Professional Documents

Culture Documents

Wegelin Document On American Taxes and Assets

Uploaded by

ZerohedgeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wegelin Document On American Taxes and Assets

Uploaded by

ZerohedgeCopyright:

Available Formats

Investment Commentary No.

265 August 24, 2009

Farewell America izers, as frequently stated in the Swiss media,

among others. It is astounding, and this is the

second interesting observation, how completely

1. A moral issue? naturally those who claim the moral high-ground

The agreement between the USA and Switzer- rush to join forces with the authorities and their

land under which Switzerland is to provide ad- financial requirements. At the risk of once again

ministrative assistance with regard to 4,450 UBS winding up certain specialists in business ethics,

clients suspected of tax fraud is, in our view, re- let us briefly recall the sort of tax authorities we

markable in three ways. Firstly, we note the way are dealing with, and the sort of state they serve: a

both parties are dressing it up in the aftermath of country that, over the last 60 years, has unques-

the battle. Everyone is talking of a “success”. The tionably been one of the most aggressive nations

IRS, the American tax authority, surely rightly, in the world. The USA has fought by far the larg-

for it has got what it wanted, namely access to a est number of wars, sometimes with, but mostly

large number of specific client names, combined without a UN mandate. It has broken the interna-

with persisting uncertainty on the part of all the tional laws of war, maintained secret prisons, and

others as to whether they are among those names. fought an absurd war against drugs, with serious

The UBS is happy not to have to pay another consequences both abroad (Columbia, Afghani-

fine, and to be rid of the heavy burden of legal stan) and at home (according to reliable sources,

proceedings. And the Swiss government regards it the tentacles of the narcotics mafia now reach

as a success inasmuch as from their perspective well into political circles). With breathtaking

the agreement preserves the rule of law and offers moral duplicity, the USA maintains enormous

the clients affected the possibility of legal re- offshore havens in Florida, Delaware and others

course to the federal administrative court. of its states. The moralizers have joined sides with

a nation that still makes extensive use of the

But there are also losers, of course. These are the death penalty, and that has a legal system under

people affected, who must now expect legal pro- which lawyers can get rich on the misfortunes of

ceedings against them as suspected tax cheats, their clients. Liability cases often end in verdicts

and who had, until relatively recently, been prom- with exorbitant damages, which makes business

ised that precisely this would not happen. Prom- activity extremely risky, for medium-sized enter-

ised by whom? By the bank concerned (among prises in particular. The moralizers provide intel-

others), which had generously interpreted and lectual support for a country that allows its infra-

intensively exploited an explicit gap in the 2001 structure to collapse, and then stuffs convicts into

“Qualified Intermediary” (QI) agreement; by the hopelessly overfilled jails, after what are not in-

supervisory authorities, which were fully cogni- frequently dubious proceedings. They fund a

zant of all this activity, but never questioned it; by nation that tolerates – or rather, causes – regular

the Swiss government, which only a few months crises in the global financial system that it man-

ago had spoken of the “brick wall” that foreign ages. A country whose underclass enjoys neither

authorities would encounter, were they to attack the benefits of an adequate education, nor a half-

Swiss banking secrecy – for example through way functional healthcare system; a country

fishing expeditions, such as an application for whose economic system is increasingly inclined to

administrative assistance against several thousand overconsumption, and in which saving and invest-

clients. Promises, connivance, a pretence of reso- ing have increasingly become alien concepts, a

lute behaviour – and now collapse. The appear- situation that has undoubtedly been one of the

ance of success conceals the reality of a breach of driving forces behind the current recession, with

trust. all its catastrophic consequences for the whole

Trust: is this the right word at all for something so world.

disgraceful as tax evasion, or even tax fraud? Those who wish to wield the sword of morality

Serves them right, these bloated capitalists, if they against tax evaders cannot avoid facing some

land in the dock! This is the position of the moral- critical questions with regard to the morality of

W EGELIN & C O .

resource allocation. Were such questions to be Things are different under Anglo-Saxon law.

excluded, we would be left with nothing but the There is no forced heirship, so American inheri-

issue of just taxation, which also arises, as we well tance tax is levied on the “estate”; that is, the

know, when, in Sicily, one baker must make a physical goods, such as property, goods and chat-

contribution to the honourable society, and an- tels, and securities. If they are US securities, then

other not … It is more productive, particularly in they are liable to tax, regardless of the final domi-

matters of taxation, to leave morality aside, and cile or main place of residence of the deceased.

to take a non-judgmental view of tax liability, the US securities are basically defined as securities

meeting of obligations, and, if need be, the vari- issued in the United States, such as the stock of

ous forms of evasion, as givens resulting from the American companies like Apple, General Electric

prevailing legislation and its enforceability. or Pfizer and US funds and US bonds, in particu-

Which brings us to the third thing that seems lar Treasury bills. American inheritance tax law

remarkable. What exactly was the “prevailing makes specific reference to both US citizens (in-

legislation”? And what about its enforceability? cluding, particularly, US citizens resident abroad)

In 1996, the USA concluded a new double taxa- and “non-resident aliens”. These latter are for-

tion agreement with Switzerland, which, among eigners with no permanent residence in the

other things, regulated the conditions for adminis- United States; in other words, all non-Americans

trative assistance in matters of taxation. Switzer- in possession of US securities.

land agreed to provide assistance with regard to American inheritance tax rates are variable, with

“tax fraud and the like”. In other words, the ex- the top rate at 45 percent. Significant exemptions,

tension of the concept of “tax fraud” had long of over 1 million US dollars, are allowed for US

been pre-programmed; the USA had to wait for citizens; the limit for non-Americans is 60,000 US

its enforcement only until Switzerland had appar- dollars, unless there is a double taxation agree-

ently, and perhaps in reality, been driven into a ment setting a higher limit. For Switzerland, the

corner by the activities of the accident-prone limit is calculated on the basis of the double taxa-

UBS. In fact, truth to tell, we should have known: tion agreement of 1951, based on the proportion

