of Kit Kat Caramel CrunchyJunaid YNo ratings yet

- Case-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Document6 pagesCase-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Anirban KarNo ratings yet

- Mergers and AcquisitionDocument38 pagesMergers and AcquisitionRajesh WariseNo ratings yet

- Vaishak - AmulDocument22 pagesVaishak - AmulVaishak Nair75% (4)

- Asianpaints Group5Document27 pagesAsianpaints Group5Prabhu Murugaraj100% (1)

- Strengths in The SWOT Analysis of Berger PaintsDocument9 pagesStrengths in The SWOT Analysis of Berger Paintsaditya100% (1)

- Strategy Implementation at RomeroDocument4 pagesStrategy Implementation at Romerosushanthabhishek100% (1)

- BI Software at SYSCODocument21 pagesBI Software at SYSCOBala Chandran M K92% (13)

- Alphatech India LimitedDocument8 pagesAlphatech India LimitedArun Ahlawat50% (2)

- ConclusionDocument3 pagesConclusionHoney AliNo ratings yet

- IHCL (Indian Hotels Company LTD.) : Performance Measurement Through Ratio AnalysisDocument29 pagesIHCL (Indian Hotels Company LTD.) : Performance Measurement Through Ratio AnalysisJalaj VLNo ratings yet

- Indian Business Environment IntroductionDocument42 pagesIndian Business Environment Introductionsamrulezzz75% (4)

- 7 Negotiation and PartneringDocument22 pages7 Negotiation and PartneringWishnu SeptiyanaNo ratings yet

- Corporate Parenting AnalysisDocument2 pagesCorporate Parenting AnalysisEric PottsNo ratings yet

- The Parenting Matrix Sum UpDocument2 pagesThe Parenting Matrix Sum Upilikesummer1234No ratings yet

- Corporate Strategy - The Quest For Parenting AdvantageDocument3 pagesCorporate Strategy - The Quest For Parenting Advantagehakiki_nNo ratings yet

- Stretegic ManagementDocument7 pagesStretegic ManagementArfah NaquieyahNo ratings yet

- Decentralized AccountingDocument1 pageDecentralized AccountingSuzZette TianzonNo ratings yet

- Decentralized AccountingDocument1 pageDecentralized AccountingSuzZette TianzonNo ratings yet

- Decentralized AccountingDocument1 pageDecentralized AccountingSuzZette TianzonNo ratings yet

- A Case Study - JK CementDocument6 pagesA Case Study - JK CementSuzZette TianzonNo ratings yet

- Engagement Letter 001Document3 pagesEngagement Letter 001SuzZette TianzonNo ratings yet

- Engagement Letter 001Document3 pagesEngagement Letter 001SuzZette TianzonNo ratings yet

- C FL Fort Lauderdale 1991 Preschool Executive SummaryDocument6 pagesC FL Fort Lauderdale 1991 Preschool Executive SummarySuzZette TianzonNo ratings yet

- ObjectivesDocument3 pagesObjectivesSuzZette TianzonNo ratings yet

- Music Quiz QuestionsDocument29 pagesMusic Quiz QuestionsSuzZette Tianzon100% (1)

- Cash Collection ProceduresDocument6 pagesCash Collection ProceduresSuzZette TianzonNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- Special Education Needs in The Pre School Sector Executive SummaryDocument15 pagesSpecial Education Needs in The Pre School Sector Executive SummarySuzZette TianzonNo ratings yet

- C FL Fort Lauderdale 1991 Preschool Executive SummaryDocument6 pagesC FL Fort Lauderdale 1991 Preschool Executive SummarySuzZette TianzonNo ratings yet

- Small BusinessDocument10 pagesSmall BusinessSuzZette TianzonNo ratings yet

- The Rámáyana of Tulsi Dás PDFDocument748 pagesThe Rámáyana of Tulsi Dás PDFParag SaxenaNo ratings yet

- STAFF SELECTION COMMISSION (SSC) - Department of Personnel & TrainingDocument3 pagesSTAFF SELECTION COMMISSION (SSC) - Department of Personnel & TrainingAmit SinsinwarNo ratings yet

