Professional Documents

Culture Documents

Property Tax Calculations For Bangalore

Uploaded by

Naveen KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Tax Calculations For Bangalore

Uploaded by

Naveen KumarCopyright:

Available Formats

Taxation and Legal - Property Tax Calculations For Bangalore

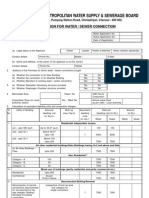

REFERENCE: Property Tax Self-Assessment Scheme (Bangalore Mahanagara Palike) 2000 The Bangalore Mahanagara Palike (BMP) offers its citizens a Self-Assessment System to calculate property tax. The property tax assessment system is based on the Annual Rateable value (ARV). As per section 109(2), ARV of a property is the gross annual rent at which the building or land may reasonably be expected to let from year to year. Section 109(2) (a) (ii) provides the method for assessing property tax, when the gross annual tax cannot be estimated. The new scheme has been evolved on the mass appraisal system of properties. The city of Bangalore has been classified into six zones based on the property valuation done by the Department of Revenue (Registration). Further, the properties have been classified based on cost of construction value at current market rate. The per sq. ft. per month rates applicable are related to the zone and class of building. While rates for rented buildings have been fixed at much lower than prevailing market rates, owner occupied buildings have been given a further concession of 50%. The rates for different classes/zones have been arrived at after factoring several criteria like the location, type of construction, built up area, use of property and the age of the building. Citizens have been given a range of choice to file their statement of property tax at any of the branches of Vijaya Bank and Syndicate Bank, besides the offices of the concerned Asst. Revenue Officer. House Tax / Property Tax It is a specific percentage of the rateable value of lands and buildings. Annual Rateable Value Annual Rateable Value of any land or building assessable to property taxes shall be the annual rent at which such land or building might reasonably be expected to let from year to year.

Residential Property (Examples) 1000 SQ. FT FLAT RESIDENTIAL WITH RCC CONSTRUCTION UNDER 5 YEARS. Self Occupied: Area x RV RV=Rs. 2.50/sq.ft pm (see Annexure I) 1000 sq. ft. X Rs. 2.50 /sq.ft. pm = Rs. 2500 pm (MRV) Rs. 2500 X 10 = Rs. 25000 pa ARV (2 months deduction for maintenance allowance) Rs. 25000 X 0.90 = Rs. 22500 pa ARV (10% depreciation, under 5 years old, see Annexure III) Rs. 22500 X 0.20 = Rs. 4500 pa PT (20% of ARV for residential use) Rs. 4500 X 1.34 = Rs.6030 pa Property Tax (additional cess - 34% of property tax) See Note-1 Total Cess of 34% = 10% education cess + 15% health cess + 3% beggary cess + 6% library cess) Tenant (rental residential): RV = Rs. 5.00 /sq.ft/month (see Annexure I) 1000 sq. ft X Rs. 5.00 /sq.ft.pm = Rs 5000 pm MRV Rs. 5000 X 10 = Rs. 50000 pa ARV ( 2 months deduction for maintenance allowance) Rs. 50000 X 0.90 = Rs. 45000 pa ARV (10% depreciation Annexure III, under 5 years) Rs. 45,000 X 0.2 = Rs. 9000 pa PT (20% of ARV for residential) Rs. 9000 X 1.34 = Rs. 12060 pa Property Tax (additional cess - 34% of property tax ) See Note 1

The following section contains three annexure, two notes and a set of general conditions as shown below. ANNEXURE-I 1. This contains various rates, per sq. foot per month (RV) that the property owner has to use for arriving at Annual Rateable Value (ARV) of the residential properties. The table has six zones from A to F (Column-5) and five property classifications from category I to V (column-I). The rates, per sq. ft. per month, applicable for arriving at the Annual Rateable Value are shown under different zone/category for rented and owner occupied properties, separately. RATES FOR ARRIVING AT THE ANNUAL RATEABLE VALUES FOR ASSESSMENT OF RESIDENTIAL PROPERTY IN BANGALORE CITY. For bringing in uniformity in the matters of assessment of property, the annual gross rent at which the building/land may, at the time of assessment, reasonably be expected to be let from month to month or year to year shall be

calculated as under

ANNEXURE- I (UNIT: PER SQ. FT. / PER MONTH) Description of the Cost of Category property construction (including apartments) I ZONE ZONE ZONE ZONE ZONE A B C D E

