Professional Documents

Culture Documents

Tax Reviewer by Gelle

Uploaded by

Muji JaafarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Reviewer by Gelle

Uploaded by

Muji JaafarCopyright:

Available Formats

CLASSIFICATION OF TAXES As to subject matter 1. Personal tax also known as capitalization or poll tax. 2.

. Property tax assessed on property of a certain class. 3. Excise tax imposed on the exercise of a privilege. 4. Custom duties duties charged upon commodities on being imported into or exported from a country !. Local taxes taxes levied by local government units pursuant to validly delegated power to tax As to burden 1. Direct tax incidence and impact of taxation fall to one person and cannot be shifted to another. 2. Indirect tax incidence and liability for the tax fall to one person but the burden thereof can be passed on to another. As to purpose 1. General taxes taxes levied for ordinary or general purpose of the government. 2. Special taxes levied for a special purpose. As to measure of application 1. Speci ic tax" tax imposed by the head or number or by some standard of weight or measurement. 2. Ad !alorem tax tax imposed upon the value of the article. As to rate: 1. Pro"ressi!e taxes rate increases as the tax base increases. 2. #e"ressi!e taxes rate increases as tax base decreases. $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ LI%ITATIONS ON T&E PO'E# TO TAX #. $%&'('%) *$+$)#)$,% proceeds from the very nature of the taxing power itself. )hey are otherwise known as .elements/characteristics of taxation0 1. 2,%-)$)3)$,%#* *$+$)#)$,%A( IN&E#ENT LI%ITATIONS 1. 2. 3. 4. !. Public 4urpose of taxes Non"delegability of the taxing power )erritoriality or situs of taxation )ax exemption of government and International comity (eferring to the 4?!6999.99 appropriation for the pro@ected feeder roads in 7uestion6 the legality thereof depended upon whether said roads were public or private property when the bill6 which6 latter on6 became (epublic #ct ;296 was passed by 2ongress6 or6 when said bill was approved by the 4resident and the disbursement of said sum became effective6 or on Aune 296 1;!3. $nasmuch as the land on which the pro@ected feeder roads were to be constructed belonged then to respondent =ulueta6 the result is that said appropriation sought a private purpose6 and hence6 was null and void. )he donation to the 8overnment6 over five B!C months after the approval and effectivity of said #ct6 made6 according to the petition6 for the purpose of giving a Dsemblance of legalityD6 or legalizing6 the appropriation in 7uestion6 did not cure its aforementioned basic defect. 2onse7uently6 a @udicial nullification of said donation need not precede the declaration of unconstitutionality of said appropriation. )he test of the constitutionality of a statute re7uiring the use of public funds is -4et4er t4e statute is desi"ned to promote t4e pu)lic interest5 as opposed to t4e urt4erance o t4e ad!anta"e o indi!iduals6 although each advantage to individuals might incidentally serve the public 1. 5hether the thing to be furthered by the appropriation of public revenue is something which is the duty of the state6 as a government6 to provide *duty+test, 2. 5hether the proceeds of the tax will directly promote the welfare of the community in e7ual measure. *promotion o "eneral -el are test, PASC.AL /S( SEC#ETA#0 OF P.1LIC 'O#2S 8.(. %o. *"1949! :ecember 2;6 1;<9 FACTS3 4etitioner 4ascual in his capacity as governor of (izal filed a declaratory relief regarding the appropriation of government funds to be used in the construction6 reconstruction and repair of feeder roads. &e alleged that the said property where the road is to be constructed is owned by -enator =ulueta. ! months after the effectivity of said tax law6 said property was donated to the government6 and was accepted by the same. )he trial court dismiss the petition on the ground that the appropriation was validated by the donation of the property to the government. ISS.E3 5hether or not the subse7uent donation of the property to the government rendered the tax law valid> #.LING3 %o6 the court stressed that the validity of a statute depends upon t4e po-ers o Con"ress at t4e time o its passa"e or appro!al 6 not upon events occurring6 or acts performed6 subse7uently thereto6 unless the latter consists of an amendment of the organic law6 removing6 with retrospective operation6 the constitutional limitation infringed by said statute.

1. 4ublic 4urpose of taxes Test in Determinin" Pu)lic Purpose

2. %on"delegability of the taxing power )he power of taxation is peculiarly and exclusively legislative. 2onse7uently6 the taxing power as a general rule may not be delegated. Non+dele"a)le Le"islati!e Po-er 1. selection of property to be taxed 2. determination of the purposes for which taxes shall be levied 3. fixing of the rate of taxation rules of taxation in general Dele"a)le Le"islati!e Po-er 1. #uthority of the 4resident to fix tariff rates6 import and export 7uotas *Art( /I5 Sec( 678695 :;7< Constitution,( 2. 4ower of local government units to tax sub@ect to limitations as may be provided by *ocal 8overnment 2ode *Art( X5 Sec( =5 :;7< Constitution,( 3. :elegation to #dministrative 1odies Tax Le"islation not delegable to administrative bodies refers to the elements that enter into the imposition of the followingE 1. the person6 property or occupation to be taxed 2. the amount or rate of the tax> 3. )he purpose for which taxes shall be levied Bpublic purposes onlyC 4. )he kind of tax to be collected !. )he apportionment of the tax Bgeneral or limited to a particular localityC <. )he situs of taxation and F. )he method of collection. Tax Administration administrative bodies collection unctions, delegable to *assessment and

