Professional Documents

Culture Documents

KIM Technical Campus MBA Accounting Model Exam Questions

Uploaded by

rathiramsha7Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KIM Technical Campus MBA Accounting Model Exam Questions

Uploaded by

rathiramsha7Copyright:

Available Formats

KARAIKUDI INSTITUTE OF MANAGEMENT KIT & KIM TECHNICAL CAMPUS

Keeranipatti, Thalakkavur, Karaikudi 630 307 MBA 2013-14 :: I SEMESTER MODEL EXAMINATION BA 7106 - ACCOUNTING FOR MANAGEMENT Time: 3 Hrs Answer ALL questions PART A ( 10 x 2 = 20 Marks ) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. What is GAAP? What are human resources accounting? What are statutory books? What is meant by Employees Stock option scheme? What are the limitations of Ratio scheme? What is fund from operation? What is breakeven point? What is budgetary control? What is codification? Name any two accounting software. Maximum Marks : 100

PART B (5 x 16 = 80 Marks) 11. a) Explain the various accounting concepts and conventions. Or b) Discuss the advantages and disadvantages of inflation accounting. 12. a) Murugan Ltd. was formed on 1-7-96 to acquire the business of Johnson & Sons with effect from 1-1-96. When the companys first accounts were prepared on 31-12-96, the following were noted: a) Sales for the year Rs.3,00,000 b) Sales in January, February, April and May were only 50% of the annual average. Sales of August, September and December were twice the annual average. Calculate the Sales ratio. Or

b) The following is the Trial Balance of Shree Ganesh on 30th June 2007. Name of Account Capital Drawings Stock(1.7.2006) Sundry Creditors Sundry Debtors Machinery Patents Freehold Land Buildings sales Purchases Debit Credit 1, 86,000 15,735 17,280 18,900 43,500 60,000 22,500 30,000 96,000 2,96,340 1,22,025

Sales Returns Purchases Returns Cash at Bank Cash in hand Insurance General Expenses Salaries Wages Factory fuel and power Carriage on Purchases Carriage on Sales Rent

2,040 1,500 7,890 1,620 1,800 9,000 45,000 25,440 14,190 6,120 9,600 27,000 5, 29,740 5, 29,740

The following adjustments are to be effected; Stock on 30th June 2007 Rs.20,400 5% on Sundry Debtors is to be written off as bad. Salaries for the month of June 2007 amounting to Rs.4, 500 were unpaid. Rent Rs. 3000 is accrued but not received. Depreciate Machinery @ 10% and Patents @ 20%. You are required to prepare Trading and Profit and Loss Account and the Balance Sheet as on 30th June 2007.

a) The following are the Financial Statements of Sun Ltd. For the year 2012-13 13. Liabilities 1,00,000 equity shares of Rs. 10 each General Reserve Profit and Loss A/C 6% Debentures Sundry Creditors Proposed Dividends Rs. Balance Sheet ( as on 31-03-2013) Assets Fixed Assets Stocks Sundry Debtors Cash

Rs. 12,50,000 3,50,000 1,80,000 5,15,000

10,00,000 9,00,000 25,000 2,00,000 1,20,000 50,000 22,95,000

22,95,000

Profit and Loss Accounts(for the year ended 31-03-2013) Sales Less : Cost of Goods Sold Gross Profit Expenses Net Profit You are required to compute the following ratio: Current Ratio Acid Test Ratio Gross Profit Ratio Net Income to Capital Debt to Equity Ratio Fixed Asset to Turnover Ratio. 24,00,000 16,00,000 8,00,000 7,00,000 1,00,000

Or b) Given below are the balance sheets of RK Ltd., as on 31-03-2012 and 31-03-2013 Liabilities 2012 (Rs.) 2013 (Rs) Equity Share Capital 2,00,000 3,00,000 Long-Term Loan 1,00,000 1,00,000 Creditors 1,50,000 2,00,000 Bills Payable 2,00,000 3,00,000 Retained Earnings 1,80,000 2,00,000 8,30,000 11,00,000

Assets Cash Stock Debtors Goodwill Plant and Machinery Land and Building Furniture

2012 (Rs) 60,000 1,20,000 80,000 2,00,000 1,00,000 2,00,000 70,000 8,30,000

2013 (Rs) 30,000 1,90,000 1,20,000 1,50,000 2,00,000 4,00,000 10,000 11,00,000

Prepare Schedule of changes in Working Capital Fund flow statement. 14. a) Discuss the various classifications of manufacturing costs. Or b Year Sales ) 2011 1,00,000 2012 Find out P/V Ratio Fixed cost Breakeven Point Sales, to earn a profit of Rs.30,000 15. a) Explain the significance of computerised accounting system. Or b) Discuss the utility of Pre-packaged accounting software in business.