USE

ZONE F

MORE THAN RCC/Madras Owner Rs.250/- per 2.50 Terrace Occupied sq.ft. Tenanted 5.00 MORE THAN Rs.150/RCC/Madras Owner BUT LESS 2.00 Terrace Occupied THAN Rs.250 per sq. foot Tenanted 4.00

2 4

1.80 3.60

1.60 3.20

1.40 2.80

1.20 2.40

II

1.75

1.50

1.25

1.00

0.60

3.50 1.50 3.00

3.00 1.25 2.50

2.50 1.00 2.00

2.00 0.80 1.60

1.50 0.60 1.20

III

RCC/Madras Terrace

LESS THAN Rs. 150/per sq.ft.

Owner 1.75 Occupied Tenanted 3.50

IV

TILED AND SHEET OF ALL KINDS

ESTIMATED TO BE LESS Owner 1.50 THAN Rs.150 Occupied Per sq. ft. Tenanted 3.00

1.25

1.00

0.80

0.70

0.50

2.50

2.00

1.60

1.40

1.00

THATCHED Rs. 40/- per sq. ft. per month with a minimum HOUSE/HUT

NOTE-1: HOW TO ARRIVE AT THE RATEABLE VALUE FOR RESIDENTIAL PROPERITES Cost of construction means the cost of the building if constructed at the prevailing market rates. Accordingly, choose the appropriate category at Column 1 and Zone at Column 5. Measure the total built-up area of the property. The built-up area means the total built-up area, which includes covered balcony, all covered areas including the garage area. If the property is a mixed construction, i.e. both RCC and tiled/sheet then measure the area separately and apply the rates appropriate to the category. Multiply the total area with the rateable value specified in column 5 for respective zones listed in Annexure-I. This gives the Monthly Rateable Value (MRV). Multiply MRV by 10 months to arrive at the Annual Rateable Value (ARV). (Two months deduction is given in lieu of all allowance for repair or on any other account whatever.) Assessment of vacant land: If the vacant land exceeds 3 times the built-up area, such land in excess shall be assessed @ 30% of the rate fixed for built-up area of such property. On the ARV, deduct for the age of the building depreciation as per Annexure-III. On the balance ARV, apply tax @ 20% for residential use or 25% for non-residential use to arrive at the property tax payable for the year. To the property tax add 34% of the property tax, towards cess, viz:Educational cess - 10% Health cess. - 15% Beggary cess. - 3% Library cess. - 6% Total 34%

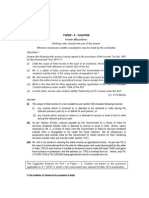

Non-Residential Property (Examples) 1000 SQ. FT non-residential self occupied shop constructed under 5 years old. Self Occupied: RV=Rs. 10.00/sq.ft pm Annexure II 1000 sq. ft X Rs. 10 /sq. ft. pm = Rs.10000 pm MRV Rs. 10000 X 10 = Rs. 100000 pa ARV (2 months deduction for maintenance allowance) Rs. 100000 X 0.90 = Rs. 90000 pa ARV (10% depreciation, under 5 years old, Annexure III) Rs. 900000 X 0.25 = Rs. 22500 pa PT (25% of ARV for non-residential use) Rs. 22500 X 1.34 = Rs. 30150 pa Property Tax (additional cess - 34% of property tax) See Note-2

ANNEXURE-II NON-RESIDENTIAL This contains the details of rates for arriving at the Annual Rateable Value (ARV) for non-residential buildings. All the non-residential buildings have been classified into group A and B. Group 'A' consists of six categories (VI to XI) of buildings and the rate per sq. ft. is based on the zone in which the property is located. As in the case of Annexure-I, here too, rates applicable per sq. ft. per month for respective zones and class of building have been shown separately for rental and owner occupied buildings.