3. 1usiness tax where business is conducted 4. Pri!ile"e or occupation tax where occupation is pursued !. Sales tax where transaction takes place <. #eal property tax where property is located F. Personal property tax tangible where it is physically located intangibleE sub@ect to -ec. 194 of 2)(4 and principle of mobilia se7uuntur personam ?. Income where income is earned or residence or citizenship of the taxpayer ;. Trans er tax residence or citizenship of the taxpayer or location of the property 19. Franc4ise tax -tate which granted the franchise 11. Tax on corporations and ot4er ?udicial entities law of incorporation. 4. )ax exemption of government and + #s a matter of public policy6 property of the -tate or any of its political subdivisions devoted to government uses and purposes are generally exempt from taxation. $ncome from governmental functions are exempt from tax B-ec. 32 1C $ncome from proprietary functions are taxable

+ +

!. $nternational comity + + + Par en parem imperium non habet .+ost favored nation clause0 .4aid under similar circumstances0 4rinciples of $nternational *aw are binding upon nations accordingly6 property of a foreign government may not be taxed by another

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ 1( CONSTIT.TIONAL LI%ITATIONS 1. Due Process o La- B-ec.16 #rt. $$$ of the 2onstitutionC #e@uisites3 a. )he interests of the public generally as distinguished from those of a particular class re7uire the intervention of the -tate and b. )he means employed must be reasonably necessary to the accomplishment of the purpose and not unduly oppressive.

3. )erritoriality or situs of taxation an inherent mandate that taxation shall only be exercised on persons6 properties and excises within the territory of the taxing power means place of taxation6 that is6 the country which has @urisdiction to impose a particular tax upon persons6 property or business transaction

Factors t4at determine t4e situs o taxation3 1. 2. 3. 4. %ature of the tax -ub@ect matter of the tax 2itizenship of the taxpayer (esidence of the taxpayer and -ource of income

P#O/INCE OF A1#A !s( &ONO#A1LE &A#OLD %( &E#NANDO 8.(. %o. *"4;33<. #ugust 316 1;?1 FACTS3 )he 4rovincial #ssessor of #bra levied a tax assessment on the properties of respondent (oman 2atholic 1ishop of 1angued. #n action for declaratory relief by private respondent (oman 2atholic 1ishop of 1angued desirous of being exempted from a real estate tax followed by a summary @udgment granting such exemption6 without even hearing the side of petitioner. $n the rather vigorous

Application o Situs o Taxation3 1. Tax on persons residence of the taxpayer 2. Community tax residence or domicile of the person taxed

language of the #cting 4rovincial Giscal6 as counsel for petitioner6 respondent Audge Dvirtually ignored the pertinent provisions of the (ules of 2ourt . . . wantonly violated the rights of petitioner to due process6 by giving due course to the petition of private respondent for declaratory relief6 and thereafter without allowing petitioner to answer and without any hearing6 ad@udged the case all in total disregard of basic laws of procedure and basic provisions of due process in the constitution6 thereby indicating a failure to grasp and understand the law6 which goes into the competence of the &onorable 4residing Audge.D )he latter filed a petition for declaratory relief on the ground that it is exempted from payment of real estate taxes6 its properties being actually6 directly and exclusively used for religious or charitable purposes as sources of support for the bishop6 the parish priest and his helpers. 4etitioner filed a motion to dismiss but the same was denied. #fter conducting a summary hearing6 respondent Audge granted the exemption without hearing the side of petitioner. &ence6 this present petition for certiorari and mandamus alleging denial of procedural due process. ISS.E3 5hether the present re7uirement of actual exclusive and direct use of property for charitable and religious purposes is material> &ELD3 3nder #rticle H$6 -ection 226 paragraph 3 of the 1;3! 2onstitutionE D2emeteries6 churches6 and parsonages or convents appurtenant thereto6 and all lands6 building6 and improvements used exclusively for religious6 charitable6 or educational purposes shall be exempt from taxation.D )he present 2onstitution B#rticle H$$$6 -ection 1F6 paragraph 3C added Dcharitable institutions6 mos7ues6 and non"profit cemeteriesD and re7uired that for the exemption of Dlands6 buildings6 and improvements6D they should not only be DexclusivelyD but also DactuallyD and DdirectlyD used for religious or charitable purposes. )he 2onstitution is worded differently. )he change should not be ignored. $t must be duly taken into consideration. 4etitioner 4rovince of #bra is therefore fully @ustified in invoking the protection of procedural due process. $f there is any case where proof is necessary to demonstrate that there is compliance with the constitutional provision that allows an exemption6 this is it. $nstead6 respondent Audge accepted at its face the allegation of private respondent. #ll that was alleged in the petition for declaratory relief filed by private respondents6 after mentioning certain parcels of land owned by it6 are that they are used Dactually6 directly and exclusivelyD as sources of support of the parish priest and his helpers and also of private respondent 1ishop. $n the motion to dismiss filed on behalf of petitioner 4rovince of #bra6 the ob@ection was based primarily on the lack of @urisdiction6 as the validity of a tax assessment may be 7uestioned before the *ocal 1oard of #ssessment #ppeals and not with a court. )here was also mention of a lack of a cause of action6 but only because6 in its view6 declaratory relief is not proper6 as there had been breach or violation of the right