Swiss banking secrecy with regard to the USA of the entire estate represented by the assets in

was well and truly relativized not in 2009, but the United States. To claim the allowance, the

already in 1996. “estate” – that is, in continental terms, the heirs –

What we need to do now, sine ira et studio, (and must disclose the entire, global legacy to the IRS.

putting aside all politically motivated window- On account of the IBM shares that he was so

dressing, all genuine, or merely nominal, moral attached to, the children of the late Hans Rüdi-

issues) is to analyze the situation, draw conclu- sühli of Melchnau must file with the IRS and

sions and, where necessary, act upon them. This is present a valuation of all other family assets.

exactly what we intend to do in what follows, by There is a remarkable lack of double taxation

taking a closer look at two important components agreements with the countries of Latin America,

of American tax law. And, surprise, surprise; the Asia and the Middle East. Mr Abdullah of Dubai,

next round of fiscal enforcement staged by the let’s say, a typical owner of treasuries, industrial

Americans will be devoted not to the American bonds and GM shares, is liable to American in-

super-rich, but to non-Americans who never in heritance tax on his decease. Not his problem, but

their lives had any intention of evading taxes. it may well become one for his 12 sons, Omar,

Yakub and all.

Or maybe not? For he had placed his securities in

2. Hans Rüdisühli and Muhammad Abdullah: an institutional structure, a trust or a company

liable to inheritance tax? domiciled on one of the Caribbean islands – and

To get some idea of how the inheritance tax of a institutions cannot die, can they? Indeed not.

foreign state can become a serious problem for However, the Americans are increasingly going

third parties, we need to start with a fundamental over to regarding such structures as look-through

difference between continental and Anglo-Saxon entities, and trying to get access to the bene-

inheritance law. On the continent, the view pre- ficiaries and their tax liabilities.

vails that the logical recipients of assets left by the Another common objection: it’s impossible any-

deceased are their descendants. Accordingly, way. How on earth can the IRS make the connec-

continental inheritance law provides for forced tion between a US security and a deceased for-

heirship, whereby a portion of the estate is legally eigner? The USA is not even capable of register-

required to be left to close relatives. Under such a ing its own residents, so how should it be able to

system, it is not difficult to see where any taxation control the rest of the world? Simple answer: it

of the inheritance should occur: with these heirs.

Investment Commentary No. 265 Page 2

W EGELIN & C O .

doesn’t have to. Rather, American inheritance tax ment was, though, monitored by a special audit

law focuses on the executor. If there is no execu- following a process laid down by the US tax au-

tor, the role is fulfilled by the custodian bank, thorities. Our bank was among the signatories to

which is liable for the tax due. In order to exclude the agreement from the start and passed the sub-

this liability, the American custodians of foreign sequent audits, in 2002 and 2007, with flying col-

banks will go over to requiring their partners ours.

abroad to freeze the estate when one of their There are three definitions in this QI agreement

clients dies. that are of decisive importance: that of a US per-

Final objection: it was a dead letter for foreigners son, that of a US security, and that of a legal en-

anyway. Yes indeed. But with the revised provi- tity belonging wholly or in part to a US person.

sions of the Qualified Intermediary agreement, The definition of a US security is fairly unprob-

the USA will require the signatory banks to en- lematic, in that it is effectively determined by the

able an American auditor to control their compli- retention of the withholding tax by the custodian.

ance with the agreement, which entails giving The other two definitions, however, have caused,

such auditors access to all files, including client and continue to cause, almost insurmountable

data. This will create the means of directly linking problems for QIs, and thus generate considerable

US securities with non-American owners. Any- legal uncertainty.

one who believes that this will not soon result in Sadly, it is entirely unclear who actually counts as

obligatory reporting by the US auditor is as naive a US person and who does not. In addition to the

as those who failed to realize that “fraud and the clear case of US citizens resident in the USA, the

like” would eventually be interpreted to the al- American understanding of the category also

most unlimited advantage of the tax authorities. includes foreigners living in the USA, those in

An act passed in 2001 by the previous President possession of a social security card, holders of a

Bush envisaged a “sunset clause” for the then “green card”, US citizens not resident in the

controversial but reintroduced inheritance tax. USA, and also those who pass the so-called “Sub-

Unless extended, the Estate Tax would expire in stantial Physical Presence Test”. This “Presence

2010 and, if not reformed, come into effect again Test” has a particularly delightful design: it is

on 1 January 2011. The Obama administration is passed when someone has been in the USA for at

currently working not merely on an extension, but least 31 days in the current year and a total of 183

on making the law stricter with regard to recog- days over a period of three years; in the first year

nized loopholes. The possibility of further un- the days count for 1/6, in the second for 1/3, and

pleasant surprises can certainly not be ruled out. in the third year they are counted full. By this

definition, a student, perhaps Muhammad Abdul-

lah’s son Omar, who is doing an MBA at Har-

3. A “qualified extended arm” vard, very probably counts as a US person. The

Next, we need to look more closely at the already- problem is that the QI has to know whether he

mentioned Qualified Intermediary agreement. In does or not. For the agreement has turned the QI

2001 the USA introduced a new withholding tax into the extended arm of the American tax au-

system, with the aim of avoiding the complicated thorities.

and expensive reimbursement of tax levied on Even trickier is the question of how far the bene-

those not liable to taxation, and thus to give for- ficiaries of legal entities are liable to withholding

eigners easier access to the American capital mar- tax. Clearly liable, according to the text, are active

ket, and also of obliging US persons with securi- businesses; an American company holding securi-

ties deposited with intermediaries whose coun- ties in Switzerland, for example. Trusts, institu-

tries had no automatic exchange of information tions and foundations are exempt if they meet

with the USA to include all their US holdings in certain – naturally highly complex – conditions.

their tax declarations. This was done by imposing This was probably the trap in which the UBS

a withholding tax of 30 percent, which US persons clients were caught. Once the trap had closed, the

could avoid entirely by full disclosure, and non- American tax authorities shouted “Abuse, fraud

