Professional Documents

Culture Documents

1/19/09 Declaration by Stanley Chais, Attesting That The Chais Family Foundation's 990 For The Year Ended 5/31/08 Is True.

Uploaded by

jpeppardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1/19/09 Declaration by Stanley Chais, Attesting That The Chais Family Foundation's 990 For The Year Ended 5/31/08 Is True.

Uploaded by

jpeppardCopyright:

Available Formats

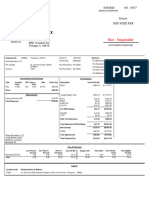

01/19/2009 21:33 FAX 12125811399 (,HAIS ^uvu

Form 990- Ff'(2007 ) CHAIS FAMILY FOUNDATION 95-4 r' !. 7323 Page 10

' rivate Operating Foundations (see instructions and Part VII-A, question 9) N/A

1 a if the foundation has received a rulin g or determination letter that it is a private operating foundation , and the ruling

is effective for 2007, enter the date of the ruling . .. ..... .... .. .... . ..... ............... ...... ..

b Check box to indicate whether the foundation is a orivate operatlna foundation described in section r I 4942 (1)(3) or 49426)(5)

2a Enter the lesser of the adjusted net Tax year Prior 3 years

income from Part I or the minimum

investment return from Part X for (a) 2007 (c) 2005 (d) 2004

each year listed

b85% of line 2a.. . .. . . . ...

c Qualifying distributions from Part XII,

line 4 for each year listed...............

d Amounts included in line 2c not used directly -

for active conduct of exempt activities . .

e Qualifying distributions made directly

for active conduct of exem p t activities.

Subtract line 2d from line 2c .......... .

3 Complete 3a, b, or c for the

alternative test relied upon:

a Assets' alternative test - enter;

(1) Value of all assets . .. . ..

(2) Value of assets qualifying under

section 4942 (j)(3)(S)(i) .... .. ...

b Endowment' alternative test - enter 2/3 of

minimum investment return shown In Part X,

line 6 for each year listed ....................

c Support ' alternative test - enter.

(1) Total support other than gross

Investment Income ( interest,

dividends , rents , payments

on securities loans (section

512(a )(5)), or royalties). . .....

(2) Support from general public and 5 or

more exempt organizations as provided

in section 4942(j)(3)(B)(11i ), . . . . ... .

(3) Largest amount of support from

an exempt organization .............

(4) Gross investment income .

WROW Supplementary information (Complete this part only if the organization had $5, 000 or more in

assets at any time durlnq the year - see instructions.)

1 Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the

close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

None

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of

a partnership or other entity) of which the foundation has a 10% or greater interest.

None

2 Information Regarding Contribution , Grant, Gift, Loan , Scholarship , etc, Programs:

Check here ' if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited

requests for funds. If the foundation makes gifts, grants, etc, (see instructions) to individuals or organizations under other conditions,

complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include.

c Any submission deadlines.

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

SAA TEEAO31OL 07/31/07 Form 990-PF (2007)

01/19/2009 21:34 FAX 12125811399 CHAIS e004

0425874015

Jan. 02, 2009 LTR 2697C 0 R

95-4017323 200805 44 000

00039041

CHAIS FAMILY FOUNDATION

MANTOVANI

16255 VENTURA BLVD #840

ENCINO CA 91436

@6

DECLARATION

009702

Under penalties of perjury, I declare that I have

examined the return identified in this letter, including

._acrampanying -schedules an-d statements, and to- the

best of my knowledge and belief, it is true, cdFect'I'Stfe, I

complete. I understand that this declaration will become

a perm ent part of that return.

ignature of fficer or Trustee Date

^iC^ ^ n ^1n1 i

Title

w- -•

You might also like

- US Vs Ho Wan Kwok (Guo Wengui) Bankruptcy CaseDocument70 pagesUS Vs Ho Wan Kwok (Guo Wengui) Bankruptcy CasejpeppardNo ratings yet

- Sergeants Benevolent Association Widows & Children's Fund NYS CHAR500 2019Document55 pagesSergeants Benevolent Association Widows & Children's Fund NYS CHAR500 2019jpeppardNo ratings yet

