Professional Documents

Culture Documents

Chapter 05 - Valuing Different Types of Debts

Uploaded by

Faula Iman SitompulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 05 - Valuing Different Types of Debts

Uploaded by

Faula Iman SitompulCopyright:

Available Formats

Chapter 05 Valuing Different Types of Debt (Bonds) I.

Financing with Bonds A bond is a debt instrument issued by a corporation, which obligates that corporation to make period interest payments to the holder of the bond as well as to repay the principal at the maturity date. 1. Security and Seniority Debenture bonds general unsecured obligation of the company with a maturity of 15 years or more. Shorter unsecured debt instruments are usually termed notes. Both debentures and notes may be senior claims or they may be subordinate to the senior bonds or to all other creditors. When a company defaults on a secured obligation, the debtor may take possession of the rele ant assets. !f these are insufficient to satisfy the claim, the remaining debt will ha e a general claim alongside any unsecured debt against the other assets of the firm. Mortgage bonds secured debt "here is no specific limit to the amount of bonds that may be secured #in which case the mortgage is said to be opened$ or there is a specific limit, which has not been reached #in which case the mortgage is said to be limited open-end$. Some of these mortgages are %closed& so that no more bonds may be issued against the mortgage. Collateral trust bond resemble mortgage bonds e'cept that in this case the claim is against securities (stocks( held by the corporation. )enerally these bonds are issued by railroads or industrial holding companies that is, firm subsidiaries. "he problem for the lender is that stock is junior to all other claims on the assets of the subsidiaries, and so the collateral trust issue will usually include detailed restrictions to the freedom of the subsidiaries to issue debt or preferred stock. !uip"ent trust certificate * used to finance new railroad rolling stock #standardi+ed with an acti e secondary market$. A trustee obtains formal ownership of the e,uipment. "he railroad company makes a down payment of 1-*.5/ of the cost of the e,uipment and the balance is pro ided by a package of trust certificates with different

maturities. 0nly when all these debts ha e been paid off does the railroad company becomes a formal owner of the e,uipment. .. 1ayment of interest Coupon bonds also known as bearer bonds are printed with a series of coupon attached which are clipped by the bondholder and are sent to the bond issuer when interest is due. !f the coupon is not sent, interest is not paid, because the owner of the bearer bonds is not registered with the issuing firm. #egistered bonds automatically sent interest payments to those bondholders registered with the company. Fi$ed coupon rate bonds pay fi'ed rate for the maturity of the bond. Floating coupon rate bonds the interest is ad2usted up or down depending on the mo ement of the market interest rates in general. "he introduction of floating rate debt securities is due to the increased olatility of interest rates and the e er*increasing rate of inflation. Inco"e bonds the actual payment of interest is re,uired only when earnings are a ailable to make such a payment. %ero coupon bond pays no interest for the life of the contract. "he in estors earn a return by purchasing the bond at one price and either selling it in a secondary market at a different price or simply holding it to maturity and recei ing the par alue. &riginal'issue deep'discount bonds similar to +ero coupon bonds e'cept that a small coupon rate is offered in order to attract in estors, the in estments are sold at a deep discount from the par alue. "hese types of bonds eliminate the rein estment rate risk. 3. Bond 4ating 5oody6s !n estors Ser ice Standard 7 1oor6s 8orporation "he poorer the ,uality rating, the higher the coupon rate of the bond (see "able 1(. "he rating ser icing attempts to assess the ability of the issuing firm to meet its debt obligation. II. #epay"ent (ro)isions 1. 5ost bonds ha e pro isions for sinking funds. 1art of the issue can be repaid on a regular base before the maturity. "o do this the company makes regular repayments into a sinking fund. "his payment can be made either in the form of cash or bonds that the company has bought. !f it is cash, the trustee selects bonds by lottery and uses the cash to redeem them at par.