US persons could avoid in part or, depending on (and the like…)!” They set the trap themselves.

the double taxation agreement, entirely, by self-

declaration to the Qualified Intermediary. Matters become really awkward when an impec-

cably non-American legal entity suddenly be-

The 2001 QI agreement took account of countries comes “contaminated” by a US person. Let’s

with banking secrecy to the extent that clients assume that Mr Abdullah has named his son

could be assigned to their individual categories by Omar, as well as some of his other adult sons, as a

the QIs themselves. Compliance with the agree- beneficiary of his trust. As American tax law has

Investment Commentary No. 265 Page 3

W EGELIN & C O .

turned him into a US person, Omar renders the 3. The “green book” seeks the compulsory im-

trust liable to tax, and when Mr Abdullah dies, position of withholding tax at 30 percent on

this may mean that the entire inheritance be- US securities held by non-American compa-

comes liable to US estate tax, possibly at 45 per- nies. Any reclaiming would have to be done

cent, for Mr Abdullah was extremely wealthy. by the company itself, and involve disclosure

Perhaps, and then again, perhaps not. But that of its ownership structure. According to the

doesn’t matter – the QI should have known. “green book”, exceptions would be possible

The QI agreement of 2001 already exposed all the for pension funds, listed public companies

signatory banks worldwide to significant legal and the like.

risks vis-à-vis the American tax authorities. Even 4. Also stipulated is the introduction of with-

without actively canvassing for clients in the holding tax at 20 percent on all gross revenue

USA, as the UBS did with Alinghi and by other from transactions via a non-QI intermediary

means, the mere fact that someone can mutate, and in a country with no double taxation

almost unnoticed, from a non-US person into a agreement or inadequate exchange of infor-

US person is an unacceptable situation. For the mation.

result can be an entirely innocent misdeclaration. 5. The “green book” envisages compulsory dec-

laration of transactions over 10,000 US dol-

4. Green book; red content lars involving US persons via a non-QI inter-

mediary.

The Obama administration set out its intentions

with regard to various tax matters in May 2009, in 6. Notification to or recording by the IRS of the

a “green book” entitled “General Explanations of acquisition or foundation of an “offshore en-

the Administration’s Fiscal Year 2010 Revenue tity” on behalf of a US person is now also

Proposals”. In addition to the notion of forcing prescribed.

American businesses operating abroad to pay 7. Lastly, the involvement of an American audi-

more tax in America, the focus was on the exten- tor to monitor compliance with the QI agree-

sion of the “Estate Tax” and the tightening up of ment is envisaged. The report will have to be

the QI system. Essentially, the Obama admini- signed by this auditor.

stration is seeking to expand the application of This list of the intended amendments is not neces-

the QI system, and to plug all known and con- sarily complete, and may also contain minor inac-

ceivable loopholes. Seven significant changes curacies. What is clear, though, is that the USA is

deserve comment: attempting to exploit its almost unlimited position

1. The definition of a US security has been ex- of strength with regard to the international trans-

panded. In future, the QI system will also in- action systems (Swift, clearing systems, custodi-

clude equity swaps on US securities and on ans) and the fundamental attractiveness of its

securities lending. This should prevent US capital market to impose its ideas on the rest of

persons from entirely, and non-US persons the world. There is no question that signatories to

from partly, avoiding withholding tax by this new version of the QI agreement will need to

means of an OTC contract. According to the revise their business models for cross-border

“green book” the QI agreement is not (for wealth management, at least as far as US persons

the time being?) being expanded to cover are concerned. Both Swiss-style banking secrecy

non-US funds or derivatives that replicate US and the Austrian and Luxembourg versions, and

securities. indeed all Anglo-Saxon-style structures, whether

2. US persons are now required to report earn- managed from London, Dubai, Singapore or

ings and gross revenue from non-American Hong Kong, are called into question. As far as US

sources. This will extend the QI agreement to persons are concerned, the USA aims to abolish

cover the entire global financial universe, and cross-border business.

enforce disclosure by all US persons, in par- It might reasonably be observed that so long as

ticular those who, by not holding US securi- this really only affects its own citizens, the USA is

ties, had previously remained outside the QI absolutely entitled to do this. And to the extent

agreement. Should an intermediary wish to that it can exploit its position of power in the

remain outside the QI system, withholding world to enforce its intentions, we must – as we

tax at 30 percent is levied compulsorily, and have decided on as non-judgmental an analysis as

may only be reclaimed by the beneficiary, not possible – take note of this and adapt, or possibly

the intermediary. redimension our own business activities. The

concept of the “green book” is extraordinarily

Investment Commentary No. 265 Page 4

W EGELIN & C O .

intelligent. The aim must have been “no way out” But that too is only part of the truth. A look at

– no loopholes. Sadly, however, the matter has who are the most important creditors of Amer-

not been properly thought through. The real ica’s highly indebted public finances reveals

problem lies not in the rigour of the law, but in something truly remarkable. It is the public au-

the lack of clarity about actual tax liability, and thorities themselves! A study by Sprott Asset

the resulting disproportionate effort required for Management, a Canadian asset management firm

monitoring and management. The enormously distinguished for its intelligent macroeconomic

expansive view of what constitutes a US person, analyses, showed that in 2008 over 4 trillion of the

and the potential, imperialist, expansion of inheri- total outstanding public debt of some 10 trillion,

tance tax liability to cover the whole world sub- or around 40 percent, was in the hands of so-

stantially increase the risk of investing in Amer- called “intragovernmental holdings”. These hold-

ica, and thus on the US capital market. This ap- ings include social welfare institutions, whose

plies for investors, but even more so for interme- assets, accumulated in order to be (halfway) able

diaries. While the old QI agreement put the to meet future liabilities, are invested in special

thumbscrews on them, the intended agreement Treasury debt instruments, known as “intragov-

will crush them in a vice. It is becoming clear that ernmental bonds”. In other words, the paying

it will be simply too dangerous to own US securi- recipient of, say, Medicare, the American health

ties, to hold them as a custodian for third parties, service, is an indirect source of finance for the

or to trade them as a bank. Treasury. Unusual, remarkable, or rather, alarm-

ing? Debtors are now simultaneously creditors.

