Professional Documents

Culture Documents

Loan Recommendation For Loan Approval

Uploaded by

Place279Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Recommendation For Loan Approval

Uploaded by

Place279Copyright:

Available Formats

USAID/BUSINESS FINANCE

BRFF/OMU

LOAN RECOMMENDATION

BORROWER:

LOAN PURPOSE: AGENT BANK: ENVIRONMENTAL: US SFOR SECTOR (Y/N) CANTON: CIT): MUNICIPALIT):

)EAR * 2 State )EAR + )EAR ,

)ea' * C#a&& - .at on Men Wo"en Natu'e o- Bu& ne&&: In$u&t'4 Se.to': Co5Bo''o6e'7&8: O6ne'7&8 an$ Pe'.enta%e& De"o/ # 0e$ So#$ e'& Retu'n n% Re-u%ee& Gene'a# Po!u#at on Date: Loan #:

LOAN AMOUNT/USE OF PROCEEDS (DM) Equ !"ent: Bu #$ n%& an$ Lan$: Wo'( n% Ca! ta#: TOTAL LOAN AMOUNT:

NEW TOTAL EMPLO)MENT OWNERS1IP:

Te'": G'a.e Pe' o$: Inte'e&t Rate: Pa4"ent&: Co##ate'a#:

2 P' 3ate

USAID GOAL7S8 MET: Select whatever applies from the drop-down menu, but dont get carried away with minute

effects. Also, dont say the loan provides high employment, unless employment creation is greater than one job for every DM !,!!! lent, i.e., at least half of the target.

TRANSACTION SUMMAR):

"he principal audience for the "ransaction Summary is #SA$D. "he summary should %tell the story& in a few pithy sentences that demonstrate why the loan is a good use of program resources. #SA$D should find your summary a pleasure to fa' to an in(uisitive )ongressman. *e sure it includes+ A description of the firms bac,ground and principal lines of business. "he %company bac,ground& section has been eliminated from the body of the recommendation form, so ma,e these three or four sentences sing. A statement of the use of funds, and the most convincing reasons the loan should be recommended and approved. -or e'ample, the loan might fund e(uipment that will eliminate a bottlenec, in the production process, enable production of higher-(uality goods, or allow start-up of a new product line under the guidance of a proven management team. .mphasi/e issues central to #S objectives in *osnia, such as employment. %"he e'panded operation will provide jobs to 0!! refugees.& A statement to the effect that the loan is sound, e.g., %1rojected cash flow is sufficient to cover the *- obligation throughout the term of the loan.& 2ever fear, credit issues are discussed in greater depth on the ne't page. A description of the physical location of the borrower that would allow a reasonably ,nowledgeable reader to visuali/e the firm. %"he firm is located on a ten-acre industrial site 3! ,m. south of *anja 4u,a, on the east side of the road to "u/la.&

CREDIT POLIC) E9CEPTIONS:

Approvals:

Len$ n% A&&o. ate: LENDING OFFICER: )redit Manager5"eam 4eader+ BF C: e- o- Pa't4: Bruce Spake

Date: Date:

Date:

USAID Bu& ne&& F nan.e Loan Re.o""en$at on USAID D 'e.to': CRAIG G. BUCK

;A!!# .ant<

Date:

3 of 5

USAID Bu& ne&& F nan.e Loan Re.o""en$at on

;A!!# .ant<

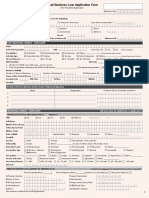

SUMMAR) OF FINANCIAL INFORMATION

000 DM Sa"e (DM) Gro Mar,-. (/)

6ross 1rofit Sales

Ac!ua" Dec. &''(

Ac!ua" Dec. &'')

Ac!ua" Mar. &''*

#ro$ec!e% Dec. &''*

#ro$ec!e% Dec. &'''

#ro$ec!e% Dec. +000

#ro$ec!e% Dec. +00&

0per. #rof-! Mar,-. (/)

7perating 1rofit Sales

Ne! #rof-! (DM) Ca 1 2"o3 (DM)

