Professional Documents

Culture Documents

6sgp 2006 Jun Qa

Uploaded by

Anslem TayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6sgp 2006 Jun Qa

Uploaded by

Anslem TayCopyright:

Available Formats

Drafting Financial Statements

(Singapore)

ACCA CERTIFIED ACCOUNTING TECHNICIAN EXAMINATION ADVANCED LEVEL MONDAY 5 JUNE 2006

QUESTION PAPER Time allowed 3 hours ALL FOUR questions are compulsory and MUST be answered

Do not open this paper until instructed by the supervisor This question paper must not be removed from the examination hall

The Association of Chartered Certified Accountants Certified Accounting Technicians (Singapore) Ltd

Paper T6(SGP)

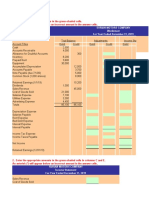

ALL FOUR questions are compulsory and MUST be attempted 1 The balance sheet of Hadrian, a limited liability company, as at 31 May 2006 is provided below together with comparative figures for the previous year. Hadrian Balance Sheets as at 31 May 2006 2005 $000 $000 $000 $000 Assets Non-current assets 2,000 1,500 Current assets Inventory 340 230 Trade receivables 270 150 Bank 4 614 70 450 2,614 1,950 Equity and liabilities Capital and reserves Ordinary share capital 2,100 1,550 Retained earnings 314 130 2,414 1,680 Non-current liabilities 10% Loan note 60 Current liabilities Trade payables 120 150 Taxation 80 200 60 210 Total equity and liabilities 2,614 1,950 Additional Information (i) Interest paid was $6,000 during the year ended 31 May 2006.

(ii) There was no over or under provision of tax for the year ended 31 May 2005. (iii) Dividends paid were $100,000 during the year ended 31 May 2006. (iv) Depreciation of $300,000 was charged for the year ended 31 May 2006. (v) Non-current assets with a net book value of $80,000 were sold at a profit of $20,000 during the year ended 31 May 2006. Required: (a) Calculate the profit before interest and tax of Hadrian for the year ended 31 May 2006. (3 marks)

(b) Prepare a cash flow statement for Hadrian for the year ended 31 May 2006 in accordance with FRS 7 Cash Flow Statements, using the indirect method. (20 marks)

Further Information (i) Sales revenue for the year ended 31 May 2006 was $800,000.

(ii) 2,000,000 shares are issued and outstanding as at 31 May 2006. (iii) The latest average ratios for the industry in which Hadrian operates are as follows: Return on capital employed Quick ratio Receivables collection period Earnings per share 10% 2:1 80 days 15 cents

(c) Calculate the following ratios for Hadrian for the year ended 31 May 2006 ONLY: (i) (ii) (iii) (iv) Return on capital employed; Quick ratio; Receivables collection period; Earnings per share. (6 marks)

State the formula used for each ratio.

(d) Using information from your cash flow statement, the industry ratios and the ratios you have calculated in (c), comment on the financial performance of Hadrian. (11 marks) (40 marks)

[P.T.O.

Paul and Barry are in a business partnership. Their trial balance as at 31 May 2006 is given below: Dr Cr $ $ Sales revenue 568,000 Returns inwards 5,100 Purchases 375,600 Rent 18,760 Selling expenses 55,600 General expenses 3,680 Allowance for receivables at 1 June 2005 2,100 Bank 13,980 Wages 18,000 Trade payables 41,300 Current accounts at 1 June 2005 Paul 3,570 Current accounts at 1 June 2005 Barry 2,190 Motor vehicles, at cost 30,000 Fixtures and fittings, at cost 14,000 Accumulated depreciation at 1 June 2005: Accumulated depreciation Motor vehicles 9,000 Accumulated depreciation Fixtures and fittings 7,000 Insurance 1,540 Inventory at 1 June 2005 39,200 Motor vehicle expenses 9,300 Trade receivables 47,500 Discounts allowed 8,900 Drawings Paul 16,000 Drawings Barry 11,000 Capital accounts at 1 June 2005 Paul 20,000 Capital accounts at 1 June 2005 Barry 15,000 668,160 668,160 The following additional information as at 31 May 2006 is available: 1 2 3 4 5 6 7 Paul and Barry share profits and losses in the ratio 2:1 respectively. Inventory was valued at $32,000. During the year, Barry has taken some goods for his own use to the value of $450, but this has not yet been recorded in the accounts. Interest on drawings for the year were $420 for Paul and $180 for Barry. Paul is entitled to a salary of $15,000 per annum before profits are shared. Insurance of $900 has been paid in advance. Depreciation is to be provided for as follows: Motor vehicles at 20% using the reducing balance method Fixtures and fittings at 15% using the straight line method There are outstanding general expenses of $600. Debts of $1,100 are to be written off and the allowance for receivables is to be adjusted to the equivalent of 5% of the remaining trade receivables, based on past experience.

