Professional Documents

Culture Documents

ACC2001 Aug 2011 Practice Exam Questions

Uploaded by

Shin TanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC2001 Aug 2011 Practice Exam Questions

Uploaded by

Shin TanCopyright:

Available Formats

QUESTION 1 Born to Play, Inc., is a popular source of musical instruments for professional and amateur musicians.

The company's accountants make necessary adjusting entries monthly, and they make all closing entries annually. Born to Play is growing rapidly and prides itself on having no long-term liabilities. The company's year-end is 31 December and has provided the following unadjusted trial balance at 31December 2010: $ Cash Accounts receivable Allowance for doubtful accounts Inventory Office supplies Prepaid insurance Building and fixtures Accumulated depreciation Land Accounts payable Unearned customer deposits Income tax payable Share Capital Retained earnings Revaluation reserve (for land) Revenue Cost of goods sold Bank service charges Bad debts expense Salary expense Office supplies expense Insurance expense Utilities expense Depreciation expense Income tax expense Dr $45,000 125,000 250,000 1,200 6,600 1,791,000 800,000 89,800 70,000 8,000 75,000 1,000,000 240,200 6,000 1,600,000 958,000 200 9,000 395,000 400 6,400 3,600 48,000 75,000 3,804,200 Cr

$5,000

3,804,200

Additional information: 1. The company's most recent bank statement reports a balance of $46,975. Included with the bank statement was a $2,500 cheque from Sing Ding Ting, a professional musician, charged back to Born to Play as NSF. The bank's monthly service charge was $25. Three cheques written by Born to Play to suppliers of merchandise inventory had not been cleared by the bank for payment as at the statement date. These cheques included: no. 507, $4,000; no. 511, $9,000; and no. 521, $8,000. Deposits made by Born to Play of $16,500 had reached the bank too late for inclusion in the current statement. The company prepares a bank reconciliation at the end of each month. 2. During December, $6,400 of accounts receivable were written off as uncollectible. A recent aging of the company's accounts receivable helped management to conclude that an allowance for doubtful accounts of $8,500 was needed at 31 December 2010.

-2ACC1002 __________________________________________________________________________ 3. The company uses a perpetual inventory system. A year-end physical count revealed that several guitars reported in the inventory records were missing. The cost of the missing units amounted to $1,350. This amount is not considered significant relative to the total cost of inventory on hand. 4. At 31 December, approximately $900 in office supplies remained on hand. 5. The company pays for its insurance policies 12 months in advance. Its most recent payment was made on 1 November 2010. The cost of this policy was slightly higher than the cost of coverage for the previous 12 months. 6. Depreciation expense related to the company's building and fixtures is $5,000 for the month ending 31 December 2010. 7. Although Born to Play carries an extensive inventory, it is not uncommon for musicians to order custom guitars made to their exact specifications. Manufacturers do not allow any sales returns of custom-made guitars. Thus, all customers must pay in advance for these special orders. The entire sales amount is collected at the time a custom order is placed, and it is credited to an account entitled "Unearned Customer Deposits." As at 31 December, $4,800 of these deposits remained unearned. Assume that the cost of goods sold and the reduction in inventory associated with all custom orders is recorded when the custom merchandise is delivered to customers. Thus, the adjusting entry requires only a decrease to unearned customer deposits and an increase to revenue. 8. Accrued income tax payable for the entire year ending 31 December 2010 total $81,000. No income tax payments are due until early 2011. 9. Land is revalued to $92,300 on 31 December 2010. Required: a) Prepare all necessary journal entries as at 31 December 2010. Ignore closing entries. Dates and descriptions are not required.

b) Prepare the income statement for the year ended 31 December 2010. c) Prepare the classified statement of financial position (balance sheet) as at 31 December 2010.

-3ACC1002 __________________________________________________________________________ QUESTION 2 Note from Dr Winston Kwok: Will be similar to those articles you encountered as Critical Thinking questions in your tutorials. This is on a well-known company which was in the news recently and also mentioned during my lecture.

QUESTION 3 Following are selected balance sheet accounts of Winston Corp. at 31 December 2009 and 2008. Also presented are selected income statement information for the year ended 31 December 2009, and additional information. Selected Balance Sheet Accounts 2009 2008 ______________________________________________________________________ Assets Accounts receivable Property, plant, and equipment Accumulated depreciation Liabilities and Shareholders' Equity Notes payable Dividends payable Share capital-ordinary, no-par value Retained earnings

$ 34,000 277,000 (178,000)

$ 24,000 247,000 (167,000)

49,000 8,000 31,000 104,000

46,000 5,000 22,000 91,000

Selected Income Statement Information for the Year Ended 31 December 2009 ______________________________________________________________________ Sales revenue Depreciation Gain on sale of equipment Income before taxes Net income $ 155,000 33,000 13,000 40,000 28,000