of government to assess and collect taxes on such property. $t clearly appears6 therefore6 that in failing to accord a hearing to petitioner 4rovince of #bra and deciding the case immediately in favor of private respondent6 respondent Audge failed to abide by the constitutional command of procedural due process. 2. E@ual Protection o t4e La- B-ec. 16 #rt. $$$ of the 2onstitutionC #e@uisites or a !alid classi ication3 a. b. c. d. +ust not be arbitrary +ust be based upon substantial distinctions +ust be germane to the purposes of law +ust not be limited to existing conditions only and e. +ust apply e7ually to all members of a class. /ICTO#IAS %ILLING CO( /S( %.NICIPALIT0 OF /ICTO#IAS 8( *"211?36 2F -eptember 1;<? FACTS3 ,rdinance 1 B1;!<C was approved by the municipal council of Hictorias by way of an amendment to 2 municipal ordinances separately imposing license taxes on operators of sugar centrals and sugar refineries. )he changes wereE B1C with respect to sugar centrals6 by increasing the rates of license taxes and B2C as to sugar refineries6 by increasing the rates of license taxes as well as the range of graduated schedule of annual output capacity. Hictorias +illing 7uestioned the validity of ,rdinance 1 as it6 among others6 allegedly singled out Hictorias +illing 2o. since it is the only operator of a sugar central and a sugar refinery within the @urisdiction of the municipality. ISS.E3 5hether ,rdinance 1 is discriminatory> &ELD3 )he ordinance does not single out Hictorias as the only ob@ect of the ordinance but is made to apply to any sugar central or sugar refinery which may happen to operate in the municipality. )he fact that Hictorias +illing is actually the sole operator of a sugar central and a sugar refinery does not make the ordinance discriminatory. )he ordinance is unlike that in ,rmoc -ugar 2ompany vs. +unicipal 1oard of ,rmoc 2ity6 which specifically spelled out ,rmoc -ugar as the sub@ect of the taxation6 the name of the company herein was never mentioned in the ordinance. 3. Freedom o speec4 and o t4e press B-ection 46 #rt. $$$C 4. Non+in rin"ement o #eli"ious Freedom and 'ors4ip *#rt. $$$6 -ec. 24 of the 2onstitutionC

TOLENTINO /( SEC#ETA#0 OF FINANCE 24; -2(# <3! FACTS3 4etitioners B)olentino6 Iilosbayan6 $nc.6 4hilippine #irlines6 (oco6 and 2hamber of (eal 'state and 1uilders #ssociationC seek reconsideration of the 2ourtJs previous ruling dismissing the petitions filed for the declaration of unconstitutionality of (.#. %o. FF1<6 the 'xpanded Halue"#dded )ax *aw. 4etitioners contend that the (.#. did not .originate exclusively0 in the &o( as re7uired by #rticle <6 -ection 24 of the 2onstitution. )he -enate allegedly did not pass it on second and third readings6 instead passing its own version. 4etitioners contend that it should have amended the &ouse bill by striking out the text of the bill and substituting it with the text of its own bill6 so as to conform with the 2onstitution. ISS.E3 5/% the (.#. is unconstitutional for having .originated0 from the -enate6 and not the &,(> &ELD3 4etition is unmeritorious. )he enactment of the -enate bill has not been the first instance where the -enate6 in the exercise of its power to propose amendments to bills Bre7uired to originate in the &ouseC6 passed its own version. #n amendment by substitution Bstriking out the text and substituting itC6 as urged by petitioners6 concerns a mere matter of form6 and considering the petitioner has not shown what substantial difference it would make if -enate applied such substitution in the case6 it cannot be applied to the case at bar. 5hile the aforementioned 2onstitutional provision states that bills must .originate exclusively in the &o(60 it also adds6 .but the -enate may propose or concur with amendments.0 )he -enate may then propose an entirely new bill as a substitute measure. 4etitioners erred in assuming the -enate version to be an independent and distinct bill. 5ithout the &ouse bill6 -enate could not have enacted the -enate bill6 as the latter was a mere amendment of the former. #s such6 it did not have to pass the -enate on second and third readings. 4etitioners 7uestion the signing of the 4resident on both bills6 to support their contention that such are separate and distinct. )he 4resident certified the bills separately only because the certification had to be made of the version of the same revenue bill which #) )&' +,+'%) was being considered. 4etitioners 7uestion the power of the 2onference 2ommittee to insert new provisions. )he @urisdiction of the conference committee is not limited to resolving differences between the -enate and the &ouse. $t may propose an entirely new provision6 given that such are germane to the sub@ect of the conference6 and that the

respective houses of 2ongress subse7uently approve its report. 4etitioner 4#* contends that the amendment of its franchise by the withdrawal of its exemption from H#) is not expressed in the title of the law6 thereby violating the 2onstitution. )he 2ourt believes that the title of the (.#. satisfies the 2onstitutional (e7uirement. 4etitioners claim that the (.#. violates their press freedom and religious liberty6 having removed them from the exemption to pay H#). -uffice it to say that since the law granted the press a privilege6 the law could take back the privilege anytime without offense to the 2onstitution. 1y granting exemptions6 the -tate does not forever waive the exercise of its sovereign prerogative. *astly6 petitioners contend that the (.#. violates due process6 e7ual protection and contract clauses and the rule on taxation. 4etitioners fail to take into consideration the fact that the H#) was already provided for in '.,. %o. 2F3 long before the (.#. was enacted. )he latter merely 'K4#%:- the base of the tax. '7uality and uniformity in taxation means that all taxable articles or kinds of property of the same class be taxed at the same rate6 the taxing power having authority to make reasonable and natural classifications for purposes of taxation. $t is enough that the statute applies e7ually to all persons6 forms and corporations placed in s similar situation. !. Non+impairment o Contracts B#rt. $$$6 -ec. 19 of the 2onstitutionC 2lassification of )ax 'xemption 1. 'xpress 2. $mplied by ,mission 3. 2ontractual CAGA0AN ELECT#IC /S( CO%%ISSIONE# FACTS3 2agayan 'lectric 4ower L *ight 2o.6 $nc is the holder of a legislative franchise6 (epublic #ct %o. 324F6 under which its payment of 3M tax on its gross earnings from the sale of electric current is Din lieu of all taxes and assessments of whatever authority upon privileges6 earnings6 income6 franchise6 and poles6 wires6 transformers6 and insulators of the grantee6 from which taxes and assessments the grantee is hereby expressly exempted. ,n Aune 2F6 1;<?6 (epublic #ct %o. !431 amended section 24 of the )ax 2ode by making liable for income tax all corporate taxpayers not specifically exempt under paragraph BcC B1C of said section and section 2F of the )ax 2ode notwithstanding the Dprovisions of existing special or general laws to the contraryD. )hus6 franchise companies were sub@ected to income tax in addition to franchise tax.