8 9

Required: Prepare the following statements for the partnership: (a) the income statement and appropriation account for the year ended 31 May 2006. (b) the partners current accounts for the year ended 31 May 2006; and (c) the balance sheet as at 31 May 2006. (16 marks) (4 marks) (10 marks) (30 marks) 4

The summarised income statements of two companies, Liverton and Everpool, for the year ended 31 May 2006 are provided below. Liverton acquired 3,000,000 ordinary shares in Everpool for $3,500,000 on 1 June 2004. At that time, the retained earnings of Everpool were $200,000. Income statements for the year ended 31 May 2006 Liverton $000 Sales revenue 6,400 Cost of sales (3,700) Gross profit 2,700 Distribution costs (1,100) Administrative expenses (700) Profit from operations 900 Dividends received from Everpool 150 Profit before tax 1,050 Tax (400) Net profit for the period 650 The following information is also available: (i) Since 1 June 2004, Everpools total share capital has consisted of 4,000,000 ordinary shares. The par value of the shares on 1 June 2004 was $1 each. Everpool $000 2,600 (1,450) 1,150 (490) (320) 340 340 (80) 260

(ii) At 31 May 2005 Liverton had valued the goodwill arising from the acquisition of Everpool at $200,000. An impairment review of this goodwill at 31 May 2006 valued it at $130,000. (iii) During the year ended 31 May 2006 Liverton sold goods costing $110,000 to Everpool for $200,000. At 31 May 2006, 60% of these goods remained in Everpools inventory. Required: (a) Calculate the goodwill arising on the acquisition of Everpool. (b) Prepare the consolidated income statement for Liverton for the year ended 31 May 2006. (3 marks) (8 marks)

(c) Explain the criteria that should be met for a company to be accounted for as an associate company. (4 marks) (15 marks)

[P.T.O.

(a) Define an adjusting event after the balance sheet date and a non-adjusting event after the balance sheet date and state how each should be accounted for. (4 marks) (b) Jilton Newl is a large manufacturing company. After the date of the balance sheet, but prior to the financial statements being authorised for issue, the following material events occurred: (i) It was discovered that a receivables balance existing at the balance sheet date will not now be received.

(ii) Jilton Newl has announced a bid to take over another company. (iii) Some material errors have been discovered which show the financial statements are incorrect. (iv) The factory workforce at Jilton Newl has started strike action for an indefinite length of time. Required: For each of the events described above, state if they should be treated as an adjusting or non-adjusting event after the balance sheet date. (4 marks) (c) Define a contingent liability and a contingent asset, and explain how each should be treated in the financial statements. (7 marks) (15 marks)

End of Question Paper

You might also like

- Manufacturing process WIP calculationDocument6 pagesManufacturing process WIP calculationNasir Iqbal100% (1)

- F2 Past Paper - Question06-2007Document13 pagesF2 Past Paper - Question06-2007ArsalanACCA100% (1)

- F2 Mock Questions 201603Document12 pagesF2 Mock Questions 201603Renato WilsonNo ratings yet

- Functional BudgetsDocument12 pagesFunctional BudgetsAyush100% (1)

- Test t4 Labor CostingDocument2 pagesTest t4 Labor CostingSyed Muzaffar Ali ShahNo ratings yet

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- ACCA F2 AC N MCDocument10 pagesACCA F2 AC N MCSamuel DwumfourNo ratings yet