Group B consists of non-residential buildings grouped into five categories (XII to XVI) and the per sq. Ft. rate for these properties is not related to zonal classification, since the value of the type of non-residential properties included in this group is not related to the zone in which they are located. Hence, for 5 types of properties categorized as class XII to XVI, an independent system of assessment unrelated to the zone, but based on certain norms has been evolved. Annexure-II, Group-B contains per sq.ft./per month rate applicable to calculate the ARV.

RATES FOR ARRIVING AT THE ANNUAL RATEABLE VALUES FOR ASSESSMENT OF Non-RESIDENTIAL PROPERTY IN BANGALORE CITY.

UNIT: PER SQ. FT./ PER MONTH Non-Residential Group-A: Category Description of the property (including apartments) All Commercial Complexes, Banks, Offices, Shops and commercial establishments other than those specifically mentioned in other categories in Annexure-VI Cost of construction USE ZONE ZONE ZONE ZONE ZONE ZONE A B C D E F

VI

MORE THAN Rs.250/- per sq.ft.

Owner Occupied

10

Tenanted Hotels, pub bar/restaurant & lodging homes including all clubs/Association where articles of food and/or liquor are served MORE THAN Rs.150/- BUT Owner LESS THAN Occupied Rs.250 per sq. ft. Tenanted Clinics, poly-clinics, diagnostic centers, laboratories, and other health care system/services other than nursing homes & hospital.

20

14

10

VII

10

20

16

12

VIII

LESS THAN Rs. 150/- per sq.ft.

Owner Occupied

Tenanted Exclusive sports centers including gym and physical fitness centers where articles of food and for liquor are not served.

16

14

10

IX

Owner Occupied

1.50

Tenanted

12

10

Student hostel & educational institutions not covered under section 110 of the KMC Act.

Owner Occupied

Tenanted Other kinds of not-residential properties not specifically included under the nonresidential group A or group B mentioned here in after

XI

Owner Occupied

10

Tenanted

20

14

10

Non-Residential Group-B: Category Description of the property XII Rateable Value All Star Hotels, as categorized by the Ministry of Tourism Govt. of Karnataka/ Govt. of India, at the rate of Rs. 15/- per sq. ft., irrespective of the location within the Bangalore Mahanagara Palike. Cinema theaters Category Rate per Sq.ft. Cinema theaters have been classified into 5 categories based on the location, quality of construction, Air-condition, and other facilities provided. For the details of the categories please refer to Annexure-1V A Rs 4 B Rs 3.50 C Rs 3 D Rs 2.50

XIII

E) Touring theaters and semi-permanent theaters irrespective of zones shall pay Rs. 8000/-annually as property tax, payable in two half-yearly installments. Kalyana ManatapShadi Mahal, Kalyana Mantap etc. under this category have been classified into 5 Community hall, Convention groups based on the location, quality of construction facilities provided hall Party Hall etc. let out for all of which determine the charges for letting out the premises. Under marriage, reception, this category, charges for hall include charges for air-conditioning, chairs, meetings or for any function. utensils, vessels, shamiana, electricity, water, fuel, interior or exterior Category decoration and the like but do not include any charges for food and Rate per Sq. ft. drinks. Accordingly where the charges are:More than Between Between Between Rs. Rs.30,000 and Rs.20,000 and Rs.10,000 and Less than Rs. 5000 30,000 Rs 20,001per Rs. 10,001 per Rs. 5,001 per per day per day day day day A Rs. 5 Industrial Buildings (Industrial units as defined by the Director of Industries & Commerce Govt. of Karnataka or Govt. of India) They have been classified as (Rs. /per Sq.ft.) Owner occupied Tenanted a) Large Scale b) Medium Scale c) Small Scale d) Tiny Scale 4 3.50 3 2 8 7 6 4 B Rs. 4.50 C Rs. 4 D Rs. 3.50 E Rs. 3

XIV

XV

e) Public sector Industrial buildings (State Govt. or Central Govt.) Rs. 3/per sq. foot irrespective of the scale of the Industry.

