Professional Documents

Culture Documents

Advance Accounting Prelim BSAT

Uploaded by

Lenie Lyn Pasion TorresOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Accounting Prelim BSAT

Uploaded by

Lenie Lyn Pasion TorresCopyright:

Available Formats

University of the Assumption (Pampanga) ACCOUNTING 11-a: Advance Accounting Part 1 Prelim Examination: Partnership Formation and Operation

1st Semester, A.Y. 2013-2014

Score:

Name: _____________ Year &Section: _____________ Date _________

1._____ 2. _____ 3. _____ 4. _____ 5. _____ 6._____ 7. _____ 8. _____ 9. _____ 10. _____

11._____ 12. _____ 13. _____ 14. _____ 15. _____ 16._____ 17. _____ 18. _____ 19. _____ 20. _____

21._____ 22. _____ 23. _____ 24. _____ 25. _____ 26._____ 27. _____ 28. _____ 29. _____ 30. _____

INSTRUCTIONS: Select the correct answer for each of the following questions. STRICTLY NO ERASURES ALLOWED. PROVIDE SOLUTIONS.

Multiple Choices:

1. J and K are partners who shares profits and losses in the ratio of 60%: 40%, respectively. Js salary is P60,000 and P30,000 for K. The partners are also paid interest on their average capital balances. In 2011, J received P30,000 of interest and K, P12,000. The profit and loss allocation is determined after deductions for the salary and interest payments. If Ks share in the residual income (income after deducting salaries and interest) was P60, 000 in 2011, what was the total partnership income? a. 192,000 b. 345,000 c. 282,000 d. 387,000

2. The partnership has the following amounts Sales Cost of goods sold Operating expenses Salary allocations to partners Interest paid to banks Partners withdrawals

P70,000 40,000 10,000 13,000 2,000 8,000

The partnership net income (loss) is a. 20,000 b. 18,000 c. 5,000 d. (3,000) 3. Lancelot is trying to decide whether to accept a salary of P40,000 or a salary of P25,000 plus a bonus of 10% of net income after salary and bonus as a means of allocating profit among the partners. Salaries traceable to the other partners are estimated to be P100,000. What amount of income would be necessary so that Lancelot would consider the choices equal? a. 165,000 b. 290,000 c. 265,000 d. 305,000

4. The partnership agreement of X,Y and Z provides for the year-end allocation of net income in the following order: First, X is to receive 10% of net income up to P200,000 and 20% over P200,000. Second, Y and Z each are to receive 5% of the remaining income over P300,000. The balance of income is to be allocated equally among the three partners. The partnership income was P50, 000 before any allocations to partners. What amount should be allocated to X? a. 202,000 b. 216,000 c. 206,000 d. 220,000 5. The partnership agreement of R and S provides that interest at 10% per year is to be credited to each partner on the basis of weighted-average capital balances. A summary of S capital account for the year ended December 31, 2011 is as follows: Balance, January 1 Additional investment, July 1 Withdrawal, August 1 Balance, December 31 420,000 120,000 (45,000) 495,000

What amount of interest should be credited to S capital account for 2011? a. 45,750 b. 49,500 c. 46,125 d. 51,750

6. A, B, and C are partners with average capital balances during 2011 of P360, 000, P180, 000 and P120, 000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P90,000 to A and P60,000 to C the residual profit and loss is divided equally. In 2011 the partnership incurred P99,000 loss before interest and salaries to partners. By what amount should As capital account change? a. 21,000 decrease b. 33,000 decrease c. 105,000 decrease d. 126,000 increase 2

7. A and D created a partnership to own and operate a food store. The partnership agreement provided that A receive a salary of P10,000 and D a salary of P5,000 to recognize their relative time spent in operating the store. Remaining profits and losses were divided 60:40 to A and D, respectively. Income for 2010, the first year of operations, of P13,000 was allocated P8,800 to A and P4,200 to D. On January 1, 2011 the partnership agreement was changed to reflect the fact that D could no longer devote any time to the stores operations. The new agreement allows A a salary of P18,000 and the remaining profits and losses are divided equally. In 2011, an error was discovered such that the 2010 reported income was understated by P4,000. The partnership income of P25,000 for 2011 included the P4,000 related to2010 In the reported net income of P25,000 for the year 2011, A and D would have: A 21,900 17,100 -012,500 D 3,100 17,100 -012,500

a. b. c. d.

8. On January 1, 2011 D and E decided to form a partnership. At the end of the year, the partnership made a net income of P120, 000. The capital accounts of the partnership show the following transactions. D Dr January 1 April 1 June 1 August 1 September October December 1 P5,000 10,000 10,000 P3,000 5,000 4,000 1,000 5,000 Cr P40,000 Dr E Cr P25,000

Assuming that an interest of 20% per annum is given on average capital and the balance of the profits is allocated equally, the allocation of profits should be: a. D, P60,000; E, P59,400 b. D, P61,200; E, P58,800 c. D, P67,200; E, P58,200 d. D, P68,800; E, P51,200

9. Z and X are partners in a business. Z's original capital was P20, 000 and X's was P30,000. They agree to share profits and losses as follow: Z X As salaries P14,000 P20,000 As interest on original capital 10% 10% Remaining profits or losses 2/5 3/5 If the profits for the year were P60,000, what share of the profits would Z receive? a. P16,000 b. P24,400 c. P22,400 d. P28,600 3

10. G and H formed a partnership on January 2, 2011, and agreed to share income 80% and 20%, respectively. G contributed a capital of P175,000,000 and H, P25,000. H is the general partner and is given a salary of P5,000 per month; an interest of 5% of the beginning capital (both partners) and a bonus of 15% of net income before salary, interest and the bonus. The partnership's 2011 income statement follows: Revenues Cost of goods sold Gross profits Expenses including salary, interest and bonus) Net Income What is H's 2011 bonus? a. P13,304 b. P16,456 c. P18, 000 d. P20,700

P875, 000 700,000 P175, 000 143,000 P 32,000

11. A, B and C are partners with average capital balances during 2011 of P472,500, P238,650 and P162,350, respectively. The partners receive 10% interest on their average capital balances; AFTER deducting salaries of P122,325 to A and P82,625 to C, the residual profits and loss is divided equally. In 2013, the partnership had a net loss of P125,624 before the interest and salaries to partners. By what amount should A and Cs capital account change- increase (decrease)? A 30,267 29,476 40,844 28,358 C (40,448) 17,536 31,235 32,458

a. b. c. d.

12. The same information in Number 11, except that the partnership had a loss of P125,624 after the interest and salaries to partners. By what amount should Bs capital account change increase (decrease)? a. (115,443) b. 23,865 c. (41,875) d. (18,010)

13. Van, Matt, and Den are to form a partnership. Van is to contribute cash of P500, 000, Matt, 50,000 and Den P500, 000. Van and Den are not to actively participate in the management of the business, but will refer customers, while Matt will manage it. Matt has given up his job which gives him an annual income of P600, 000. Partners agree to share profits and losses equally. The capital balances of each partner upon formation of the partnership respectively are: A. P500, 000; P50, 000; and P500, 000. B. P500, 000 P650, 000; and P500, 000. C. P350000; P350, 000; and P350, 000. D. P550, 000; P550, 000; and P550, 000. 4

14. . The partnership of Emmanuel and Chris was formed on February 28, 2011. The following assets were contributed: Emmanuel P125, 000 Chris P175, 000 275,000 500,000

Cash Merchandise Building Furniture and Equipment

75,000

The building is subject to a mortgage loan of P150, 000 which is to be assumed by partnership. The partnership agreement provides that Emmanuel and Chris share profits or losses 1:3, respectively. If the partnership agreement provides that the partners initially should have equal interest in partnership capital with no contribution of intangible assets, Emmanuel's capital account at February 28, 2011 would be A. B. C. D. 500, 000 575, 000 1, 000,000 1, 150,000

Items 15 and 16 are based on the following information: Seth, Van and Mitch are forming a new partnership, each contributing cash of P400,000 and their respective office equipment and supplies valued at P200,000, P400,000, and P600,000, respectively. Seth's non- cash contribution is his own developed software valued at cost, which he could sell for thrice the amount. Partners agree to admit his software at market value and they would share profits equally. 15. Capital balances upon formation, respectively are: a. P600, 000; P800, 000; and P1, 000,000 b. P1, 000,000; P800, 000; and P1, 000,000. c. P800, 000; P800, 000; and P800, 000. d. P933, 333; P933, 333; and P933, 334.

16. Assuming that each partner will have equal interest in the partnership and maintain the same total capital, the partnership should recognize: a. Goodwill of P200, 000. b. Bonus of P200, 000. c. Goodwill of P600, 000. d. Bonus of P133, 333.

17. Effective August 1, 2013, Kevin and Jasper agreed to form a partnership from their two respective proprietorships. The balance sheets presented below reflect the financial position of both proprietorships as of July 31, 2013: Kevin Jasper

Cash Accounts Receivable Merchandise Inventory Prepaid Rent Store Equipment Accumulated Depreciation Building Accumulated Depreciation Land Totals Accounts Payable Mortgage Payable Kevin, Capital Jasper, Capital Totals

12,000 72,000 198,000 240,000 (90,000) 750,000 (150,000) 360,000 1,392,000 45,000 360,000 987,000

30,000 42,000 252,000 24,000 180,000 (108,000)

420,000 18,000

402,000 1,392,000 420,000

As of August 1, 2013, the fair values of Kevins assets were: merchandise inventory, P162, 000; store equipment, P90, 000; building, P1, 500,000; and land, P600, 000. For Jasper, the fair values of the assets on the same date were: merchandise inventory, P270, 000; store equipment, P39, 000; prepaid rent, P 0. All other items on the two balance sheets were stated at their fair values. How much is the net assets of the new partnership? a. P1,389,000 b. P2,394,000 c. P2,817,000 d. P1,812,000

Items 18 and 19 are based on the following information: The balance sheet of the proprietorship of Anthony as of June 30, 2013 showed the following assets and liabilities Cash Accounts Receivable Inventory Equipment Accounts Payable P 40,000 53,600 88,000 65,600 63,520

The cash balance included a 200- share certificate of BW Resources common at acquisition cost of P1, 600; the current market quotation is 70 per share. Of the accounts receivable, an estimated 5% is considered to be doubtful of collection. 6

Certain inventory items, booked at a cost of P22, 960, are currently worth P16, 000. Depreciation has not been recorded; the equipment, acquired two years ago, has a remaining useful life of about eight more years. Prepaid expense of P12, 800 and accrued expense of P6, 120 have not been properly recognized. James and Bert will join Anthony in a partnership. Anthony will invest the net assets of his business, after effecting the appropriate adjustments, and he will be allowed credit for goodwill equal to 10% of his initial capital credit. James and Bert will each contribute cash to secure the respective interests of 1/3 and 1/6 respectively. 18. Anthonys goodwill credit would be: a. P16, 600 b. P18, 000 c. P20, 000 d. P21, 000 19. James' cash investment would be: a. P61, 267 b. P66, 000 c. P132, 000 d. P133, 333 20. Paolo and Gene entered into a partnership on February 1, 2012 by investing the following assets: Paolo Gene Cash P180, 000 Merchandise Inventory P540, 000 Land 180,000 Building 780,000 Furniture and Fixtures 1,200,000 The agreement between Paolo and Gene provides that profits and losses are to be divided 40% and 60%, respectively, and that the partnership is to assume the P360, 000 mortgage loans on the building. If Paolo is to receive a capital credit equal to his profit and loss ratio, how much cash must Gene invest? a. P870,000 b. P930,000 c. P780,000 d. P810,000

Problem 1(2pts)

Darwin and Paul formed DP Partnership on January 1, 2013. Darwin and Paul had been operating as sole proprietors. The book values and the fair values of the contributions to be made by each of the partners, as agreed upon by the partners are as follows: Darwin Book value Fair value 5,000 5,000 12,000 14,000 15,000 16,000 10,000 10,000 Paul Book value 10,000 4,000 30,000 8,000 30,000

Cash Accounts receivable, net Inventory Machinery, net Land Building

Fair value 10,000 5,000 35,000 10,000 30,000 7

The partnership is to assume accounts payable of Darwin and Paul in the accounts of P10, 000 and P20, 000, respectively. 1. What amount of capital should be credited to Darwin and Paul? 2. At what values should the assets contributed be recorded in the books?

Problem 2 (8pts)

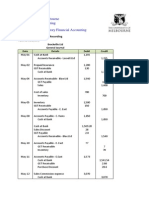

N and F organized the Levin Partnership on January 1, 2011. The following entries were made in their capital accounts during 2013: Debit N, capital January 1 April 1 October 1 F, capital January 1 March 1 September 1 November 1 Credit P180,000 P50,000 10,000

P60,000 P10,000 20,000 10,000

Required: if the partnership net income, computed before salaries, interest or bonus is P56,000 for 2011. Indicate its division between the partners under each of the following independent profit sharing agreements: a. Interest at 4% is allowed on average capital investments, and the balance is divided equally. b. A salary of P24,000 is to be credited to F, 4% interest is allowed on each partner on his ending capital balance, and the balance in the ratio of beginning capital balances. c. Salaries allowed to N and F in the amounts of P34,000 and P38,000, respectively, and remaining profits and losses are divided in the ratio of average capital balances. d. A bonus of 10% of the partnership net income is credited to N, a salary of P16,000 is allowed to F and remaining profits and losses are shared equally ( the bonus is regarded as an expense for the purposes of calculating the bonus amounts.)

-End of Examination-

You might also like

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Quiz Bee4thyrDocument5 pagesQuiz Bee4thyrlalala010899No ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- Activity - Chapter 4Document2 pagesActivity - Chapter 4Greta DuqueNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaNo ratings yet

- Problem 6 - PARENT acquires SON shares, contingent consideration and guaranteeDocument7 pagesProblem 6 - PARENT acquires SON shares, contingent consideration and guaranteeJrllsyNo ratings yet

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDocument57 pagesPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNo ratings yet

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezNo ratings yet

- Da'Lore Collections audit report 2013-2012Document6 pagesDa'Lore Collections audit report 2013-2012Ken CosaNo ratings yet

- Answer - ELEC 001Document2 pagesAnswer - ELEC 001Kris Van HalenNo ratings yet

- Bus Com 11Document3 pagesBus Com 11Chabelita MijaresNo ratings yet

- Unit 2. CashDocument8 pagesUnit 2. CashDaphne100% (1)

- Private Not-for-Profit Entities: Accounting Principles and Reporting PracticesDocument44 pagesPrivate Not-for-Profit Entities: Accounting Principles and Reporting PracticesYuvia KeithleyreNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- AFAR 1 Exams 2020Document7 pagesAFAR 1 Exams 2020RJ Kristine DaqueNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationJia CruzNo ratings yet

- Nature of Accountancy ResearchDocument29 pagesNature of Accountancy ResearchRodNo ratings yet

- Partnership Liquidation DistributionDocument2 pagesPartnership Liquidation DistributionIvy BautistaNo ratings yet

- Practical Accounting 2.2Document14 pagesPractical Accounting 2.2Jao FloresNo ratings yet

- Accounting Cycle: Exercise 6.1Document11 pagesAccounting Cycle: Exercise 6.1Joanna GarciaNo ratings yet

- Acctg7 - CH 9Document29 pagesAcctg7 - CH 9Jao FloresNo ratings yet

- CPA REVIEW: Calculating Depreciation and Estimated LiabilityDocument41 pagesCPA REVIEW: Calculating Depreciation and Estimated LiabilityalellieNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Document6 pagesAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNo ratings yet

- Parco CorporationDocument2 pagesParco CorporationWawex DavisNo ratings yet

- Practical Accounting 2 - ExaminationDocument10 pagesPractical Accounting 2 - ExaminationPrincess Claris ArauctoNo ratings yet

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryNo ratings yet

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsDocument100 pagesChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonNo ratings yet

- Module 1.1 Orientation & PFRS 15Document22 pagesModule 1.1 Orientation & PFRS 15NCTNo ratings yet

- Assets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atDocument15 pagesAssets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atBerna MortejoNo ratings yet

- Chapter 18Document16 pagesChapter 18Christian Blanza LlevaNo ratings yet

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Seatwork Income MaDocument3 pagesSeatwork Income MaJoyce Ann Agdippa Barcelona0% (1)

- NFJPIA Mockboard 2011 P2Document6 pagesNFJPIA Mockboard 2011 P2ELAIZA BASHNo ratings yet

- 8901 - Partnership FormationDocument3 pages8901 - Partnership FormationRica Jane Santos Marcelo100% (1)

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Partnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionDocument2 pagesPartnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionKyo TieNo ratings yet

- AFAR - Revenue Recognition, JointDocument3 pagesAFAR - Revenue Recognition, JointJoanna Rose DeciarNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Chapter 15 PDFDocument5 pagesChapter 15 PDFRenzo RamosNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Audit of Investments - Equity Securities Supplementary ProblemsDocument2 pagesAudit of Investments - Equity Securities Supplementary ProblemsNIMOTHI LASE0% (1)

- ACSTRAN - Realization and LiquidationDocument4 pagesACSTRAN - Realization and LiquidationDheine MaderazoNo ratings yet

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyNo ratings yet

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- AudprobDocument3 pagesAudprobJonalyn MoralesNo ratings yet

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- Accounting quiz on partnership formation and operationsDocument10 pagesAccounting quiz on partnership formation and operationsLenie Lyn Pasion TorresNo ratings yet

- Session 2 - Partnership Operations - Problems January 29, 2016Document10 pagesSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesNo ratings yet

- Partnership Accounting BreakdownDocument13 pagesPartnership Accounting BreakdownHoneylyne PlazaNo ratings yet

- Partnership Operations & Dissolution Quiz SolutionsDocument7 pagesPartnership Operations & Dissolution Quiz SolutionsKenncy100% (1)

- Practice Sets 3 & 4: Accounting For PartnershipDocument4 pagesPractice Sets 3 & 4: Accounting For PartnershipRey Joyce AbuelNo ratings yet

- RA 10963 (TRAIN Law) PDFDocument54 pagesRA 10963 (TRAIN Law) PDFReinald Kurt Villaraza100% (3)

- Nfjpia Mockboard 2011 BLTDocument6 pagesNfjpia Mockboard 2011 BLTjamesNo ratings yet

- Glimpses 2015.01.23 PDFDocument19 pagesGlimpses 2015.01.23 PDFLenie Lyn Pasion TorresNo ratings yet

- Cpa Board SyllabusDocument3 pagesCpa Board Syllabusjune_radiNo ratings yet

- Multiple Choice Test and Tax ProblemsDocument6 pagesMultiple Choice Test and Tax ProblemsimaNo ratings yet

- Syllabus of Theory of AccountsDocument4 pagesSyllabus of Theory of AccountsAries SiasonNo ratings yet

- Excel Training ExcercisesDocument25 pagesExcel Training ExcercisesLenie Lyn Pasion TorresNo ratings yet

- 2014 MYOB Adjustment Entries - Harmattan Unit TrustDocument6 pages2014 MYOB Adjustment Entries - Harmattan Unit TrustLenie Lyn Pasion TorresNo ratings yet

- Advance Excel PresentationDocument71 pagesAdvance Excel PresentationLenie Lyn Pasion Torres50% (2)

- Auditing ProblemsDocument1 pageAuditing ProblemsLenie Lyn Pasion TorresNo ratings yet

- CPA Licensure Exam Results October 2013Document81 pagesCPA Licensure Exam Results October 2013Lenie Lyn Pasion TorresNo ratings yet

- Cpa Licensure Examination Taxation SyllabusDocument3 pagesCpa Licensure Examination Taxation SyllabusKhrist Dulay100% (1)

- Chapter07 - AnswerDocument17 pagesChapter07 - AnswerLenie Lyn Pasion TorresNo ratings yet

- Chapter08 - Answer Cabrera Applied Auditing 2007Document29 pagesChapter08 - Answer Cabrera Applied Auditing 2007Pau Laguerta100% (6)

- Kieso 14e TB-IfRS Error P1Document35 pagesKieso 14e TB-IfRS Error P1Lenie Lyn Pasion TorresNo ratings yet

- Quiz Bee - Pa1 & Toa - ReviewerDocument14 pagesQuiz Bee - Pa1 & Toa - ReviewerLenie Lyn Pasion TorresNo ratings yet

- Accounting quiz on partnership formation and operationsDocument10 pagesAccounting quiz on partnership formation and operationsLenie Lyn Pasion TorresNo ratings yet

- Chapter02 - AnswerDocument4 pagesChapter02 - AnswerLenie Lyn Pasion TorresNo ratings yet

- MQC - Quiz On Segment, Cash To Accrual, Single and CorrectionDocument10 pagesMQC - Quiz On Segment, Cash To Accrual, Single and CorrectionLenie Lyn Pasion Torres0% (1)

- Elvie B. Castro: 027 P1 San Felipe City of San Fernando Pampanga, PhilippinesDocument2 pagesElvie B. Castro: 027 P1 San Felipe City of San Fernando Pampanga, PhilippinesLenie Lyn Pasion TorresNo ratings yet

- Introduction to Philippine LiteratureDocument50 pagesIntroduction to Philippine Literature1234leo100% (7)

- 1 JSJJSJDocument7 pages1 JSJJSJLenie Lyn Pasion TorresNo ratings yet

- Final Report in MGMTDocument19 pagesFinal Report in MGMTLenie Lyn Pasion TorresNo ratings yet

- Philippine Economy - NCSB and NedaDocument1 pagePhilippine Economy - NCSB and NedaLenie Lyn Pasion TorresNo ratings yet

- Final Report in MGMTDocument19 pagesFinal Report in MGMTLenie Lyn Pasion TorresNo ratings yet

- Cost of Capital ChapterDocument57 pagesCost of Capital ChapterVina 비나 Pedro100% (4)

- Outlook BusinessDocument100 pagesOutlook BusinessAshutosh Pandey100% (1)

- SFP- key financial statementsDocument14 pagesSFP- key financial statementsJuvie Rose BuenaventeNo ratings yet

- Foundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnDocument166 pagesFoundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnMy TranNo ratings yet

- White Corporation Depreciation CalculationsDocument8 pagesWhite Corporation Depreciation CalculationsAlbert Macapagal100% (2)

- Intercompany Profit Transactions - Inventories: Answers To Questions 1Document22 pagesIntercompany Profit Transactions - Inventories: Answers To Questions 1NisrinaPArisantyNo ratings yet

- Pharmexcil DataDocument86 pagesPharmexcil DataRandoNo ratings yet

- Worksheet Finacre KashatoDocument4 pagesWorksheet Finacre KashatoKHAkadsbdhsg50% (2)

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- Management Controls PDF FreeDocument78 pagesManagement Controls PDF FreeJohn Rich GamasNo ratings yet

- Accenture Professional Services IndustryDocument32 pagesAccenture Professional Services IndustryEsayas DeguNo ratings yet

- Master of Professional Accounting (MPAADocument8 pagesMaster of Professional Accounting (MPAAsaraNo ratings yet

- Chapter 3Document5 pagesChapter 3Julie Neay AfableNo ratings yet

- Cash Inflow and OutflowDocument6 pagesCash Inflow and OutflowMubeenNo ratings yet

- Hoa by Laws NeighborhoodDocument19 pagesHoa by Laws Neighborhoodtheengineer3100% (2)

- Journal Balance Sheet Activity PDFDocument1 pageJournal Balance Sheet Activity PDFIrish CanutoNo ratings yet

- Marginal costing definition and principlesDocument15 pagesMarginal costing definition and principlesShivani JainNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisJasper Briones IINo ratings yet

- AAFR Book (Publish) - 2023Document166 pagesAAFR Book (Publish) - 2023Muhammad Asif KhanNo ratings yet

- Vertical Analysis of URC Financial StatementDocument2 pagesVertical Analysis of URC Financial StatementMalou De MesaNo ratings yet

- JR business transactions April 2020Document18 pagesJR business transactions April 2020Phoebe Balino100% (2)

- Asset Accounting in SAPDocument62 pagesAsset Accounting in SAPYogi100% (5)

- Understanding Accruals R12 05012013Document58 pagesUnderstanding Accruals R12 05012013prasanthbab7128No ratings yet

- Finance Dept ObservationsDocument3 pagesFinance Dept ObservationsMohanMahiNo ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- Fiji National University course explores financial statement analysisDocument15 pagesFiji National University course explores financial statement analysisManraj LidharNo ratings yet

- Audit and Assurance December 2010 Exam Paper, ICAEWDocument8 pagesAudit and Assurance December 2010 Exam Paper, ICAEWjakariauzzalNo ratings yet

- Impairment loss calculation problemsDocument2 pagesImpairment loss calculation problemsShane TabunggaoNo ratings yet

- UntitledDocument7 pagesUntitledKit BalagapoNo ratings yet

- Analyze Costs Using Marginal CostingDocument13 pagesAnalyze Costs Using Marginal CostingmohitNo ratings yet

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNo ratings yet