Professional Documents

Culture Documents

International Journal of Management (Ijm) : ©iaeme

Uploaded by

IAEME PublicationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Journal of Management (Ijm) : ©iaeme

Uploaded by

IAEME PublicationCopyright:

Available Formats

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), INTERNATIONAL JOURNAL OF MANAGEMENT (IJM) Volume

e 4, Issue 6, November - December (2013)

ISSN 0976-6502 (Print) ISSN 0976-6510 (Online) Volume 4, Issue 6, November - December (2013), pp. 217-220 IAEME: www.iaeme.com/ijm.asp Journal Impact Factor (2013): 6.9071 (Calculated by GISI) www.jifactor.com

IJM

IAEME

ANALYSIS OF THE PERFORMANCE OF ARTIFICIAL NEURAL NETWORK TECHNIQUE FOR FORECASTING MUTUAL FUND NET ASSET VALUES

Dr. E. Priyadarshini Assistant Professor, Sathyabama University, Chennai-119.

ABSTRACT In this paper, the Net Asset Values of four Indian Mutual Funds were predicted using Artificial Neural Network after eliminating the redundant variables using PCA and the performance was evaluated using standard statistical measures such as MAPE, RMSE, etc. Keywords: Artificial Neural Networks, Principal Component Analysis, Net Asset Values, Prediction. 1. INTRODUCTION The Financial Market is the most complex area in an investment business where prediction often misfires since the number of variables that cause a price change is too many. Shares should be sold when their investment potential has deteriorated to the extent that they no longer merit a place in the portfolio. The investors are torn between the desire to protect profits or minimize further losses and the protection of price appreciation. The selection of input data is an important decision that can greatly affect the model performance. There are hundreds of financial and macroeconomic variables available for analysis. However, many of the variables may be irrelevant or redundant to the prediction of stock returns. Principal component analysis (PCA) is a variable reduction procedure and is widely used in data processing and dimensionality reduction.

217

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

2. DATA FOR ANALYSIS The Net Asset Values of four of the top ten Indian Mutual Funds namely 1. HDFC Mutual Fund Top 200(equity) 2. ING Mutual Fund - Dividend Yield Growth option(equity) 3. ICICI Mutual Fund-prudential Growth option(equity) 4. Reliance Mutual Fund Regular savings(equity) were modeled using ANN for a period of five years between 2006 and 2010 (Source: amfiindia). Based on the literature review, regarding the data access restriction and on consultation with Chartered Financial Analyst, 13 macro-economic and financial variables were selected as input variables for the Indian Mutual Funds. The input variables used are: BSE Index , NSE Index , Crude Oil (%) , Gold/Gram (Rs), Silver/ Gram (Rs), Dollar Equivalent (Rs), Inflation (%), 91 Day Treasury Bill(Rs),Gross Domestic Product (%),Reserve Money(Rs) ,Unemployment Rate (%), Price/EarningsSensex , Dividend-Yield-Sensex. 3. OBTAINING RELEVANT VARIABLES USING PCA

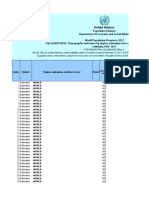

The collinearity statistics of the inputs clearly shows that the Variance Inflation Factor (VIF) for most of the inputs is greater than 5, indicating potential multi-collinearity problem. In order to identify relevant variables and redundant or irrelevant variables, PCA (Principal Component Analysis) technique is used. High value of KMO (0.804>.05) indicates that a factor analysis is useful for the present data. The next step in the process is to decide about the number of factors to be derived. The rule of thumb is applied to choose the number of factors for which Eigen values are greater than unity. The Component matrix so formed is further rotated orthogonally using Varimax algorithm which is the standard rotation method. Among the two factors identified, about 80% of the total variance was explained. The Scree plot obtained for the components best explains the prominence of the two factors. Using these two factors identified by PCA, the mutual funds are modeled using Artificial Neural Network. Error Estimate and Bias of the predicted NAVs using ANN