!nstead of paying cash, the company can buy bonds in the market place and pay these to the fund. "his is a aluable option for the company9 !f the price of the bond is low, the firm will buy bonds in the market place and hand them to the sinking fund: !f the price is high, it can call the bonds by lottery at par. .. 5any bonds ha e a call option, which allows the firm to call or retire the bond earlier. !f it does so, it is re,uired to pay a call premium, which is e,ual in the first year to the annual coupon and which declines progressi ely to +ero. 3. 4estricti e 8o enants can be negati e or positi e ;egati e9 !ssues of senior bonds usually prohibit the company from issuing further senior debt if the ratio of net tangible assets to senior debt would fall short of some specified minimum. !ssues of subordinated bonds usually also prohibit the company from issuing further senior or 2unior debt if the ratio of net tangible assets to all debt would fall short of some specified minimum. <nsecured bonds incorporate a negati e pledge clause, which prohibits the company from securing additional debt without gi ing the same treatment to the e'isting unsecured debt. 5ost bonds place a limit on the company6s di idend payment. 1ositi e9 =or e'ample some issues re,uire the company to maintain a minimum le el of working capital or net worth. Since a deficiency in either is a good indication of financial weakness, this condition pro ides bondholders the right to claim a default and get their money out while the company still has a substantial alue. III. #etiring Debt before Maturity 8all pro isions allow the issuing firm to retire bonds before maturity under prespecified conditions dealing with the call price and the time periods o er which a bond can be called back. "he most ob ious reason is that if the original bonds were issued at a high rate of interest due to the then pre ailing tight money conditions but rates subse,uently fall it may be ad antageous to issue new lower-rate coupon bonds and use the proceeds to retire the older more e'pensi e debt.

!mportant factors and ta' considerations9 8all premium that must be paid to the e'isting bondholders. !ssuing (flotation( costs of the e'isting bond issue are to be amorti+ed o er the life of the bond. "he unamorti+ed portion must be e'pensed in full in the year that the issue is retired. "he unamorti+ed portion of the discount, if the bond is sold at a discount from the par alue, must be e'pensed in full in the year of retirement. !f sold at a premium the amorti+ed premium is accounted for as ordinary income and ta'ed as such. "he same is true for the new issue that will refund the e'isting bond issue. 0 erlapping interest in general, when a bond issue is retired earlier, the new issue will be market before the date of retirement to ensure that the funds are obtained in order to payoff the e'isting bondholders. 8onse,uently, for a period #month or more$, the firm must pay interest on both bond issues. A bond retirement is similar in nature to a capital budgeting decision. We calculate the ;1> of the bond retirement by subtracting the 1> of the initial outflow from the 1> of the benefits of the bond retirement. "he calculated ;1> is an estimate of the increase in shareholder wealth generated by retiring the e'isting bond issue, by refunding it with a new lower cost issue. "he discount rate used in the analysis should be the after*ta' cost of new borrowing. "he only risk is credit or default risk, but the bond market imposes a premium for this in the cost of debt. Since the corporations set the coupon rate so that the new bond issue will sell at or close to par we will use the coupon rate as the before*ta' re,uired return the creditors demand on the new bond issue. After*ta' discount rate ? 8oupon rate ' #1 "$

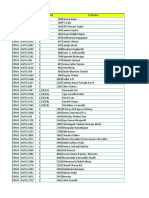

"able 1. Auality 4atings <sed by 5oody6s and Standard 7 1oorBs

5oodyBs 4ating Standard 7 1oorBs System 4ating System Aaa AAA Aa AA A Baa Ba B 8aa 8a 8 A BBB BB B 888 88 8 DDD DD D !nterpretation Cigh*,uality debt instruments Strong to ade,uate ability to pay principal and interest

Ability to pay principal and interest speculati e

!n default

;ote9 Both rating ser ices use factors to amend the abo e rating categories to indicate a range within a gi en rating. 5oodyBs uses a 1, ., or 3 factor, and Standard 7 1oorBs uses a plus or minus factor. =or e'ample, a 5oodyBs rating of Aa. indicates a firm that is in the midrange of all firms with a double*A rating.