2et 1rofit 8 Depreciation

De4! Ser5-ce Co5er. Ra!-o

2et 1rofit 8 Deprec. 8 $nterest $nterest 9 1rincipal Due

Break6e5e. Sa"e (DM)

7p. .'penses - Depreciation 6ross 1rofit Margin

Curre.! Ra!-o 7u-ck Ra!-o

)ur. Assets )ur. 4iabilities

)ash 8 A5: )urrent 4iabilities

De4!6!o68or!1

"otal 4iabilities .(uity

9o!a" :;u-!< (DM) Co""a!era" Co5era,e= >oa.6!o65a"ue USES OF FUNDS Co ! :;u-p@e.! Bu-"%-., a.% >a.% 8ork-., Cap-!a" 9o!a"

:e(uested 4oan ;alue of 1roposed )ollateral

SOURCES OF FUNDS 03.er? Ne3 03.er? #r-or I.5e !@e.! I.5e !@e.!

0pera!-., Ca 1 2"o3

USAID Bu -.e 2-.a.ce

0!1er 2-.a.c-.,

ANAL)TICAL SUMMAR)

<hile the "ransaction Summary presents issues of programmatic importance to #SA$D, the Analytical Summary should focus on credit. Again, the objective is to %tell the story,& highlighting the most important issues e'posed in the %Analyst )omments& and %-inancial Analysis& sections below. *egin with bullets that substantiate approval, followed by bullets that highlight the ,ey ris,s and mitigating factors of the credit. "hese bullets should be followed by a narrative analysis of the %strengths and wea,nesses& you have highlighted. )lose with our boiler-plate recommendation for approval.

Su/&tant at on

<hy is this loan a good asset for *-= <hat ma,es you %feel good& about the credit= $s cash flow e'ceptionally strong= Do you have confidence in managements ability to meet the sales projections= Does the company demonstrate unusually good financial management=

Su4 !a.!-a!-o. Su4 !a.!-a!-o.

+ of 5

USAID Bu& ne&& F nan.e Loan Re.o""en$at on Su4 !a.!-a!-o. R &(&

;A!!# .ant<

<hat specific e'posures does the company >and *-? face in meeting the proposed obligation= $s the companys mar,eting5distribution plan sufficient to support the sales projection= Are the companys suppliers reliable= Are financial management systems in place= <ould a small delay or shortfall in sales ma,e the company unable to meet its obligations= .ach ris, cited should be accompanied by an assessment of any mitigating factors.

R- kA M-!-,a!-., 2ac!or R- kA M-!-,a!-., 2ac!or R- kA M-!-,a!-., 2ac!or Na''at 3e Ana#4& &

.'plain why the loan should be recommended and approved on credit criteria. @our words in this section reflect our central contribution to the #SA$D *usiness Development 1rogram. 1lease provide your professional judgement of the company and the proposed credit. $dentify the relative importance you ascribe to salient features of the companys performance and describe how you have incorporated the bulleted factors above in the credit via the grace period, disbursement schedule, covenants, etc.

Re.o""en$at on -o' a!!'o3a# & /a&e$ u!on t:e ana#4& &= te'"& an$ .on$ t on& :e'e n>

ANAL)ST COMMENTS

1lease analy/e briefly each bolded aspect of the credit. $talici/ed suggestions are suggestions only. $f there is nothing particularly profound to say about the production process, for e'ample, just list the products and move on. Avoid repeating data from the Applicationyour goal should be to synthesi/e the impact of that data on the soundness of the credit.

P'o$u.t& (4ack,rou.% %a!a -. Sec!-o. B of App"-ca!-o.)=

4ist the companys e'isting products, as well as those planned to be developed with loan proceeds. 2ote your impressions of the efficiency of the production process and indicate any potential problems with suppliers.