Mutual Funds

HDFC

ICICI

ING

RELIANCE

MAPE

0.0203

0.058

0.044

0.037

218

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

Actual versus Neural Network Predicted Chart for the four mutual funds

4. CONCLUSION From the model developed using Artificial Neural Networks for the NAV of the four Mutual Funds namely ICICI Mutual Fund, ING Mutual Fund, HDFC Mutual Fund and Reliance Mutual Fund, it has been observed that the network predictions agree with the actual values reasonably well for all the other four schemes. The maximum value of bias is 0.829 for ICICI otherwise it is small for the rest of the mutual fund. The plot of actual rates versus predicted rates indicates that the model fits the given data well. The scatter plots of predicted and actual values for the four mutual funds confirms this. 5. REFERENCES 1. S. J. Kon and F. C. Jen, The Investment Performance of Mutual Funds: An Empirical Investigation of Timing, Selectivity and Market Efficiency, Journal of Business, vol. 52, pp. 263-289, 1979. 2. E. C. Chang and W. G. Lewellen, Market Timing and Mutual Fund Investment Performance, Journal of Business, vol. 57, pp. 57-62,1984.

219

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

3. N. F. Chen, R. Roll, and S. Ross, Economic Forces and the Stock Market, Journal of Business, vol. 59, pp. 383-403, 1986. 4. Chen CH , Neural networks for financial market prediction, Proceedings of the IEEE Int. Conf. Neural Netw., 2: 11991202, 1994. 5. M. H. Pesaran and A. Timmermann, A Recursive Modelling Approach to Predicting U.K. Stock Returns, Economic Journal, vol.110, pp. 159-191, 2000. 6. M. V. Kamath, Empirical Investigation of Multifactor Asset Pricing Model Using Artificial Neaural Networks, NSE Research Initiative, Paper 10, 2002. 7. Joarder Kamrwzaman and Ruhul A Sarkeg, Forecasting of Currency Exchange Rates using ANN: A Case Study, IEEE Int. Conf. Neural Networks and Signal Processing, Vol.1, pp. 793 797, China, 2003. 8. Sindhu.K.P and Dr. S.Rajitha Kumar, Influence of Characteristics of Mutual Funds on Investment Decisions A Study, International Journal of Management (IJM), Volume 4, Issue 5, 2013, pp. 103 - 108, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 9. A.Vennila and Dr. R. Nandhagopal, Study on Performance Evaluation of Mutual Fund Schemes in India During Pre-Recession, Recession and Post-Recession Period, International Journal of Management (IJM), Volume 3, Issue 1, 2012, pp. 126 - 134, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 10. Ashwini Pravin Navghane and Dr.Pradeep Mitharam Patil, Forecasting Stock Market Movement: A Neural Network Approach, International Journal of Electronics and Communication Engineering & Technology (IJECET), Volume 4, Issue 5, 2013, pp. 117 - 125, ISSN Print: 0976- 6464, ISSN Online: 0976 6472. 11. E. Priyadarshini and Dr. A. Chandra Babu, An Analysis of Stability of Trends in Gold Prices using Fractal Dimension Index (FDI) Computed from Hurst Exponents, International Journal of Management (IJM), Volume 1, Issue 2, 2011, pp. 9 - 13, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 12. R.Karthik and Dr.N.Kannan, Impact of Foreign Direct Investment on Stock Market Development: A Study with Reference to India, International Journal of Management (IJM), Volume 2, Issue 2, 2011, pp. 75 - 92, ISSN Print: 0976-6502, ISSN Online: 0976-6510.