5. The USA’s Achilles’ heel An unusual form of self-financing

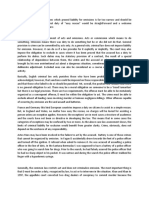

4.3%1.2% 1.0% Ownership of US state debt

The sensibilities of their own capital market: this 4.6%

40.3% Intragovernmental holdings

is what the smart guys in the IRS have very 4.9%

Foreign

probably failed to take into account. Their one-

Other

sided regulatory proposals, focused on maximiz- 7.2%

Funds

ing the tax take, are based on the entirely unprob-

States

lematic and undisputed attractiveness of the USA 7.7%

Fed

as a place of investment for investors from all

Pension funds

over the world. We believe this assumption to be

Insurance companies

utterly wrong. Why?

Banks, savings banks

A glance at the USA’s debt situation suffices to

28.8%

show that apart from oil, there is really only one Note: Figures as of 31 December 2008

element of strategic importance that the USA will

Source: Financial Management Service (Bureau of the United

need in the coming years: capital. The (declared) States Department of the Treasury). Ownership of Federal

public debt – national, state and community – Securities and Federal Reserve Statistical Release.

amounted to some 70 percent of GDP in 2008. These “intragovernmental bonds” are certainly

With the absorption of further debt in the wake of not assets of genuine intrinsic value. Were we to

the financial crisis, by 2014 the level of explicit consolidate both balance sheets – that of the

debt is likely to be significantly above 100 percent Treasury and that of the institution concerned – it

of GDP. By then the interest will have doubled would produce a tautologous situation that would

from around 10 percent of total public revenue to only not result in the total loss of value of the

around 20 percent, on moderate assumptions. social welfare trust’s assets if the Treasury were in

This is generally well known. What is generally a position to avail itself of the capital market to

less well known is that in the USA too, as in so an ever greater extent. So let us look at this abso-

many ailing European states, this explicit perspec- lutely decisive cash flow situation.

tive reveals less than half the truth about what has According to the Canadian study quoted above,

been implicitly promised by the state in the way the American Treasury had to finance new debt

of future benefits. Correctly accounted – that is, of 705 billion dollars in 2008. This was needed to

as probable future payment flows discounted to cover the budget deficit of 455 billion dollars and

present values – the picture would look a good a special deficit for the war in Iraq and Afghani-

deal bleaker. There are studies, such as the one stan of 250 billion dollars. New debt in 2009 will

by the Frankfurt Institute in November 2008, that amount to somewhat more than 2,000 billion dol-

reckon with a total level of debt for the USA of lars, with some 200 billion going to the Middle

up to 600 percent (!) of GDP. Eastern war chest and 1,845 billion to the “regu-

lar” budget deficit. This debt must be bought,

Investment Commentary No. 265 Page 5

W EGELIN & C O .

financed, by someone. So how are the individual And nota bene: we have not yet discussed the

categories of creditors behaving? Number 2 in the quality of the growth. Over the last 15 years it

ranking of creditor groups are the “Foreign and has, as we know, increasingly come mainly from

International Holders”; that is, the total of all consumption and state expenditure; investment in

foreign creditors, including central banks, sover- the USA is extraordinarily weak. Far too little

eign wealth funds, private investors and so on. In potential for the future is being created.

2008 they bought some 560 billion dollars’ worth;

in this year so far, just 460 billion. In March and

April they were net sellers of government securi- 6. Rats leaving the sinking ship

ties. Other categories, such as pension funds, It can hardly be a coincidence that two of the

states, communities and investment funds, also most prominent and most successful American

seem to be tending to unload government paper investors, Warren Buffett and Bill Gross, chose

this year. This means that the usual sources of precisely the same moment to speak out very

finance for the American state are drying up. The clearly against their own domestic currency and

last hope of salvation comes from the Fed, which, against investments in US government securities.

with its quantitative easing programme for print- In an op-ed article in the New York Times on 18

ing money, is currently having to buy up to half August 2009, Buffett described the Treasury’s

the newly issued debt, month after month. current financing problems, with similar assump-

This will be OK as long as it’s OK. A Ponzi tions and observations to those of Sprott Asset

scheme, for that is undoubtedly what we are talk- Management, and lamented the necessity for the

ing about, goes on working as long as its growing Fed, as the lender of last resort, to intervene so

overindebtedness does not arouse any doubt extensively, by means of the printing press. In his

among the public as to the scheme’s continuing own words: “The United States economy is now

performance, and the flow of funds to the scheme out of the emergency room and appears to be on

is not significantly disturbed by other influences. a slow path to recovery. But enormous dosages of

As we know, Madoff’s scheme only collapsed monetary medicine continue to be administered

when individual creditors had liquidity problems and, before long, we will need to deal with their

and were obliged to withdraw funds. side effects. For now, most of those effects are

invisible and could indeed remain latent for a

Hopelessly in debt long time. Still, their threat may be as ominous as

Debt as % of US GDP

400%

that posed by the financial crisis itself.” Buffett

Government fears high inflation, and consequently advises

350% States

Financial sector against the purchase of long-term Treasury bills.

300% Businesses

Households Bill Gross of Pacific Investment Management Co.