,n #ugust 46 1;<;6 petitionerJs franchise was amended thereby reenacting the tax exemption in its original charter. 1y reason of the amendment to section 24 of the )ax 2ode6 the 2ommissioner of $nternal (evenue re7uired the petitioner to pay deficiency income taxes for 1;<?"to 1;F1. )he petitioner contested the assessments. )he 2ommissioner cancelled the assessments for 1;F9 and 1;F1 but insisted on those for 1;<? and 1;<;. )he petitioner filed a petition for review with the )ax 2ourt6 which on Gebruary 2<6 1;?2 held the petitioner liable only for the income tax for the period from Aanuary 1 to #ugust 36 1;<; or before the passage of (epublic #ct %o. <929 which reiterated its tax exemption. )he petitioner appealed to the -upreme 2ourt. ISS.E3 5,% 2agayan 'lectric is liable for income tax Baside from franchise taxC from Aanuary to #ugust 1;<;. &ELD3 %o. )he petitionerJs exemption was restored by the subse7uent enactment of (epublic #ct %o. <929 on #ugust 46 1;<;. )he )ax 2ourt thus acted correctly in holding petitioner liable for income tax from Aanuary 1 to #ugust 36 1;<;6 the period when its tax exemption was modified by (epublic #ct %o. !431. )he -2 however noted that the 1;<; assessment was highly controversial. )he 2ommissioner at the outset was not certain as to petitionerNs income tax liability. Gor this reason6 the 2ourt held that 2agayan 'lectric should be liable only for tax proper and should not be held liable for the surcharge and interest. <. Non+imprisonment or Non+payment o Poll Tax B#rt. $$$6 -ec. 29 of the 2onstitutionC F. #ule re@uirin" t4at appropriations5 re!enue and tari )ills s4all ori"inate exclusi!ely or t4e &ouse o #epresentati!e B-ec. 246 #rt. H$C A1A2ADA Guro Party List !s( Ermita G(#( No( :A7B=A Septem)er :5 6BB= FACTS3 1efore (.#. %o. ;33F took effect6 petitioners #1#I#:# 83(, 4arty *ist6 et al.6 filed a petition for prohibition on +ay 2F6 299! 7uestioning the constitutionality of -ections 46 ! and < of (.#. %o. ;33F6 amending -ections 19<6 19F and 19?6 respectively6 of the %ational $nternal (evenue 2ode B%$(2C. -ection 4 imposes a 19M H#) on sale of goods and properties6 -ection ! imposes a 19M H#) on importation of goods6 and -ection < imposes a 19M H#) on sale of services and use or lease of properties. )hese 7uestioned provisions contain a uniformp ro v is o authorizing the 4resident6 upon recommendation of the -ecretary of Ginance6 to raise the H#) rate to 12M6 effective Aanuary 16 299<6 after specified conditions have been satisfied. 4etitioners

argue

that

the

law

is

unconstitutional.

ISS.ES3 1. 5hether or not there is a violation of #rticle H$6 -ection 24 of the 2onstitution> 2. 5hether or not there is undue delegation of legislative power in violation of #rticle H$ -ec 2?B2C of the 2onstitution> 3. 5hether or not there is a violation of the due process and e7ual protection under #rticle $$$ -ec. 1 of the 2onstitution> #.LING3 1. -ince there is no 7uestion that the revenue bill exclusively originated in the &ouse of (epresentatives6 the -enate was acting within its constitutional power to introduce amendments to the &ouse bill when it included provisions in -enate 1ill %o. 1;!9 amending corporate income taxes6 percentage6 and excise and franchise taxes. 2. )here is no undue delegation of legislative power but only of the discretion as to the execution of a law. )his is constitutionally permissible. 2ongress does not abdicate its functions or unduly delegate power when it describes what @ob must be done6 who must do it6 and what is the scope of his authority in our complex economy that is fre7uently the only way in which the legislative process can go forward. 3. )he power of the -tate to make reasonable and natural classifications for the purposes of taxation has long been established. 5hether it relates to the sub@ect of taxation6 the kind of property6 the rates to be levied6 or the amounts to be raised6 the methods of assessment6 valuation and collection6 the -tateJs power is entitled to presumption of validity. #s a rule6 the @udiciary will not interfere with such power absent a clear showing of unreasonableness6 discrimination6 or arbitrariness.

TOLENTINO !s( SEC( OF FINANCE G(#( No( ::=C== 6D= SC#A ADB *:;;C, FACTS (# FF1<6 otherwise known as the 'xpanded Halue"#dded )ax *aw6 is an act that seeks to widen the tax base of the existing H#) system and enhance its administration by amending the %ational $nternal (evenue 2ode. )here are various suits 7uestioning and challenging the constitutionality of (# FF1< on various grounds. )olentino contends that (# FF1< did not originate exclusively from the &ouse of (epresentatives but is a mere consolidation of &1. %o. 111;F and -1. %o. 1<39 and it did not pass three readings on separate days on the -enate thus violating #rticle H$6 -ections 24 and 2<B2C of the 2onstitution6 respectively. #rt. H$6 -ection 24E #ll appropriation6 revenue or tariff bills6 bills authorizing increase of the public debt6 bills of local application6 and private bills shall originate exclusively in the &ouse of