220

You might also like

- Explainable AI: Interpreting, Explaining and Visualizing Deep LearningFrom EverandExplainable AI: Interpreting, Explaining and Visualizing Deep LearningWojciech SamekNo ratings yet

- Fin Irjmets1681823617 PDFDocument6 pagesFin Irjmets1681823617 PDFappuNo ratings yet

- Applied Analytics through Case Studies Using SAS and R: Implementing Predictive Models and Machine Learning TechniquesFrom EverandApplied Analytics through Case Studies Using SAS and R: Implementing Predictive Models and Machine Learning TechniquesNo ratings yet

- Visualizing and Forecasting Stocks Using Machine LearningDocument7 pagesVisualizing and Forecasting Stocks Using Machine LearningIJRASETPublications100% (1)

- Stock Price Prediction Using Machine LearningDocument15 pagesStock Price Prediction Using Machine LearningIJRASETPublications100% (1)

- Multivariate Index Relationship Exploration Using Advanced Machine Learning TechniquesDocument13 pagesMultivariate Index Relationship Exploration Using Advanced Machine Learning TechniquesIJRASETPublicationsNo ratings yet

- Enhancing_Stock_Market_Predictability_A_ComparativDocument8 pagesEnhancing_Stock_Market_Predictability_A_Comparativhamrahrah76No ratings yet

- 174-Article Text-586-1-10-20220718Document10 pages174-Article Text-586-1-10-20220718AdjfjNo ratings yet

- Technical Analysis of Selected Pharmaceutical Companies of IndiaDocument7 pagesTechnical Analysis of Selected Pharmaceutical Companies of IndiaPrathamesh TaywadeNo ratings yet

- Technical Analysisof Selected Pharmaceutical Companiesof IndiaDocument7 pagesTechnical Analysisof Selected Pharmaceutical Companiesof IndiaABOOBAKKERNo ratings yet

- Impact of Security Analysis...... 2015Document10 pagesImpact of Security Analysis...... 2015Yoh Sandriano Naru HitangNo ratings yet

- 19 Stock Price Trend Predictionusing Multiple Linear RegressionDocument6 pages19 Stock Price Trend Predictionusing Multiple Linear Regressionnhoxsock8642No ratings yet

- Paper 07Document96 pagesPaper 07subhamNo ratings yet

- Stock Closing Price Prediction Using Machine Learning SVM ModelDocument7 pagesStock Closing Price Prediction Using Machine Learning SVM ModelIJRASETPublications100% (1)

- Analysis of Trends in Stock MarketDocument10 pagesAnalysis of Trends in Stock MarketIJRASETPublications100% (1)

- Stock Market Prediction Using LSTMDocument7 pagesStock Market Prediction Using LSTMIJRASETPublications100% (1)

- A Hybrid Model of Artificial Neural Network and Particle Swarm Optimization For Forecasting of Stock Price of Tata MotorsDocument7 pagesA Hybrid Model of Artificial Neural Network and Particle Swarm Optimization For Forecasting of Stock Price of Tata MotorsYASHWANTH PATIL G JNo ratings yet

- Stock Market Analysis PDFDocument5 pagesStock Market Analysis PDFVrinda VashishthNo ratings yet

- Stock Market Prediction Using LSTM TechniqueDocument11 pagesStock Market Prediction Using LSTM TechniqueIJRASETPublications100% (1)

- JARDCSSpecialIssue2017 SILPAKSpublishedDocument11 pagesJARDCSSpecialIssue2017 SILPAKSpublishedhardikbhuva2804No ratings yet

- A Technique To Stock Market Prediction Using Fuzzy Clustering and Artificial Neural Networks Rajendran SugumarDocument33 pagesA Technique To Stock Market Prediction Using Fuzzy Clustering and Artificial Neural Networks Rajendran SugumarMaryam OmolaraNo ratings yet

- A Time Series Analysis-Based Stock Price PredictioDocument54 pagesA Time Series Analysis-Based Stock Price PredictioNasar AnsariNo ratings yet

- Prediction of Stock Market Using Machine Learning AlgorithmsDocument12 pagesPrediction of Stock Market Using Machine Learning AlgorithmsterranceNo ratings yet

- Ann Model PaperDocument7 pagesAnn Model PaperHimanshuNo ratings yet

- A Study On Fundamental Analysis of Selected IT Companies Listed at NSEDocument11 pagesA Study On Fundamental Analysis of Selected IT Companies Listed at NSEHarish.PNo ratings yet