250%

(Pimco), which manages the biggest bond fund in

200%

the world, advises investors to sell dollar invest-

150% ments “before the central banks and sovereign

100% wealth funds do”. It’s time to take advantage of

50% the recovery of the US dollar to get one’s cur-

0%

rency diversification in order. The somewhat

1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 strident commodities specialist Jim Rogers takes

Source: Federal Reserve. Flow of Funds Account. the same line, and also announces his new favour-

ite currency – the Chinese yuan. He is seconded,

We now believe that the combination of the US with a good deal more substance, by Hossein

tax authorities’ anti-capital-market plans with the Askari, a professor at George Washington Uni-

Treasury’s specific financing problems could re- versity. In a very readable article in the Asia

sult in such a situation. For the growth of debt Times on 6 August 2009, he also advocated a

alone would give sufficient cause for doubt as to global currency, which “would not be allowed to

performance. The figure above shows the long- be used to finance state debt or stimulation meas-

term development of overall US debt – that is, ures”.

public, household and business debt – compared

to economic performance. It is obvious that, for Without in any way wishing to overdramatize

about 30 years now, additional growth has only matters, we do believe that such signals should be

come at the cost of ever-higher debt. Today, taken seriously. In exactly the same way as it is

every dollar of growth comes with about 4 dollars inadvisable to ignore rats leaving a sinking ship.

of debt. For they often know the crucial aspects of the

ship better than the captain and the officers. The

least worst outcome that we expect for the USA,

Investment Commentary No. 265 Page 6

W EGELIN & C O .

and for the Treasury in particular, is significantly own efforts. Those who produced too cheaply

higher financing costs for debt incurred in the were taken to court, big businesses were given

future. We calculate the medium-term contribu- blatantly preferential treatment, and property

tion by the American tax authorities to this added rights increasingly threatened. Without the exter-

expense, as a result of the “keep foreigners out” nal event of the Second World War, Roosevelt

strategy described above, at around 50 basis would have been numbered among the most un-

points. And this is precisely the Obama admini- successful American presidents of all time.

stration’s miscalculation. Their aggressive attitude The financial crisis has given momentum to anti-

to tax exiles will generate extra funds, perhaps capitalist, and thus anti-market forces in the USA

running into billions, but the price they pay will (and elsewhere). That promises little good for this

be exorbitant. An increase in the credit spread of part of the world, but it makes it somewhat easier

50 basis points on total public debt of over for investors to take their leave. Our bank is in

10 trillion US dollars represents increased costs of the process of recommending our clients to exit

50 billion per annum. The sums don’t work: to from all direct investments in US securities. This,

make up for this would require additional taxable on the grounds of the threat of inheritance tax

funds of some 2 trillion US dollars. coupled with the uncertainty as to whether one

might not, one way or another, be turned into a

7. Unattractive anyway US person.

Furthermore, the stupendous increase in Ameri- We do not deny that by doing this, we hope to

can debt is by no means a problem only for the significantly reduce the risk carried by our bank

Treasury, but affects the economy as a whole. The as an intermediary. Should we maintain QI status

state’s ravenous appetite for debt is preventing under the new, more rigorous conditions, we will

private borrowers from getting access to the avail- have so far reduced our holding of US securities

able finance. This is known as the “crowding-out that we shall effectively be spared most dealings

effect”. The aim of the Fed’s quantitative easing with these cumbersome foreign authorities. Inves-

policy is to counter this effect. At the same time, tors who need US exposure on diversification

distressed banks, and whole industry sectors, like grounds, can obtain it via non-US securities – the

car manufacturers, are being subsidized with “green book” explicitly excludes derivatives and

enormous sums, which ultimately must result in non-US funds from withholding tax. And as we

further distortions, and crass disadvantages for assume that we are not the only ones who will be

the unsubsidized part of the economy. pursuing a policy of exit from the American capi-

tal market, we expect that the range of non-US

This generally anti-entrepreneurial policy of dis- securities with American exposure will expand

couraging investment is further reinforced by significantly. This may be good news for Mr Ab-

wholly disproportionate efforts to intensify the dullah of Dubai.

regulation of small businesses. From the Wall

Street Journal, we learn that legislation already But then again, it may not. If this picture of a

exists in Washington that would impose reporting tautologous construct round the US Treasury is

obligations on small venture capital enterprises – correct, then we must at the very least be ex-

exactly those that have powered the rise of Silicon tremely cautious about nominal values. For

Valley – whose administrative burden would be Treasury bonds and bills would then be seriously

simply unsupportable. And this just because of overvalued, as would the US dollar itself, which

the concern that hedge funds, which, rightly or would naturally argue against all other US bonds.

wrongly, are felt to require greater control, might In our view, not even an engagement in US stocks

be able to operate in the guise of such venture is really worthwhile. Despite depreciation in the

capital companies. If Washington gets its way, this financial crisis, according to our calculations they

will mean the end for many small businesses with are still valued at around 12 percent above the

10 to 20 employees. long-term fair price, whereas European stocks are

undervalued by almost 17 percent. And these

In this economic crisis, the Obama administration calculations do not include the impact of any fu-

is making exactly the same mistake as its great ture increases in taxation or interest rates.

hero, Franklin D. Roosevelt, made in what is

quite wrongly regarded as the exemplary “New We live at a time of shifting power and influence

Deal”. Driven by Keynesian ideology and a belief in the world. Asia is on the rise, and Brazil too,

in the possibility of an upturn caused by appro- probably. Australia will catch on to their coattails,

priate state intervention, in the course of the and Europe may once more be able to position

1930s, Roosevelt deprived businesses of any hope itself within these countries’ recoveries. The USA

of being able to make money again through their will remain the unquestioned military power and

Investment Commentary No. 265 Page 7

W EGELIN & C O .

also an enormous repository of debt and other why we are well advised to take a general farewell

problems. Because they are painful, and there of America. This will be painful, for the USA was

is always an inclination to shift the blame for once the most vital market economy in the world.

them onto third parties, redimensioning processes But for now, it’s time to say goodbye.

always harbour the potential for aggression. Switz-

erland is currently experiencing just this. But it

won’t end there. Potential aggression and eco-

nomic progress are mutually exclusive. Which is KH, 24.08.2009

WEGELIN & CO. PRIVATE BANKERS PARTNERS BRUDERER, HUMMLER, TOLLE & CO.