RATEABLE VALUE FOR NON-GOVERNMENT HOSPITALS & NURSING HOMES IN BANGALORE CITY UNIT: RATE PER SQ. FOOT PER MONTH CATEGORY BASED ON BED STRENGTH XVI Year of commencement (Financial year) 2000 & after Between 1990-2000 Between 1980-1989 Prior to 1980 More than 200 A Rs. 6 5 4.50 4 Between 100-199 B Rs. 5 4.50 4 3.00 Less Between Between than 25 50-99 C Rs. 25-49 D Rs. E Rs. 4.50 4 3.50 2.50 4 3.50 3 2 3.50 3 2.50 3.50

NOTE-2: HOW TO ARRIVE AT THE RATEABLE VALUE FOR NON-RESIDENTAL PROPERTIES Measure the total built-up area of the property. The built-up area means the total built-up area, which includes covered balcony and covered areas including the garage area. Under non-residential property, 25% of the total built-up area in Category II & V in Group A and all Categories in Group B shall be considered as utility/ service area and such area shall be assessed to property tax at 50% of the rate prescribed for such property.

Multiply the total area with the rateable value specified for built up area and utility area, separately, for the respective category. This gives the Monthly Rateable Value (MRV). Multiply MRV by 10 months to arrive at the Annual Rateable Value (ARV). (Two months deduction is given in lieu of all allowance for repair or on any other account whatsoever.)

Assessment of vacant land: if the vacant land exceeds 3 times the built-up area, such land in excess shall be assessed @ 10% of the rate fixed for built-up area of such property.

On the ARV, deduct for the age of the building depreciation as per Annexure-III. On the balance ARV, apply tax @ 25% for non-residential use to arrive at the property tax payable for the year. To the property tax add 34% of the property tax, towards cess, viz:Educational cess - 10% Health cess - 15% Beggary cess - 3% Library cess - 6% Total - 34%

It contains the rates of depreciation allowed on buildings according to the age. These rates are applicable to all the 16 classes of properties. The depreciation for Building of the Clause referred to in sub-clause II of class (a) of the proviso to sub -section (2) of section 109 of KMC Act, 1976 shall be as follows:

ANNEXURE III Age of the Building If the age of the Building: 1.Does not exceed Five years 2.Exceeds Five years but does not exceed Ten Years 3.Exceeds Ten years but does not exceed Fifteen years 4.Exceeds Fifteen years but does not exceed Twenty years 5.Exceeds Twenty years but does not exceed Twenty-Five years 6.Exceeds Twenty-Five years but does not exceed Thirty years 7.Exceeds Thirty years but does not exceed Thirty-Five years 8.Exceeds Thirty-Five years but does not exceed Forty-Five years 9.Exceeds Forty years but does not exceed Forty-Five years 10.Exceeds Forty-Five years but does not exceed Fifty years 11.Exceeds Fifty years but does not exceed Fifty-Five years 12.Exceeds Fifty-Five years and above 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 70% Depreciation

This Self-Assessment Scheme came into effect from 01/04/2000 and shall remain in force until 31/03/2005. Annexure IV, V and VI from the Bangalore Mahanagara Palike booklet have not been shown here, due to lack of space, but must be referred to, at all times. Disclaimer: This article is provided only as a guideline for estimating Bangalore property taxes and must be used as such. Refer to the latest updates from the Bangalore Municipal Corporation. For more support and tips, feel free to write to us at: info@bricksandwall.com

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Sri Venkateswara Suprabhatam Kannada LargeDocument6 pagesSri Venkateswara Suprabhatam Kannada LargeNaveen Kumar50% (2)

- African Oil Policy Initiative Group - White PaperDocument19 pagesAfrican Oil Policy Initiative Group - White Paperbear clawNo ratings yet

- PARTNERSHIP LAW: KEY ELEMENTS & REQUIREMENTSDocument18 pagesPARTNERSHIP LAW: KEY ELEMENTS & REQUIREMENTSOne DozenNo ratings yet

- Method of Assessment of Property Tax in Andhra Pradesh MunicipalitiesDocument7 pagesMethod of Assessment of Property Tax in Andhra Pradesh MunicipalitiesgokedaNo ratings yet

- Final Notification (384 - III - UDD - BBMP DC - Rev - 5675) (Only Notification) PDFDocument15 pagesFinal Notification (384 - III - UDD - BBMP DC - Rev - 5675) (Only Notification) PDFChetan SharmaNo ratings yet