- Equity AnalysisDocument11 pagesEquity AnalysisAbhigna ChanderNo ratings yet

- A Study On Risk and Return Analysis of Selected Stocks in IndiaDocument5 pagesA Study On Risk and Return Analysis of Selected Stocks in IndiarajathNo ratings yet

- Analysis of Factors Governing The Market Price of The Shares From National Stock Exchange of Ten Selected Companies in Banking SectorDocument8 pagesAnalysis of Factors Governing The Market Price of The Shares From National Stock Exchange of Ten Selected Companies in Banking SectorIAEME PublicationNo ratings yet

- 05.stock Market Prediction UsingDocument4 pages05.stock Market Prediction Usingkamran raiysatNo ratings yet

- Stock Market Prediction Using Deep LearningDocument9 pagesStock Market Prediction Using Deep LearningIJRASETPublications100% (1)

- Stock Price Prediction Using Arima Forecasting and LSTM Based Forecasting, Competitive AnalysisDocument7 pagesStock Price Prediction Using Arima Forecasting and LSTM Based Forecasting, Competitive AnalysisIJRASETPublicationsNo ratings yet

- Stock Market Analysis Using Classification Algorithm PDFDocument6 pagesStock Market Analysis Using Classification Algorithm PDFResearch Journal of Engineering Technology and Medical Sciences (RJETM)No ratings yet

- Stock Price Prediction Based On Financial Statements Using SVMDocument10 pagesStock Price Prediction Based On Financial Statements Using SVMyudhien4443No ratings yet

- Time Series Analysis With RDocument6 pagesTime Series Analysis With RGregorio MendozaNo ratings yet

- Equity Analysis in Banking Sector: Pravar TikooDocument7 pagesEquity Analysis in Banking Sector: Pravar TikooHemanshu DholariyaNo ratings yet

- Analysing Long Short Term Memory Models For Cricket Match Outcome PredictionDocument10 pagesAnalysing Long Short Term Memory Models For Cricket Match Outcome PredictionIJRASETPublicationsNo ratings yet

- An Effective Time Series Analysis For Equity Market Prediction Using Deep Learning ModelDocument6 pagesAn Effective Time Series Analysis For Equity Market Prediction Using Deep Learning ModelJESUS DAVID CLAVIJO CARDENASNo ratings yet

- ANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesDocument21 pagesANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesGazi Mohammad JamilNo ratings yet

- Stock Market Analysis and Prediction: Jabalpur Engineering College, Jabalpur (M.P.)Document12 pagesStock Market Analysis and Prediction: Jabalpur Engineering College, Jabalpur (M.P.)Amit AmarwanshiNo ratings yet

- Kelompokk 1Document10 pagesKelompokk 1Muhamad SolehNo ratings yet

- Forecasting Stock Trend Using R and Technical IndicatorsDocument14 pagesForecasting Stock Trend Using R and Technical Indicatorsmohan100% (1)

- ProjectDocument10 pagesProjectsandy santhoshNo ratings yet

- A Review On Artificial Intelligence in Stock MarketDocument5 pagesA Review On Artificial Intelligence in Stock MarketIJRASETPublications100% (1)

- Artificial Intelligence Based Stock Market Prediction Model Using Technical IndicatorsDocument8 pagesArtificial Intelligence Based Stock Market Prediction Model Using Technical IndicatorsEditor IJTSRDNo ratings yet

- Stock Market ForecastingDocument7 pagesStock Market ForecastingIJRASETPublications100% (1)

- Stock Market Prediction Using Machine LearningDocument7 pagesStock Market Prediction Using Machine LearningIJRASETPublications100% (1)

- 62 Ijcse 07430 25 PDFDocument11 pages62 Ijcse 07430 25 PDFAditya JambagiNo ratings yet

- Stock Price Prediction Using Transfer Learning TechniquesDocument6 pagesStock Price Prediction Using Transfer Learning TechniquesIJRASETPublications100% (1)

- 19 StateDocument7 pages19 StateAshish V MeshramNo ratings yet

- Stock Market Prediction Analysis by Incorporating Social and News Opinion and SentimentDocument7 pagesStock Market Prediction Analysis by Incorporating Social and News Opinion and SentimentRahul TiwariNo ratings yet

- Visualization and Prediction of The Company's Revenue Using Machine Learning and Data AnalysisDocument9 pagesVisualization and Prediction of The Company's Revenue Using Machine Learning and Data AnalysisIJRASETPublications100% (1)

- Sip Part 1.2Document22 pagesSip Part 1.2anshikaNo ratings yet

- Tcs Report PDFDocument13 pagesTcs Report PDFavik boseNo ratings yet

- Stock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyDocument5 pagesStock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyPRABHASH SINGHNo ratings yet

- Deep Learning Based Model To Forecast The Direction of Stock Exchange Market Using Social Media A ReviewDocument5 pagesDeep Learning Based Model To Forecast The Direction of Stock Exchange Market Using Social Media A ReviewIJRASETPublications100% (1)

- Stock Market Prediction & AnalysisDocument7 pagesStock Market Prediction & AnalysisIJRASETPublicationsNo ratings yet

- Seasonality Effect in Indian Stock Market With Reference To BSE SENSEX IndexDocument5 pagesSeasonality Effect in Indian Stock Market With Reference To BSE SENSEX IndexRamasamy VelmuruganNo ratings yet

- IC and Bank StabilityDocument30 pagesIC and Bank StabilityDharmendra SinghNo ratings yet

- A Hybrid Model To Forecast Stock Trend UDocument8 pagesA Hybrid Model To Forecast Stock Trend URam KumarNo ratings yet

- Analyse The User Predilection On Gpay and Phonepe For Digital TransactionsDocument7 pagesAnalyse The User Predilection On Gpay and Phonepe For Digital TransactionsIAEME PublicationNo ratings yet

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDocument18 pagesRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationNo ratings yet

- A Study On The Reasons For Transgender To Become EntrepreneursDocument7 pagesA Study On The Reasons For Transgender To Become EntrepreneursIAEME PublicationNo ratings yet

- Determinants Affecting The User's Intention To Use Mobile Banking ApplicationsDocument8 pagesDeterminants Affecting The User's Intention To Use Mobile Banking ApplicationsIAEME PublicationNo ratings yet

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDocument9 pagesEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationNo ratings yet

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDocument7 pagesA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationNo ratings yet

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDocument10 pagesImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationNo ratings yet

- Broad Unexposed Skills of Transgender EntrepreneursDocument8 pagesBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationNo ratings yet

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDocument14 pagesModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationNo ratings yet

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDocument16 pagesInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationNo ratings yet

- Visualising Aging Parents & Their Close Carers Life Journey in Aging EconomyDocument4 pagesVisualising Aging Parents & Their Close Carers Life Journey in Aging EconomyIAEME PublicationNo ratings yet

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDocument13 pagesA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationNo ratings yet

- Voice Based Atm For Visually Impaired Using ArduinoDocument7 pagesVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationNo ratings yet

- Gandhi On Non-Violent PoliceDocument8 pagesGandhi On Non-Violent PoliceIAEME PublicationNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDocument15 pagesAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationNo ratings yet

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDocument10 pagesA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationNo ratings yet

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDocument16 pagesA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationNo ratings yet

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDocument13 pagesAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationNo ratings yet

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDocument8 pagesDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationNo ratings yet

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDocument19 pagesApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationNo ratings yet

- Various Fuzzy Numbers and Their Various Ranking ApproachesDocument10 pagesVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationNo ratings yet

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDocument13 pagesOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationNo ratings yet

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDocument8 pagesKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationNo ratings yet

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDocument7 pagesModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationNo ratings yet

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDocument9 pagesFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationNo ratings yet

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDocument7 pagesQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationNo ratings yet

- A Review of Particle Swarm Optimization (Pso) AlgorithmDocument26 pagesA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationNo ratings yet

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDocument13 pagesPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationNo ratings yet

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDocument9 pagesAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationNo ratings yet

- Icce06 (CN) Dec18 LRDocument264 pagesIcce06 (CN) Dec18 LRKashif AyubNo ratings yet

- Middle East Asia: Group MembersDocument28 pagesMiddle East Asia: Group MembersGuneesh ChawlaNo ratings yet

- Who Should Tata Tea Target?: Arnab Mukherjee Charu ChopraDocument7 pagesWho Should Tata Tea Target?: Arnab Mukherjee Charu Chopracharu.chopra3237No ratings yet

- Krispy Kreme Doughnuts-ProjectDocument18 pagesKrispy Kreme Doughnuts-ProjectHarun Kaya0% (1)

- What Is Non-Fund Based Lending?: Following Are The Parties Involved in A Letter of CreditDocument3 pagesWhat Is Non-Fund Based Lending?: Following Are The Parties Involved in A Letter of CreditAbhijeet RathoreNo ratings yet

- Feasibility StudyDocument5 pagesFeasibility StudyInza NsaNo ratings yet

- Wpp2022 Gen f01 Demographic Indicators Compact Rev1Document6,833 pagesWpp2022 Gen f01 Demographic Indicators Compact Rev1Claudio Andre Jiménez TovarNo ratings yet

- Press Release - Post Chapter Launch AnnouncementDocument1 pagePress Release - Post Chapter Launch AnnouncementTrina GebhardNo ratings yet

- Agri Business NKDocument34 pagesAgri Business NKKunal GuptaNo ratings yet

- Economic Globalization: Kathlyn D. Gellangarin BAB1ADocument23 pagesEconomic Globalization: Kathlyn D. Gellangarin BAB1AJong GellangarinNo ratings yet

- Labour Law Reforms: GroupDocument5 pagesLabour Law Reforms: GroupsanjeevendraNo ratings yet

- Commentary Tour GuidingDocument1 pageCommentary Tour GuidingMarisol Doroin MendozaNo ratings yet

- Cola Wars and Porter Five Forces AnalysisDocument10 pagesCola Wars and Porter Five Forces Analysisshreyans_setNo ratings yet

- Gr08 History Term2 Pack01 Practice PaperDocument10 pagesGr08 History Term2 Pack01 Practice PaperPhenny BopapeNo ratings yet

- Research Briefing - Global: EM Coronavirus Rankings - Bad For All, Awful For SomeDocument4 pagesResearch Briefing - Global: EM Coronavirus Rankings - Bad For All, Awful For SomeJHONNY JHONATAN QUISPE QUISPENo ratings yet

- Vavavoom Businss PlanDocument11 pagesVavavoom Businss PlanDrushti DoorputheeNo ratings yet

- Financial Management in Public Service Delivery in Zambia A Brief Literature ReviewDocument4 pagesFinancial Management in Public Service Delivery in Zambia A Brief Literature ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Case 5 - Merchendising Perpetual and PeriodicDocument2 pagesCase 5 - Merchendising Perpetual and PeriodicNajla Aura KhansaNo ratings yet

- Competitive Strategy Techniques For Analyzing Industries and CompetitorsDocument2 pagesCompetitive Strategy Techniques For Analyzing Industries and CompetitorsIvan Leong0% (2)

- PWC Intagible AssetDocument393 pagesPWC Intagible AssetEnggar J PrasetyaNo ratings yet

- Brand BlueprintDocument1 pageBrand BlueprintFirst Floor BD100% (1)

- TRAINING AND DEVELOPMENT SURVEYDocument32 pagesTRAINING AND DEVELOPMENT SURVEYKhushboo KhannaNo ratings yet

- Monetary Policy and Fiscal PolicyDocument15 pagesMonetary Policy and Fiscal Policycarmella klien GanalNo ratings yet

- Final ExamDocument3 pagesFinal ExamNguyễn Phương UyênNo ratings yet

- MCQ - 202 - HRMDocument7 pagesMCQ - 202 - HRMjaitripathi26No ratings yet

- Chapter 2 Strategy and ProductivityDocument46 pagesChapter 2 Strategy and ProductivityAngel LyxeiaNo ratings yet

- Presentation On Capital BudgetingDocument15 pagesPresentation On Capital BudgetingNahidul Islam IUNo ratings yet

- Chapter: 3 Theory Base of AccountingDocument2 pagesChapter: 3 Theory Base of AccountingJedhbf DndnrnNo ratings yet

- Group Discussion Topics Covering Education, History, GlobalizationDocument8 pagesGroup Discussion Topics Covering Education, History, Globalizationshrek_bitsNo ratings yet

- 2021 - 04 Russian Log Export Ban - VI International ConferenceDocument13 pages2021 - 04 Russian Log Export Ban - VI International ConferenceGlen OKellyNo ratings yet

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (54)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (12)

- ChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindFrom EverandChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindNo ratings yet

- AI Money Machine: Unlock the Secrets to Making Money Online with AIFrom EverandAI Money Machine: Unlock the Secrets to Making Money Online with AINo ratings yet

- Artificial Intelligence: A Guide for Thinking HumansFrom EverandArtificial Intelligence: A Guide for Thinking HumansRating: 4.5 out of 5 stars4.5/5 (30)

- How to Make Money Online Using ChatGPT Prompts: Secrets Revealed for Unlocking Hidden Opportunities. Earn Full-Time Income Using ChatGPT with the Untold Potential of Conversational AI.From EverandHow to Make Money Online Using ChatGPT Prompts: Secrets Revealed for Unlocking Hidden Opportunities. Earn Full-Time Income Using ChatGPT with the Untold Potential of Conversational AI.No ratings yet

- ChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessFrom EverandChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessNo ratings yet

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceFrom EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceRating: 4.5 out of 5 stars4.5/5 (38)

- 2084: Artificial Intelligence and the Future of HumanityFrom Everand2084: Artificial Intelligence and the Future of HumanityRating: 4 out of 5 stars4/5 (81)

- The Emperor's New Mind: Concerning Computers, Minds, and the Laws of PhysicsFrom EverandThe Emperor's New Mind: Concerning Computers, Minds, and the Laws of PhysicsRating: 3.5 out of 5 stars3.5/5 (403)

- AI and Machine Learning for Coders: A Programmer's Guide to Artificial IntelligenceFrom EverandAI and Machine Learning for Coders: A Programmer's Guide to Artificial IntelligenceRating: 4 out of 5 stars4/5 (2)

- 100+ Amazing AI Image Prompts: Expertly Crafted Midjourney AI Art Generation ExamplesFrom Everand100+ Amazing AI Image Prompts: Expertly Crafted Midjourney AI Art Generation ExamplesNo ratings yet

- Mastering Large Language Models: Advanced techniques, applications, cutting-edge methods, and top LLMs (English Edition)From EverandMastering Large Language Models: Advanced techniques, applications, cutting-edge methods, and top LLMs (English Edition)No ratings yet

- The Digital Mindset: What It Really Takes to Thrive in the Age of Data, Algorithms, and AIFrom EverandThe Digital Mindset: What It Really Takes to Thrive in the Age of Data, Algorithms, and AIRating: 3.5 out of 5 stars3.5/5 (7)

- Killer ChatGPT Prompts: Harness the Power of AI for Success and ProfitFrom EverandKiller ChatGPT Prompts: Harness the Power of AI for Success and ProfitRating: 2 out of 5 stars2/5 (1)

- ChatGPT for Business the Best Artificial Intelligence Applications, Marketing and Tools to Boost Your IncomeFrom EverandChatGPT for Business the Best Artificial Intelligence Applications, Marketing and Tools to Boost Your IncomeNo ratings yet

- System Design Interview: 300 Questions And Answers: Prepare And PassFrom EverandSystem Design Interview: 300 Questions And Answers: Prepare And PassNo ratings yet