"able .. 8apital Structure of )eneral 5otors #5illions of Dollars$

1EEE Fong*term liabilities Fong*term debtG 8apitali+ed leases 0ther liabilities Deferred credits StockholdersB e,uity 1referred stock #H5.-- 7 H3.I5 series$GG 8ommon stockGGG H1*.(3 par alue 8lass L common 8lass C common 8apital surplus ;et income retained Accumulated foreign currency translation "otal shareholdersB e,uity "otal capital structure H.,@1I.@ 355.5 5,EI1.E 1,I@E.. .55.. 5.E.. ..E M 3,3@I.K .-,IEJ.J #I1I.K$ .@,.1@.3 H5.,1@@.E .--H.,5--.. 3JI.I,@1E.K 1,EJ..J .5-.I 531.@ J.J J.J J,JJI.K ..,J-J.J #5@5.-$ .E,5.@.I HJ3,K3..K

;ote9 G Fong*term debt consists of <.S. dollar*denominated notes and debentures as well as foreign debt resulting from subsidiary financing in arious currencies.

5

GG

1referred stock, H5.-- series, has no par alue and is cumulati e. Stated alue is H1-per share redeemable at the corporationBs option at H1.- per share. 1referred stock, H3.I5 series, has no par alue and is cumulati e. Stated alue is H1-- per share redeemable at the corporationBs option at H1-- per share. GGG Colders of H1*.(3 par alue common, of 8lass L common stock, and 8lass C common stock are entitled to one, one*,uarter, and one*half ote per share, respecti ely, on all matters submitted to the stockholders for a ote. Source9 )eneral 5otors 8orporation Annual 4eport, .---.

You might also like

- Prodi Akuntansi 2006-2008Document123 pagesProdi Akuntansi 2006-2008Nat Wahyu SrikuningNo ratings yet

- Career Pathways TemplateDocument4 pagesCareer Pathways TemplateFaula Iman SitompulNo ratings yet

- Factors Influencing Knowledge Management: Becerra-Fernandez, Et Al. - Knowledge Management 1/e - © 2004 Prentice HallDocument19 pagesFactors Influencing Knowledge Management: Becerra-Fernandez, Et Al. - Knowledge Management 1/e - © 2004 Prentice HallFaula Iman SitompulNo ratings yet

- 4 - SHRMDocument38 pages4 - SHRMabhishekksahayNo ratings yet

- Worlds Simplest Marketing Plan TemplateDocument1 pageWorlds Simplest Marketing Plan TemplateFaula Iman SitompulNo ratings yet

- Competency-Based People ManagementDocument31 pagesCompetency-Based People ManagementFaula Iman Sitompul100% (1)

- Analyzing competencies for selecting junior foreign service officersDocument40 pagesAnalyzing competencies for selecting junior foreign service officersFaula Iman SitompulNo ratings yet

- Factors Influencing Knowledge Management: Becerra-Fernandez, Et Al. - Knowledge Management 1/e - © 2004 Prentice HallDocument19 pagesFactors Influencing Knowledge Management: Becerra-Fernandez, Et Al. - Knowledge Management 1/e - © 2004 Prentice HallFaula Iman SitompulNo ratings yet

- ACCT 101 Lecture Notes Chapter 12 F09 SCFDocument5 pagesACCT 101 Lecture Notes Chapter 12 F09 SCFKahfi Revi AlfatahNo ratings yet

- Contoh Cash FlowDocument8 pagesContoh Cash FlowferdinadandmurniNo ratings yet

- Eastern GearDocument5 pagesEastern GearFaula Iman Sitompul0% (1)

- Developing HRD Strategic PlanDocument14 pagesDeveloping HRD Strategic PlanFaula Iman SitompulNo ratings yet

- 840 RobinsonDocument12 pages840 RobinsonFaula Iman SitompulNo ratings yet

- POM - Toys Case Study G1 ReportDocument5 pagesPOM - Toys Case Study G1 ReportMohan100% (1)

- GCG Assessment Report PDFDocument3 pagesGCG Assessment Report PDFFaula Iman SitompulNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Let's Talk Book 2Document17 pagesLet's Talk Book 2Valentina Verginia100% (1)