Additional information: a. Accounts receivable relate to sales of merchandise. b. During 2009, equipment costing $40,000 was sold for cash. c. During 2009, $20,000 of notes payable were issued in exchange for property, plant, and equipment. Continued on next page

-4ACC1002 __________________________________________________________________________ Required: Items 1 through 5 represent activities that will be reported in Winston's statement of cash flows for the year ended 31 December 2009. For each item, write down: The $ amount that should be reported in Winston's 2009 statement of cash flows. The category in which the amount should be reported in the statement of cash flows. Write O for Operating activity, I for Investing activity, and F for Financing activity. If you think the item can be classified in more than one category, write down all the possible categories. $ Amount Category ______________________________________________________________________ 1. Cash collections from customers (direct method). _______ ______ ______ ______ ______ ______

2. Payments for purchase of property, plant, and equipment. _______ 3. Proceeds from sale of equipment. 4. Cash dividends paid. 5. Repayment or retirement of notes payable. _______ _______ _______

Note from Dr Winston Kwok: The above does not imply that only the direct method will be examined. Your final exam question may be on the direct or indirect method, or both.

You might also like

- ACCT 110 - Assignment - EBR DecDocument17 pagesACCT 110 - Assignment - EBR DecBen Noah EuroNo ratings yet

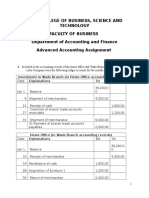

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- Assignment Accounting For BusinessDocument5 pagesAssignment Accounting For BusinessValencia CarolNo ratings yet

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- DL PT1Q F3 201301Document14 pagesDL PT1Q F3 201301MpuTitasNo ratings yet

- Accounting Textbook Solutions - 72Document19 pagesAccounting Textbook Solutions - 72acc-expertNo ratings yet

- Home Work 1Document2 pagesHome Work 1api-280585803No ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- 04 Altprob 7eDocument8 pages04 Altprob 7eHNo ratings yet

- Accounting Textbook Solutions - 19Document19 pagesAccounting Textbook Solutions - 19acc-expertNo ratings yet

- For CDEEDocument7 pagesFor CDEEmikiyas zeyedeNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- T1.Tutorials 1 Introduction To Fin STMDocument4 pagesT1.Tutorials 1 Introduction To Fin STMmohammad alawadhiNo ratings yet

- The Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkDocument4 pagesThe Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkRadithNo ratings yet

- Latihan MatrikulasiDocument4 pagesLatihan MatrikulasiD Ayu Hamama PitraNo ratings yet

- Ch1 5 1 6eDocument7 pagesCh1 5 1 6eswoop9No ratings yet

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- Que 01 12Document13 pagesQue 01 12Cosovliu RamonaNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- ICMA Questions Dec 2012Document55 pagesICMA Questions Dec 2012Asadul HoqueNo ratings yet

- Sample Midterm QuestionsDocument14 pagesSample Midterm QuestionsdoofwawdNo ratings yet

- Preparing Financial Statements: (International Stream)Document13 pagesPreparing Financial Statements: (International Stream)Jerahmeel JalalNo ratings yet

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocument4 pagesSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- Module Exam Financial Accounting Winter Term 20xy/xz Mock ExamDocument9 pagesModule Exam Financial Accounting Winter Term 20xy/xz Mock ExamShahid NaseemNo ratings yet

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- Cvcitc: College of Business and Accountancy Department of AccountancyDocument16 pagesCvcitc: College of Business and Accountancy Department of AccountancyjoyceNo ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- Fa 1 CompreDocument16 pagesFa 1 CompreTwainNo ratings yet

- Comprehensiveexam BDocument15 pagesComprehensiveexam BKayla Julian100% (2)

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- 123Document18 pages123Andrin LlemosNo ratings yet

- Income StatementDocument13 pagesIncome StatementThéotime HabinezaNo ratings yet

- 2017 Sem1 Final Revision QuestionsDocument4 pages2017 Sem1 Final Revision Questionsbrip selNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- Review Sessiokkbk 1 TEXTDocument6 pagesReview Sessiokkbk 1 TEXTMelissa WhiteNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- Cash Flow and InterpretationDocument9 pagesCash Flow and InterpretationPriya NairNo ratings yet

- Example Mid TermDocument7 pagesExample Mid TermvelusnNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- Accounting Chapter 3 William HakaDocument6 pagesAccounting Chapter 3 William HakaBilal AhmadNo ratings yet

- IA1 - Midterm ExamDocument25 pagesIA1 - Midterm ExamDaniella Mae ElipNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Facilitation Feedback Guide V5.2Document5 pagesFacilitation Feedback Guide V5.2Shin TanNo ratings yet