******* ALL THE BEST *******

Profit 20,000 25,000

1,20,000

You might also like

- Ed Cell Reg FormDocument1 pageEd Cell Reg Formrathiramsha7No ratings yet

- Kim - Lab QuesDocument6 pagesKim - Lab Quesrathiramsha7No ratings yet

- Mark AllotmentDocument1 pageMark Allotmentrathiramsha7No ratings yet

- ProfessionalEthics - 2 Mark & 16 Mark Question BankDocument9 pagesProfessionalEthics - 2 Mark & 16 Mark Question Bankrathiramsha7No ratings yet

- DateDocument1 pageDaterathiramsha7No ratings yet

- 13-Qp - Resemblance - Batch V Mba 2014 Reg - MMDocument2 pages13-Qp - Resemblance - Batch V Mba 2014 Reg - MMrathiramsha7No ratings yet

- Strategies to Help Oppressed People through Microfinance - A Case Study of GRAMDocument1 pageStrategies to Help Oppressed People through Microfinance - A Case Study of GRAMrathiramsha7No ratings yet

- Join Indian Army NCC Entry SchemeDocument1 pageJoin Indian Army NCC Entry Schemerathiramsha7No ratings yet

- Design and Fabricatiion of Unprotected Flange CouplingDocument12 pagesDesign and Fabricatiion of Unprotected Flange Couplingrathiramsha7No ratings yet

- Karaikudi Institute of Technology: Year/Dept: Ii/Cse Date: 07.08.2014 Time:09:20 A.M. - 11:00 A.MDocument2 pagesKaraikudi Institute of Technology: Year/Dept: Ii/Cse Date: 07.08.2014 Time:09:20 A.M. - 11:00 A.Mrathiramsha7No ratings yet

- CoachingDocument3 pagesCoachingrathiramsha7No ratings yet

- Karaikudi Institute of Technology Kit and Kim Technical Campus Keeranipatti, Thalakkavur, Karaikudi - 630 307Document3 pagesKaraikudi Institute of Technology Kit and Kim Technical Campus Keeranipatti, Thalakkavur, Karaikudi - 630 307rathiramsha7No ratings yet

- cs2352 LPDocument5 pagescs2352 LPrathiramsha7No ratings yet

- Karaikudi Institute of Technology: Kit & Kim Technical CampusDocument1 pageKaraikudi Institute of Technology: Kit & Kim Technical Campusrathiramsha7No ratings yet

- Karaikudi Institute of Technology: Kit & Kim Technical CampusDocument2 pagesKaraikudi Institute of Technology: Kit & Kim Technical Campusrathiramsha7No ratings yet

- Bvuyhguyg H Jibi Kjbikb NJ IDocument1 pageBvuyhguyg H Jibi Kjbikb NJ Irathiramsha7No ratings yet

- CS2401 QB 1Document5 pagesCS2401 QB 1Praveen JoeNo ratings yet

- Chendhuran College of Engineering and TechnologyDocument2 pagesChendhuran College of Engineering and Technologyrathiramsha7No ratings yet

- My Own ExceptionDocument1 pageMy Own Exceptionrathiramsha7No ratings yet

- Urgent request to claim dormant bank fundsDocument3 pagesUrgent request to claim dormant bank fundsrathiramsha7No ratings yet

- KIT Engineering Maths TestDocument4 pagesKIT Engineering Maths Testrathiramsha7No ratings yet

- Internal QP Template 2Document1 pageInternal QP Template 2rathiramsha7No ratings yet

- Viva QuestionsDocument2 pagesViva Questionsrathiramsha7No ratings yet

- Karaikudi Institute of Technology: Kit & Kim Technical CampusDocument1 pageKaraikudi Institute of Technology: Kit & Kim Technical Campusrathiramsha7No ratings yet

- Questions Unit-I S.no Sec No.: Year & Branch Subject Code & Name Staff Name:IT2032 & Software TestingDocument2 pagesQuestions Unit-I S.no Sec No.: Year & Branch Subject Code & Name Staff Name:IT2032 & Software Testingrathiramsha7No ratings yet