- Hospital Waste Management ArticleDocument5 pagesHospital Waste Management ArticleFarrukh AzizNo ratings yet

- Newsletter 20 - January 2008Document12 pagesNewsletter 20 - January 2008Alexander Mendoza100% (1)

- Family Planning Counseling: Optional Session III, Slide #1Document8 pagesFamily Planning Counseling: Optional Session III, Slide #1dhira aninditaNo ratings yet

- From Ramesh - Updated CRO Names 03022021Document90 pagesFrom Ramesh - Updated CRO Names 03022021Vamsi SattiNo ratings yet

- Why Jamf?Document3 pagesWhy Jamf?Prakash MaharajNo ratings yet

- Economy India (Bain Report)Document103 pagesEconomy India (Bain Report)Yogesh GuttaNo ratings yet

- Comparative Forms of Adjectives Esl Grammar Gap Fill Exercises WorksheetDocument2 pagesComparative Forms of Adjectives Esl Grammar Gap Fill Exercises WorksheetAnonymous LELyuBoNo ratings yet

- Plant Inspector CV.Document7 pagesPlant Inspector CV.Khalilahmad KhatriNo ratings yet

- Southern Majority 20/20 Insights PollingDocument5 pagesSouthern Majority 20/20 Insights PollingSoMa2022No ratings yet

- Atty Paras Reprimanded for Delayed ComplianceDocument10 pagesAtty Paras Reprimanded for Delayed ComplianceMK KMNo ratings yet

- Pyramid Ias Academy Karaikudi: Engineering Surveying Practice Paper SYLLABUS: Importance of Surveying, PrinciplesDocument21 pagesPyramid Ias Academy Karaikudi: Engineering Surveying Practice Paper SYLLABUS: Importance of Surveying, PrinciplesvijayNo ratings yet

- TBM220Document12 pagesTBM220ErikoNo ratings yet

- 5-Health Information SystemDocument2 pages5-Health Information SystemCristyn BMNo ratings yet

- Mapeh MusicDocument8 pagesMapeh MusicMarry JaneNo ratings yet

- I Saw The Light - Stan Slack BanjoDocument2 pagesI Saw The Light - Stan Slack BanjoENo ratings yet

- RA 7942 Plus CasesDocument53 pagesRA 7942 Plus CasesJessielleNo ratings yet

- Description: Super Thoroseal Is A Blend of PortlandDocument2 pagesDescription: Super Thoroseal Is A Blend of Portlandqwerty_conan100% (1)

- Surgical Emergencies: in Obstetrics & GynecologyDocument20 pagesSurgical Emergencies: in Obstetrics & GynecologyAnonymous hHfqtTNo ratings yet

- MCP 101 Product Realization Lab ManualDocument75 pagesMCP 101 Product Realization Lab ManualjasvindersinghsagguNo ratings yet

- Edmar Mednis How To Be A Complete Tournament Player 1991Document121 pagesEdmar Mednis How To Be A Complete Tournament Player 1991Pya Casiano100% (4)

- Template How-To: Purpose of This TemplateDocument5 pagesTemplate How-To: Purpose of This TemplateLouis TrầnNo ratings yet

- MAT I CES Request Form 137Document1 pageMAT I CES Request Form 137Israel AbarcaNo ratings yet

- Differences in anthropometric characteristics and somatotype in young soccer players and karate practicionersDocument8 pagesDifferences in anthropometric characteristics and somatotype in young soccer players and karate practicionerssyafiqahNo ratings yet

- Secrets of Leadership, by J. Donald WaltersDocument4 pagesSecrets of Leadership, by J. Donald WaltersMary Kretzmann100% (1)

- Biological Basis of BehaviourDocument6 pagesBiological Basis of BehaviourRichard ManuelNo ratings yet

- Fridleifsson BenefitDocument9 pagesFridleifsson BenefitWanambwa SilagiNo ratings yet

- Zabbix Manual 1.8.1Document143 pagesZabbix Manual 1.8.1fjrialNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument8 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Cello BachDocument3 pagesCello BachPera PericNo ratings yet