Ma'(et&= Ma'(et n%= an$ D &t' /ut on (4ack,rou.% %a!a -. Sec!-o. 5 of App"-ca!-o.)=

2ote the mar,et segment to which the company sells. 1rovide your analysis of the companys mar,eting abilities. <hat does past mar,eting performance suggest about the companys ability to mar,et new >or higher volume? products= Does past performance lend credence to the companys sales projections= $s the companys distribution system sufficient to support planned sales=

In$u&t'4 an$ Co"!et t on (4ack,rou.% %a!a -. Sec!-o. ( of App"-ca!-o.)=

<hat is the health of the industry in which the company operates= $s it e'panding or consolidating= Aow does the company compare to its competition, both local and foreign= <hat distinguishes the companys products from those of its competitors= Does the company have the long-term strength to survive in its mar,et=

3 of 5

USAID Bu& ne&& F nan.e Loan Re.o""en$at on

;A!!# .ant<

Mana%e"ent an$ Co'!o'ate Go3e'nan.e (4ack,rou.% %a!a -. Sec!-o. ) of App"-ca!-o.)=

Assess the strengths and wea,nesses of the companys management >and *oard of Directors, if applicable?. Do the managers appear to have a long-term commitment to the company= Are they distracted by other ventures= Are they capable of meeting the sales goals in the financial projections= 7f controlling e'penses to protect profitability= Aow well do the managers ,now their mar,et= "he production process=

FINANCIAL ANAL)SIS

7/a.(%'oun$ $ata n Se.t on ? o- A!!# .at on8

)ombine your analysis of the historicals with your analysis of the pro for@a . Again, italici/ed suggestions are suggestions only.

Income Statement

<hat have been the trends of sales, direct costs, gross profits, operating e'penses, and net profits over time= <hat factors have driven company performance to date= Are they still in force today= Are the companys projections for gross and net profit realistic= <hat wea, points e'ist in the projectionsunrealistic sales goals= $nability to control costs=

Ba#an.e S:eet

<hat have been the trends in company leverage >debt-to-worth? and li(uidity >current ratio? over time= <hat does the companys management of its accounts receivable and payable suggest about financial management and responsibility= Aas the company serviced its debts as agreed= <hat is the justification for projected improvements in inventory turnover and collection of accounts receivable= Are all re(uired increases in wor,ing capital and other debt foreseen by this loan re(uest= <hat other capital investment needs can be predicted over the life of the loan=

Ca&: Bu$%et

Describe the companys collection cycle. <hat is the impact of seasonality on wor,ing capital re(uirements= Aave you proposed a structure to match=

De/t Se'3 .e

<ill the company produce enough cash to cover its obligations to *- and other creditors throughout the life of the loan= During which periods will the companys ability to service its debts be most in doubt= $s there a repayment structure you can suggest that would better meet the needs of the firm while protecting the integrity of *- capital=

Su!!#e"enta# Rat o&

Ca 1 Co5era,e Ra!-o (N#A9 C D)/# De4! Co5era,e Ra!-o (:BI9/(-/(p/&69r)) 8/C A%$u !e% Ca 1 Co5era,e Ra!-o 2ree Ca 1 2"o3 Se. -!-5-!< A@ou.! of 2C2 Se. -!-5-!< (DM)

)ea' *

)ea' +

)ea' ,

Co##ate'a# Co3e'a%e (4ack,rou.% %a!a -. Sec!-o. + of App"-ca!-o.)

<hat is your assessment of the mar,etability of the proposed collateral, as opposed to its valuation in the Application= $n your opinion, could the collateral pledged be li(uidated (uic,ly= <ould its sale price cover the full amount of the loan=

B of 5

USAID Bu& ne&& F nan.e Loan Re.o""en$at on

;A!!# .ant<

MONITORING/DOCUMENTATION:

*-s standard pre-disbursement documentationas well as the standard covenants to which borrowers must adhere throughout the life of the loanare listed below. 6iven your ,nowledge of this borrower and the purpose of the loan, please suggest any adjustments or additions to the standard conditions precedent and covenants that would either provide additional protection for *- capital or match distinct characteristics of the proposed borrower. Modifications could ta,e several forms, including re(uired training, outside audits, maintenance of licenses, etc.