- Final Notification (384 - III - UDD - BBMP DC - Rev - 5675)Document686 pagesFinal Notification (384 - III - UDD - BBMP DC - Rev - 5675)callme100% (1)

- Income From House Property-1Document18 pagesIncome From House Property-1Aaditya BhardwajNo ratings yet

- Rent Building GO in Rural and UrbanDocument4 pagesRent Building GO in Rural and UrbananilNo ratings yet

- Circular (Revision of Property Tax in GHMC - Final)Document20 pagesCircular (Revision of Property Tax in GHMC - Final)Dasharath Tallapally62% (13)

- 2 Notifications Cic CD - Conversion ChargesDocument9 pages2 Notifications Cic CD - Conversion ChargesSushil TyagiNo ratings yet

- House Property PDFDocument43 pagesHouse Property PDFK Vijay Bhaskar ReddyNo ratings yet

- Real Property Assessment &taxation - Engr NonatoDocument54 pagesReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- Step 1: GBWASP ChargesDocument3 pagesStep 1: GBWASP Chargesk_vk2000No ratings yet

- Income from House PropertyDocument7 pagesIncome from House Propertysb_jainNo ratings yet

- CPWD NormsDocument13 pagesCPWD NormsBIJAY KRISHNA DASNo ratings yet

- Chennai Metropolitan Water Supply & Sewerage Board: Application For Water / Sewer ConnectionDocument11 pagesChennai Metropolitan Water Supply & Sewerage Board: Application For Water / Sewer Connectionsaravanand1983No ratings yet

- Tax On Rental Income 2015-16Document8 pagesTax On Rental Income 2015-16Uganda Revenue AuthorityNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaP VenkatesanNo ratings yet

- NYCLL84 SummaryDocument2 pagesNYCLL84 SummaryCUNY BPLNo ratings yet

- Rera ProjectDocument26 pagesRera ProjectNidhi PiousNo ratings yet

- Stamp Duty Rates For Maharashtra in 2014Document11 pagesStamp Duty Rates For Maharashtra in 2014kailashNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- New System of Property Tax AssessmentDocument12 pagesNew System of Property Tax Assessmentpoornima_npNo ratings yet

- REM1 Hand OutDocument42 pagesREM1 Hand OutFrancis LNo ratings yet

- Guidelines For Floor Charges User ChargesDocument8 pagesGuidelines For Floor Charges User ChargesRaghuNo ratings yet

- Online bids with digital signatureDocument6 pagesOnline bids with digital signatureMark KNo ratings yet

- Income Under The Head "Income From House Property" and Its ComputationDocument20 pagesIncome Under The Head "Income From House Property" and Its ComputationAanchal SinghalNo ratings yet

- Letter Inviting TenderDocument7 pagesLetter Inviting TenderMark KNo ratings yet

- Notes NHFS Up To Cir. 25 2015 EMI CorrectedDocument34 pagesNotes NHFS Up To Cir. 25 2015 EMI CorrectedAnoop PS Sasidharan100% (1)

- Depreciation 2013 ActDocument14 pagesDepreciation 2013 Actlucky2340No ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property PracticalShreekanta DattaNo ratings yet

- HP 2016-17Document14 pagesHP 2016-17Bhaskar KrishnappaNo ratings yet

- Research Methodology ProjectDocument19 pagesResearch Methodology Projectswapnil_022No ratings yet

- G.o.ms - No.112, Deviation RulesDocument4 pagesG.o.ms - No.112, Deviation RulesbharatchhayaNo ratings yet

- Rates On Profession TaxDocument7 pagesRates On Profession Taxknikesh58No ratings yet

- AP GoO: Lease Buildings Rent Enhancement 18-04-2011Document2 pagesAP GoO: Lease Buildings Rent Enhancement 18-04-2011Guru Prasad88% (8)

- Taxation Philippines: Leasehold ImprovementsDocument17 pagesTaxation Philippines: Leasehold Improvementsmarklogan67% (3)

- GO282PRDocument8 pagesGO282PRhimabindu20No ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- Deduction of Housing Loan Repayment and InterestDocument7 pagesDeduction of Housing Loan Repayment and Interestar8ku9sh0aNo ratings yet