CH-9004

Investment St. Gallen Bohl 17

Commentary No.Telephone

265 +41 71 242 50 00 Fax +41 71 242 50 50 wegelin@wegelin.ch www.wegelin.ch Page 8

ST. GALLEN BASEL BERNE CHUR GENEVA LAUSANNE LOCARNO LUGANO SCHAFFHAUSEN ZURICH

You might also like

- Offshore: Tax Havens and the Rule of Global CrimeFrom EverandOffshore: Tax Havens and the Rule of Global CrimeRating: 3.5 out of 5 stars3.5/5 (4)

- Lugano ReportDocument4 pagesLugano Reportprem101No ratings yet

- History of Crime and Criminal Justice in America EditedDocument7 pagesHistory of Crime and Criminal Justice in America EditedcarolineNo ratings yet

- 622 - WORD The Logos and The RhemaDocument18 pages622 - WORD The Logos and The RhemaAgada Peter100% (1)

- Speech by DavynDocument4 pagesSpeech by DavynNicole Lebrasseur100% (1)

- Doing What We Can For Haiti, Cato Policy AnalysisDocument8 pagesDoing What We Can For Haiti, Cato Policy AnalysisCato InstituteNo ratings yet

- 4LOLES Gregory Govt Supp Reply Sentencing MemoDocument26 pages4LOLES Gregory Govt Supp Reply Sentencing MemoHelen BennettNo ratings yet

- Accounting for Derivatives and Hedging ActivitiesDocument22 pagesAccounting for Derivatives and Hedging Activitiesswinki3No ratings yet

- International Pack of Climate CrooksDocument10 pagesInternational Pack of Climate CrooksPatschef2100% (1)

- German Federalism - Still ADocument7 pagesGerman Federalism - Still AAliSaumerNo ratings yet

- Laws Lifting Sovereign Immunity in Selected CountriesDocument19 pagesLaws Lifting Sovereign Immunity in Selected CountriesBeverly TranNo ratings yet

- Benefits of SecuritisationDocument3 pagesBenefits of SecuritisationRohit Kumar100% (2)

- 2LOLES Gregory Govt Supp Sentencing MemoDocument403 pages2LOLES Gregory Govt Supp Sentencing MemoHelen BennettNo ratings yet

- FREE and FAIR-How Australias Low Tax Egalitatianism Confounds The World-Alexander-2010Document13 pagesFREE and FAIR-How Australias Low Tax Egalitatianism Confounds The World-Alexander-2010Darren WilliamsNo ratings yet

- De 77 2023 02 23 (Fuller) 1st Amd ComplaintDocument124 pagesDe 77 2023 02 23 (Fuller) 1st Amd ComplaintChris GothnerNo ratings yet

- 3 OmmissionDocument3 pages3 OmmissionMahdi Bin Mamun100% (1)

- The Myth of Manipulation The Economics of Minimum WageDocument65 pagesThe Myth of Manipulation The Economics of Minimum WageAndrew Joliet100% (1)

- British Virgin IslandsDocument12 pagesBritish Virgin IslandsRamona SerdeanNo ratings yet

- BOL ACLUPR CCR Submission To UN HRC On Self-Determination 9.12.2023Document105 pagesBOL ACLUPR CCR Submission To UN HRC On Self-Determination 9.12.2023acluprNo ratings yet

- February 15, 1898Document4 pagesFebruary 15, 1898TheNationMagazineNo ratings yet

- Why The US Embargo Against Cuba FailedDocument11 pagesWhy The US Embargo Against Cuba FailedRuohan Hannah ZhangNo ratings yet

- ORR Staff MemoDocument56 pagesORR Staff MemoblankamncoNo ratings yet

- February 17, 1913Document6 pagesFebruary 17, 1913TheNationMagazineNo ratings yet

- Owen, Henry. El Banco Mundial ¿Son Suficientes 50 Años. 12 Páginas, Inglés.Document8 pagesOwen, Henry. El Banco Mundial ¿Son Suficientes 50 Años. 12 Páginas, Inglés.Karo GutierrezNo ratings yet

- O T Public - PleaDocument2 pagesO T Public - PleaoldeproNo ratings yet

- PEC 2º Semestre - Abraham Lincoln The Emancipation Proclamation 1863Document5 pagesPEC 2º Semestre - Abraham Lincoln The Emancipation Proclamation 1863Olga Iglesias EspañaNo ratings yet

- Great Red Dragon Short VersionDocument88 pagesGreat Red Dragon Short VersionChristTriumphetNo ratings yet

- Van Camp V BradfordDocument2 pagesVan Camp V Bradfordjohnconnorpatriot100% (1)

- Mock Trial Case Andrew JacksonDocument3 pagesMock Trial Case Andrew JacksonForis KuangNo ratings yet

- U.S. Attorney Request For RehearingDocument45 pagesU.S. Attorney Request For RehearingXerxes WilsonNo ratings yet

- Lawsuit Against DeWine, Ohio Over Coronavirus RestrictionsDocument56 pagesLawsuit Against DeWine, Ohio Over Coronavirus RestrictionsJo InglesNo ratings yet

- Ethical Analysis and Evaluation Enron Corporation Scandal Prepared For: Marcos A. KerbelDocument7 pagesEthical Analysis and Evaluation Enron Corporation Scandal Prepared For: Marcos A. Kerbellcorrente12100% (1)

- The Pseudoscience of EconomicsDocument30 pagesThe Pseudoscience of EconomicsPeter LapsanskyNo ratings yet

- Module 3 Topic 3 Tax Havens and GlobalizationDocument12 pagesModule 3 Topic 3 Tax Havens and GlobalizationRosalyn BacolongNo ratings yet

- Time To Shake Down The Swiss BanksDocument4 pagesTime To Shake Down The Swiss Banksrvaidya2000No ratings yet

- Corporate Layoffs Lists 2000 To 2005 Volume IIDocument310 pagesCorporate Layoffs Lists 2000 To 2005 Volume IIJaggy GirishNo ratings yet

- Criminals On Our ShoresDocument5 pagesCriminals On Our Shorestrinadadwarlock666100% (1)

- Annavonreitz-Pay To USDocument3 pagesAnnavonreitz-Pay To USaplawNo ratings yet

- Wall Street Lies Blame Victims To Avoid ResponsibilityDocument8 pagesWall Street Lies Blame Victims To Avoid ResponsibilityTA WebsterNo ratings yet