(epresentatives6 but the -enate may propose or concur with amendments. #rt. H$6 -ection 2<B2CE %o bill passed by either &ouse shall become a law unless it has passed three readings on separate days6 and printed copies thereof in its final form have been distributed to its +embers three days before its passage6 except when the 4resident certifies to the necessity of its immediate enactment to meet a public calamity or emergency. 3pon the last reading of a bill6 no amendment thereto shall be allowed6 and the vote thereon shall be taken immediately thereafter6 and the yeas and nays entered in the Aournal. ISS.E 5hether or not (# FF1< violated #rt. H$6 -ection 24 and #rt. H$6 -ection 2<B2C of the 2onstitution> &ELD %o. )he phrase .originate exclusively0 refers to the revenue bill and not to the revenue law. $t is sufficient that the &ouse of (epresentatives initiated the passage of the bill which may undergo extensive changes in the -enate. -1. %o. 1<396 having been certified as urgent by the 4resident need not meet the re7uirement not only of printing but also of reading the bill on separate days. ?. .ni ormity5 E@uita)ility5 and Pro"ressi!ity o Taxation B#rt. H$6 -ec. 2? B1C of the 2onstitutionC De initions3 a( .ni ormity3 #ll taxable articles or kinds of property of the same class shall be taxed at the same rate. # tax is uniform when it operates with the same force and effect in every place where the sub@ect of it is found. )( E@uita)ility3 )axation is said to be e7uitable when its burden falls to those better able to pay. c( Pro"ressi!ity3 (ate increases as the tax base increases. T&E CO%%ISSIONE# OF INTE#NAL #E/EN.E !s( LINGA0EN G.LF ELECT#IC PO'E# CO(5 INC( and T&E CO.#T OF TAX APPEALS FACTS3 )he respondent taxpayer operates an electric power plant serving the ad@oining municipalities of *ingayen and 1inmaley6 both in the province of 4angasinan6 pursuant to the municipal franchise granted it by their respective municipal councils6 under (esolution %os. 14 and 2! of Aune 2; and Auly 26 1;4<6 respectively. 1ureau of $nternal (evenue B1$(C assessed against and demanded from the private respondent deficiency franchise taxes and surcharges for the years 1;4< to 1;!4 applying the franchise tax rate of !M on gross receipts from +arch 16 1;4? to :ecember 316 1;!4 as prescribed in -ection 2!; of the %ational

$nternal (evenue 2ode6 instead of the lower rates as provided in the municipal franchises. (espondent submits that (.#. %o. 3?43 is unconstitutional insofar as it provides for the payment by the private respondent of a franchise tax of 2M of its gross receipts6 while other taxpayers similarly situated were sub@ect to the !M franchise tax imposed in -ection 2!; of the )ax 2ode6 thereby discriminatory and violative of the rule on uniformity and e7uality of taxation. 2ourt of tax #ppeals ruled in favor of respondent. ISS.E3 5hether or not -ection 4 of (.#. %o. 3?436 assuming it is valid6 could be given retroactive effect so as to render uncollected taxes in 7uestion which were assessed before its enactment> &ELD3 O'-. #ppealed decision was affirmed. # tax is uniform when it operates with the same force and effect in every place where the sub@ect of it is found. 3niformity means that all property belonging to the same class shall be taxed alike )he *egislature has the inherent power not only to select the sub@ects of taxation but to grant exemptions. )ax exemptions have never been deemed violative of the e7ual protection clause. $t is true that the private respondents municipal franchises were obtained under #ct %o. <<F of the 4hilippine 2ommission6 but these original franchises have been replaced by a new legislative franchise6 i.e. (.#. %o. 3?43. 8iven the validity of said law6 it should be applied retroactively so as to render uncollectible the taxes in 7uestion which were assessed before its enactment. )he 7uestion of whether a statute operates retrospectively or only prospectively depends on the legislative intent. $n the instant case6 #ct %o. 3?43 provides that .effective P upon the date the original franchise was granted6 no other tax and/or licenses other than the franchise tax of two per centum on the gross receipts P shall be collected6 any provision to the contrary notwithstanding.0 (epublic #ct %o. 3?43 therefore specifically provided for the retroactive effect of the law. ;. Limitations on t4e con"ressional po-er to dele"ate to t4e President t4e aut4ority to ix tari rates5 imports and export @uotas 19. Tax

Exemption o Properties Actually5 Directly5 and Exclusi!ely .sed or #eli"ious5 C4arita)le and Educational Purposes B-ee

#rt. H$6 -ec. 2?B3C of the 2onstitution *ladoc vs. 2ommissioner 4rovince of #bra vs. &ernandoC. )his provision refers only to property taxes.

L.NG CENTE# OF T&E P&ILIPPINES /S E.EFON CIT0 FACTS3 *ung 2enter of the 4hilippines is a non"stock and non" profit entity established by virtue of 4: %o. 1?23. $t is the registered owner of the land on which the *ung 2enter of the 4hilippines &ospital is erected. # big space in the ground floor of the hospital is being leased to private parties6 for canteen and small store spaces6 and to medical or professional practitioners who use the same as theirprivate clinics. #lso6 a big portion on the right side of the hospital is being leased for commercial purposes to a private enterprise known as the 'lliptical ,rchids and 8arden 2enter. 5hen the 2ity #ssessor of Quezon 2ity assessed both its land and hospital building for real property taxes6 the *ung 2enter of the 4hilippines filed a claim for exemption on its averment that it is a charitable institution with a minimum of <9M of its hospital beds exclusively used for charity patients and that the ma@or thrust of its hospital operation is to serve charity patients. )he claim forexemption was denied6 prompting a petition for the reversal of the resolution of the 2ity #ssessor with the *ocal 1oard of #ssessment #ppeals of Quezon 2ity6 which denied the same. ,n appeal6 the 2entral 1oard of #ssessment #ppeals of Quezon 2ity affirmed the local boardJs decision6 finding that *ung 2enter of the 4hilippines is not a charitable institution and that its properties were not actually6 directly and exclusively used for charitable purposes. &ence6 the present petition for review with averments that the *ung 2enter of the 4hilippines is a charitable institution under -ection 2?B3C6 #rticle H$ of the 2onstitution6 notwithstanding that it accepts paying patients and rents out portions of the hospital building to private individualsand enterprises. ISS.E3 $s the *ung 2enter of the 4hilippines a charitable institution within the context of the 2onstitution6 and therefore6 exempt from real property tax> &ELD3 )he *ung 2enter of the 4hilippines is a charitable institution. )o determine whether an enterprise is a charitable institution or not6 the elements which should be considered include the statute creating the enterprise6 its corporate purposes6 its constitution and by"laws6 the methods of administration6 the nature of the actual work performed6 that character of the services rendered6 the indefiniteness of the beneficiaries and the use and occupation of the properties. &owever6 under the 2onstitution6 in order to be entitled to exemption from real property tax6 there must be clear