- ACCA F2 Sample Study NoteDocument21 pagesACCA F2 Sample Study Notebillyryan10% (1)

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- Test of Labour Overheads and Absorption and Marginal CostingDocument4 pagesTest of Labour Overheads and Absorption and Marginal CostingzairaNo ratings yet

- Part C F5 RevisionDocument20 pagesPart C F5 RevisionMazni HanisahNo ratings yet

- D10-CAC Spring 2013Document4 pagesD10-CAC Spring 2013Mudassir HaiderNo ratings yet

- CIMA Process Costing Sum and AnswersDocument4 pagesCIMA Process Costing Sum and AnswersLasantha PradeepNo ratings yet

- 6Document459 pages6sunildubey02100% (1)

- Financial Information For Management: Time Allowed 3 HoursDocument14 pagesFinancial Information For Management: Time Allowed 3 HoursAnousha DookheeNo ratings yet

- Limiting FactorsDocument63 pagesLimiting FactorsCk Cheah100% (2)

- F2 and FMA Full Specimen Exam Answers PDFDocument4 pagesF2 and FMA Full Specimen Exam Answers PDFSNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- 2024_AAA2_Lecture note& Question bank_sent to STUDENTSDocument64 pages2024_AAA2_Lecture note& Question bank_sent to STUDENTSendoh1810No ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- 6int 2006 Dec QDocument9 pages6int 2006 Dec Qrizwan789No ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- F2 Past Paper - Question12-2005Document13 pagesF2 Past Paper - Question12-2005ArsalanACCA100% (1)

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Absorption vs Marginal Costing: Worked ExamplesDocument5 pagesAbsorption vs Marginal Costing: Worked ExamplesSUHRIT BISWASNo ratings yet

- Tuition Mock D11 - F7 Questions FinalDocument11 pagesTuition Mock D11 - F7 Questions FinalRenato WilsonNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- Limiting Factors & Linear ProgrammingDocument8 pagesLimiting Factors & Linear ProgrammingMohammad Faizan Farooq Qadri AttariNo ratings yet

- Service CostingDocument2 pagesService CostingMohammad Faizan Farooq Qadri Attari100% (1)

- Financial Accounting December 2009 Exam PaperDocument10 pagesFinancial Accounting December 2009 Exam Paperkarlr9No ratings yet

- CAT T10 - 2010 - Dec - ADocument9 pagesCAT T10 - 2010 - Dec - AHussain MeskinzadaNo ratings yet

- Cost Classification and Profit Reporting - MCQsDocument7 pagesCost Classification and Profit Reporting - MCQsmajidghauriNo ratings yet

- ACCA F2 Revision Notes OpenTuition PDFDocument25 pagesACCA F2 Revision Notes OpenTuition PDFSaurabh KaushikNo ratings yet

- F5 CKT Mock1Document8 pagesF5 CKT Mock1OMID_JJNo ratings yet

- Questions Cma-2Document5 pagesQuestions Cma-2Daniel100% (1)

- 2001-SEPTEMBER To 2013-SEPTEMBER-Q - TAHA POPATIA - PAST PAPERS OLD PAST PAPERSDocument106 pages2001-SEPTEMBER To 2013-SEPTEMBER-Q - TAHA POPATIA - PAST PAPERS OLD PAST PAPERSShehrozSTNo ratings yet

- B5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaDocument9 pagesB5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaSHWAIBU SELLANo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- F2 Pre-Exam QuestionsDocument7 pagesF2 Pre-Exam Questionsaddi420100% (1)

- F2 Past Paper - Ans12-2006Document8 pagesF2 Past Paper - Ans12-2006ArsalanACCANo ratings yet

- f3 Mock TestDocument11 pagesf3 Mock TestSai SandhyaNo ratings yet

- MA1 test chapter 03 costingDocument4 pagesMA1 test chapter 03 costingshahabNo ratings yet

- F2 Past Paper - Question12-2003Document15 pagesF2 Past Paper - Question12-2003ArsalanACCANo ratings yet

- F7 FR Jun21 Mock QuestionDocument19 pagesF7 FR Jun21 Mock QuestionAnuj ShethNo ratings yet