Co.%-!-o. #rece%e.!= S!a.%ar% Docu@e.!a!-o. D. D. >oa. Co5e.a.! = No a"e of a e! o5er EEEEEEEEEEE DM 3-!1ou! !1e pr-or 3r-!!e. co. e.! of USAID Bu -.e 2-.a.ce. No a%%-!-o.a" a,,re,a!e 1or!6!er@ %e4! o5er EEEEEEEEEEE DM 3-!1ou! !1e pr-or 3r-!!e. co. e.! of USAID Bu -.e 2-.a.ce. Ma-.!a-. a curre.! ra!-o of EEEEEEE or ,rea!er a.% a %e4!/3or!1 of EEEEE or "e !1rou,1ou! !1e !er@ of !1e "oa.. D. D.

5 of 5

You might also like

- Loan Management PolicyDocument11 pagesLoan Management Policyvinayak_cNo ratings yet

- Project For Bank LoanDocument2 pagesProject For Bank Loangopi_saumyaNo ratings yet

- HOME LOAN Idlc NEWDocument9 pagesHOME LOAN Idlc NEWMohammad Tamzid SiddiqueNo ratings yet

- MITC terms for business loanDocument6 pagesMITC terms for business loansandeep Kumar Dubey100% (1)

- The Loan AgreementDocument4 pagesThe Loan AgreementblsandcoNo ratings yet

- Loan Policy: Uttar Bihar Gramin BankDocument27 pagesLoan Policy: Uttar Bihar Gramin BankNaim Siddiqui100% (1)

- LoanDocument97 pagesLoanBui Thanh LoanNo ratings yet

- Loan-Agreement Citi MortgagesDocument80 pagesLoan-Agreement Citi Mortgagesmrinal lalNo ratings yet

- Factors, Impact, Symptoms of NPADocument7 pagesFactors, Impact, Symptoms of NPAMahesh ChandankarNo ratings yet

- Loan Management in 40 CharactersDocument28 pagesLoan Management in 40 CharactersSrihari Prasad100% (1)

- Credit Monitoring and Follow-Up: MeaningDocument23 pagesCredit Monitoring and Follow-Up: Meaningpuran1234567890100% (2)

- Investment Application FormDocument2 pagesInvestment Application FormAdnan Zahid100% (1)

- SBI Car LoanDocument42 pagesSBI Car LoanShweta Yashwant Chalke100% (5)

- Bank Loan DocumentsDocument10 pagesBank Loan DocumentsSatish KanojiyaNo ratings yet

- Mod 1Document41 pagesMod 1Raghav Mehra100% (2)

- Loan Policy GuidelinesDocument4 pagesLoan Policy GuidelinesNauman Malik100% (1)

- Credit Monitoring in BankDocument40 pagesCredit Monitoring in BankAGB AGB100% (1)

- Bank Loan Covenants PrimerDocument5 pagesBank Loan Covenants PrimerPropertywizzNo ratings yet

- Yes Bank Online Deposit SlipDocument1 pageYes Bank Online Deposit SlipnaguficoNo ratings yet

- Fund Loan Form PDFDocument3 pagesFund Loan Form PDFsarge18100% (1)

- Deposit Schemes at Vijaya BankDocument83 pagesDeposit Schemes at Vijaya BankSethu PathiNo ratings yet

- Salary LoanDocument11 pagesSalary LoanJanessa EstayoNo ratings yet

- Personal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Document5 pagesPersonal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Kudakwashe Mugwagwa100% (1)

- Bank Letter Guarantee FormatDocument1 pageBank Letter Guarantee Formatspkeenan100% (1)

- Credit LinesDocument43 pagesCredit Linespdastous1No ratings yet

- ICICI Bank Car Loans Primary DetailsDocument11 pagesICICI Bank Car Loans Primary DetailsAastha PandeyNo ratings yet

- Credit Rating ProcessDocument36 pagesCredit Rating ProcessBhuvi SharmaNo ratings yet

- Importance of Loan Documents and Legal ImplicationDocument64 pagesImportance of Loan Documents and Legal ImplicationVishnu TandiNo ratings yet

- Personal Loan Agreement eDocument5 pagesPersonal Loan Agreement eabdusssNo ratings yet

- Letter of Bank AccountDocument1 pageLetter of Bank AccountHazel LopezNo ratings yet