- B.Com. Degree Exam Income Tax PaperDocument0 pagesB.Com. Degree Exam Income Tax PaperbkamithNo ratings yet

- GST Impact on Real Estate SectorDocument4 pagesGST Impact on Real Estate SectorjvnraoNo ratings yet

- Unit 2 (Income From House Property)Document13 pagesUnit 2 (Income From House Property)Vijay GiriNo ratings yet

- Instructions On How To Create A MACRS Depreciation ScheduleDocument4 pagesInstructions On How To Create A MACRS Depreciation ScheduleMary100% (2)

- Kerala Taxes and Building RulesDocument3 pagesKerala Taxes and Building RulesAnandNg100% (1)

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- Labour CESSDocument6 pagesLabour CESSVipul JainNo ratings yet

- GOMSNo 589Document9 pagesGOMSNo 589Raghu Ram100% (1)

- Japan's Urban Land Use Planning SystemDocument8 pagesJapan's Urban Land Use Planning SystemMohammad Edris SadeqyNo ratings yet

- GO MS 245, Dt.30-06-2012Document6 pagesGO MS 245, Dt.30-06-2012Raghu RamNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof Submissiongopikiran6No ratings yet

- StructureRate 2013Document5 pagesStructureRate 2013viharikapavuluri1290No ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet

- Unit 4.3 Royalty Accounts Exam ProblemsDocument4 pagesUnit 4.3 Royalty Accounts Exam ProblemsRashmi AnuththaraNo ratings yet

- 4GB-3GBPE Generic Building BOQDocument148 pages4GB-3GBPE Generic Building BOQforbeskaNo ratings yet

- CONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)Document4 pagesCONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)ALEEM MANSOORNo ratings yet

- Scheme For Solar Pumping Programme For Irrigation and Drinking Water Under Offgrid and Decentralised Solar ApplicationsDocument10 pagesScheme For Solar Pumping Programme For Irrigation and Drinking Water Under Offgrid and Decentralised Solar ApplicationsShubham ChoudharyNo ratings yet

- Property Tax Calculation and Payment Form for East DelhiDocument8 pagesProperty Tax Calculation and Payment Form for East DelhiimachieverNo ratings yet

- Writ Petition Scrutiny PDFDocument7 pagesWrit Petition Scrutiny PDFNaveen KumarNo ratings yet

- Appeal Allowed by Seesion Case No.2Document13 pagesAppeal Allowed by Seesion Case No.2Naveen KumarNo ratings yet

- OA Dismissal ChennaiDocument24 pagesOA Dismissal ChennaiNaveen KumarNo ratings yet

- Writ Appeal Filing RequirementsDocument5 pagesWrit Appeal Filing RequirementsNaveen KumarNo ratings yet

- See Man ThamDocument1 pageSee Man ThamNaveen KumarNo ratings yet

- DRT Court FeeDocument10 pagesDRT Court FeeNaveen KumarNo ratings yet

- Form-I and AffidavitDocument3 pagesForm-I and AffidavitNaveen KumarNo ratings yet

- Form-I and AffidavitDocument3 pagesForm-I and AffidavitNaveen KumarNo ratings yet

- Format On Handbook Court MatterDocument27 pagesFormat On Handbook Court MatterNaveen KumarNo ratings yet

- AnjDocument5 pagesAnjNaveen KumarNo ratings yet

- ADOPTION ONLY SON-K.R.sivasankar Vs 1St On 6 December, 2007Document15 pagesADOPTION ONLY SON-K.R.sivasankar Vs 1St On 6 December, 2007Naveen KumarNo ratings yet

- Surity AffidevitDocument3 pagesSurity AffidevitNaveen Kumar50% (2)

- Point To Argue Before DRTDocument13 pagesPoint To Argue Before DRTNaveen Kumar100% (1)

- Agmforsale PPDocument13 pagesAgmforsale PPBhavesh VaishnavNo ratings yet

- Dishonour of ChequesDocument17 pagesDishonour of Chequeschirag78775% (4)

- Agreement To Sell and PurchaseDocument2 pagesAgreement To Sell and PurchaseMuhammad DarwishNo ratings yet