- Birkenfeld 2010Document3 pagesBirkenfeld 2010Kang Ian2No ratings yet

- Freedom Without BordersDocument192 pagesFreedom Without BordersIrfan Sylvanto100% (1)

- Wall Street Is To BlameDocument3 pagesWall Street Is To BlameUruk SumerNo ratings yet

- Handouts & Pickpockets - Our Government Gone Berserk 1996Document197 pagesHandouts & Pickpockets - Our Government Gone Berserk 1996Anonymous nYwWYS3ntV100% (2)

- Werner - Revisiting The Necessity ConceptDocument4 pagesWerner - Revisiting The Necessity ConceptMieras HandicraftsNo ratings yet

- America As Tax HavenDocument4 pagesAmerica As Tax Havensmarak_kgpNo ratings yet

- Threats To Financial Privacy and Tax Competition, Cato Policy Analysis No. 491Document14 pagesThreats To Financial Privacy and Tax Competition, Cato Policy Analysis No. 491Cato InstituteNo ratings yet

- CautionaboutbondsDocument3 pagesCautionaboutbondsWayne Lund100% (3)

- 20sep16 Anna Von Reitz The Truth Has Come Out Finally and ConclusivelyDocument6 pages20sep16 Anna Von Reitz The Truth Has Come Out Finally and ConclusivelyNadah8100% (2)

- This Massive Bubble Is Just Weeks Away From Bursting. andDocument24 pagesThis Massive Bubble Is Just Weeks Away From Bursting. andAdiy666No ratings yet

- Here Is A Method That Is Helping International Tax AccountantdqqriDocument4 pagesHere Is A Method That Is Helping International Tax Accountantdqqributterfoot87No ratings yet

- Dropping The BombDocument6 pagesDropping The BombDevi PurnamasariNo ratings yet

- Blog On Bribery: ReportsDocument4 pagesBlog On Bribery: ReportsHarry BlutsteinNo ratings yet

- The Revolution Will Be DigitizedDocument4 pagesThe Revolution Will Be DigitizedToronto Star100% (1)

- Matt Taibbi The Big TakeoverDocument21 pagesMatt Taibbi The Big Takeovergonzomarx100% (1)

- Why Switzerland Is Ending Its Precious - Banking Secrecy Laws?Document2 pagesWhy Switzerland Is Ending Its Precious - Banking Secrecy Laws?Ashwin RajuNo ratings yet

- Panama PapersDocument22 pagesPanama PapersBeLa JuniartNo ratings yet

- The Dispatch of Merchants - Copy P.7Document72 pagesThe Dispatch of Merchants - Copy P.7Luc LeblancNo ratings yet

- Gekko Echo - A Closer Look at The "Decade of Greed"Document12 pagesGekko Echo - A Closer Look at The "Decade of Greed"Jeffery ScottNo ratings yet

- Registration Leads to ConfiscationDocument8 pagesRegistration Leads to ConfiscationAJ SinghNo ratings yet

- All India Weather Bulletin - September 14, 2012Document6 pagesAll India Weather Bulletin - September 14, 2012ParvanehNo ratings yet

- LHC Schedule 2012Document1 pageLHC Schedule 2012ParvanehNo ratings yet

- All India Weather Bulletin - September 30, 2012Document7 pagesAll India Weather Bulletin - September 30, 2012ParvanehNo ratings yet

- All India Weather Bulletin - September 30, 2012Document7 pagesAll India Weather Bulletin - September 30, 2012ParvanehNo ratings yet

- Bahrain Land OwnershipDocument45 pagesBahrain Land OwnershipParvanehNo ratings yet

- All India Weather Bulletin - July 19, 2012Document6 pagesAll India Weather Bulletin - July 19, 2012ParvanehNo ratings yet

- All India Weather Bulletin - August 22, 2012Document6 pagesAll India Weather Bulletin - August 22, 2012ParvanehNo ratings yet

- General Authority of State Registration DescriptionDocument27 pagesGeneral Authority of State Registration DescriptionParvanehNo ratings yet

- All India Weather Bulletin - August 29, 2012Document6 pagesAll India Weather Bulletin - August 29, 2012ParvanehNo ratings yet

- All India Weather Bulletin - July 6, 2012Document7 pagesAll India Weather Bulletin - July 6, 2012ParvanehNo ratings yet

- All India Weather Bulletin - August 2, 2012Document6 pagesAll India Weather Bulletin - August 2, 2012ParvanehNo ratings yet

- Syrian Draft Constitution 2012Document23 pagesSyrian Draft Constitution 2012ParvanehNo ratings yet

- All India Weather Bulletin - August 8, 2012Document6 pagesAll India Weather Bulletin - August 8, 2012ParvanehNo ratings yet

- All India Weather Bulletin - July 25, 2012Document6 pagesAll India Weather Bulletin - July 25, 2012ParvanehNo ratings yet

- National Federation of Independent Business v. SebeliusDocument193 pagesNational Federation of Independent Business v. SebeliusCasey SeilerNo ratings yet

- IMD Monsoon Onset 2012Document4 pagesIMD Monsoon Onset 2012ParvanehNo ratings yet

- End of Season Report Monsoon 2011Document14 pagesEnd of Season Report Monsoon 2011ParvanehNo ratings yet

- CERN BE Newsletter May 2012Document9 pagesCERN BE Newsletter May 2012ParvanehNo ratings yet

- OCC's Bank Trading and Derivatives Activities Report Q2 2011Document36 pagesOCC's Bank Trading and Derivatives Activities Report Q2 2011ParvanehNo ratings yet

- 1109Document24 pages1109الغزيزال الحسن EL GHZIZAL HassaneNo ratings yet

- OTC Derivatives Market Activity in The First Half of 2011Document32 pagesOTC Derivatives Market Activity in The First Half of 2011ParvanehNo ratings yet