- Home LoanDocument130 pagesHome LoanAnkit ButtoliaNo ratings yet

- WAMU Subprime Underwriting GuidelinesDocument53 pagesWAMU Subprime Underwriting GuidelinessamuriamiNo ratings yet

- Loan Commitment-Conditions of Qualifications 02.20.2006 Bates (SCHNEIDERS 00158-00163Document6 pagesLoan Commitment-Conditions of Qualifications 02.20.2006 Bates (SCHNEIDERS 00158-00163larry-612445No ratings yet

- Mse Lending PolicyDocument10 pagesMse Lending PolicytanweerwarsiNo ratings yet

- Types of LoanDocument59 pagesTypes of LoanLavina Chandwani100% (2)

- Home Loan - Master BCC BR 106 380Document158 pagesHome Loan - Master BCC BR 106 380binalamitNo ratings yet

- Collateral Loan Info PDFDocument8 pagesCollateral Loan Info PDFcasmith43No ratings yet

- Good Loan Policy Sample BankDocument57 pagesGood Loan Policy Sample Bankdetri100% (3)

- Business Loan ApplicationDocument4 pagesBusiness Loan ApplicationRocketLawyer100% (1)

- Syndicate LaonDocument6 pagesSyndicate Laonarpitm61No ratings yet

- Credit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin BankDocument13 pagesCredit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin Bankniravtrivedi72No ratings yet

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Purpose of Loan Information of Borrower Co-MakerDocument2 pagesPurpose of Loan Information of Borrower Co-MakerSophia GonzalesNo ratings yet

- Free Investment Banking TutorialsDocument38 pagesFree Investment Banking Tutorialsmurary0% (1)

- Sample E-Sanction LetterDocument1 pageSample E-Sanction LettersamNo ratings yet

- Debit OrderDocument2 pagesDebit Orderpaul0% (1)

- SBI Home Loan AssignmentDocument13 pagesSBI Home Loan AssignmentRonduck50% (2)

- Approval LetterDocument1 pageApproval LetterRuth Hilerio-AltrecheNo ratings yet

- DCB Vehicle Loan AgreementDocument136 pagesDCB Vehicle Loan AgreementCaxe1No ratings yet

- Sample Loan PolicyDocument7 pagesSample Loan PolicyDivina GammootNo ratings yet

- Digital Payment Modes: 1.prepaid Cards 2.Debit/Rupay Cards 3.ussd 4.mobile Wallets 5.aeps 6.upiDocument37 pagesDigital Payment Modes: 1.prepaid Cards 2.Debit/Rupay Cards 3.ussd 4.mobile Wallets 5.aeps 6.upiRajesh KannaNo ratings yet

- Revolving Credit AgreementDocument2 pagesRevolving Credit AgreementRocketLawyerNo ratings yet

- GAYATHRI V S3 MBA CET - Term Loans ExplainedDocument30 pagesGAYATHRI V S3 MBA CET - Term Loans Explainedgayathrihari100% (2)

- Letter of Credit and Bank GuaranteeDocument3 pagesLetter of Credit and Bank GuaranteeSojan MaharjanNo ratings yet

- Sample-Loan Commitment LetterDocument3 pagesSample-Loan Commitment LetterJustice Williams100% (1)

- Small Business Loans Application FormDocument6 pagesSmall Business Loans Application Formchinmay patilNo ratings yet

- Retail Lending Policy 2010-11Document25 pagesRetail Lending Policy 2010-11Bhandup YadavNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- ProjectDocument6 pagesProjectRohit GuptaNo ratings yet

- Credit Appraisal at Uco BankDocument115 pagesCredit Appraisal at Uco BankRaju Rawat0% (1)

- Type of Costs Description Type of Source of Company Contribution 1.salariesDocument4 pagesType of Costs Description Type of Source of Company Contribution 1.salariesPlace279No ratings yet

- PZ Podgrme-Ì - The Challenge - MAPDocument9 pagesPZ Podgrme-Ì - The Challenge - MAPPlace279No ratings yet

- Phase 3 Base 2Document2 pagesPhase 3 Base 2Place279No ratings yet

- Phase 1 Basel 2Document2 pagesPhase 1 Basel 2Place279No ratings yet

- Ownership of Croatian InsuranceDocument2 pagesOwnership of Croatian InsurancePlace279No ratings yet

- III Time Framework For Implementation of Basel II in Federation of BihDocument1 pageIII Time Framework For Implementation of Basel II in Federation of BihPlace279No ratings yet

- FBA Strategy English December 08Document2 pagesFBA Strategy English December 08Place279No ratings yet

- Transition From The Original Basel I Framework To The New Basel II FrameworkDocument1 pageTransition From The Original Basel I Framework To The New Basel II FrameworkPlace279No ratings yet

- Phase 2 Base 2Document2 pagesPhase 2 Base 2Place279No ratings yet

- Introduction FbaDocument3 pagesIntroduction FbaPlace279No ratings yet

- Basel I in The Federation of Bosnia and HerzegovinaDocument1 pageBasel I in The Federation of Bosnia and HerzegovinaPlace279No ratings yet

- Ownership of Croatian InsuranceDocument2 pagesOwnership of Croatian InsurancePlace279No ratings yet

- Introducing The Basel Core Principles For Banking SupervisionDocument2 pagesIntroducing The Basel Core Principles For Banking SupervisionPlace279No ratings yet

- Core Principles For Effective Banking Supervision in The Federation of BiHDocument1 pageCore Principles For Effective Banking Supervision in The Federation of BiHPlace279No ratings yet

- Ii New Considerations and New International Framework of Capital of BanksDocument2 pagesIi New Considerations and New International Framework of Capital of BanksPlace279No ratings yet

- List of Some Important Acts of The Insurance FrameworkDocument2 pagesList of Some Important Acts of The Insurance FrameworkPlace279No ratings yet

- Croatia in DepthDocument2 pagesCroatia in DepthPlace279No ratings yet

- Market Conditions On Ag Insurance in CroatiaDocument3 pagesMarket Conditions On Ag Insurance in CroatiaPlace279No ratings yet

- Legal Framework of The Insurance Market in CroatiaDocument2 pagesLegal Framework of The Insurance Market in CroatiaPlace279No ratings yet

- Benchmarking Report 2011 - Wood Metal Sectors in BosniaDocument15 pagesBenchmarking Report 2011 - Wood Metal Sectors in BosniaPlace279No ratings yet

- Agriculture in CroatiaDocument3 pagesAgriculture in CroatiaPlace279No ratings yet

- Croatia Econ IndicatorsDocument2 pagesCroatia Econ IndicatorsPlace279No ratings yet

- Project Cycle Management Training GuideDocument13 pagesProject Cycle Management Training GuidePlace279No ratings yet

- Croatia Fact Sheet Annex 27Document2 pagesCroatia Fact Sheet Annex 27Place279No ratings yet

- Agriculture Insurance in Croatia 2011Document37 pagesAgriculture Insurance in Croatia 2011Place279No ratings yet

- Letter of SupportDocument1 pageLetter of SupportPlace279No ratings yet

- Letter of Support - SampleDocument1 pageLetter of Support - SamplePlace279No ratings yet

- Pants - HlaceDocument1 pagePants - HlacePlace279No ratings yet

- Preliminary Outline Project To Assist The Government of Uzbekistan in Restructuring Its Fiscal SystemDocument1 pagePreliminary Outline Project To Assist The Government of Uzbekistan in Restructuring Its Fiscal SystemPlace279No ratings yet

- Barents Group Style Guide Table of ContentsDocument1 pageBarents Group Style Guide Table of ContentsPlace279No ratings yet

- Software Engineering Chapter 6 ExercisesDocument4 pagesSoftware Engineering Chapter 6 Exercisesvinajanebalatico81% (21)

- Kimwa Compound, Baloy 04/01/2023 03/27/2023 LYL Development Corporation 006430292000Document1 pageKimwa Compound, Baloy 04/01/2023 03/27/2023 LYL Development Corporation 006430292000Maricel IpanagNo ratings yet

- Repair Guides - Wiring Diagrams - Wiring DiagramsDocument18 pagesRepair Guides - Wiring Diagrams - Wiring DiagramsAlvaro PantojaNo ratings yet

- C M P (P N) : Ommunication Anagement LAN Roject AMEDocument8 pagesC M P (P N) : Ommunication Anagement LAN Roject AMEArun BungseeNo ratings yet

- BBEK4203 Principles of MacroeconomicsDocument20 pagesBBEK4203 Principles of MacroeconomicskiranaomomNo ratings yet

- Nissan service bulletin DTC C1A12 C1A16 sensor cleaningDocument5 pagesNissan service bulletin DTC C1A12 C1A16 sensor cleaningABDULNAZER C P 001No ratings yet

- The Structural Engineer - August 2022 UPDATEDDocument36 pagesThe Structural Engineer - August 2022 UPDATEDES100% (1)

- Animal HusbandryDocument69 pagesAnimal HusbandryKabi RockNo ratings yet

- BITUMINOUS MIX DESIGNDocument4 pagesBITUMINOUS MIX DESIGNSunil BoseNo ratings yet

- Hydrostatic Test ReportsDocument3 pagesHydrostatic Test ReportsHanuman RaoNo ratings yet

- Appraising and Managing PerformanceDocument20 pagesAppraising and Managing PerformanceAnushkar ChauhanNo ratings yet

- CP Officer Exam AnswerDocument3 pagesCP Officer Exam AnswerDaniel GetachewNo ratings yet

- ERP ImplementationDocument47 pagesERP Implementationattarjaved100% (1)

- Trash and Recycling Space Allocation GuideDocument24 pagesTrash and Recycling Space Allocation GuideJohan RodriguezNo ratings yet

- To Revision of DDPMAS-2002: Centre For Military Airworthiness and Certification (CEMILAC)Document11 pagesTo Revision of DDPMAS-2002: Centre For Military Airworthiness and Certification (CEMILAC)Jatinder Singh100% (1)

- PDF Online Activity - Gerunds and InfinitivesDocument3 pagesPDF Online Activity - Gerunds and InfinitivesJORDY ALEXANDER MONTENEGRO ESPEJONo ratings yet

- G.R. No. 173637 - Speedy TRial and Double JeopardyDocument3 pagesG.R. No. 173637 - Speedy TRial and Double Jeopardylr dagaangNo ratings yet

- Jan 2012Document40 pagesJan 2012Daneshwer Verma100% (1)

- PDF-6.2 The Pressurized Water ReactorDocument35 pagesPDF-6.2 The Pressurized Water ReactorJohn W HollandNo ratings yet

- Erasmo WongDocument3 pagesErasmo WongGabriel GutierrezNo ratings yet

- Excessive Heat: Current HazardsDocument14 pagesExcessive Heat: Current HazardsPeter MahonNo ratings yet

- Politische StrategiesEnd 2012 de en FINALDocument405 pagesPolitische StrategiesEnd 2012 de en FINALFomeNo ratings yet

- Banking Sector Project ReportDocument83 pagesBanking Sector Project ReportHarshal FuseNo ratings yet

- Catalogue: See Colour in A Whole New LightDocument17 pagesCatalogue: See Colour in A Whole New LightManuel AguilarNo ratings yet

- About 1,61,00,00,000 Results (0.20 Seconds) : All Books Shopping Videos More Settings ToolsDocument2 pagesAbout 1,61,00,00,000 Results (0.20 Seconds) : All Books Shopping Videos More Settings Toolsupen097No ratings yet

- Assessment of Electronic Collection Development in Nigerian University LibrariesDocument24 pagesAssessment of Electronic Collection Development in Nigerian University Librariesmohamed hassanNo ratings yet

- Master I M Lab ManualDocument44 pagesMaster I M Lab ManualwistfulmemoryNo ratings yet

- 2003 Expedition/Navigator 4WD Systems Workshop Manual DiagnosisDocument18 pages2003 Expedition/Navigator 4WD Systems Workshop Manual DiagnosisAngelina IsaacsNo ratings yet

- Bang Olufsen Beocenter - 2 Service Manual 1Document54 pagesBang Olufsen Beocenter - 2 Service Manual 1Seb Schauer- QuigleyNo ratings yet