- MNO2009 - MNO Individual Assignment CaseDocument10 pagesMNO2009 - MNO Individual Assignment CaseShin TanNo ratings yet

- AHL - Annual Report 2019 PDFDocument111 pagesAHL - Annual Report 2019 PDFShin TanNo ratings yet

- Course Outline 2013Document13 pagesCourse Outline 2013lynruzNo ratings yet

- Test 1 A 14 ADocument9 pagesTest 1 A 14 AShin TanNo ratings yet

- Business As UsualDocument16 pagesBusiness As UsualShin TanNo ratings yet

- Lecture7 SocialCorpDocument39 pagesLecture7 SocialCorpShin TanNo ratings yet

- Ingredient List For RecipeDocument5 pagesIngredient List For RecipeShin TanNo ratings yet

- From Renter To OwnerDocument21 pagesFrom Renter To OwnerAllen & UnwinNo ratings yet

- 20092018090907893chapter18 RedemptionofPreferenceSharesDocument2 pages20092018090907893chapter18 RedemptionofPreferenceSharesAbdifatah SaidNo ratings yet

- Oracle HCM On Cloud NotesDocument9 pagesOracle HCM On Cloud Notesckambara4362No ratings yet

- 1.supply Chain Management 1&2Document56 pages1.supply Chain Management 1&2Abdul Hafeez0% (1)

- Customer Service ExampleDocument27 pagesCustomer Service ExampleSha EemNo ratings yet

- Kotler Mm15e Inppt 10Document20 pagesKotler Mm15e Inppt 10Wildan BagusNo ratings yet

- Why Average Cost Curve IsDocument2 pagesWhy Average Cost Curve IsHasinaImamNo ratings yet

- Raw Fury ContractDocument14 pagesRaw Fury ContractMichael Futter100% (1)

- Report PT Bukit Uluwatu Villa 30 September 2019Document146 pagesReport PT Bukit Uluwatu Villa 30 September 2019Hanif RaihanNo ratings yet

- BfinDocument3 pagesBfinjonisugandaNo ratings yet

- UNIBANKDocument9 pagesUNIBANKFidan S.No ratings yet

- Formation of The Shariah Supervisory CommitteeDocument3 pagesFormation of The Shariah Supervisory Committeeapi-303511479No ratings yet

- Worlducation Team Performance Plan: BSBTWK502 Manage Team EffectivenessDocument10 pagesWorlducation Team Performance Plan: BSBTWK502 Manage Team Effectivenessstar trendzNo ratings yet

- Eva Vs RoceDocument5 pagesEva Vs RoceNuno LouriselaNo ratings yet

- Bhavani. K - Pay Roll Management - Not SubmittedDocument52 pagesBhavani. K - Pay Roll Management - Not SubmittedLakshmi priya GNo ratings yet

- Infosys - Competitor AnalysisDocument2 pagesInfosys - Competitor AnalysisAkhilM100% (1)

- AS-Fill The Skill - 2Document2 pagesAS-Fill The Skill - 2Eema AminNo ratings yet

- MB0045 Financial ManagementDocument4 pagesMB0045 Financial ManagementAbhinav SrivastavaNo ratings yet

- Word DiorDocument3 pagesWord Diorlethiphuong15031999100% (1)

- XYZ Investing INC. Trial BalanceDocument3 pagesXYZ Investing INC. Trial BalanceLeika Gay Soriano OlarteNo ratings yet

- Summer Internship Project ReportDocument32 pagesSummer Internship Project ReportAbhilasha Singh33% (3)

- GARGAR - PARTNERSHIP DISSOLUTION - LongQuizDocument5 pagesGARGAR - PARTNERSHIP DISSOLUTION - LongQuizSarah GNo ratings yet

- MKT MGT - Sju - W1BDocument20 pagesMKT MGT - Sju - W1BCamelia MotocNo ratings yet

- Lecture 4 MCQs AnswersDocument3 pagesLecture 4 MCQs AnswersDeelan AppaNo ratings yet

- Task 1Document2 pagesTask 1Marina AlvesNo ratings yet

- Rohit Summer ProjectDocument12 pagesRohit Summer ProjectRohit YadavNo ratings yet

- Notice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-GujratDocument7 pagesNotice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-Gujratashim1No ratings yet

- Understanding Process Change Management in Electronic Health Record ImplementationsDocument35 pagesUnderstanding Process Change Management in Electronic Health Record ImplementationsssimukNo ratings yet

- Spyder Active Sports Case AnalysisDocument2 pagesSpyder Active Sports Case AnalysisSrikanth Kumar Konduri100% (3)

- Sales Inquiry FormDocument2 pagesSales Inquiry FormCrisant DemaalaNo ratings yet