- CS2401 QB 1Document5 pagesCS2401 QB 1Praveen JoeNo ratings yet

- KIT Engineering Maths TestDocument4 pagesKIT Engineering Maths Testrathiramsha7No ratings yet

- University Old Questions Unit-I Unit-IDocument3 pagesUniversity Old Questions Unit-I Unit-Irathiramsha7No ratings yet

- Lab Ques SampleDocument3 pagesLab Ques Samplerathiramsha7No ratings yet

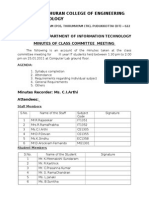

- KIT & KIM Technical Campus CS Dept Meeting Minutes ReportDocument2 pagesKIT & KIM Technical Campus CS Dept Meeting Minutes Reportrathiramsha7No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ABC analysis inventory classificationDocument10 pagesABC analysis inventory classificationSunnyPawarȜȝNo ratings yet

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- Philippine Steel Industry CompetitivenessDocument49 pagesPhilippine Steel Industry CompetitivenessEricka CabreraNo ratings yet

- Budget ProjectDocument6 pagesBudget Projectapi-283546611No ratings yet

- 17.defect Liability Period and Account Closing - en .Wan SaipallahDocument34 pages17.defect Liability Period and Account Closing - en .Wan SaipallaherickyfmNo ratings yet

- Marine InsuranceDocument27 pagesMarine Insuranceabdulkiam67% (3)

- Statutory Construction Chapter 10Document12 pagesStatutory Construction Chapter 10mickeysdortega_41120No ratings yet

- 2007 Annual ReportDocument65 pages2007 Annual ReportKhristopher J. BrooksNo ratings yet

- Rotomac Global Public Banks Conned AgainDocument3 pagesRotomac Global Public Banks Conned AgainAkansha SharmaNo ratings yet

- A Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byDocument23 pagesA Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byVarsha PaygudeNo ratings yet

- Industry ProfileDocument15 pagesIndustry ProfileP.Anandha Geethan80% (5)

- Avarta WhitepaperDocument33 pagesAvarta WhitepaperTrần Đỗ Trung MỹNo ratings yet

- ProjectDocument23 pagesProjectSaakshi TripathiNo ratings yet

- Company Law 2Document12 pagesCompany Law 2PRABHAT SINGHNo ratings yet

- Leverage My PptsDocument34 pagesLeverage My PptsMadhuram SharmaNo ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- Pilmico - Mauri Foods Corporation v. CIRDocument34 pagesPilmico - Mauri Foods Corporation v. CIRYna YnaNo ratings yet

- Principles of Corporate PersonalityDocument27 pagesPrinciples of Corporate PersonalityLusajo Mwakibinga100% (1)

- Solidbank VS Permanent Homes, Inc. 625 SCRA 275Document16 pagesSolidbank VS Permanent Homes, Inc. 625 SCRA 275June DoriftoNo ratings yet

- An Introduction To Value Investing Slides Whitney Tilson 11 5 08 PDFDocument95 pagesAn Introduction To Value Investing Slides Whitney Tilson 11 5 08 PDFdmoo10No ratings yet

- Forbes 12 Best Stocks To Buy For 2024Document29 pagesForbes 12 Best Stocks To Buy For 2024amosph777No ratings yet

- Talavera Senior High School: Municipal Government of Talavera Talavera, Nueva EcijaDocument32 pagesTalavera Senior High School: Municipal Government of Talavera Talavera, Nueva Ecijaanthony tabudloNo ratings yet

- Soybean Profile PDFDocument112 pagesSoybean Profile PDFsatyahil86No ratings yet

- Sole Proprietorship Guide - Everything You Need to KnowDocument15 pagesSole Proprietorship Guide - Everything You Need to KnowPARTH Saxena0% (1)

- Answers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Document17 pagesAnswers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Yew KeanNo ratings yet

- Accounting StandardsDocument7 pagesAccounting StandardsPoojaNo ratings yet

- Gravestone DojiDocument2 pagesGravestone Dojilaba primeNo ratings yet

- 63 Useful Exam Formulas for ACCA Paper F9Document4 pages63 Useful Exam Formulas for ACCA Paper F9Muhammad Imran UmerNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- Assignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessDocument7 pagesAssignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessTuong Tran Gia LyNo ratings yet