- LR Questions PDFDocument10 pagesLR Questions PDFkumassa kenyaNo ratings yet

- FA2 Accruals and PrepaymentsDocument4 pagesFA2 Accruals and Prepaymentsamna zamanNo ratings yet

- Instructions To CandidatesDocument17 pagesInstructions To CandidatesBiplob K. SannyasiNo ratings yet

- T1 - Tutorial MaDocument10 pagesT1 - Tutorial Matylee970% (1)

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- 6gbr 2006 Jun QaDocument6 pages6gbr 2006 Jun QaAnslem TayNo ratings yet

- Pilot Paper F7Document6 pagesPilot Paper F7Dorian CaruanaNo ratings yet

- 2-5hkg 2007 Jun QDocument11 pages2-5hkg 2007 Jun QKeshav BhuckNo ratings yet

- Exams 1Document6 pagesExams 1P VenkatesanNo ratings yet

- P1 - Financial Accounting April 07Document23 pagesP1 - Financial Accounting April 07IrfanNo ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Cash flow statement analysisDocument3 pagesCash flow statement analysisAvinash ThomasNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Ch6 EMADocument6 pagesCh6 EMAAnslem TayNo ratings yet

- Ch3 TargetCostDocument8 pagesCh3 TargetCostAnslem TayNo ratings yet

- Progress Test 3 - Business FinanceDocument3 pagesProgress Test 3 - Business FinanceKaito KirinoNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument184 pagesF8 Workbook Questions & Solutions 1.1 PDFAnslem TayNo ratings yet

- F6 (MYS) Specimen Qs Dec 2015Document22 pagesF6 (MYS) Specimen Qs Dec 2015rayyan darwishNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument184 pagesF8 Workbook Questions & Solutions 1.1 PDFAnslem TayNo ratings yet

- Investment Appraisal Methods GuideDocument42 pagesInvestment Appraisal Methods GuideAnslem TayNo ratings yet

- Professional ModuleDocument24 pagesProfessional ModuleAnslem TayNo ratings yet

- ACCA F7 EXAM CHANGESDocument3 pagesACCA F7 EXAM CHANGESAnslem TayNo ratings yet

- Professional ModuleDocument24 pagesProfessional ModuleAnslem TayNo ratings yet

- MinDocument1 pageMinAnslem TayNo ratings yet

- MaterialDocument1 pageMaterialAnslem TayNo ratings yet

- F6 (MYS) Specimen Qs Dec 2015Document22 pagesF6 (MYS) Specimen Qs Dec 2015rayyan darwishNo ratings yet

- ExAns Ch10Document32 pagesExAns Ch10Anslem TayNo ratings yet

- Dec 2004 - AnsDocument13 pagesDec 2004 - AnsHubbak Khan100% (1)

- F6mys 2008 Dec ADocument7 pagesF6mys 2008 Dec ARuma RashydNo ratings yet

- Financial Management Objectives and Environment RevisionDocument12 pagesFinancial Management Objectives and Environment RevisionAnslem TayNo ratings yet

- F6mys 2007 Dec PPQDocument19 pagesF6mys 2007 Dec PPQAnslem TayNo ratings yet

- I Love YouDocument1 pageI Love YouAnslem TayNo ratings yet

- Hero SupercellDocument1 pageHero SupercellAnslem TayNo ratings yet

- Sao IndexDocument6 pagesSao IndexAnslem TayNo ratings yet

- 2010-05-01 024611 Blue 2Document3 pages2010-05-01 024611 Blue 2Anslem Tay100% (1)

- 6gbr 2006 Jun QaDocument6 pages6gbr 2006 Jun QaAnslem TayNo ratings yet

- f5 Jun 2011 AnsDocument11 pagesf5 Jun 2011 AnsSami IslamNo ratings yet

- Kids Clothing Store Business PlanDocument19 pagesKids Clothing Store Business PlanAnslem Tay50% (2)