- Types of Electronic CommerceDocument2 pagesTypes of Electronic CommerceVivek RajNo ratings yet

- Business and Transfer Taxation Chapter 11 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 11 Discussion Questions AnswerKarla Faye LagangNo ratings yet

- Property Accountant Manager in Kelowna BC Resume Frank OhlinDocument3 pagesProperty Accountant Manager in Kelowna BC Resume Frank OhlinFrankOhlinNo ratings yet

- Business LawDocument4 pagesBusiness LawMelissa Kayla ManiulitNo ratings yet

- NBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiDocument41 pagesNBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiCCMbasketNo ratings yet

- Solution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFDocument24 pagesSolution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFsusan.lemke155100% (11)

- Fs 6 Learning-EpisodesDocument11 pagesFs 6 Learning-EpisodesMichelleNo ratings yet

- Drought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanDocument16 pagesDrought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanLiban SwedenNo ratings yet

- Consent of Action by Directors in Lieu of Organizational MeetingsDocument22 pagesConsent of Action by Directors in Lieu of Organizational MeetingsDiego AntoliniNo ratings yet

- Summary of Kamban's RamayanaDocument4 pagesSummary of Kamban's RamayanaRaj VenugopalNo ratings yet

- Important PIC'sDocument1 pageImportant PIC'sAbhijit SahaNo ratings yet

- Aqua Golden Mississippi Tbk Company Report and Share Price AnalysisDocument3 pagesAqua Golden Mississippi Tbk Company Report and Share Price AnalysisJandri Zhen TomasoaNo ratings yet

- PSEA Self Assessment Form - 2024 02 02 102327 - YjloDocument2 pagesPSEA Self Assessment Form - 2024 02 02 102327 - Yjlokenedy nuwaherezaNo ratings yet

- A Student Guide To Energy PDFDocument1,320 pagesA Student Guide To Energy PDFravichan_2010100% (1)

- Anon (Herbert Irwin), Book of Magic Anon (Herbert Irwin), Book of MagicDocument15 pagesAnon (Herbert Irwin), Book of Magic Anon (Herbert Irwin), Book of MagicAmirNo ratings yet

- The Basketball Diaries by Jim CarollDocument22 pagesThe Basketball Diaries by Jim CarollEricvv64% (25)

- 8098 pt1Document385 pages8098 pt1Hotib PerwiraNo ratings yet

- ERA1209-001 Clarification About Points 18.4 and 18.5 of Annex I of Regulation 2018-545 PDFDocument10 pagesERA1209-001 Clarification About Points 18.4 and 18.5 of Annex I of Regulation 2018-545 PDFStan ValiNo ratings yet

- Introduction to Social Media AnalyticsDocument26 pagesIntroduction to Social Media AnalyticsDiksha TanejaNo ratings yet

- Connotation Words Reading Kelompok 3Document11 pagesConnotation Words Reading Kelompok 3Burhanudin Habib EffendiNo ratings yet

- Ombudsman Complaint - TolentinoDocument5 pagesOmbudsman Complaint - TolentinoReginaldo BucuNo ratings yet

- SAS HB 06 Weapons ID ch1 PDFDocument20 pagesSAS HB 06 Weapons ID ch1 PDFChris EfstathiouNo ratings yet

- Vista Print TaxInvoiceDocument2 pagesVista Print TaxInvoicebhageshlNo ratings yet

- Unique and Interactive EffectsDocument14 pagesUnique and Interactive EffectsbinepaNo ratings yet

- RAS MARKAZ CRUDE OIL PARK SITE INSPECTION PROCEDUREDocument1 pageRAS MARKAZ CRUDE OIL PARK SITE INSPECTION PROCEDUREANIL PLAMOOTTILNo ratings yet

- Principles of Administrative TheoryDocument261 pagesPrinciples of Administrative TheoryZabihullahRasidNo ratings yet

- Flowserve Corp Case StudyDocument3 pagesFlowserve Corp Case Studytexwan_No ratings yet

- Senate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesDocument83 pagesSenate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesScribd Government DocsNo ratings yet