- PACER USA Vs Pierre Girgis Jan 6 2022 IndictmentDocument6 pagesPACER USA Vs Pierre Girgis Jan 6 2022 IndictmentjpeppardNo ratings yet

- Americans For Prosperity 2019 990Document54 pagesAmericans For Prosperity 2019 990jpeppardNo ratings yet

- Householder Complaint AffidavitDocument82 pagesHouseholder Complaint AffidavitWCPO 9 NewsNo ratings yet

- Donors Trust 2017 990Document192 pagesDonors Trust 2017 990jpeppardNo ratings yet

- Donors Trust 2019 990Document113 pagesDonors Trust 2019 990jpeppardNo ratings yet

- Guo Wengui Aka Miles Kwok Chapter 11 Petition Dated Feb 15 2022Document14 pagesGuo Wengui Aka Miles Kwok Chapter 11 Petition Dated Feb 15 2022jpeppardNo ratings yet

- Americans For Prosperity 2020 990Document57 pagesAmericans For Prosperity 2020 990jpeppardNo ratings yet

- USA Vs Roger & Nydia Stone 0:21-cv-60825-RARDocument18 pagesUSA Vs Roger & Nydia Stone 0:21-cv-60825-RARjpeppardNo ratings yet

- PACER US Vs Adam Hageman Complaint - Nov 12 2020Document5 pagesPACER US Vs Adam Hageman Complaint - Nov 12 2020jpeppardNo ratings yet

- DOJ Sentencing Memo Re David Correia - Feb 1 2021Document46 pagesDOJ Sentencing Memo Re David Correia - Feb 1 2021jpeppardNo ratings yet

- Donald J. Trump, Linda Cuadros & American Conservative Union Vs Twitter & Jack DorseyDocument40 pagesDonald J. Trump, Linda Cuadros & American Conservative Union Vs Twitter & Jack DorseyjpeppardNo ratings yet

- Donors Trust 2018 990Document87 pagesDonors Trust 2018 990jpeppardNo ratings yet

- Donors Trust 2016 990Document176 pagesDonors Trust 2016 990jpeppardNo ratings yet

- China Branding Group Vs Tony BobulinskiDocument4 pagesChina Branding Group Vs Tony BobulinskijpeppardNo ratings yet

- Stephanie Winston Wolkoff WH Services AgreementDocument5 pagesStephanie Winston Wolkoff WH Services AgreementjpeppardNo ratings yet

- SEC Vs Lev Parnas & David Correia - Feb 4 2021Document23 pagesSEC Vs Lev Parnas & David Correia - Feb 4 2021jpeppardNo ratings yet

- Tony Bobulinski Vs Adam Roseman Et Al Amended ComplaintDocument29 pagesTony Bobulinski Vs Adam Roseman Et Al Amended ComplaintjpeppardNo ratings yet

- PACER Terry Woods Vs Hudson Holdings, Avi Greenbaum & Steven MichaelDocument73 pagesPACER Terry Woods Vs Hudson Holdings, Avi Greenbaum & Steven Michaeljpeppard100% (1)

- DOJ Vs Lev Parnas, Igor Fruman Et Al. Superseding Indictment 9/17/2020Document35 pagesDOJ Vs Lev Parnas, Igor Fruman Et Al. Superseding Indictment 9/17/2020jpeppardNo ratings yet

- Melania Trump Vs Stephanie Winston WolkoffDocument17 pagesMelania Trump Vs Stephanie Winston WolkoffjpeppardNo ratings yet

- PACER - Request For Discovery - Igor KolomoiskyDocument12 pagesPACER - Request For Discovery - Igor KolomoiskyjpeppardNo ratings yet

- US Vs Sargeant Marine Inc (Harry Sargeant) Filed Sept 23, 2020Document25 pagesUS Vs Sargeant Marine Inc (Harry Sargeant) Filed Sept 23, 2020jpeppardNo ratings yet