- 4 2004 Jun ADocument9 pages4 2004 Jun Aapi-19836745No ratings yet

- MaterialDocument1 pageMaterialAnslem TayNo ratings yet

- 6sgp 2006 Jun QaDocument6 pages6sgp 2006 Jun QaAnslem TayNo ratings yet

- Unilever ProfileDocument33 pagesUnilever ProfileAnslem TayNo ratings yet

- Financial Accounting ChapterDocument23 pagesFinancial Accounting Chapterronnel100% (1)

- Chapter Four: Complied By: Ganfure T., (WSU, 2006)Document27 pagesChapter Four: Complied By: Ganfure T., (WSU, 2006)Tariku KolchaNo ratings yet

- Management Consulting Partnership Capital BalancesDocument48 pagesManagement Consulting Partnership Capital BalancesMingNo ratings yet

- Sesi 11 & 12 SharedDocument28 pagesSesi 11 & 12 SharedDian Permata SariNo ratings yet

- FUNAC TheoriesDocument5 pagesFUNAC TheoriesAlvin QuizonNo ratings yet

- Measuring Business Income ChapterDocument26 pagesMeasuring Business Income ChapterRuman MahmoodNo ratings yet

- Financial Accounting & ReportingDocument4 pagesFinancial Accounting & Reportingkulpreet_20080% (1)

- ReSA CPA Review Batch 43 Separate & Consolidated Financial StatementsDocument10 pagesReSA CPA Review Batch 43 Separate & Consolidated Financial StatementsHasmin AmpatuaNo ratings yet

- Cash flow statement analysisDocument3 pagesCash flow statement analysisAvinash ThomasNo ratings yet

- Research Methodology and Data CollectionDocument17 pagesResearch Methodology and Data CollectionMitali Patel100% (1)

- Screenshot 2022-10-06 at 9.42.46 AMDocument20 pagesScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNo ratings yet

- Oktay Urcan: Financial Accounting: Advanced TopicsDocument39 pagesOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalNo ratings yet

- PT Nikko Sekuritas IndonesiaDocument71 pagesPT Nikko Sekuritas IndonesiaAnggita Puri SavitriNo ratings yet

- Annual-Report-13-14 AOP PDFDocument38 pagesAnnual-Report-13-14 AOP PDFkhurram_66No ratings yet

- Ias 1 Presentation of Financial StatementsDocument42 pagesIas 1 Presentation of Financial StatementsEjaj-Ur-RahamanNo ratings yet

- Case AnalysisDocument3 pagesCase Analysisanjali shilpa kajalNo ratings yet

- Intro To Accounting Ch. 3Document5 pagesIntro To Accounting Ch. 3Bambang HasmaraningtyasNo ratings yet

- Wahlen Int3e EX03-12Document6 pagesWahlen Int3e EX03-12林義哲No ratings yet

- Explanation of The Most Important ProvisionsDocument40 pagesExplanation of The Most Important ProvisionsvictorNo ratings yet

- ICBP Bilingual 31 Des 20 ReleasedDocument160 pagesICBP Bilingual 31 Des 20 Releasedadmid aisyahNo ratings yet

- GAAP Differences SummaryDocument7 pagesGAAP Differences SummaryAmitesh PandeyNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Chapter 2 - Statement of Cash FlowsDocument23 pagesChapter 2 - Statement of Cash FlowsCholophrex SamilinNo ratings yet

- US GAAP Conversion To IFRS: A Case Study of The Balance SheetDocument8 pagesUS GAAP Conversion To IFRS: A Case Study of The Balance SheetJasonNo ratings yet

- Financial Reporting Act 2015 BNDocument31 pagesFinancial Reporting Act 2015 BNOsman GoniNo ratings yet

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocument3 pagesMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Lecture Notes 2 Formation of A PartnershipDocument14 pagesLecture Notes 2 Formation of A PartnershipMegapoplocker MegapoplockerNo ratings yet

- Stardust Corporation Accounts Receivable Aging ScheduleDocument14 pagesStardust Corporation Accounts Receivable Aging Scheduleyen claveNo ratings yet

- Financial Engineering Class Sesi 1 Ver 2.0Document16 pagesFinancial Engineering Class Sesi 1 Ver 2.0Davis FojemNo ratings yet

- Basic Acctg MidtermDocument8 pagesBasic Acctg MidtermLouie De La Torre100% (3)