and une7uivocal proof that B1C it is a charitable institution and B2Cits real properties are #2)3#**O6 :$('2)*O and 'K2*3-$H'*O used for charitable purposes. 5hile portions of the hospital are used for treatment of patients and the dispensation of medical services to them6 whether paying or non"paying6 other portions thereof are being leased toprivate individuals and enterprises. 'xclusive is defined as possessed and en@oyed to the exclusion of others6 debarred from participation or en@oyment. $f real property is used for one or more commercial purposes6 it is not exclusively used for the exempted purposes but is sub@ect to taxation 11. %a?ority /ote o all %em)ers o Con"ress #e@uired in Case o a Le"islati!e Grant o Tax Exemptions #rt. H$6 -ec. 2? B4C of the 2onstitutionC 12. Non+impairment o t4e Supreme CourtGs Hurisdiction in Tax Cases R#rt. H$$$6 -ec. 2B1C and #rt.

H$$$6 -ec.!BbC of the 2onstitutionS

13. Tax Exemption o #e!enues and Assets o 5 includin" Grants5 Endo-ments5 Donations5 or Contri)utions to5 Educational Institutions B#rt.

K$H6 -ecs. 4B3C and B4C of the 2onstitutionC

You might also like

- Mnemonics in Taxation Law - GarciaDocument82 pagesMnemonics in Taxation Law - Garciadavaounion100% (2)

- Taxation Law Review: Key Concepts and PrinciplesDocument11 pagesTaxation Law Review: Key Concepts and PrinciplesGretch MaryNo ratings yet

- General PrinciplesDocument84 pagesGeneral PrinciplesHazelNo ratings yet

- Income Taxation Principles ExplainedDocument40 pagesIncome Taxation Principles ExplainedJessaNo ratings yet

- General Principles of TaxationDocument5 pagesGeneral Principles of Taxationmync89100% (3)

- PRINCIPLES OF TAXATION POWERDocument8 pagesPRINCIPLES OF TAXATION POWERMay AbiaNo ratings yet

- General Principles and Income TaxationDocument7 pagesGeneral Principles and Income TaxationLucy HeartfiliaNo ratings yet

- INCOME TAXATION UNDER THE TRAIN LAWDocument18 pagesINCOME TAXATION UNDER THE TRAIN LAWcerayNo ratings yet

- Taxation ReportDocument79 pagesTaxation ReportkimNo ratings yet

- A. General Concepts and Principles of TaxationDocument4 pagesA. General Concepts and Principles of TaxationAngelica EsguireroNo ratings yet

- Module in Income and Business TaxationDocument126 pagesModule in Income and Business TaxationKatryn Mae Yambot CabangonNo ratings yet

- Principles of Taxation ExplainedDocument25 pagesPrinciples of Taxation ExplainedMarinella GonzalesNo ratings yet

- Illustrations of Lifeblood TheoryDocument11 pagesIllustrations of Lifeblood TheoryDarwin Ilustre BacayNo ratings yet

- Basics of Taxation ConceptsDocument6 pagesBasics of Taxation ConceptsAngela CanayaNo ratings yet

- BA CORE 4 Module in Income and Business Taxation 7.12.20Document119 pagesBA CORE 4 Module in Income and Business Taxation 7.12.20Andrea Kriselle Abesamis CristobalNo ratings yet

- Taxation Law ReviewerDocument62 pagesTaxation Law ReviewerAdelaine Faith Zerna96% (23)

- 01-Principles of Taxation (Part 3)Document21 pages01-Principles of Taxation (Part 3)Deanne Lorraine V. GuintoNo ratings yet

- MidTaxR2 key requirementsDocument7 pagesMidTaxR2 key requirementsErnuel PestanoNo ratings yet

- Exercises On General Principles of TaxationDocument9 pagesExercises On General Principles of TaxationMicah Amethyst TaguibaoNo ratings yet

- TAXATION - PrelimsDocument8 pagesTAXATION - PrelimsPrincess Dianne CamachoNo ratings yet

- Viii. TaxationDocument23 pagesViii. TaxationAnghelikaaaNo ratings yet

- TAX 1973-1985 Q & A (Student - S Answers (Not of Any Author)Document107 pagesTAX 1973-1985 Q & A (Student - S Answers (Not of Any Author)Roy DaguioNo ratings yet

- Taxation: General PrinciplesDocument30 pagesTaxation: General PrinciplesJao FloresNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- General Principles Lecture Notes (1) TAXATION 1Document9 pagesGeneral Principles Lecture Notes (1) TAXATION 1Angie Louh S. Dioso100% (4)

- Week2: Principles of Taxation: Sandra HaroDocument30 pagesWeek2: Principles of Taxation: Sandra HaroMariah ConcepcionNo ratings yet

- Pointers To Review For Final Examination in TaxationDocument4 pagesPointers To Review For Final Examination in TaxationCJNo ratings yet

- Limitations on Taxing PowerDocument8 pagesLimitations on Taxing PowerFranco David BaratetaNo ratings yet

- Taxation Law ReviewerDocument62 pagesTaxation Law ReviewerThemis ArtemisNo ratings yet

- General Principles: Power of TaxationDocument21 pagesGeneral Principles: Power of TaxationCarl MurphyNo ratings yet

- (TAX) Chapter 1Document14 pages(TAX) Chapter 1Nikko Franchello SantosNo ratings yet

- Taxation Virgilio D. Reyes 2 PDFDocument194 pagesTaxation Virgilio D. Reyes 2 PDF?????No ratings yet

- I. General Principles of TaxationDocument62 pagesI. General Principles of TaxationJeanne Pabellena DayawonNo ratings yet

- Taxation Law ReviewerDocument81 pagesTaxation Law ReviewerSimeon SuanNo ratings yet

- Taxation - Ramen NotesDocument8 pagesTaxation - Ramen NotesborgyambuloNo ratings yet

- Review Guide - Checks and BalancesDocument8 pagesReview Guide - Checks and BalancesJoshuaNo ratings yet

- Basic Principles of TaxationDocument33 pagesBasic Principles of TaxationHenicel Diones San Juan100% (1)

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- Definition and Concept of TaxationDocument11 pagesDefinition and Concept of TaxationJackie Calayag100% (4)

- TAXATION Finals ReviewerDocument38 pagesTAXATION Finals ReviewerJunivenReyUmadhay100% (1)

- Fundamental Principles of Taxation: ObjectivesDocument12 pagesFundamental Principles of Taxation: ObjectivesChristelle JosonNo ratings yet

- Chapter 1 Income TaxationDocument7 pagesChapter 1 Income TaxationAihla Michelle Berido100% (1)

- Taxation (Lecture 1)Document10 pagesTaxation (Lecture 1)Criselda TeanoNo ratings yet

- AMBOL-TR Assignment 1Document8 pagesAMBOL-TR Assignment 1Cetacean HumpbackNo ratings yet

- Tax Principles ExplainedDocument273 pagesTax Principles ExplaineditsmenatoyNo ratings yet

- Taxatio N: Avecilla, Eunice. M. Banjaon, Jan Trace ADocument25 pagesTaxatio N: Avecilla, Eunice. M. Banjaon, Jan Trace ANorielyn AustralNo ratings yet

- Taxation ModuleDocument90 pagesTaxation ModuleabanquilanNo ratings yet

- Module 2 General Principles of TaxationDocument18 pagesModule 2 General Principles of TaxationLyric Cyrus Artianza CabreraNo ratings yet

- Taxation 1 Case Analysis No. 1Document5 pagesTaxation 1 Case Analysis No. 1PJ OrtizNo ratings yet

- General Principles of TaxationDocument24 pagesGeneral Principles of TaxationPines MacapagalNo ratings yet

- Tax Dec 3 (Pantawid Recit)Document7 pagesTax Dec 3 (Pantawid Recit)D Del SalNo ratings yet

- TAx JulianoDocument3 pagesTAx Julianojanel anne yvette sorianoNo ratings yet

- Taxes vs Fees and Special AssessmentsDocument9 pagesTaxes vs Fees and Special AssessmentsKenneth Abarca SisonNo ratings yet

- Tax File 8Document3 pagesTax File 8joyNo ratings yet

- Tax I DigestsDocument172 pagesTax I DigestsSara Dela Cruz AvillonNo ratings yet

- Taxation 8Document62 pagesTaxation 8Nelson BJ OstiqueNo ratings yet

- TAXATION-General Principles: 3. Based Ability To PayDocument11 pagesTAXATION-General Principles: 3. Based Ability To PayJudy Ann Matos DiaganNo ratings yet

- 2013 Tariff and Customs CodeDocument31 pages2013 Tariff and Customs CodeemerbmartinNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bar Review Companion: Remedial Law: Anvil Law Books Series, #2From EverandBar Review Companion: Remedial Law: Anvil Law Books Series, #2Rating: 3 out of 5 stars3/5 (2)

- PCADocument9 pagesPCAMuji JaafarNo ratings yet

- Fm-Pur-007 Subcon Accreditation Form Rev.00Document8 pagesFm-Pur-007 Subcon Accreditation Form Rev.00Muji JaafarNo ratings yet

- Zack Community Chemical Safety Training - 0623Document3 pagesZack Community Chemical Safety Training - 0623Muji JaafarNo ratings yet

- Succession PartitionDocument12 pagesSuccession PartitionMuji JaafarNo ratings yet

- Aberca vs. VerDocument16 pagesAberca vs. VerMuji Jaafar0% (1)

- CEDAWDocument7 pagesCEDAWMuji JaafarNo ratings yet

- Receipt of work itemsDocument1 pageReceipt of work itemsMuji JaafarNo ratings yet

- De GuzmanDocument8 pagesDe GuzmanMuji JaafarNo ratings yet

- Gelle PartnershipDocument3 pagesGelle PartnershipMuji JaafarNo ratings yet

- Reviewer Tax by GelleDocument5 pagesReviewer Tax by GelleMuji JaafarNo ratings yet

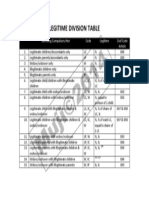

- Legitime Division TableDocument1 pageLegitime Division TableMuji JaafarNo ratings yet

- Partnership GelleDocument6 pagesPartnership GelleMuji JaafarNo ratings yet

- Prudential Bank vs. BAGDocument6 pagesPrudential Bank vs. BAGMuji JaafarNo ratings yet

- Partition Case DigestDocument4 pagesPartition Case DigestMuji JaafarNo ratings yet

- Legitime Division TableDocument1 pageLegitime Division TableMuji JaafarNo ratings yet

- Aberca vs. VerDocument16 pagesAberca vs. VerMuji Jaafar0% (1)

- SC rules on jurisdiction over defendant in foreign judgment enforcement caseDocument10 pagesSC rules on jurisdiction over defendant in foreign judgment enforcement caseMuji JaafarNo ratings yet

- Aberca vs. VerDocument16 pagesAberca vs. VerMuji Jaafar0% (1)

- JG Summit V Ca - DoclawxDocument7 pagesJG Summit V Ca - DoclawxMara Corteza San PedroNo ratings yet

- Case Digest On Simple Loan or MutuumDocument9 pagesCase Digest On Simple Loan or MutuumMuji JaafarNo ratings yet

- 4Document5 pages4Muji JaafarNo ratings yet

- Ruling on Preference of Separation Pays over Taxes in InsolvencyDocument2 pagesRuling on Preference of Separation Pays over Taxes in InsolvencyMuji JaafarNo ratings yet

- LAW On SALES - Label On MemaidDocument1 pageLAW On SALES - Label On MemaidMuji JaafarNo ratings yet

- JG Summit V Ca - DoclawxDocument7 pagesJG Summit V Ca - DoclawxMara Corteza San PedroNo ratings yet

- Ii. Sources of International Law: Restatement (Third) of Foreign Relations Law of The United StatesDocument5 pagesIi. Sources of International Law: Restatement (Third) of Foreign Relations Law of The United StatesMuji JaafarNo ratings yet

- Prudential Bank vs. BAGDocument6 pagesPrudential Bank vs. BAGMuji JaafarNo ratings yet

- References 2.0Document1 pageReferences 2.0Muji JaafarNo ratings yet

- References 2.0Document1 pageReferences 2.0Muji JaafarNo ratings yet

- Domagas vs. JensenDocument10 pagesDomagas vs. JensenMuji JaafarNo ratings yet

- Mastering ArpeggiosDocument58 pagesMastering Arpeggiospeterd87No ratings yet

- York Product Listing 2011Document49 pagesYork Product Listing 2011designsolutionsallNo ratings yet

- 2 - How To Create Business ValueDocument16 pages2 - How To Create Business ValueSorin GabrielNo ratings yet

- 1 - Nature and Dev - Intl LawDocument20 pages1 - Nature and Dev - Intl Lawaditya singhNo ratings yet

- MiQ Programmatic Media Intern RoleDocument4 pagesMiQ Programmatic Media Intern Role124 SHAIL SINGHNo ratings yet

- 5 6107116501871886934Document38 pages5 6107116501871886934Harsha VardhanNo ratings yet

- Irony in Language and ThoughtDocument2 pagesIrony in Language and Thoughtsilviapoli2No ratings yet

- ACS Tech Manual Rev9 Vol1-TACTICS PDFDocument186 pagesACS Tech Manual Rev9 Vol1-TACTICS PDFMihaela PecaNo ratings yet

- Golin Grammar-Texts-Dictionary (New Guinean Language)Document225 pagesGolin Grammar-Texts-Dictionary (New Guinean Language)amoyil422No ratings yet

- Training Effectiveness ISO 9001Document50 pagesTraining Effectiveness ISO 9001jaiswalsk1No ratings yet

- Ethiopian Civil Service University UmmpDocument76 pagesEthiopian Civil Service University UmmpsemabayNo ratings yet

- Digi-Notes-Maths - Number-System-14-04-2017 PDFDocument9 pagesDigi-Notes-Maths - Number-System-14-04-2017 PDFMayank kumarNo ratings yet

- Data FinalDocument4 pagesData FinalDmitry BolgarinNo ratings yet

- Database Interview QuestionsDocument2 pagesDatabase Interview QuestionsshivaNo ratings yet

- 4AD15ME053Document25 pages4AD15ME053Yàshánk GøwdàNo ratings yet

- Professional Ethics AssignmentDocument12 pagesProfessional Ethics AssignmentNOBINNo ratings yet

- FCE Listening Test 1-5Document20 pagesFCE Listening Test 1-5Nguyễn Tâm Như Ý100% (2)

- TAX & DUE PROCESSDocument2 pagesTAX & DUE PROCESSMayra MerczNo ratings yet

- McLeod Architecture or RevolutionDocument17 pagesMcLeod Architecture or RevolutionBen Tucker100% (1)

- Phasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary EssayDocument4 pagesPhasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary Essayapi-428138727No ratings yet

- Equity Inv HW 2 BHDocument3 pagesEquity Inv HW 2 BHBen HolthusNo ratings yet

- Sample Letter of Intent To PurchaseDocument2 pagesSample Letter of Intent To PurchaseChairmanNo ratings yet

- MVD1000 Series Catalogue PDFDocument20 pagesMVD1000 Series Catalogue PDFEvandro PavesiNo ratings yet

- Notes Socialism in Europe and RussianDocument11 pagesNotes Socialism in Europe and RussianAyaan ImamNo ratings yet

- NAZRUL - CV ChuadangaDocument2 pagesNAZRUL - CV ChuadangaNadira PervinNo ratings yet

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- RA 4196 University Charter of PLMDocument4 pagesRA 4196 University Charter of PLMJoan PabloNo ratings yet

- Housekeeping NC II ModuleDocument77 pagesHousekeeping NC II ModuleJoanne TolopiaNo ratings yet

- Administrative Law SyllabusDocument14 pagesAdministrative Law SyllabusKarl Lenin BenignoNo ratings yet

- Module 6: 4M'S of Production and Business ModelDocument43 pagesModule 6: 4M'S of Production and Business ModelSou MeiNo ratings yet