- Canal and River Trust - Code of PracticeDocument21 pagesCanal and River Trust - Code of PracticeSimon WoodsNo ratings yet

- Unit 4 BDocument10 pagesUnit 4 BR20PLP020 Kavya Reddy YNo ratings yet

- Special Power of Attorney-BaclaranDocument1 pageSpecial Power of Attorney-BaclaranMelinda LapusNo ratings yet

- Lamsis V Dong e DigestDocument2 pagesLamsis V Dong e DigestNicole MenesNo ratings yet

- Borromeo Vs Descallar Case DigestDocument2 pagesBorromeo Vs Descallar Case DigestPaula BitorNo ratings yet

- Case Law Digest On DocumentsDocument190 pagesCase Law Digest On DocumentsSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (4)

- The PSI State ExamDocument20 pagesThe PSI State ExamTom BlefkoNo ratings yet

- Ruben Balane Succession Reviewer PDFDocument73 pagesRuben Balane Succession Reviewer PDFinno KalNo ratings yet

- Real Property Tax ReviewerDocument5 pagesReal Property Tax ReviewerAtty. Rheneir MoraNo ratings yet

- Deed of Absolute Sale of Land in Calamba CityDocument4 pagesDeed of Absolute Sale of Land in Calamba CityRaysanNo ratings yet

- DVC Service (Conduct) Regulations, 1955Document9 pagesDVC Service (Conduct) Regulations, 1955Latest Laws TeamNo ratings yet

- CUADIG502 Design Digital ApplicationDocument2 pagesCUADIG502 Design Digital Applicationknow beastNo ratings yet

- Constitution 2 NotesDocument169 pagesConstitution 2 NotesRuby BucitaNo ratings yet

- Digest of Zayas v. Luneta Motor Co. (G.R. No. L-30583)Document2 pagesDigest of Zayas v. Luneta Motor Co. (G.R. No. L-30583)Rafael PangilinanNo ratings yet

- Supreme CourtDocument40 pagesSupreme CourtAndrew BelgicaNo ratings yet

- Equitable Mortgage ExplainedDocument6 pagesEquitable Mortgage ExplainedJoy TagleNo ratings yet

- Chapter 4 Gross EstateDocument4 pagesChapter 4 Gross EstateJohn Dominic Bobis ArtiagaNo ratings yet

- Easement by PrescriptionDocument11 pagesEasement by PrescriptionCălin CâmpianuNo ratings yet

- Florencio B. Nedira, Substituted by His Wife Emma G. Nedira, Petitioner, vs. NJ World Corporation, Represented by Michelle Y. Bualat, Respondent.Document16 pagesFlorencio B. Nedira, Substituted by His Wife Emma G. Nedira, Petitioner, vs. NJ World Corporation, Represented by Michelle Y. Bualat, Respondent.Anonymous DDyjiQEENo ratings yet

- Manila Memorial Park v. Secretary of DSWD, G.R. No. 175356, December 03, 2013Document83 pagesManila Memorial Park v. Secretary of DSWD, G.R. No. 175356, December 03, 2013Johnric PandacNo ratings yet

- Adjudication With Waiver Salanatin Eva JoyDocument2 pagesAdjudication With Waiver Salanatin Eva JoyRichelle OlivaNo ratings yet

- Problems On Income From House Property - 2023 2024Document3 pagesProblems On Income From House Property - 2023 2024goli pandeyNo ratings yet

- The Coimbatore City Municipal Corporation Act, 1981Document297 pagesThe Coimbatore City Municipal Corporation Act, 1981Tarun KumarNo ratings yet

- 2008gad MS528Document2 pages2008gad MS528ChennurMallikarjunuduNo ratings yet

- Sample Deed of Usufruct Over A Real Property PDFDocument5 pagesSample Deed of Usufruct Over A Real Property PDFNur Azlin IsmailNo ratings yet

- CovergaeDocument5 pagesCovergaePatty PerezNo ratings yet

- Halili Vs CA - 113539 - March 12, 1998 - JDocument7 pagesHalili Vs CA - 113539 - March 12, 1998 - JkimuchosNo ratings yet