- Ivanka Trump: United States Vs Moshe Lax, Et Al - Martin (Mordechai Ehrenfeld)Document17 pagesIvanka Trump: United States Vs Moshe Lax, Et Al - Martin (Mordechai Ehrenfeld)jpeppardNo ratings yet

- The Case of Al Franken by Jane Mayer New Yorker July '19Document30 pagesThe Case of Al Franken by Jane Mayer New Yorker July '19jpeppardNo ratings yet

- 2017 Trump Carousel LLC New York City Vendor FilingDocument46 pages2017 Trump Carousel LLC New York City Vendor FilingjpeppardNo ratings yet

- Ivanka Trump 2017 Financial DisclosureDocument98 pagesIvanka Trump 2017 Financial DisclosurejpeppardNo ratings yet

- Charles A. Gargano: Eagle Building Technologies Inc.Document127 pagesCharles A. Gargano: Eagle Building Technologies Inc.jpeppardNo ratings yet

- David Correia, Lev Parnas & Newco Partners Vs Hudson Holdings LLC, Andrew Greenbaum & Steven MichaelDocument157 pagesDavid Correia, Lev Parnas & Newco Partners Vs Hudson Holdings LLC, Andrew Greenbaum & Steven MichaeljpeppardNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Invoice: Billed To: Invoice DetailsDocument1 pageTax Invoice: Billed To: Invoice DetailsVINAY BANSAL100% (1)

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- Invoice of Smart BazarDocument1 pageInvoice of Smart BazarSanjan SameerNo ratings yet

- Manitoba Tax: Form MB428 2022Document3 pagesManitoba Tax: Form MB428 2022Ademuyiwa OlaniyiNo ratings yet

- Sample Questions On WTWDocument1 pageSample Questions On WTWBaldovino VenturesNo ratings yet

- Form DGT-1 Pg2Document1 pageForm DGT-1 Pg2Imantoni NainggolanNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryAnonymous k9nrtxANo ratings yet

- Financial Management Solution ZHJJJJJJJZBBZBZBBZDocument4 pagesFinancial Management Solution ZHJJJJJJJZBBZBZBBZJoylyn CombongNo ratings yet

- Kinds of TaxDocument1 pageKinds of TaxMaricar Corina CanayaNo ratings yet

- W-9 FormDocument2 pagesW-9 FormTrish HitNo ratings yet

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- Thermal Gun Tax InvoiceDocument2 pagesThermal Gun Tax InvoicePapun GhoshNo ratings yet

- Company Unit 4th - Aug - 2021Document17 pagesCompany Unit 4th - Aug - 2021cubadesignstudNo ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- Tax Control Sheet Key ConceptsDocument1 pageTax Control Sheet Key ConceptsArman KhanNo ratings yet

- Amazon Invoice Books 6Document2 pagesAmazon Invoice Books 6raghuveer9303No ratings yet

- TRAIN LawDocument38 pagesTRAIN LawJorrel BautistaNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Cagayan Electric Power Vs CIRDocument2 pagesCagayan Electric Power Vs CIRJosephine Huelva VictorNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amount1399Rimjhim GuptaNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amit SinghNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Bir Ruling (Da-042-04)Document3 pagesBir Ruling (Da-042-04)E ENo ratings yet

- BIR Form 1701Q Quarterly Income Tax ReturnDocument1 pageBIR Form 1701Q Quarterly Income Tax ReturnMark De JesusNo ratings yet

- 2023 - ADM - CFIPC5376Q - Grievance Resolution Letter - 1056457278 (1) - 23092023Document1 page2023 - ADM - CFIPC5376Q - Grievance Resolution Letter - 1056457278 (1) - 23092023VINU KNo ratings yet

- Income Tax Payment Challan: PSID #: 42730325Document1 pageIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifNo ratings yet

- Assignment 2 Midterm MacatangayC3SDocument3 pagesAssignment 2 Midterm MacatangayC3Schad macatangayNo ratings yet

- Notice of Assessment 2021 03 11 12 47 30 085217Document4 pagesNotice of Assessment 2021 03 11 12 47 30 085217gilli billiNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet