Professional Documents

Culture Documents

Continue or Eliminate Analysis

Uploaded by

MaryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continue or Eliminate Analysis

Uploaded by

MaryCopyright:

Available Formats

Continue or Eliminate Analysis

Introductions:

Think of the divisions of a company like leaves on an Aspen tree. Like the leaves on an Aspen tree, divisions in a company have a life cycle. It is up to the accountant to help management to determine when to eliminate an old unprofitable division in order to keep the company healthy and productive. If divisions are eliminated at the wrong time, it can result in harm to the entire company just as removing leaves from an Aspen tree could harm the tree.

Prezi Presentation

A profitable division is one that produces income, which covers variable cost, fixed cost, and produces a profit. The problem with eliminating unprofitable divisions is that sometimes those divisions are producing income that covers allocated fixed cost. Without those divisions fixed cost would have to be transferred to other profitable divisions, which would reduce profits from those divisions. The end result would be a decrease in income, which would result in an overall drop in net income. It is very important to determine the overall effect of eliminating a division before any action is taken by the company. You must always remember to look at the effects of elimination on the whole. The only exception to this rule is if the company has a replacement division that will be profitable to replace the old unprofitable division. Limited resources often require the replacement of old unprofitable division to make ways for new divisions that can produce a profit. Also note that if a unprofitable division is not covering variable cost, not producing a positive contribution margin, then it should without question be eliminated to prevent future losses. For a full presentation on the Continue or Eliminate Analysis go to this Web link: http://prezi.com/7usjx2zailku/continue-or-eliminate-analysis-for-divisions-within-a-company/

12/2013 MJC

Page 1

Continue or Eliminate Analysis

Example problem:

Jeni Maynard, a new executive for Francisco Corporation has been evaluating the operating performance of her corporation. She has developed a proposal to eliminate the Gates Division in order to increase profitability. The management of Francisco Corporation has asked your input on this proposal. Prepare a Continue or Eliminate Analysis to determine if the management of the corporation should accept Jenis proposal or not.

Information provided:

The other three Divisions Sales Cost of goods sold Gross Profit Operating expenses Net Income 1,324,000 850,000 474,000 260,000 214,000

Gates Division 120,000 80,000 40,000 45,000 (5,000)

Total 1,444,000 930,000 514,000 305,000 209,000

In the Gates Division, cost of goods sole is 42,000 variable and 38,000 fixed, and operating expenses are 25,000 variable and 20,000 fixed. None of the Gates Divisions fixed costs will be eliminated if the division is eliminated. Instructions: 1. Prepare a Continue or Eliminate Analysis. 2. Should Francisco Corporation implement Ms. Maynards proposal? Why or Why not?

12/2013 MJC

Page 2

Continue or Eliminate Analysis

Answer:

The Continue or Eliminate Analysis

Continue Sales Variable Costs: Cost of Goods Sold Operating Expenses Total Variable Costs Contribution Margin Fixed Costs: Cost of Goods Sold Operating Expenses Total Fixed Cost Net Loss 120,000 42,000 25,000 67,000 53,000 38,000 20,000 58,000 (5,000) Eliminate 0 0 0 0 0 38,000 20,000 58,000 (58,000) Net Income Increase or Decrease (120,000) 42,000 25,000 67,000 (53,000) 0 0 0 (53,000)

Calculations:

Variable costs are added to get total variable cost: 42,000 + 25,000 = 67,000 Total variable costs are subtracted from sales to get contribution margin: 120,000 67,000 = 53,000 Fixed costs are added to get total fixed cost: 38,000 + 20,000 = 58,000 Contribution Margin minus total fixed cost equals Net Loss: For Continue: 53,000 58,000 = 5,000 For Eliminate: 0 58,000 = 58,000 Increase or Decrease is determined by subtracting the net loss to arrive with the amount for increase or decrease in net income: 58,000 5,000 = 53,000

Under the continue section the corporation would continue to have net losses of $5,000 but under the eliminate section the corporation would need to allocate net losses of $53,000 to the other divisions. All income along with variable costs would be eliminated if the division was eliminated.

Results:

Should Francisco Corporation implement Ms. Maynards proposal? Why or Why not? The answer is no. If Ms. Maynards proposal was implemented, the corporation would loss income that covers $53,000 in fixed cost each year. This course of action would result in an overall reduction of net income by $53,000. Only if this division can be replaced with a profitable division should Francisco Corporation eliminate the Gate Division.

12/2013 MJC

Page 3

You might also like

- Instructions On How To Create A MACRS Depreciation ScheduleDocument4 pagesInstructions On How To Create A MACRS Depreciation ScheduleMary100% (2)

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Owners Equity Statement Form InstructionsDocument2 pagesOwners Equity Statement Form InstructionsMary100% (4)

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Ratio CalculationDocument8 pagesRatio CalculationSohel MahmudNo ratings yet

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Partial PaymentsDocument1 pagePartial PaymentsMaryNo ratings yet

- Analyzes of A Business TransactionDocument13 pagesAnalyzes of A Business TransactionMary100% (1)

- Basic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleDocument4 pagesBasic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleMary100% (1)

- Unit Costs Under Traditional Costing MethodDocument2 pagesUnit Costs Under Traditional Costing MethodMary67% (3)

- Journal Entries For Long Lived AssetsDocument2 pagesJournal Entries For Long Lived AssetsMary100% (20)

- US CMA PPT 3 Investments in DebtDocument11 pagesUS CMA PPT 3 Investments in DebtmohammedNo ratings yet

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Basic Instructions For LIFO Inventory MethodDocument4 pagesBasic Instructions For LIFO Inventory MethodMary100% (4)

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Federal Insurance Contributions ActDocument3 pagesFederal Insurance Contributions ActMaryNo ratings yet

- Stop DepreciationDocument8 pagesStop DepreciationDeepak GhugardareNo ratings yet

- Basic Instructions For Weighted Average Inventory MethodDocument4 pagesBasic Instructions For Weighted Average Inventory MethodMary100% (7)

- Cost Sheet FormatDocument2 pagesCost Sheet FormatAMIN BUHARI ABDUL KHADERNo ratings yet

- SUTA and FUTA CalculationsDocument2 pagesSUTA and FUTA CalculationsMary83% (12)

- Accounts Payable QuizDocument4 pagesAccounts Payable Quiz5variaraNo ratings yet

- Template-FinStatement Analysis v8 1Document14 pagesTemplate-FinStatement Analysis v8 1maahi7No ratings yet

- Bench - Co Income Statement Excel TemplateDocument31 pagesBench - Co Income Statement Excel TemplateMay CañebaNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- SAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011Document36 pagesSAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011talhaadnanNo ratings yet

- Basic Instructions For A Cash Budget StatementDocument4 pagesBasic Instructions For A Cash Budget StatementMary100% (6)

- Accounting Entry (FI)Document9 pagesAccounting Entry (FI)Manoj PradhanNo ratings yet

- AP Debit Memos and Credit Memos TrainingDocument9 pagesAP Debit Memos and Credit Memos TrainingyadavdevenderNo ratings yet

- BVA CheatsheetDocument3 pagesBVA CheatsheetMina ChangNo ratings yet

- I) Short Term Solvency or Liquidity Ratios: Net IncomeDocument2 pagesI) Short Term Solvency or Liquidity Ratios: Net Incomedude devilNo ratings yet

- Final Exam - 2020Document10 pagesFinal Exam - 2020mshan lee100% (1)

- FI User Manual Cross ChargesDocument25 pagesFI User Manual Cross ChargesJose Luis Becerril BurgosNo ratings yet

- Periodic Inventory Valuation MethodsDocument10 pagesPeriodic Inventory Valuation MethodsMary100% (1)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Flash Card SlidesDocument29 pagesFlash Card SlidesMary100% (2)

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- M&A Activity in India and Key MotivationsDocument19 pagesM&A Activity in India and Key MotivationsreedbkNo ratings yet

- Cost Accounting MethodsDocument26 pagesCost Accounting MethodsshaimaNo ratings yet

- Unit 1 Written Assignment - Updated VersionDocument6 pagesUnit 1 Written Assignment - Updated VersionSimran Pannu100% (1)

- Radio AnalysisDocument100 pagesRadio Analysisabhayjain686No ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- FM PPT Ratio AnalysisDocument12 pagesFM PPT Ratio AnalysisHarsh ManotNo ratings yet

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- How To Create Corporation WorksheetDocument4 pagesHow To Create Corporation WorksheetMaryNo ratings yet

- Tma01 B100Document3 pagesTma01 B100Martin SantambrogioNo ratings yet

- US CMA - PART - I PPT 2 Cash, Accounts Receivables and InventoryDocument62 pagesUS CMA - PART - I PPT 2 Cash, Accounts Receivables and Inventorymohammed100% (1)

- Module 9 Inter Corporate InvestmentsDocument24 pagesModule 9 Inter Corporate Investmentsdsantin84No ratings yet

- Rolling Forecast TemplateDocument4 pagesRolling Forecast TemplatebenaikodonNo ratings yet

- Costing of Service SectorDocument42 pagesCosting of Service SectorSaumya AllapartiNo ratings yet

- Instructions - Smithville - Full Version - 16edDocument53 pagesInstructions - Smithville - Full Version - 16edsachin2727No ratings yet

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Document686 pagesXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiNo ratings yet

- Companies DatabaseDocument29 pagesCompanies DatabaseSuji ChaNo ratings yet

- Transaction AnalysisDocument14 pagesTransaction AnalysisMaryNo ratings yet

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- The Accounting Cycle ExplainedDocument61 pagesThe Accounting Cycle ExplainedHottie-Hot SoniNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- Make or Buy AnalysisDocument4 pagesMake or Buy AnalysisMaryNo ratings yet

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Special Order AnalysisDocument2 pagesSpecial Order AnalysisMaryNo ratings yet

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Product Cost AnalysisDocument10 pagesProduct Cost AnalysisMaryNo ratings yet

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- Simplified Charts - Percentage Method Income Tax Withholding 2012Document4 pagesSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNo ratings yet

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

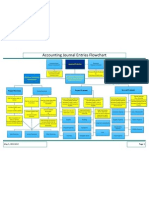

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Transaction Analyzes For A CorporationDocument2 pagesTransaction Analyzes For A CorporationMaryNo ratings yet

- Simplified Charts-Percentage Method Income Tax Withholding 2008Document4 pagesSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNo ratings yet

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Table Factors For Present and Future Value of One DollarDocument6 pagesTable Factors For Present and Future Value of One DollarMaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Anatomy of Lone Wolf Terrorism Special EDocument30 pagesAnatomy of Lone Wolf Terrorism Special EMika RainmanNo ratings yet

- Research On Motivation TheoriesDocument15 pagesResearch On Motivation TheoriesNayeem Md SakibNo ratings yet

- Sohail KhanDocument3 pagesSohail KhanRashid Muhammad SarwarNo ratings yet

- Top Sellers Fall Protection Catalogue 2020 ENDocument44 pagesTop Sellers Fall Protection Catalogue 2020 ENtcNo ratings yet

- Financial Plan Checklist: Planning For EmergenciesDocument2 pagesFinancial Plan Checklist: Planning For EmergenciesInsan CornerNo ratings yet

- Human Persons As Oriented Towards Their Impendeing DeathDocument28 pagesHuman Persons As Oriented Towards Their Impendeing DeathMaxwell LaurentNo ratings yet

- 10 B Plas List PPR Eng GreenDocument15 pages10 B Plas List PPR Eng GreenZakaria ChouliNo ratings yet

- Ascha_ASJ19_Nonsurgical Management of Facial Masculinization and FeminizationDocument15 pagesAscha_ASJ19_Nonsurgical Management of Facial Masculinization and Feminizationallen.515No ratings yet

- The Payment of Bonus Act 1965 PDFDocument30 pagesThe Payment of Bonus Act 1965 PDFappu kunda100% (1)

- Social Learning TheoryDocument23 pagesSocial Learning TheoryJacqueline Lacuesta100% (2)

- Idioma Extranjero I R5Document4 pagesIdioma Extranjero I R5EDWARD ASAEL SANTIAGO BENITEZNo ratings yet

- Wheel Horse by YearDocument14 pagesWheel Horse by YearNeil SmallwoodNo ratings yet

- Peaditrician All IndiaDocument66 pagesPeaditrician All IndiaGIRISH JOSHINo ratings yet

- R02.4 Standard III (A) - AnswersDocument11 pagesR02.4 Standard III (A) - AnswersShashwat DesaiNo ratings yet

- Cloudsoc For Amazon Web Services Solution Overview enDocument6 pagesCloudsoc For Amazon Web Services Solution Overview enmanishNo ratings yet

- Asrs For AutomationDocument25 pagesAsrs For AutomationJavedNo ratings yet

- Success On The Wards 2007Document32 pagesSuccess On The Wards 2007mnNo ratings yet

- CCE Format For Class 1 To 8Document5 pagesCCE Format For Class 1 To 8Manish KaliaNo ratings yet

- Reglas para Añadir Al Verbo Principal: Am Is Are ReadDocument8 pagesReglas para Añadir Al Verbo Principal: Am Is Are ReadBrandon Sneider Garcia AriasNo ratings yet

- wk4 Stdconferencereflection ElmoreajaDocument4 pageswk4 Stdconferencereflection Elmoreajaapi-316378224No ratings yet

- Microsoft Word - SOP ON DispensingDocument4 pagesMicrosoft Word - SOP ON DispensingPalawan Baptist HospitalNo ratings yet

- 2 - Electrical Energy Audit PDFDocument10 pages2 - Electrical Energy Audit PDFPrachi BhaveNo ratings yet

- Forensic Science Project Group B5518Document5 pagesForensic Science Project Group B5518Anchit JassalNo ratings yet

- Introduction To The Philosophy of The Human PersonDocument17 pagesIntroduction To The Philosophy of The Human Personrovie andes100% (1)

- Automotive ElectronicsDocument44 pagesAutomotive ElectronicsRohit Kumar100% (1)

- INTUSSUSCEPTIONDocument1 pageINTUSSUSCEPTIONMaecy PasionNo ratings yet

- Development and Validation of Stability Indicating RP-HPLC Method For Simultaneous Estimation of Sofosbuvir and Ledipasvir in Tablet Dosage FormDocument4 pagesDevelopment and Validation of Stability Indicating RP-HPLC Method For Simultaneous Estimation of Sofosbuvir and Ledipasvir in Tablet Dosage FormBaru Chandrasekhar RaoNo ratings yet

- Test Bank Contemporary Behavior Therapy - Michael-Spiegler - 6th EditionDocument12 pagesTest Bank Contemporary Behavior Therapy - Michael-Spiegler - 6th Editionlewisbacha0% (1)

- Sheet 01Document1 pageSheet 01Rajeshwari YeoleNo ratings yet

- Finding the Right Pharmacy for Your NeedsDocument4 pagesFinding the Right Pharmacy for Your Needsprabakar VNo ratings yet