- Report of The Head of The League of Arab States Observer Mission To Syria For The Period From 24 December 2011 To 18 January 2012Document30 pagesReport of The Head of The League of Arab States Observer Mission To Syria For The Period From 24 December 2011 To 18 January 2012aynoneemouseNo ratings yet

- Measurement of The Neutrino Velocity With The OPERA Detector in The CNGS BeamDocument32 pagesMeasurement of The Neutrino Velocity With The OPERA Detector in The CNGS BeamParvanehNo ratings yet

- Statement of Admiral Mullen Before The Senate Armed Services CommitteeDocument8 pagesStatement of Admiral Mullen Before The Senate Armed Services CommitteeParvanehNo ratings yet

- UARSDocument11 pagesUARSThe Huntsville TimesNo ratings yet

- Pager - M 6.9 - India-Nepal Border RegionDocument1 pagePager - M 6.9 - India-Nepal Border RegionParvanehNo ratings yet

- Summary of Losses/damages Due To Rain in Sindh - 2011 - 9/15Document1 pageSummary of Losses/damages Due To Rain in Sindh - 2011 - 9/15ParvanehNo ratings yet

- Status of Countermeasures Fukushima Daiichi 11.09.2011Document2 pagesStatus of Countermeasures Fukushima Daiichi 11.09.2011ParvanehNo ratings yet

- SNB: Extension of Dollar-LiquidityDocument1 pageSNB: Extension of Dollar-LiquidityParvanehNo ratings yet

- Job Openings and Labor Turnover Summary - July 2011Document16 pagesJob Openings and Labor Turnover Summary - July 2011ParvanehNo ratings yet

- Dissertation On Debt Securities Market in IndiaDocument103 pagesDissertation On Debt Securities Market in Indiaumesh kumar sahu0% (2)

- (New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFDocument331 pages(New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFioannaNo ratings yet

- ReadingDocument205 pagesReadingHiền ThuNo ratings yet

- Pest VietnamDocument4 pagesPest VietnamMelisa SureNo ratings yet

- Government Securities Market in IndiaDocument66 pagesGovernment Securities Market in Indiasanketgharat83% (12)

- Recomandare CEDocument7 pagesRecomandare CEclaus_44No ratings yet

- MSL 873: Security Analysis and Portfolio Management Minor AssignmentDocument9 pagesMSL 873: Security Analysis and Portfolio Management Minor AssignmentVasavi MendaNo ratings yet

- The World Bank-Boosting The Recovery-160410Document65 pagesThe World Bank-Boosting The Recovery-160410SetipputihNo ratings yet

- Nivetha.V 531900782 ProjectDocument73 pagesNivetha.V 531900782 ProjectDeepuNo ratings yet

- Why the IMF was Created and How it WorksDocument14 pagesWhy the IMF was Created and How it Worksnaqash sonuNo ratings yet

- 5QQMN937 - Week 8Document25 pages5QQMN937 - Week 8example3335273No ratings yet

- Bond Yields & Interest Rates ExplainedDocument4 pagesBond Yields & Interest Rates ExplainedAsh kaliNo ratings yet

- Leadership in A New Era (By McKinsey)Document102 pagesLeadership in A New Era (By McKinsey)Emil Urmanshin100% (3)

- Internship Report On Financial Performance Analysis of Sonali Bank LimitedDocument47 pagesInternship Report On Financial Performance Analysis of Sonali Bank LimitedSyed Mostakin69% (13)

- International Capital Before "Capital Internationalization" in Spain, 1936-1959 (WPS 79) Julio Tascón.Document29 pagesInternational Capital Before "Capital Internationalization" in Spain, 1936-1959 (WPS 79) Julio Tascón.Minda de Gunzburg Center for European Studies at Harvard UniversityNo ratings yet

- Financial Service UK Banks Performance Benchmarking Report HY Results 2011Document66 pagesFinancial Service UK Banks Performance Benchmarking Report HY Results 2011Amit JainNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaIBBF FitnessNo ratings yet

- 6-Two Faces of DebtDocument29 pages6-Two Faces of DebtscottyupNo ratings yet

- Drobny 121712 10 24 13Document4 pagesDrobny 121712 10 24 13fbdhaNo ratings yet

- ECB Bond Buying Boosts EurozoneDocument3 pagesECB Bond Buying Boosts EurozoneUday SethiNo ratings yet

- S&P Global Ratings Definitions: AUGUST 18, 2016 1Document45 pagesS&P Global Ratings Definitions: AUGUST 18, 2016 1Sonal AggarwalNo ratings yet

- David Tembo Proposal RevisedDocument32 pagesDavid Tembo Proposal RevisedMasela ChilibaNo ratings yet

- Public Fiscal ManagementDocument5 pagesPublic Fiscal ManagementClarizze DailisanNo ratings yet

- Ads514 Penjanawrittenassignment Am2284c 2 PDFDocument24 pagesAds514 Penjanawrittenassignment Am2284c 2 PDFNur AisyahNo ratings yet

- Divya Jaiswal 1904 A71318219001 B.A. (H) Economics, Sem-4 2019-2022 Book ReviewDocument4 pagesDivya Jaiswal 1904 A71318219001 B.A. (H) Economics, Sem-4 2019-2022 Book ReviewfrootiNo ratings yet

- Introduction To Securities and Investment Ed30 PDFDocument278 pagesIntroduction To Securities and Investment Ed30 PDFjeff76% (21)

- WK 10 Balanced and Unbalanced BudgetDocument21 pagesWK 10 Balanced and Unbalanced BudgetGODSTIME EGBO JOSEPHNo ratings yet

- Effects of Foreign Exchange Rates On Indian EconomyDocument43 pagesEffects of Foreign Exchange Rates On Indian EconomyMohamed Rizwan0% (1)

- dp97 v2Document13 pagesdp97 v2zubishuNo ratings yet

- A Project Report On: Disinvestment Policy of IndiaDocument44 pagesA Project Report On: Disinvestment Policy of Indialatest movieNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessFrom EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNo ratings yet